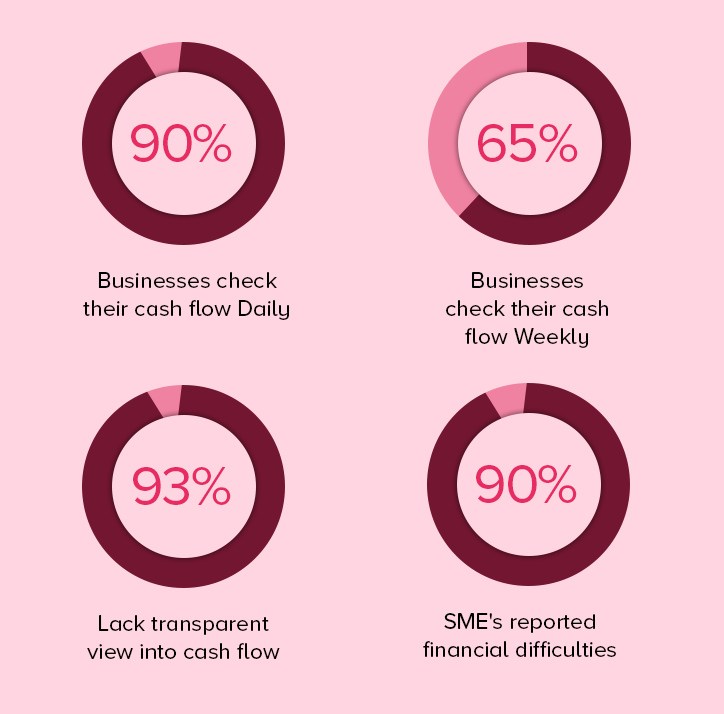

A healthy cash flow management understands every inflow and outflow of cash.The main reason behind maximum startup failures is the inefficiency in cash flow management. It is important to keep a close eye on cash flow for SMEs, in order to easily sustain and grow the new venture. Small businesses in order to maintain a healthy cash flow are taking a lot of steps and, experimenting with the ace technology available to bring in the positive change.

If you can easily answer these questions, you can start to plot your cash flow profile. And, most importantly start managing your cash flow for SMEs efficiently.

- Have you ever wanted real-time visibility into money owed and when it’s due?

- What can I do to hold cash and pay invoices as late as possible while taking discounts?

- Can Payments be received in the next month or group payments by due date?

- Is automated process of receivables is an exact necessity?

- Can you monitor real time approach or manage regulations, business risk and policies?

- Can you create financial reports without IT involvement?

- Yes, I’m getting profit, what can you do to be even better?

- Are every products and service contributing to the profitability?

- Are you getting paid for all your expenses?

A healthy cash flow management is essential to keep the new business options rolling with handling expenses efficiently, control business credits with clients and vendors, negotiating deals and forecasting finances.

Also, know more about the importance of cash-flow for business.

Here are some reasons why you need to manage cash flow for SMEs:

Unstable Revenue

When the customers are not completely aware of the product, that results in the unpredictable level of sale. Thus the amount of the inventory that one has to keep to maintain the level of sales is higher than optimum.

The position of the business depends on the cash flow. One has to ensure that there is the constant flow of revenue for the startup to manage a healthy level of cash.

Decision on the amount of cash to be invested

Every startup is looking to spread product awareness and acceptance. The initial expenditure on marketing and promotions depends on the expected return on the invested capital is relatively less.

It is a huge risk, so one has to be careful while pumping in cash, in the marketing activities.

The return tracked for each activity has to be optimized with the right level of cash flow for SMEs.

Related Post: Digital Agencies: How To Keep A Healthy Cash Flow

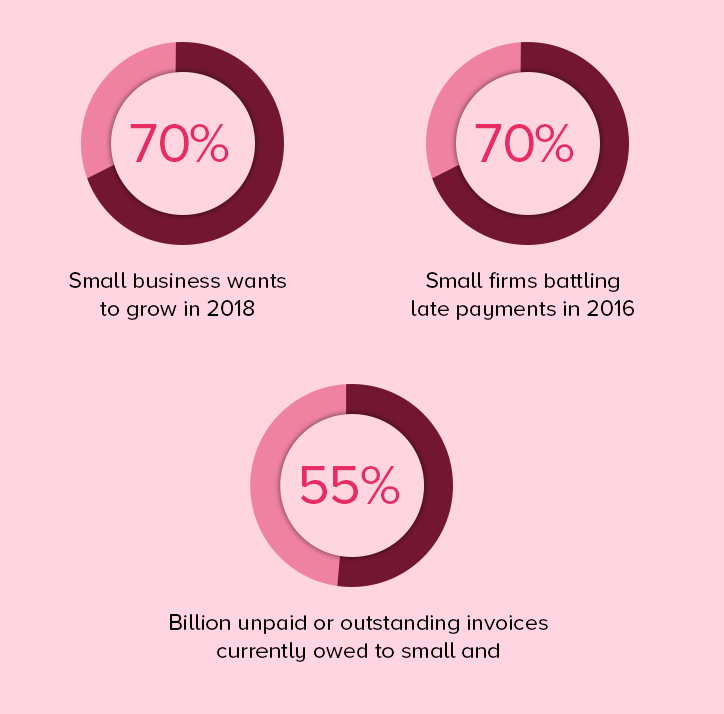

Late Paying & Credit note Clients

As a startup, the business is looking for more and more clients. There is a constant tradeoff, between having more number of clients and having a limited number of clients who always pay on time.

This adds to the struggle for a startup business looking to generate revenue, while also generating more cash.

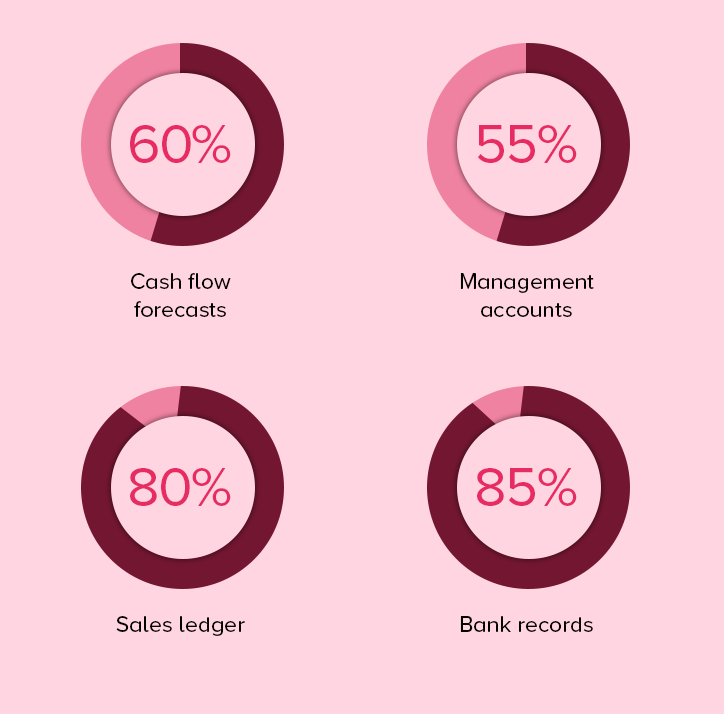

Improper Finance Forecasting

Many times, startups find it hard to forecast the revenue and expenses as precisely as required.

Unforeseen expenses and lack of judicious spending are the key reasons behind cash flow problems that businesses face, oftentimes.

Expenses must be documented and past expenses must be analyzed well, to control futures ones.

Investments and Expansion

This becomes a major reason for a cash flow for SMEs. As a business owner, one is tempted to add to the line of products and services.

This calls for increased investment in manpower and resources. One has to be vigilant with each level of investment so that the cash flow for SMEs can be managed effectively and as required.

Planning The Free Trials

The free trials in a startup must be strategized in an effective manner to ensure that the customers are also opting for the paid subscriptions.

Many a times startups fall into the trap of too many free trials, resulting in a cash crunch for the business.

Online Payments

Every client is looking for a simplified method of payments so the payments can be made faster.

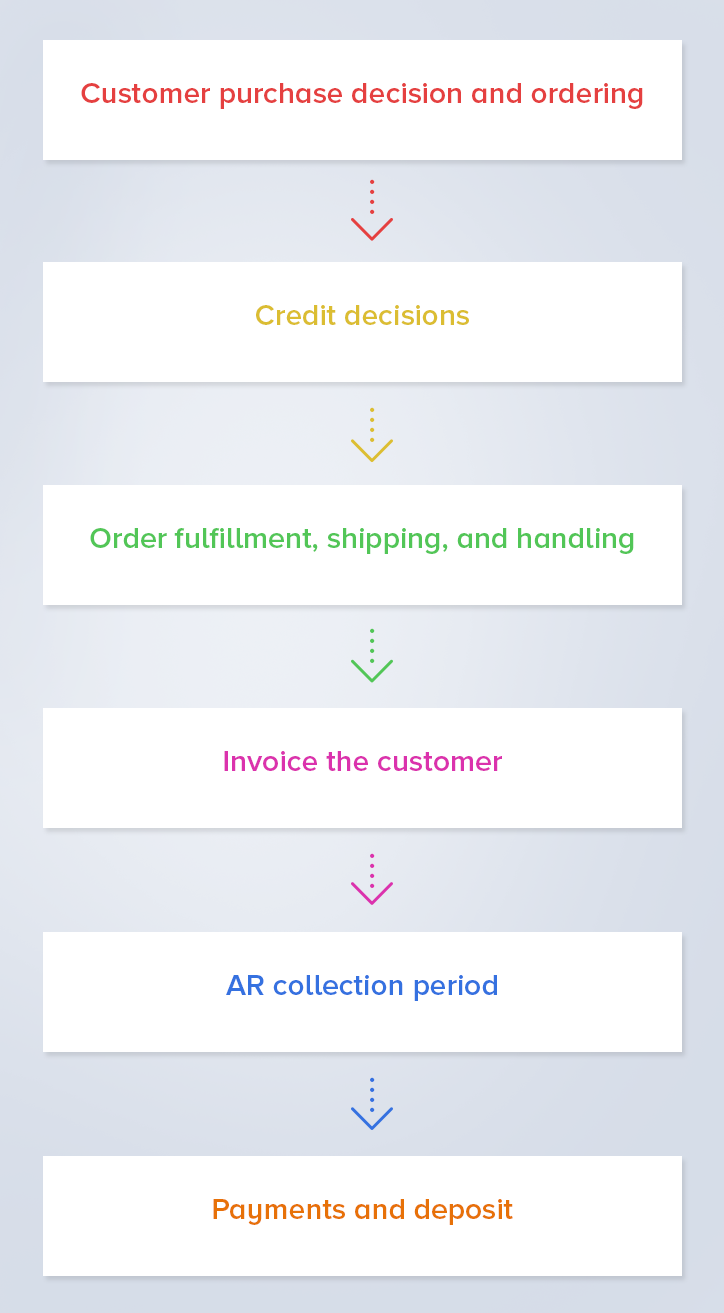

Understanding Cash Flow Cycle For Business

A startup must use an online invoicing solution that provides the appropriate payment integration so the client can make the payments easily and effectively. Invoicera is the only online invoicing software that has more than 30 online payment gateways. And, features like multi language and currency support to help you deal with global clients easily.

Send invoices in real time

Many businesses don’t end up taking the invoicing process seriously. This can lead to severe cash flow problems.

If the invoices are sent out late, they reach the client late and this leads to late payments.

On the other hand, if the invoices have errors on them, it becomes difficult for them to be processed in timely manners.

Every business must take the invoicing process seriously, to the cash flow for SMEs, on track.

Conclusion

It is important for small businesses and startups to have a clear track of cash flow from the very beginning. It helps them track growth and forecast finance and investment in the crucial days of business. One of the major steps taken by startups and small businesses is to opt for online invoicing system. With the major task of creating and sending invoices, it also help you manage your day to day business activities efficiently. Invoicera can be easily customised according to the need of each business type and make the complicated task of invoicing easy. With Invoicera, Organisation apart from sending invoices can keep a track of their cash flow and finances all in one place.

Here are some of the key features of Invoicera that are extremely useful:

- Add a late fee to invoices and get the client to pay on time

- Automatic payment reminders

- Inventory management and optimization

- Expense management and control

- Invoice scheduling

- Online payments

- Error free and professional business invoicing

Plan and forecast your business with proper account receivables aging reports, operating margins and keeping track of inventory turnover. Handle the business metrics like a pro with proper invoicing and billing solutions. FREE SIGN UP NOW!