Every organization, big or small, is always concerned about one big thing- finance management.

The proper financial management of small business holds the key to surviving the volatile economy and the extensive market competition. Taking financial decisions consciously from the very beginning will act as a stair guide to your business taking it to the higher levels of growth.

To run a business successfully, it takes a lot more than just a good idea. Every business needs a financial structure and guidance in order to generate maximum profits and stay credible. Entrepreneurs need to be equipped with good money management abilities to turn their venture into a successful story.

A report by Intuit says as much as 40% of business owners are financially unaware and inexperienced but still manage their finances themselves.

But that doesn’t mean all hope is lost; here we are, trying to aid you with five secrets to build better financial management practices.

Here Are 5 Secrets for Managing Small Business Finances

1. Educate Yourself

The first thing you can do to increase your area of financial learning is to educate yourself in the various aspects of finances. Beginners can start by learning how to read financial statements. It is one important document for you as it tells you where your money originated from, the number of hands it has traveled, and then its final resting area.

The cash flow statement is an analysis of your investments, operating activities and financial to & fro. The balance sheet of the company consists of information related to the company’s assets, liabilities and equity. Whereas, the income statement reflects the revenue earned within a specific period of time by the company.

2. Separate Personal and Business Finances

Mixing your business finances with your personal funds is never a good idea! Keep your personal and business finances separate. The best way you can opt for is by getting a business credit card and carrying out all your expenses through it. This is the best way you can keep a track of all your expenses without any hard bookkeeping.

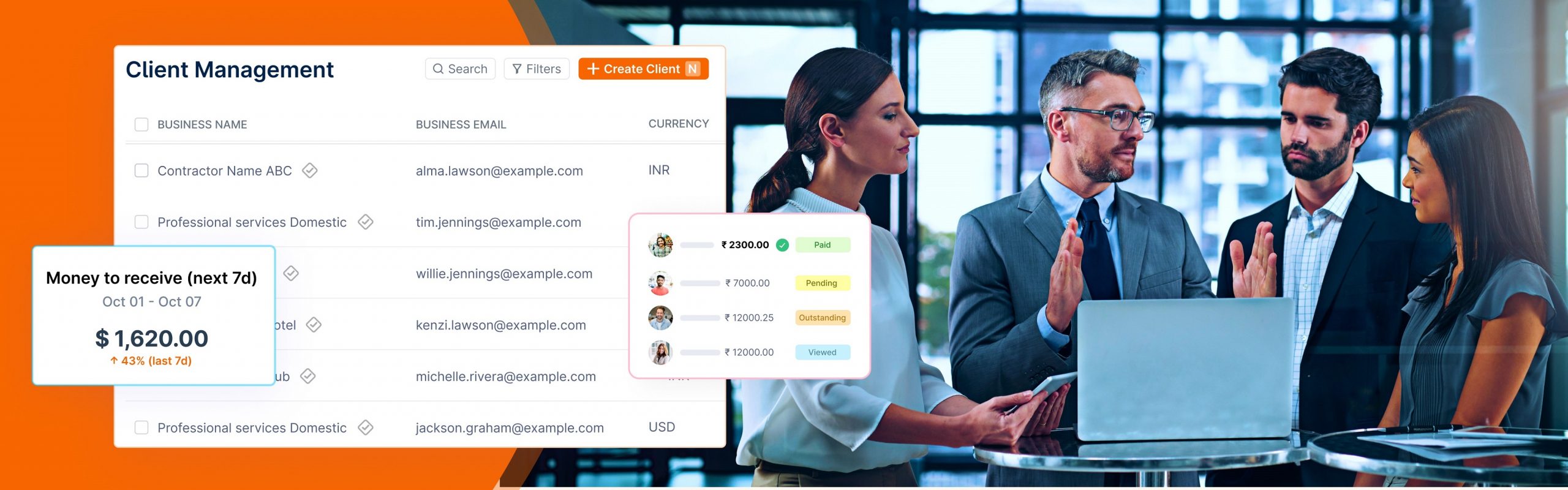

The other best way of keeping all your business expenses and cash flow on track and recorded is by opting for the best financial management software. The account management software will help you bill your clients, keep a track of all your finances and later on generate reports as and when required for analysis. Also, the best financial software lets you manage your taxes in the same dashboard without having to consult a different accountant or his team, saving you little extra money.

3. Cut Costs

For entrepreneurs, it is important to stay tight-fisted to keep their expenses on track without hampering regular business activities. The importance of the statement increases 10 folds when it comes to small business owners.

Every business has 2 types of costs that it caters to fixed and variables. While fixed costs are to be borne irrespective of your business profits status. There is a scope of saving your variable costs depending upon your business activities and exposure.

For Example: Instead of having an entirely dedicated accounts team, you can opt for account management software. This will help you to save bombs of money spent on fixed and variable costs and space. Also, the finance management software will work as and when you require it without asking much from you. The additional perks you get are that some of the cash flow software is actually free of cost. Boom! You have just saved your pocket from getting some major piercing.

4. Invest in Cloud-based Accounting Software

While you are investing in any regular invoicing software, it will add more to your to-do lists making your jobs more tedious. In order to make financing convenient opt for financial management software that will keep a track of all your financial incomings and outgoings without you having to take much of the headache.

Best financial management software for small businesses provides you with real-time insights as most allow you to save, update, track and access data from anywhere at any time. Whether you’re at the home, office or are travelling, you can conveniently work on the go with your data. It is error-free, hassle-free and dependable.

5. Monitor and Measure Performance

In order, to take leaps of growth, it is of utmost importance to keep a tab of every movement of your money most importantly when a large amount is involved. Keep a tab of all your past finance activities in respect to performance and then decide on your future plans, revenue, cash flow and activities.

The best way to keep your finances on track is by recording all of them in one single dashboard associated with a small business financial management software and generating and analysing reports as and when required.

Invoicera for Your Small Business

Although you can choose any suitable billing software in the vast market by comparing their features, Invoicera can be the best choice. Have a look at the below-mentioned features:

- Automated Invoicing:

You can automate the whole invoicing process and generate automated recurring invoices, ensuring you receive timely payments.

- Customization of Templates:

You can generate professional invoices with your own brand logos and impress your clients with customizable templates.

- Expense Tracking:

Juggling with multiple expenses, you can take help from this tool to record and categorize expenses. It can further let you monitor where you are spending your money.

- Cloud-Storage:

This feature of Invoicera makes the invoicing job easy, as you can access cloud storage from any corner of the world.

- Integrated Payment Gateways:

So far, Invoicera offers 14+ payment gateways, aiding clients to choose any preferred method and making the transaction job easier.

Conclusion

Owning and running a business can be exciting and nerve-wracking at the same time. Especially when it comes to handling finances and expense for the business. Don’t let your business suffer because of poor financial management. Keep the above tips in mind and lead your business to the paths of success.

Without cash, profits are meaningless. Many small businesses come to an end because of stagnant cash and slow cash flow. Organisations that don’t follow good finance management skills often lead to troubles. along with critical thinking, it is also important to invest in the best financial management software like Invoicera.

Invoicera is one of the leading online invoice software in the market. The cloud-based invoicing and billing software has catered to more than 3.5 million users around the globe for the past 16+ years. The software can be customized according to individual business needs and works for Enterprises, Small Businesses and Freelancers.

The invoicing software offers many unique features customised to the specific business needs of freelancers, small businesses and enterprises. It helps you to automate and simplify your business processes and communication with online invoicing and payments, expense management, recurring/subscription billing, client/vendor panels, time tracking, invoice approval process, multi-lingual & multi-currency support, staff permissions, financial reporting & analysis, purchase order management.

Have you come across some serious cash flow? How did you resolve it? Let us know in the comment section below your finance management tips and tricks.

FAQs

Q. Can I manage Business finances with this Financial management solution?

A. Invoicera offers a complete solution to managing your invoices, payments and cash flow to have control over your profit & loss statement.

Q. Does Invoicera helps in Cash flow management?

A. Invoicera is the best financial management software to keep an accurate track of your cash flow. It makes sure all of your accounts payable and receivables are automatically tracked for you to have a complete analysis of cash flow.

Q. How Invoicera is the Best Financial Software for Small businesses?

A. Invoicera is the best business financial management software for small businesses because it offers accurate forecasting of finances with detailed reports created with Invoicera. Expense, staff productivity, project, and estimate, generate all the reports from the same dashboard. Keep your business performing and growing!