Liabilities often considered dreadful are the company’s legal obligations that occur for a business during its course of operations. Liabilities, a.k.a accounts are the money that a business needs to pay to its vendors and investors for the services and supplies. They are an important factor for business and reflect on the left side of a balance sheet. Such liabilities are classified as current or short term liabilities. Under the common liabilities that exist in any business, there exist two payables: accounts payable and notes payable.

Let’s understand note vs account payable:

What are Accounts Payable?

Accounts payable are the money that your company owes to the suppliers in against of the goods/services purchased on credit basis. These are the short term liabilities that the company needs to pay to its suppliers in a smaller span of time.

Most companies follow a trend of paying or getting paid in 30 days and do not opt for generating interest payments. To analyze how well a company pays its accounts payable, some companies calculate and find their accounts payable turnover ratio. The formula for accounts payable to calculate the ratio is as follows: divide total supplier purchases by the average accounts payable for the period. This information is very important to managers and investors as they calculate in a given time period how many times a company pays its account payables.

What are Notes Payable?

Notes payable are the written promissory notes that a company receives when it borrows money. For example, a company borrows $10,000 from a bank. The company posts a credit to its notes payable account for $10,000 and a debit to its cash account for $10,000. If a company plans to repay its notes payable within one year, it includes it in the balance sheet as a current liability. If the note is due after one year, the company lists the notes payable as a long-term liability.

So, that was a quick difference between notes payable vs accounts payable!

——————————————————————————————————————————–

Also Read: Difference Between Accounts Receivable & Accounts Payable Management

——————————————————————————————————————————–

Interest Amount on Notes Payable

The promissory note issued to the borrower states a specific amount of interest to be paid on the money borrowed. In Most cases, software consulting companies pay interest on the amount of money borrowed from the lender. Some of the common interest terms ask companies to pay interests every six months. A company is required to keep an account of all the interests paid to the lender and the outstanding amount that is yet to be paid. When a company accrues interest, it debits interest expense and credits interest payable. When a company makes a payment on the principal balance and interest, it debits notes payable, interest expense and interest payable and credits cash.

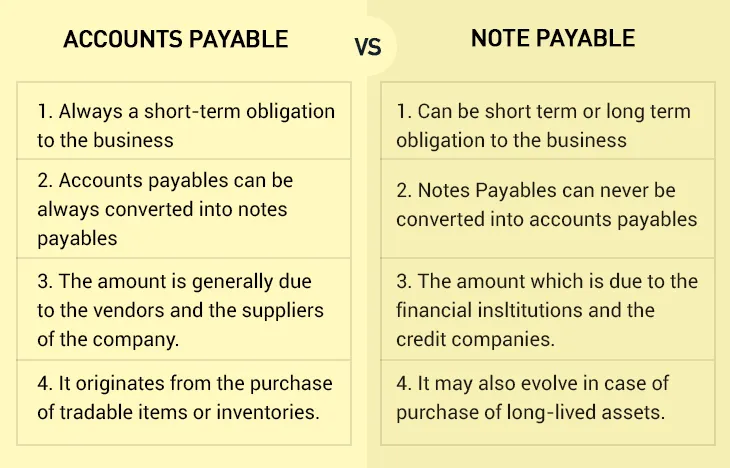

What is the difference between notes payable and accounts payable?

The Balance Sheet

Both, accounts payable and notes payable are listed on a company’s balance sheet as a part of its liabilities. The balance sheet is a reflection of a company’s financial position at a given point. It is very important to managers and investors as they use the balance sheet to make important financial decisions regarding a company. Accounts payable and notes payable are used in coordination with other accounts on financial statements to calculate important financial ratios.

About Invoicera

Invoicera, the online invoicing software is specifically designed to cater to individual needs of each all types of enterprise, small business, and freelancers. With 14+ years of experience into the industry of online invoicing, we understand the needs and cater to different business aspects with different pricing plans.

From invoicing to tracking business expenses or managing staff tasks, you can easily manage every single business activity. The custom invoice software for your business for Accounts receivable and accounts payable management lets you keep a track of every penny that is either owed to you or that your business owes. It makes calculating and analyzing important financial ratios super easy. 30+ online payment gateways help to receive payments from the global clientele without much hassle and cash flow super smooth. The additional features of grouping taxes or sending invoices in any language that your client prefers help retaining an interest in the business and road to success a little less of a hassle.