Introduction

Have you ever found yourself in a frustrating loop of waiting for payments that are never on time?

It’s a common struggle among businesses—almost 60% grapple with this challenge!

But fear not!

There’s a solution: creating a foolproof accounts receivable workflow.

Now, there comes a question: how to create it?

For this, we have a guide to take you out of the chaos, helping you build a system that not only smoothens your cash flow but also minimizes the headache of chasing late payments.

Let’s start by understanding the receivable process and why it matters so much.

What Is the Accounts Receivable Process?

Accounts Receivable (AR) is the lifeline of a business, detailing the money owed by customers for products or services rendered. The AR process encompasses the steps taken to manage and collect these outstanding payments, ensuring a smooth cash flow for the company.

Benefits Of A Foolproof Accounts Receivable Workflow

Having a reliable accounts receivable workflow is like having a superpower for your business. Here’s why it benefits you:

- Improved Cash Flow: With a well-defined accounts receivable process, you get paid faster. Timely invoicing, clear payment terms, and consistent follow-ups ensure that money flows steadily, boosting your cash flow.

- Reduced Late Payments: Late payments can be a headache, but a solid workflow minimizes these occurrences. Clear communication and prompt reminders help clients remember their payment obligations, reducing delays.

- Enhanced Client Relationships: A streamlined workflow isn’t just about numbers; it’s about nurturing relationships too. Having a reliable process in place shows your clients that you’re organized and professional, building trust and loyalty.

- Minimized Errors and Disputes: Mistakes happen, but a foolproof workflow catches them before they become significant issues. Accurate invoicing and transparent documentation help prevent misunderstandings and disputes, saving you time and headaches.

- Efficient Resource Utilization: By automating repetitive tasks and standardizing processes, you free up valuable time for your team. This means they can focus on more strategic activities, ultimately boosting productivity.

- Better Decision-Making: When your accounts receivable workflow provides real-time insights into your financial health, you make informed decisions. Access to up-to-date data helps you strategize for growth and navigate challenges proactively.

Overall, a foolproof accounts receivable workflow is your key to financial stability, stronger client relationships, and smoother operations.

Creating Accounts Receivable Workflow

Assessing Current Processes And Identifying Gaps

Before diving into a new accounts receivable workflow, it’s crucial to closely examine your current system. Identifying the strengths and weaknesses allows for a more targeted and effective improvement plan.

Here’s how assessing your current processes can benefit you:

- Spotting Inefficiencies: By reviewing your current methods, you can pinpoint areas causing delays or inefficiencies in receiving payments.

- Recognizing Gaps: Understanding where your current system falls short helps in creating a more foolproof workflow. It’s like finding the missing puzzle pieces to ensure a smoother process.

- Improving Accuracy: Sometimes, processes may lead to errors or discrepancies. Assessing allows you to catch these issues and prevent them in the future.

Steps To Develop A Comprehensive Workflow

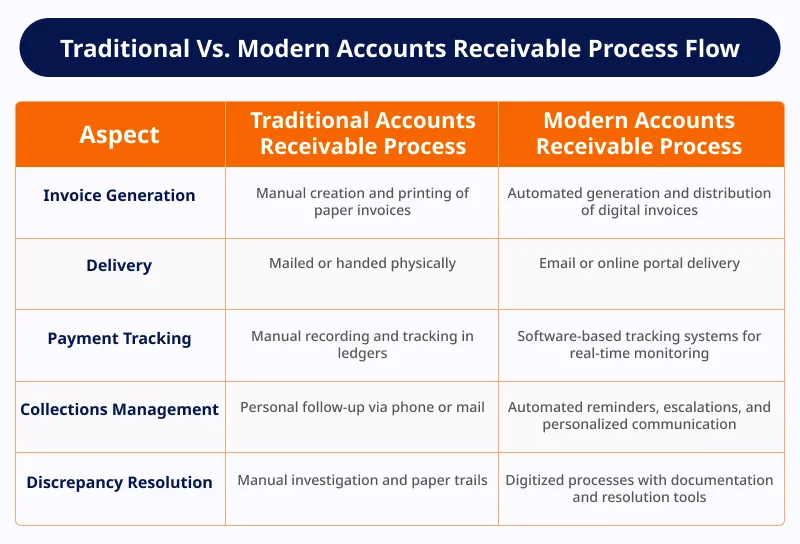

- Invoice Generation: The first step to a solid accounts receivable workflow is generating clear and accurate invoices. Ensure they include all necessary details like item descriptions, prices, and payment terms. Accuracy here sets the stage for smooth transactions.

- Delivery: Once invoices are ready, it’s time to deliver them promptly to your customers. Whether via email, traditional mail, or an online portal, make sure the invoice reaches the right hands in a timely manner. This step is crucial for initiating the payment process.

- Monitoring And Tracking Payments: Keep a keen eye on incoming payments. Utilize software or tracking systems to monitor payment statuses. This helps identify late payments early, allowing for timely follow-ups and maintaining a healthy cash flow.

- Managing Collections: When payments aren’t on time, it’s essential to have a structured process for collections. Create a timeline for reminders or escalations. Friendly reminders can precede more assertive ones, ensuring a respectful yet effective payment collection approach.

- Resolving Discrepancies: Sometimes, discrepancies or disputes can arise. It’s vital to address these promptly and with clarity. Establish a protocol for handling discrepancies, ensuring clear communication and documentation. Resolving issues swiftly helps maintain good relationships with clients while ensuring accurate accounting.

Building a foolproof accounts receivable workflow involves attention to detail at each step. Clear communication, diligent tracking, and timely actions are key elements that contribute to a streamlined and effective process.

Role Of Automation In Streamlining AR Workflow

Let’s dive into how automation can be a game-changer in making your accounts receivable workflow foolproof.

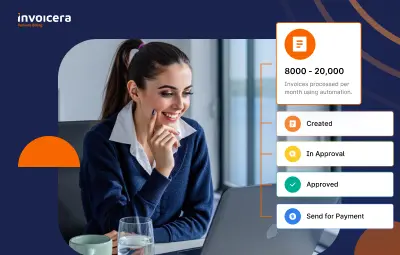

Automation in financial processes is like having a trusty assistant who handles repetitive tasks for you. In the context of accounts receivable, it means using technology to handle invoicing, payment reminders, data entry, and more—tasks that can be tedious when done manually.

Benefits Of Automating Accounts Receivable

- Faster Payments: When you automate, you streamline the whole process. That means your invoices get out faster, and payments come back quicker. No more waiting around for checks in the mail or chasing after late payments.

- Improved Accuracy: Automation cuts down on human errors. Forget about mistyped numbers or missing details. Your invoices will be accurate every time, which keeps everything running smoothly.

- Better Cash Flow: With automation, you get a clearer cash flow picture. You’ll know when payments are expected, making it easier to plan and manage your finances.

- Customer Satisfaction: Quick, error-free invoicing makes for happier customers. They get their bills on time and can sort things out without any hassles, improving their experience with your business.

- Time Savings: Automating saves you a ton of time. You won’t have to spend hours on manual data entry or chasing late payments. That means you can focus on other important tasks and grow your business.

- Insightful Reporting: Automation gives you access to valuable data and reports. You can track trends, see who owes what and when, and make informed decisions to improve your financial strategy.

- Reduced Costs: With fewer errors and faster processing, you’ll save money in the long run. Plus, you won’t need as many resources to manually manage accounts receivable.

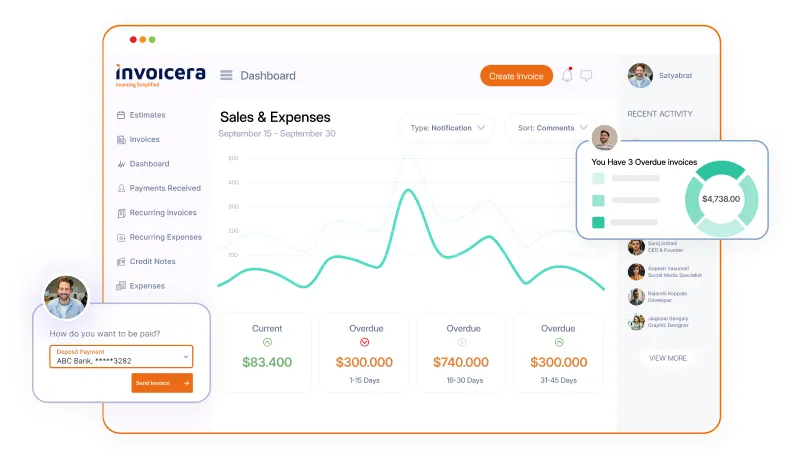

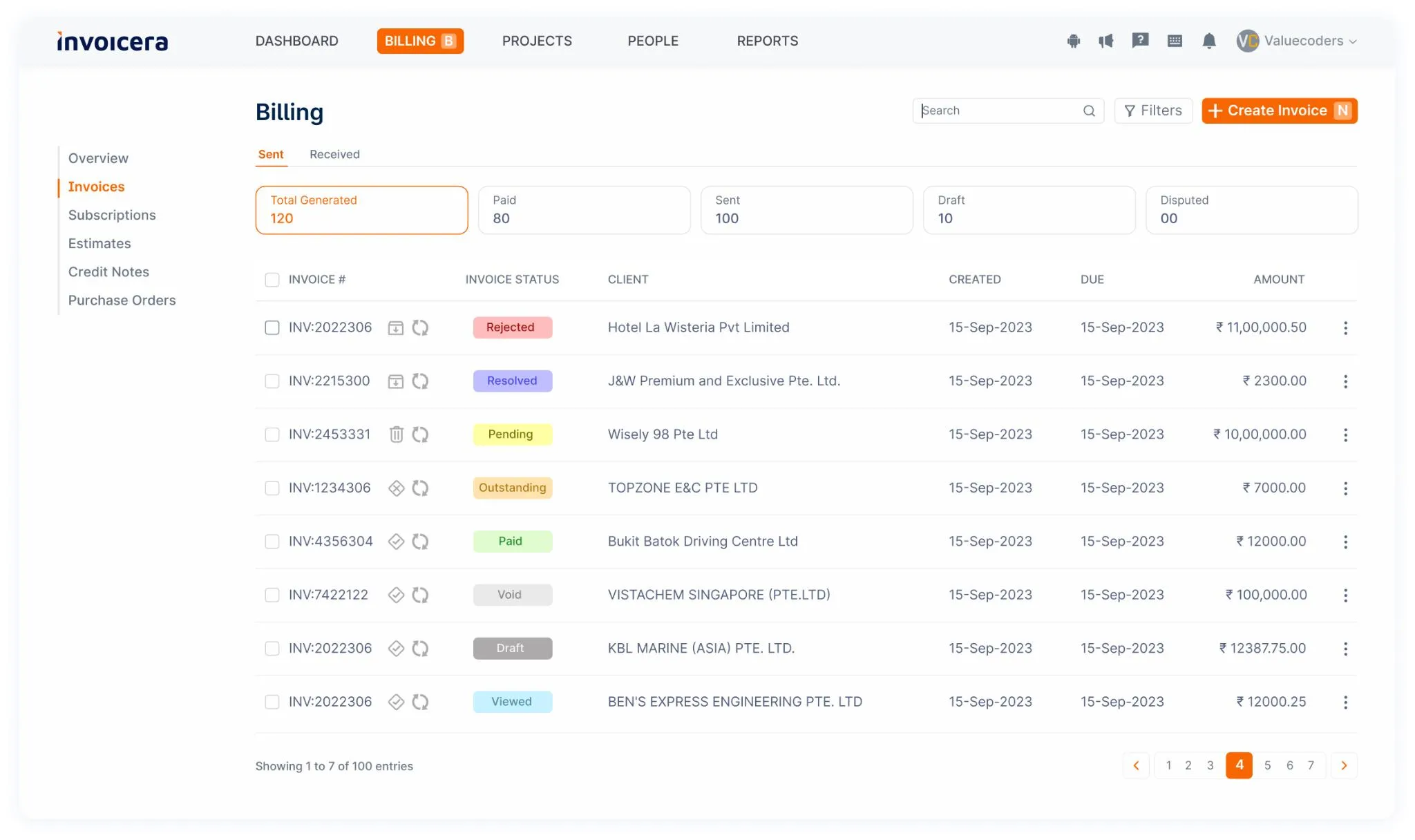

Automate Your AR Workflow With Invoicera

When managing your accounts receivable efficiently, using a tool like Invoicera can be a game-changer. Invoicera isn’t just an invoicing software; it’s your ally in ensuring smoother payment processes. Here’s a sneak peek at how Invoicera can transform your accounts receivable workflow:

How Invoicera Streamlines Payment Processes

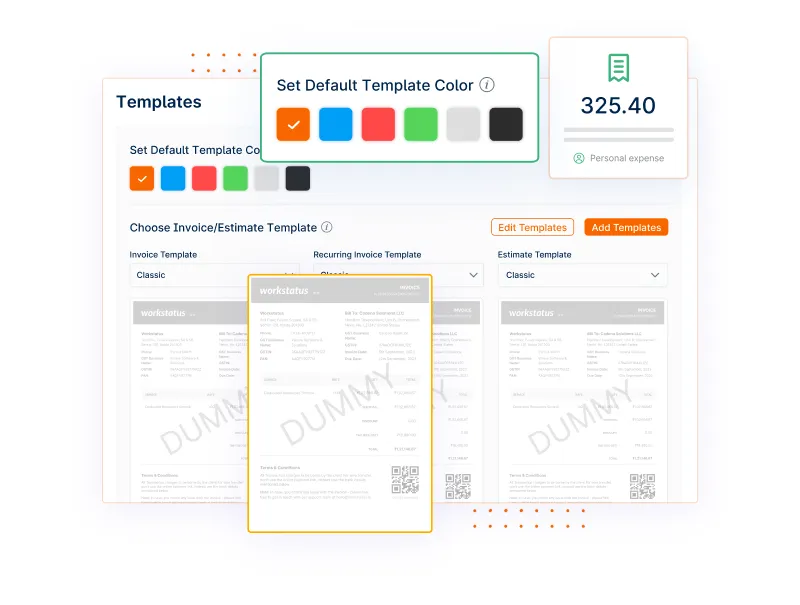

Customizable Invoices: You can create professional-looking invoices representing your brand. Personalize them with your logo, color schemes, and specific details, making a lasting impression on your clients.

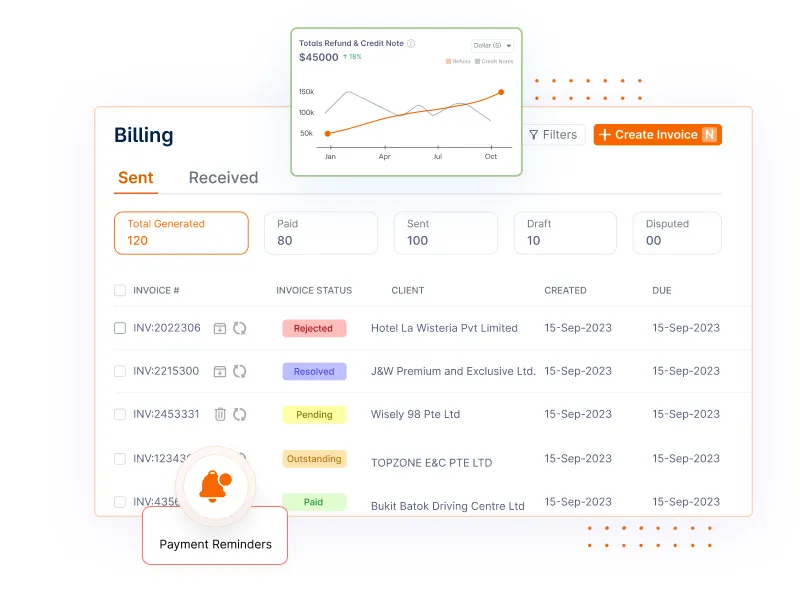

Automated Invoicing: With Invoicera, you can set up recurring invoices for regular clients. Say goodbye to the hassle of manually sending out the same invoices repeatedly.

Payment Gateway Integration: Seamlessly integrate multiple payment gateways to offer your clients various payment options. Whether it’s credit cards, PayPal, or other online payment methods, Invoicera has got you covered.

Late Payment Reminders: No need to chase overdue payments manually. Invoicera automates late payment reminders, ensuring your clients are gently but consistently nudged.

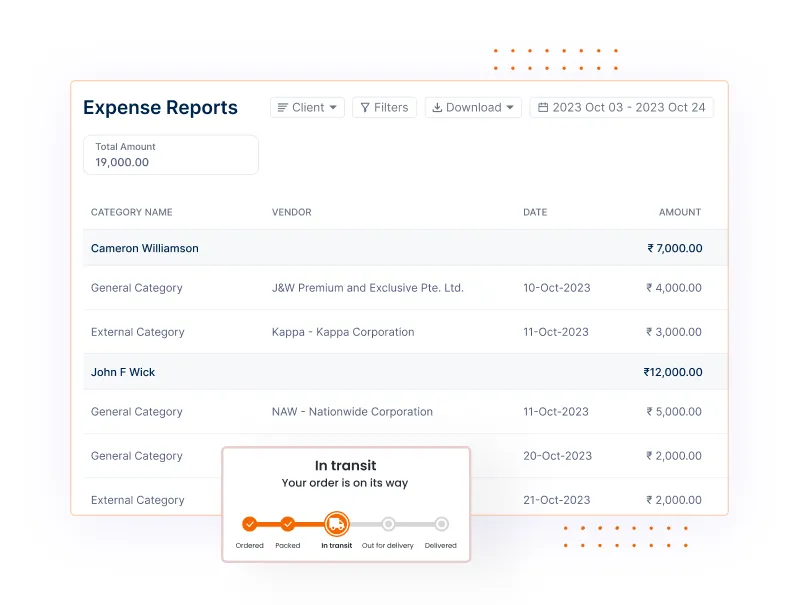

Expense Management: Keep track of expenses efficiently by recording and categorizing them within Invoicera. This feature makes it simpler to reconcile expenses with your invoices.

Client Portal: Invoicera provides a dedicated client portal where your clients can view their invoices, make payments, and track their billing history, fostering transparency and trust.

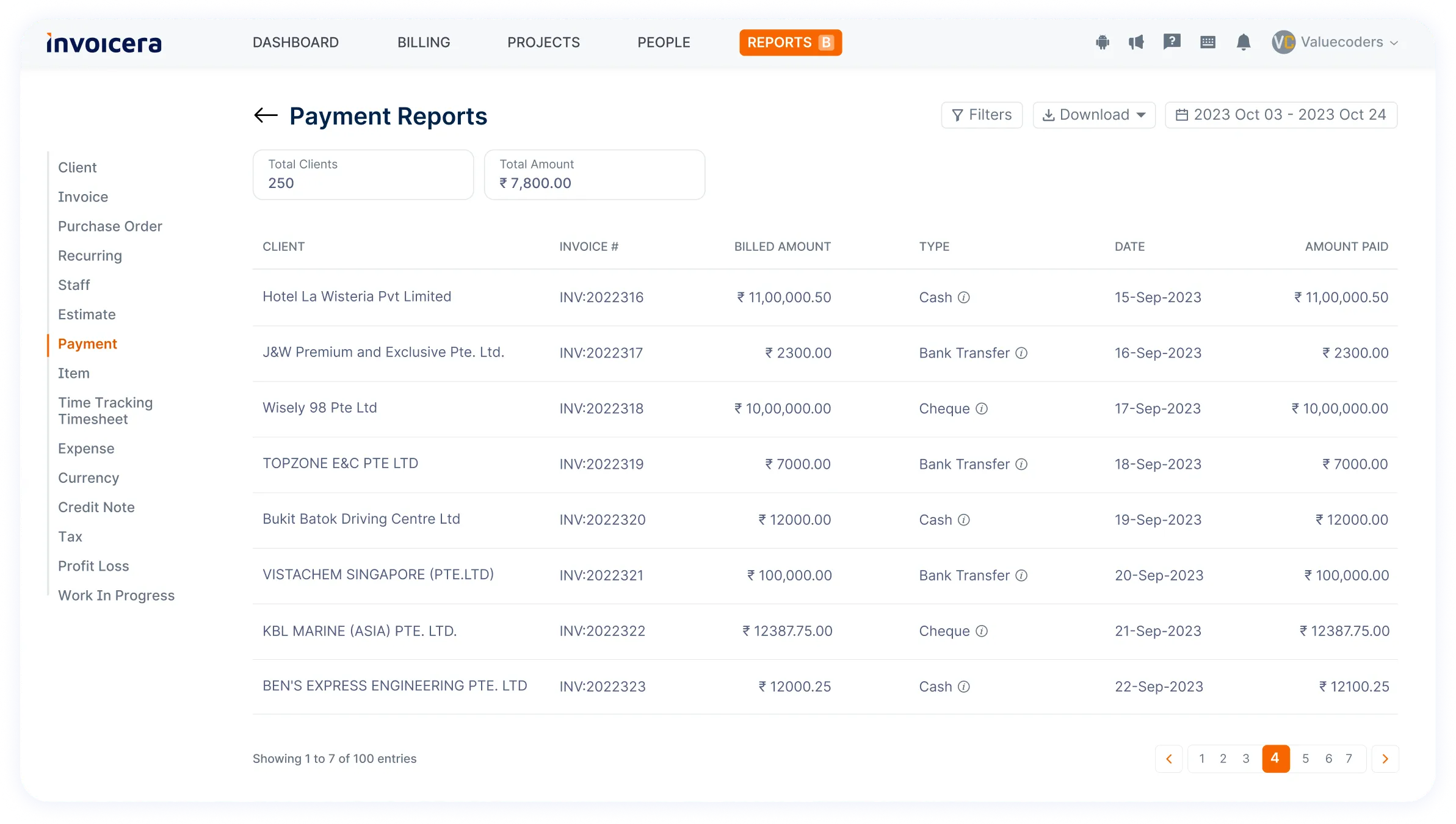

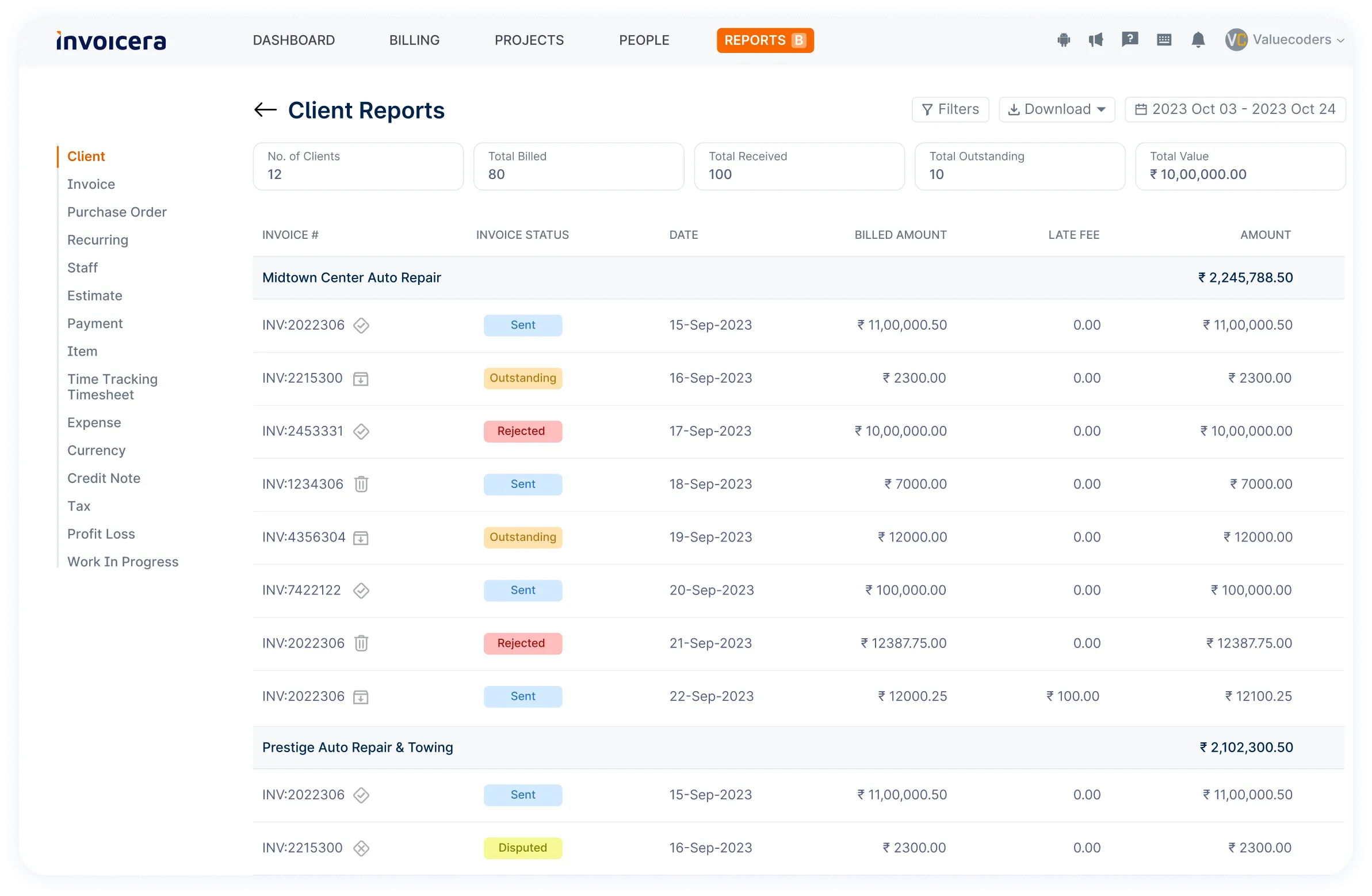

Reports and Analytics: Gain insights into your financial performance with detailed reports and analytics offered by Invoicera. Understand payment trends, outstanding balances, and more to make informed business decisions.

Steps To Integrate Invoicera Into AR Workflow

1. Setting Up Your Account: Sign up on Invoicera and create your account. Input your business details to personalize your invoices.

2. Uploading Client Information: Import your client details or manually input them into Invoicera. This step ensures accurate billing and smooth communication.

3. Customizing Invoices: Customize your invoice templates to reflect your brand and include all necessary details, ensuring clarity for your clients.

4. Scheduling Recurring Invoices: For clients on regular payment schedules, set up recurring invoices to be sent automatically. This feature saves you time and ensures timely billing.

5. Connecting Payment Gateways: Integrate your preferred payment gateways with Invoicera to allow clients to pay directly through the invoice, making the payment process convenient for them and faster for you.

6. Tracking Payments and Expenses: Regularly monitor payments and expenses within Invoicera. This step helps in maintaining accurate financial records and aids in decision-making.

7. Utilizing Client Management Tools: Leverage Invoicera’s client management features to keep track of client interactions, payment histories, and communication logs for better client relationships.

Challenges In Adopting Automation

Automation in the accounts receivable workflow offers immense benefits, but it’s not without challenges. Let’s walk through some common hurdles and see how Invoicera steps in to tackle them:

1. Resistance to Change

Embracing automation might face resistance from your team accustomed to traditional methods. You might worry about the learning curve or fear losing control over processes.

Pro tip: Invoicera’s user-friendly interface and comprehensive support ease the transition. Its intuitive design simplifies operations, making it easier for your team to adapt.

2. Integration Issues

Existing systems and software might not seamlessly integrate with new automation tools, leading to disruptions and data discrepancies.

Pro tip: Invoicera’s compatibility with various platforms and APIs ensures smooth integration with your current systems, preventing any disruptions in your workflow.

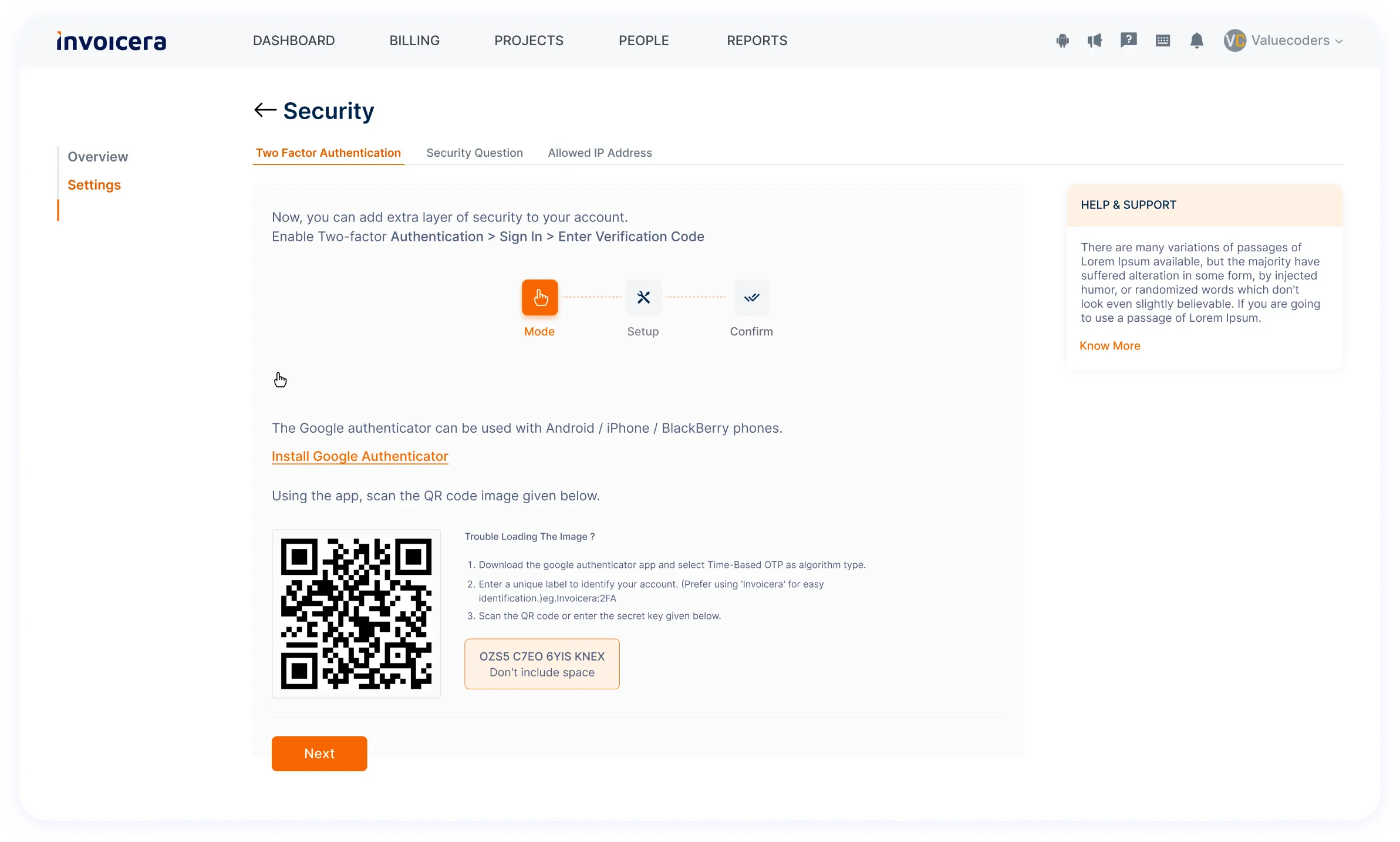

3. Data Security Concerns

Trusting automation with sensitive financial data can be a significant concern. Security breaches and data leaks are always a worry.

Pro tip: Invoicera employs robust security measures like SSL encryption and secure servers, ensuring the safety of your data at every step.

4. Cost and ROI Analysis

The upfront investment for automation tools might seem daunting, and calculating the return on investment (ROI) can be challenging.

Pro tip: Invoicera’s cost-effective plans and transparent pricing structure make it easier to assess the costs and clearly determine the ROI, showcasing its value for your business.

5. Customization and Scalability

Not all automation tools are flexible enough to adapt to your unique business needs. Scaling operations might also be a concern.

Pro tip: Invoicera’s customizable features cater to various business requirements, allowing you to tailor the workflow to your specific needs. Its scalability ensures growth without compromising efficiency.

6. Training and Support

Proper training and ongoing support are vital for successful implementation. Without adequate resources, the transition can be challenging.

Pro tip: Invoicera offers comprehensive training resources and responsive customer support. Guiding your team through the setup and providing assistance whenever needed.

Let’s Summarize

- Embracing automation streamlines AR processes and reduces errors.

- Invoicera’s user-friendly interface simplifies adoption and integration.

- Security measures in Invoicera ensure data safety and compliance.

- Cost-effective plans and scalability enhance business efficiency.

- Customizable features and robust support aid in a smooth transition.

Invoicera streamlines AR processes with user-friendly automation and robust security measures, offering scalable solutions and comprehensive support for seamless integration.

FAQs

Why is an efficient accounts receivable workflow essential for a business?

An efficient workflow ensures timely payments, better cash flow management, and stronger client relationships. It also minimizes errors and streamlines financial processes.

How can I measure the success of an accounts receivable workflow?

Metrics like Days Sales Outstanding (DSO), percentage of overdue payments, collection effectiveness index, and customer satisfaction surveys can help measure the efficiency and success of your workflow.

What is the cost of implementing an automated accounts receivable system?

The cost depends on the software provider, the features you require, and the size of your business. Look for providers with transparent pricing structures and consider the long-term benefits in terms of time and resource savings.

Customizable Invoices: You can create professional-looking invoices representing your brand. Personalize them with your logo, color schemes, and specific details, making a lasting impression on your clients.

Customizable Invoices: You can create professional-looking invoices representing your brand. Personalize them with your logo, color schemes, and specific details, making a lasting impression on your clients. Automated Invoicing:

Automated Invoicing: Payment Gateway Integration:

Payment Gateway Integration:  Late Payment Reminders:

Late Payment Reminders:  Expense Management:

Expense Management: Client Portal: Invoicera provides a dedicated client portal where your clients can view their invoices, make payments, and track their billing history, fostering transparency and trust.

Client Portal: Invoicera provides a dedicated client portal where your clients can view their invoices, make payments, and track their billing history, fostering transparency and trust. Reports and Analytics: Gain insights into your financial performance with detailed reports and analytics offered by Invoicera. Understand payment trends, outstanding balances, and more to make informed business decisions.

Reports and Analytics: Gain insights into your financial performance with detailed reports and analytics offered by Invoicera. Understand payment trends, outstanding balances, and more to make informed business decisions.