Financial management is particularly vital for small businesses since 61% rely on personal savings to meet their funding needs.

The above statistics clearly depict how much of a requirement there is for financial management tools.

Additionally, with the average loan under the SBA’s 7(a) program being approximately $479,685 in 2023, having robust financial management systems becomes crucial for businesses to handle loans effectively and avoid financial pitfalls.

In the current business world, manual financial management is the biggest risk as it can result into blunders. Therefore, a right tool is important in order to manage finances automatically, thus, saving more time.

No doubt, the market is full of these software that can make your job easy. From tracking expenses to forecasting cash flow, everything is covered.

Therefore, this blog will explore the top 10 financial management tools for CFOs in 2025.

Let’s get started by having a bit of discussion about why these tools play an important role.

Why Are Financial Tools Important?

Financial tools play a crucial role in managing a company’s resources effectively, regardless of its size or industry. They help businesses streamline operations, make data-driven decisions, and maintain financial stability in an ever-changing market. Here’s why they are indispensable:

Improves Accuracy

Manual financial processes are prone to errors, which can lead to costly consequences. Financial tools automate calculations, ensuring precision in expense tracking, invoicing, and reporting, minimizing the risk of discrepancies.

Saves Time

Managing finances manually is time-consuming. Tools like expense trackers, budget planners, and forecasting software save valuable time by automating routine tasks, allowing CFOs and teams to focus on strategic decision-making.

Provides Better Financial Visibility

Financial tools provide real-time insights into cash flow, expenses, and profitability. This transparency allows businesses to monitor performance closely and address issues proactively.

Helps in Better Decision-Making

With advanced analytics and reporting features, financial tools offer actionable insights, enabling businesses to make well-informed decisions. Whether it’s planning investments or cutting unnecessary expenses, these tools guide every step.

Keeps Compliant and Secure

Many tools come with built-in compliance checks and data encryption features, ensuring businesses adhere to regulations and protect sensitive financial information.

List of Top Financial Management Tools

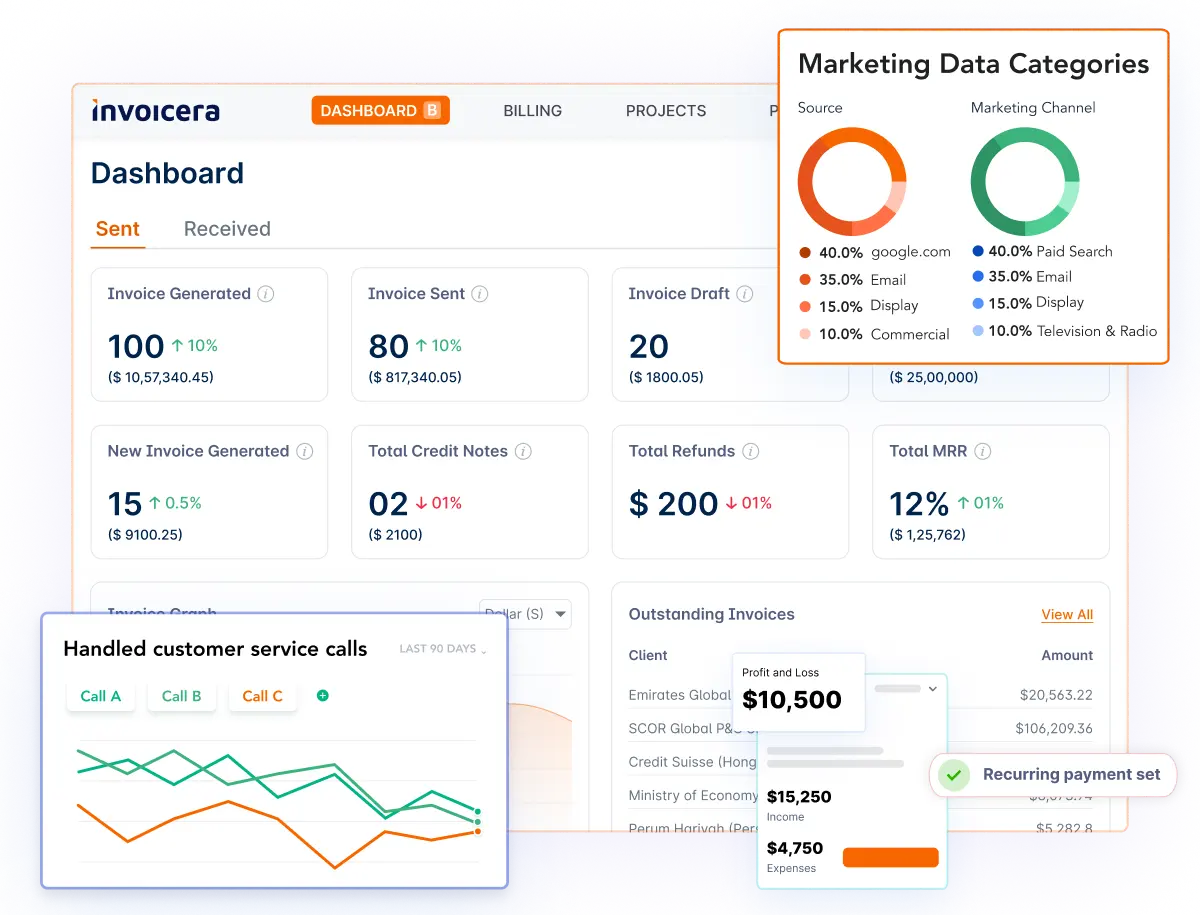

1. Invoicera

Features

- Automated invoice generation and reminders

- Credit note management

- Payment tracking dashboard

- Expense monitoring tools

- Custom financial reporting

- Client portal access

- Purchase order creation

- Multi-currency support

- Secured online payments

Pricing

Pricing plans Start at $15/month

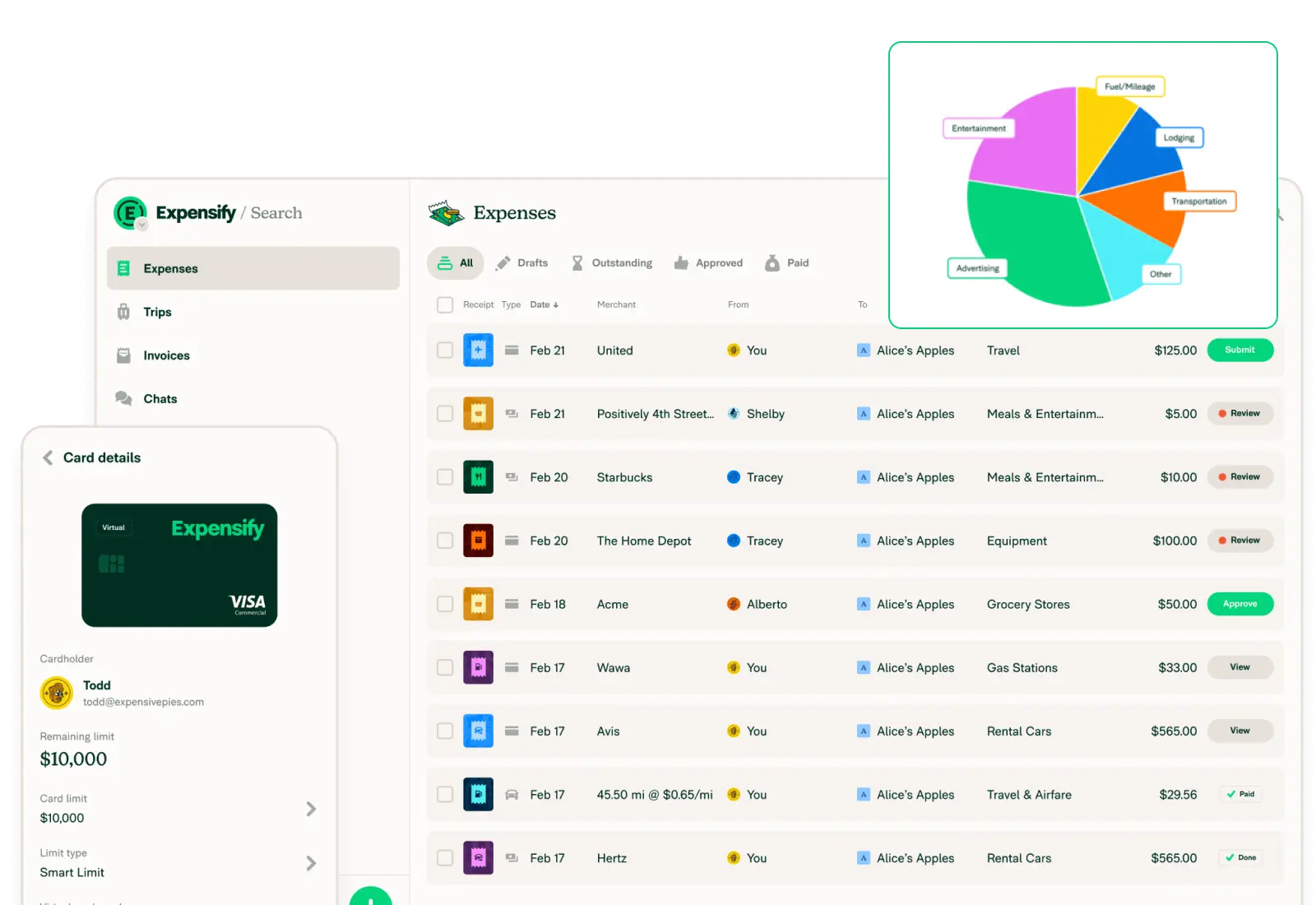

2. Expensify

Features

- One-click receipt scanning and data extraction

- Corporate card with cash-back rewards

- Real-time expense approvals and tracking

- Global currency support for payments

- Automated tax and fee calculations

- Direct accounting software integration

- Custom approval workflows

- Mobile receipt capture

Pricing

Starts at $5/user/month (annual plan)

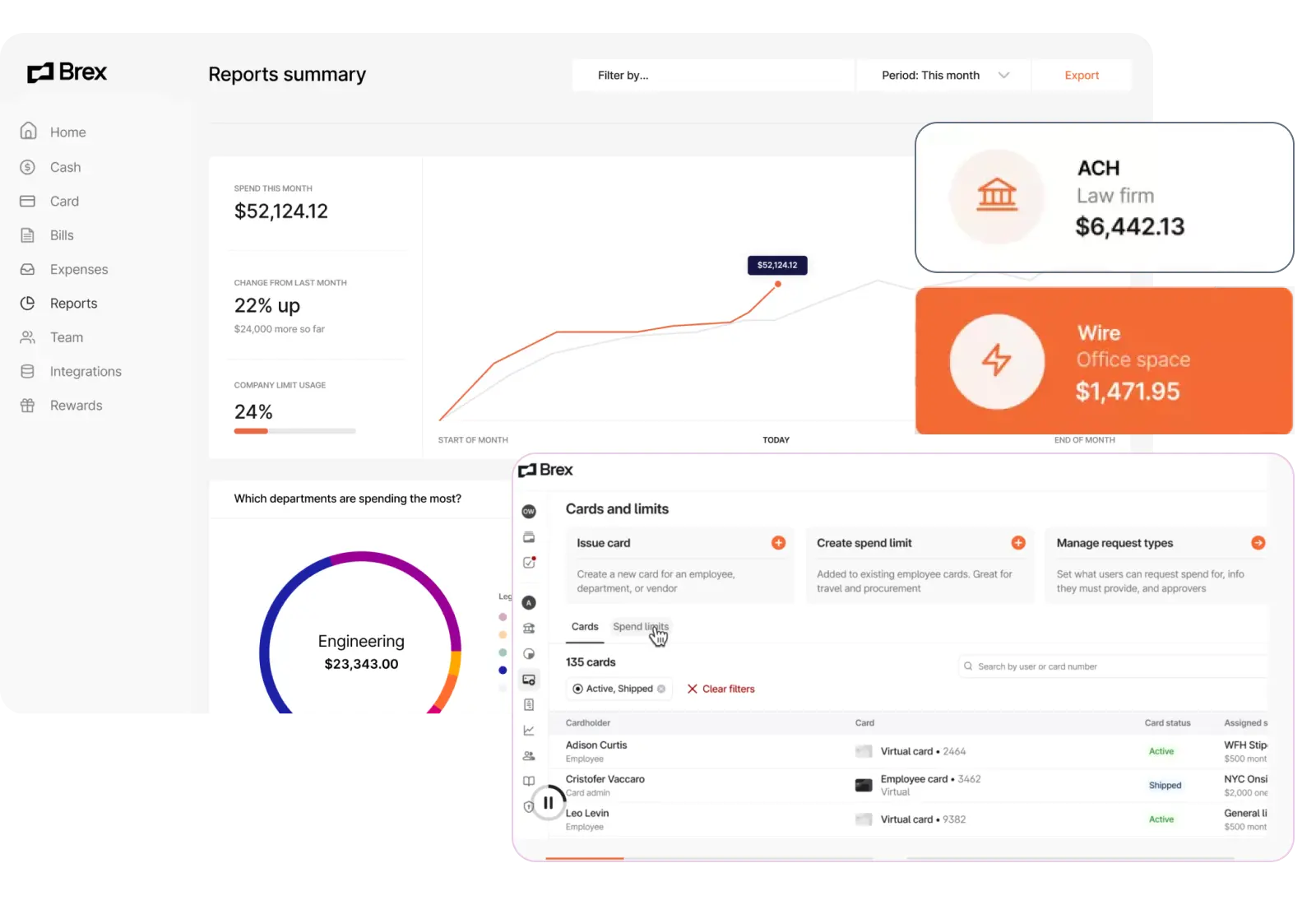

3. Brex

Features

- Physical and virtual credit cards

- AI-powered expense review

- Travel booking platform

- High-yield business account

- Custom spend policies

- Receipt capture automation

- Vendor bill processing

- Real-time spend tracking

Pricing

Starts at $12/user/month

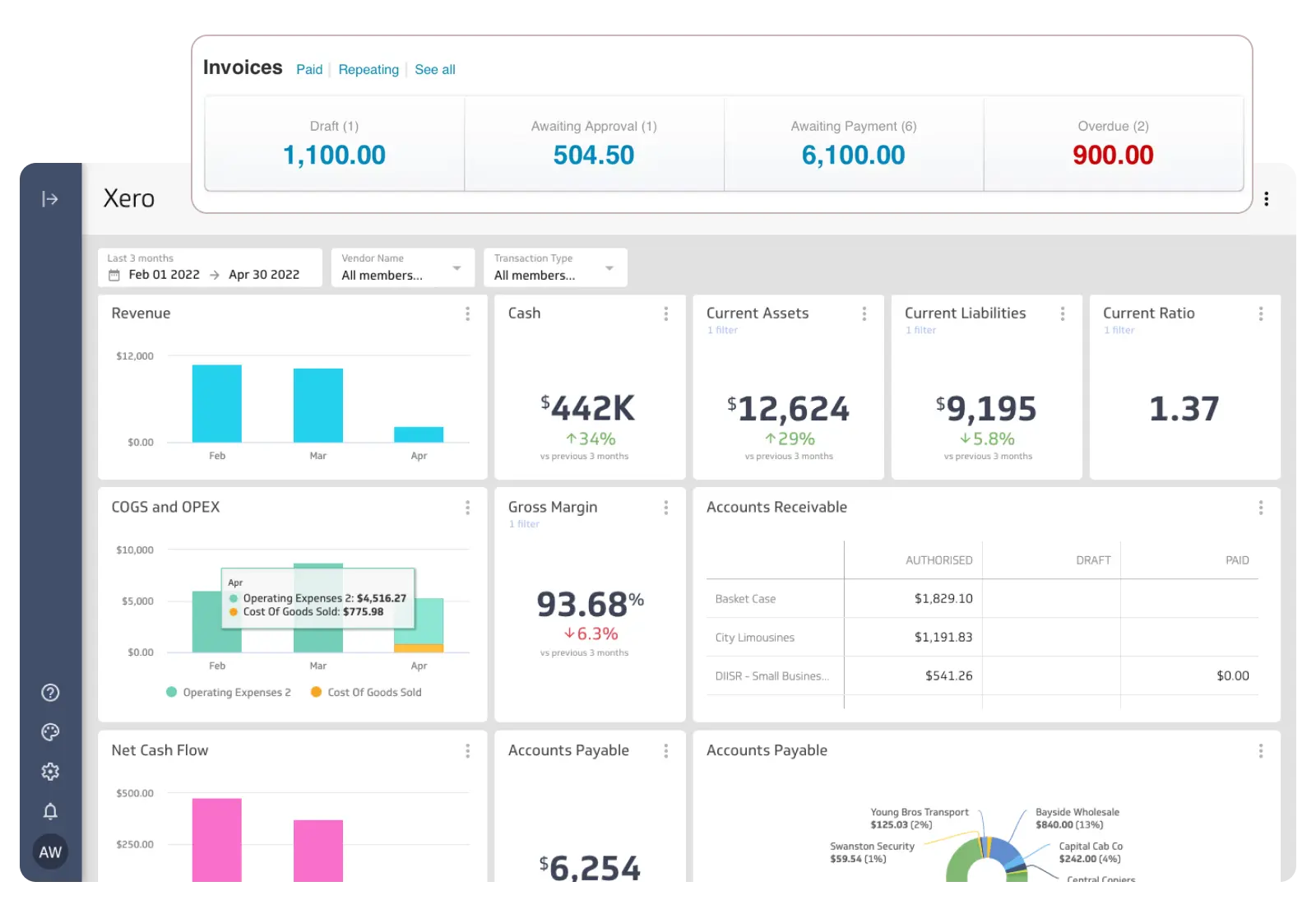

4. Xero

Features

- Automatic bank transaction import

- Smart invoice management

- Real-time inventory tracking

- Project cost monitoring

- Custom payment solutions

- Multi-currency support

- Mobile expense tracking

- Financial performance reports

Pricing

Starts at $2.90/month for the first 3 months, then $29

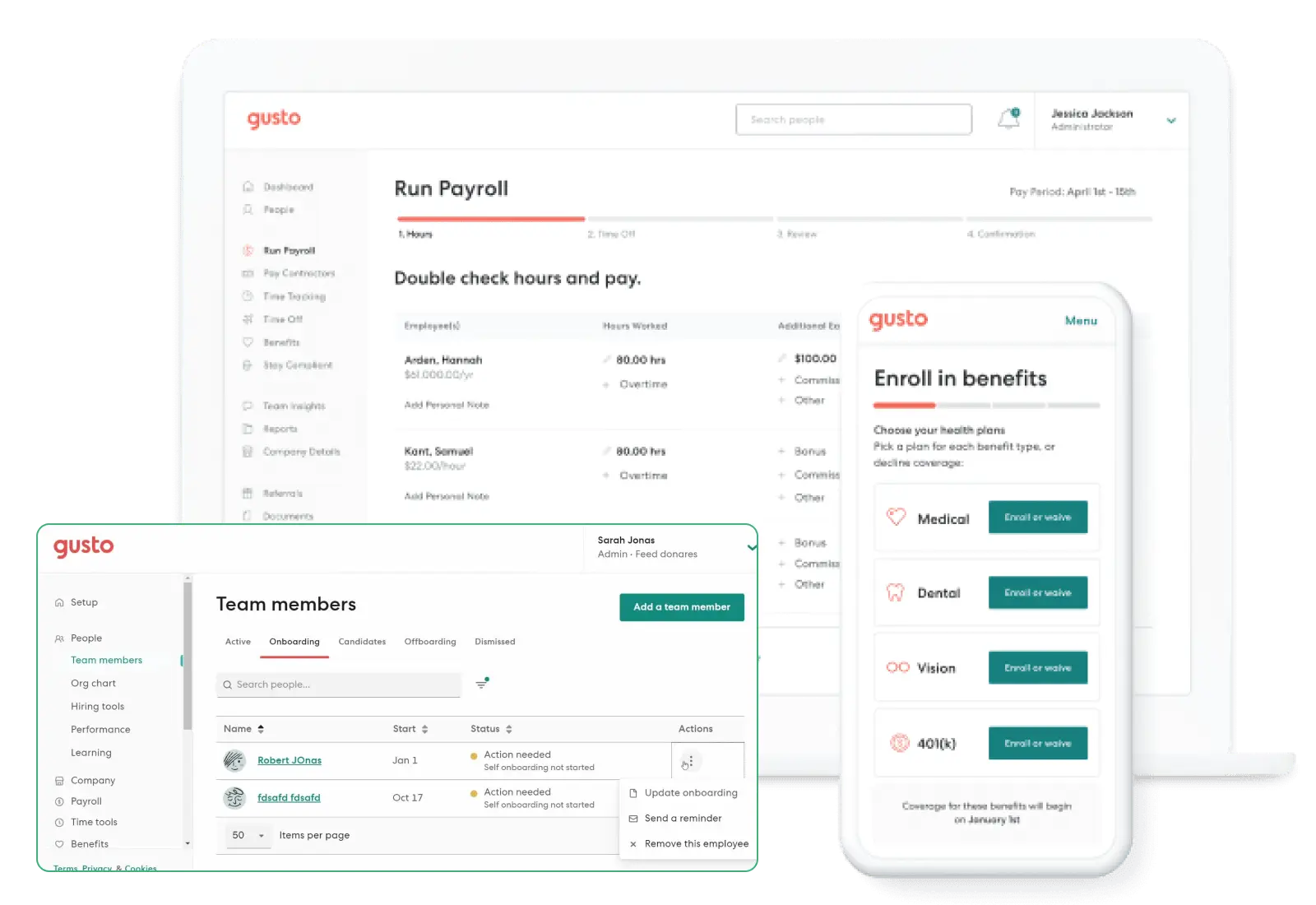

5. Gusto

Features

- Automated payroll processing

- Direct deposit management

- Tax form generation

- Benefits administration

- Time tracking tools

- HR resource center

- Employee self-service portal

- Accounting integrations

Pricing

Starts at $40/month base price

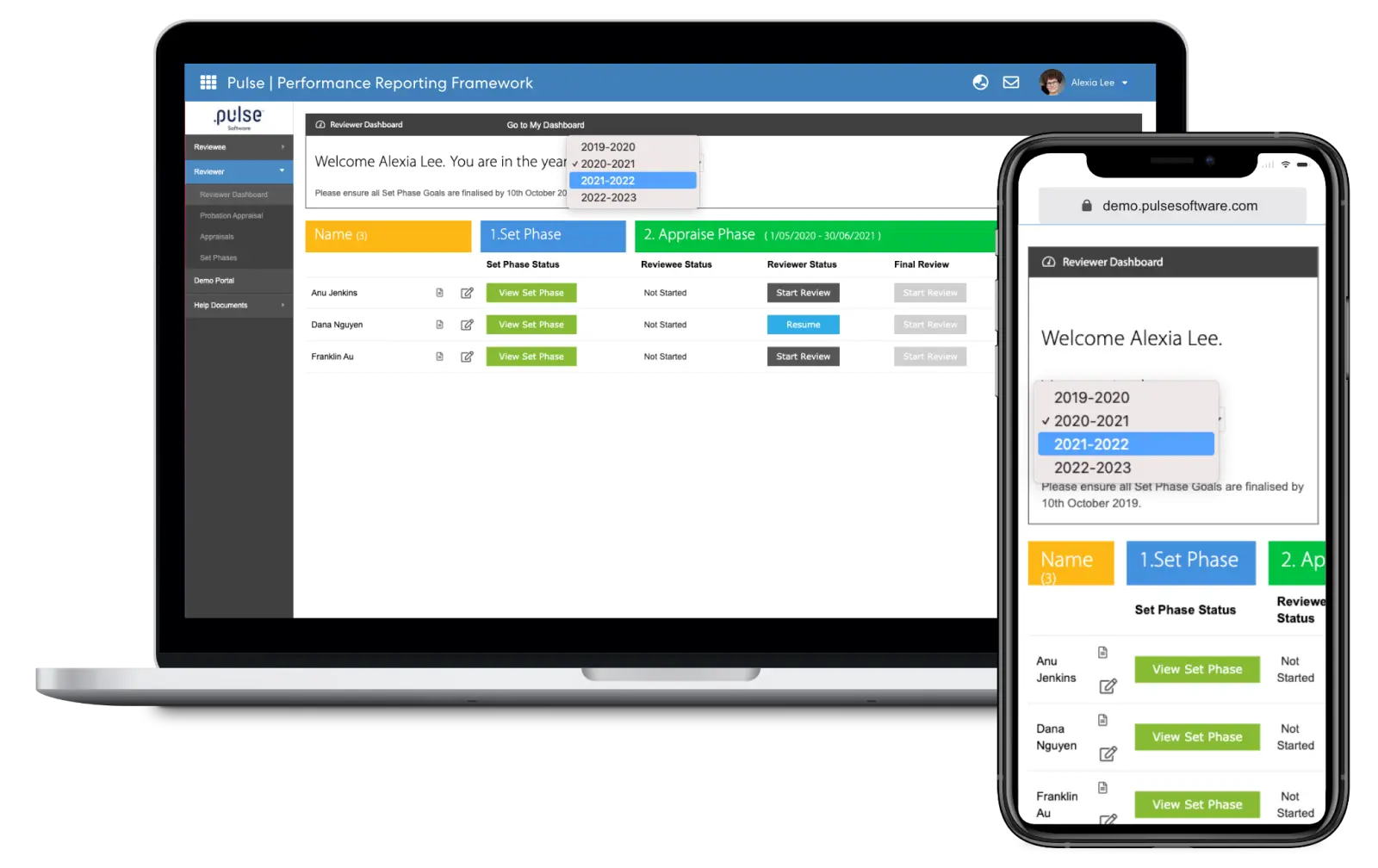

6. PULSE

Features

- AI-driven financial predictions

- Custom reporting dashboards

- Unit economics analysis

- Cash flow tracking

- System integration tools

- Visual data presentation

- Real-time decision support

- Automated forecasting

Pricing

Starts at $59/month for small business, $89/month for enterprise

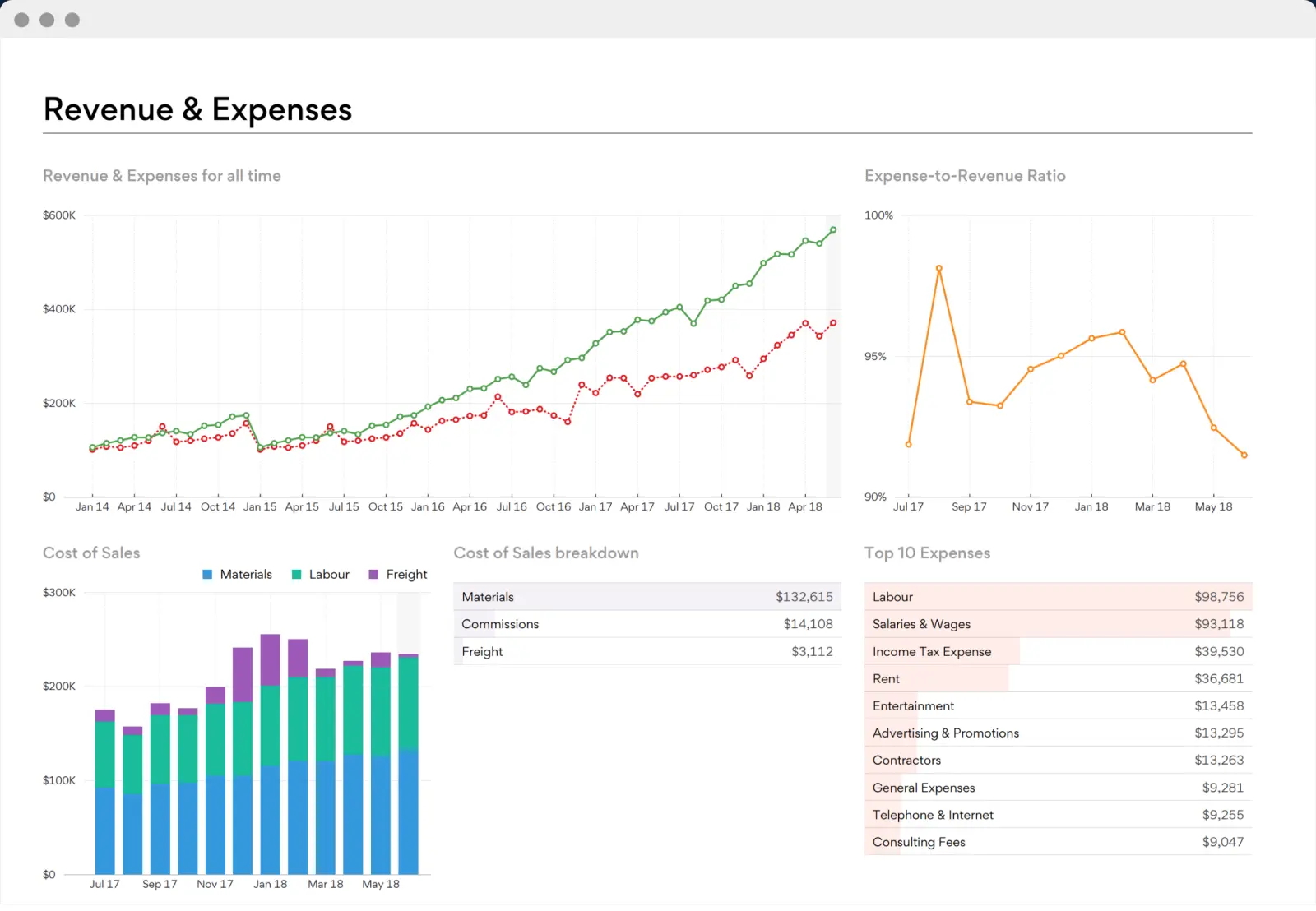

7. Fathom

Features

- Custom report builder

- Three-way cash forecasting

- Multi-entity management

- Performance benchmarking

- Visual analytics tools

- Group comparison metrics

- Automated reporting

- Integration capabilities

Pricing

Starts at $40/month per company

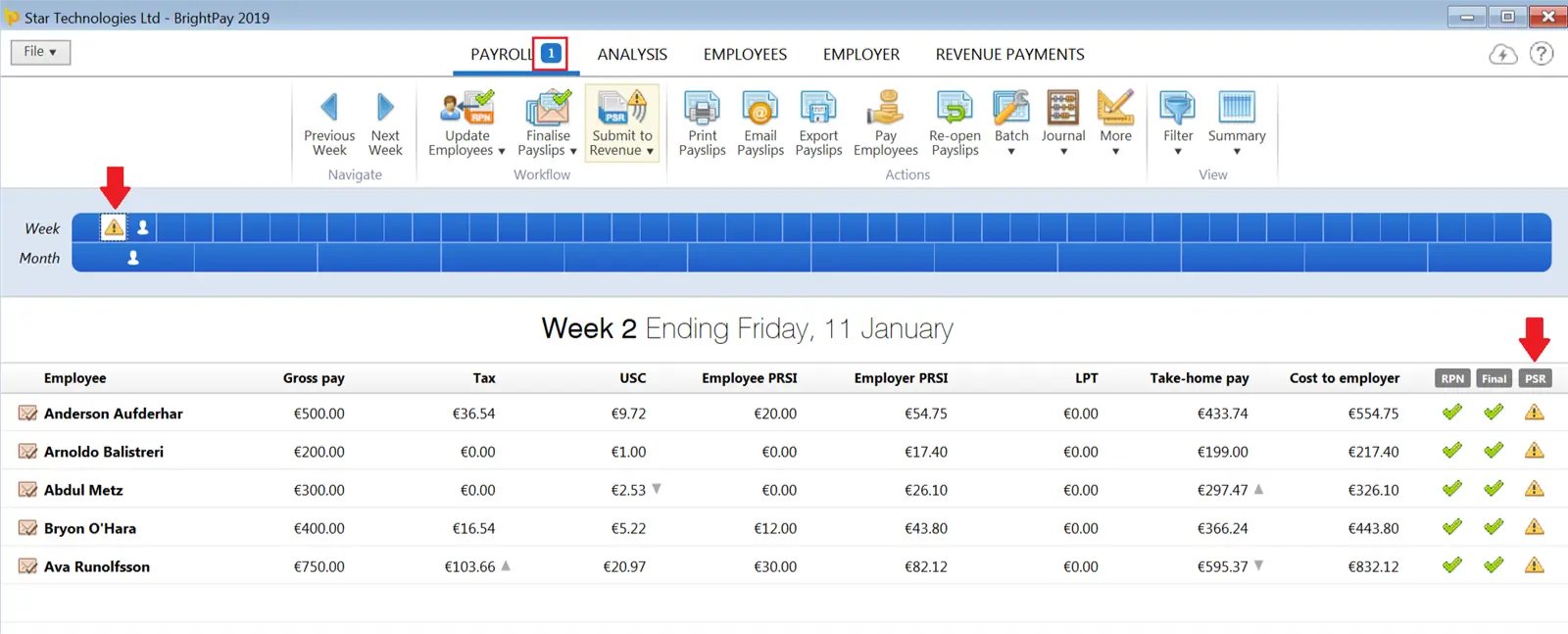

8. BrightPay

Features

- Complete payroll processing

- Leave management system

- Employee self-service

- Cloud accessibility

- Multi-device support

- Tax calculation tools

- Payment automation

- Document storage

Pricing

Starts at £84 for up to 3 employees and scales to £1,589 for unlimited

9. PlanGuru

Features

- Budget analysis tools

- Cash flow projections

- Financial forecasting

- Data integration

- Strategic planning

- Performance tracking

- Risk assessment

- Trend analysis

Pricing

$99/month

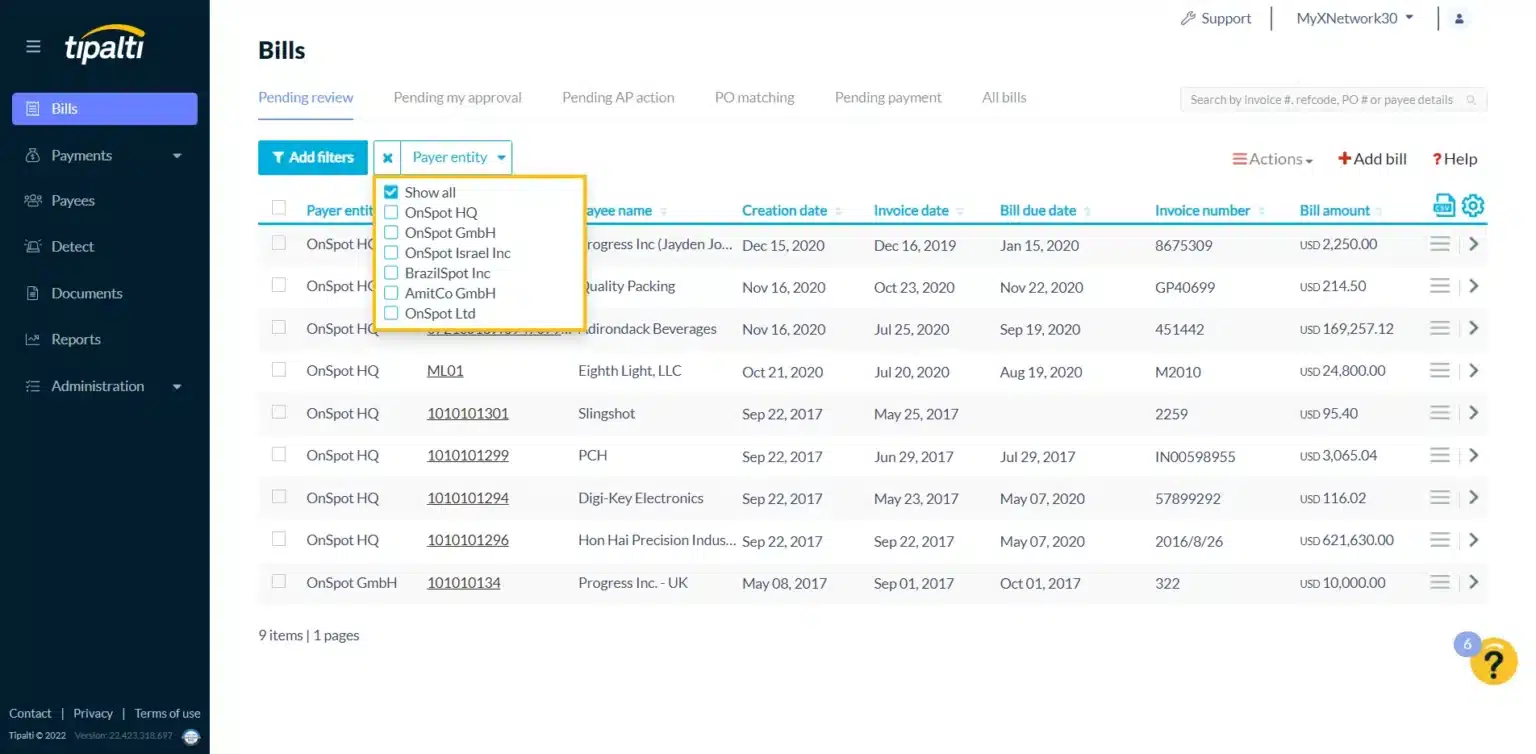

10. Tipalti

Features

- Purchase requisition automation

- Spend tracking dashboard

- ERP integration

- Custom approval workflows

- PO automation

- Spend analytics

- Vendor management

- Compliance controls

Pricing

Starts at $1,500/month

Choosing The Best Financial Management Tool

Selecting the right financial management tool for your business is not a one-size-fits-all approach. Each organization has unique needs, and the ideal tool should align with your goals, scale, and industry-specific requirements. Here are key factors to consider:

1. Features and Capabilities

Ensure the tool offers essential features such as expense tracking, invoicing, payroll management, and financial forecasting. Look for additional functionalities like integration with existing systems or support for multi-currency transactions if needed.

2. Ease of Use

A user-friendly interface can save time and improve adoption rates across your team. Choose tools that are intuitive and require minimal training.

3. Scalability

As your business grows, your financial management needs will evolve. Opt for a tool that can scale with your operations, offering advanced features or higher capacity as required.

4. Cost-Effectiveness

Analyze the pricing structure and ensure it fits your budget. Factor in hidden costs such as implementation, training, or subscription upgrades when evaluating options.

5. Customer Support

Reliable customer support is critical for resolving issues quickly and ensuring seamless operations. Check reviews and service-level commitments before making a decision.

By assessing these factors, you can identify a tool that not only meets your current needs but also supports your long-term growth.

Conclusion

There are no two ways about it; correctly organizing one’s finances can revolutionize organizations. Everything from avoiding human mistakes to delivering data in real-time, these aids help CFOs, and their teams become wiser with their money.

This highly dynamic business environment compels everyone to be more proactive in managing their finances better.

Therefore, by using the mentioned tools in this blog, businesses will be capable of attaining longer-term efficiency in their operations.

Just bear in mind that you need to select a tool that meets your present requirements as well as your long-term goals. Spend time and effort, perform calculations to determine what is best for you, and invest in a solution that benefits your financial operations.

FAQ’s

Ques. Can I customize financial tools to suit my business needs?

Ans. Yes, many financial tools offer customization options such as tailored dashboards, configurable reporting, and flexible workflows to align with your specific requirements.

Ques. How frequently are financial management tools updated?

Ans. Reputable and top financial tools receive regular updates to enhance features, fix bugs, and comply with evolving regulations, ensuring the software stays reliable and up-to-date.

Ques. Can financial tools generate automated reports?

Ans. Yes, these tools can generate real-time and scheduled reports, including profit and loss statements, balance sheets, and cash flow analyses, saving time and providing valuable insights.

Ques. What happens if I stop using a financial tool? Can I export my data?

Ans. Most financial tools allow users to export their data in formats like CSV or PDF, ensuring you retain access to your financial records even if you discontinue the service.

Ques. Can financial tools predict future trends for my business?

Ans. Many tools use AI-driven analytics to offer forecasting features, providing insights into future revenue, cash flow, and expenses based on historical data.