Managing multiple currencies is one of the biggest challenges for businesses expanding globally. Fluctuating exchange rates, varying tax structures, and complex regulations make financial operations difficult to streamline.

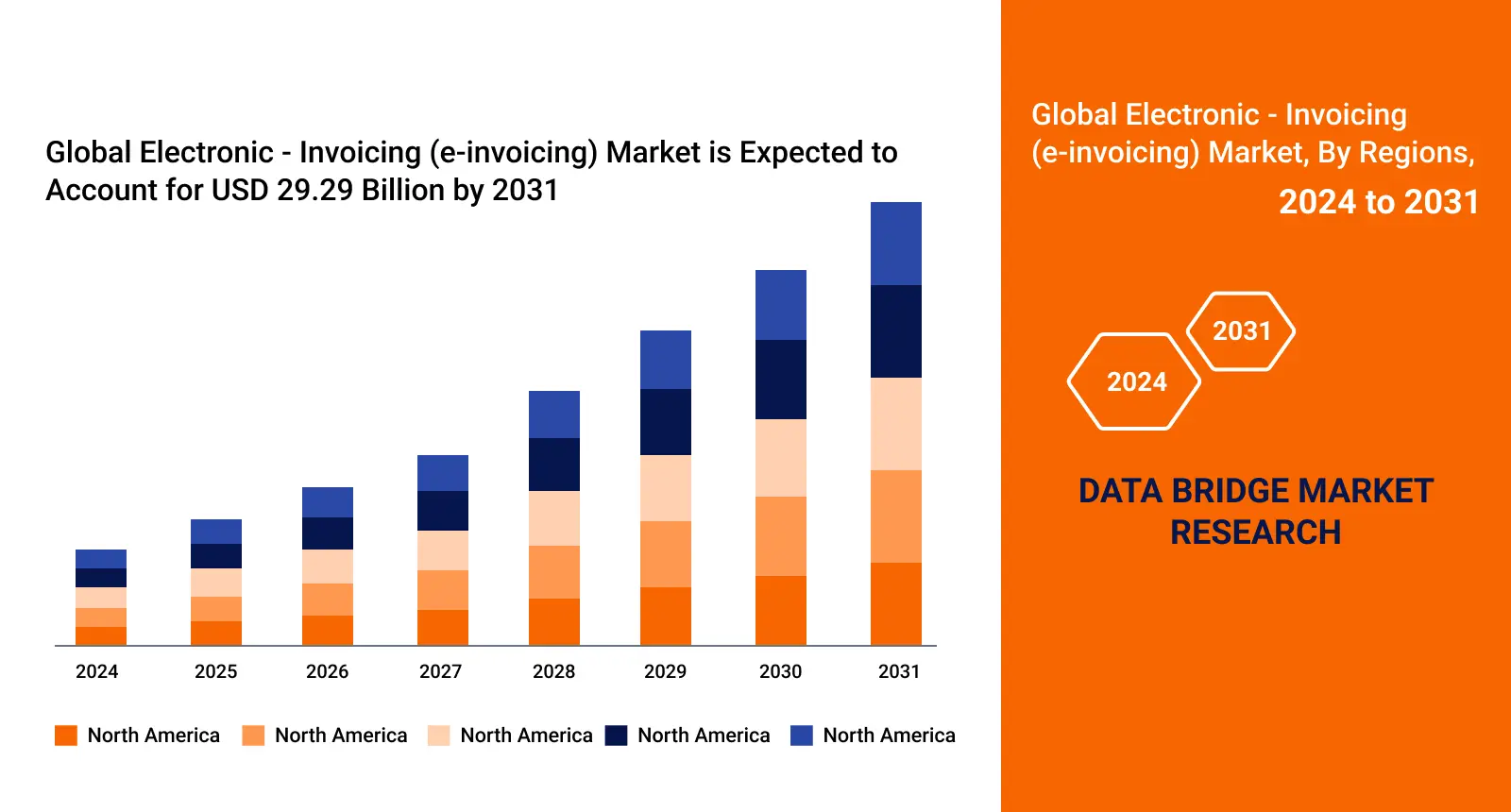

As the global e-invoicing market is expected to grow from USD 4.79 billion in 2023 to USD 29.29 billion in 2031 at a CAGR of 25.40%, the demand for multi-currency invoicing software is rising.

10 Best Multi-Currency Invoicing Software

1. Invoicera

Invoicera is a powerful multi-currency software designed to simplify global transactions.

Key Features

- Reach Any Market with 125+ Currencies: With Invoicera, you can invoice clients in more than 125 different currencies. No matter where the client is situated, you can reach any market and make cross-border transactions with ease.

- Expand Globally: When you have the ability to invoice in multiple currencies, your business can grow globally. Customer satisfaction will improve, and international dealings will become more hassle-free and seamless.

- Automatic Currency Conversion: No need for manual conversion. With Invoicera, the currency conversion takes place automatically for easy, accurate, and hassle-free transactions every time.

- Auto-Updating Exchange Rates: Say goodbye to outdated rates and manual errors. Invoicera updates you about every transaction with real-time rates so you can be sure about the accuracy of your transaction.

- Fully Customize Your Invoices: You can have your invoices look how your business and your client need them. Be it the currency preference, the layout, or the details. With Invoicera, you can create professional invoices at the click of a button.

- Automatic Currency Rate Tracking: Invoicera tracks the rate for you to ensure that you can do your business without constantly having to check the rates.

- Integrable to Any Third-Party App: Integration with any third-party applications will be seamless, which means a smoother and more efficient workflow.

- Easy Operation: Invoicera is simple to use. You will handle multi-currency invoicing without any long procedures.

Pricing

Pricing plans start from $15/month.

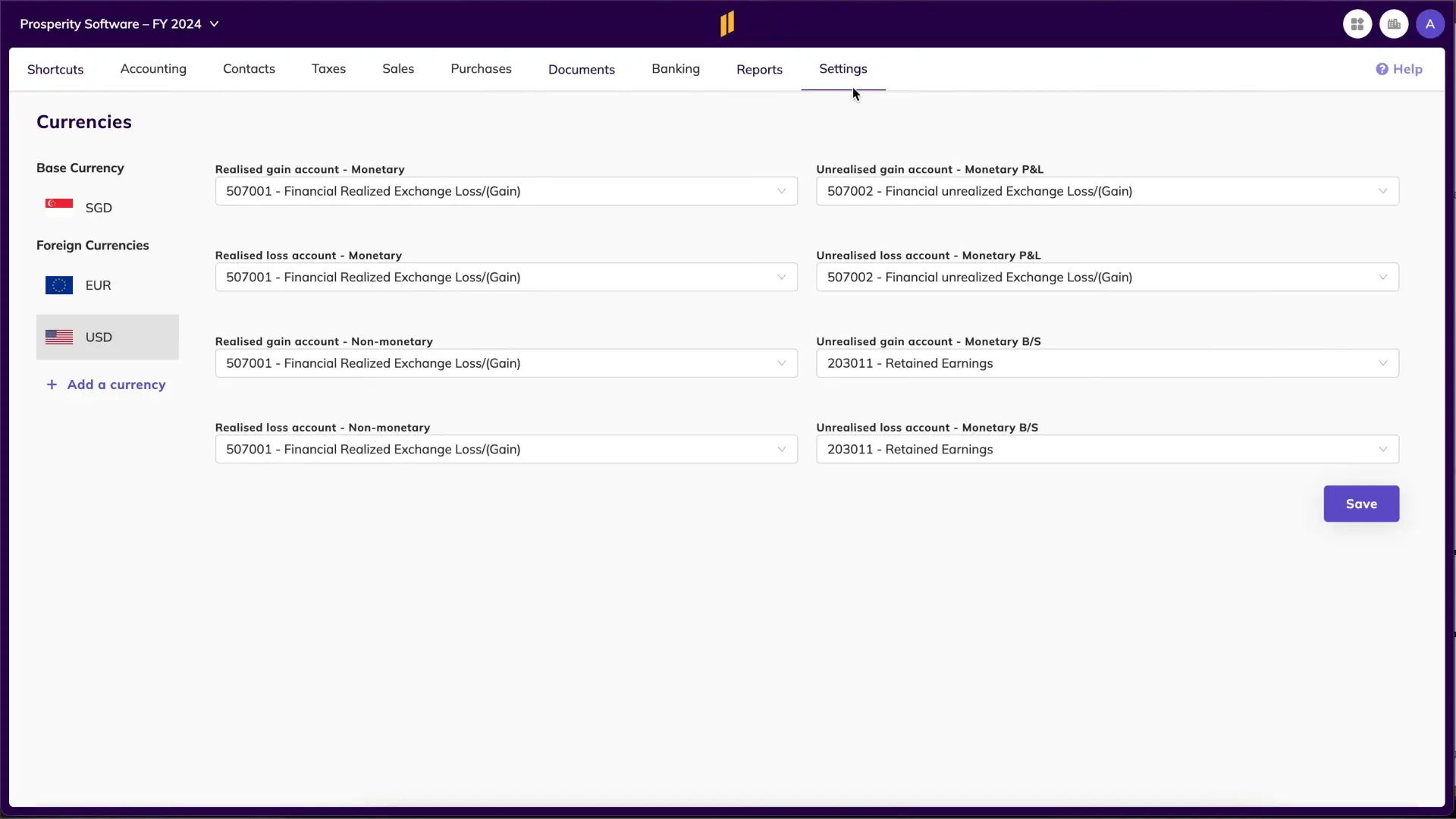

2. Eleven

Eleven is a powerful multi-currency solution that makes international transactions and accounting a breeze. Be it growing firms or complex entities, Eleven is the best route to smooth financial operations across currencies.

Key Features

- Include multiple currencies in every single journal entry and it consequently handles diverse financial data in an easy manner.

- It provides multiple options for exchange rates from automatic FX rates, making conversion easy and error-free.

- With its extended support for both monetary and non-monetary accounts, you’ll gain full insight into your financial management.

- Rather than dealing with the headaches of calculating and reporting gains and losses, spend your time wisely instead.

- Those flexible reporting and data visualization tools will give you clarity into your profitability across currencies.

Pricing

Starts at $25/month for growing businesses, with custom pricing available for enterprise needs.

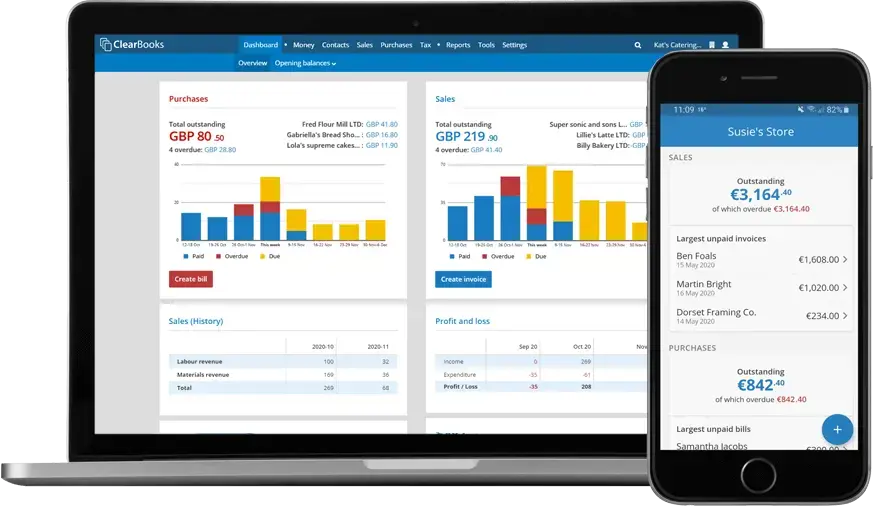

3. ClearBooks

Key Features

- Create and send invoices in the currency of your choice with ease for a global customer base.

- As an international payment option, use PayPal or Stripe.

- Choose to convert transactions back to your base currency at either the XE daily exchange rate or a custom rate for accurate reporting and tax calculations.

- Seamlessly import bank transactions and handle bills from local and international suppliers.

Pricing

Clear Books has flexible plans starting from £6.75/month for the first three months and then for standard rates scaling between £6 and £36 per month based on the plan size.

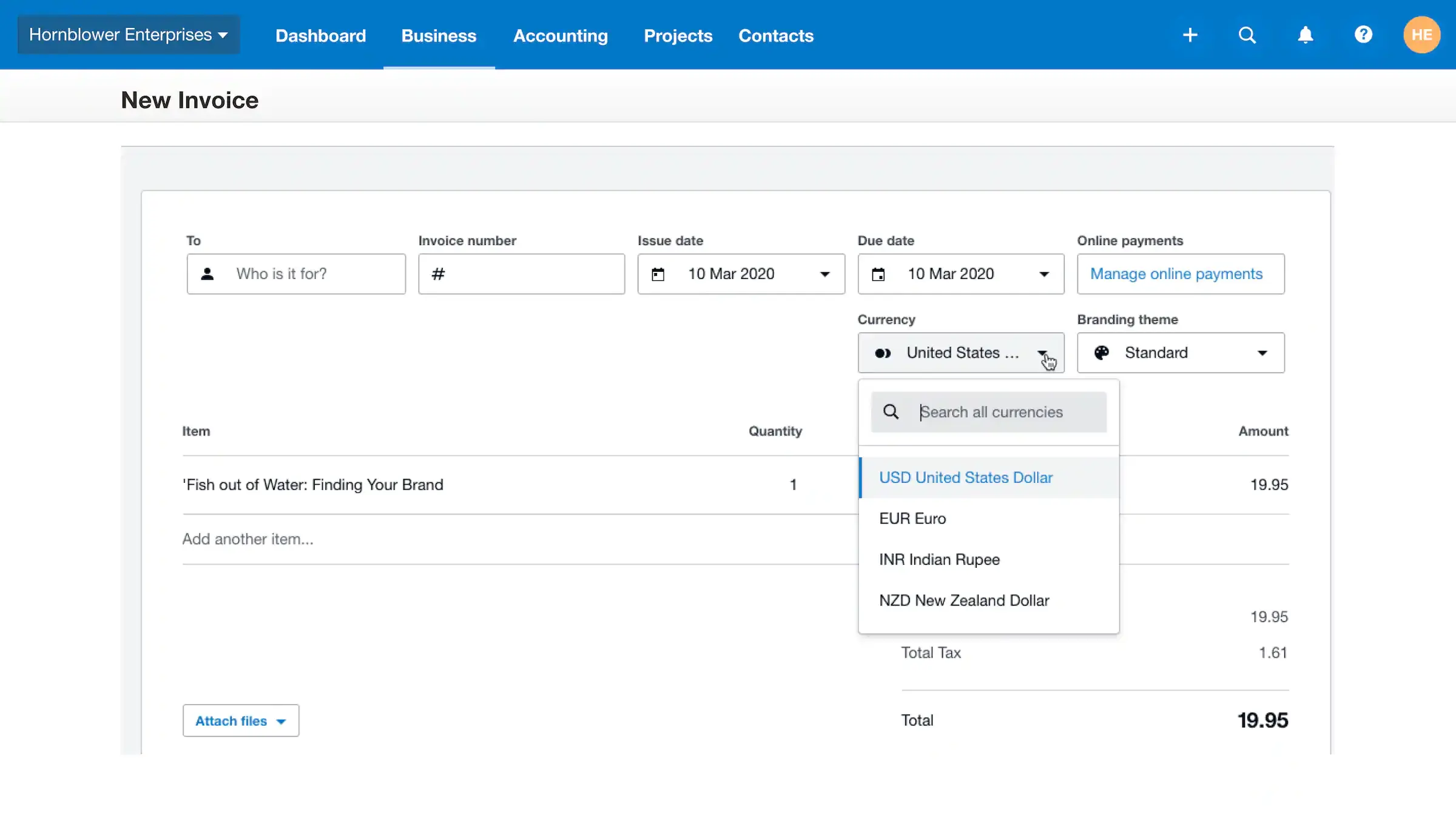

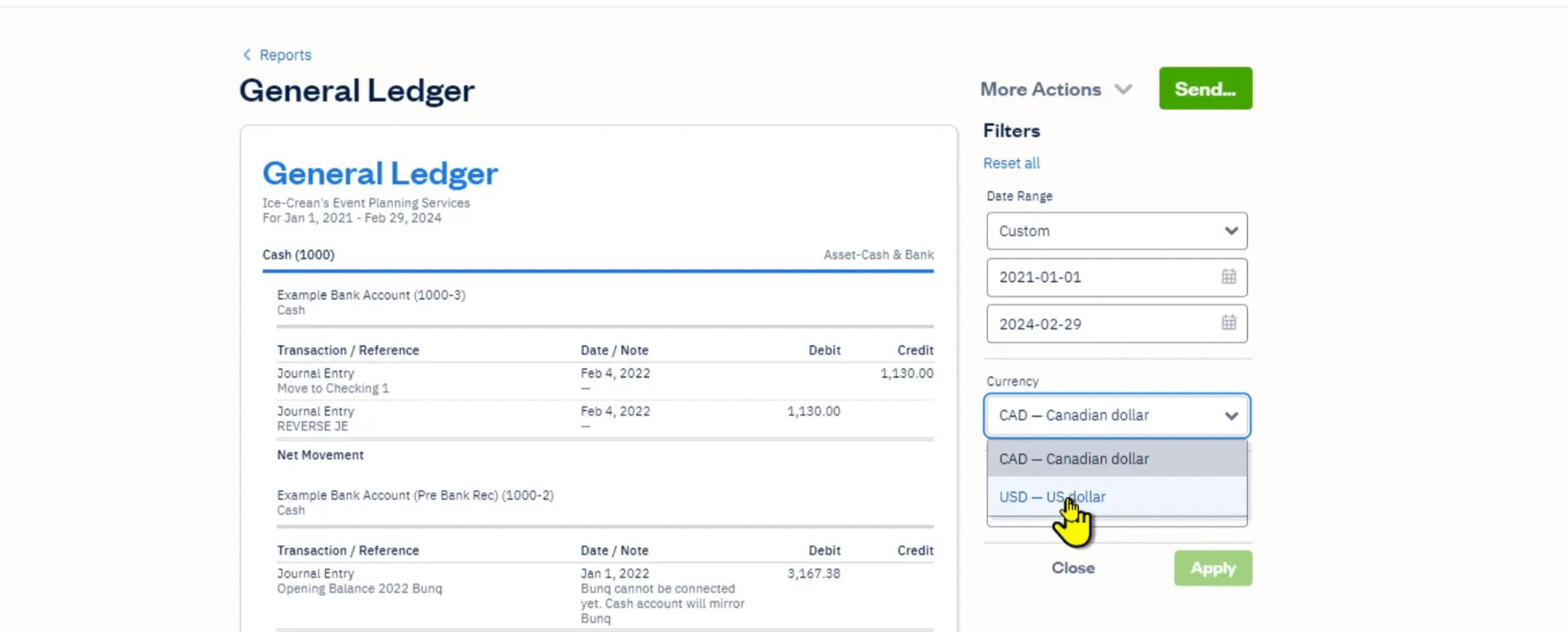

4. Xero

Key Features

- Foreign currencies will be automatically converted and entered directly into your accounting program for tracking without interruptions.

- Stay on top of changes in the exchange rate in real-time, which is highly useful for knowing any effect on your cash flow and profits.

- Offers financial reporting for both local and foreign currencies so as to give you a better understanding of how your international business is performing.

- Shows how exchange rates vary in real time and put valuable information in the hands of decision-makers for smarter action.

Pricing

Starts at $2.90/month for the first six months, then $29/month, with premium plans available up to $69/month.

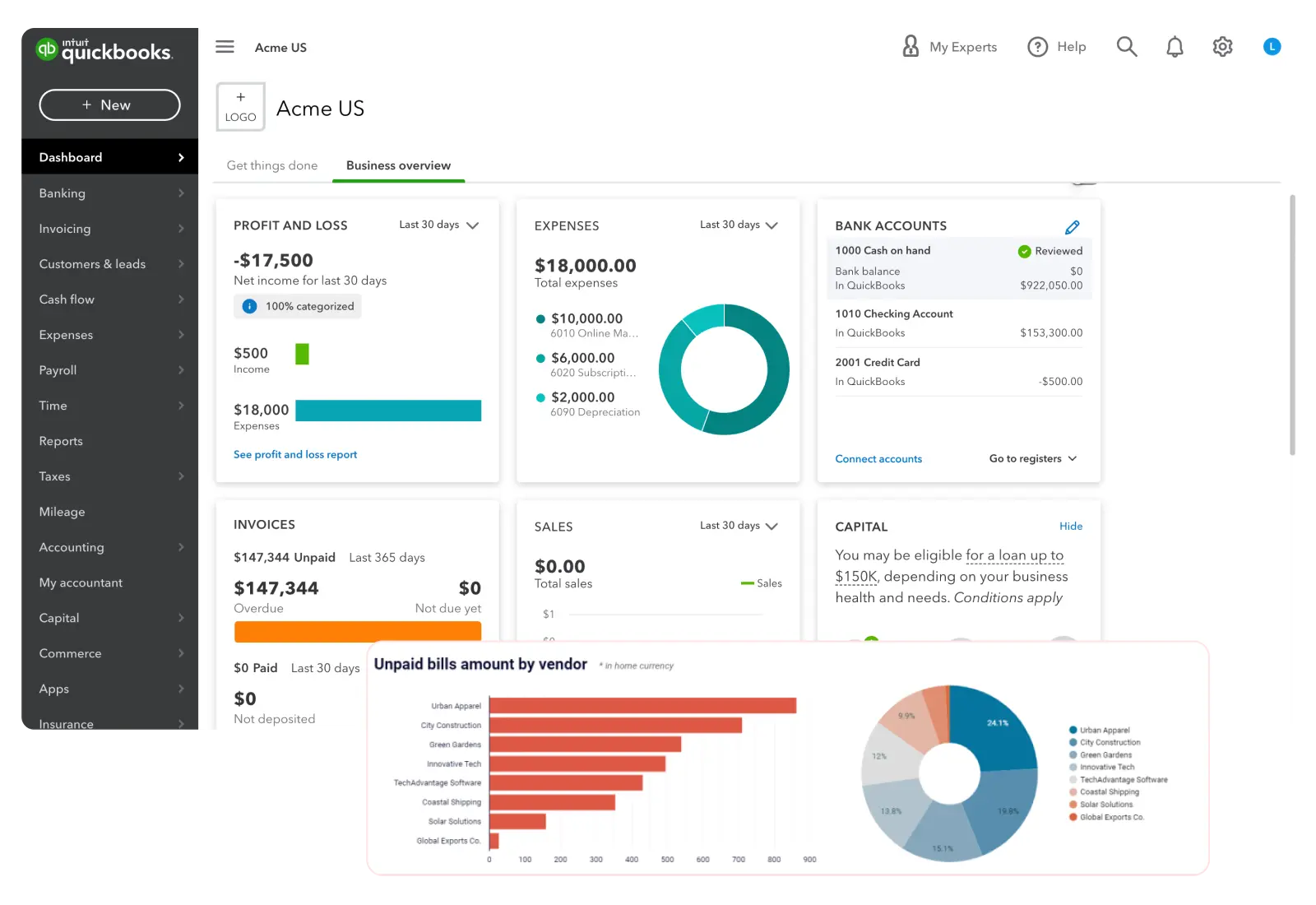

5. Quickbooks

Key Features

- Add or remove currencies when you expand into more markets.

- Set up accounts in foreign currencies that make it easier to manage finances.

- You can quickly and easily record transactions in foreign currencies without manual conversion.

- Be on the lookout for changing exchange rates that could result in errors in your general ledger.

- You can deposit payments to a bank in a foreign currency without any hassle.

- You can pay your employees in a currency that meets their local needs.

- Change the currency assigned to any customer or supplier at any time in order to remain flexible.

Pricing

Simple Start plan is $17.50/month for the first 3 months, then $35/month.

6. Odoo

Key Features

- Exchange rates can be created manually and set for automatic currency rates whenever invoices are generated.

- Odoo automatically records exchange differences on dedicated accounts, helping you maintain precise financial records.

- If a currency is set for a periodical journal, transactions in that particular journal are confined to being done in the specific currency.

- Entry in the journal regarding the exchange rates eases the conversion and reporting of currency.

Pricing

Standard plan starts at ₹760/month, while the Custom plan is available at ₹1140/month.

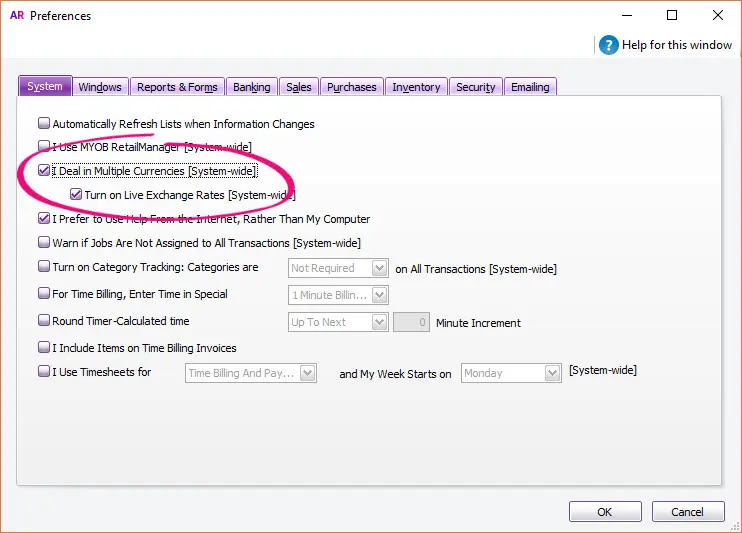

7. MYOB

Key Features

- Get real-time exchange rates for accurate transactions or set rates manually for specific transactions to take your currency management to its logical limit.

- Easily send invoices in more than 150 currencies, enabling you to do business with virtually any client from around the globe.

- Enjoy the beauty of seeing your and your client’s currency on the same transaction, ensuring clarity.

Pricing

Starting at $15.50/month for the first three months, then $31/month after the offer period.

8. Freshbooks

Key Features

- Track every expense in different currencies, making it easier for you to run finances across borders.

- Bill tracked hours in multiple currencies to ensure your clients are billed accurately by their countries of origin.

- Easily convert payments into your base currency, making financial reporting and analysis easier.

- Automatically apply the latest exchange rates to improve invoice performance and streamline the management of finance.

Pricing

The starting plan, Lite, is available for $4.75 USD per month, with 75% off for the first three months. After that, the price is $19 per month.

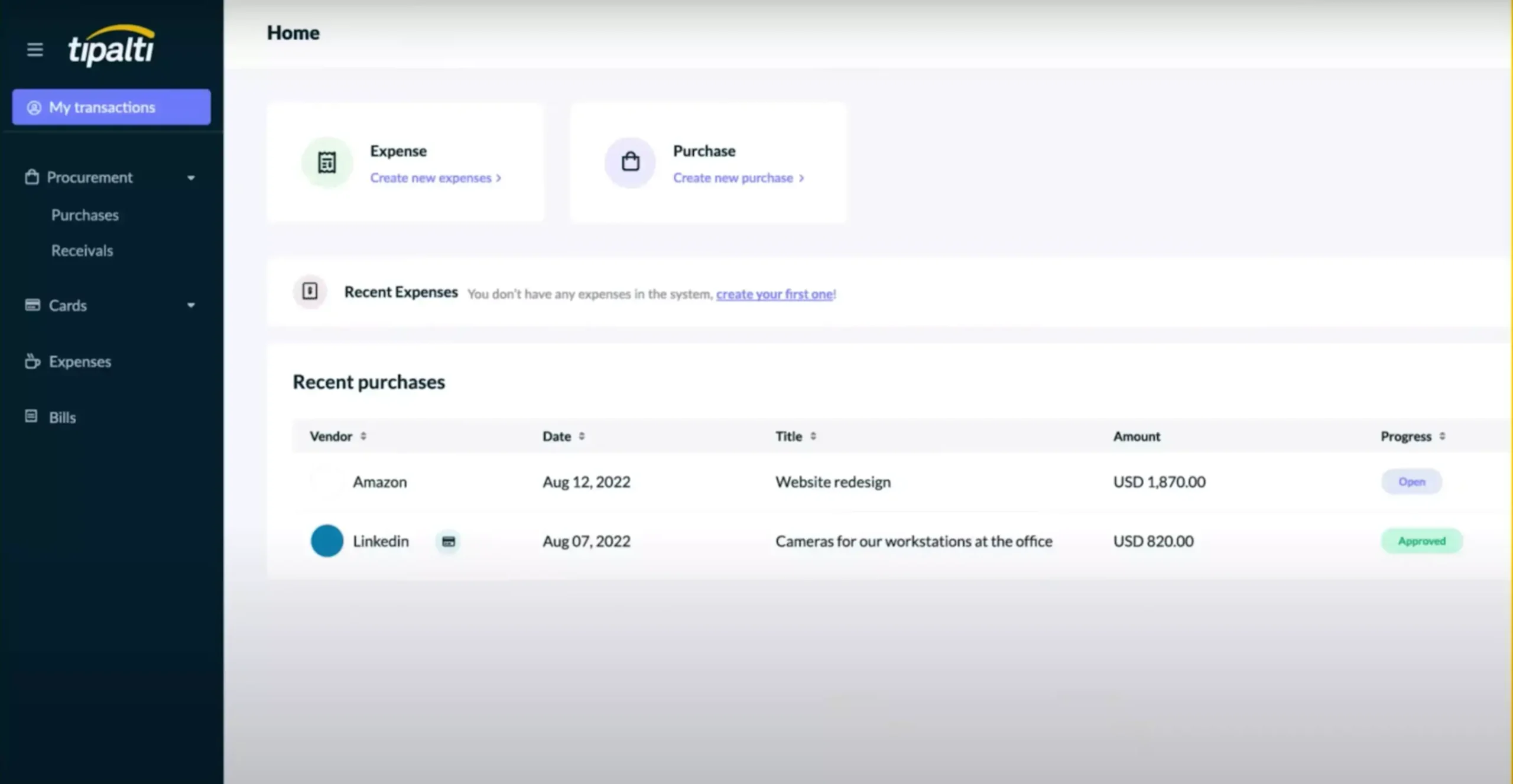

9. Tipalti

Key Features

- Tipalti allows payments to be made both quickly and accurately over international borders.

- You can fund a virtual account in your preferred currency, which gives you plenty of flexibility when it comes to international transactions.

- Funds are automatically converted to local currency, allowing cross-border payments to be made without difficulty.

- Tipalti has an automated currency conversion process in place, always working at the latest exchange rates for payments.

- Besides that, Tipalti integrates with reliable APIs and services that automatically calculate and present the converted amount to the customer during checkout, enhancing transparency.

Pricing

Custom pricing, contact sales for more details.

10. Sage 50

Key Features

- Create accounts in other currencies to easily carry out all international transactions with Sage 50.

- The software allows foreign prices to be added to inventory and service items, so you can easily keep track of costs in other currencies.

- Reports will show amounts of the foreign currency and the equivalent in home currency, making it simple and clear for financial analysis.

- It automatically looks up the exchange rate closest to your transaction date, ensuring that your transactions are accurate with just one entry per day.

Pricing

Sage 50 offers three pricing plans: Pro Accounting (1 user) at $625/year, Premium Accounting (any number of users) at $1,043/year, and Quantum Accounting (any number of users) at $1,780/year.

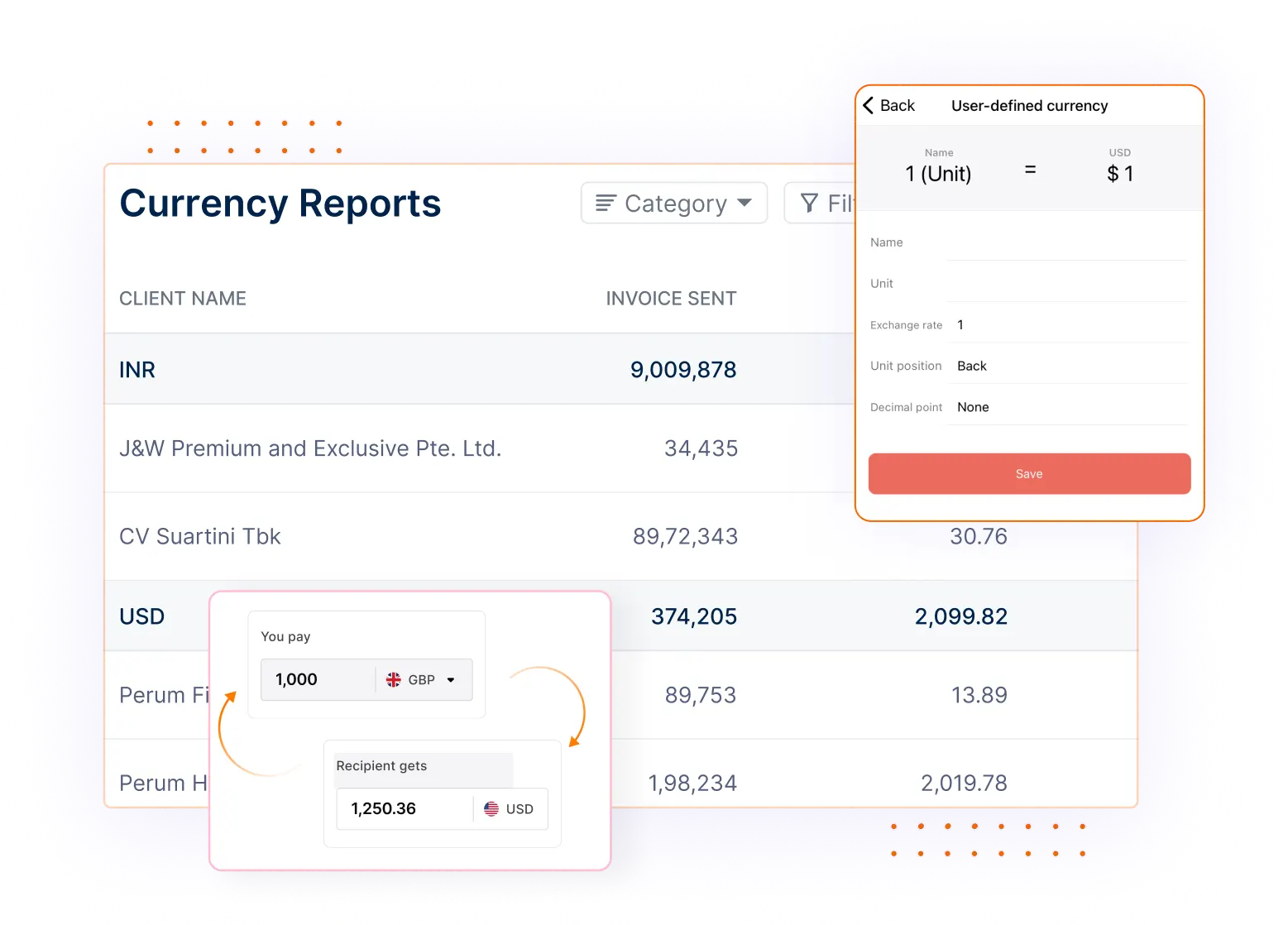

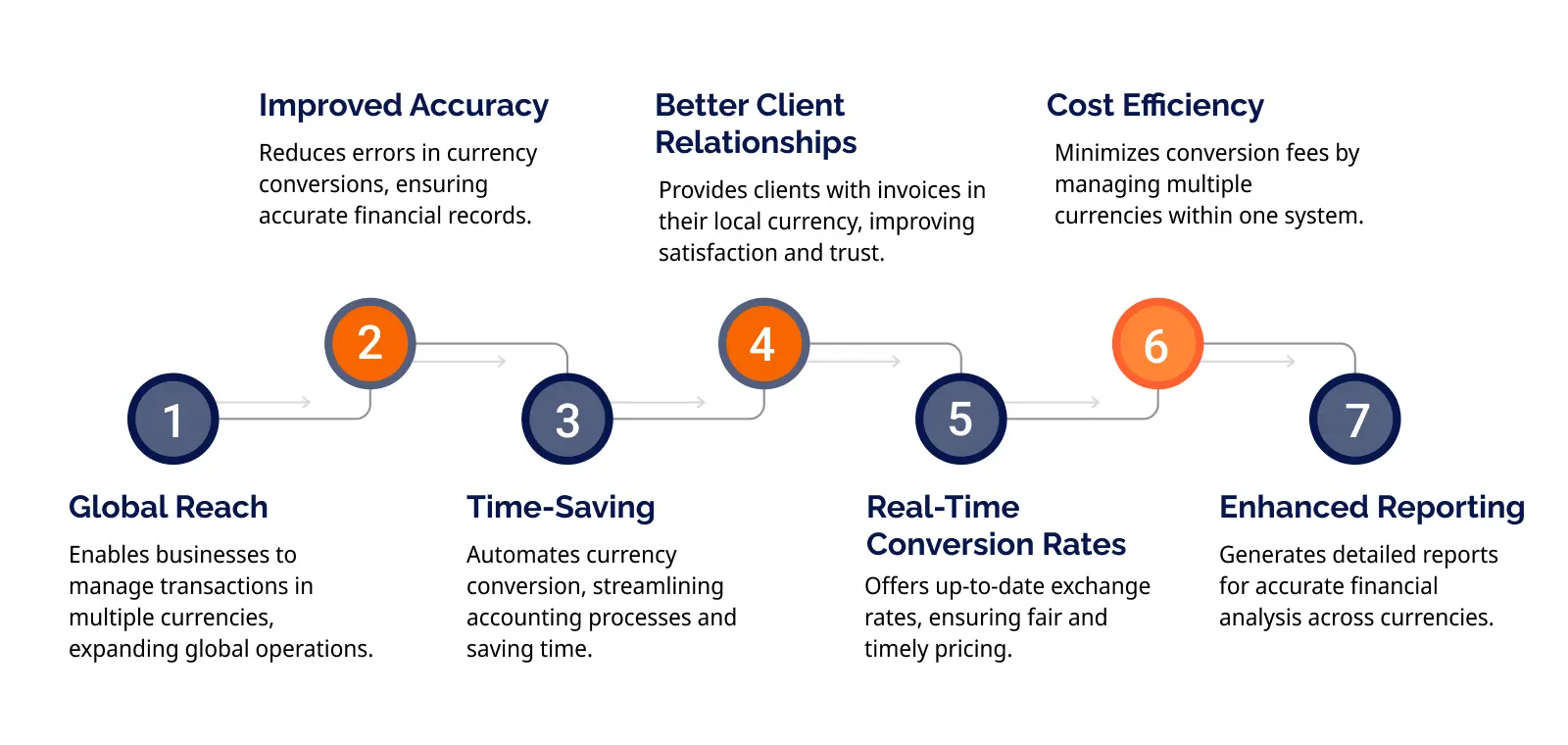

How Multiple Currency Invoicing Software Helps Businesses

Financial management across multiple currencies can be daunting, but multi-currency invoicing software eases the process so much. Here’s how it helps:

1. Automates Currency Conversion

With multi-currency software, you won’t have to perform manual exchange rate calculations anymore; the software does so for you, saving you a lot of time and diminishing manual calculation errors.

2. Ensures Real-Time Accuracy

You receive computerized integrations of real-time exchange rates into your software. That guarantees that no matter how often the market shifts, your conversions, if any, will be accurate.

3. International Transactions Made Easy

You’ll be able to invoice clients in several currencies, process payments, and keep transaction records from different markets, each within one platform.

4. Consolidates Financial Data

The multi-currency program allows you to view all your financial data, including profit and loss, through a single unified platform. That enables you to remain aware of your business’s financial health across the globe.

5. Ease of Tax Compliance

Multi-currency software would lend you invaluable help in understanding the many details of global tax regulations by supporting tax systems like VAT and GST, keeping you compliant without added hassle.

6. Fewer manual jobs and mistakes

Automating many tasks like exchange rates, tax computations, or financial reporting in multiple currency invoicing software eliminates backtracking from mistakes and minimizes the workload.

7. Provides Greater Financial Visibility

It will allow you to run reports in different currencies, meaning you can easily see how your business is performing in each market, hence enabling you to make better financial decisions.

Multi currency invoicing software not only simplifies global operations but also offers you peace of mind that all your international finances are well-managed, error-free, and reliable.

Must-Have Features for Multi-Currency Tools

1. Real-Time Exchange Rates

Real-time currency conversion into stable, reliable, accurate rates is essential to prevent currency manipulation in multi-currency software. Exchange rate updates are meant to provide organizations with market information on foreign prices.

2. Automatic Currency Conversion

The software should automatically convert payments and invoices into the appropriate currency according to current exchange rates. So businesses do not have to manually calculate conversions and expose their financial statements to selection errors.

3. Multi-Currency Bank Accounts

This feature allows businesses to easily use their multiple currency bank accounts when making foreign transactions and local payments within one software solution. No multiple banking means no more stress from financial transactions.

4. Multi-Country Tax Support

Different countries have different rules about taxation. For international businesses, compliance with these varied tax rules is vital. Multi-currency invoicing tools provide a range of tax structures, including VAT and GST, so that businesses can easily remain compliant across borders.

5. Currency-Specific Reporting

This feature permits a business to get reports showing how they perform in each market within different currencies. Other benefits are an improved vision of profit and loss and improved financial analysis.

6. Reconciliation Capabilities

Multi-currency invoicing software should provide reconciliation features for businesses, allowing them to match their records against bank statements and credit card statements in varying currencies. Thus, it reduces manual work and increases accuracy in financial reporting.

7. Customizable Invoicing

Software must include customizable invoice templates in which prices, taxes, and totals are presented in the specific currency according to arrangements. This enhances professional presentation and enables good consistency in cross-border transactions.

Benefits of Multi-Currency Software

How to Pick the Right Multi-Currency Software

Choosing the appropriate multi-currency tool is going to make a major difference in your business. You can further simplify your workflow with the best tool. Here are some things to consider:

1. Ease of use

You should look for software that is easy to learn. This way, you will not have to waste time assessing the features of the program and use the tool to your advantage.

2. Automated Conversions

Use a currency conversion tool that performs currencies automatically; this cuts out errors and saves time.

3. Real-Time Exchange Rates

Real-time exchange rates are a must. This ensures your invoices are always accurate, no matter how the market fluctuates.

4. Integration

Other tools like accounting or CRM systems will work together better if the software integrates well with them. This way, they can all be in sync together.

5. Customizability

A good software solution must permit customization in invoice creation to appear more professional to the clients.

Final Thoughts

With the increase in international business operations and transactions, choosing the right multi-currency invoicing software is important for the smooth processing of finances.

For small-scale companies that are looking to grow beyond the shores or larger enterprises that make financial transactions in multiple currencies, the tools discussed here are easy to use, versatile, and accurate.

Select what suits your demands best so as to facilitate a global operation and get a competitive position in the market!

FAQs

Ques. How does multi-currency invoicing software handle tax compliance?

Ans. Multi-currency invoicing software handles the VAT and GST compliance laws by automating the deduction of the correct tax rates based on the country.

The system also helps produce correct reports for taxation, which limits tax errors and late submissions before the authorities.

Ques. How secure is the data in multi-currency invoicing software?

Ans. Generally speaking, almost all multi-currency invoicing software have high-level security countermeasures to secure financial information, such as data encryption technology and multi-authentication.

Most systems have been designed in line with global compliance standards to prevent disclosure and mitigate against breaches of sensitive financial data.

Ques. Can multi-currency software help businesses with profit analysis in different currencies?

Ans. Yes, multi-currency software is equipped with reporting tools that allow for currency-based tracking of profits and losses within individual markets.

This creates a more precise, much more thorough understanding of how your organization is operating on a global scale, enabling more informed decisions based on the real-time data for each currency.