Effective management of cash flow is important for an organization to smoothen out financial ups and downs. A healthy cash flow helps you to easily forecast finances and have hurdle free business rides. The toxicity in cash flow management can cave paths to derail even a profitable company.

Startups and Small businesses have always been suffered by late payers, debtors and defaulters. Focus on better cash flow management to reduce the brink of the cash squeeze and steadily grow the business. Considering that this particular subset of clients continue to make life difficult for entrepreneurs, here are some tips for effective cash flow management.

Cash flow and profits are two different terms. You can have a profitable business, but a negative cash flow. So take time to analyze your business’s cash flow as soon as possible and make changes that will have a big impact on your cash flow.

- Analyse Your Credit Practices– It is always important to follow sound credit practices, especially while dealing with a new customer. Conducting a trade reference and a bank reference is helpful to know the credit worthiness of your new client.

- Invoice Promptly – Make sure to invoice your customers without any delay. The faster you mail an invoice, the faster you will be paid. If deliveries do not automatically trigger an invoice, establish a set billing schedule, preferably weekly. All invoices should include a payment due date along with invoice notes and terms and conditions.

- Follow up on Default Payments – Don’t allow an invoice to remain overdue for a very long time. As soon as a bill becomes overdue, call the customer and ask when you can expect payment. Ask delinquent customers with genuine financial problems to try to pay at least a small amount periodically. When necessary, don’t hesitate to seek professional help from an attorney or collection agency.

- Offer Trade Discounts – Offering discounts on prompt payments is a widely used technique to encourage customers for making timely payments. Given an incentive, some customers will pay sooner rather than later. Trade discounts typically give 1% – 2% off the total amount due if customers pay within a certain no. of days.

- Deposit Payments Promptly – It is always a healthy business sign when you have optimum working capital available. And sooner you make a deposit, the sooner you can put the money to work for your business. This speeds up your business cash flow and makes funds available for daily expenses.

- Review and Reduce Expenses – If you’re not sure an expense is necessary, hold back until you are confident it will have a favorable impact on the bottom line. Reduce operating costs such as switching from a weekly to a biweekly payroll to reduce payroll processing costs. Be careful not to cut costs that could hurt profits. For instance, rather than cutting the marketing budget, redirect the money to areas where it has a more positive impact.

- Pay Bills on Time – Even though you are required to pay for your bills on time, you can take the liberty to pay as late as possible but only to an extent where you do not incur late fees or interest charges. Exception could be made for bills where trade discounts are offered.

- Manage Inventory Efficiently – Inventory management is essential to maintain proper cash flow. Less cash tied up in inventory would invariably result in better cash flow. Also, make sure to order for additional inventory when current inventory level is down to bare minimum.

To Sum Up

These tips could prove very helpful for startups and small businesses in keeping the money flowing and healthy management. Cash flow management is an important part of the business cycle. Every strategy mentioned above helps you maximize the cash flow and provide streamlined benefits at each business step.

How Can An Online Invoicing Software Be Helpful?

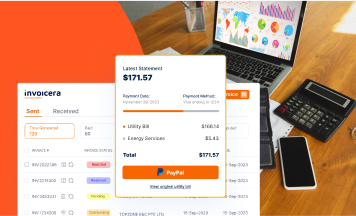

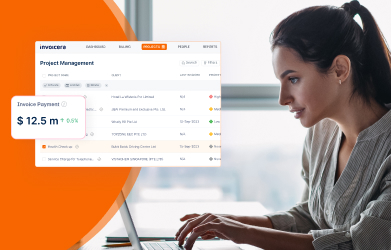

Adding more power to your business is always a good idea. Improved cash flow, and data security helps to enhance profitability through substantial gains. Using professional Invoicing and billing software like Invoicera helps to keep track and report on key business metrics.

Get the right mix of invoicing as well as business management features combined with attractive pricing scheme. Also, one of the key features unique to Invoicera is that it provides fully automated account receivable and payable management. Handle the business metrics like a pro with proper online invoicing solutions. SIGN UP TODAY TO SHIFT TOWARDS THE WORLD OF ONLINE INVOICING.