Cash flow management is the most important aspect of every business. A healthy cash flow ensures that the business can pay salaries on time and have funds for the growth and expansion of the business. Resources are also available for paying vendor bills and taxes on time. Regular analysis of business finances ensures that one can project the future cash flow with accuracy and take necessary action.

Following up on client payments and managing the accounts receivables effectively, ensures the timely flow of cash, as required by the business.

Notable Facts: Poor cash flow management may lead to business failure.

The importance of Cash Flow Management.

Above All:

Cash flow management depends upon financing and not on measuring profits. The positive result of operating activities reflects the company’s operational performance.

Measure the essential cash flow rates that help in the effective decision-making process undertaken at the small and medium-sized enterprises. The company needs to have enough cash on hand to float its operations for the duration of the collection period. Because when the business goes out of cash, operations will simply cease.

With this in mind, businesses have to pay special attention to their cash cycle that covers the gap between receivables and payable to remain sustainable.

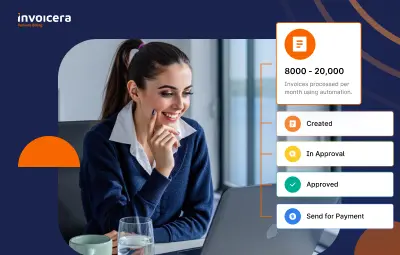

What Invoicera offers you?

Using an online invoicing solution is the key to managing business finances more effectively. The solution provides features like late fees and automatic payment reminders for getting timely payments from clients. With Invoicera, one gets to receive online payments from multiple payment gateways helping clients to pay faster and reduce the quote-to-cash cycle.