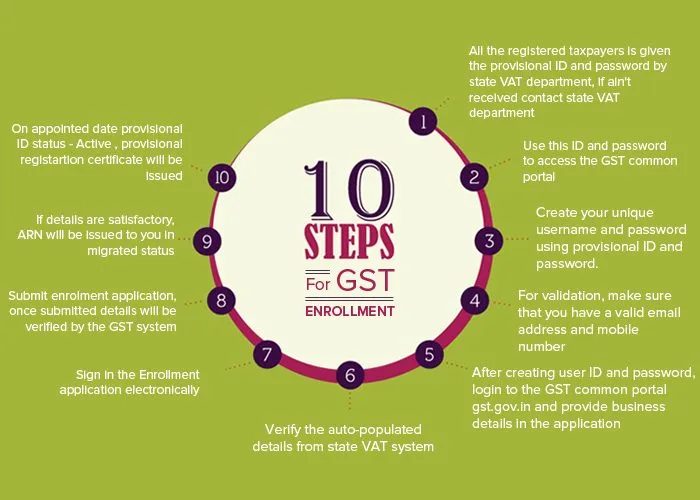

Goods and services tax is one of the different tax reforms in the history of independent India. The government has launched GST portal for existing VAT, service tax, and excise taxpayers for smooth transition system.

GST is one of the indirect tax on the supply of goods and services from the manufacturer to consumer. GST combines all the taxes into one and subsumes all the indirect taxes. This is done for all the central level and state level taxes. The nature of the GST invoice India is that it clubs almost all indirect taxes that are levied by Central and State Governments and taxes only the final customers.

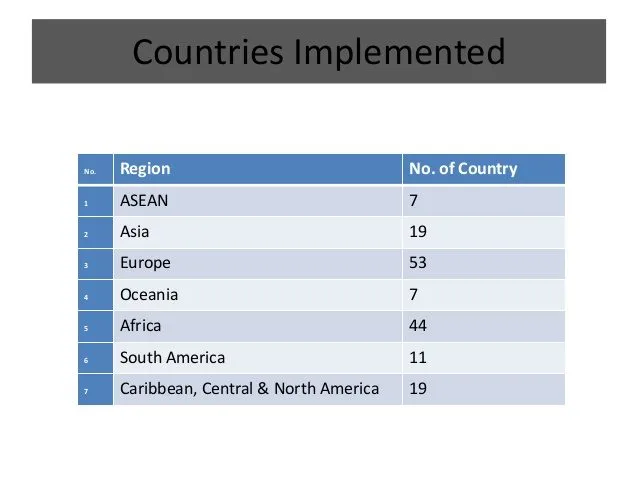

Goods and services tax is getting unboxed by every passing day. A list of 160 countries is implementing GST.

GST is implemented at its full speed from July 1st, 2017.

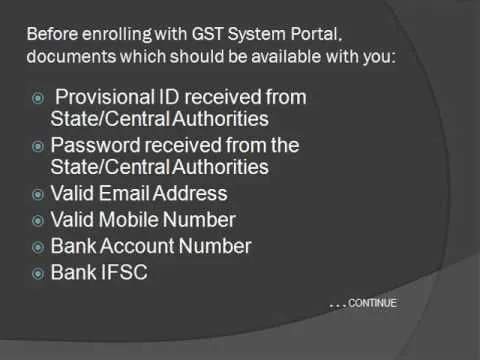

Update your profile information and upload the required documents on the GST portal. GST ensures collection of data of existing taxpayers.

The government has issued the new draft rules on registration, invoicing and payment under GST regimes.

Now when India has been gearing up for more challenging reform measure, GST invoice India

- – Simplifies administration and expand the tax net

- – Drive competitiveness

- – Increase indirect tax collection at the same rate

- – No multiple taxations, seamless flow and remove distortions in the trade

- – Simplify the tax structure and create a common marketplace

- – Reduces the hidden cost of doing business

Currently, GST transforms the way policies are planned and administered.

GST tax invoice will bring in existing implementation and significant improvements. Get the complete automation of core services like registration, return filing and payments, real-time data sharing between GSTN and tax administrations.

All this brings serious benefits not only to the tax administrations but also to the taxpayers.

Some of the unique features of a system include:

- – Fully automated process and real-time access of taxpayers

- – Fully transparent system with real-time validation of PAN, Aadhar, CIN, DIN and more

- – Comprehensive dashboard and ledgers with multiple modes for upload

- – GST compliance rating for taxpayers

How can you manage GST using Invoicera?

Invoicing is the crucial aspect of tax compliance for every business. Be aware of the rules of invoicing under GST.

Tax invoice:

Issued to registered dealers i.e. two main types of tax invoice in the current tax regime includes Excise invoice and tax invoice

Compared with

Invoicing in GST regime:

In the GST regimes, tax invoice issued to registered taxable persons supplies taxable goods or services.

Time limit for the issue of the tax invoices: Supply of goods and supply of services. The tax invoice must be issued at the time of removal of goods or delivery of goods. The invoice may be issued within 45 days of the supply of the service.

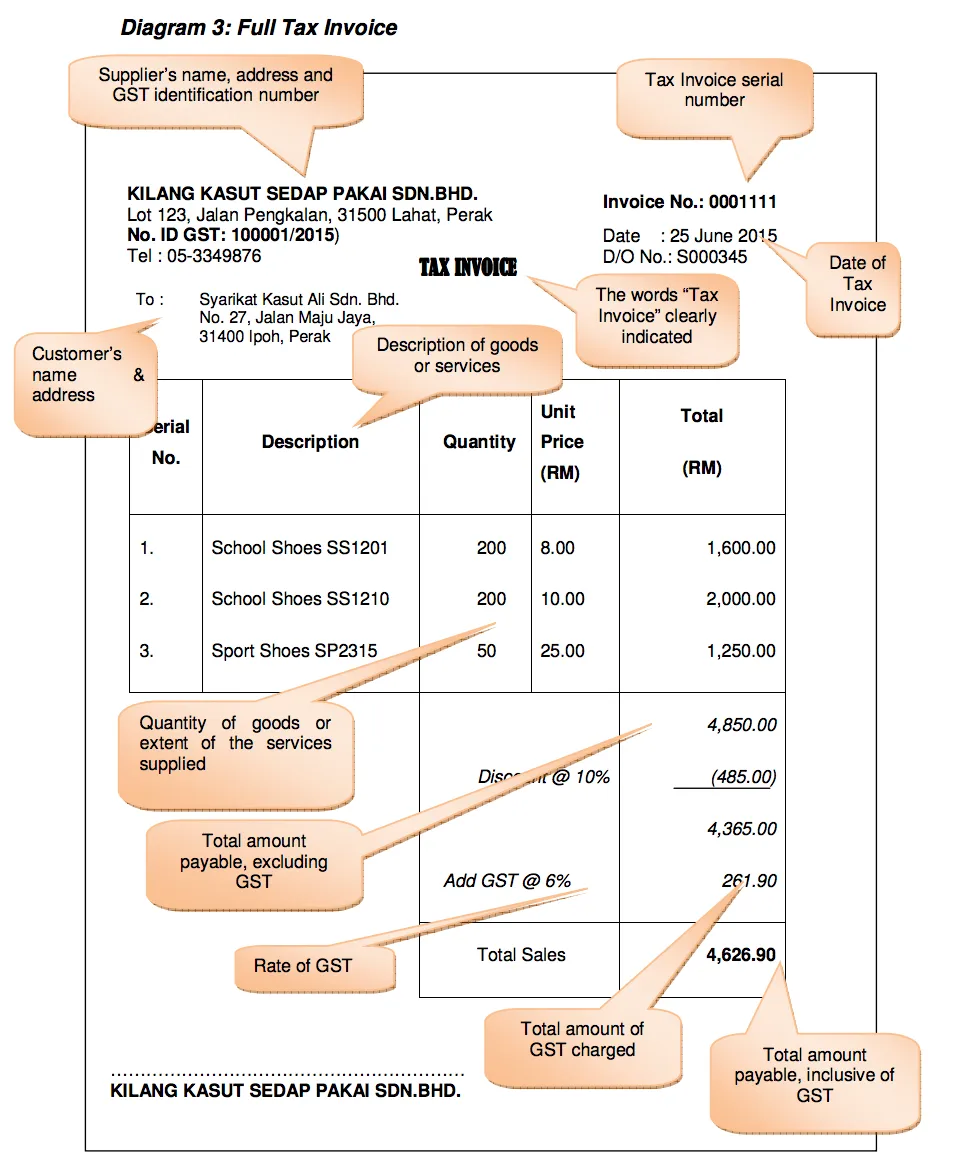

According to GST law, here are the tips to prepare GST tax invoice:

- Name and address of the supplier

- Mention registration No of GST on GST tax invoice

- Allot GST tax invoice number i.e. unique number to be mentioned not similar to invoice number

- Insert Date of GST tax invoice as per the time of the issue

- Add the recipient details in proper format

- Mention the HSN (Harmonized System Number) or SAC (Service Accounting Code Number) to compute GST as per the slab fixed

- Details of Goods and services on GST invoice i.e quantity and value of goods or services

- Both total value of sales and taxable value of sales to be clearly mentioned in the GST invoice

- Rate of GST depends upon the nature of the transaction

- Mention “GST PAID ON REVERSE CHARGES” if payable, if revised invoice then clearly mention “REVISED INVOICE” in GST tax invoice

- GST tax invoice has to be signed by the supplier as per the guidelines of the GST authorities

CONCLUSION

The business benefits that are likely to come on GST tax invoice are different in every other respects.

- -There will be no controversies as only one rate will be written that makes the invoicing simpler.

- -There will be no entry tax that causes the movement of goods by road transport easier.

- -In the GST regime, exemptions will be common between the center and state that makes the duty rates same all over India.

The common marketplace has so many rates of duty, the classification controversies will go if the exemptions are limited. Identification of commodity will go since rates of duty are different. GST completely merges most of the existing taxes into the single system of taxation and completely replaces taxes levied by Central and State Governments.

GST tax invoice is proven to be a better tax system as it is more transparent, efficient, effective and increases competitiveness in the global market.