A retail company saw steady sales growth, a loyal customer base, and expanding market presence. Despite the operational success, it faced challenges due to limited cash availability. Invoices piled up, payments were delayed, and financial planning felt more like guesswork than strategy.

The problem wasn’t the business model; but

- It was the lack of visibility.

- Control over day-to-day finances.

The right cash management software can transform the current situation. With real-time tracking, automated invoicing, and precise forecasting capabilities, a business can turn a chaotic system into a streamlined process.

If managing your cash flow feels like a daily struggle, the right cash flow management tools can make all the difference.

Let’s understand how.

What is Cash Management?

Managing company funds to optimize cash inflows and outflows is known as cash management.

Purpose: The process ensures retention of sufficient funds needed for operational expenses and salaries, coupled with necessary investments.

Key Activities

- Tracking income and expenses

- Forecasting cash flow

- Planning for short-term and long-term financial needs

- Managing unexpected changes in revenue or costs

Benefits of Good Cash Management

- Avoids cash shortages

- Optimizes working capital

- Reduces financial stress and risk

- Positions businesses for growth and stability

Effective Cash Management

- Involves making smart decisions about saving, investing, and spending

- Helps businesses thrive and succeed in the long term

Thus, managing your cash flow effectively is easier than ever with the right cash management tools.

Top Cash Management Software to Consider in 2025

Here are the top 5 cash management software options to consider:

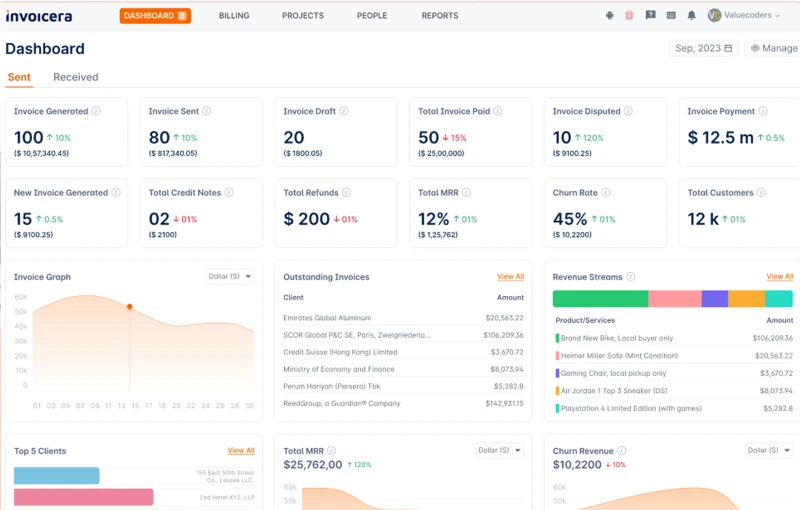

1. Invoicera

Invoicera streamlines the entire billing cycle from estimates to payment collection, and it particularly excels in managing recurring revenue streams across multiple currencies.

What It Does Best

Invoicera excels at comprehensive invoice management with exceptional customization options and multi-currency support for global businesses. It’s also a robust invoice automation software solution.

Key Features

- Advanced recurring billing with flexible scheduling options

- Client portal for streamlined payment collection

- Extensive template library with brand customization

- Time tracking integrated with billing workflows

- Robust API for custom integration with existing systems

Who It’s For

Ideal for service-based businesses with international clients, particularly agencies and consulting firms requiring detailed invoicing and client management capabilities. It’s also an excellent example of business cash flow management software.

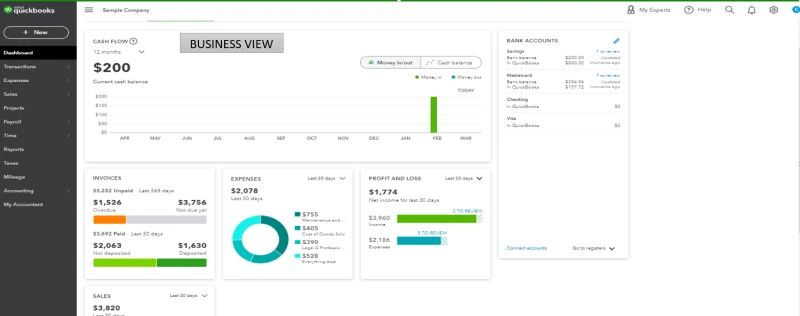

2. QuickBooks Online

Users can build tailored financial management software systems using QuickBooks through its third-party features, which exist in the company’s app marketplace.

What It Does Best

Small and medium-sized businesses need financial management technology that provides full accounting capabilities and is widely used by accountants across the organization.

Key Features

- Real-time bank synchronization across multiple accounts

- Integrated tax preparation and compliance tools

- Intelligent cash flow forecasting and scenario modeling

- Customizable financial dashboards with critical metrics

- Extensive third-party app marketplace for specialized needs

Best For

Small to medium-sized businesses require a comprehensive cash management platform with strong accounting foundations and widespread accountant familiarity.

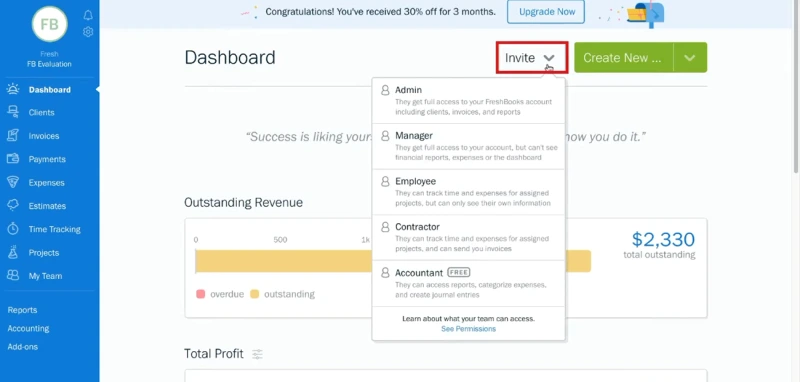

3. FreshBooks

FreshBooks allows users to manage accounting tasks efficiently. It provides an easy-to-use interface, features time monitoring, project organization, and transparent client communication systems.

What It Does Best

Service providers who need time-saving automation while tracking billable hours find FreshBooks to offer the best user experience. Its strong features also place it among the top AR AP automation software tools.

Key Features

- Streamlined expense capture with receipt scanning capabilities

- Project budgeting with real-time profitability tracking

- Client retainer management and automated billing

- Double-entry accounting with financial statement generation

- Mobile-first design for on-the-go financial management

Best For

Freelancers, contractors, and small service businesses seek intuitive cash management software solutions.

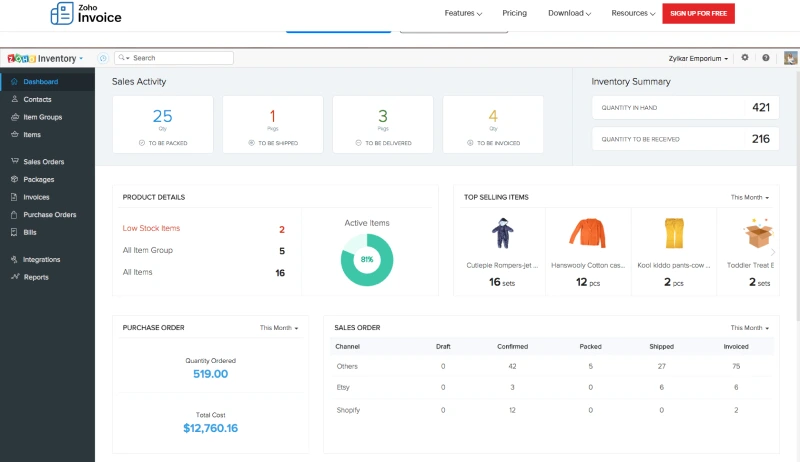

4. Zoho Books

The financial component of Zoho’s comprehensive business application suite integrates seamlessly with CRM, inventory, and project management tools. Zoho Books handles sales and purchase workflows with customizable automation to match specific business processes.

What It Does Best

Zoho Books offers outstanding value through comprehensive functionality at competitive pricing, particularly when integrated with other Zoho business tools.

Key Features

- End-to-end purchase order and inventory management

- Automated payment reminders with customizable schedules

- Multi-entity management for complex business structures

- Vendor portal for streamlined accounts payable

- Advanced workflow automation for approval processes

Best For

Growing companies seek scalable AP Automation software for their broader financial operations.

5. Xero

Xero emphasizes automated bank connections and transaction categorization while supporting complex business structures with accessible interfaces for non-accountants.

What It Does Best

Xero provides exceptional bank reconciliation capabilities with powerful collaboration tools for businesses working closely with financial advisors.

Key Features

- AI-powered transaction matching and categorization

- Fixed asset management with depreciation tracking

- Inventory management with real-time valuation

- Role-based access controls for team collaboration

- Comprehensive financial reporting with customizable views

Best For

Businesses looking for reliable cash management software solutions that support international accounting standards.

The right cash management software can transform your financial operations from a reactive process to a strategic advantage.

Benefits of Using Cash Management Software

Cash management software provides businesses with an efficient way to gain financial visibility and automate core functions.

Here are the key benefits of using cash management software:

1. Real-Time Cash Flow Visibility

- Monitor financial movements as they occur

- Maintain a comprehensive view of your current financial position

2. Strategic Forecasting Capabilities

- Develop projections based on historical financial patterns

- Prepare for upcoming expenditures with appropriate cash reserves

3. Streamlined Task Automation

- Reduce manual administrative requirements

- Automate key processes, including invoicing and payment tracking

4. Enhanced Financial Accuracy

- Minimize errors common in manual financial management

- Base decisions on current, verified financial information

5. Proactive Cash Management

- Effectively oversee incoming and outgoing funds

- Prevent unexpected shortfalls and maintain payment schedules

6. Operational Efficiency

- Accelerate essential financial processes

- Reallocate resources toward core business priorities

7. Data-Driven Decision Framework

- Utilize comprehensive financial reporting for strategic planning

- Apply actual performance metrics when evaluating business opportunities

8. Regulatory Compliance Readiness

- Maintain thorough and accessible financial documentation

- Simplify audit processes with organized record-keeping

In conclusion, the best cash flow management software allows businesses to streamline daily financial tasks and make informed, strategic decisions that can drive long-term success.

Key Features to Look for in Cash Management Software

Businesses should select cash management software that enhances their financial operational health. Their success depends on selecting suitable tools, and different tools have distinct features.

To ensure maximum efficiency, the right cash management platform should include:

1. Real-Time Cash Flow Tracking

- Track incoming and outgoing funds instantly

- Monitor cash availability and make quick decisions

2. Budgeting and Forecasting Tools

- Create accurate budgets and track actuals against projections

- Forecast future cash flow based on historical data

3. Bank Account Integration

- Automatically sync bank transactions with your software

- Eliminate manual entry and reduce errors

4. Invoice and Payment Automation

- Automate invoicing and payment reminders

- Process payments efficiently and reduce administrative tasks

5. Financial Reporting and Analytics

- Generate detailed, customizable financial reports

- Use analytics to identify trends and optimize financial strategies

6. Multi-Currency Support

- Manage transactions in different currencies

- Simplify cash management for international operations

7. User Access Control and Security

- Set permissions based on user roles

- Protect sensitive financial data with secure access controls

Thus, the best cash management software provides effective tools that are easy for business operations. Companies enhance their financial operations through real-time monitoring, automated budgeting procedures, and especially through real-time tracking functionality.

How to Choose the Right Cash Management Tool?

Closing Thoughts

In conclusion, your business needs the right cash management software to optimize financial operations and planning.

The suitable tool for managing your money will provide instant cash flow tracking and automatic invoicing with detailed financial reporting capabilities.

Solutions like Invoicera act as powerful business cash flow management software with strong integrations.

Using appropriate financial management software allows companies to gain better financial control together with lower error rates and smarter business planning for future success.

FAQs

Ques: Why do businesses need cash management tools?

Ans: Businesses need these financial tools to gain financial transparency while minimizing human mistakes through automated process management, which leads to enhanced executive choices and improved cash control.

Ques: Is cash management software suitable for small businesses?

Ans: Absolutely, multiple solutions provide small business and startup-friendly plans that deliver essential features at cost-effective pricing rates.

Ques: How does Invoicera help with cash management?

Ans: Invoicera uses one integrated platform to process automated invoices alongside time tracking and expense management, which improves users’ ability to forecast cash flow.

Ques: Can these tools help with international payments and currencies?

Ans: Yes, multiple tools allow users to handle transactions in various currencies, thus making them appropriate for businesses with international operations or clientele.

Ques: Is data secure with cash management software?

Ans: Financial data protection from leading providers relies on high-level encryption, safe backup systems, and compliance standards.