Moving to electronic payments makes bill payments easier, quicker and efficient.

Checks are being used! Why?

- – As 41% of the entrepreneurs believes that some suppliers don’t accept electronic payments

- – No hidden fees on paper checks

- – Ease of use (8%), floating checks when short on cash (1.8%) and not trusting technology (1.5 %)

Although these benefits count on, yet the importance of electronic transactions does not come to an end.

The payment information can be easily accessed 24/7. Electronic payments have given more confidence in respective job performance (33.7%), other vendors (10.1%), purchasing decisions (10%) and in hiring (25%) by executives.

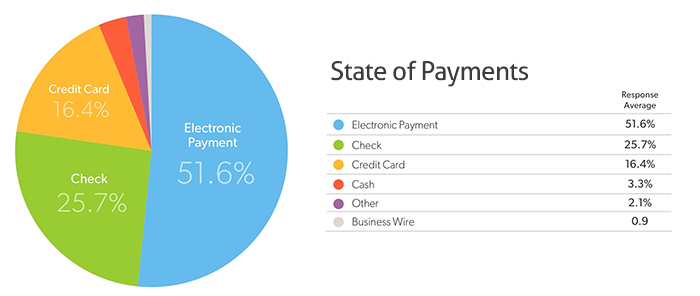

According to the recent survey:

- – Nearly 30% of the entrepreneurs moved to both electronic payments and electronic invoicing

- – Meanwhile, there are many entrepreneurs who admits to implement electronic payments varies from 36%-40% in the recent years

- – Majority of 26.9% have moved to electronic payments

- – Also, 6% said they would never move to electronic payments

Bank account connected to account receivable and payable management:

The majority of entrepreneurs admitted that banks could lure them away with offers on electronic payments and invoicing. This makes around 35% of the entrepreneurs to consider opening a new bank account if it can receive and send electronic payments.

80% of the entrepreneurs agreed that better cash flow management comes with integrating their bank accounts with invoicing and payments

Over a quarter (27.2 percent) expected to pay per transaction with no monthly fee, while (13 percent) expected to pay between $1 and $9 monthly for unlimited electronic invoicing and payments.

Related Post: Estonia mandates e-invoicing

Conclusion:

The survey data clearly shows that traditional invoicing and the old payment process are the big pain point. Rather than chasing down invoices, payments and bills, look for the solution that addresses the needs when it comes to cash flow management.

Invoicera, the most powerful Online Invoicing and Billing software come up with a range of features to manage business processes effectively and efficiently. It caters to a complete range of enterprise business verticals with an ever-growing user base of satisfied customers. Invoicera is integrated with 25+ global payment gateways.

Here are a list of features:

- – Simple and quick payment options from across the globe

- – Integration with existing ERP and CRM solutions

- – Control business expenses, estimates and track time

- – Custom workflow management and more

Use e-Invoicing to increase efficiency and improve cash flow : Try For Free