Owning a business brings new challenges every day. These also bring rewards for you as a business owner. Incurring expenses puts constant pressure on business finances.

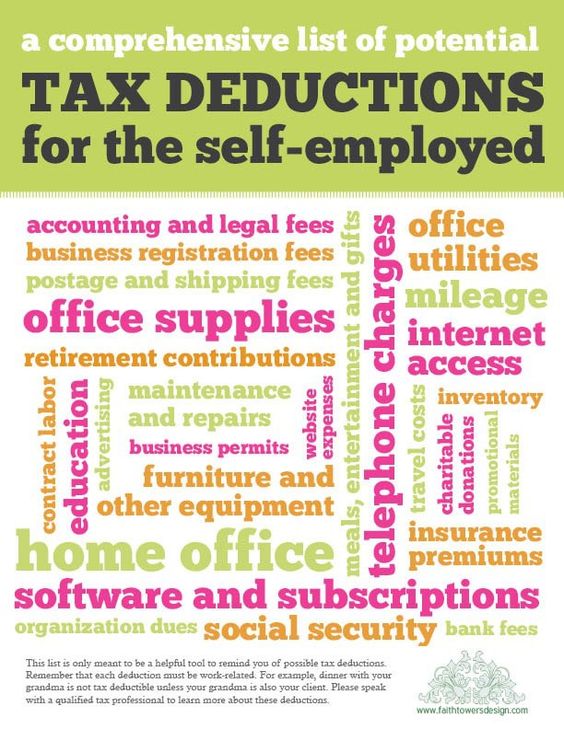

There are ways for business tax deductions to save oneself from being charged extra for taxes.

This is very important for making the business more profitable. Here is a list of some important business tax deductions ideas that you must know of:

Communication and Workspace Expenses

You can deduct direct business expenses like internet and phone bills. Personal phone use should not be deducted. Only business phone use should be deducted from taxable income.

If you use the entire internet time for the business purpose, it can be deducted from taxable income.

The office that you own or rent is a part of business expenses. The home office expense is deductible from your taxable income considering that the workspace is used exclusively for your business expenses. You should always keep a map of your office space ready with you in case you have to show it to the tax authorities. You must make sure the measurements on the map are absolutely correct.

You can deduct depreciation, interest, insurance, property tax and maintenance from your taxable income. You should preferably use the standard method to calculate these deductions. In this method, you can directly deduct the expenses that have been incurred for your workspace. If you do not have proper records of the expenses incurred, you can go for the simplified business tax deductions method in which a prescribed rate has to be multiplied with the premises square footage. You can use this option if your workspace is smaller than 300 square feet.

Insurance Premium and Food

Insurance premiums are deductible while calculating taxes for self-employed individuals. The business tax deductions also include premiums paid for spouse and children(less than 27 years of age).

Meals too are tax deductible. These could be meals that you have while traveling for business purpose or meeting clients. You should keep all receipts of the meals consumed, to avail the deduction. You can either avail 50% of the cost of meals or an equal percentage of the standard allowance.

Travel and Entertainment

You can deduct 50% of your business entertainment expenses considering that you are getting entertained with the person you are conducting business with. Keeping all records and receipts is a must in this case as well.

Business travel expenses are tax deductible too. A business trip must be a planned trip specifically for a business purpose. It should be outside the city of your workspace.The trip should include serious business activity rather than leisure combined with business.

Proper records and receipts for these expenses must be maintained for availing the deductions. Your travel expenses are completely the form of business tax deductions, the meals and entertainment will be 50% only.

Education and Subscriptions

If you incur educational and skill improvement expenses, then these would be business tax deductions. These improvements, although, must be related to the business that you are in, to qualify. If you are subscribing to educational material, magazines, and books for business purpose, then these too are a deductible expense.

Interest

If you have taken a loan for your business, then the interest that you pay is deductible from your taxable income. The interest on your credit card is tax deductible when the purchases are made for business purpose only.

Check Out: Ways to reduce tax for Small Business in 2017

CONCLUSION:

There are plenty of opportunities small business owners can take for tax deductions. Business expenses are to be deductible on a trade or business to make a profit. You can easily determine the tax deduction methods you want to follow for 2017 business return. Also, Discussing the situation with other tax advisors can qualify for a specific deduction. The past performance is a great indicator to take improved steps for business tax deductions.

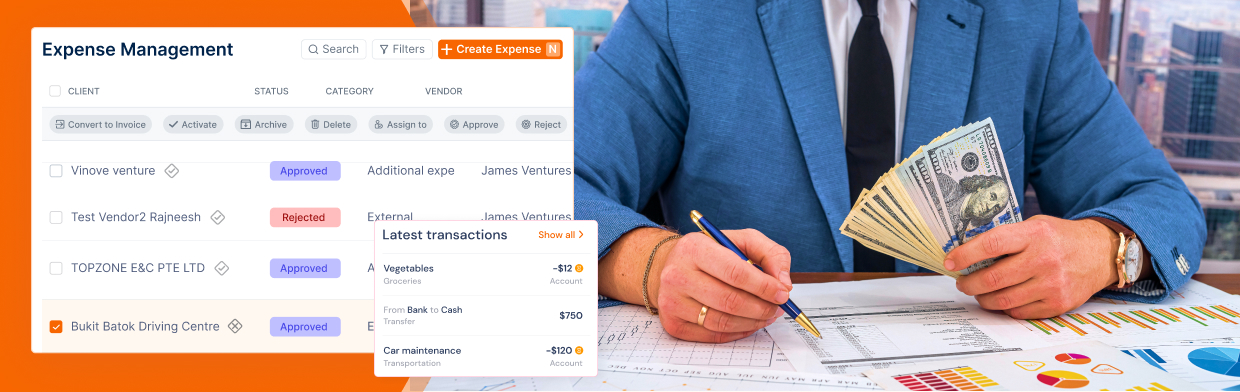

Small business taxation can be efficiently managed with the help of an online invoicing and billing software. A solution like Invoicera has detailed analysis on tax and expense reports, simpler way to add taxes to invoices, the record of every tax, complete expense management and more.