Introduction

“The lack of clarity in finances can quietly harm businesses, often remaining unnoticed until it leads to major losses.”

In the ever-changing finance world, achieving clear finances poses a tough challenge for businesses worldwide.

According to a recent Deloitte survey, about 51% of businesses face incomplete or wrong expense data issues. This problem doesn’t just affect decision-making but also blocks chances for growth.

Imagine running a business where expenses seem endless and constantly changing, and financial reports are like puzzles with missing pieces. This lack of transparency doesn’t just create uncertainty but also weakens a company’s stability and profits.

But there’s a key solution amid this complexity: Expense Reconciliation.

It’s the light guiding the way to financial clarity. By aligning and verifying financial records, expense reconciliation brings order to chaos, giving a clear view of a company’s financial health.

Join us as we explore the importance of reconciliation, strategies, and tools like Invoicera that streamline this vital process.

Let’s uncover the power of expense reconciliation and how it helps businesses sail toward success.

What Is Expense Reconciliation?

Expense reconciliation is an important financial step in matching your financial records with what you’ve spent.

It’s about carefully checking receipts, invoices, bank statements, and other documents to make sure everything matches upright.

The main goals of expense reconciliation are to make sure your recorded expenses match what you’ve spent and to catch any mistakes or differences in how things were recorded.

Why Is Expense Reconciliation Important?

Expense reconciliation is pivotal for maintaining financial health and gaining a clear understanding of an organization’s or individual’s monetary position.

Here’s why it’s so crucial:

- Accurate Financial Records: Reconciliation ensures that financial records precisely mirror the actual expenses incurred. By cross-verifying records with spending, it minimizes errors in financial statements, offering a more reliable picture of financial health.

- Spotting Discrepancies: It’s a critical tool to identify inconsistencies between recorded expenses and actual transactions. Catching these early helps prevent potential financial losses or regulatory issues.

- Effective Budget Management: Reconciliation offers clarity on fund allocation, aiding in realistic budget creation, setting financial goals, and informed decision-making on resource allocation and expenditure control.

- Compliance and Audit Preparation: Accurate reconciliation is crucial for regulatory compliance and financial reporting. It ensures audit-ready financial statements, saving time and potential penalties during audits.

- Informed Decision-Making: Derived from accurate financial data, reconciliation helps businesses make better decisions about investments, expansions, or cost-saving measures, enhancing strategic planning accuracy.

- Cost Optimization: It identifies overspending or inefficiencies, enabling businesses to optimize expenses by renegotiating contracts, cutting unnecessary costs, or finding cost-effective alternatives.

- Enhanced Stakeholder Relationships: Robust reconciliation processes offer reliable financial data, enhancing trust with investors, lenders, and partners, showcasing transparent and responsible financial management.

Common Reconciliation Challenges And Solutions

Get Financial Clarity With Expense Reconciliation

A. Organize Expense Data

1. Use Tools And Software For Expense Tracking

To achieve financial clarity through expense reconciliation, the initial step is to employ tools and software designed for efficient expense tracking.

These range from basic spreadsheet applications to comprehensive solutions like Invoicera.

These tools streamline data input and retrieval, facilitating real-time monitoring of expenses.

2. Categorize Expenses

Categorizing expenses is pivotal in establishing a structured framework for reconciliation. By classifying expenses into distinct categories (such as travel, utilities, and supplies), you create a systematic approach to track and analyze expenditures.

This categorization not only simplifies the reconciliation process but also provides a clear breakdown of where funds are allocated.

B. Regularly Review And Compare

1. Establish A Reconciliation Schedule

Consistency helps maintain accurate financial records. Establishing a regular reconciliation schedule—be it weekly, monthly, or quarterly—ensures timely reviews and comparisons of expenses against records.

This proactive approach minimizes the chances of discrepancies going unnoticed and enables prompt corrective measures.

2. Spot Inconsistencies

During the scheduled reviews, the primary focus should be identifying inconsistencies. These could range from discrepancies in amounts and dates to missing or duplicate entries.

Spotting these irregularities early on helps maintain the accuracy and reliability of financial data.

C. Resolve Discrepancies

1. Investigate Discrepancies

Upon uncovering inconsistencies, thorough investigation becomes imperative. This involves cross-referencing receipts, invoices, and transaction records to trace the root cause of the disparity.

Detailed scrutiny helps identify whether the issue stems from data entry errors, procedural lapses, or other underlying factors.

2. Take Corrective Actions

Once the source of the discrepancy is pinpointed, swift corrective actions are necessary.

This may involve rectifying erroneous entries, updating records, or communicating with relevant stakeholders, such as vendors or internal departments, to rectify mistakes.

Timely resolution ensures financial accuracy and prevents potential downstream effects on future records and decision-making processes.

Role Of Invoicera In Expense Reconciliation

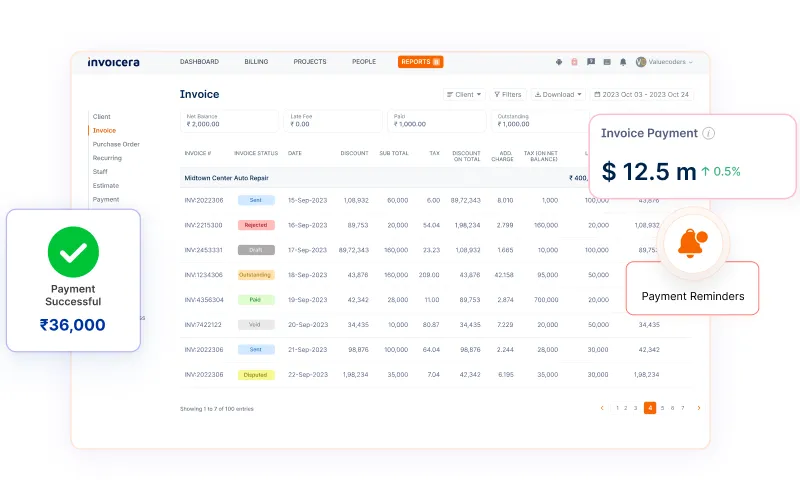

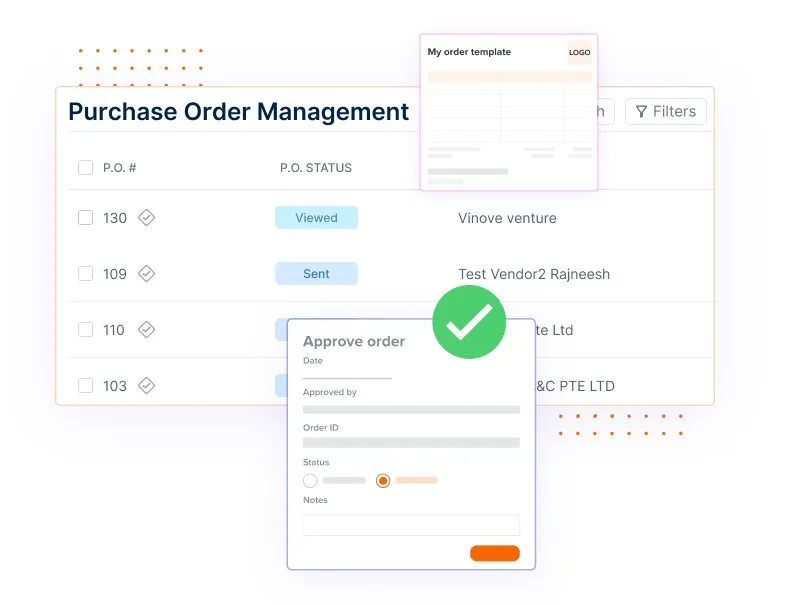

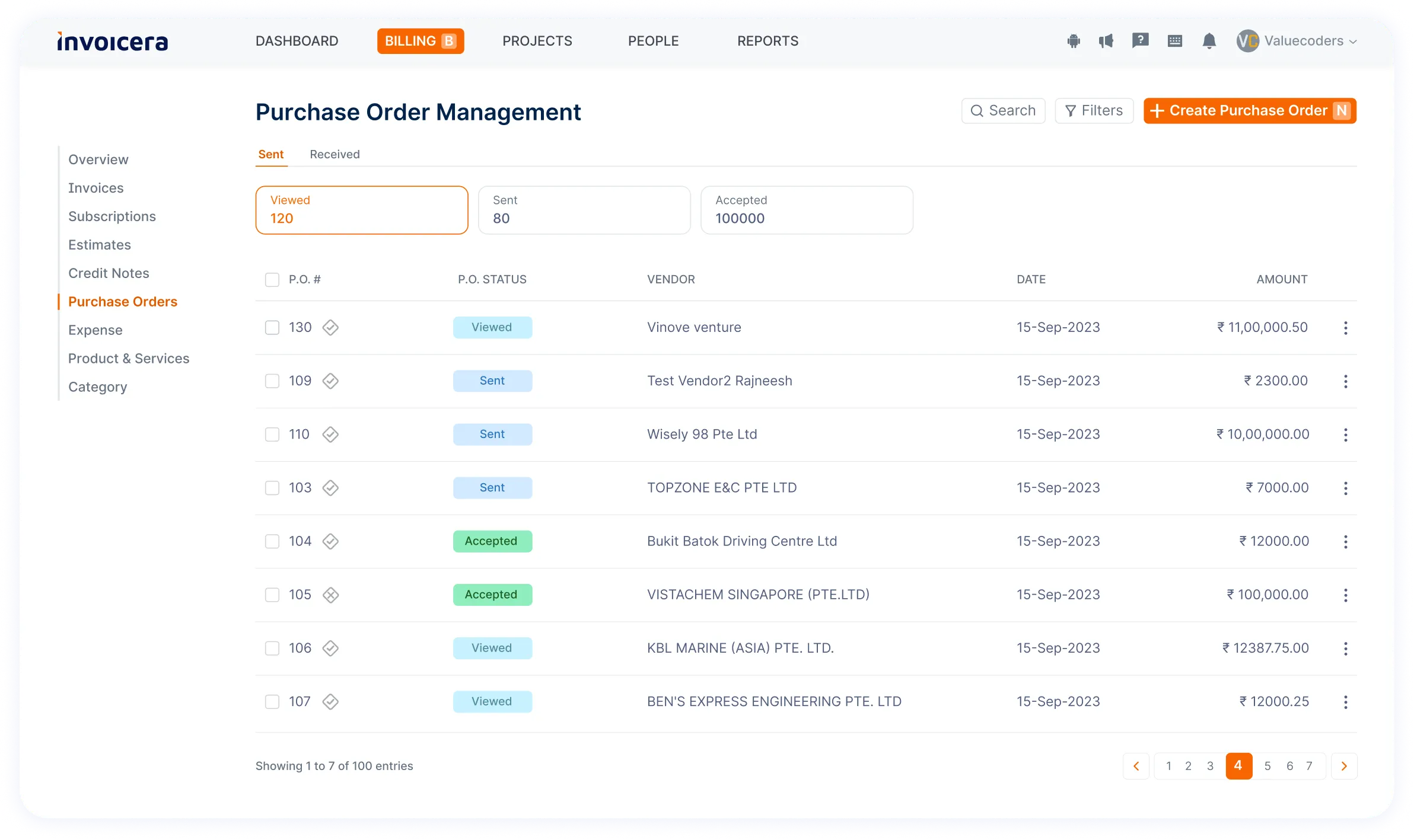

Invoicera, an innovative expense management platform, plays a pivotal role in facilitating and streamlining the expense reconciliation process.

With its comprehensive suite of features, Invoicera significantly eases the burden of managing expenses and ensures a seamless reconciliation process for businesses of all sizes.

How Invoicera Aids in Expense Management:

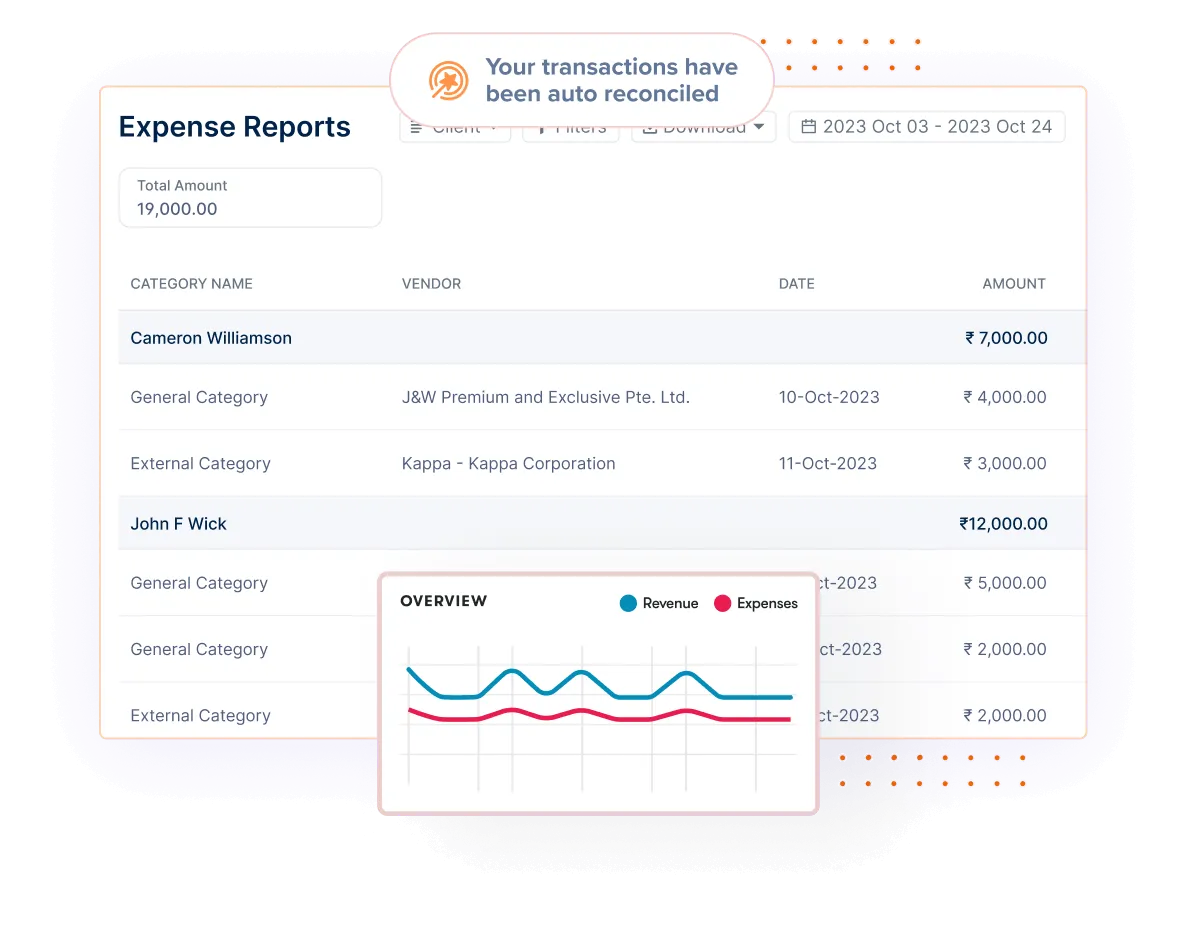

- Centralized Expense Tracking: Invoicera offers a centralized platform for tracking and recording expenses. It allows users to capture expenses from various sources, such as receipts, invoices, and bank statements, consolidating all financial data in one location.

- Customizable Expense Categories: One of Invoicera’s key strengths is its ability to customize expense categories. Users can create personalized categories tailored to their business needs, enabling precise and detailed expense tracking.

- Real-time Expense Monitoring: Invoicera provides real-time insights into expenses, allowing businesses to monitor spending patterns, identify trends, and make informed decisions promptly.

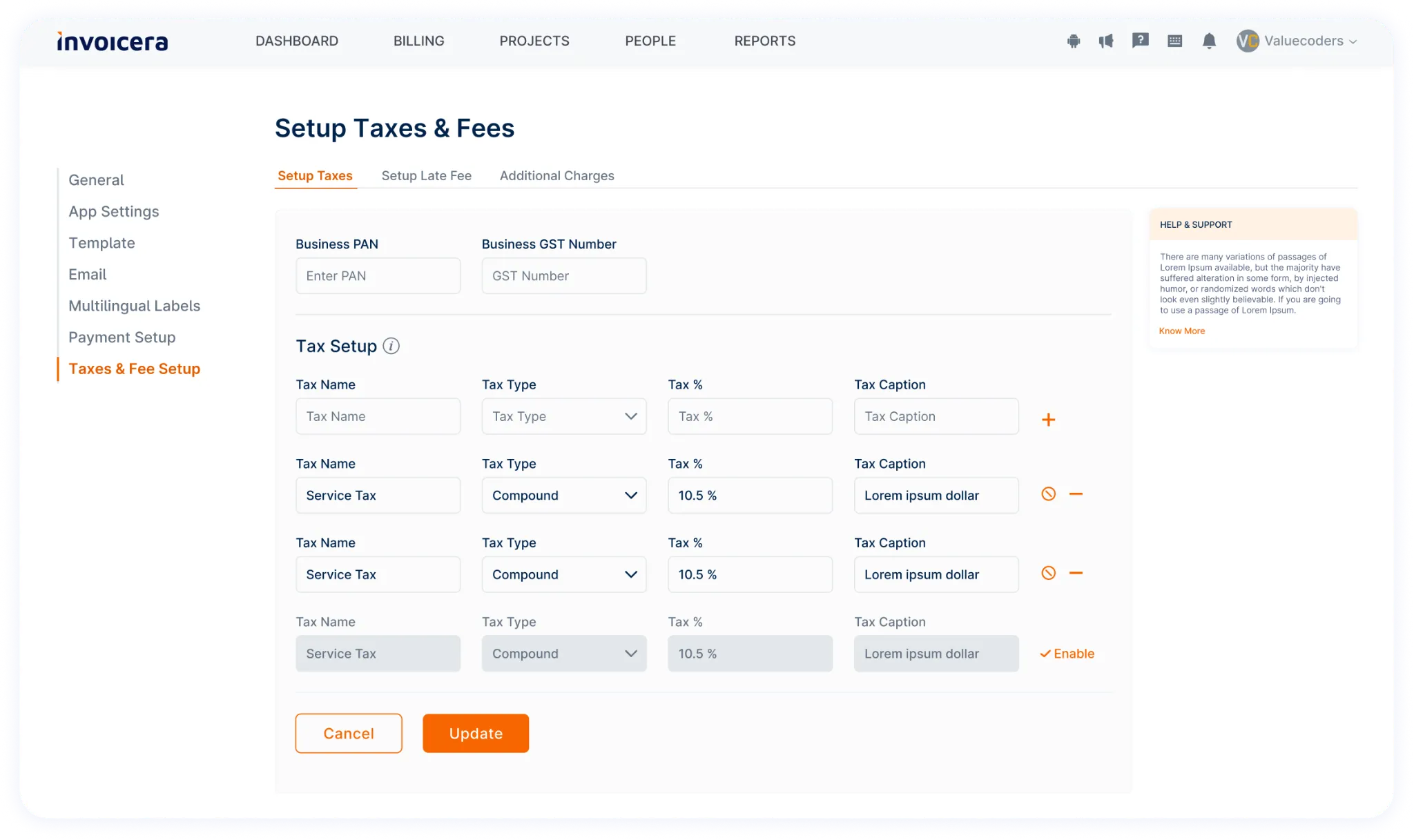

- Automated Expense Recording: Through integrations and automation features, Invoicera automates the process of recording expenses. This automation reduces manual errors and saves time typically spent on data entry tasks.

Using Invoicera for Expense Reconciliation:

- Integration with Bank Accounts and Payment Gateways: Invoicera seamlessly integrates with bank accounts and 14+ payment gateways, facilitating direct synchronization of transactions. This integration streamlines the matching of expenses with bank records during reconciliation.

- Reconciliation Workflows: Invoicera offers intuitive reconciliation workflows, simplifying the identification and resolution of discrepancies between recorded expenses and actual transactions. Its user-friendly interface assists in the swift resolution of inconsistencies.

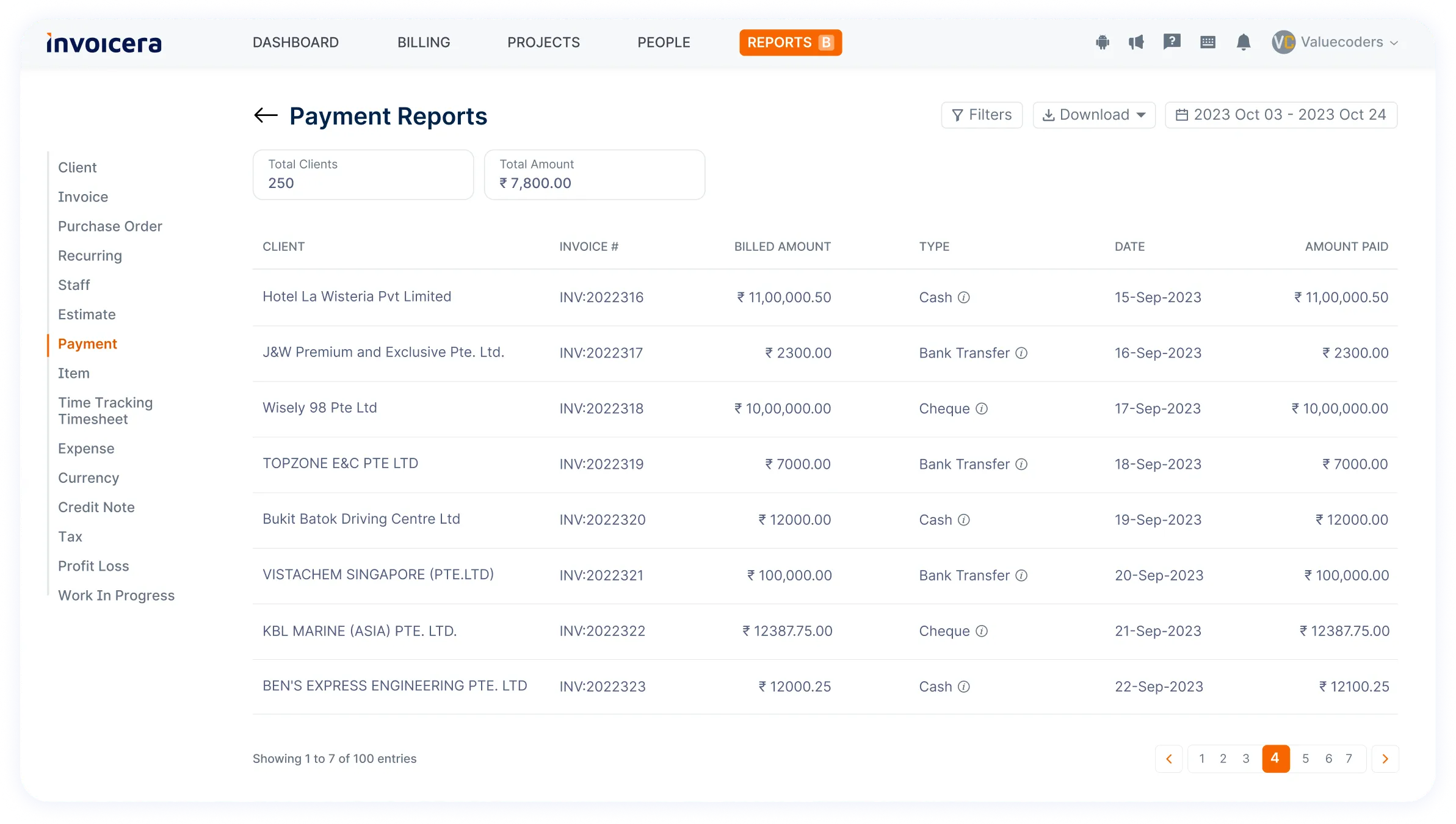

- Reporting and Analytics: Invoicera’s reporting and analytics features provide detailed insights into expense reconciliation. Users can generate customizable reports that highlight variances, aiding in a comprehensive analysis of financial discrepancies.

- Audit Trails and Compliance Support: Invoicera maintains comprehensive audit trails, ensuring transparency and compliance during the expense reconciliation process. This feature is especially beneficial for businesses navigating audits and regulatory requirements.

Invoicera’s robust functionalities and user-friendly interface make it a valuable asset in achieving accurate and efficient expense reconciliation, empowering businesses to maintain financial clarity and control.

Benefits of Achieving Financial Clarity

Attaining financial clarity through effective expense reconciliation isn’t just a checkbox exercise—it’s a pivotal step toward sustained success.

Let’s delve into the substantial benefits this practice offers to businesses:

1. Enhanced Decision-Making

Financial clarity serves as a beacon for strategic decisions. When businesses clearly understand their expenses and financial health, leaders can confidently steer the company toward growth opportunities, optimal investments, and resource allocation.

Informed decisions based on accurate financial data lay the groundwork for long-term success.

2. Improved Budgeting and Forecasting

Accurate expense reconciliation empowers businesses to create more precise budgets and forecasts. Organizations can anticipate future expenses more accurately by understanding historical spending patterns and identifying trends.

This foresight minimizes financial surprises and aids in creating realistic, achievable financial plans.

3. Regulatory Compliance and Audit Readiness

In an environment where regulatory compliance is paramount, financial clarity through meticulous expense reconciliation ensures adherence to financial regulations.

Having accurate and transparent records not only safeguards against legal repercussions but also streamlines the audit process, reducing stress and time spent in compliance procedures.

Pro tip: Invoicera guarantees smooth adherence to regulations and readies you for audits through its thorough tracking and reporting capabilities.

4. Resource Optimization

Identifying discrepancies and expense redundancies helps optimize resource allocation. Businesses can trim unnecessary expenditures, renegotiate contracts, or seek more cost-effective solutions.

This optimization frees up capital that can be redirected toward revenue-generating activities or strategic initiatives.

5. Strengthened Investor and Creditor Confidence

For businesses seeking external funding or partnerships, financial clarity significantly enhances credibility.

Clear, well-documented financial records instill confidence in investors and creditors, fostering stronger relationships and potentially unlocking new avenues for growth and collaboration.

6. Enhanced Operational Efficiency

Efficient expense reconciliation processes streamline operations. Automation tools, integrated software, and regular review mechanisms minimize errors, reduce manual labor, and improve efficiency.

This efficiency allows teams to focus on core business functions rather than getting bogged down in financial discrepancies.

7. Facilitates Growth Strategies

Financial clarity provides the necessary foundation for growth.

With a clear understanding of the financial landscape, businesses can confidently embark on expansion plans, mergers, acquisitions, or diversification strategies, knowing they have a solid financial footing.

Achieving financial clarity through robust expense reconciliation isn’t just about balancing the books—it’s about empowering businesses to make smarter decisions, ensure compliance, and ultimately thrive in a competitive landscape.

Expense reconciliation is a dynamic process that demands attention to detail and a systematic approach. To ensure its effectiveness and streamline the financial clarity journey, consider implementing the following tips:

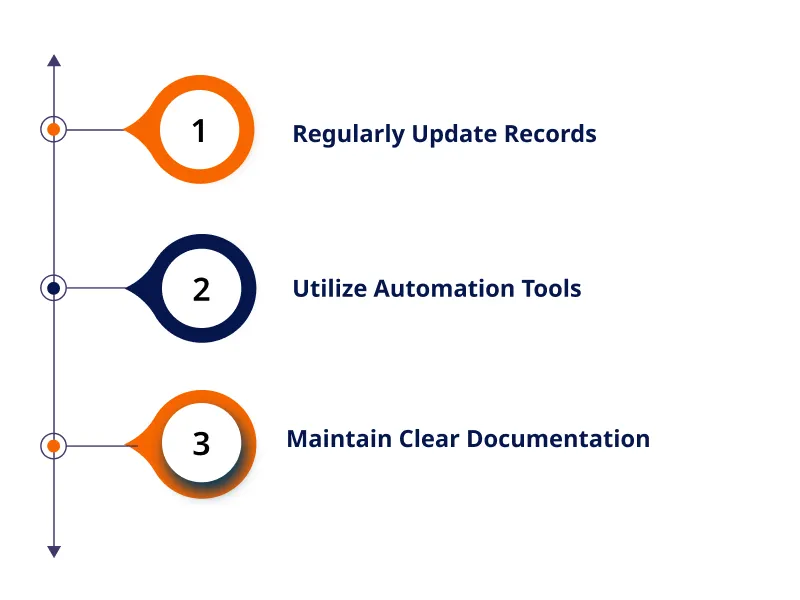

A. Regularly Update Records

Keeping your financial records updated is the cornerstone of successful expense reconciliation. Set a cadence for recording expenses—daily, weekly, or monthly—and stick to it rigorously.

This habit maintains accuracy and minimizes the chances of overlooking crucial expenses. Consistent updates ensure that your financial data remains current and reflects the actual state of affairs within your business.

To streamline this process, leverage accounting software or spreadsheets to log expenses systematically.

Prompt reimbursement processes for employee expenses can further facilitate up-to-date records by encouraging timely submission and validation.

B. Utilize Automation Tools

Automation is a game-changer in expense reconciliation. Incorporating automation tools like Invoicera significantly reduces manual effort and human errors. Look for software or platforms that offer automatic data synchronization, receipt scanning, and expense categorization.

These tools can swiftly integrate with your existing systems, making the reconciliation process more efficient and less prone to discrepancies.

Utilizing automation expedites the reconciliation process and frees up valuable time that you can allocate to strategic financial planning and analysis.

By embracing technology, businesses can enhance accuracy while accelerating the pace of reconciliation.

C. Maintain Clear Documentation

Clear and comprehensive documentation is indispensable for effective expense reconciliation. Encourage detailed receipts, invoices, and supporting documents for all transactions.

These documents serve as evidence, facilitating easy cross-referencing during reconciliation.

Implement standardized documentation practices across the organization. This consistency ensures uniformity in recording expenses, simplifying the reconciliation process and reducing confusion.

Furthermore, digital documentation systems not only promote accessibility but also facilitate easy retrieval and storage of records, ensuring they’re readily available for auditing or review purposes.

Conclusion

Striving for financial clarity involves the precise practice of expense reconciliation. It’s more than just balancing accounts; it’s ensuring every cent is in place, all records match, and any differences are resolved.

When businesses are proactive, they strengthen their financial base, enabling smarter decisions and strategic planning.

Remember, reaching financial clarity isn’t a one-time task but an ongoing commitment.

Regular updates, embracing automation, and careful documentation are the keys to successful reconciliation. By integrating these practices into daily operations, businesses gain insights into their financial well-being and confidently equip themselves to navigate changes.

Achieving financial clarity through effective expense reconciliation isn’t solely about numbers. It’s about constructing a reliable structure based on trust, transparency, and informed financial management.

As businesses adopt these principles, they embark on a path where financial clarity drives them toward sustainable growth and resilience.

FAQs

How often should I perform expense reconciliation?

The frequency depends on your business needs. Generally, monthly reconciliations are recommended, but businesses with higher transaction volumes might benefit from more frequent checks.

How can I ensure the security of financial data during reconciliation?

Use secure and encrypted platforms for storing financial data. Limit access to authorized person and regularly update passwords to prevent unauthorized access.

Can I reconcile expenses if I’m a small business or a freelancer?

Absolutely! Regardless of business size, expense reconciliation is crucial for financial clarity. Even with fewer transactions, regular reconciliation helps maintain accuracy and track financial health.

Is there a specific time frame for keeping expense records for reconciliation purposes?

It’s recommended to keep expense records for at least three to seven years for tax and auditing purposes. However, maintaining records beyond that might be beneficial for historical analysis.