Introduction

Any business needs sufficient cash flow to remain operational. A sound cash flow system enables operational efficiency and on-time financial transactions that support enduring business development.

Profitability alone does not protect businesses from cash flow challenges frequently associated with weak leadership.

Organizations use primary formulas to calculate cash flow, determine financial health, develop investment strategies, and sidestep funding problems.

The guide presents seven key cash flow formulas accompanied by explanations and examples.

How to Calculate Cash Flow?

To calculate cash flow, follow these steps:

- Identify Your Cash Inflows and Outflows: Start by listing all sources of cash coming in (revenue, investments, loans) and all outgoing payments (expenses, salaries, loan repayments).

- Use a Cash Flow Formula: Based on your needs, apply the appropriate cash flow formula to determine net cash flow, operating cash flow, or free cash flow.

- Leverage a Cash Flow Calculator: If manual calculations seem overwhelming, using a cash flow calculator can help streamline the process and eliminate errors. Simply input your inflows and outflows, and it will do the math for you.

- Analyze the Results: Compare your cash flow over different periods to track trends and make informed financial decisions.

7 Key Cash Flow Formulas and How to Use Them

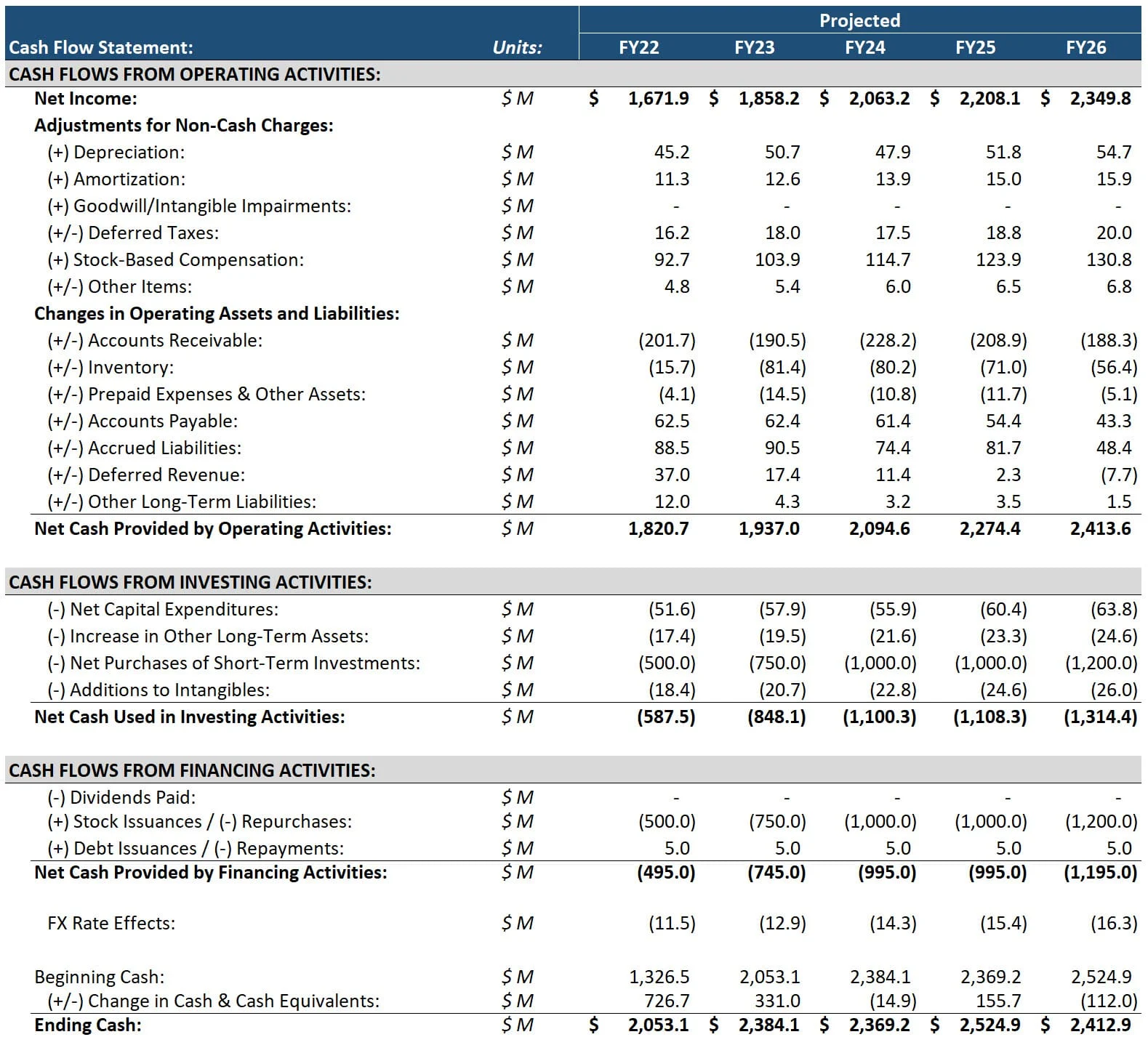

Prepare a cash flow statement, as shown in the image below, to determine the values and use them in the cash flow formulas.

Note: Values used in the below formulas are different from the cash flow statement to make it easy for you to grasp.

If you’re unsure about calculations, using a cash flow calculator can simplify the process and ensure accuracy.

Here we go with the seven essential cash flow formulas every business should know.

1. Operating Cash Flow (OCF)

What it measures

Operating Cash Flow (OCF) shows the cash a business generates from its core operations. Unlike net income, which includes non-cash items like depreciation, OCF focuses on actual cash movement.

Operating Cash Flow Formula

Example

A company reports:

- Net Income: $100,000

- Depreciation & Amortization: $20,000

- Increase in Accounts Payable: $10,000

- Increase in Accounts Receivable: $5,000

- Changes in Working Capital = Increase in Accounts Payable – Increase in Accounts Receivable

Using the formula

Why it’s Important

- Cash Generation Insight: OCF gives an insight into how efficiently a company is generating cash from its operations such that its core business is profitable in cash flow.

- Liquidity Indicator: It is a better indicator of liquidity than income, as it provides actual cash flow versus accounting-based profits.

- Investment Decision: Investors and creditors closely assess OCF to check whether the company can afford running costs and debt repayment.

2. Free Cash Flow (FCF)

What it measures

Free Cash Flow (FCF) represents the cash available after covering operating expenses and capital investments. It’s a key indicator of financial health, helping businesses plan growth, dividends, and debt payments.

Free Cash Flow Formula

Example

Using the previous OCF calculation ($125,000) and assuming capital expenditures (CapEx) of $30,000:

Why it’s important

- Financial Flexibility: The FCF measures how much cash is available for a company’s growth and to return value to shareholders via dividends and stock buybacks.

- Business Health: A healthy and growing business may be denoted by positive FCF; negative indicates over-investment or cash mismanagement.

- Investor Confidence: In this regard, investors consider FCF a major determinant of long-term profitability, that is, whether a company can fund its activities and pursue growth without relying on outside financing.

Formula 3: Cash Flow Margin

What it Measures

Cash Flow Margin shows how efficiently a company converts sales into cash. A higher percentage indicates stronger cash flow relative to revenue.

Cash Flow Margin Formula

Example

A company has:

Operating Cash Flow (OCF): $200,000

Total Revenue: $1,000,000

Using the formula:

Why it’s Important

- Profitability and Efficiency: A high cash flow margin indicates that the company converts sales quickly into cash, a critical variable when covering its operating requirements and investing for growth.

- Financial Stability: The earnings stability and sustainability of a corporation can be measured by calculating how much of its total sales ends up in cash.

- Risk Assessment: Organizations demonstrating a weak cash flow ratio face economic problems while operating inefficiently.

Formula 4: Net Cash Flow

What it Measures

Net Cash Flow (NCF) reflects the overall cash movement in a business over a period. It includes cash from operations, investments, and financing.

Net Cash Flow Formula

Example

A company reports:

Cash Inflows: $500,000 (from sales, loans, and investments)

Cash Outflows: $350,000 (for expenses, loan payments, and purchases)

Using the formula:

Why it’s important

- Overall Cash Position: The analysis reveals complete information about how money moves throughout a company and how it impacts its financial status overall.

- Liquidity Monitoring: Positive cash flow creates strong financial liquidity, yet negative cash flow suggests upcoming financial troubles.

- Strategic Decision-Making: Net cash flow analysis enables executive teams to make strategic decisions regarding capital distribution and debt responsibilities, as well as investment program development.

Formula 5: Discounted Cash Flow (DCF)

What it Measures

DCF estimates the present value of future cash flows, helping businesses and investors assess an investment’s profitability.

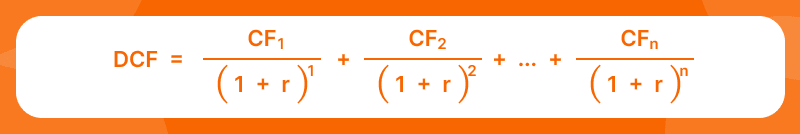

Discounted Cash Flow Formula

Where:

- CFn = Cash flow in future years

- r = Discount rate (usually the cost of capital or required rate of return)

- n = Number of years in the forecast

Example

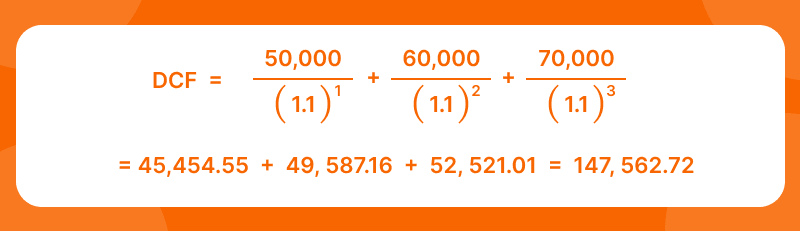

A company expects cash flows of:

- Year 1: $50,000

- Year 2: $60,000

- Year 3: $70,000

- Discount rate: 10%

Using the formula:

Why it’s Important

- Business Valuation: DCF methodology helps businesses evaluate their true worth through future price projections that lead to present-day values.

- Investment Decision: Future cash flow expectations enable investors to determine through DCF whether their investments display undervalued or overvalued characteristics.

- Long-term Planning: Long-term decision-making depends on DCF because it follows a company valuation approach that incorporates future profitability and money appreciation through time.

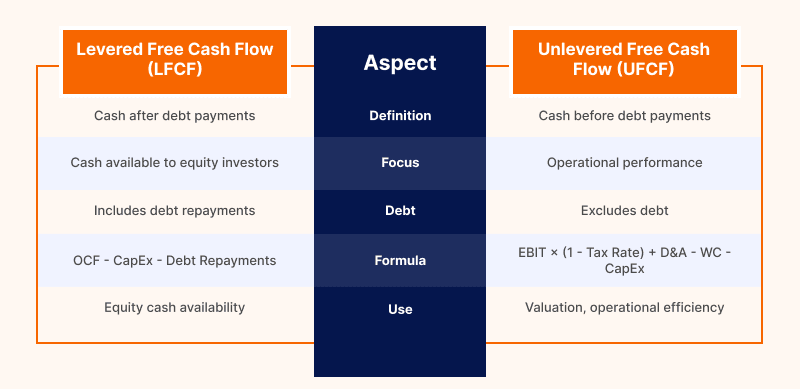

Formula 6: Levered Free Cash Flow (LFCF)

What it Measures

Levered Free Cash Flow (LFCF) enables investors to determine the cash available to equity holders after debt requirements have been fully dealt with regarding both interest payments and principal reimbursements.

The remaining cash flow delivers precise financial availability for investors to determine dividends or stock buyback investments, or project reinvestment.

In short, LFCF represents the cash equity investors maintain after paying debt service on their investments.

Levered Free Cash Flow Formula

Where:

- Operating Cash Flow (OCF): Current business operating activities of the company generate and boost cash flows measured after adjusting for non-cash transactions.

- Capital Expenditures (CapEx): The money used to maintain and buy fixed assets, including property and plant equipment, in addition to machinery.

- Debt Repayments: Money spent for debt repayment includes complete payments toward both principal and interest deductions from current debt requirements.

Example

Consider a company with the following financials:

- Operating Cash Flow (OCF): $400,000

- Capital Expenditures: $100,000

- Debt Repayments: $50,000

Using the LFCF formula:

So, the Levered Free Cash Flow for this company is $250,000.

Why is it Important?

- Equity Investors: The financial well-being of equity investors depends heavily on LFCF because it reveals what funds remain available for dividends and reinvestment while servicing debt. LFCF serves as operating funds that businesses can use for dividend payments, stock repurchases, and new investments into the business.

- Debt Repayment: The assessment of debt servicing ability with maintained financial stability depends on this measurement.

- Liquidity and Solvency: A company’s ability to repay its debts through internal cash flow operations appears in the LFCF metric.

- Business Strategy: Firms with solid LFCF flows stretching from operations use the excess funds to develop operations, deliver dividends, and pay down their debts, thus increasing investor appeal.

Formula 7: Unlevered Free Cash Flow (UFCF)

What it Measures

Unlevered Free Cash Flow (UFCF) measures operational funds that exist preceding debt costs, including interest payments. The calculation reflects the available cash that belongs to both equity and debt holders through a metric that helps evaluate operating effectiveness and money-generation capability.

UFCF provides a measure of business cash generation capacity which remains unaffected by what financial instruments are used for funding (debt or equity).

In short, UFCF shows the company’s ability to generate cash, regardless of how it is financed (via debt or equity).

Unlevered Free Cash Flow Formula

Where:

- EBIT (Earnings Before Interest and Taxes): This fundamental financial measure combines operational data with interest and tax expenses dismissed, so the operation becomes the main element under examination.

- Tax Rate: Firms need this financial assessment to determine fair tax obligations from their annual profits.

- Depreciation and Amortization: This accounting method shows a decrease in tangible asset value and this method shows the degeneration of intangible assets.

- Changes in Working Capital: Financial adjustments that capture movements in working capital assets covering receivables and payables influence cash flow statistics.

- Capital Expenditures (CapEx): Organizations allocate their cash resources to purchase and safeguard physical assets, which include building machinery and tools.

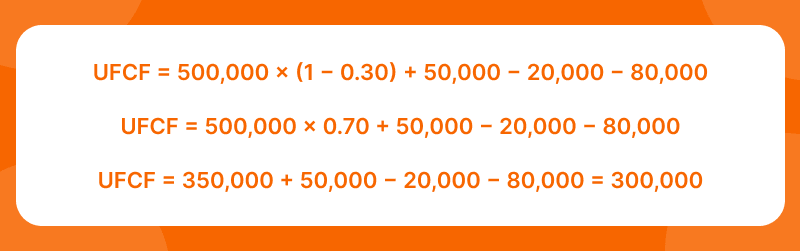

Example

Let’s assume a company has the following financials:

- EBIT: $500,000

- Tax Rate: 30%

- Depreciation and Amortization: $50,000

- Changes in Working Capital: $20,000

- Capital Expenditures: $80,000

Using the UFCF formula:

So, the Unlevered Free Cash Flow for this company is $300,000.

Why is it Important?

- Business Valuation: UFCF serves as an essential input in DCF models to value businesses since it focuses specifically on operationally generated cash without considering financing sources or uses.

- Financial Health: UFCF reveals operating cash flow separate from financing or investing activities, demonstrating the amount of core business cash generation a company can use for growth investments and debt repayment.

- Debt Independent: Because UFCF removes interest payments from calculations it enables investors to better understand operational cash flows beyond capital structure.

- Mergers & Acquisitions: When evaluating acquisitions or mergers, UFCF helps in comparing businesses with different levels of debt, focusing purely on their operational cash flow.

Conclusion

In conclusion, understanding and effectively utilizing cash flow formulas is crucial for the financial health and growth of any business.

These formulas help track liquidity, assess operational efficiency, and ensure that companies are prepared for future challenges.

By mastering key formulas like Operating Cash Flow, Free Cash Flow, and others, businesses can make informed decisions that drive profitability and stability.

Note: A reliable cash flow calculator can streamline financial planning by offering quick and accurate cash flow estimations for businesses of all sizes.

FAQs

Ques. How to calculate cash flow from the balance sheet?

Ans. Subtract the beginning cash balance from the ending balance, adjusting for changes in assets, liabilities, and equity to determine net cash flow.

Ques. How to calculate cash inflow?

Ans. Sum all revenue sources, including sales, investments, and loans, while excluding non-cash transactions to determine total cash inflow.

Ques. How to calculate cash flow in Excel?

Ans. Use formulas like =SUM(range) for inflows and outflows, then subtract outflows from inflows to calculate net cash flow.

Ques. How often should businesses calculate their cash flow?

Ans. Calculating cash flow monthly is ideal for most businesses. However, it can be done more frequently (weekly or quarterly) based on the business’s needs. Regular tracking helps businesses address cash flow issues early and make informed financial decisions.

Ques. Can negative cash flow be a good sign?

Ans. Negative cash flow may not always be bad. It can indicate investments in business growth, such as purchasing equipment or expanding operations. However, if it persists without clear investment benefits, it can signal financial trouble.

Ques. How can a company improve its cash flow?

Ans. Companies can improve cash flow by speeding up receivables, reducing inventory levels, negotiating better payment terms with suppliers, and cutting unnecessary expenses. Ensuring a steady cash inflow and controlling outflows is key to sustaining healthy cash flow.