According to a survey by PayPal, freelancers spend an average of 36 days per year solely on administrative tasks, with a significant portion dedicated to invoice creation.

Hey there, fellow freelancer!

Do you also spend a lot of time calculating your work hours and converting them into an invoice?

In the freelancing world, we know there are a lot of other challenges, such as:

- Late payments

- Inconsistent cash flow

- Creating professional invoices

- Different projects with different prices

But you are not alone! A lot of freelancers are juggling these issues daily.

Thus, we have come up with a blog with solutions to all your challenges. Not only will it help you automate the invoicing process, but as a result, you will start receiving timely payments.

Now, it’s time to dive into special invoicing tips and tricks. Let’s first learn how professional invoicing is crucial for your job.

Importance Of Invoicing For Freelancers

Invoicing isn’t just about getting paid; it’s the backbone of your freelance business.

You can call it the professional handshake between you and your clients to formalize agreements.

Explore the below points to know why invoicing matters so much:

- Get Paid Promptly: Invoicing is your ticket to getting paid. It’s not just an email; it’s a formal request for the money you’ve earned.Without clear, professional invoices, getting paid on time becomes a game of chance.

- Maintain Clear Records: Invoices are represented as your book of finances. They document the work completed, agreed-upon prices, and the due date.When you keep clear records, it helps in maintaining better finances.

- Professionalism Matters: When you send well-created and professional invoices, it leaves a good impression on your clientsIt sets the tone for your entire business relationship. It builds trust and can lead to more future proposals.

- Cash Flow Consistency: An invoicing system ensures a steady flow of income. When invoices go out regularly and are paid on time, you can better predict and manage your finances, smoothing out those cash flow bumps.

- Legal Protection:Invoices serve as legal documents. They outline the terms of your work agreement, protecting both you and your client in case there are any misunderstandings or disagreements down the line.

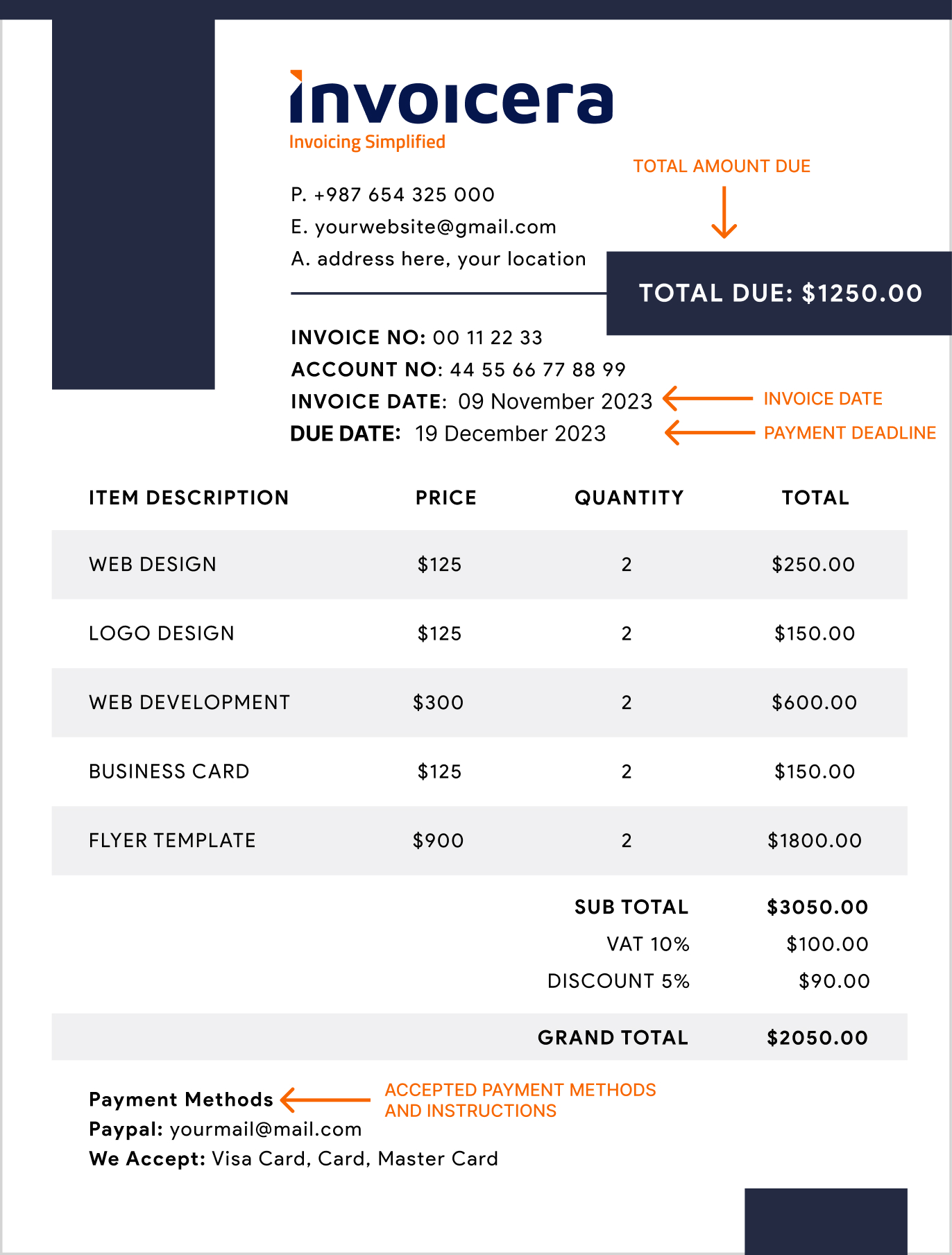

What To Include In Your Invoice?

A. Header Information

The header sets the stage for your invoice. Start with your professional details: your name, business name (if applicable), and contact information.

Make sure to include your logo for that extra touch of professionalism.

B. Client Information

Next up, don’t forget the client’s details! Include their name or company name, address, and any specific contact information they’ve provided.

This ensures clarity on who the invoice is for and where it’s heading.

C. Description of Services

This is the heart of your invoice. Detail the services you’ve provided.

Be clear and concise, outlining what you did, when you did it, and any specific details relevant to the project. It helps both you and the client stay on the same page.

D. Itemized Costs

Break down the costs for each service or task.

Itemizing costs gives your clients a transparent view of what they’re paying. It eliminates confusion and builds trust.

E. Total Amount Due

Sum it all up! Clearly display the total amount due.

This is the number your client needs to pay, so make sure it’s bold and impossible to miss.

F. Payment Terms and Conditions

Lastly, outline your payment terms and conditions. Specify the due date, preferred payment methods, and any late fees or discounts for early payments.

Clear terms ensure a smoother payment process and prevent any misunderstandings down the line.

Remember, an organized, detailed invoice not only reflects your professionalism but also sets the stage for a hassle-free payment experience.

Effective Invoicing Tips for Freelancers

1. Prompt Invoicing Practices

Being swift with your invoicing can significantly impact your cash flow. Once your work is completed or milestones are achieved, don’t delay—send that invoice promptly. It not only sets a professional tone but also encourages timely payments.

2. Clear and Concise Descriptions

Keep your invoices crystal clear. Break down your services or products with concise descriptions detailing what was delivered and the corresponding costs. This clarity minimizes confusion and helps clients understand precisely what they’re paying for.

3. Setting Payment Terms

Clearly outline your payment terms on every invoice. Specify the due date and any late fees, if applicable. Setting expectations from the get-go helps avoid misunderstandings later on.

4. Professionalism in Invoices

Your invoice is a representation of your professionalism. Ensure it’s branded with your logo, includes all necessary details like your contact information and invoice number, and is formatted neatly. A professional-looking invoice establishes credibility and reinforces your brand.

5. Regular Follow-ups on Unpaid Invoices

Sometimes, payments slip through the cracks. Don’t hesitate to follow up politely and regularly on overdue invoices. Send gentle reminders via email or make a friendly call. Often, it’s just an oversight that a prompt reminder can resolve.

Invoicing doesn’t have to be an ordeal.

These practical tips can streamline your invoicing process, bolster your professionalism, and ensure a smoother payment experience for you and your clients.

Choose The Right Invoicing Tool

When you’re juggling a lot, having the right tools is a big deal. Invoicing software is like your handy helper for your freelance gig. It makes sending bills smoother and faster.

Overview of Invoicing Software

These tools come with many features made to fit different needs. They’re simple to use and have templates you can change. Some do more than just invoicing—they track expenses, manage time, and even help coordinate with clients.

They do the boring stuff for you! Making invoices is quick and easy. And they give gentle reminders for late payments, so you don’t have to chase them up.

Benefits of Invoicing Tools for Freelancers

For freelancers, these invoicing tools are a game-changer. They bring a plethora of benefits to the table:

- Time-Saving: Say goodbye to manual data entry and chasing down clients for payments. Invoicing software automates these processes, freeing up your time to focus on your core projects.

- Professionalism: Impress clients with polished, branded invoices that reflect your professionalism and attention to detail. Customizable templates let you add your logo, colors, and personal touch.

- Improved Cash Flow: With automated reminders for overdue payments, you’re more likely to receive payments on time, ensuring a healthier cash flow for your business.

- Insightful Reporting: Many tools offer reporting features that provide valuable insights into your financial performance. Get a clear view of income, expenses, and outstanding payments.

- Accessibility: Access your invoicing platform from anywhere, anytime. Whether on your laptop, tablet, or smartphone, you can manage your invoices on the go.

Top 8 Invoicing Tools

1. Invoicera

Think of Invoicera as your all-in-one invoicing superhero. It helps you create and send professional-looking invoices with ease.

Plus, it has beneficial features like expense tracking and time management to simplify your life.

- Late Payment Reminders: Automate reminders for overdue payments, maintaining healthy cash flow by prompting clients for timely settlements.

- Automated Recurring Billing: Set up recurring invoices for regular clients or subscription-based services, saving time and ensuring consistent billing without manual intervention.

- Multiple Payment Options: Integrate various payment gateways, including credit cards, PayPal, and online bank transfers, providing clients with convenient payment methods.

- Expense Management: Track and manage expenses efficiently, allowing for accurate invoicing and better financial oversight.

- Time Tracking: Monitor billable hours precisely, easily converting tracked time into invoices, ensuring accuracy and transparency in client billing.

- Multi-Currency Support: Conduct business globally by invoicing in multiple currencies, accommodating international clients without hassle.

- Security Measures: Ensure data security with robust encryption and compliance with industry standards, safeguarding sensitive financial information.

2. FreshBooks

FreshBooks is like your organized virtual assistant. It streamlines invoicing and helps you keep track of expenses effortlessly. It’s user-friendly and perfect for freelancers looking for a hassle-free invoicing experience.

- Effortless Customization: Easily tailor invoices using automated recurring options for swift modifications.

- Real-time Client Interaction Tracking: Stay updated with live tracking of client interactions related to invoices.

- Automatic Payment Reminders: Set up automatic reminders and fees for late payments, ensuring prompt settlements.

- Seamless Online Credit Card Payments: Accept credit card payments online hassle-free, ensuring smooth transactions.

- Professional Estimate Generation: Create and send professional estimates promptly to potential clients.

- Intuitive Business Insights: Gain valuable business insights through intuitive reports and dashboards.

3. Sage

Sage is your financial helper. It’s not just about invoicing; it’s a complete accounting package.

With Sage, you can manage finances, track inventory, and handle invoicing like a pro.

- Easy Invoicing: Generate, modify, and dispatch invoices seamlessly within the software.

- Finance Management: Monitor cash flow by connecting to your bank account and instantly log sales and receipts.

- Collaborative Dashboard: Access impactful reports and dynamic dashboards. Keep tabs on project earnings, costs, and profits.

- Multi-Currency Support: Conduct transactions in diverse currencies.

4. Zoho

Zoho is your go-to option for a suite of business tools, and its invoicing feature is no exception. It’s intuitive, customizable, and seamlessly integrates with other Zoho apps, making your invoicing process smoother.

- Streamlined Invoicing Process: Generate polished invoices, automate recurring billing, and easily accept online payments.

- Unified Expense Management: Organize and bill expenses to clients seamlessly within a unified platform.

- Bank Integration: Link Zoho Books to your bank for live cash flow updates and instant transaction categorization.

- Comprehensive Financial Insights: Access insightful financial reports (P&L, Balance Sheet, Cash Flow Statement) for better financial management.

- Efficient Inventory Tracking: Implement inventory tracking to oversee stock movements efficiently.

5. Invoice2go

This one’s like your pocket invoicing buddy. It’s mobile-friendly so that you can create invoices on the go. It’s perfect for those who need flexibility and convenience in their invoicing.

- Tailored Invoices: Customize invoices using various templates to suit your style.

- Invoice Tracking: Track invoices to know exactly when clients view them.

- Automated Payment Reminders: Use payment reminders to save time on chasing unpaid invoices.

- Payments: Accept debit and credit card payments effortlessly.

6. Wave

Wave is a free invoicing tool that packs a punch. It’s designed for small businesses and freelancers, offering features like invoicing, accounting, and receipt scanning, all without breaking the bank.

- Create Estimates: Generate personalized invoices, estimates, and receipts swiftly.

- Payment Reminders: Send automatic payment reminders for timely payments.

- Payment Options: Accelerate payments by accepting credit cards, often settled within two days.

- Expense Management: Keep tabs on income, expenses, and receipts through scanning tools and bank connections.

7. Xero

Xero is your cloud-based accounting wizard. It’s user-friendly and offers a range of features beyond invoicing, like bank reconciliation and expense tracking, making it a favorite among many freelancers and small businesses.

- Recurring Billing Solution: Schedule recurring invoices for convenience.

- Reminders To Avoid Late Payments: Automate payment reminders to speed up customer payments through tailored emails.

- Various Payment Options: Accept online payments via debit/credit cards or PayPal directly from the invoice for improved cash flow.

- Mobile Invoicing: After job completion, generate and send invoices instantly from your phone or tablet.

- Enable customers to pay online using debit/credit cards or their PayPal account.

8. Chargebee

Chargebee is for subscription-based businesses. It handles recurring billing, invoicing, and subscription management, making it a perfect fit for those dealing with subscription services.

- Professional Invoices: Create stunning, detailed invoices effortlessly.

- Tax And Compliance: Simplify tax handling with Chargebee.

- Metered Billing: Use built-in metered billing to bill based on usage.

- Multiple Payment Options: Offer diverse payment options like cards, checks, direct debit, and online wallets.

- Recurring Billing Solution: Access subscription management, reporting, and analytics tools as well.

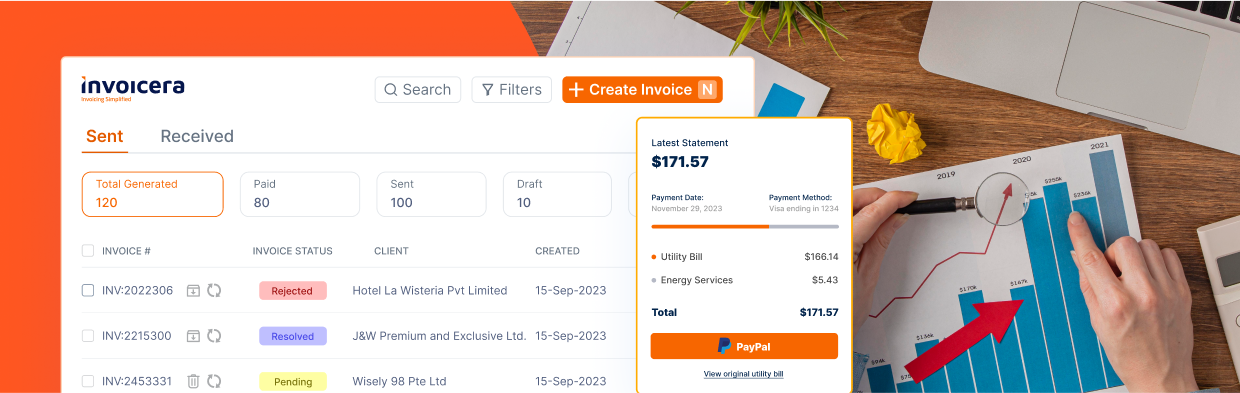

Invoicera: A Deep Dive

Invoicera is a game-changer that makes the invoicing process so easy that even a non-technical person can use it.

Whether you’re a seasoned freelancer or just starting, Invoicera has your back with its features tailored to simplify your invoicing experience.

Key Features

Customization Options

Invoicera understands that every freelancer has a unique style.

With its customization options, you can personalize your invoices to reflect your brand.

From adding logos to tweaking colors and fonts, make your invoices stand out while maintaining your professional image.

Automation Features

Time is precious, especially when you’re juggling multiple projects.

Invoicera automates repetitive tasks, such as invoice creation, recurring billing, and payment reminders.

Say goodbye to manual entries and hello to streamlined processes that save you time and effort.

Integration Capabilities

Seamlessly integrate Invoicera with other essential tools in your freelancer toolkit.

Whether syncing with accounting software, CRM systems, or payment gateways, Invoicera ensures all your invoicing data flows effortlessly across platforms.

How Invoicera Streamlines Invoicing for Freelancers

Invoicera doesn’t just stop at providing features; it revolutionizes the way freelancers handle their invoicing tasks.

By offering customizable templates and automation, you can create professional invoices in minutes, freeing up valuable time for your work.

Its integration prowess ensures that your invoicing process integrates seamlessly with your existing workflow, bringing harmony and efficiency to your financial management.

Final Thoughts

Wrapping up our journey of finding an ideal invoicing solution, let’s quickly revisit some key best practices to keep your freelance invoicing on track:

- Maintain a standardized format across all your invoices for a professional touch and easier understanding.

- Send out invoices promptly after completing a project to expedite payments.

- Clearly outline the services rendered or products provided to avoid confusion and disputes.

- Set clear payment terms and policies to ensure both you and your clients are on the same page regarding payment schedules and methods.

- Don’t hesitate to send friendly reminders for overdue payments. Persistence often pays off!

FAQs

Is Invoicera suitable for all types of freelancers?

Absolutely! Invoicera caters to a wide array of freelancers, from graphic designers and writers to consultants and developers. Its customizable features make it adaptable to various industries.

Can I integrate Invoicera with my existing accounting software?

Yes, Invoicera offers integrations with popular accounting software like QuickBooks, Xero, and more, ensuring seamless syncing of your financial data.

How secure are online payments through Invoicera?

Invoicera employs top-notch security measures, including SSL encryption, to safeguard your and your client’s payment information, ensuring safe and secure transactions.

Is there a free trial available for Invoicera?

Absolutely! You can take advantage of Invoicera’s free trial to explore its features and see how it fits into your invoicing workflow before making any commitments.