It happens quite often that many small scale enterprises simply focus on generating only direct revenue even to the extent of neglecting the proactive management of the business expenses. They fail to realize that eventually, only the gross profits are significant which are calculated after deducting the expenses from the revenue generated. Now, if the small businesses focus themselves on managing their expenses well, they can easily increase their sum of profits. Expense management is an extremely important strategy and must be worked upon with complete dedication.

Here are a few tips that you must consider in order to improve your business expense management –

Here are a few tips that you must consider in order to improve your business expense management –

1) Prepare For Tax Time :

It is highly imperative for small and medium scale enterprises to have a good hold on record-keeping as it is highly beneficial. Now, it is an obvious fact that every business owes a certain percentage of their profits as taxes to the Internal Revenue Service (IRS). Apart from this, the business expenses are deducted from the profits, hence the tax is calculated only on the final revenue generated. In order to have the expenses acknowledged by the IRS, you must maintain the receipts and accounting records perfectly.

2) Never Mix the Business and Personal Expenses :

The personal and business funds must always be evaluated separately. The bank accounts, credit cards/debit cards must always be separate for your business transactions and their use must only be confined to corporate expenses. This way, you can easily keep a record of all the business receipts and keep them for easy future reference. The best way to keep them organized is by maintaining a neat spreadsheet which clear indications about each entry.

3) Track the Expenses Efficiently :

A number of small-business expense management programs usually offer a detailed chart of accounts. By referring to it, one can easily get the information about the allowed tax-deductive business expenses. These expenses normally consist of the use of your automobile for your business, your house facilities, meals, travel, and other expenses solely for payroll and subcontractors along with capital equipment. You must ensure proper tracking of all the petty cash expenditure as well.

Read More: Are Your Business Expenses Going Out of Control?Here are some tips.

4) Hire a Professional In Case You Feel the Need for One :

You may be a good entrepreneur; however, it is not always certain that you can handle each and every portfolio yourself. You may not always hold the appropriate knowledge about the remuneration of business equipment or else, you may not be sure whether to claim a certain deductible or not. You must always hire someone knowledgeable and expert in this field. An accountant or tax agent can easily handle your business expenses without any hassles as they are always aware about the latest changes in tax laws. This helps you to always be free of any extra tax-penalties thereby, increasing your revenues.

5) Stay Up-to-date With the Technology :

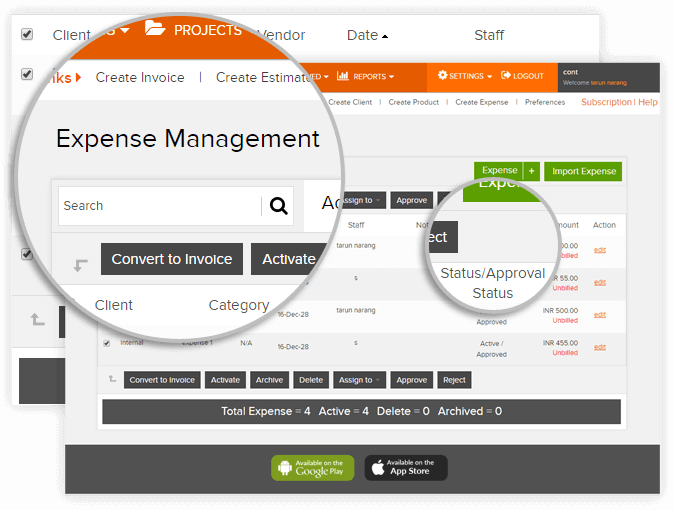

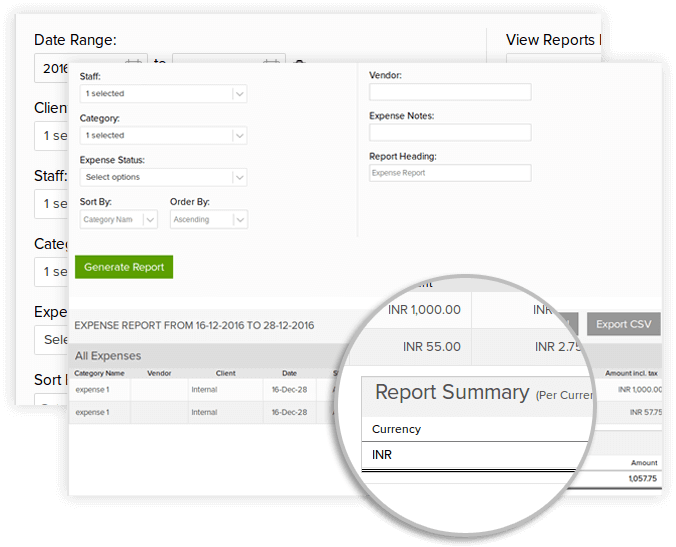

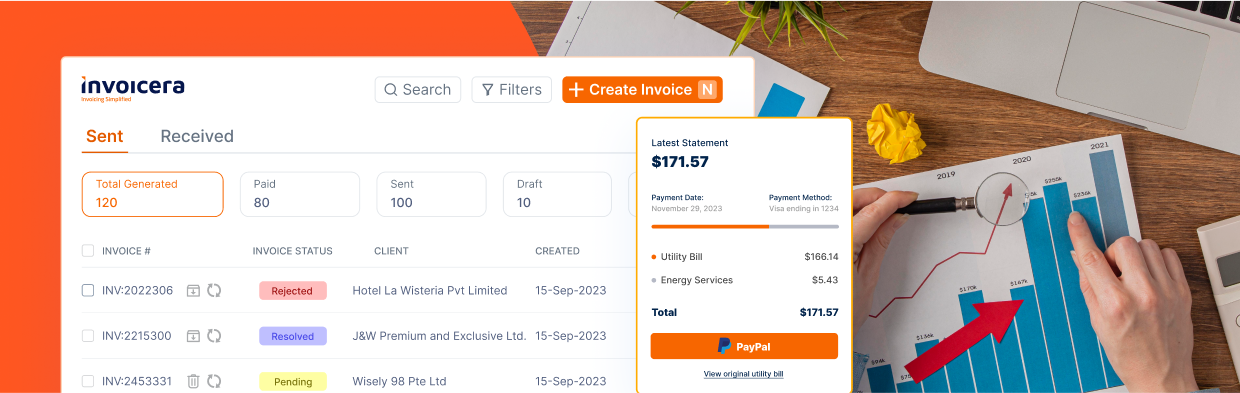

In the present era, there is nothing for which a software is not designed. Same is the case with business expense management. The automated expense management software like Invoicera which make tracking and management of expenses extremely easy. You must explore all the features of the software in order to get fully benefited from it.

Now that you are aware about the expense management software, you must also know the benefits of using one. Following are the enlisted benefits and uses of an expense management software –

-> Users can easily track and record their expenses through the portal and save it for future reference.

-> Approval of the claims that you submit at the IRS is quick, easy and electronically configured.

-> The details of each and every claim is neatly presented.

-> Expense Management Software are flexible and can be operated with ease.

-> A user can easily keep a track of the accounts of each and every client.

-> The greatest benefit of using Expense Management Software is that they save on your time wasted in creating paper trails.

-> Through the means of a technically advanced software, you can make the payments for your employees easily and instantly.

-> Users can easily carry out currency conversion to be sure about the payment that their clients owe them.

-> The expense management software can further be encoded to label and ban entries that cannot be counted as tax deductibles. In fact even certain thresholds can be set for expenses that include the meals and accommodation charges.

Invoicera offers a complete online solution for invoicing / billing & expense management for your organization’s unique needs.