All businesses have small daily costs; perhaps a rush for a quick coffee for a client meeting or a couple of office supplies in a hurry. That’s where petty cash management plays a key role. It is an easy method of paying small expenses without going through the formal payment process every time.

But here’s the thing: if not well maintained, it can lead to a pile of lost receipts, unaccounted-for spending, and financial confusion. What starts as convenience can spiral into inefficiency.

That’s why having a transparent petty cash management system is vital.

No matter whether you are a small business or dealing with a larger team, these tips will help you handle petty cash confidently and beautifully.

Let’s get into it!

What Is Petty Cash and Why Does It Matter

Petty cash refers to a relatively small amount of cash that is used to pay for small daily business needs. It’s applicable in case a company card is used, or a formal payment takes too long or is unnecessary.

Petty cash examples include:

- Office supplies

- Parking fees or delivery tips

- Reimbursing small employee purchases

- Refreshments for meetings

Though the amounts are small, effective petty cash management ensures smooth daily operations. It helps teams stay agile and reduces unnecessary delays.

Why it matters:

- Flexible for small, quick expenses

- Cuts down on formal reimbursements

- Speeds up team workflows

- Keeps cash records organized

When properly handled through a petty cash management system, these funds become an efficient tool. Poor handling, on the other hand, leads to financial inconsistencies.

Common Challenges in Managing Petty Cash

Businesses often face issues in the petty cash management process such as:

1. Missing or Incomplete Receipts: Employees may forget to bring the receipts making it hard to know how the money is spent.

2. Lack of Clear Policies: There is usually fumbling without rules of who should use petty cash and for what.

3. Poor Recordkeeping: Written logs or handwritten, disorganized notes normally result in inaccurate tracking and reporting.

4. Unauthorized Spending: If there aren’t controls, petty cash may be used for inappropriate or personal expenditures.

5. Delayed reconciliations: Delay in reconciling the fund may lead to errors that are hard to track.

Solving these early with a robust petty cash management system avoids losses and builds accountability.

Why Do You Need Petty Cash Management?

Although petty cash is handy for daily spending, it is often accompanied by its own woes, most particularly without due supervision. Such errors can always cause financial discrepancies or compliance issues.

Here’s why a structured petty cash management process is essential:

Ensures Control and Accountability

- Prevents misuse and overspending.

- Keeps transactions traceable and transparent.

- Reduces fraud and theft risks.

- Supports clean financial records and easier audits.

Improves Efficiency and Compliance

- Speeds up small purchases without delays.

- Ensures funds are used appropriately.

- Helps businesses stay compliant with policies and regulations.

- Reduces financial discrepancies and penalties.

Enhances Financial Transparency

- Provides clear oversight of petty cash usage

- Allows for easy tracking of expenses.

- Enables regular reconciliation and auditing.

- Improves visibility for managers and stakeholders.

Streamlines Operations

- Removes bottlenecks in small expenses handling.

- Lowers dependence on complex reimbursement process.

- Holds teams to their core undertakings without breakdowns.

Reduces Risks of Errors and Mismanagement

- Minimizes chances of missing receipts or untracked expenses.

- Prevents discrepancies between actual fund usage and recorded data.

- Reduces the risk of over- or under-replenishing petty cash balance.

In short, effective petty cash management empowers your team with clarity, control, and confidence.

Proven Tips and Techniques for Effective Management

Petty cash management doesn’t always have to be complicated. There are only a few smart practices that will guarantee your petty cash system operates successfully, is secure, and transparent.

Set Clear Policies and Limits

Tips

- Set guidelines for who can access petty cash and for what.

- Define spending limits to avoid overspending.

- Communicate policies clearly to employees.

Techniques

- Create written policies and share them with the team.

- Set specific limits for categories (e.g., supplies, transportation).

- Remind employees regularly of the policies.

Maintain Detailed Records

Tips

- Log each transaction with date, amount, purpose, and person responsible.

- Attach receipts for easy reference and auditing.

Techniques

- Use digital tools or spreadsheets for efficient tracking.

- Maintain a simple format (date, amount, description, receipt).

- Review and update records regularly.

Reconcile Regularly

Tips

- Reconcile the petty cash balance weekly or monthly to match records.

- Address discrepancies right away to avoid future issues.

Techniques

- Set a schedule for reconciliation and use reminders.

- Cross-check the balance with receipts and logs.

- Use digital tools for smoother reconciliation.

Use a Petty Cash Custodian

Tips

- Assign one person or a team to manage petty cash.

- This person handles tracking and receipts.

Techniques

- Choose a responsible individual or team.

- Clearly define their duties and hold them accountable.

- Document their role and responsibilities.

Limit Access and Use

Tips

- Restrict access to petty cash to authorized individuals only.

- Ensure petty cash is used for small, necessary expenses.

Techniques

- Keep the fund in a secure location.

- Use a check-out/check-in system for access.

- Conduct regular audits to monitor usage.

Consider Digital Tools

Tips

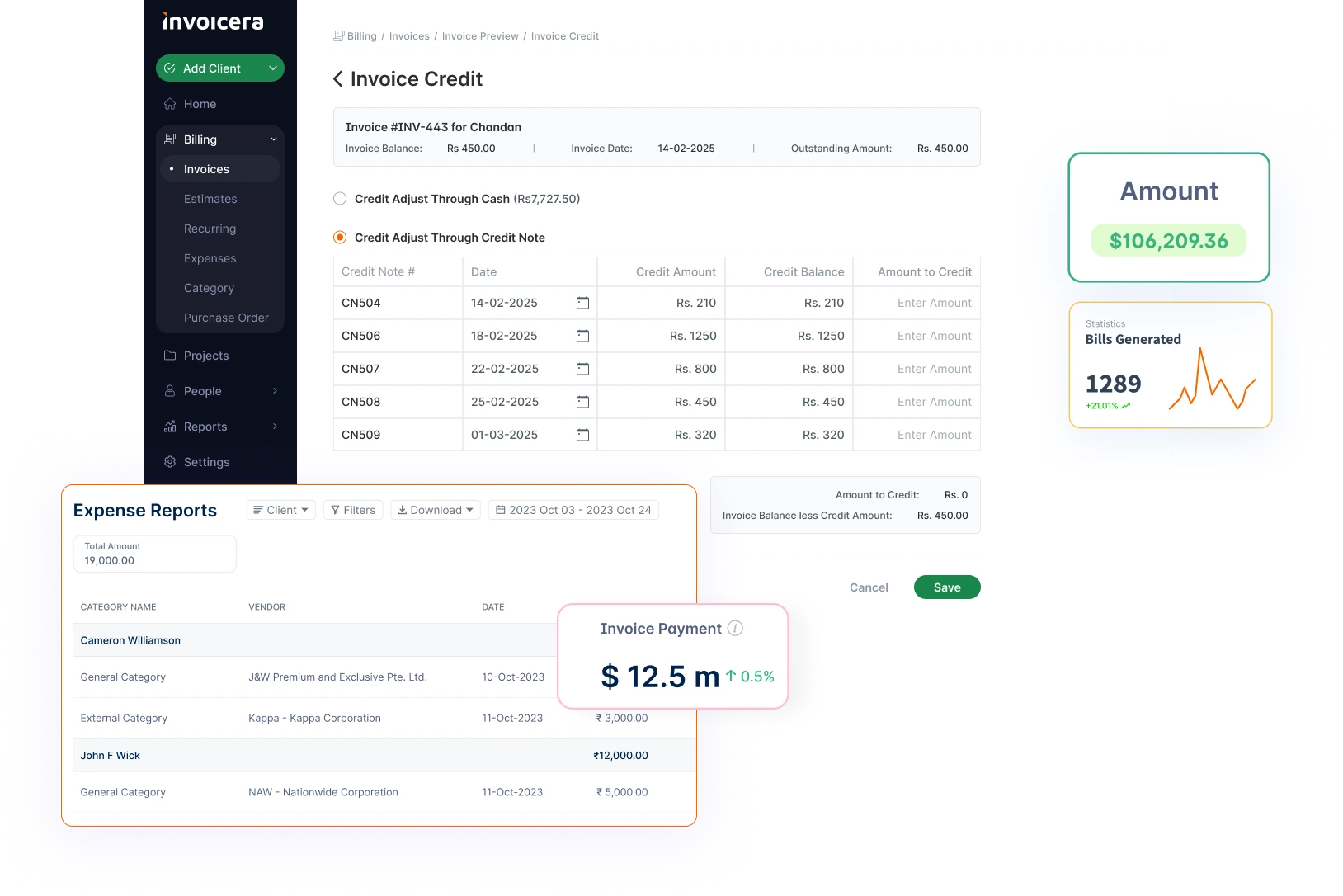

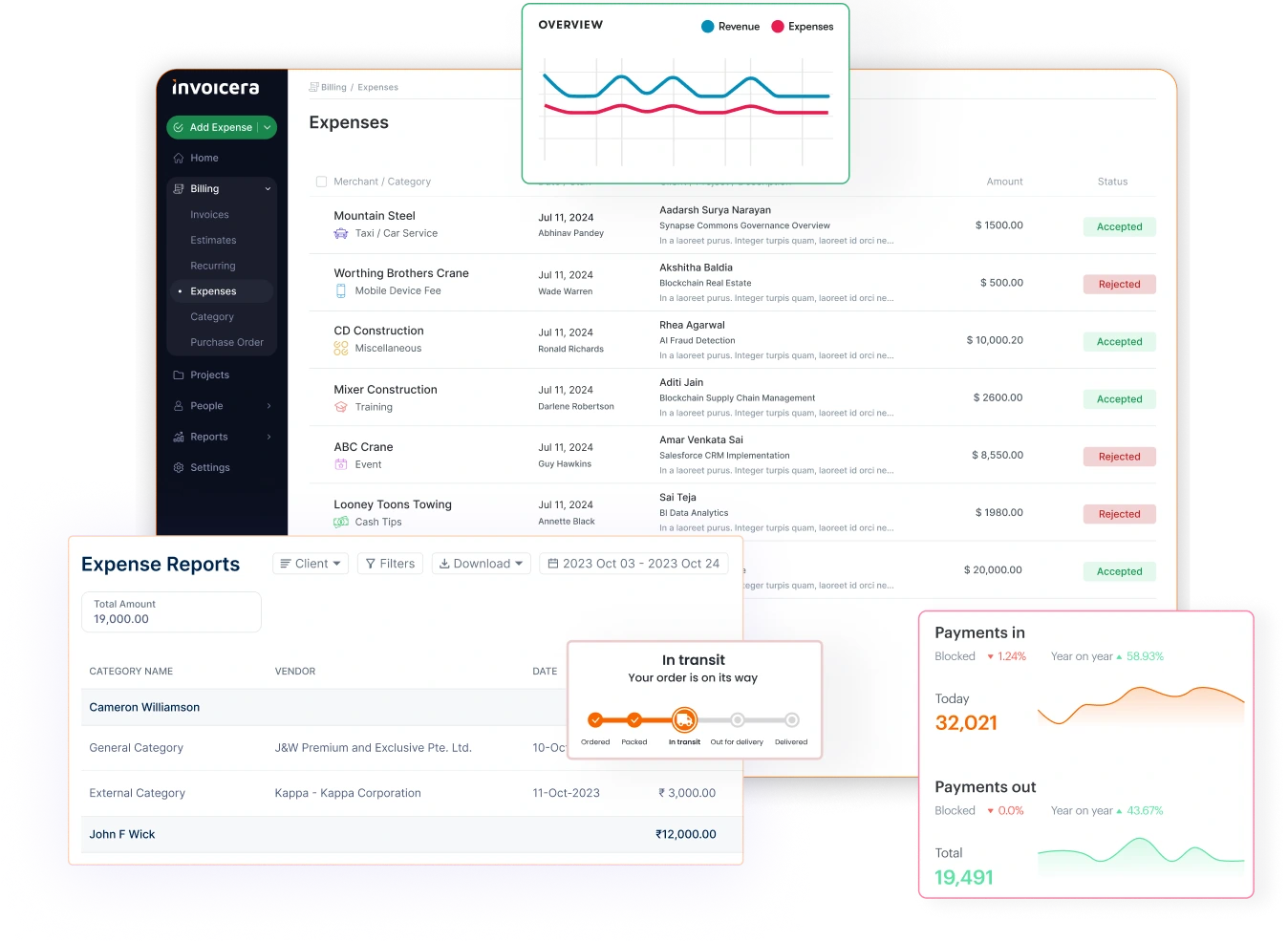

- Use expense management software like Invoicera to simplify tracking.

- Digital tools provide real-time tracking and integrate with accounting systems.

Techniques

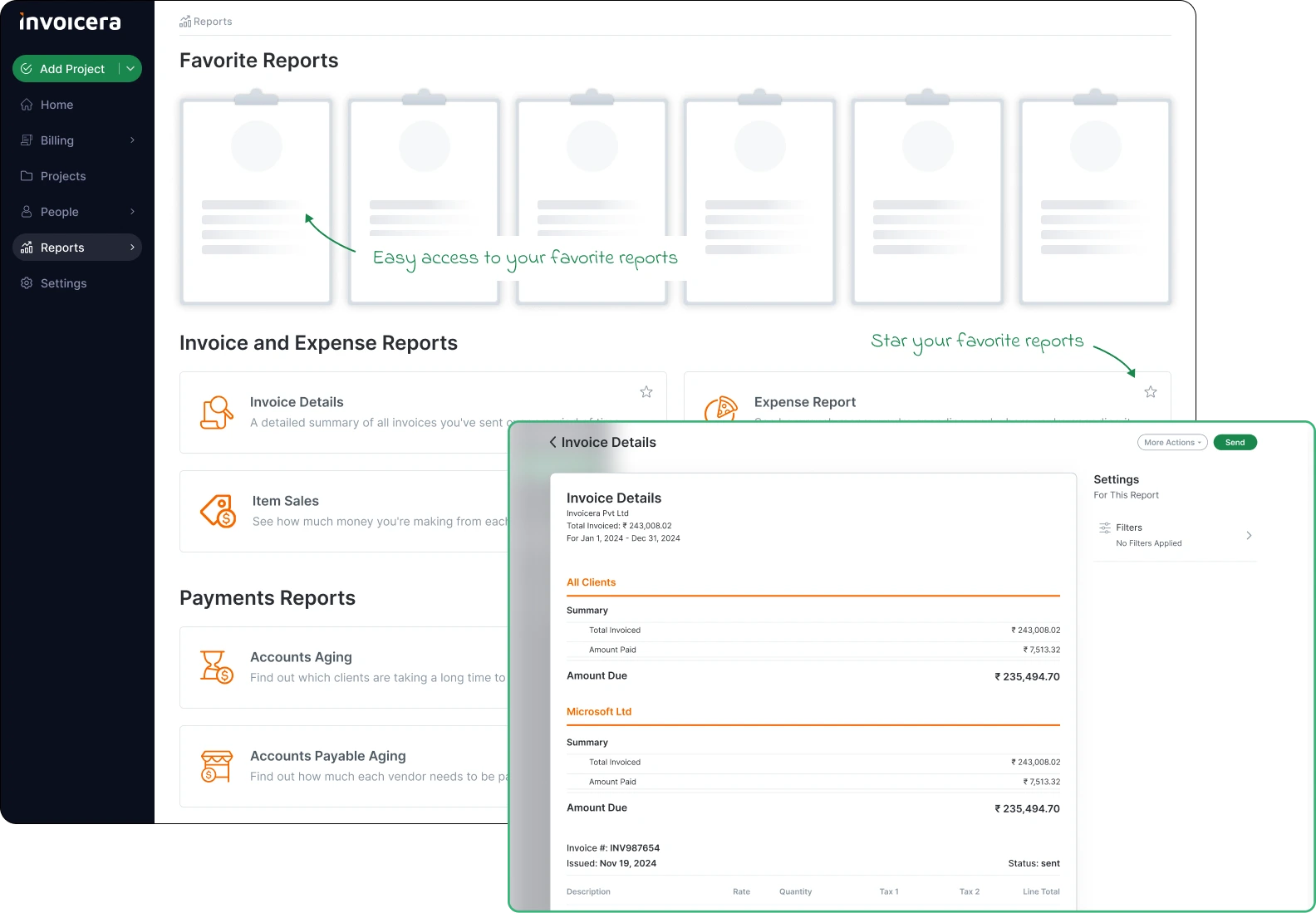

- Choose software that updates automatically and generates reports.

- Allow employees to record expenses via mobile apps.

- Set alerts for unusual spending patterns.

Establish a Clear Reimbursement Process

Tips

- Set a clear process for petty cash reimbursements, with deadlines and receipts.

Techniques

- Provide a written reimbursement process to employees.

- Use forms or platforms to track claims and approvals.

- Enforce deadlines to ensure timely reimbursements.

Following these practices ensures your petty cash management system is reliable, trackable, and efficient.

How Invoicera Helps In Petty Cash Management?

Dealing with petty cash may appear easy, but little expenses can be lost if not well managed.

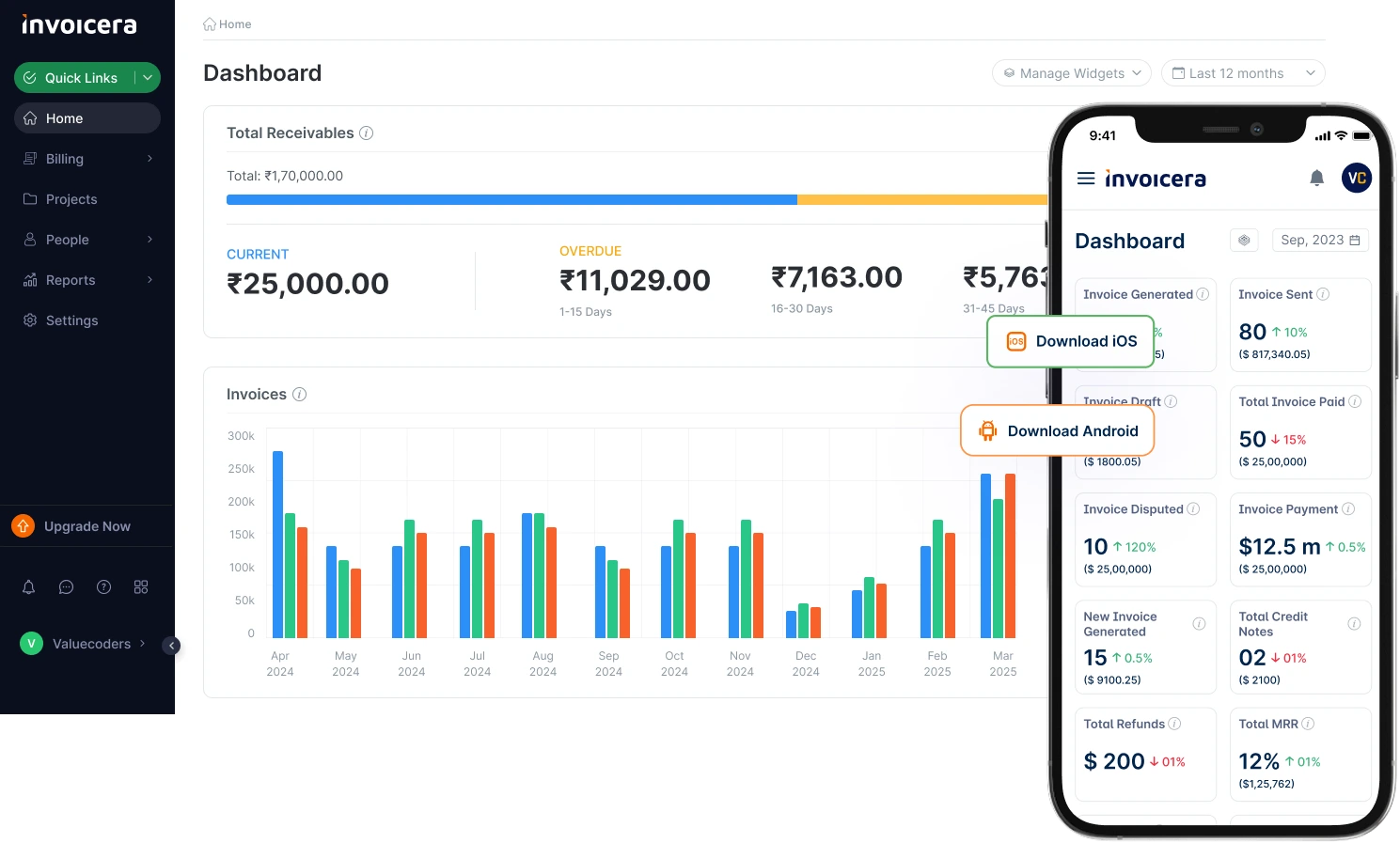

Invoicera is an all-in-one invoicing and expense management software that helps businesses monitor and streamline petty cash processes.

Beyond billing and attending to client communications, it offers powerful tools to monitor usage of petty cash and manage reimbursements, whilst keeping financial discipline without having to use spreadsheets in paper form.

Key Features

1. Real-Time Expense Logging: Instantly record petty cash expenses with details like amount, date, category, and notes.

2. Custom Expense Categories: Organize petty cash spending by categories such as office supplies, meals, travel, or repairs.

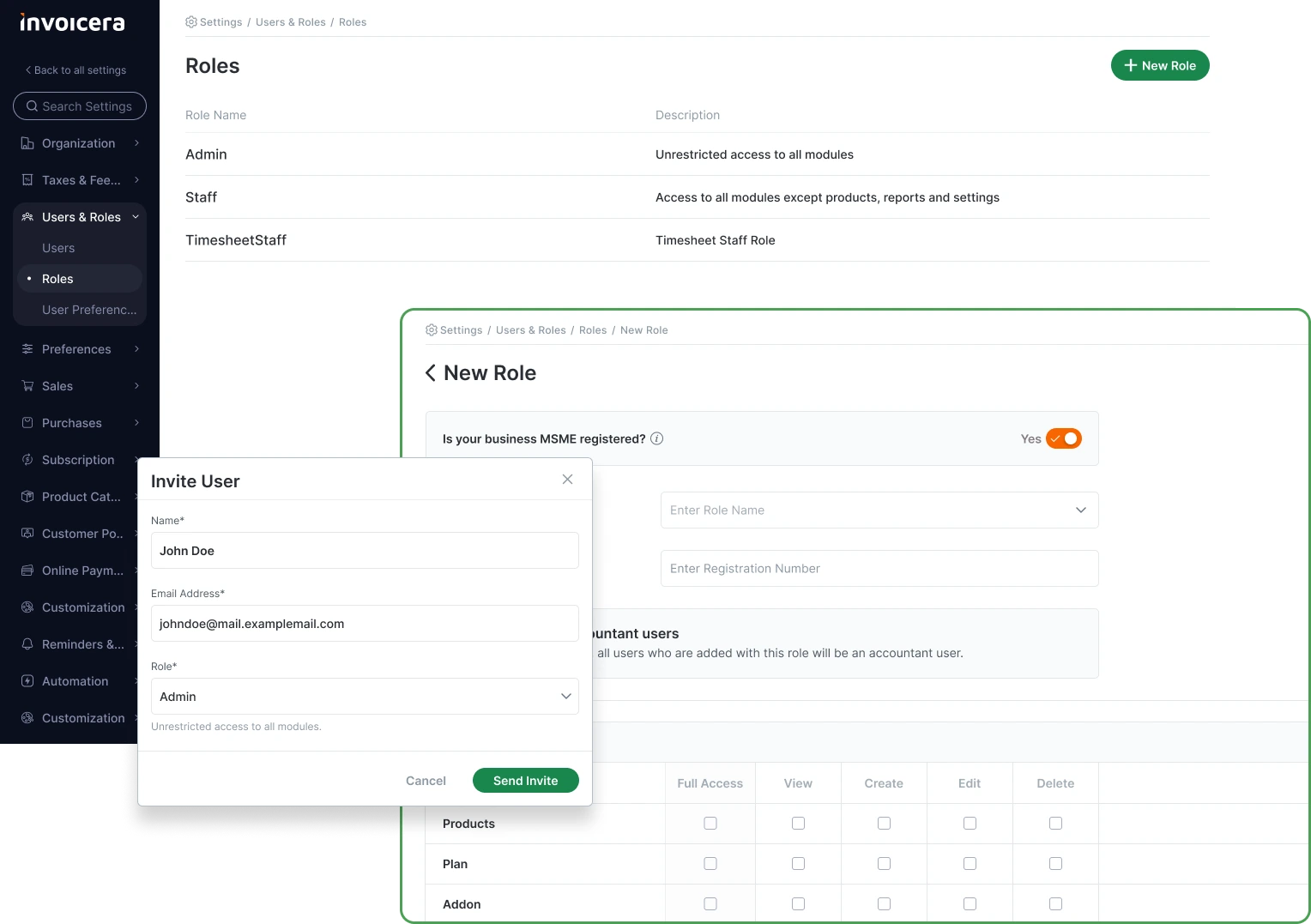

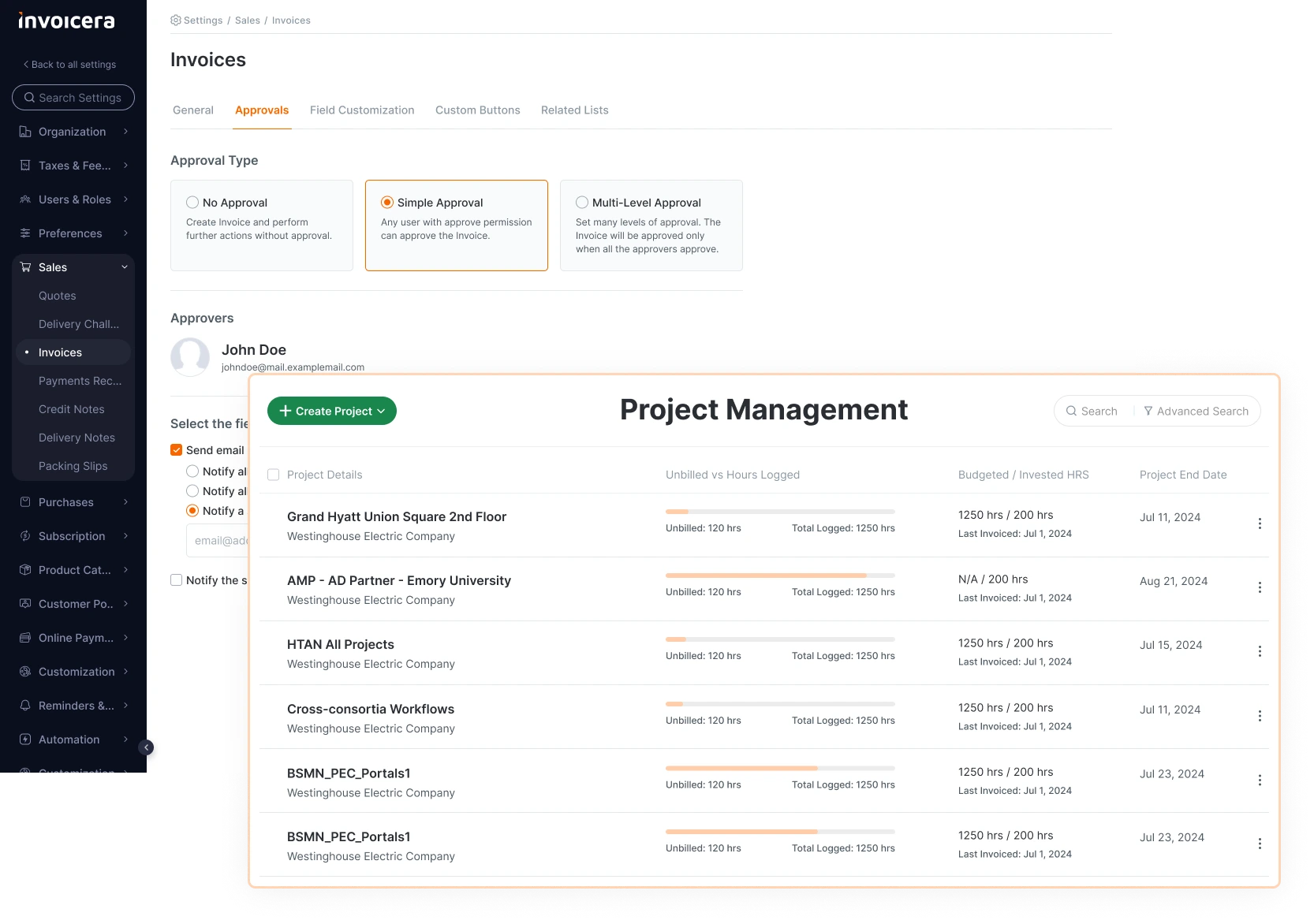

3. Role-Based Access Control: Only authorized personnel can view, add to, or manage petty cash entries.

4. Automated Financial Reports: Generate detailed, audit-ready reports on petty cash usage with just a few clicks.

5. Approval Workflow Management: Set approval rules for petty cash expenses to avoid misuse and ensure accountability.

6. Mobile-Friendly Access: Enable employees to log petty expenses and upload receipts directly from their smartphones.

Invoicera makes the petty cash management systematic and efficient; ensuring every rupee is accounted for, every cost is recorded and your team is kept focussed on the most important thing.

Going Digital: Smarter Alternatives to Petty Cash

Traditional petty cash systems can be a mess, full of errors, delays, and not having accountability. Financial practices of the businesses change with their evolution. Using digital solutions is a smarter, safer and time-efficient way to manage little day-to-day charges.

Why Go Digital?

- Better Transparency: All expenses are tracked in real time, with no temptation of misuse.

- Faster Approvals: Digital tools simplify expense submit and respond; no paperwork and delays.

- Accurate Reporting: Automated reports give a clear insight into spending patterns and aid budgeting and audit.

- Remote Access: Employees can log and manage expenses from anywhere—ideal for hybrid or remote teams.

- Simplified Reimbursements: Digital workflows reduce the back-and-forth and ensure quicker employee payouts.

Smart Digital Alternatives

- Expense Management Software: Tools like Invoicera offer real-time tracking, automated logs, and category tagging to simplify petty expense handling.

- Prepaid Expense Cards: Issue reloadable cards to employees with set spending limits and built-in controls.

- Mobile Wallets or UPI: Secure, traceable, and instant; these platforms are great for low-value transactions.

- Internal Reimbursement Platforms: Set up digital reimbursement systems where employees can submit receipts and get approvals without using physical cash.

A digital petty cash management system replaces confusion with clarity, control, and speed.

Closing Thoughts

Managing petty cash may seem minor, but poor handling causes financial leaks and trust issues. With proper policies and the right tools, you’ll prevent overspending and simplify reconciliations.

Even though traditional methods still exist, using a digital finance management software like Invoicera is the smarter route. It simplifies your petty cash management process, keeps records audit-ready, and ensures complete visibility.

A well-managed petty cash management system saves time, improves accountability, and helps you scale with confidence, without the mess.

FAQs

Ques: What is petty cash used for?

Ans: Petty cash refers to everyday expenditures made in the business, such as office supplies, local travel, and minor repairs, that do not necessitate a formal purchase order or reimbursement.

Ques: Who should manage petty cash?

Ans: There should be an appointed petty cash custodian, who has character and organizational skills; to manage the fund in order to be accountable and for efficient record keeping.

Ques: How often should petty cash be reconciled?

Ans: Reconciliation must be carried out regularly; weekly of monthly so as to make sure the physical cash tallies with the transaction log and receipts.

Ques: What are the common mistakes in petty cash management?

Ans: Common problems that cause errors or misuse include a lack of documentation, confusion of policies, unauthorized access, and late reconciliations.

Ques: Can petty cash be tracked digitally?

Ans: Yes, tools such as Invoicera can digitally record, track, and categorize these petty cash expenses in real time, increasing transparency and control.