Whether we’re purchasing groceries, paying for subscriptions, or buying tickets, online payments have simplified how we handle our finances. But behind each digital transaction lies a robust mechanism called the payment gateway.

Serving as a bridge between customers, businesses, and banks, online payment gateways ensure the security and efficiency of every transaction. Platforms like PayPal, Stripe, and Square are some of the popular examples that simplify e-commerce payments. But how exactly do these systems work?

In this article, we’ll explore the ins and outs of online payment gateways: what they are, how they operate, their essential components, and how businesses can choose the best payment gateway for their needs.

What is an Online Payment Gateway?

An online payment gateway is a technology that securely authorizes payments between buyers and sellers in e-commerce transactions. It ensures that the transaction is safe, quick, and successful by verifying the payment details.

Unlike a payment processor, which simply handles the financial data, the gateway acts as a security shield for transferring sensitive information between the buyer, merchant, and bank.

In simple terms, it’s the “middleman” of online transactions, allowing businesses to accept various payment methods such as credit cards, debit cards, digital wallets, and even bank transfers.

Payment gateways provide robust security measures that protect customer data and enhance trust between businesses and buyers, ensuring that sensitive information remains secure throughout the payment process.

Key Components of a Payment Gateway System

Payment gateways consist of multiple components, each responsible for specific functions that ensure seamless transactions. Here’s a breakdown:

1. User Interface (UI)

The user-facing section of a payment gateway where customers enter their payment information.

2. Security Protocols

Payment gateways implement protocols like SSL (Secure Socket Layer) encryption, ensuring data privacy and PCI (Payment Card Industry) compliance for secure processing.

3. Integration with Merchant Accounts

A payment gateway is linked to the merchant account, which is necessary for processing transactions and receiving funds into the business’s bank account.

4. Transaction Processing

The steps taken to complete a transaction, from initial request to final settlement. Each stage is managed by different parties involved in the transaction, including the bank, the merchant’s account, and the payment network.

Together, these components form the backbone of an online payment gateway, enabling smooth transactions.

Step-by-Step Process of Online Payment Gateway Transactions

To better understand how online payment gateways work, let’s walk through the typical stages of an online payment transaction:

1. Customer Initiates Payment

The process begins when a customer decides to make a purchase on a website and clicks the “Pay Now” button.

2. Payment Information is Collected and Encrypted

Customers enter their payment details, such as card number, expiration date, and CVV, on the gateway’s UI. These details are then encrypted to ensure they cannot be intercepted.

3. Data Sent to Payment Processor

The payment gateway securely transfers the encrypted data to the payment processor, which forwards the request to the customer’s issuing bank.

4. Authorization Request and Bank Verification

The issuing bank verifies the details and checks for sufficient funds. If approved, an authorization code is sent back to the payment gateway to confirm the transaction.

5. Transaction Completion and Confirmation

Once authorized, the payment gateway relays this confirmation to both the customer and the merchant. Funds are then transferred from the customer’s bank to the merchant’s account, completing the transaction.

6. Confirmation to Customer

The customer receives a confirmation message that the payment has been successful, completing the entire process in seconds.

Types of Payment Gateways

Payment gateways are categorized into three types based on how they handle the transaction process:

1. Hosted Payment Gateways

These gateways redirect the customer to an external payment page, like PayPal or Stripe, where the payment is processed securely. Hosted gateways are popular for small businesses as they handle security and compliance requirements, making them easier to integrate.

2. Self-Hosted Payment Gateways

In this model, customers enter their payment details on the merchant’s website, which then forwards the data to the gateway provider. It offers a more integrated experience but requires higher security compliance.

3. API/Non-Hosted Payment Gateways

These gateways allow businesses to directly integrate with the payment gateway through APIs, offering complete control over the user experience. Although complex to set up, it provides maximum flexibility and is favored by larger enterprises.

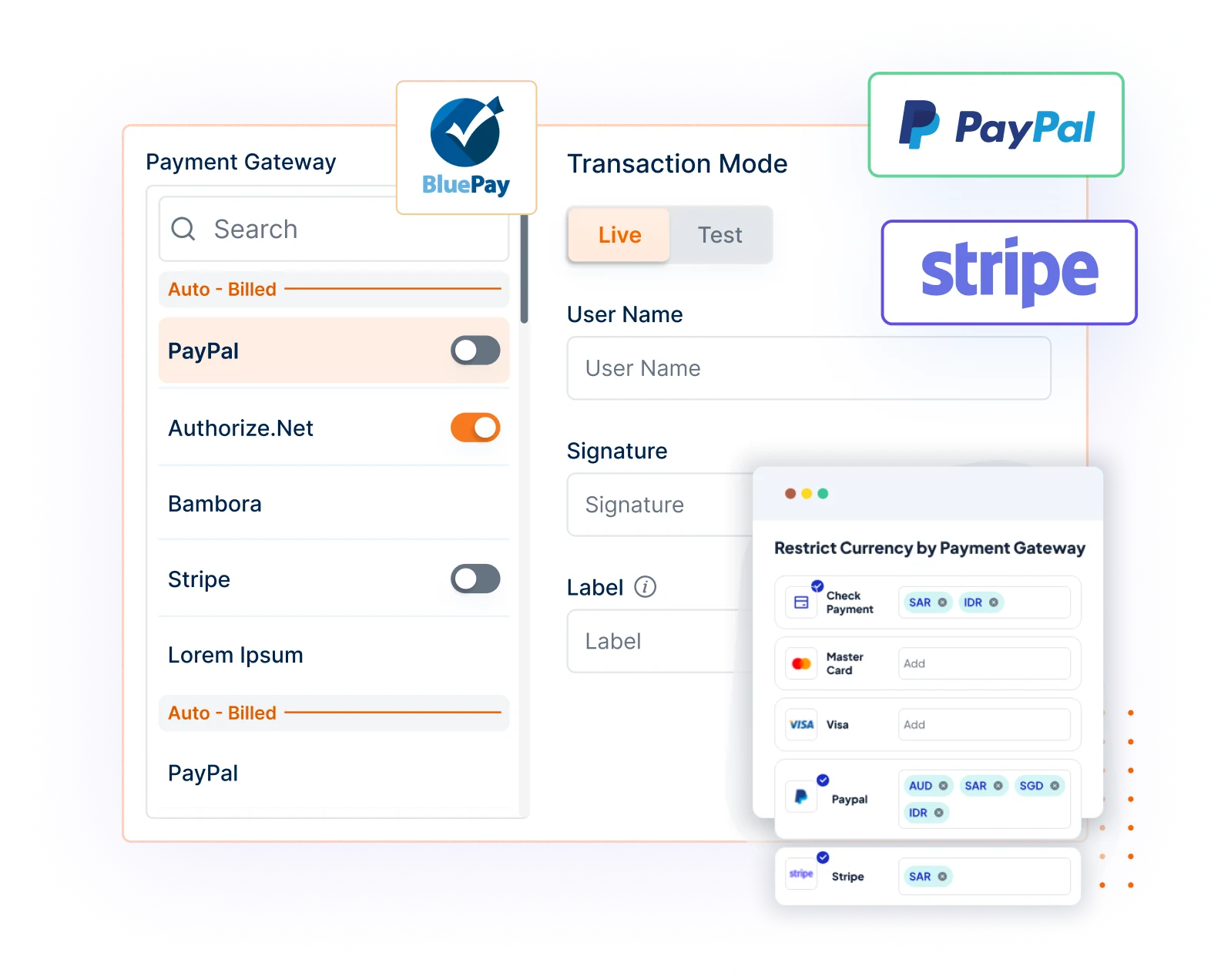

Invoicera’s Diverse Payment Gateway Integration

Invoicera streamlines business payments by integrating with 14+ leading payment gateways, including PayPal, Stripe, Authorize.Net, 2Checkout, and WorldPay.

This comprehensive payment ecosystem enables businesses to cater to diverse customer preferences while maintaining robust security through PCI-DSS compliance. The platform excels in handling multiple currencies and cross-border transactions, making it ideal for international operations.

By offering flexible payment options and automated reconciliation, Invoicera helps businesses optimize their payment collection process while reducing transaction complexities and ensuring secure financial operations.

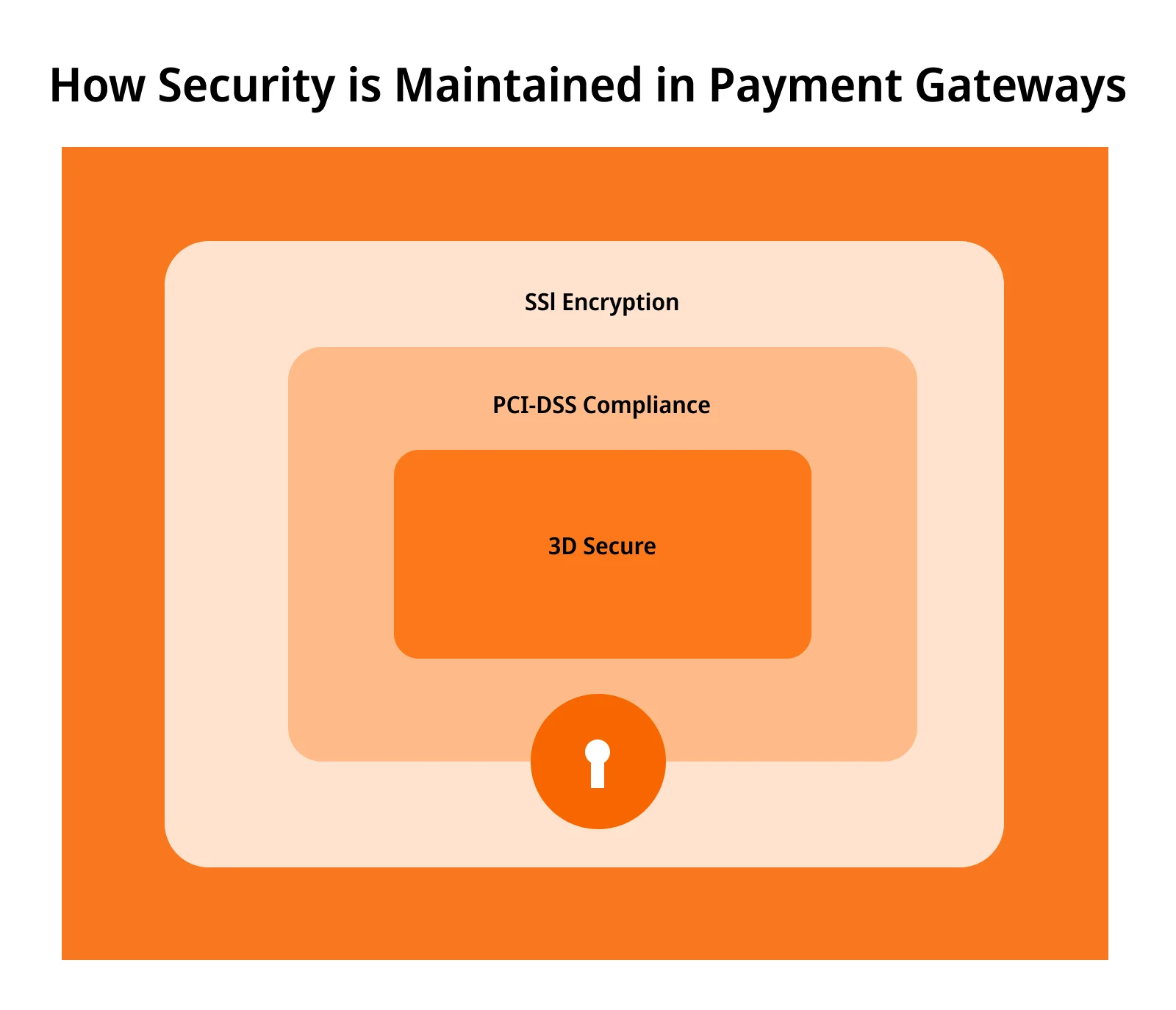

Security is the cornerstone of any payment gateway. To protect against fraud and unauthorized access, payment gateways employ several key security measures:

1. PCI-DSS Compliance

Payment gateways must adhere to the Payment Card Industry Data Security Standard (PCI-DSS), which ensures that customer data is handled securely and protects against breaches.

2. 3D Secure Authentication

This additional layer of authentication, known as 3D Secure, requires customers to verify their identity with a password or OTP, adding extra security.

3. Encryption and Tokenization

Payment gateways use SSL encryption to protect data during transfer. Additionally, tokenization replaces sensitive data with unique tokens, ensuring that even if data is intercepted, it cannot be used maliciously.

4. Fraud Detection and Prevention

Incorporate algorithms to identify suspicious transactions and prevent fraud. For example, many systems use machine learning to analyze patterns and detect irregularities.

5. SSL Certification

By using SSL certification, payment gateways ensure that all information transferred is encrypted, safeguarding data from unauthorized access.

Common Challenges and Solutions in Using Payment Gateways

While payment gateways streamline online transactions, businesses can encounter challenges such as transaction failures, fraud risks, and integration difficulties:

Transaction Failures

Technical errors can disrupt transactions, leading to lost sales. To prevent this, businesses should work with providers who offer high uptime and reliable support.

Fraud Risks

Fraudulent transactions pose a threat to businesses. Using gateways with strong fraud detection systems minimizes this risk.

Integration Issues

Integrating a payment gateway can be complex, particularly for self-hosted solutions. Many providers offer developer support, API documentation, and plugins to simplify the integration process.

Benefits of Using Online Payment Gateways

Opting for an online payment gateway offers multiple advantages for businesses and customers alike:

Faster Transaction Processing

Payment gateways automate and expedite the transaction process, making payments fast and easy.

Enhanced Security

With advanced encryption and fraud detection systems, payment gateways provide a secure platform for online payments.

Global Reach and Multi-Currency Support

Gateways allow businesses to cater to international customers by accepting multiple currencies.

Improved Customer Experience

Providing a variety of secure payment options fosters trust, increasing customer satisfaction and conversion rates.

Choosing the Right Payment Gateway for Your Business

Selecting the right payment gateway is crucial for a smooth customer experience and operational efficiency. Here are factors to consider:

1. Business Size and Transaction Volume

Choose a gateway that aligns with your business’s transaction volume. Smaller businesses might benefit from hosted gateways, while larger businesses may need API integrations for higher volumes.

2. Security Features

Ensure the gateway complies with PCI-DSS standards and offers additional security features like encryption, tokenization, and 3D Secure.

3. Integration and Support

Look for providers with easy-to-integrate APIs, plugins, and responsive support.

4. Fees and Pricing Models

Each gateway has unique fee structures, including transaction fees, monthly fees, and chargeback fees. Compare costs and choose a gateway that offers the best balance of price and features.

5. Customer Experience

The gateway should provide a seamless and trustworthy user experience with minimal transaction disruptions.

Creating a comparison checklist can help businesses evaluate their options, considering their specific needs and customer preferences.

Conclusion

In today’s digital world, online payment gateways are the lifeblood of e-commerce transactions. By securely processing payments, they enable businesses to thrive in a competitive marketplace while ensuring a safe and convenient shopping experience for customers.

Understanding how these gateways work helps businesses make informed decisions, ensuring they choose the best gateway tailored to their specific needs.

Embracing the right payment gateway solution can foster customer loyalty, enhance security, and expand global reach—ultimately boosting business growth.

FAQs

Ques. What are the typical processing times for different payment methods through a payment gateway?

Ans. Processing times vary by payment method. Credit/debit card transactions typically process within 1-3 business days, while bank transfers may take 2-5 business days. Digital wallet payments are often processed instantly. However, actual settlement times can vary depending on your bank and the payment gateway provider.

Ques. Are there transaction limits when using payment gateways?

Ans. Most payment gateways have both minimum and maximum transaction limits. These limits can vary based on factors like your business type, transaction history, and chosen payment gateway provider. It’s recommended to discuss specific limits with your provider during setup.

Ques. What happens if a customer disputes a transaction?

Ans. Payment gateways typically have built-in dispute resolution processes. When a customer initiates a dispute, you’ll be notified and given time to provide evidence supporting the transaction. The gateway usually provides a dedicated dashboard to manage and respond to disputes, though resolution times can vary from a few days to several weeks.