Introduction

You have come to the correct spot if you are looking for information on creating a cash flow statement model. A cash flow statement mimics the flow of funds into and out of your business to give you a more realistic picture of your current financial situation and the possibility of future changes.

Even though cash flow statements are usually simple to understand, their capacity to convey correct information can be significantly diminished by a few common misconceptions about how they should be created and used.

Initially, how many hours did you spend staring at the cash flow statement with your head in your hands? It takes a lot of time and effort, mainly if you must perform all the computations yourself. It is exasperating and causes a headache.

Regardless of your accounting standards, assembling cash flow statements will likely be one of the trickiest things. Whether you use IFRS or US GAAP, this process can be complicated. There are a lot of individuals who find it challenging to prepare cash flows because-

- It’s the only statement produced in cash terms, not on an accrual basis.

- Accounting records must be modified to remove non-cash elements, which may be difficult.

By following these ten tips, prepare a cash flow statement model that balances.

How To Create A Balanced Cash Flow Statement Model?

A. Organize cash flow categories

Effective cash flow statements resemble a well-organized filing system. They categorize monetary activities into distinct sections, clarifying income, operational expenses, investments, and financing.

Think of it as compartmentalizing your finances for better understanding. This organization allows for a clear snapshot of how money moves in and out of your business, ensuring a comprehensive view of your financial health.

B. Take help from reliable data sources

Professionals in finance depend on dependable data to generate accurate reports, just as chefs use premium ingredients to produce mouthwatering dishes.

Using trustworthy financial data sources, such as loan documentation, spending reports, and sales records, improves the integrity of the cash flow statement.

Minimizing errors that could cause misunderstandings or mistakes establishes the foundation for financially stable decision-making.

What Are The Steps For Creating a Model Cash Flow Statement

1. Prepare A Trial Balance

Do a trial balance on your financial statements before building your cash flow statement model. Simply use a pen and paper; no fancy equipment is required. This is an essential step for three reasons:

- It ensures that your trial balance is balanced.

- You will better understand which accounts are created when (and why) by writing out all of your journal entries.

- You’ll start getting familiar with your balance sheet and income statement formats.

Some businesses have self-balancing cash flow statements, so they don’t require a trial balance. Put otherwise, money coming in equals money going out. Nevertheless, creating a cash flow statement is worthwhile if you discover that your current one doesn’t balance.

2. List All Assets and Liabilities

Liabilities include debt due immediately (accounts payable) and long-term commitments like leases or insurance contracts that must be paid later. Accounts receivable and inventory are examples of assets. The primary purpose of most cash flow statements is to track the monthly inflows and outflows of cash for a business.

Make sure you have them listed. Find out the details of any loan you took out or an item on your balance sheet that you need clarification on, then note it down.

———————————————————————————————————————————————————

Also Read: 7 Proven Strategies to Increase Cash Flow with Passive Income

———————————————————————————————————————————————————

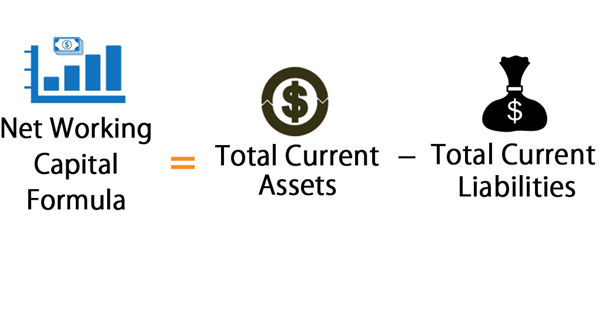

3. Calculate the Net Working Capital

Your cash flow statement model’s net-working capital column is computed by deducting current liabilities from current assets. Generally, accounts payable, receivables, inventories, and fixed assets should be included while determining net working capital. Although current assets are anticipated to surpass current liabilities, businesses may have negative net working capital if their commitments exceed their short-term holdings.

The net working capital is negative if there are more obligations than assets. It can indicate that your business has many accounts payable, overstock, or unpaid suppliers. It can also suggest that your products sell better, so your business needs to make more money. Alternatively, it might result from poor cash flow or a sizable asset loss caused by a natural disaster or theft. Any of these problems can seriously harm your business and threaten its viability.

4. Calculate the Current Ratio and Quick Ratio

First, your model should include calculations for the current and quick ratios. By comparing current assets to current liabilities, the current ratio evaluates liquidity and shows how well-positioned a company is to pay its short-term debt.

Divide current assets by current liabilities to get the current ratio. The outcome is contrasted with past performance or industry norms. Big businesses frequently have larger ratios than smaller ones since they usually have more cash.

The current ratios of two companies- A and B, are calculated as given below for FY 21:

| Company | Current Assets | Current Liabilities | Current Ratio |

| A | $130 billion | $100 billion | 130/100=1.30 |

| B | $100 billion | $110 billion | 100/110= 0.90 |

It implies that for every $1 of current debt, ‘A’ had 130 cents to pay for its debts. Similarly, ‘B’ had 90 cents available to pay each dollar of current debt.

Quick Ratio looks similar, but it’s slightly more conservative. It splits current assets into liabilities and short-term debt. This might be interpreted as a measure of the speed at which a business could use its liquid assets to settle its short-term debt.

Quick Ratio comes in handy when you know if a business can fulfill some of its commitments immediately, even if it can only pay some in full.

For example:

The quick ratios of two companies- P and Q, are calculated as given below for FY 21:

| Company | Quick Assets | Current Liabilities | Quick Ratio |

| P | $15,000 million | $35,000 million | 15000/33000=0.42 |

| Q | $40,000 million | $42,000 million | 100/110= 0.95 |

With a quick ratio of 0.95, the company ‘Q’ is better positioned to cover its current liabilities than ‘P,’ with a quick ratio well below 1, at 0.42.

A lower Quick Ratio suggests that there needs to be more liquidity available. Like the Current Ratio, it also gives you an idea of how easily a company can access its liquid assets to meet obligations and whether or not they are using those resources efficiently enough.

5. Calculate EBIT before adjustments

My favorite metrics for assessing financial performance are earnings before interest and taxes, or EBIT. Before making changes, it’s a simple way to gauge how operations are going for your business.

Let’s learn to calculate EBIT for any organization-

Assume that ‘XYZ’ is a healthcare company, and we possess the following financial data from its previous fiscal year:

$12,000,000 in revenue

Product Cost: $4,000,000

Revenue – Cost of Goods Sold = Gross Profit

$12,00,000 – $4,00,000 = $8,00,000 is the gross profit.

Total Revenue: $8,000,000

Before deducting overhead costs, the gross profit for “XYZ” is $8,000,000. The company had the following overhead expenses listed as administrative, general, and sales expenses:

Overhead Expenses= Sales + General + Administrative: $4,00,000

The EBIT is calculated as:

EBIT equals Gross Profit – Overhead Expenses, or $8,000,000 – $4,000,000, or $4,000,000.

$4,000,000 in EBIT

Entrepreneurs can assess a company’s profitability and financial standing by computing EBIT, which helps them decide whether to invest in new ventures or grow their business. EBIT analysis can also assist business owners in evaluating the performance of their companies and pinpointing opportunities for increased revenue.

Register to use the automated online invoice generator of the most significant credit note management software to help you manage your cash flow more efficiently.

Examine your work and make any necessary corrections.

Your three-year cash flow statement model needs to be balanced after calculating it. You should next review how you conducted your forecasts for the following categories: operations, finance, sales, and marketing. You may need to correct these inputs. If that’s not the case, then something in your inputs changed drastically between your base year and forecast year (perhaps an employee left or became ill).

Make corrections where necessary, but be sure that those changes do not fundamentally change other parts of your financial model (such as business structure). Also, confirm that your accounting is still accurate; even small mistakes can cause models not to balance.

———————————————————————————————————————————————————

Also Read: Beginner’s Guide For Managing Cash Flow as a Freelancer

———————————————————————————————————————————————————

7. Read Cash Flow Analysis For Clues About Future Performance

Although it is impossible to predict future outcomes ideally based on previous performance, patterns and problems that will impact future outcomes can be identified. Cash flow may assist in identifying costs (such as unpaid invoices) that could otherwise go unreported until they become liabilities.

Another example is identifying cash inflows from one-time events (e.g., over-billing from old clients) that are masking negative operating trends within your business. Whatever your industry or business model, take advantage of cash flow management software tools like Invoicera for clues about what’s going on with your performance—both now and in the future.

8. Examine Cash Flows for Investing, Operating, Financing, and Operations

One of your primary responsibilities when creating a cash flow statement is balancing your monthly opening and closing balances. This implies that all inflows and outflows should be balanced on both sides of your cash flow statement whenever they are recorded.

However, many things can trip you up when recording these flows and make your statements unbalanced. For a cash flow statement model to accurately depict real-world events, you must ensure that it remains evenly balanced from beginning to end.

Balance The Statement Of Cash Flows In Every Month Over The Year.

9. Don’t Create An Income Statement With a Negative Net Income

A balanced cash flow statement is only as valuable as its starting point and will provide no value for your business if it contains negative net income. So, before you set out to create a cash flow statement, ensure you already have net income; otherwise, your results will need to be more accurate and correct.

If you have a negative net income, create an income statement with a positive net income before making your cash flow statement. Once you have a positive net income, your cash flow model will be relevant and reliable.

Take the sales revenue and deduct operating expenditures to get net income. Then, add non-cash components to get the total profit. After that, everything will be set up for you to create a solid cash flow statement model that fairly depicts the state of your company’s finances.

10. Adjust For Any Large Non-Cash Transactions

Many businesses merely participate in non-cash transactions, including borrowing money through credit lines, rather than having significant cash inflows or outflows. When preparing your model, account for these types of transactions. Consider balancing debits and credits by adjusting any additional income received with expenses paid using assets or equity. For example, if your firm borrowed $50,000 from its line of credit and spent $25,000 towards equipment (an asset), add that transaction to your CFSM as an adverse cash flow event.

In most CFSMs, you’ll need to adjust for non-cash transactions. Adjusting your CFSM in such a way will ensure that it more accurately represents how much cash your business needs from an operational perspective. The debit and credit balance should equal zero before using your CFSM as a working model.

Closing Thoughts

So, ten accurate methods exist for preparing a cash flow statement that balances. With the correct tools, creating a cash flow statement is possible, even though it may appear overwhelming. Additionally, if you’re looking for a quicker way to finish the task, think about utilizing cash flow software. Using this helpful application, you don’t need an accounting degree to build and monitor your company’s cash flow.

Ready to give it a try? Check out the best financial software to prepare the right cash flow statement model for your business here.

Thanks for reading!!