Small and medium sized businesses have always been troubled by late payers, debtors and defaulters. Considering that this particular sub-set of clients continue to make life difficult for entrepreneurs, here are some tips to keep the cash flowing.

Though there should be more stringent laws in dealing with such clients, this does not mean that small businesses are powerless in the face of the organizations they sell to.

Businesses are most likely to receive late payments from new customers; making them more vulnerable to new clients. Small businesses must be ready to negotiate terms when they receive an order, particularly from new customers.

Following are some tips:

- Send an estimate/quotation before sending the final invoice.

- Understanding and identifying the payment terms – where invoices should be sent, what references or order numbers should be quoted, and whether the customer only accepts online invoices.

- Have effective internal procedures in place: what level of credit checking is required and how frequently credit limits are reviewed.

- If there is a difference between your payment terms and theirs, don’t ignore the issue, negotiate.

- Make sure sales invoices meet the customer’s requirements, send invoices as soon as possible to the correct address and department, ensuring they comply with requirements for VAT invoices, and follow progress.

- Make notes of telephone calls regarding customer payments, including dates and times of conversations, to whom you spoke and the outcome, and take action quickly.

- Establish a policy on how long an invoice is allowed to be outstanding before resorting to debt collection and when supply of goods or services should be stopped.

- Regularly review the debtors’ ledger for customers behind with payment. Get sales staff to visit these customers to seek information and set targets for credit collection.

- Employ professional credit staff.

- Carefully consider potential orders with longer payment terms. Consider the implications for profitability, cash flow, financing and bad debts.

- Consider factoring or invoice discounting to help manage cash flow.

- Use business invoices as an instrument to retain customers by way of mentioning discounts, offers and other schemes at the footer.

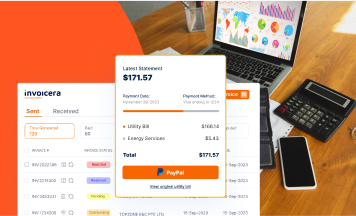

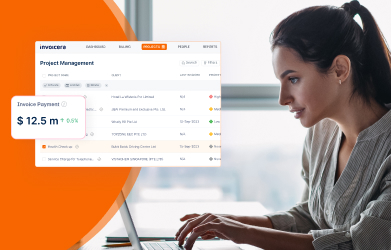

Using Online invoicing for the above purposes can be the best remedy. It offers clutter free invoicing and allows businesses to keep track of the payments effortlessly. It takes out the time required to maintain paper files from the equation.