Is managing finances proving a headache for you?

If yes, you are not alone in this. Whether running a start-up or an established organization, you will face challenges managing finances if you don’t have a dedicated and modern financing solution in place.

Another two common problems are:

- Having an outdated payment management system

- Not properly implementing the system

Traditional paper-based payments have long been frustrating for enterprises, bogging down with time-consuming processes and potential security risks.

Amidst this backdrop, digital payments emerge as a game-changing solution, offering a seamless and secure alternative to traditional methods.

This blog post aims to discuss every difficulty associated with paper-based payments and explore the transformative potential of digital payments. As a takeaway solution, you will get familiar with the modern finance management system Invoicera and how to implement it to help you manage your digital payments and other financial operations.

Let’s dive in.

Challenges in Traditional Enterprise Transactions

1. Cash Handling and Security Issues:

Dealing with hard cash can be a logistical nightmare for businesses, leading to security vulnerabilities and the risk of theft or loss. Counting, storing, and transporting cash safely adds unnecessary complexity to daily operations, diverting valuable resources from core business activities.

2. Manual and Paper-Based Processes:

The reliance on manual and paper-based payment processes leads to a slow and error-prone system. Labor-intensive tasks such as invoice generation, physical check writing, and mail deliveries contribute to delays and inefficiencies, hindering swift payment settlements.

3. Delays in Payments and Settlements:

In traditional enterprise transactions, payment processing can take a lot of work. Waiting for checks to arrive, clear, and settle can disrupt cash flow, affecting vendor relationships and creating uncertainties in financial planning.

4. High Processing Costs:

Paper-based payment management comes with hidden costs, including printing, postage, and administrative expenses. These costs can quickly accumulate, affecting profit margins and hindering financial performance.

5. Limited Payment Options:

Traditional payment methods often offer limited choices, making it challenging to accommodate diverse customer preferences. The lack of digital payment alternatives can alienate tech-savvy consumers and limit the potential for broader market reach.

What are Digital Payments?

Digital payments refer to electronic transactions that enable individuals and businesses to make payments or transfer money using various digital channels. These channels include online platforms, mobile apps, digital wallets, and electronic fund transfers. Digital payments, compared to traditional or paper-based payment methods, provide convenience, speed, and increased security, revolutionizing how we exchange money.

Importance of Digital Payments in Enterprises

Discussing facts and stats on how enterprises pay digitally

Efficiency and Speed

Digital payments streamline financial processes within enterprises, eliminating the need for time-consuming manual tasks. With just a few clicks, businesses can settle invoices, process payroll, and make vendor payments instantly. This efficiency saves time, enhances overall productivity, and reduces operational costs.

Enhanced Security

Traditional payment methods involving checks or cash are prone to theft and fraud. In contrast, digital payments offer robust security measures, such as encryption and authentication protocols, protecting sensitive financial data and reducing the risk of fraudulent activities. This security boost fosters trust among customers and partners.

Global Accessibility

Digital payments can cross geographical boundaries, enabling enterprises to conduct international transactions seamlessly. With the ability to send and receive payments in various currencies, businesses can effortlessly expand into global markets, reaching new customers and establishing international partnerships.

Customer Convenience

By embracing digital payment options, enterprises can cater to the evolving preferences of modern customers who seek convenience and seamless experiences. Whether online purchases, mobile payments, or contactless transactions, digital payment solutions offer a smooth and user-friendly customer journey, ultimately enhancing customer satisfaction. Small companies can use proposal software to automate billing and payments, streamlining their financial processes even further and boosting customer satisfaction.

Data-Driven Insights

Digital payments generate valuable data that can be leveraged for business insights and informed decision-making. Enterprises can analyze transaction patterns, customer behaviors, and spending trends to refine marketing strategies, optimize inventory management, and enhance overall business performance. If your business uses MySQL, migrating data from MySQL to BigQuery can further enhance your ability to process and analyze large datasets for deeper insights.”

Cost Savings

Traditional payment methods often have hidden costs, including paper, printing, and manual processing expenses. Embracing digital payments helps enterprises minimize these overheads and save costs in the long run. Additionally, digital payment solutions often offer competitive processing fees, which can be cost-effective for businesses of all sizes.

Seamless Integration

Digital payment systems seamlessly integrate with other financial and accounting software, streamlining record-keeping and financial reporting. This integration simplifies reconciliation processes and provides a holistic view of the enterprise’s financial health, facilitating better financial planning and forecasting.

Popular Digital Payment Methods for Enterprises

Popular Digital Payment Methods for Enterprises

Embracing digital payment methods streamlines financial operations and enhances efficiency and security. Here are some of the most popular digital payment methods for enterprises:

a. Electronic Funds Transfer (EFT):

Electronic Funds Transfer, or EFT, allows seamless money transfer from one bank account to another electronically. It eliminates the need for physical checks, reducing processing time and ensuring faster payments.

b. Automated Payments Software:

Automated payments software, such as Invoicera, simplifies and accelerates the invoicing and payment processes. With integrations with various payment gateways, it helps businesses manage cash flow effectively.

c. Mobile Payments:

Mobile payments leverage smartphones and mobile applications to facilitate transactions. Businesses can receive customer payments with a simple tap or scan, making it convenient for both parties.

d. Virtual Credit Cards:

Virtual credit cards are a secure way to make online payments. These temporary card numbers offer enhanced protection against fraud and allow controlled spending.

How can Automated Software Streamline Transactions?

Automated software has numerous benefits to enhance financial processes and overall productivity. From saving time and costs to reducing manual invoicing, it helps staff focus on other important tasks.

Moreover, with customizable features provided by Invoicera, businesses can incorporate brands into invoices, increasing professionalism and reinforcing brand identity.

What to Look for in Digital Payment Platforms?

Payment Options Diversity:

Look for software that offers various payment options to cater to your customer’s preferences. Multiple choices, from credit cards and bank transfers to digital wallets and mobile payments, ensure seamless transactions.

User-Friendly Interface:

A user-friendly interface is vital for both your team and customers. An intuitive platform reduces the learning curve and streamlines payment processes, enhancing overall efficiency.

Mobile Compatibility:

With the increase in mobile transactions, make sure your platform is compatible with a wide range of devices and operating systems. This allows you to serve customers as per demand and accept payments quickly.

Invoicing and Billing Integration:

Select a platform that connects smoothly with your invoicing and billing processes. This interface streamlines the payment process, ensuring invoices are paid on time and correctly.

Advanced Reporting and Analytics:

Robust reporting and analytics help you gain insights into your transaction data. Look for platforms that offer detailed reports on payment trends, customer behavior, and financial performance.

Security Considerations for Digital Payments:

When you go for any digital enterprise payment system, you must consider the following security aspects:

a. Two-Factor Authentication:

2-factor authentication is an extra layer of protection that asks users to perform an additional verification step, such as entering OTP, TOTP, etc., to access their accounts.

b. SSL Certificates:

Ensure the platform uses encryption and SSL certificates to protect sensitive data during transmission, like credit card details and personal information.

c. Fraud Prevention:

Systems must have strong fraud detection capabilities; otherwise, there could be chances of losing sensitive or important financial data.

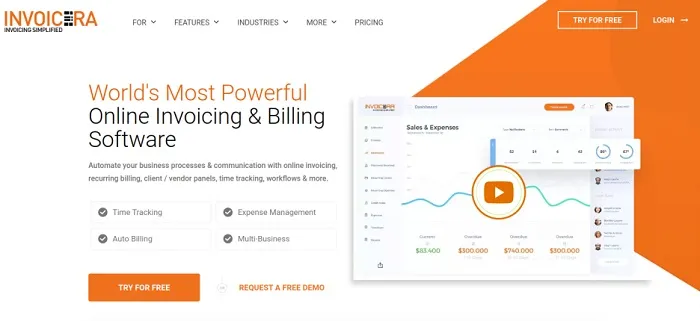

Invoicera is a comprehensive automated software with all the essential features for efficient invoicing and payment management. It supports multiple currencies and languages, has strong security features, and is simple to integrate with numerous payment gateways. These qualities make it an excellent alternative for organizations looking for smooth financial operations.

In light of transforming enterprise transactions, understanding network security practices like vulnerability scanning is essential. As digital payment systems grow, such scanning can identify potential security risks before cyber threats exploit them. Regular vulnerability scanning for network security helps protect sensitive financial data from fraud and enhances compliance with regulatory standards.

Simplify Enterprise Transactions with Invoicera

Invoicera Features

1. Customized Invoicing

Create professional and customizable invoices that reflect your brand identity. Add logos, personalize colors, and tailor invoice templates to impress clients.

2. Recurring Payments

Automate recurring payments for subscription-based services or regular billings. This feature ensures a hassle-free experience for both you and your clients.

3. Multi-Currency and Multi-Language Support

Expand your global reach with Invoicera’s multi-currency and multi-language capabilities. Invoice clients in their preferred currencies and languages, enhancing international transactions.

4. Payment Gateway Integrations

Invoicera seamlessly integrates with popular payment gateways, enabling your customers to make payments conveniently through various channels.

5. Expense Tracking

Monitor and manage expenses efficiently with Invoicera’s expense tracking tools. Keep a close eye on your financials to optimize spending and boost profitability.

6. Real-Time Reports

Gain valuable insights into your organization’s performance with detailed real-time reports. Track payment trends, overdue invoices, and outstanding amounts to stay on top of your finances.

Conclusion

Undoubtedly, digital payments help a lot in streamlining enterprise transactions. With many user-friendly features, advanced security measures, and seamless integration capabilities, digital payment platforms like Invoicera have revolutionized how we conduct financial transactions.

The diverse payment options and mobile compatibility it offers cater to the dynamic needs of modern consumers, fostering convenience and efficiency.

It’s time to unlock new levels of success with the power of digital payments. Get started and try Invoicera today.

FAQs

Are digital payments secure for enterprise transactions?

Yes, generally, digital payments are secure. But always consider a reputable platform with robust security measures, as protecting sensitive data is essential for any business.

How can Invoicera help in better cash flow management for enterprises?

Digital payments and Invoicera significantly improve cash flow management for enterprises. With quicker and automated payment processing, businesses can receive payments faster, reducing the time between invoicing and receipt of funds.

What is one security feature of digital payments?

One security feature of digital payments is encryption, which involves encoding sensitive information such as credit card numbers, personal identification details, and transaction data into a secure format to prevent unauthorized access or interception by cybercriminals.

Popular Digital Payment Methods for Enterprises

Popular Digital Payment Methods for Enterprises