Freelancing is the most beneficial method of income for youngsters. Freelancers move from 9-to-5 employment to freelancing in a variety of fields. You can enjoy flexible working hours with a competitive compensation package as a freelancer. Unsurprisingly, freelancers are hardworking individuals, with many working week-to-week for around 30-50 hours.

Freelancers work on a variety of projects for a diversified clientele all around the world. There is no specific salary to be received at the end of every month, but late payments are becoming more important. As a result, it’s critical to discover a reputable online payment system that ensures your services are paid on schedule. What could be better than an online invoice payment processing solution?

How can multiple payment methods help freelancers to grow their business?

Having multiple payment options for freelancers can help them grow because it gives their clients the flexibility to pay however they prefer. For example, some clients might want to use a credit card or PayPal, and others might not have these means of payment. Multiple options can offer peace of mind for the freelancer and their client.

Other advantages come with having more than one option as well. The main benefit is that- Multiple payment gateways are a great way to expand your business. Different methods often provide higher conversion rates to freelancers because it’s easier on their clients, who may not have one specific method to pay them back. With so many choices available, there’ll be something there for everybody.

Freelancers can offer buyers a variety of ways to pay for services such as PayPal, Stripe, Razorpay, etc., with options such as debit card payments and apps. Such freelancer payment methods allow clients with different needs to use other forms of payment. It is no longer necessary for the worker to determine which credit card or e-wallet the customer might have available, making the transaction process more efficient and profitable.

Furthermore, it is now possible to charge customers in seconds or minutes after they purchase a product without having them leave the site.

Key benefits of providing different freelance payment options to clients

Source: PayKun

1. Retain current customers

Retaining current consumers is generally more straightforward and less expensive than acquiring new ones. Customers may have their favorite payment option, but that does not imply they will stick to the same one in the future.

Customers will alter their payment method to what is most convenient for them at the time or according to current circumstances. They would also like a new payment mechanism they have only recently discovered and would appreciate more than they had previously.

Consequently, even if your customers have been purchasing from you for years, you should provide them with new payment options. Customers want to discover something new and different. It might be tedious to perform the same thing day after day. As a result, it is critical to research and poll existing consumers regarding their preferred payment methods.

2. Make way for new clients

Millennials are more likely to become your newest consumers. They embrace digital payments far more than older customers. Cash, debit, and bank transfers are preferred payment methods among older customers.

The most accessible approach to attracting these new consumers is to show that your firm accepts current technology and continuously seeks new ideas and inventions.

Each payment option is tailored to attract a diverse audience of consumers. By focusing on this aspect of exceptional customer service, you may win over more individuals and boost sales.

You can also attract international clients because some additional payment methods you offer may handle multiple currencies and comply with foreign payment regulations.

3. Better cash flow

Over time, a variety of payment options are used. If you stick to only one payment approach, you may not see your funds in your account.

Using alternative payment options like direct debit, cryptocurrency, and e-cash allows you to receive money almost instantly and maintain steady cash flow—an essential strategy for keeping your business running smoothly through all economic cycles. However, it’s crucial to consult a tax advisor to understand the implications of accepting cryptocurrency payments, as crypto tax regulations can be complex. You may also consider consulting a Web3 marketing agency to learn the best practices and tips for accepting cryptocurrency payments effectively.

4. Increase sale size

Multiple payment options give sellers more flexibility and can increase sales. The prospect of low prices on a wide range of goods typically attracts customers who like to shop online, but customers may profit from specific payment options.

Customers may receive discounts or rebates on occasion. Due to the savings they make and the additional services they receive, they will develop a stronger liking for your company.

Follow-up question: Which are the best payment methods? Read the following section to know the answer.

Nine best payment methods for freelancers

We have compiled a list of the nine best payment methods for freelancers to make life simple :

1. PayPal

PayPal has successfully set the industry standard for online payment security and identification. Thanks to its assistance, you may offer your customers a better experience when making purchases or sending invoices. It allows customers to save time by paying their bills on schedule using a straightforward menu of options.

Customers can access the service anywhere, on whatever device (PC/mobile), using Invoicera’s high level of expertise.

2. 2checkout

2checkout payment gateway is a popular and extensive service provider in digital payment processing. It delivers guaranteed fraud protection and allows you to accept payments securely online.

Every purchase gets a unique number that allows you to track it throughout the entire processing cycle. It evaluates what you’re selling, how much the buyer is paying for it, and whether or not to approve or reject the transaction – all in real time.

3. Sage pay

Sage Pay is undoubtedly one of the most effective Internet transaction systems available. Its aggressive pricing has given it an edge over competitors.

Not only do they have competitive pricing, but their system also offers improved levels of security. Its goal is to make processing secure and efficient.

Are you looking for the best multi-currency accounting software?

Sign up to try the best freelance invoice software that offers multiple freelance payment methods here-

4. Bambora

Many global clients wonder how to pay freelancers overseas! Bambora offers an international payment solution enabling online businesses to accept credit card payments from customers worldwide. With Bambora, you can securely process payments in various currencies, minimizing exchange rate risks.

It’s a smart choice for businesses looking to serve Eastern Europe, Western Europe, the US, and Canada with one reliable platform. It also provides tools to manage their finances across multiple countries, currencies, and exchange rates.

5. BluePay

Bluepay is ideal for companies because it supports a variety of platforms. It. It allows you to get paid faster with competitive fees and clear statements that give you a comprehensive picture of your transactions.

Safeguard your company with its industry fraud prevention capabilities, including chargeback prevention and risk mitigation techniques that are still adjustable enough to fit any business. You can get paid in any currency you choose, which helps you do business on a global scale without worrying about foreign exchange fees or associated costs.

6. Braintree

Braintree Payment Gateway is a popular payment gateway for businesses and customers. It offers lightning-fast processing, minimal costs, and built-in credit card authorization.

Braintree can handle transactions for clients from over 100 countries. It also supports a wide range of credit cards issued by all central US banks and many thousand other international financial institutions members of the MasterCard or Visa networks, including nearly all card types used worldwide.

7. Stripe

Today, Stripe is one of the most well-known payment gateways. It can handle a wide range of transactions at a cheap rate. The difference is determined by how big your company is and how many transactions you execute.

Credit card processors collaborate with substantial banks across the United States (and other countries) to allow merchants to accept credit cards without establishing new merchant accounts.

8. Razorpay

RazorPay is a payment gateway for Indian businesses that allows them to take payments on their websites and mobile apps. It’s a well-known, stable, versatile solution with complete account control.

The developer-friendly APIs allow you to connect your business’ website quickly, and the simple connection protects consumers.

9. Alipay

Alipay is one of the most highly reputable payment solutions for freelancers, with 700 million users worldwide. It supports transactions in 14 major foreign currencies, offers free additional escrow services to assist customers, checks items before releasing funds, and is secure because it’s based in China.

It also accepts payments via Bancário, Transferência Bancária, Maestro, Boletos, WebMoney, and Visa and MasterCard.

What makes Invoicera the best choice among freelancers?

Running a successful online store or website can be challenging in today’s business world. To beat the competition, you have to have the latest technology on your side! This will help your business run smoothly and give you an edge.

There are few alternatives for combining numerous payment interfaces into a simple-to-use integration solution because most online businesses rely on a single payment gateway.

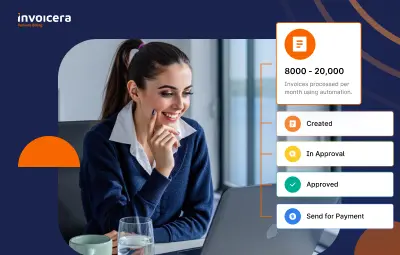

Invoicera is an online invoicing program that lets you link numerous freelancer payment methods into your billing system. Rather than searching for different possibilities, you may focus on improving your company’s operations. Its twelve connected gateways make it simple for businesses to take credit card payments from various providers.

Being the best accounts payable management and accounts receivable software, it helps your eCommerce business succeed by offering an extensive range of multi-currency and multi-payment processing solutions that can be integrated into virtually any eCommerce solution. It also provides flexible API connections to fit your business needs and an excellent mobile invoicing app for easy access from anywhere.

Closing Thoughts

In today’s dynamic freelancing landscape, offering multiple payment methods is essential for business growth and client satisfaction. Diverse payment options not only attract new clients across different regions and demographics but also enhance cash flow and increase transaction sizes by providing convenience and flexibility.

Freelancers benefit from secure, reliable gateways like PayPal, Stripe, Razorpay, and others, which support seamless, timely payments across currencies and platforms.

Among these, Invoicera stands out by integrating numerous payment gateways into one user-friendly invoicing system, simplifying billing processes and reducing administrative hassles. Its multi-currency support, extensive payment integrations, and mobile accessibility empower freelancers to manage their finances efficiently while catering to a global client base.

Are you interested in knowing more about Invoicera? Request a free demo of invoicing software for freelancers to check out how well it integrates with other software tools, so you don’t have any extra work on your plate while still getting paid fast and efficiently–no matter what kind of customer you might have!

Embracing such versatile and best payment methods equips freelancers to thrive in a competitive market, ensuring smoother transactions, faster payments, and ultimately, greater business success.