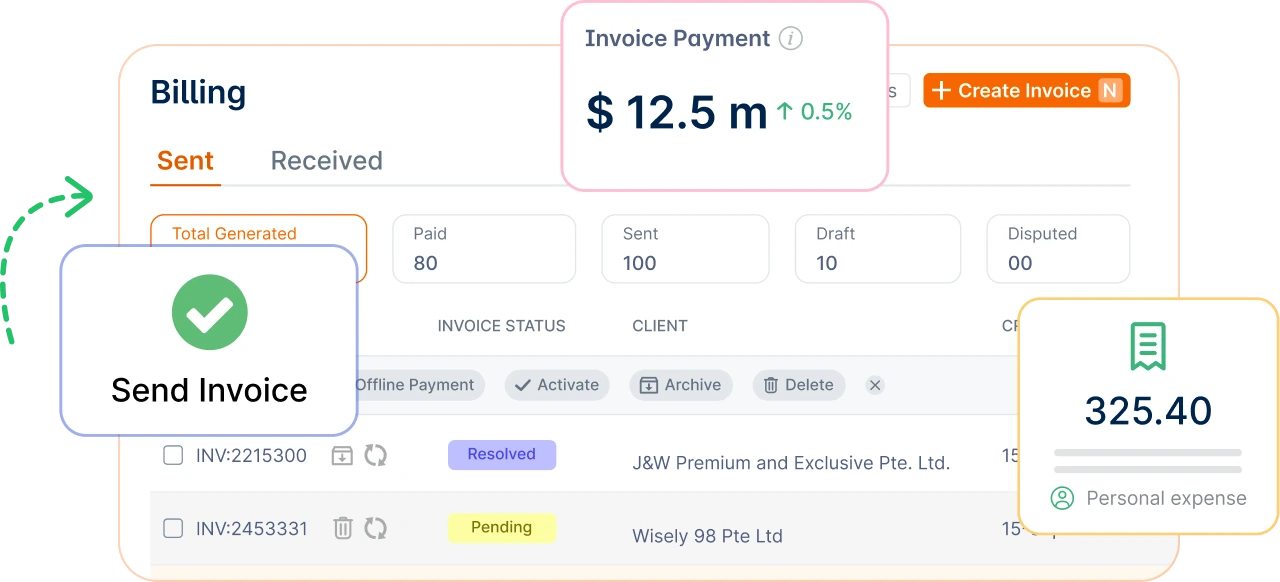

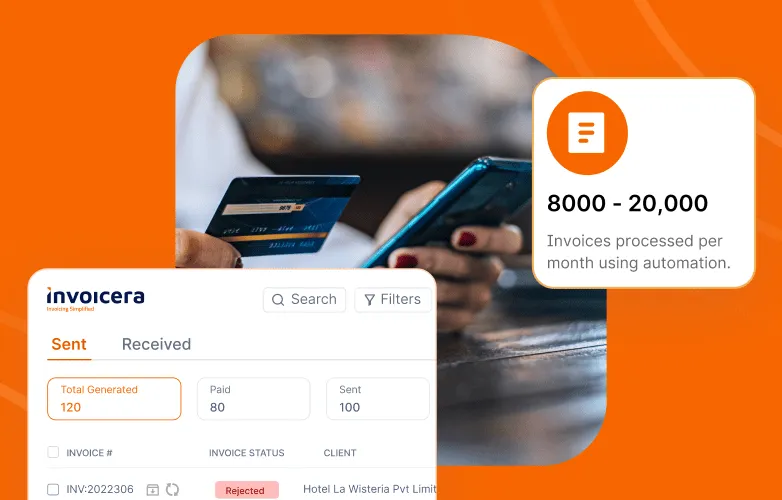

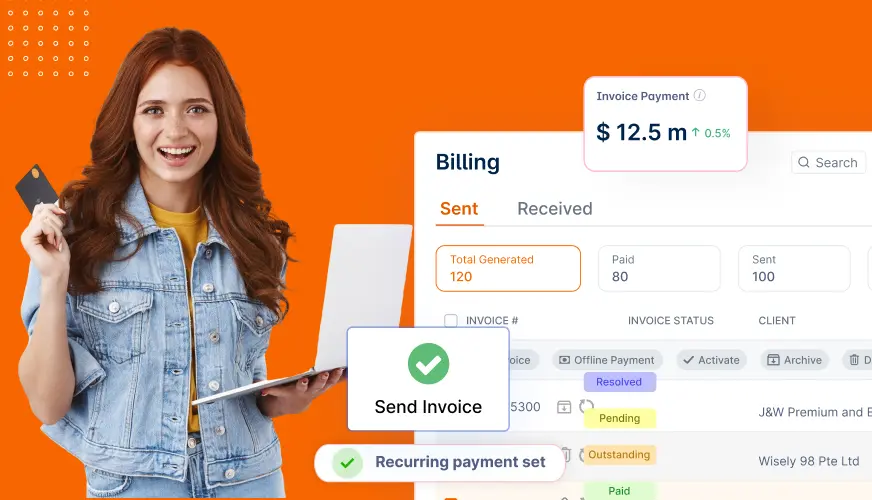

Organizations have started adopting automation as the right solution to overcome these challenges. Using the specialized accounts receivable and accounts payable software can help to make these processes faster and more accurate.

In this blog, you will learn potential AR and AP management issues and 13 top AR and AP software solutions to resolve them.