According to the Accounting Coach – the term bad debts usually refers to accounts receivable (or trade accounts receivable) that will not be collected. However, the impact of bad debts can also refer to notes receivable that will not be collected.

The impact of bad debts associated with accounts receivable is reported on the income statement as Bad Debts Expense or Uncollectible Accounts Expense.

When the allowance method is used, the journal entry to Bad Debts Expense will include a credit to Allowance for Doubtful Accounts, a contra account and a valuation account to the asset Accounts Receivable. The allowance method anticipates the losses and therefore requires the use of estimates.

Under the direct write-off method, the Allowance for Doubtful Accounts is not used. Rather, Bad Debts Expense will be debited when an account receivable is actually written off. The credit in this entry will be to the asset Accounts Receivable.

Is the impact of Bad Debts Harmful?

As they are called, the impact of bad debts is not good for your business. If you have a large number of bad debts, then you really need to take quick action and ensure that your accounts receivable process is being managed effectively. To say the least, the impact of bad debts are poisonous to your business.

Here are some essential tips, using which you can achieve a state of zero bad debts for your business:

Take Calculated Risks

Every time you work with a new client you need to ensure that you decide on the payment terms, well in advance. Work with clients who are financially stable and are capable of making payments in a timely manner. This is extremely crucial to reduce the payment risk that you run with each of your clients. Don’t run after every client – always choose your clients wisely.

Related Posts: Managing Cash Flow For SME’s and Startups

Define Your Payment Terms

Creating standardized payment terms documents is essential for your business. Giving early payment discounts is a useful way to get paid quicker for your sale. A late fee that is payable upon late payments must also be a part of the terms and conditions. Make sure that your customers sign the acceptance of the terms and conditions.

Reason Out

Every time a client delays a payment, look for reasons:

One reason behind delaying a payment could be dissatisfaction at the client’s end. This may be because of delayed or sub-standard products or services.

Find out problems if any in the invoicing workflow. This needs to check at the client’s end and at your end as well.

There are times when your client is facing a temporary cashflow problem. Consider their problem but ensure they are paying you at a later date that is mutually agreed upon.

Use A Collection Service

You can also hire a debt collection agency to ensure that the receivables are being collected on time. In the case of situations where nothing else is working, you can take the help of your lawyer to help you recover the payment.

Related Post: Digital Agencies: How to Keep A Healthy Cash Flow

Be Assertive

You need to clearly communicate the expectations you have from your client – as far as payments are concerned. This will always keep them alert about your payments. The more assertive you are about the importance of payments, the better will it be.

Be Stringent

As a business owner, you really need to be stringent about your payments. If a certain client consistently defaulting on the payments front, then you need to stop supplying products and services to that client. You might lose some business in the short run but this will be really rewarding for long-term business success.

Treat Each Case As Separate

It is not always important to be rigid with your terms and condition. A little bit of flexibility always helps in maintaining happy client relationships. If you feel that the client has some genuine problem, then allowing him some extra time to make the payment is quite harmless.

Dispute Resolution

As a business owner, you must ensure that the products and services delivered to the client are of desired quality. One of the key reasons for disputes between a buyer and a seller is quality or the delivery. If these are in order, there will be lesser reasons for a dispute or a delayed payment.

Analyze Reports

Generating financial reports and analyzing which of the clients are paying late, consistently, can help you take corrective action. Reports of outstanding, invoice aging and payments can be really helpful.

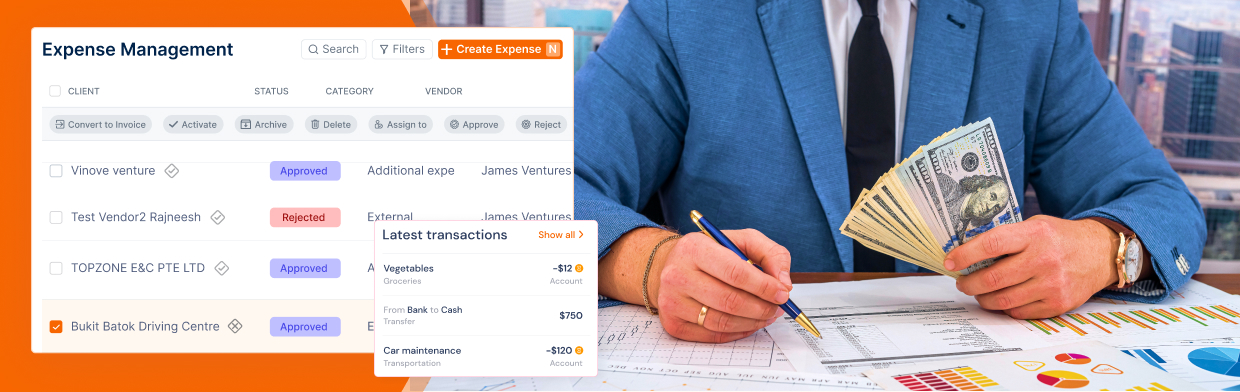

Choose an online Invoicing solution like Invoicera to ensure that you maintain a zero bad debt level in your business. Invoicera provides you with the following set of features:

1. Automatic Payment Reminders

2. Late Fee

3. Recurring and Auto Billing

4. Customized Solutions

Interested: FREE SIGN UP

FAQs

Q. Is the impact of bad debts harmful on companies?

A. Bad debt can be damaging to your business, especially if it happens frequently. Not being able to collect payments when you provide a good or service can slow your cash flow. And it can have a negative impact on your company’s bottom line. Late or missed payments can lead to serious business problems – from unhappy employees to not being able to maintain supply and demand for other customers.

Q. How do you deal with bad debt customers?

A. Following actions can be taken up while dealing with bad debt customers-

- Develop a motivated mindset

- Reduce your financial liabilities

- Friendly payment reminders should be conveyed

- Understand the root cause of the problem

- Don’t allow too much time to pass without taking action on unpaid debts

- Consider using a debt collection agency as the last action

Q. How long can debts be chased for?

A. As per the Limitation Act 1980, a creditor has 6 years to pursue most unsecured unpaid debts or 12 years for some mortgage defaults. This “limitations time frame” begins when you make your last payment or acknowledgment of the debt, not the entire time you have been making payments.

Q. Is allowance for bad debts an asset?

A. An allowance for doubtful accounts is known as a “contra-asset” because it reduces the amount of an asset, in this case, the account receivables. The allowance, sometimes referred to as a provision for bad debts, represents management’s estimate of the number of receivables that will not be paid by customers.

Q. What is the difference between bad debts and doubtful debts for example?

A. A doubtful debt is an account receivable that is probably going to go unpaid while, If it is clear that the receivable cannot be collected, the receivable must be classified as a bad debt. For example, if a customer secretly leaves the country to avoid payment or goes bankrupt, it is obvious that he will not pay his debt.

Q. How provisions for bad debts and reserves for bad debts are different from each other?

A. In the case of doubtful debts, we recognize the fact that we may have to treat the receivables as bad debts in the future – if they cannot be recovered. In accordance with the principle of prudence, the Organization, therefore, accrues an amount known as the provision for doubtful debts. This is recorded on the balance sheet.

In summary, the terms “provision for doubtful accounts” and “provision for uncollectible accounts” are used interchangeably in some textbooks, but they usually mean the same thing – it is a provision for doubtful accounts.