Business expenses can put a lot of pressure on profits if not controlled properly. For a business to grow consistently, one has to ensure that expenses are controlled equally consistently. Reducing the operational costs is the proven practice to gain better margins. A profitable organization is the one which is able to keep a check over its expenses, not the one which can sell more. Proper assessment of profit loss statement can have an adverse impact on the performance of your business.

Thus, expense tracking can be accredited for keeping an organization profitable and yielding.

Are Your Business Expenses Going Out of Control? Here are some tips.

1) Hire Remote Contractors

Hiring employees who work in a remote location, ensures that you can save on fixed infrastructure costs and hire them on temporary basis. These people do not require social security and medical benefits which is an additional expense while hiring full time employees. Cloud tools and simplified communication helps hiring such resources which can be a cut business costs.

2) Travel Expenses

Many a times, a business owner does not realise when the travel expenses got out of control. For this, one has to be vigilant about the amount of travel that one is doing for business purposes. The same has to be evaluated on an individual employee level. Putting business costs as priority on employee travel expenses is a useful way to control these expenses. Employee orientation helps to cut business costs to an optimum level.

3) Managing An Appropriate Level of Inventory

Inventory, both in terms of goods and human resources ( in case of services ) needs to be managed efficiently. This is crucial for prevention of a liquidity crunch caused due to excessive inventory in the organisation. Inventory can be streamlined by analyzing demand and supply on a regular basis and back ordering only as much, as required. This can help you invest the surplus funds at the right places where the return on investment is optimum.

Read More: Purchase Order: Component of Effective Inventory Management

4) Know About Your Tax Deductions

Being aware of all tax deductions can help you save on taxes and reduce your tax burden. Keeping all the records of expenses with actual receipts helps to cut business costs a smooth manner.

5) Keep a Check On Expense Reports

Ensuring that your employees are submitting genuine expenses and expense reports is very important for your business. Having an employee expense policy in place, helps in keeping a check on fraudulent practices. One has to keep a check on employees doing a double bill or a personal expense addition. Strict action must be taken against such employees to set the right example for others.

6) Control Fixed Costs

Office rentals, vehicles for travel and other fixed assets must be planned well. The return from each invested fixed asset must be understood before acquiring any. Controlling fixed business costs can save a lot in terms of the overall expenditure of the company.

7) Productivity Management

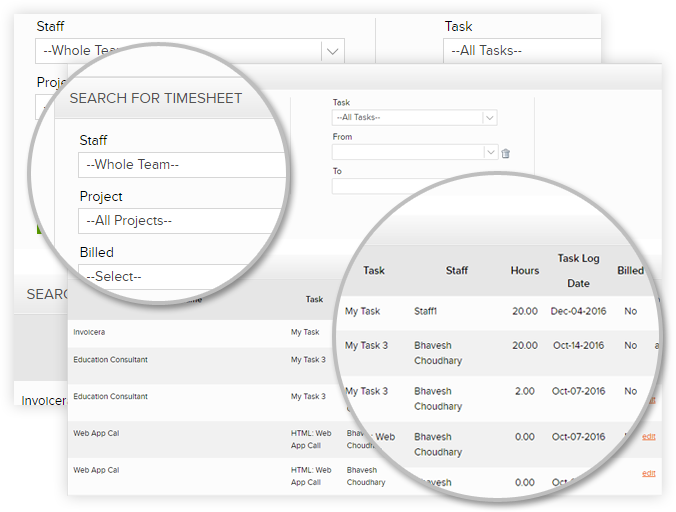

Employee productivity can be a huge factor in saving costs for the company. Leakages in the system can be easily reduced by managing the productivity of the employees in a better way. Encouraging them to use online invoicing tools for better productivity and collaboration is a must. Using a time tracking software is essential for tracking how productive the employees are and how can they improve.

ABOVE ALL:

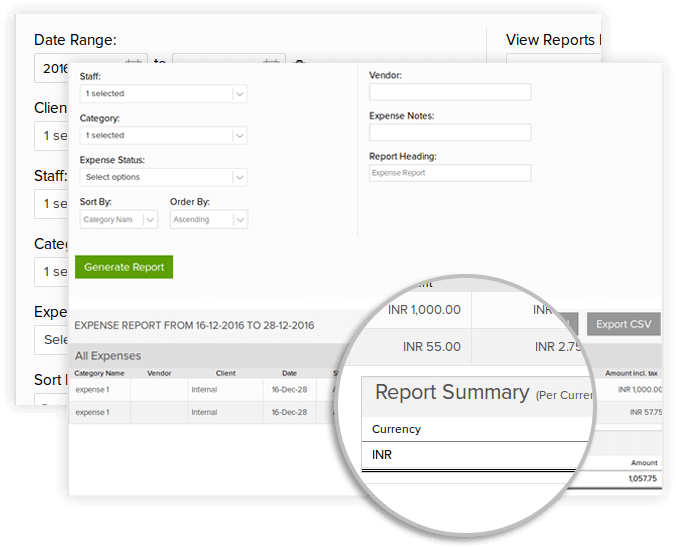

At a time when all organisations are looking to lower operational costs, online expenses offers businesses to eliminate bottlenecks in your processes. You’ll see your costs go down. The availability of expert expense tracking software has taken the burden off the shoulders of business professionals. Now with the help of expense management software, business owners can easily track down expenses, without losing their mind. Online Expenses replaces slow, inaccurate manual processes with an automated and accurate process to save time and money.

Invoicera To Reduce Operational Costs! How ?

Managing expenses more efficiently, using an expense management software helps keep a check on expenses, anytime, anywhere. Tools provide interesting features like approval and rejection of expenses, ensuring complete control over expenses. Expense reports are useful in analysing expenses, periodically and ensuring corrective action wherever necessary.