Are you ready to embark on an insightful journey through accounts payable challenges?

In the fast-paced business world, we’re sure that you are also facing a fair share of hurdles when it comes to managing your accounts payable processes. These challenges can be quite demanding, as they involve handling a high volume of invoices and ensuring timely payments. Even seasoned professionals may find themselves tested by these tasks.

However, fear not! Our exploration will be filled with positivity and optimism as we delve into the ten most significant accounts payable challenges. Together, we will explore the complexities of each challenge and equip ourselves with practical strategies and solutions to overcome them.

So, let’s jump right in and gain the knowledge we need to confidently tackle these challenges. By doing so, we can pave the way for smoother and more efficient accounts payable operations. Get ready for an engaging and enlightening journey ahead!

But before digging deeper, let’s understand what account payables are.

Understanding Accounts Payable

These liabilities can accrue swiftly during periods of heightened sales when numerous invoices are received in rapid succession. Typically, these debts must be resolved within a specified timeframe, typically ranging from 30 to 90 days.

Failure to fulfill payment obligations may result in suppliers imposing late fees and interest charges, ultimately increasing the overall cost beyond the original invoice amount in many instances.

82% of Businesses fail due to Poor Cash Flow Management.

Source: U.S Bank Study

Good accounts payable software is essential for business because it helps maintain all the records, including purchase orders, receipts, and invoices. It can help maintain good business relationships with vendors, boosting credit ratings and improving overall efficiency.

How Can Negative Accounts Payable Affect a Company?

Negative accounts payable can dramatically affect a company’s cash flow. Whether it’s through bad debt, lost invoices, or incomplete records, many companies are paying their suppliers late.

Delays in paying your vendors lead to longer payment terms, making estimating cash flow planning very difficult. If you can’t estimate your company’s cash flow accurately, it becomes hard to predict where and when you will need money and how much it will cost. This creates a cycle that eventually eats away all your profitability.

Companies discover that negative accounts payables have become an endemic problem that costs them a lot to fix. Indeed it takes discipline, organization, and management skills to keep track of payables, but it’s worth doing from a cost perspective alone.

Reducing bad debts by even 5% saves businesses hundreds of thousands of dollars annually. Most businesses aren’t even aware of just how big an impact bad debt has until someone steps back and looks at the big picture.

10 Biggest Accounts Payable Challenges Every Company is Facing

1) Manual Cash Management

To deal with this, you can opt for third-party financial solutions where an entity manages multiple accounts payable companies under one umbrella. This will help your business manage its cash flows better than before.

2) Processes Aren’t Up to Speed

According to a study by BIS, out of all of their respondents, companies who handle between $100 million and $2 billion in annualized revenue, 64% reported that they’re getting paid late every day. In comparison, 21% said they were getting paid less than three days late.

The big problem here is late payments.

Late payments disrupt cash flow and force you to pay more interest rates on your existing debt, which means you’ll have even less money for payroll. It also makes it harder to take advantage of opportunities when they arise.

You may need to implement new internal AP processes around invoice management to deal with these chronic payment issues. For example, some companies are experimenting with an automated-billing system in which invoices are automatically sent after delivery of services or products.

Another option is integrating software into your accounting systems so that you can quickly analyze accounts receivable data and get earlier warnings about potential billing problems, problems in accounting, or inconsistencies. With Invoicera, you can automate your payments and also get payment reminders.

By doing this, your business can reap the benefits faster rather than spending time worrying about late payments from customers.

3) Inaccurate Data

Inaccurate or missing data can cause several issues for vendors, including slow or delayed payments, which are a curse for business relationships. When information is sent incorrectly from accounting to finance, invoices go out late; when invoices go out late but payment terms aren’t changed, then vendor relationships suffer.

So before sending any data between departments, verify accuracy and make sure it makes sense.

Again, before transferring data, ensure it was entered correctly and verifiably before being transmitted elsewhere. Be diligent about accurate data entry!

4) Theft And Fraud

This causes Accounts payable professionals sleepless nights! And at the end of their nine-to-five shifts, you can bet they’re doing everything they can to ensure their organization isn’t on that list. Unfortunately, this just gets harder every day without internal controls in place.

To avoid this fate for your company, consider security measures like increased anti-fraud training or new policies limiting how/when employees can issue payments.

The more you know about your business risks, the more steps you can take to help mitigate them.

A secure platform like Invoicera have multiple layers of security to avoid any kind of fraud.

5) Growth Rate vs. Accounts Payable Turnover

While growth can signify a company’s potential, it also means additional work for your accounts payable department.

As your company grows, your account payable team will need to figure out how to manage larger volumes of invoices, both from new and existing suppliers, with greater payment terms. This growth creates challenges for account payable professionals who are used to managing smaller amounts of accounts daily.

Business owners, who typically don’t sit in their companies’ accounts payable departments, should know what changes may come in their businesses as they grow.

If they don’t adapt to these changing needs. In that case, they could set themselves up for errors that could damage relationships with suppliers, delay payments and negatively impact financial ratios like accounts receivable turnover rate. That’s why business owners must understand these key metrics and take the necessary measures.

6) Erratic Processing

While most small-business owners have some control over their cash flow, many are plagued by erratic processing, and many don’t know how accounts payable solves cash flow problems.

To handle this challenge, consider working with your clients and vendors to set standard terms for payment. You can avoid these issues, which will reduce your risk for chargebacks and boost your cash flow.

7) The Vendor Isn’t Communicating Correctly

This could be because there’s some financial error in their favor that they want to protect by keeping quiet about it, like duplicate billing, or maybe their system is down, and nobody knows how to fix it! Whatever issues you’re experiencing, remember that vendors are just as busy and stressed out as everyone else. If you think something might be wrong, don’t hesitate to dig deeper into things with them.

Let them know immediately that there needs to be an improvement in communication so you can get back on track with payments. Hopefully, they will respond accordingly and work to rectify an issue if there’s one at hand. Keeping lines of communication open between your company and its vendors can help prevent late payments from arising.

8) Double Payment Error

One of the top accounts payable risks in the industry is double payment error. Some companies handle invoices with auto-pay, while others cannot review every invoice before paying. As a result, many small companies suffer from payments twice or more.

For example, you have two vendors that ask for 1$ invoice each, and you both paid them on the 30th day of the month, so on the 31st day, those invoices were auto-paid again by the account payable department. So what will you do then? Nothing but wait for the rest of 15 days until the 60th day, when your bank account will be debited by $2.

Reviewing all your invoices manually can be complicated, but imagine how hard it will be if there are thousands of invoices.

To tackle this problem, you can use an effective system for reviews. After implementing this system correctly, you don’t need to check it manually. Run reports, and you will be alerted when something suspicious is found.

This will help you to save time and money. Also, reviewing your reports once a week will help you catch mistakes sooner rather than later because, after four days of old invoices, your brain cannot work as effectively as fresh ones.

9) Receiving Invoices From Multiple Channels

Receiving Invoices from multiple Channels can create chaos in your accounts payable department. It can affect your finances, cash flow and cost you time. Managing these invoices manually from different channels will also increase the headache for your accounts payable managers.

To avoid this, you must be organized and prioritize which invoices you pay first. It’s also a good idea to maintain records of paid invoices so that if an invoice comes up twice or as an adjustment due to a price decrease, you can quickly identify which invoice was actually paid.

10) Overpayments

It’s a huge problem for both parties. The vendor will say that you never or already paid them; there’s no way to prove otherwise.

Now imagine how much time and money could be saved if each company kept its own payment history records. Each transaction would be matched up accordingly through each client’s unique identifier assigned by your business management software provider, eliminating both overpayment issues as well as late payment/no payment issues.

Invoicera tracks each and every payment and never lets you overpay any invoices, and it makes you receive double payments.

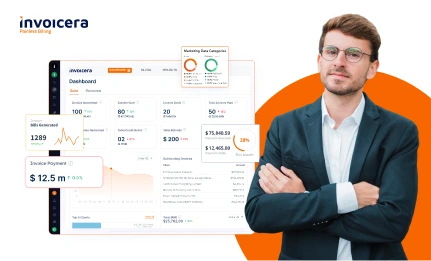

Invoicera – Best Online Invoicing and Billing Software

Invoicera expense management software is a proven invoicing and billing software system that makes online billing as easy as possible. It saves you time, money, and effort by automating all your daily tasks, helping you invoice clients faster than ever before.

In fact, through its automation features and intuitive design, it can save you up to 4 hours per day in administration work; that’s 40 extra hours per month!

Invoicera is the best invoicing software that saves time and money by automating manual tasks such as sending invoices and collecting payments. You can make changes to your billing or payment information at any time. Plus, Invoicera’s automatic invoice reminders make it easier to pay on time than ever before.

Invoicera accounts payable automation software has everything you need to simplify your workday. In addition, all data is synced automatically across all supported platforms, such as desktop, mobile, and tablets, so you always have access to your billing information when you need it the most.

With its modern design and simple-to-use features, you’ll be up and running within minutes. You can send your first invoice in less than 15 minutes!

So what are you waiting for?

Sign Up for our free Invoicera trial and make your business more efficient than ever.

Conclusion

Whether it’s a large corporation, a mid-sized company, or even a small business, managing accounts payable (A/P) is a challenge all companies face. Fortunately, there are some solutions available to help address these challenges.

Our guide has covered every company’s ten most significant accounts payable problems and solutions. We have also included some tips to make your accounts payable management easier for you and your clients. Feel free to use one if you think it fits your needs more than another option you already know about!

We hope reading through our Accounts Payable Challenges guide was informative and fun! Stay tuned for more guides on essential business topics.

If you have any suggestions or questions, please ask them in the comments below.

Also, let us know if you think we forgot anything important in our list of challenges.

Good luck with managing your accounting payable, and good luck with your business!

Thank You !!