Many small business owners might face shortage of funds during their initial business start ups especially in today’s economy. When small business financing options such as loans and credit are limited, some business owners will turn to accounts receivable factoring. Others have limited cash so they are not able to grow their business.

What is Accounts Receivable Factoring?

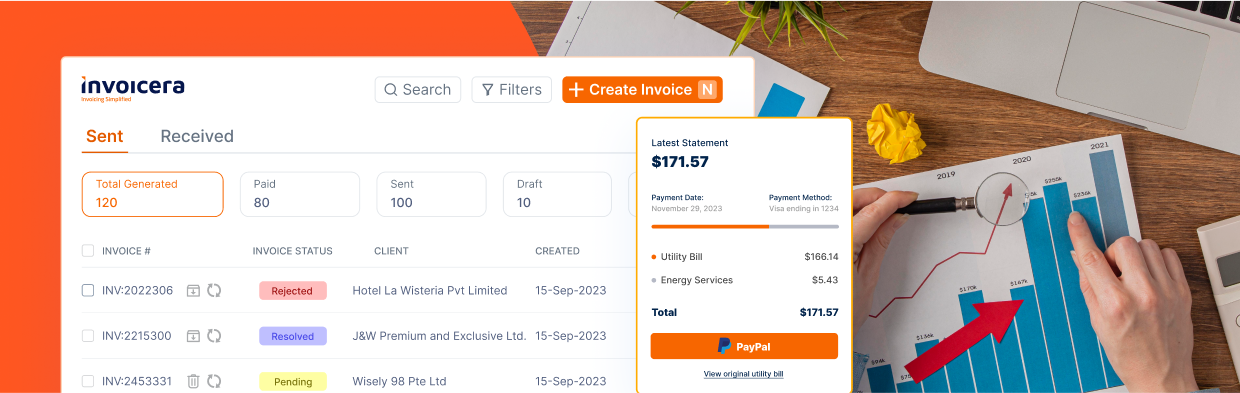

So, if you are confused about what is AR factoring, let us explain you! Account receivables financing is also referred to as “invoice factoring” Factoring is a fast, easy and flexible way to improve your cash flow and generate working capital for your company. It is an alternative source of financing that involves selling your open invoices for their face value and you get the cash now. This cash can be used for almost any business expense such as paying for utility expenses, giving salaries to their employees, buying new equipment, or even paying for a new marketing campaign. But factoring is generally more expensive than other forms of financing.

In an Account Receivable Factoring transaction, your company basically sells its outstanding invoices to the factoring company at a discount. Once you factor that outstanding invoice that you have issued to a customer, you transfer your rights to the factoring company to collect that amount. The factoring company acts as the principal, and not as your mediator. Customers who are required to pay the amount are informed that their invoices have been factored and then, they make their payment directly to the factoring company. This means you have basically shifted your right to the amount invoiced, and your responsibility for collection, to the factoring company in return for a discounted amount of fast cash and balance of the payment.

Benefits of Account Receivable Factoring :

• You can obtain quick payment following shipment, delivery and invoicing to generate cash much sooner than if you collect the money on your own.

• Prior to acquiring your invoice, a factor conducts a credit analysis on the customer you are invoicing to determine the risk. You are allowed to the resulting analysis and factoring company can support you in your future business transactions with that client.

• By factoring your outstanding invoices and showing a stronger currency position on your accounts balance sheet, you may find it easier to obtain traditional bank financing.

• Factoring companies take on the liability for collection and they make sure that your client’s pay for their outstanding invoices on time. Funds would be given to you as early as possible

• Factoring eradicate the need to spend time in collection from their clients, since the factoring company takes over these responsibilities to collect the balance.

• By using your own assets to finance your operations, you may be able to evade taking on more debt to raise more equity for running or developing your business.

Thus, factoring is a fast, easy and unfailing financial operation that allows you quick access to your working capital that is based on the financial soundness of your customers. So, this may be a good source for short-term financing when you need money for growth when you are unable to acquire bank loans.

Author Bio :This post is contributed by Steven Smith, an Editor of smallbusinessfriends.com, a business blog that shares tips and information about various business related topics. You can follow him at @SmallBizFriends