Many contractors started signing the projects, earning as a side job, then slowly it became their business as independent contractors. This means now the independent contractors should undergo basic requirements. You must be thinking, ‘as long as I am working and getting paid, will this really matter?’ The answer is: yes, whenever you provide service to your client and receive payment, you must go through several government policies, even if you work for an hour, week, or month.

Let’s know what these basic requirements are.

What are the minimum requirements as an Independent Contractor?

When starting from the basics, these 4 things are essential criteria when you are starting off as an independent contractor:

- Ensure at first that you are an Independent Contractor

- Select unique Business name

- Get a Tax registration certificate

- Pay tax as per your business income estimates

——————————————————————————————

Also Read: A Guide To Creating A Professional Contractor Invoice

——————————————————————————————

Ensure that you are an Independent Contractor

At first, you must make sure you are an independent contractor working in a business for yourself. If you are working under someone else’s control, then you are an employee. As an independent contractor, you have the right to control what and how to do the job.

If you are entitled as an employee, you will be working for one particular organization. Employees get health insurance, and companies will also bear expenses for equipment to work on. On the other hand, if you are an independent contractor, you need to invest in all the equipment. Furthermore, you can easily handle your expenses very efficiently with online expense management, which saves data on the cloud.

Taking the below points into consideration will help you be sure that you are an independent contractor. Check out:

Test for Independent Contractor Status

In clear context, there is no such particular test that governs a worker’s status. However, many government agencies follow the ‘right to control test. From this test, you can calculate your work status as an employee or independent contractor. The test underlines, if the hiring firm control’s every bit of your work,i.e. what, when, where, and how the work has to be done then you are designated as an employee. But, if the firm has negligible control over your work from the first stage to the final delivery then, you can be considered as an independent contractor.

Some factors that can be counted as an independent contractor:

- Working for multiple clients at the same time

- No interruption from hiring firms

- Invests business expenses oneself

- Works according to their own time schedule

- Using written independent contractor agreement

Are Gig workers and Independent Contractors the same?

The gig worker can be identified as the workers who work for online hiring platforms like Upwork, Postmates, Uber, Lyft, and many other platforms. Gig workers who work as the employee-employer term for less duration and have the freedom to work with their flexibility set their own working hours, choose or leave the job.

But, many online firms have control over the assignment decision, payment criteria, and other aspects that are not similar to independent contractor-client relationships.

However, the research states that California is trying hard to classify gig workers as independent contractors.

Select unique Business name

To have a professional look in the market and to get a value addition, you need to have a business name rather than using your name on an invoice or business card. Thereafter, get it registered with the government. Many business owners don’t want their name to be registered as the legal person of his/her business. Such people can get it registered as a fictitious business name, also known as an assumed name, or DBS (doing business as). For instance,

There reason why it is necessary to register the business name are:

- The customers will have a straightforward approach with the business owner for complaints.

- Bank will disapprove the account as your business name until you provide ID proof.

- You won’t be able to enforce any action if you sign a contract under an unregistered name.

———————————————————————————————————————

Must Read: 6 Common Invoicing Mistakes Contractors Commit

———————————————————————————————————————

How to register as a fictitious business name?

Different countries generally have different processes and charges. Like in California and many other states, it is registered on the country level by the country clerk. And, in states like Florida, the registration is on the state level by the Department of State. In suggestion, you should reach out to the country clerk’s department and ask for the information, i.e., procedure, requirements, and the fees.

Alternative Way

If you use your full name as your business name, there is no requirement to register it.

Get a tax registration certificate

Many cities and countries want every business to be it small business (a single-handed business), home-based work to register with local tax collectors, and get a tax certificate. This certificate can be defined as a business license that you are doing business in a particular city. And, to get the privilege to set up your business in the city, you need to pay tax.

Alternative Way

Some businessmen avoid or fail to register with the tax collectors. Thus, they can be under the local government’s radar. However, the registration cost is inexpensive, but the penalty for running the business without a license can be hundreds of dollars.

Pay tax as per your business income estimates

Being an independent contractor, you are responsible for all works, i.e., completing tasks, tracking ROI, and managing your tax. Thus, you need to save the money for paying your Tax at the end of the year.

If your business income is $400 and above, then you should report this income to the IRS. Furthermore, if your income is a significant profit, the IRS asks you to pay in four installments (estimated taxes).

How to manage IC taxes?

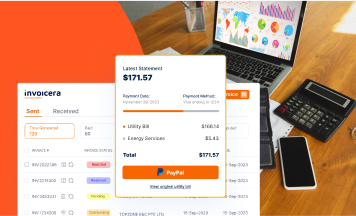

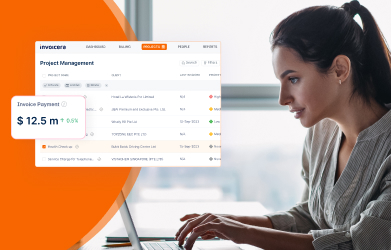

Well, as an independent contractor, you will have multiple projects at a single time. Working on the tasks can be easy as compared to managing your income taxes. To make this process simple and hassle-free, you can use contractor invoice software that will single-handedly manage your reports, expenses, track ROI, and tax calculation automatically.

Many freelancers, self-employed or independent contractors are already using this software in different parts of the world. You may find different varieties of such custom invoicing software in the market. Choose the one that meets your requirements in your budget. According to our research, Invoicera software can be a feasible choice for independent contractors as it has 18+ features at 0 cost charge.

How to register with the IRS as an IC?

To be identified as an independent contractor taxpayer with the IRS, you simply have to pay the estimated taxes. You can get the estimated tax form from the official site of the IRS. (Form 1040 ES)

———————————————————————————————————————

Related: Top 5 Invoicing Best Practices For Consultants and Contractors

———————————————————————————————————————

Final words

Once you complete the 4 basic steps, you can provide service as an independent contractor. Among these four steps, the major concern under your surveillance is tracking the ROI of your business and tax calculation every year. Thus, as explained above, the safe and secure way is using contractor invoice software to avoid any interrogation if your manual accounting turns out wrong by chance. Therefore, don’t leave any room to get any objection as an independent contractor.