GST is emerging as the tax of the future that changes the architecture between the state and center. It unifies all the current indirect taxes under the Dual tax structure of GST.

The implementation of GST impacts the structure, computation of indirect taxes leading to comprehensive restoration of the current tax regime.

GST council finalized tax rates on 19th/ 20th May 2017 meeting in Srinagar. Out of 1211 goods and services,

- – 48% of the goods and services taxed at 18%

- – 8% of the goods and services taxed at 0%

- – 19% of the goods and services taxed at 15%

- – 16% of the goods and services taxed at the 28% slab rate

- – 12% of the goods taxed at 5%

For every industry verticals, the whole payment process would become very convenient for the buyer if there is a clear uniform rate for one tax. It includes everything that they need to pay in taxes to authorities.

Know more about GST in India: Impact of working capital on businesses

With the implementation GST, following taxes can be replaced:

Central taxes: central excise duty, service tax, additional customs duty, surcharge and cess

State taxes: VAT/ Sales tax, Entertainment tax, Entry tax, other taxes and duties (include luxury taxes, taxes on lottery, betting and gambling, and all cesses and surcharges by states ).

The impact of GST on various industries sector on the basis of a difference in GST rates:

TOURS AND TRAVELS

Around 30% of the tour value for tourism sector (i.e. an effective rate of 4.5% service tax is levied).

Composition scheme:

A person not having any inter state supply or neither a casual taxable person nor a nonresident taxable person and whose aggregate turnover in the preceding financial year does not come across 50 lakh rupees can avail the benefit under composition scheme.

The rate of Tax in case of Composition scheme shall not exceed 2.5% of CGST as well as 2.5% of SGST totaling to 5%.

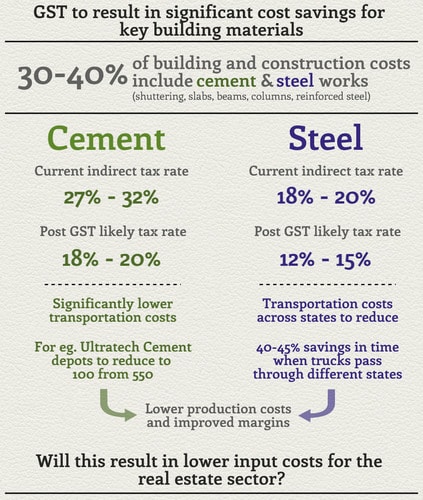

REAL ESTATE

Real estate is one of the most significant sectors of the Indian economy. The impact of GST on real estate is intended to be neutral.

In real estate sector, there is a high percentage of each project expenditure that goes unrecorded on the books currently. The impact of GST will cut down the percentage due to cloud storing of invoicing.

Secondly, the impact of GST on the buyers of resale properties is likely to be limited.

Thirdly, the under construction properties have to pay VAT and service tax. As most buyers of under-construction properties take home loans to fund their purchase that generates the process to appear difficult.

Currently, the sale of land and buildings have been kept out of the reach of GST but it is expected to be taxed within a period of a year.

RESTAURANTS AND HOTELS

Hotels and lodges that charge INR 1000 a day or less are relieved from the GST,

Those charging INR 1,000 to INR 2,500 will be taxed at 12 pc ,which is a slight decrease from the current rate of 13-14 pc.

Those charging INR 2,500 to INR 5,000 will have to pay 18 pc tax.

Similarly, there are different tax rates on the basis of the annual turnover. For example: small restaurants with less than INR 50 lakh annual turnover will be taxed at 5 pc, non-air-conditioned restaurants will be taxed at 12 pc and air-conditioned restaurants will be taxed at 18 pc.

Food and beverages bills can inflate the bills by 30-35% having multiple components. A single-slab tax will benefit consumers and should lead to savings of 10-15% on the overall bill.

Luxury and other service taxes in hospitality sectors amount to more than 22%, compared with the proposed 18% under the GST regime. Overall, the impact of GST on restaurants and hotels should be positive assuming the multiplicity of taxes will go away in food and beverages.

TRANSPORTATION AND LOGISTICS

The standard logistic costs can be determined by the development of logistics infrastructure. Currently, the logistic standard rate is about 18-21% but with the implementation of GST reduces up to 20%. Also, the current combined center and state statutory rate for most goods and all services work out to be 26.5%.

DIGITAL AGENCIES

GST levied at multiple rates ranging from 0 percent to 28 percent. If the GDP grows by 8% then advertising grows by 12% which is 1.5-2 times. And if the GDP comes down by 1%, advertising comes down to 1.5-2%

Also, the impact of gst is the positive one that will end up spending more with the regime of tax moving from 15%-18%. For advertising and media agencies, the tax rate may go from 15% to 18%.

Overall GST should be value intrusive to the advertising industry. The distribution and availability of price & goods will also enhance. The media and entertainment are no exceptions to change, GST will have a major impact of gst on print, television and the digital sector as it will get subsumed under the bill.

MANUFACTURERS

The implementation of GST enriches the performance of India’s manufacturing sector. It benefits significantly with the introduction of GST. The new GST model will unify the Indian market and assist the smooth flow of goods within the country. The impact of gst on manufacturing sector leads to lower cost of production. The availability of input tax credit can remove an extra level of warehousing in the supply chain, hence leading to greater cost benefit.

INSURANCE

The insurance sector provides 18 percent as GST rate. All insurance industry and policyholders will be affected by GST implementation. It shows that direct impact on the premium being paid by the policyholders.

Risk Premium Plan

Term plans: offers death benefit applicable if the insured dies during the term of the policy, the sum is assured to the nominee.

At present, the premium cost of 15% is imposed on all term plans

As per GST rates, it will be 3% costlier or 18%.

NOTE: It implies that for every Rs 100 paid towards premium which currently attracts Rs 15 as service tax will be replaced by additional Rs 18 as GST under the new tax regime.

Health insurance plans: In the current tax regime, health plan premium attracts a 15% on its premium. After the implementation of GST, it will attract a tax of 18% on premium from July 2017.

Motor Insurance: Motor Insurance service tax of 15% will rise to 18% from July 2017 after the implementation of GST.

Saving Products

Endowment Plan: offers both death and maturity benefits, whichever occur first. Currently, it attracts a service tax of 3.75% that will rise to 4.5% under the new tax regime in the first year. In the second year, the service tax will be levied from 1.88% to 2.25% after the implementation of GST.

ULIP: It offers dual benefit of insurance and investment. Earlier the service tax of 3.5% is levied which turn to be 4.5% after implementation of GST. In the second year, it ensures 1.75% which turns to 2.25% after GST.

INVOICING

According to the section 25 of the Model Law (Refer) requires uploading of invoices on Goods and Services Tax Network (GSTN) by 10th of the next month. It means each and every service wherever the recipient of service wants to avail input tax credit, where under certain fee or commission or charges have been charged and on which GST is levied, is required to be uploaded electronically on the GSTN by the service provider.

AS SHOWN ABOVE:

The introduction of GST improves the tax collections and boost economic development by breaking the tax barriers through a uniform tax rate. Moreover, GST has the potential to transform not only the tax system but also provides the impetus to Indian industry and inclusive growth!

The invoice becomes a vital factor in the whole purchase or sale transaction. There are several categories of invoices under the GST regime including GST invoice, debit notes, vouchers, credit notes, supplementary invoice and bill of supply. GST specifies the transaction as supply where there is exchange, transfer, rental,disposal, license of goods or services.

Whenever a transaction take place, a tax invoice has to be issued depending on the certain event and time limit. Know more about Invoicing in GST regime!

Join Invoicera for accurate GST compliant invoices ! Experience the GST journey now.