You work all your life in hope of a comfortable retirement. However, unless planned carefully, retirement can be all your nightmares coming true-your salary, the regular stream of income would dried up while expenses, such as health care and living, would have only shot up. Here are four simple keys to ensure your golden years are spent comfortably.

1. Know How Much to Save

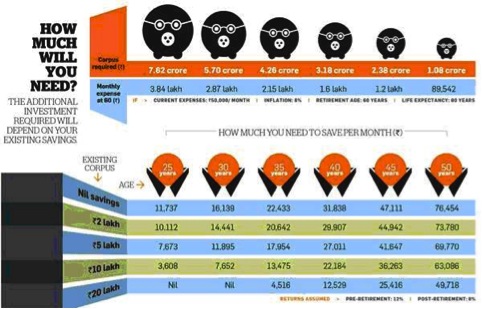

More than 24% of the 2,578 respondents to an online survey conducted last year said they were saving less than 5% of their income for retirement. Another 25% are putting away 5-10% of their income for their sunset years. It is unlikely this will be enough to sustain their current lifestyles when they stop working.

A 2012 study by the US-based Putnam Research Institute says that the fund selection, asset allocation and portfolio rebalancing do not impact the final portfolio as much as the quantum of savings. You should ideally be saving to cover 80-90% of your current expenses if you want a comfortable life after retirement. Anything less than that will require lifestyle compromises. Don’t include EMIs, education and other children-related expenses in this calculation. This should just be the amount you and your spouse will need to sustain your desired lifestyle after you stop working. As mentioned earlier, the pattern of expenses will change-health care, insurance and transportation costs are likely to go up but entertainment and clothing may come down.

2. Start Early

Most of us do not think about retirement till our late thirties. The actually planning begins when we are nearing 50 and have just ten odd years to save. This delay takes away a vital ingredient out of any retirement plan-the magic of compounding. What one saves in the first few years of starting a career burgeons into a massive amount over the next 25-30 years even though the individual saves more in the later years as his income grows. Even if he enhances his savings by 10% every year, what he puts away in the first 10 years will account for almost 24% of the total retirement corpus.

If you don’t start at the age of 25-30, you lose out on the wonder years of growth. Don’t save for the first five years and your corpus will be 18% slimmer. Even a 3-year delay can make the corpus 7% smaller.

Just starting early won’t be enough. You have to be a disciplined saver as well. Committing yourself to a long-term insurance plan can automatically instill such discipline.

3. Beat Both-Inflation and Volatility

These two words become a double-edged sword that ruthlessly attacks your retirement corpus. Inflation is a silent killer. Even a moderate rate of 6% can be debilitating in the long term. So you need some equity on your side to beat this evil. Health care, which accounts for barely 1-2% of your total expenses at the age of 25-30, will become one of your biggest expenses after retirement. Healthcare inflation is rising 2-3 times faster than the wholesale price inflation.

Bringing the equity angle in might help in handling price rise but brings in an even more worrisome aspect to tackle-volatility. As product prices and healthcare costs shoot up, investors saving for retirement are faced with the prospects of choppy returns. Very few investment options now give assured returns and even government-managed small savings schemes, such as the PPF and NSCs, have become market-linked. It’s hardly surprising then that 33% of the respondents to the online survey said that their biggest worry regarding retirement was the uncertainty of returns. So you might not even get back the money you are stashing away for your sunset years unless there is some guarantee on the capital invested like the ones offered by some unit-linked pension plan, or ULPP. Some insurers promise up to 195% of all premiums paid. So, an insurance plan also helps plugging in tax leaks in your retirement corpus.

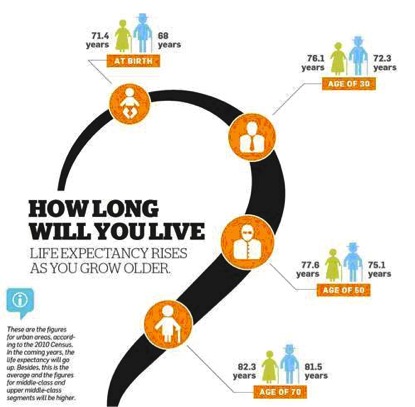

4. Plan an Income for Life

Retirement planning doesn’t stop at accumulating the corpus. You need to ensure that it lasts as well. You or your spouse may live to be 90 or 95 years old. Believe it or not, the life expectancy will only rise as you grow older. But do you have enough money to live this long in retirement? One common denominator for all your retirement financial plans must offer income for life. After working hard for the majority of your life, facing financial insufficiency due to poor financial planning offers a depressing thought. A no-brainer option is buying annuities, an insurance product that pays out regular income for investors who want to receive a steady income stream in retirement.