We hope that you know the importance of finance in business!

Finance for a business is a key to its growth. Call it the lifeline instead, that is required for the well being of a business, irrespective of the size business is working in. Apart from all the reasons a business needs finances, one of the major reason is the fight for survival and growth.

Since, finance is the most important aspect of a business, business owners or freelancers must create a financial plan or strategy to stay in control of their finances.

Given below are a few tips to draft an appropriate financial strategy:

Financial plan

Financial planning should be there at each and every step of running a business. Start planning as soon as you get the business idea. Do not look back. Planning now would give you freedom to flex your hands a bit, giving you some time to act, if something urgent had to come up. Keep reserves for the rainy day.

Forecast Finances Easily

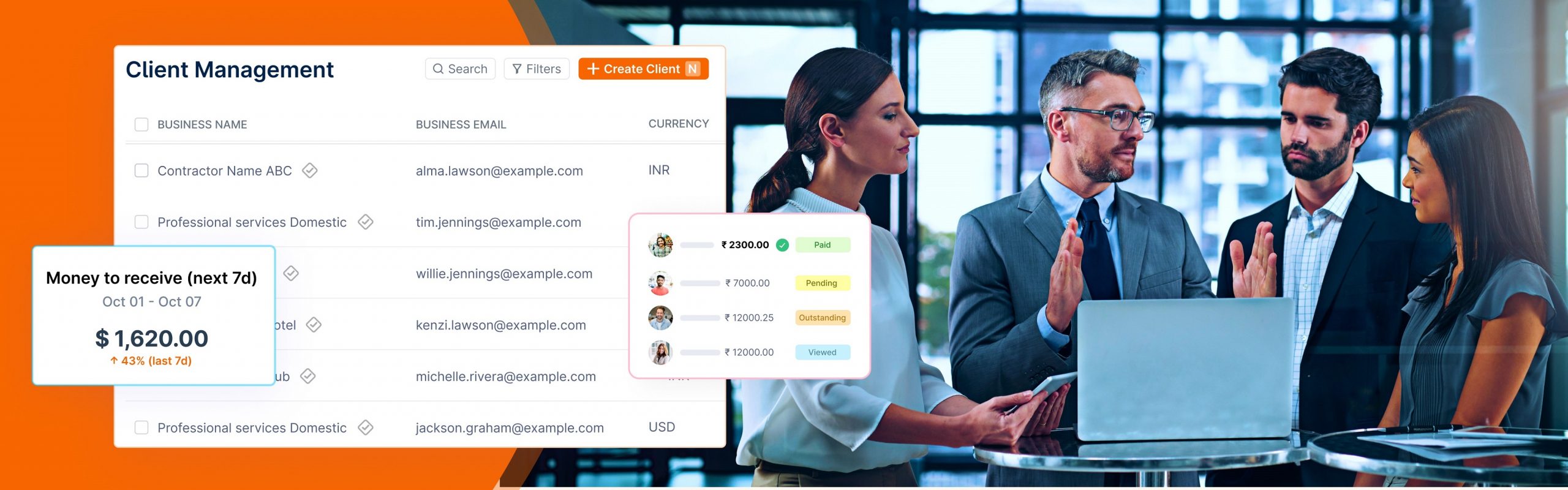

While it’s not literally possible to peep into the future, you could just picture what your goal is and then take some efforts to manage your finances efficiently. Study and analyse on how likely you are to spend and invest your money. Depending upon the same try and create a blueprint of the plan on which you would take things forward. Invoicera is a finance management software available online that have revolutionised the entire experience of finance management. The trusted partner for more than 3 million users has created a platform for businesses to make the complex task of finance management easier.

Read : 3 Easy Finance Management tips for Small business

Keep your lenders aware

Quite often, it is seen that small business owners borrow money from outside. Lenders, in turn expect a quick return. Hence, they should be well informed of a business’s financial condition and the rate at which it’s progressing.

Make changes, if needed

Forecasting your finances is not an easy task to do. It could be difficult but with changing scenarios, the budget you created in the beginning might look foggy few months down the line. Make sure you stay updated with your financial plans as per the market.

Use of an Online Finance Management Software

An online financial management software allows you save all your cash flow data on cloud. Unlike, paper invoicing, Online invoicing lets you access your data at the ease of your convenience. The online available financial management solution have given a new area to businesses to work on. With a financial management software, you can easily keep a track of all your cash flow. The added spreadsheets create an effortless segregation of entire record giving you accurate information in no time.

Quick Tip:

Why not? Experience does count when it comes to financial planning. Try consulting a financial expert who could help you out in drafting budgets and long-term plans.Usually, small businesses prefer consulting these advisers, owing to their expertise and understanding in such situations.

So, in case you were planning to start-up a business, make use of these tips to put your finances in good use.