Statistics say that in 2023 alone, the global accounts receivable automation market was valued at $3.81 billion. It is expected to grow at a rapid CAGR of 12.9% from 2024 to 2030.

Managing your business Accounts receivable and payable is tough!

With a number of invoices, pending payments, and a lot of reconciliations, it can really stress you more than anything else.

This is the reason that many organizations are shifting towards automation.

The most significant changes have occurred in North America. This country led to a huge revenue share of 31% in 2023.

Companies in this region have already begun to reap benefits with timely invoice processing, enhanced cash flow and reduced errors.

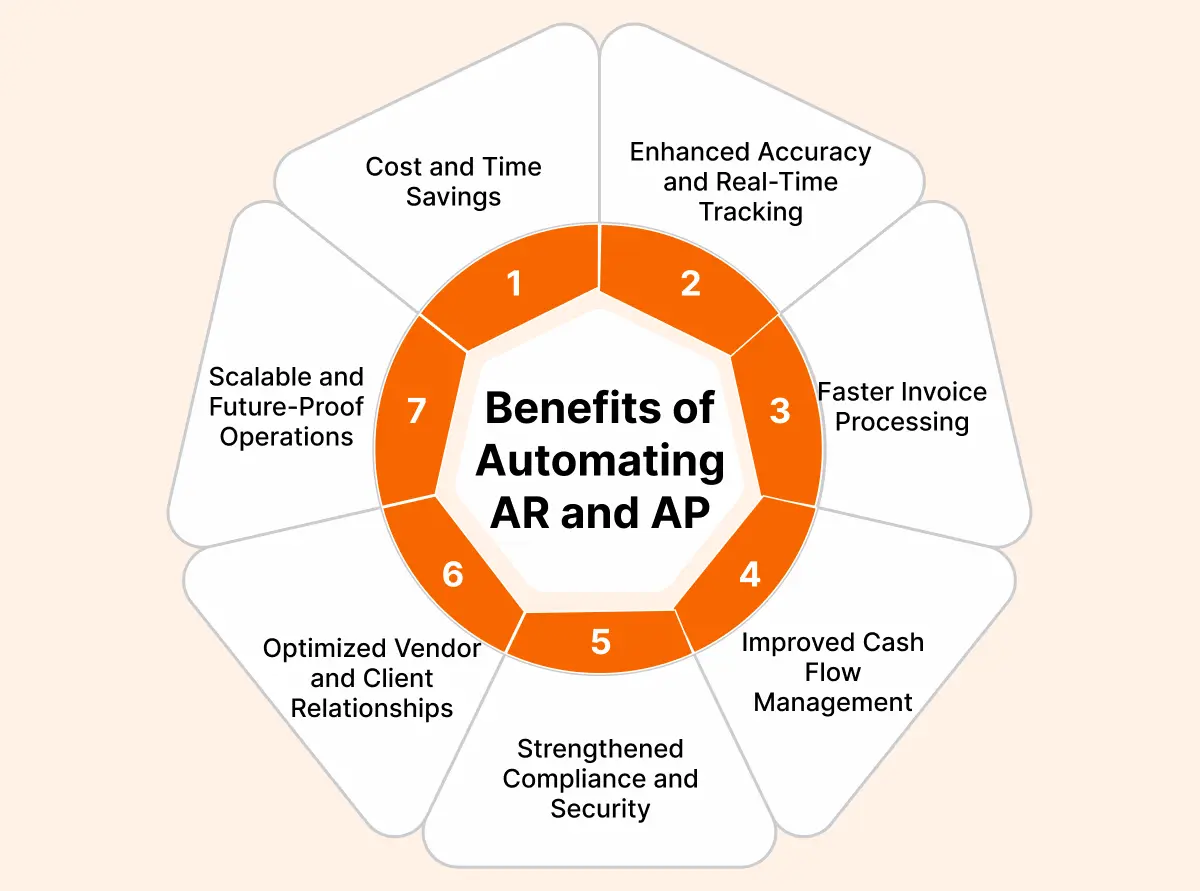

Why should your business embrace this rising trend? In this blog, we will discuss the top 7 benefits of automating AR and AP processes to help you become competitive.

How Automating AR and AP Benefits You?

Let’s take a look at the Top 7 Benefits of automating AR and AP and how these improvements can impact your business.

1. Cost and Time Savings

As the old saying goes: “Time is money.” Nothing could be closer to the truth than in business. One of the core benefits of automating accounts payable and accounts receivable is that it reduces the time spent on reactive tasks and saves time and cost.

How automation saves time and money:

Less time on admin tasks

You and your team can focus on more value-added activities while invoice preparation, manual reconciliations, and data entry are automated.

Lower labor costs

Automation can streamline boring processing tasks, free up your team to focus on more strategic activities, and reduce labor costs.

Non-bottleneck workflows

Instead of forwarding this invoice to another person more than once, the automated system handles the process in a way that reduces bottlenecks and delays.

In addition, manual data entry and human errors often create costly mistakes. Automation makes certain that everything from payment amounts to tax calculations is right, meaning a minimized risk of financial discrepancies. Less time coupled with fewer errors means lower operational costs.

By automating accounts receivable and accounts payable, companies can do much more with operational efficiency and ensure resources are utilized in ways that drive growth.

2. Enhanced Accuracy and Real-Time Tracking

Benjamin Franklin rightly observed: “An ounce of prevention is worth a pound of cure.”

With respect to financial management, there can be no better maxim. Manual processes are subject to human error, whether in the form of missed payments, improper invoices, or wrong calculations.

These errors can develop into massive snowballs, causing discrepancies, penalties, and damaging business relations. Automation eliminates all such issues by delivering accurate data with real-time tracking.

Key benefits of enhanced accuracy and real-time tracking:

Accurate invoicing and payments

With automation, invoices are corrected in real-time with data pulled directly from your system, removing the potential for any data-entry mistakes that could cause delays and aggravation for the clients or vendors.

Real-time bookkeeping

Automated systems will enable you to track all your accounts receivables and payables live, making sure that you have information about your cash flow and outstanding balances all the time.

Audit-ready records

Automated systems allow every transaction to be recorded in minute detail so that auditors would not have to do much checking and ensure that all records are up to date and compliant. This is important, especially during tax seasons when you have to see to it that all invoices, receipts, and payments are in order.

Real-time tracking while doing the financial recording keeps you alerted at all times regarding the current situation of your cash flow and fastens decision-making. Any issues really easy to spot, like late payments and overdue invoices, can help you take action fast without dawdling.

3. Faster Invoice Processing

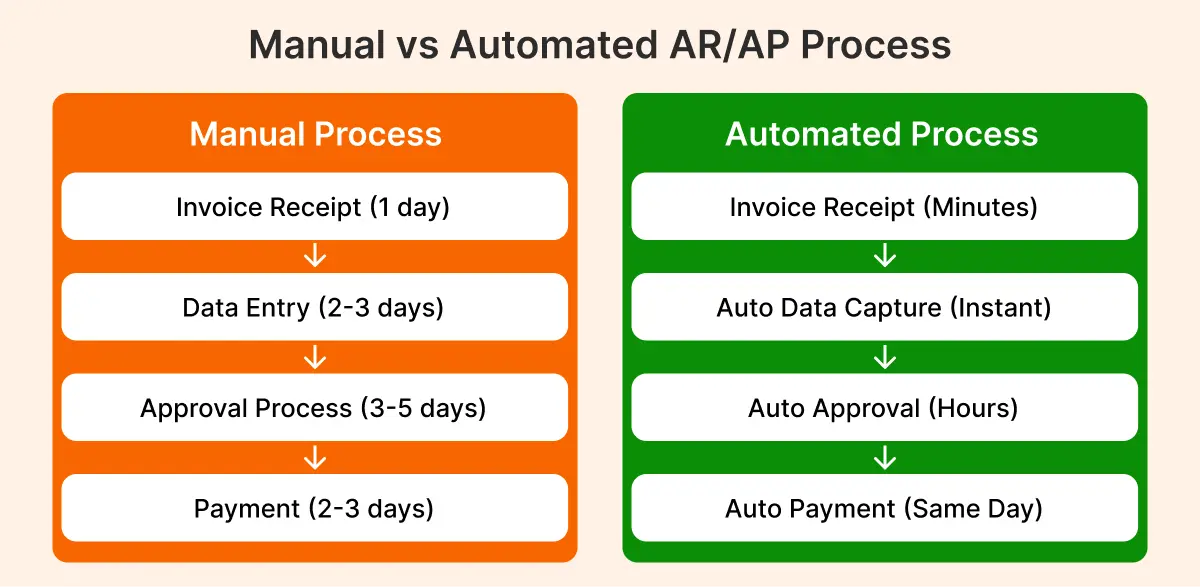

The faster you can process invoices and make payments, the quicker your cash flow improves. When done manually, you risk experiencing delays in invoice received validations due to the time it takes to enter data manually, validate documents, and send payments. Automation accelerates all these processes.

How automation accelerates invoice processing:

Instant invoice creation

Automated systems generate invoices instantly based on pre-set templates and integrated data from sales or service records. This removes delays associated with manual invoice creation.

Automatic approvals

The invoices take the course of an automated approval process, eliminating the countless hours spent waiting for team members to approve the invoice.

Instant delivery

The approved invoices do not remain waiting; they get dispatched to the customers with the help of an email or any other integrated platform. It makes the receiving speed faster, and the payment cycles run within shorter time frames.

The overall result is that it reduces the total time devoted to each step in the invoicing process, making it possible for business organizations to significantly advance their cash flow. This is important for businesses that are characterized by fast payment cycle constraints.

4. Improved Cash Flow Management

Every business depends on cash flow to function properly, and good cash flow management is the difference between survival and failure. As “Cash flow is king” is often said in business circles, ensuring that you have a positive cash balance is important for the daily operations and growth of the business in the long term.

Accounting automation allows for timely cash flow management and provides a good overview of the cash flow situation by monitoring accounts receivable and accounts payable in one minute.

What benefits automation transmits when it comes to cash flow management:

Accurate forecasting

Automation systems have several predictive components that allow the software to monitor incoming revenue and outgoing payments which enables a more accurate assessment of future cash flow balances.

Faster collections

When debtors are late in making payments, automated systems can issue reminders and charges, resulting in faster payments and lower outstanding balances.

Proactive management

You escape the opportunity to solve an invoice ‘issue’ two days later after payment has been missed, and you keep within the borders of prediction, with only automated reminders keeping you in touch.

You achieve more effective long-term management with cash flow management practices that enable you to avoid cash-flow cycle deficits, get access to more efficient resources, and make things better around.

5. Strengthened Compliance and Security

When it comes to compliance, a proactive approach is necessary. One of the key benefits of AR AP automation is that it provides built-in tools for ensuring that your AR and AP processes are compliant with the latest financial regulations and standards.

How automation strengthens compliance and security:

Automated tax calculations

When issuing invoices, you can be confident that the business has met the local tax rate, as with automation, natural disasters, and geopolitical events that alter tax rules are avoided.

Data encryption and protection

Automated technology enhances the credibility of the financial transaction by guaranteeing advanced encryption and fraud protection.

Auditing and reporting

With automated systems, you get detailed reports and audit trails for all transactions, making it easier to comply with government regulations and pass financial audits with flying colors.

Security and compliance are crucial for maintaining the integrity of your business’s financial operations. Automation ensures that both of these areas are handled efficiently and with minimal risk.

6. Optimized Vendor and Client Relationships

As the famous quote by Jeff Bezos goes, “Your brand is what other people say about you when you’re not in the room.” Your relationship with clients and vendors significantly impacts how they view your brand. Timely payments and clear, accurate invoices reflect positively on your business. Automation ensures that both clients and vendors have a seamless experience with your financial processes.

How automation optimizes vendor and client relationships:

On-time payments

Automated systems ensure timely payment of vendor invoices to promote good relations with suppliers and avoid incurring late fees.

Clear invoicing

Automation takes the guesswork out of invoicing and facilitates prompt payments by sending itemized invoices that are easy for clients to understand.

Proactive communication

Automation sends out useful reminders and updates to ensure both the vendor and the client are updated at every stage of an invoice’s life cycle during the course of the payment process.

With better invoicing and payment systems, you will be able to create good vendor/client relationships that will lead to mutually beneficial terms, more repeat business, and long-term partnerships.

7. Scalable and Future-Proof Operations

Business environments are constantly evolving, and as your business grows, so do your financial needs. Manual systems may work well for a small business but can become overwhelmed as transactions increase. Automation, however, is scalable and can easily grow with your business.

How automation future-proofs your business:

Easily adaptable

Automated systems can scale to accommodate higher transaction volumes, more customers, and international operations without requiring major changes to your processes.

Cloud integration

Many automated AR and AP systems are cloud-based, allowing you to integrate them with other tools and easily access financial data from anywhere at any time.

Support for new technology

When your company expands, automation systems will be able to channel new technology in a way that will allow financial activities to remain applicable in the future.

With a growth-oriented and adaptive system, businesses are bound to have all their AR and AP procedures ready with the necessary bandwidth whenever business expansion, market alterations, or any technological change occurs.

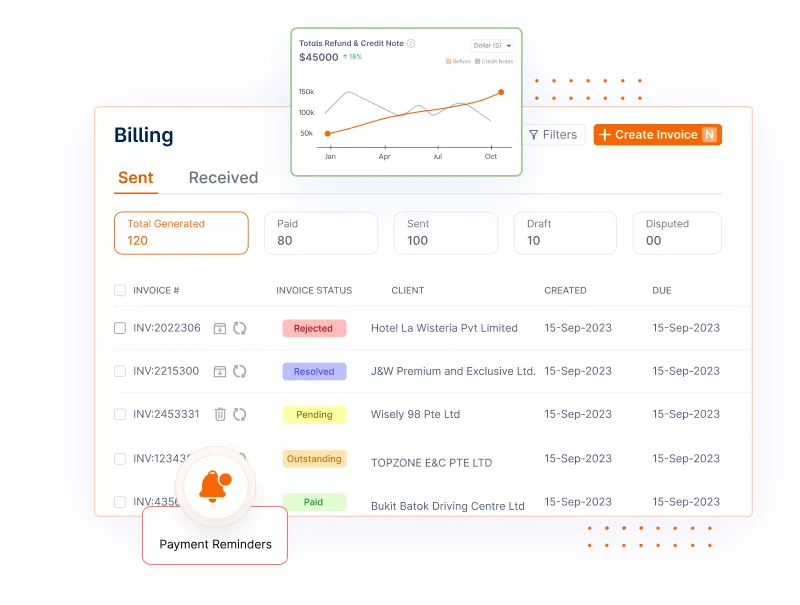

How Invoicera Simplifies AR and AP Automation

Invoicera provides businesses with a complete and easy-to-understand solution that addresses the major pain points of the business and automates accounts receivable(AR) and accounts payable(AP).

This is how Invoicera makes AR AP automation easy for businesses:

1. Customizable Workflows

Invoicera’s AR and AP system is customizable in a way that businesses can make workflows unique to their needs. Whether it’s creating approval levels or recurrent payments, it integrates into your business with minimal interaction.

2. Real-Time Tracking and Reporting

With Invoicera, receiving information about receivables and payables can be done instantly. The system contains informative dashboards, and reports that are useful to finance managers to understand and manage the inflow and outflow of cash by highlighting unpaid overdue invoices and payment’s current phase.

3. Seamless Integrations

4. Automated Invoicing and Payment Reminders

5. Enhanced Accuracy and Compliance

By automating data entry and tax calculations, Invoicera minimizes errors and ensures compliance with financial regulations. The system also provides audit-ready records, making it easier to meet reporting requirements.

6. Secure and Scalable Platform

With advanced encryption and cloud-based accessibility, Invoicera guarantees flexible and accessible data for any business imaginable. Small companies grew into one-night successes, while big ones generally endured for years. Invoicera’s software evolves with your needs, enabling your scaling up with the process.

AR and AP automation through Invoicera brings time savings, reduced costs, and better control to businesses. Want your financial management to change? Explore Invoicera today!

Conclusion

There are many benefits of automating accounts receivable and accounts payable process.

From time and cost savings to accuracy, cash flow management, and compliance, automation allows faster financial processes while providing businesses with future success.

Automated systems provide, above all else, better insight, eliminate human errors, and build stronger relationships with clients and vendors.

As automation continues to rapidly evolve, it’s definitely one investment that any business cannot afford to miss.

FAQs

Ques. What are the common challenges in manual AR and AP management?

Ans. Manual AR and AP management often lead to delays, errors, and inefficiencies. Common challenges include:

- High error rates due to manual data entry

- Inefficient workflows and approval processes

- Difficulty in tracking outstanding invoices and payments

- Lack of real-time visibility into cash flow

Automation helps overcome these challenges by streamlining processes and reducing errors.

Ques. How does automation impact cash flow management?

Ans. Automation significantly improves cash flow management by providing real-time insights, faster payment processing, and better forecasting capabilities. With automated reminders for overdue invoices and detailed financial reporting, businesses can maintain a positive cash flow and plan expenditures effectively.

- Faster collections

- Improved forecasting

- Reduced risk of cash shortages

Ques. Can Invoicera be integrated with existing accounting tools?

Ans. Yes, Invoicera offers seamless integration with most accounting tools, such as QuickBooks, Xero, and Sage. This ensures a smooth transition to automation without disrupting existing processes. Integrating Invoicera enhances efficiency by consolidating data and automating workflows, making financial management more effective.

Ques. Is AR and AP automation suitable for small businesses?

Ans. Absolutely! Small businesses benefit greatly from automation by reducing manual workload, saving costs, and gaining real-time financial insights. Automation is scalable and can adapt to the growing needs of small businesses, allowing them to compete effectively in the market.

Key benefits for small businesses:

- Cost-effective solutions

- Time savings

- Enhanced accuracy

Ques. What are the key factors to consider when choosing automation software?

Ans. When selecting AR and AP automation software, consider factors such as:

- Ease of integration with existing tools

- Customization options for workflows

- Scalability to meet future needs

- Security and compliance features

- Reliable customer support

By focusing on these criteria, businesses can choose software that aligns with their unique requirements.