Introduction

Errors are inevitable in any process. Although sometimes they might be annoying and time-consuming to rectify, it’s not impossible to fix them. And we know you are having difficulty managing your accounts payable errors, but it is crucial to maintain a healthy financial system.

We aim to empower you with practical tips to help you avoid costly mistakes and enhance your financial management capabilities.

Implementing these tips can significantly minimize errors and foster a smoother and more accurate accounts payable workflow. Moreover, you can save valuable time, reduce the risk of errors, and ultimately improve your organization’s financial health.

But before jumping into that, let’s understand what accounts payables are.

What are Accounts Payable?

Accounts payable(AP) are generally an organization’s outstanding debts which consist of money owed to other companies, vendors, or creditors who have provided services or goods and have not yet been paid.

However, accounts payable can accumulate rapidly during high sales periods when many invoices arrive in short order. The debts must be paid within a specific period, usually 30 to 90 days. Meanwhile, if the supplier finds that money is not getting paid for some reason, they start charging late fees and interest payments, which in turn cost more than paying off the original bill in most cases.

Now, let’s have a look at the different types of accounts payable errors that occur.

Types Of Accounts Payable Errors

Several problems may occur with accounts payable; some of the Accounts Payable Errors are:

1. Duplicate Payments

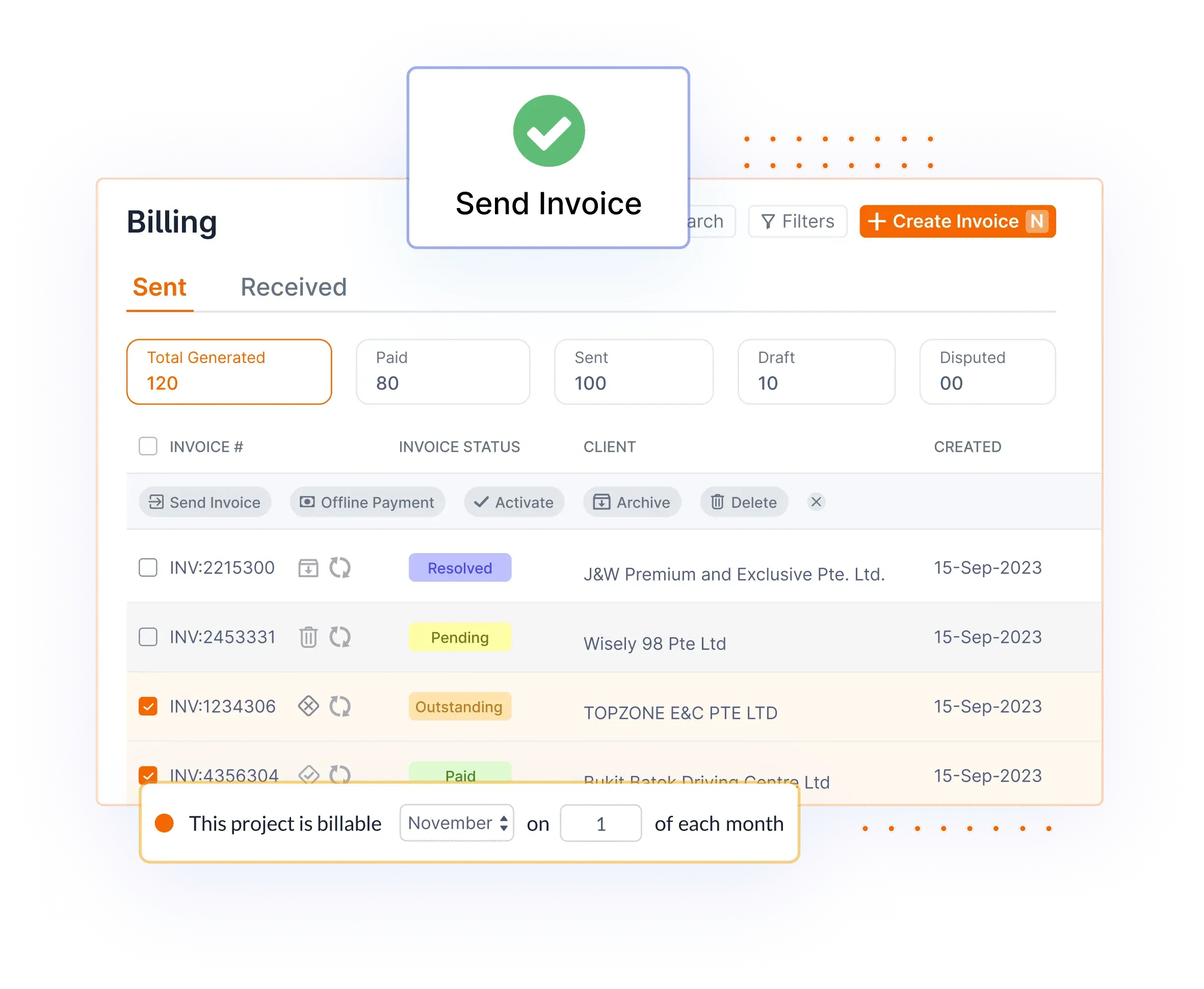

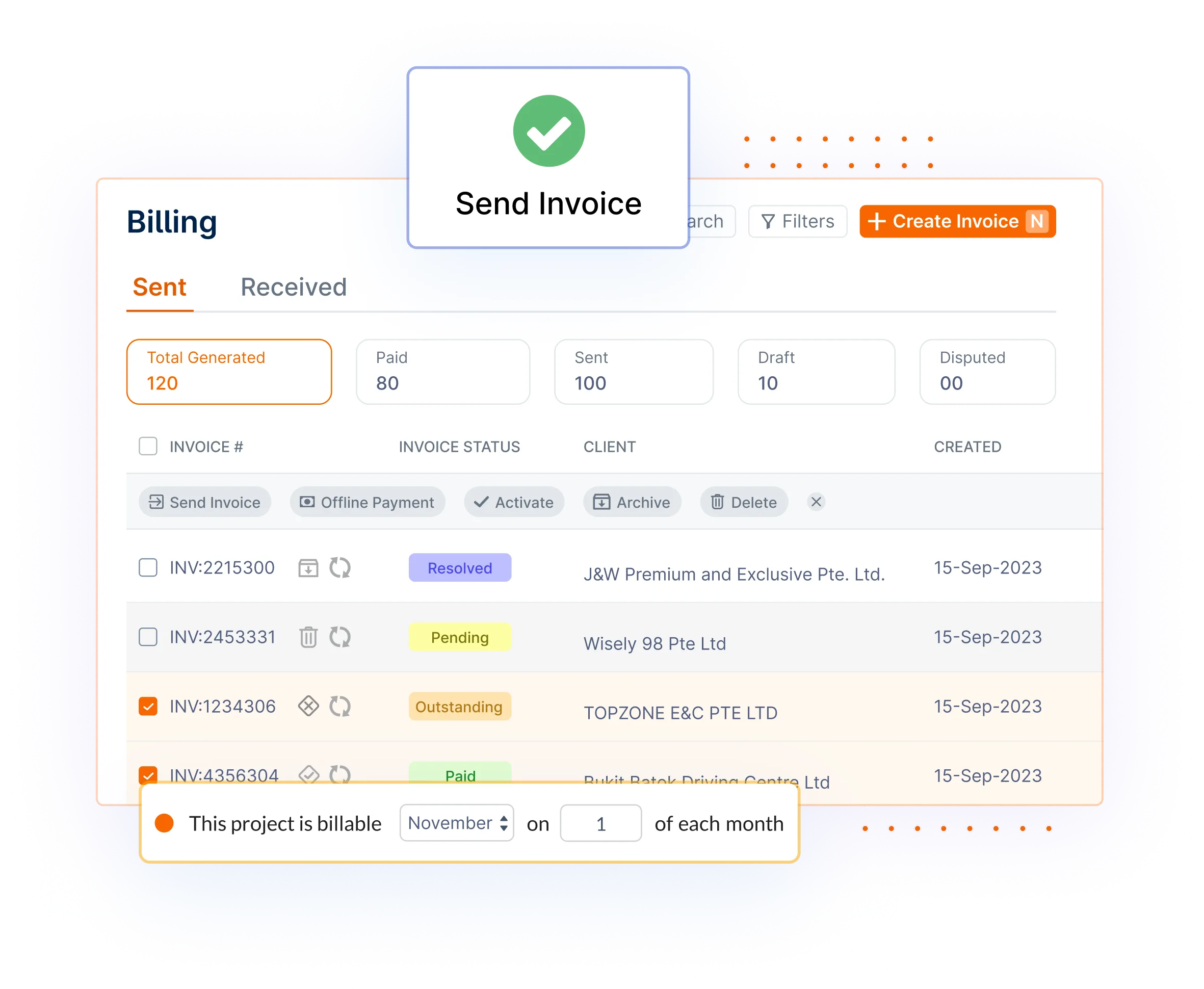

Duplicate payments can occur if invoices are received through different communication channels, say email or post. In this case, the organization pays both invoices, leading to financial losses. Sometimes, you may get the money back, but cash flow gets disrupted in most cases. However, it is a stupid mistake but could be avoided using an invoicing tool like Invoicera that avoids duplicate payments.

2. Incorrect Amount

The cheque that clear an account need to be legible and match exactly with what has been sent over, so it’s critical to double-check your accounting department before making any allegations.

3. Payments Not Recorded

For example, if you receive a 1099-INT for $500 but don’t record it until a year later, you will owe taxes on $500 in interest in addition to any late fees or penalties that could apply.

4. Data Entry Errors

With large numbers of transactions, even a few simple errors will begin to affect your financial areas. Because financial documents must be reviewed for accuracy, nothing must go unchecked as you input data into an accounting system.

You can significantly reduce the chances of an error by knowing what kinds of mistakes are expected and how you can avoid them before they have a chance to happen. However, the professional approach is to always use the latest OCR-based solutions such as Prepostseo to automate data extraction procedures for minimal errors. You can also use accounts payable software to help you deal with these errors feasibly.

5. Excessive Overpayments

Overpaying your suppliers is an accounting mistake that looks innocent on paper but can lead to intractable problems. Overpaid money is complicated or requires a lot of work to get back. This error also creates a hassle for accounts payable departments.

Instead of blindly paying invoices as they come in, it’s essential to understand how overpayments affect your balance sheet and cash flow. This way, you’ll be less likely to do it again. After all, a small mistake today can become a major problem tomorrow.

This was a piece of brief information about account payables and their different types.

Let’s move on to the strategies that will reduce errors in your Accounts Payable and help you save time and money!

8 Tips to Reduce Errors in Accounts Payable

1) Get Rid Of Manual Data Entry

Spend money on software or accounting outsourcing services, whatever it takes to get out of manual data entry. Just because you have an old system doesn’t mean you have to keep using it. Technology has changed quite a bit, with some tools becoming more powerful than others.

It may take some research and trial-and-error before finding what works for your business. For this reason, we have a great choice Invoicera for you that will reduce the use of manpower and automate the invoicing process.

2) Improve Communication

Since errors are more common than most companies would like to admit, improving your communications with vendors can help reduce mistakes and save you money.

3) No More Excel

With a smooth-running automated process, you’ll be able to get back in control of your AP while saving valuable time and money.

4) Control The Process

Control how you pay your bills. While it’s tempting to pay all your bills online, if you have a lot of them, spending hours on an accounts payable system can be frustrating. Instead, try making payments by cheque or by hand when possible. This will help keep control of each invoice and reduce errors from confusion over which payment goes with which bill.

Ensure that every single receipt for your business is accounted for so that no unidentified costs or revenues appear out of nowhere.

5) Perform Reconciliations Regularly

When many people use your accounts payable system, it’s important to regularly reconcile your list of vendors with a recent bank statement.

Reconciliation ensures that all transactions are recorded accurately, and there are no duplicate entries or errors. This can go a long way toward keeping errors low and reducing concerns about security breaches. It also helps you catch mistakes before they grow into nerve- problems.

With proper reconciliation procedures in place at all times, there should be fewer transactions to double-check and fewer mistakes to slip through.

6) Use Control Accounts Wisely

Control accounts track revenue and expenses that are associated with a specific project. Using control accounts wisely will help you manage projects from start to finish and reduce errors associated with closing out multiple general ledger accounts simultaneously. To minimize the mistakes in Accounts Payable, use control accounts like items on an invoice.

A good rule of thumb is to have one control account for each GL account you’re paying. This will help you to account for your costs and revenues more accurately as they flow through your business. It also makes balancing a lot easier at month-end since all of your expenses should be accounted for in their respective accounts, no matter how many invoices or purchase orders you’ve got outstanding.

7) Automate Billing And Payments

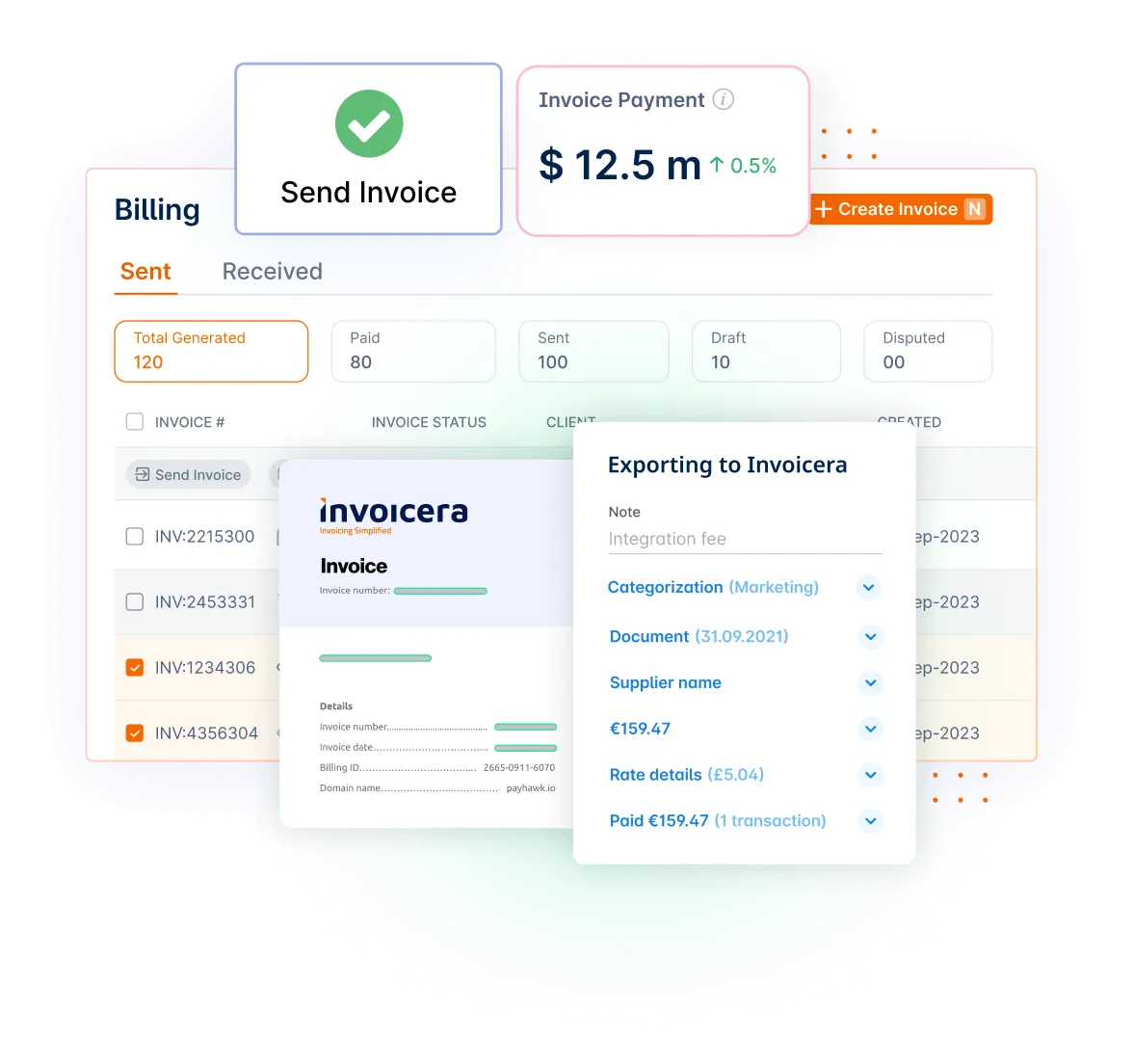

Automating tasks is one of many ways you can reduce errors in Accounts Payable. By automating your billing, you ensure that payments are only made for invoices approved and sent through a process that includes internal and external parties. Invoicera automates the invoices and gets approvals through an electronic invoice approval process. Automating your payment processing saves time and money by ensuring that payments are correctly processed. And also, there’s no need to worry about misfiled documents or incorrect data entry with automation.

Create rules that dictate how each invoice should be paid so it happens automatically. This allows you to reduce manual work and focus more on growing your business.

8) Select The Right Tools

Before you even set up an accounts payable system, choosing the right software for your company is important. Some solutions are perfect for small businesses, and others better serve larger organizations. Research different products and compare their features before choosing one.

Suppose you decide on one that can be used across multiple devices, for example, on a mobile device and your desktop computer. In that case, you’ll have more flexibility when processing invoices, entering transactions, and making payments.

Invoicera lets you access and manage invoices from all around the globe.

9) Have an approval system

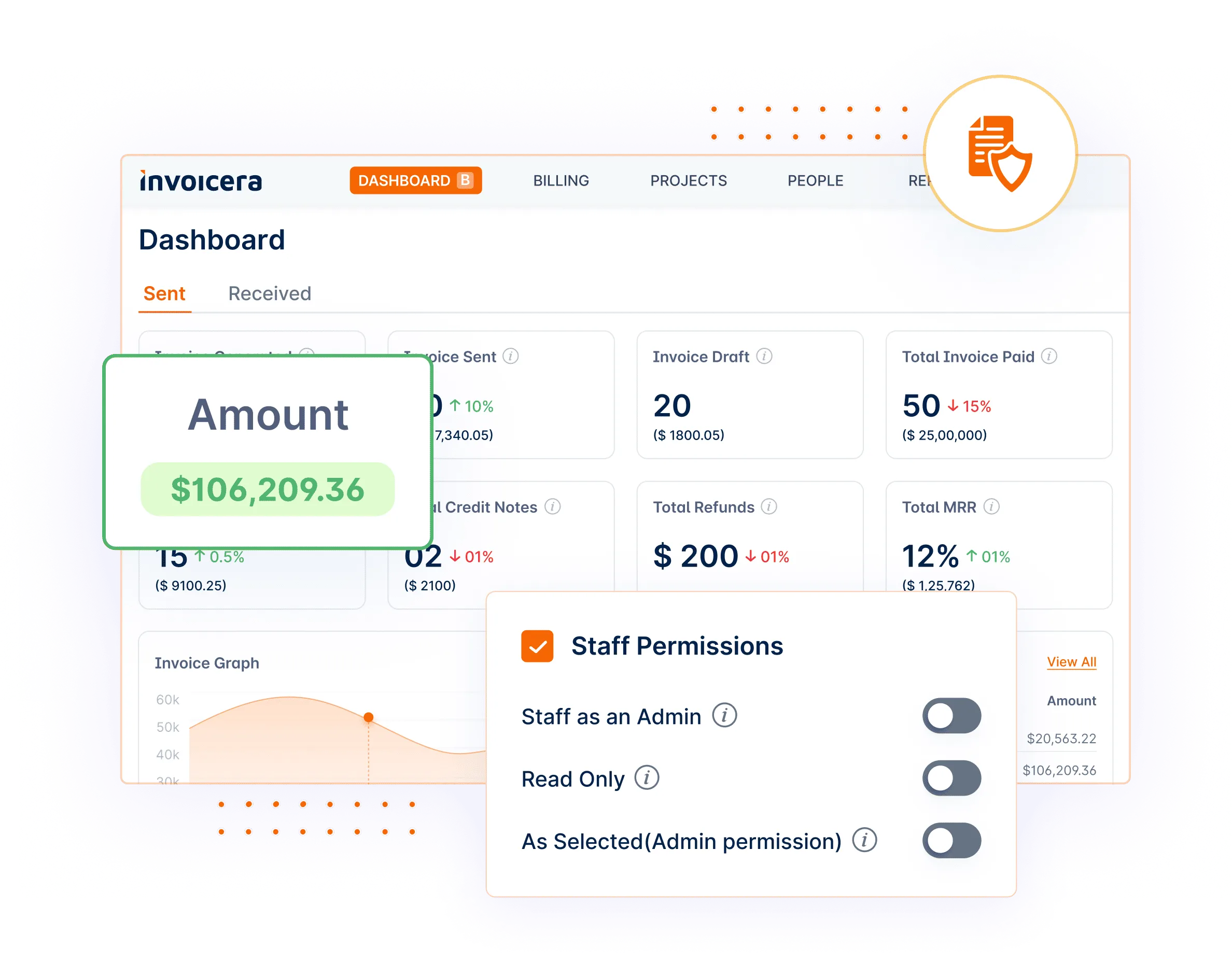

A proper approval system like Invoicera could be beneficial in streamlining the invoice approval process.

Through this, stakeholders can electronically review and authorize the invoices which eventually enhances transparency and accountability. Moreover, it enables hassle-free coordination between people involved in the approval process.

Best Online Billing Software: Invoicera

With Invoicera’s best online invoice software, companies can manage accounts payable and invoices and track payments within their browser. Whether you’re just getting started or are already handling thousands of invoices every month, our accounting software provides a full suite of tools designed to make your life easier.

We aim to create an online invoicing experience that seamlessly fits your workflow without sacrificing quality at a price that allows even small businesses access to powerful features they previously only dreamed about.

Invoicera helps your business and account payable to be more efficient by making it easier for customers to pay you with advanced features like one-click payments, email reminders, partial payment tracking, and much more. Recurring invoices can also be generated and modified using Invoicera recurring billing software to make your working process more efficient.

Additionally, our best invoicing software allows you to make changes before they go out while ensuring that all edits are tracked within a built-in audit trail. With Invoicera, you can save time and money on each invoice and free up more of both for other aspects of your business.

So what are you waiting for?

Manage your vendors with Invoicera’s bestonline billing software. Whether you have a few invoices every month or thousands, we have an option that fits your business needs.

Sign up for our free plan today and start improving your accounting processes!

Final Thoughts

Every business, no matter how large or small, requires a compelling accounts payable process. Whether you are a small business or a multinational corporation, your vendors deserve to be paid on time and receive accurate invoices.

However, most businesses lack the time and resources to handle paper checks and physical invoices. This causes them to make costly mistakes, such as paying late fees or sending inaccurate payments, which cost them time and money in the long run. Fortunately, these problems can be avoided with the appropriate tool or software.

Instead of managing antiquated processes that are unsuitable for today’s digital world, many businesses choose online invoice management solutions that save time, reduce errors, and simplify operations.

FAQs

Q. What are the advantages of reducing errors in accounts payable?

Ans. Error reduction benefits all processes, including accounts payable. As a result, having fewer errors aids in maintaining accurate financial records, preventing duplicate payments, and improving client relationships while ensuring efficient cash flow.

Q, Is it necessary to have clear accounts payable policies and procedures?

Ans. Well-defined policies and procedures ensure consistency in invoice processing, improve accountability, reduce confusion, and serve as a framework for error prevention and resolution in accounts payable operations.

Q, How does Invoicera help to reduce accounts payable errors?

Ans, Using automation tools and invoice management software, such as Invoicera, simplifies data entry, reduces manual errors, allows for better invoice tracking, and improves overall accuracy and efficiency in accounts payable processes.

Q, What are the consequences if accounts payable or receivable are not performed accurately?

Ans, Inaccuracies in accounts payable or receivable can lead to cash flow problems, strained vendor relationships, and financial reporting issues. Using a solution like Invoicera can help automate and streamline these processes, reducing errors and ensuring accuracy.

Q, What happens if you overpay a vendor or pay the same bill twice?

Ans, If you overpay a vendor or pay the same bill twice, it can lead to cash flow issues and potentially strained vendor relationships. Invoicera’s automated invoice processing can help prevent such duplicates or overpayments.