Are you curious how those confusing numbers on food bills relate to taxes?

Understanding VAT (Value Added Tax) for food can be like cracking a secret code in the food world – it’s puzzling for most people, including those in the food business.

Nowadays, VAT has a significant impact, affecting menu prices and how much profit is made.

Did you know that VAT rates for food can be different from one country to another?

For example, in the UK, some foods have no VAT while others have a 20% tax. This tax maze often leaves both customers and food businesses confused.

Confusion about VAT results in misunderstandings and money problems for restaurants, cafes, and food stores.

So,

- What is VAT on food?

- How does VAT on food really affect food businesses?

- What are the problems startups face?

- Is there a way to make this tax stuff simpler?

This blog post lists all the details about VAT on food, including how it can affect a business and how it can be beneficial.

Remember, figuring out VAT for food isn’t just about understanding rules; it’s about making money and running businesses better in the exciting food world of startups.

VAT On Restaurant Food

So, you might be thinking is there vat on restaurant food! Let’s answer this to you.

Value Added Tax (VAT) is a significant aspect of the food industry that often leads to confusion and questions among consumers and businesses.

Understanding how VAT applies to different types of food can be crucial for everyone involved.

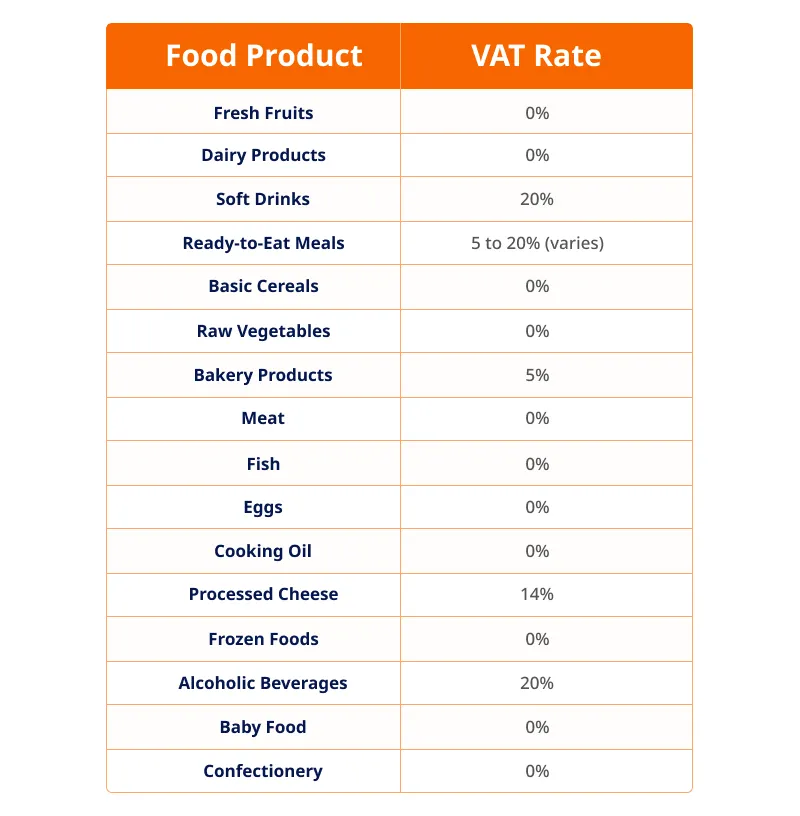

VAT Rates For Various Food Items

The VAT rates for food items can differ based on their types. Generally, most basic food items like raw vegetables, fruits, meat, fish, bread, and cereals have a zero VAT rate.

However, the scenario changes when these items undergo processing or preparation.

For instance:

- Restaurant And Takeaways: When food is prepared and served in restaurants or takeaways, it’s subject to the standard rate of VAT, which can vary by country but is typically higher than the zero rate.

- Drinks: Non-alcoholic drinks like tea, coffee, and certain beverages might have a different VAT rate than food items. Alcoholic drinks usually attract higher VAT rates or additional taxes due to their nature.

Exemptions To Certain Food Products

Some food items are exempt from VAT, regardless of whether they’re raw or prepared. This often includes items considered essential for daily sustenance, such as certain bakery products, some forms of milk, and specific dietary staples.

The reason for exemptions usually aligns with government policies aiming to make basic food items more affordable for everyone.

VAT on Prepared Food vs. Raw Ingredients

The distinction between VAT on prepared food and raw ingredients lies in the level of processing or preparation the food undergoes before reaching the consumer.

- Raw Ingredients: Items in their unprocessed or minimally processed state typically attract zero or reduced VAT rates as they’re considered essential for meal preparation and are usually seen as necessities.

- Prepared Food: Any form of cooking, mixing, or significant alteration to the original raw ingredients often means the food will incur the standard VAT rate. This includes ready-to-eat meals, packaged foods, and meals served at restaurants or takeaways.

Understanding these nuances helps consumers make informed choices and assists businesses in adhering to VAT regulations in the food industry.

It’s always beneficial to stay updated with local tax laws and consult financial experts to ensure compliance with VAT regulations specific to your area.

VAT Rates For Different Products

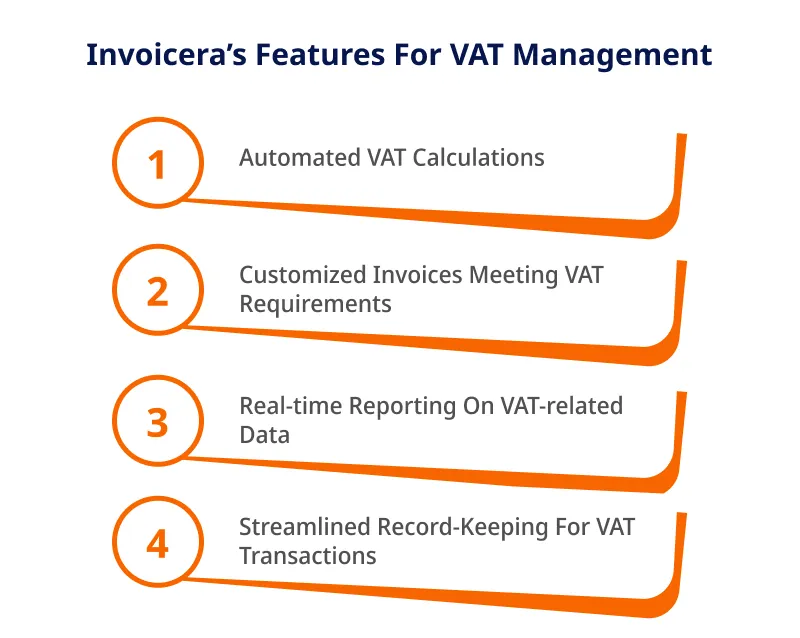

Simplifying VAT Management With Invoicera

Invoicera is a robust platform designed to simplify the complex world of VAT management, especially within the food industry.

Thanks to its intuitive interface and robust features, it’s a must-have tool for food businesses facing VAT challenges.

- Automated VAT Calculations: Invoicera eliminates the hassle of crunching numbers by automating VAT calculations. This feature ensures accurate computations without the headache of manual errors. It saves time and guarantees precision in every transaction. Just add the VAT rates the first time, and Invoicera will calculate and add the rates for other invoices automatically.

- Customized Invoices Meeting VAT Requirements: Tailoring invoices to meet specific VAT requirements is crucial in the food industry. Invoicera allows for personalized invoices that comply with VAT regulations, making the process seamless and ensuring that your business stays on the right side of the law.

- Real-time Reporting On VAT-related Data: Instant access to VAT-related data is essential for informed decision-making. Invoicera provides real-time reporting, offering a comprehensive view of your VAT transactions. You can track, analyze, and strategize effectively.

- Streamlined Record-Keeping For VAT Transactions: Keeping meticulous records is fundamental when dealing with VAT. Invoicera simplifies record-keeping by organizing VAT transactions systematically. It ensures that records are up-to-date and easily accessible, aiding in audits and compliance.

Invoicera stands out as an ally in the food industry’s VAT challenges, empowering businesses to navigate the complexities of VAT management efficiently.

Its features streamline processes and ensure adherence to regulations, allowing food businesses to focus on growth and customer satisfaction.

Challenges In VAT Management

VAT (Value Added Tax) in the food industry is a crucial yet complex aspect that demands careful attention and understanding.

It’s not just about the delicious cuisines or the fresh produce on our plates; there’s a layer of taxation intricacies that businesses in this industry grapple with daily.

Complexities In VAT Calculations For Food Items

Picture this: A bakery selling bread.

Seems simple, right? But when it comes to VAT, things get challenging. Different items might have varying VAT rates or exemptions.

Take a freshly baked croissant – is it considered a basic bread item, subject to a lower VAT rate, or is it categorized as a luxury pastry with a higher VAT tag?

These nuances in classification are often complex. Calculating VAT for food items requires a keen eye for detail, a good understanding of tax regulations, and, sometimes, a touch of creative interpretation.

Compliance Issues And Regulatory Changes

Keeping up with VAT compliance in the food industry is akin to a chef creating a new recipe every time tax regulations shift.

Imagine a new law stating that certain food additives now fall under a different VAT category.

Businesses must swiftly adapt their pricing structures, update their systems, and comply with the updated rules. It’s a deal with legislation, where missteps can lead to penalties or reputation damage.

Navigating through these regulatory changes demands constant vigilance and proactive measures.

Staying informed, perhaps even partnering with tax experts, becomes vital for businesses to avoid falling into the VAT compliance pothole.

Record-Keeping Challenges Specific To VAT

Now, let’s talk paperwork. Imagine a bustling restaurant where hundreds of food transactions happen daily. Each receipt, each ingredient purchase, each sale – all need to be meticulously recorded for VAT purposes.

But what if there’s a spill in the kitchen, and some records get lost or mixed up?

Maintaining accurate records amidst the chaos of a busy kitchen or a packed dining hall can be a chef’s nightmare.

Yet, precise record-keeping is the backbone of VAT compliance in the food industry.

Specialized accounting software like Invoicera or digital tools can be saviors, easing the burden of maintaining comprehensive records.

Benefits Of Using Invoicera For VAT Management

That’s where Invoicera steps in, offering a lifeline of efficiency, accuracy, and adaptability that can make VAT management a breeze for food businesses.

Efficiency In VAT Calculations And Compliance

Invoicera takes the hassle out of VAT calculations. Its streamlined system automates VAT calculations, reducing the chances of errors and ensuring compliance with the ever-evolving VAT regulations.

With its user-friendly interface, even complex VAT calculations become straightforward, letting you focus on your core business without the headache of manual computations.

Cost-Effectiveness And Time-Saving Aspects

Time is money, especially in the fast-paced food industry. Invoicera’s VAT management solution saves both.

By automating repetitive tasks, Invoicera frees up valuable time for your team to concentrate on creating delectable dishes and growing your business.

Plus, the cost-effectiveness of Invoicera means that you invest in a tool that pays for itself through the efficiency it brings to your VAT processes.

Improved Accuracy In VAT-Related Documentation

Keeping accurate records is crucial in VAT management. Invoicera’s robust system ensures that your VAT-related documentation is precise and up-to-date.

From invoices to receipts, everything is meticulously organized and easily accessible, saving you from the headache of sifting through piles of paperwork during tax time.

Enhanced Ability To Adapt To Changing VAT Regulations

VAT regulations change frequently, and keeping up can be challenging.

Invoicera stays ahead of the curve, continuously updating its system to reflect the latest VAT regulations.

This adaptability means you can confidently navigate through changes without missing a beat, ensuring your business stays compliant.

Invoicera’s efficiency, cost-effectiveness, accuracy, and adaptability are tailored to meet the specific needs of businesses dealing with food products, making it a standout choice for VAT management solutions.

Say goodbye to VAT headaches and hello to streamlined processes with Invoicera by your side!

Tips For Effective VAT Management

1. Categorizing Food Right

Getting your food items in the right tax basket is crucial. Different VAT rates apply to different food products.

Don’t let a simple mistake in categorization lead to overpaying or underpaying VAT.

2. Keeping Systems Updated

Stay ahead by ensuring your systems and software are in sync with the latest VAT rules.

Regulation changes happen, and updating tools will save you from headaches later.

3. Educating Your Team

Equip your staff with VAT knowledge specific to the food industry.

A well-informed team can help prevent errors and ensure compliance, making the VAT process smoother.

4. Seeking Expert Guidance

For intricate VAT matters, seeking professional help is a smart move. Sometimes, the complexity of VAT in the food sector might need an expert’s eye to navigate effectively.

Don’t hesitate to bring in specialized support when needed.

Key Takeaways

VAT on food varies across different regions and countries, impacting how food-related businesses operate and price their products. It’s important to grasp the basics:

- VAT is a tax imposed on goods & services at every production and distribution step.

- In many countries, basic food items like fruits, vegetables, and some unprocessed goods may be exempt or subject to reduced VAT rates. However, processed or luxury food items often face higher VAT rates.

- The application of VAT on food can be intricate. Different jurisdictions have varying regulations, exemptions, and rates for different types of food products.

- Food businesses must understand VAT to price their products competitively, manage cash flows and comply with tax laws. If you fail to do so, it can result in financial penalties or legal issues.

- Seeking guidance from tax experts or accountants familiar with food industry taxation can aid businesses in navigating the complexities of VAT on food.

FAQs

Is food exempt from VAT?

In many regions, basic food items like fresh fruits, vegetables, certain dairy products, bread, and grains are often exempt or subjected to reduced VAT rates.

Are there instances where VAT rates on food vary within the same country?

Yes, VAT rates on food can vary based on the item’s processing level. Processed or luxury items might face higher VAT rates than basic, unprocessed foods.

Are there resources available for businesses to understand VAT on food better?

Yes, governmental tax departments, industry publications, and professional accounting services often provide resources and guidance on VAT regulations specific to the food industry.

Is there a VAT on bread?

In the United States, basic groceries such as bread are typically exempt from sales tax, including VAT (Value Added Tax). However, it’s essential to note that tax laws can vary by state, and some states may impose sales tax on certain food items, depending on their classification and other factors. Generally, though, bread is not subject to VAT in the US.