Introduction

Entering the 21st century, it’s hard to imagine that you can still conduct transactions without physical currency. That might not be the case in the future, though, as we move toward an era when traditional forms of exchange could become less common and businesses deal exclusively with digital transactions.

A society without physical currency is becoming an inevitability as electronic payments and online money transfers become increasingly popular across the globe, particularly in urban areas where physical transactions are expensive and inconvenient.

This shift to a completely digitized society could yield numerous benefits for consumers and businesses alike, but there’s still some uncertainty over how this change will happen in practice.

Cashless societies have been talked about for years, but now it’s starting to feel like the inevitable choice worldwide. And if you haven’t yet done so, it’s time to start getting prepared because a cashless society will change how you transact and how your business operates.

To understand why a society without physical currency seems inevitable, consider the following three reasons why it will become the norm in the near future.

But before getting started with those three reasons, let’s first understand the Cashless Society.

What Is A Cashless Society?

A cashless society is one in which cash is not used as an official medium of exchange. Instead, people pay amount through electronic transactions, typically via a debit card or credit card.

Looking back in history, we’ll discover that cashless systems have long existed. The well-known barter system was one of the popular exchange methods at the time.

By being cashless, businesses can avoid lost or stolen payments and fraudulent payments. Also, it makes accounting easier because payment records can be recorded immediately and in real-time.

To sum up, the impact of cashless society is it will help reduce fraud, theft, and paperwork. It will also improve business management by enabling you to have more precise tracking of cash flow, revenues, and profits.

Different Types of Cashless Payments Mode

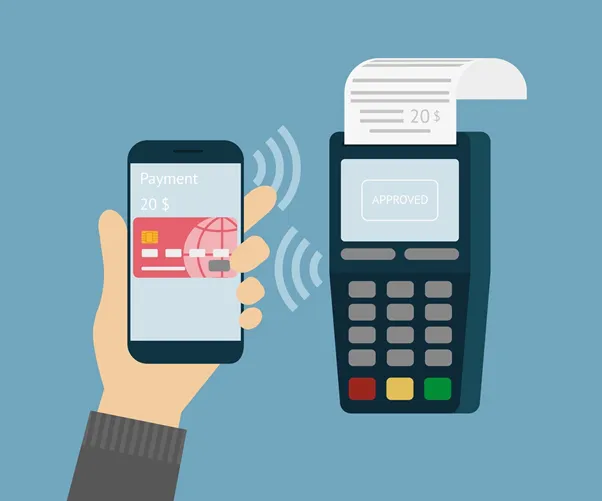

1. Banking Card

A banking card is a debit or credit card issued by a bank. It allows its holder to initiate transactions on a point-of-sale terminal with only their card instead of cash or check. These cards are used as electronic funds transfers at point-of-sale (EFTPOS).

EFTPOS and other similar services allow businesses to accept any credit or debit card. They have also helped reduce inefficiencies such as carrying large amounts of change, waiting for checks to clear, etc.

2. Mobile Wallet Apps

These days, you can pay for virtually anything from your phone, whether it’s at a convenience store, a vending machine, or even an online retailer. By using your mobile wallet app (like Apple Pay, GooglePay, Paytm), you’ll always have a payment method in your pocket, and there will be no worry about carrying around exact change.

If you have good credit, some apps will allow you to transfer money with just a few taps. And if you want to buy something at a store that doesn’t accept your particular app? You might be able to use a barcode on your smartphone screen as a way to make contactless purchases helping you avoid those long lines.

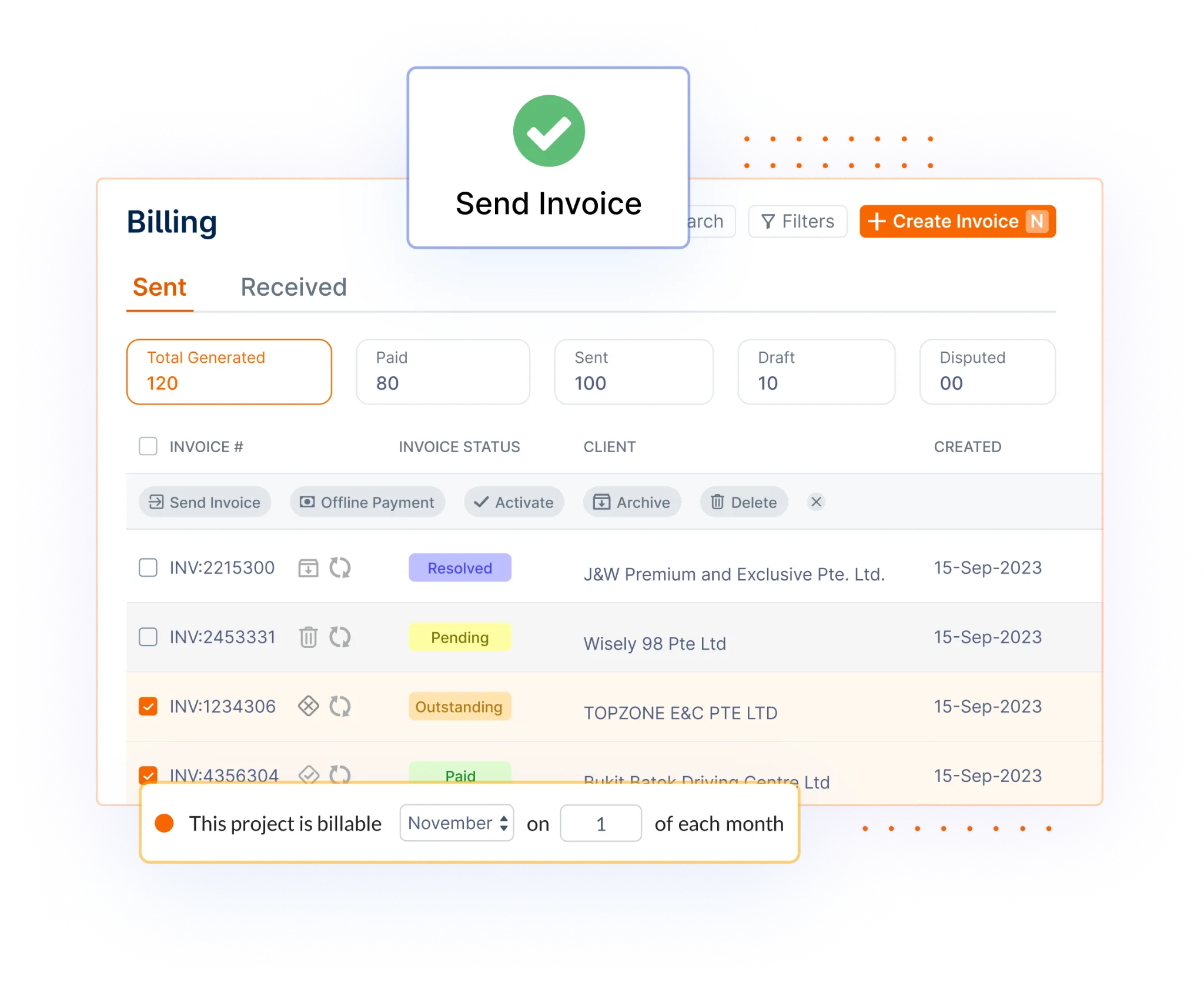

3. Invoicing Software

Invoicing software offers one or more ways to let your customers pay you online. They can accept payment in several different formats, including credit cards and various mobile wallets, such as PayPal and Apple Pay.

These services include features that will help keep you organized, such as time tracking, expense tracking, and reporting. Invoice software allows you to go cashless by storing your customer information for easy invoice generation. This also gives you access to reports about how much each customer owes you at any given time.

Finally, let’s discuss the

3 Reasons Why A Cashless Society Is Inevitable

A Cashless Society Could Reduce Crime.

By making it harder to exchange stolen goods for cash, giving police more oversight into transactions, and allowing businesses to issue credit notes online, we could be looking at lower crime levels. There’s also some evidence that countries with high levels of cashlessness have lower levels of corruption.

The reason for these correlations may seem that simple people who can receive their payment digitally are less likely to slip into corruption due to knowing their earnings are easier traceable by law enforcement officials.

Another important factor is transparency. When businesses in other countries offer credit notes online, customers get accustomed to tracking any money owed via an electronic trial. This will help in reducing crime and improving lives.

Higher Transaction Speed

Businesses love cash because it allows them to make transactions quickly and easily, but cash flow management can become difficult when you need to pay suppliers across town.

However, credit notes enable businesses of all sizes to track payments digitally and complete transactions faster than ever before.

The convenience and speed of these payment solutions will help pave the way for an inevitable cashless society. Not only do digital payment methods save time, but they also reduce travel time and costs.

Employees can also complete administrative tasks more effectively with cashless solutions since they don’t have to worry about carrying around large amounts of money or managing bills from different vendors.

It Will Help People From All Over The World.

A cashless society will help the world because it allows people to transfer money and do their business without visiting an actual place.

One of the most important benefits for countries that don’t have so many ATMs developed in their countries, such as South America or Africa.

Banks are also more secure. Thanks to credit notes and other kinds of payment, fraud can almost be avoided.

Additionally, cashless payments are accessible around the clock, unlike ATMs that may not be open at night. This helps you avoid foreign exchange fees and ensures you have a convenient payment option anytime you need it.

How You Can Go Cashless?

1) Use Your Card Everywhere To Make The Transaction

Once you have a credit card, you should use it everywhere. Once you start using your card, every time, everywhere that offers it as a payment option, eventually, you’ll get comfortable with leaving your cash at home.

Going cashless is going to save you a lot of hassle. Not only will you never have to worry about carrying cash around, but you’ll also be able to track your spending more efficiently by developing your money management skills.

2) Use Cash Flow Software

To manage your cash flow and avoid visiting a bank, try using a cash flow software program. These programs help you keep track of income and expenses and even suggest an ideal amount for monthly savings.

Plus, they help you go cashless by eliminating your need to visit a bank and withdraw cash from an ATM or write checks. You can quickly transfer money online with these programs. Many are free, but some have fees depending on what type of service you’re looking for.

3) Get A Contactless Card

Source

A contactless card is a special credit or debit card that allows you to pay for purchases by waving it in front of a scanner rather than swiping. There’s no need to insert your card into a slot physically. It reduces the time spent waiting in long lines at checkout and makes purchasing more convenient.

Contactless cards can also be used in other areas of life such as public transportation, vending machines, and parking meters, making them a versatile alternative to cash. It helps you stay on top of spending while making purchases faster and easier.

4) Use Your Phone For Making Transactions

Source

There are many apps available to make transactions easier. Mobile Wallet lets you use your phone as a virtual wallet to pay for goods and services.

If you have an Android phone, check if your bank has a mobile app with Apple Pay or Samsung Pay that allows you to make NFC payments at retail outlets. The entire process is quick and convenient and reduces the need to carry large amounts of cash with you everywhere. Moreover, Keeping control of finances becomes much easier with these apps.

5) Use Invoice Generator Software

Invoice Generator Software is a cloud-based program that helps you to create invoices and manage your cash flow. It also offers easy-to-use features to help you automate billing, stay on top of overdue accounts, and collect payments.

Online Invoice Generator Software helps business owners go cashless by allowing you to send electronic invoices and save on printing costs. It also reduces collection delays by allowing your customers to pay directly from their bank accounts.

Invoicera Best Online Expense Tracker Software

Invoicera is an online expense tracker that helps track and manage your expenses. One of its most significant advantages over competitors is its user-friendly software which makes it easy to monitor your spending, even if you’re on the go or just trying to check something quickly.

Invoicera also comes with other useful features, such as credit note management software and tools that allow you to determine whether certain purchases can be expensed at all.

You can also create custom invoices so that you never have to waste time by stopping and creating a new invoice for each expense.

Its online credit note management tool allows users to generate credits and receive reports on what has been sent already, which helps track and manage credit notes from your clients or suppliers even better than before.

So what are you waiting for?

Invoicera is a highly-rated online expense tracker, especially when it comes to its credit note management software, and if you haven’t already tried it out yet, then here’s your chance. Simply go ahead and get your free trial by signing up today.

Conclusion

A cashless society is inevitable. It’s clear that credit cards and electronic payment services make life much easier. However, they also increase spending. By removing cash from our wallets, we are able to spend a little more freely.

A cashless society will be a significant change for everyone. We may have to suffer through a few more cash-free days, but with all of its benefits, we know it will be worth it in the end. There is no definitive date for when a cashless society will take over, but certain factors indicate it could happen sooner than expected.

Until then, there are so many cash flow management services that can help you and your business manage even in today’s cash-heavy world.

We hope you loved our three reasons why a cashless society will be inevitable. Share your thoughts in the comment section and subscribe for more great content that can help your business get back on track.

Until next time, from all of us, Cheers to an easier future!

Thank You !!