Managing your expenses can be a nightmare, whether you need to wrap up expenses in the office, travel expenses, treat lunch with clients, or subscribe to some software. Unless you continue to use notebooks or spreadsheets, there is a good chance that you are missing some of the finer points of business (and possibly money too).

The good news? You don’t need to spend a rupee to get your expenses under control.

We’ve picked 7 of the best free expense tracking tools that help you:

- Record daily expenses quickly

- Save receipts without paper piles

- Sort spending by project or category

- See clear reports without doing the math

As a freelancer, small business, or someone simply aiming at better management of finances, these expense tracking software solutions will help you to track money easily and without any stress.

Let’s take a look.

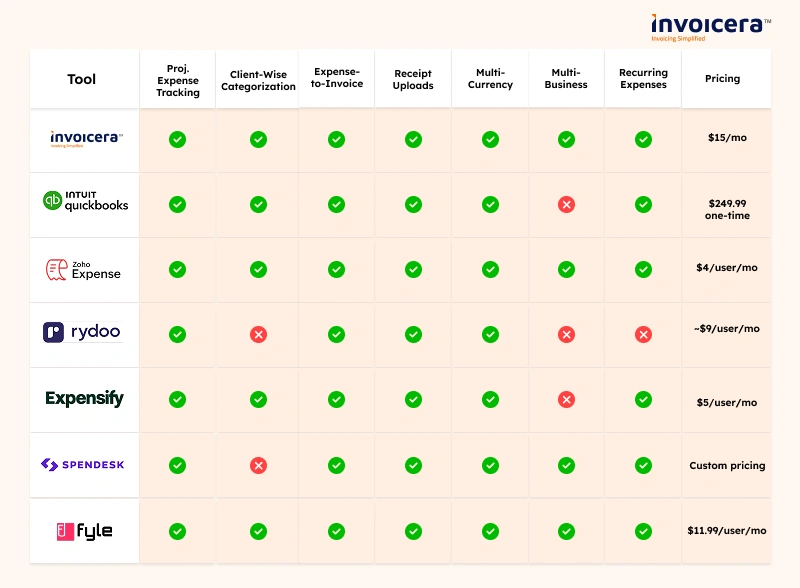

Comparison Table

List of 7 Free Expense Tracking Software

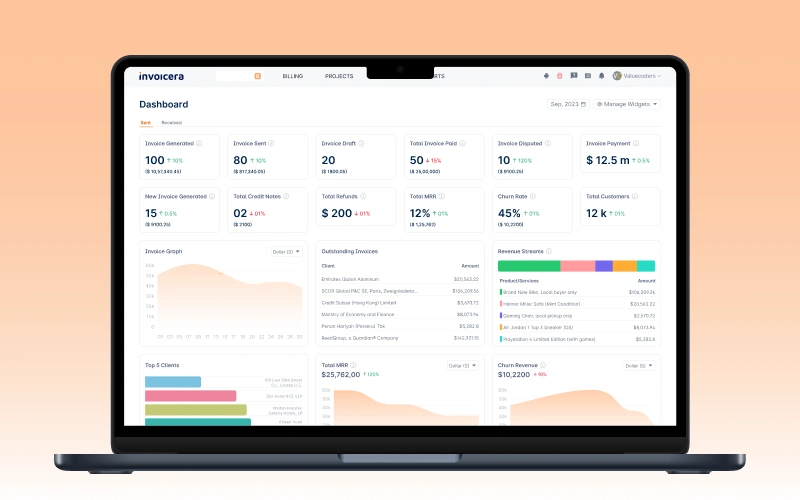

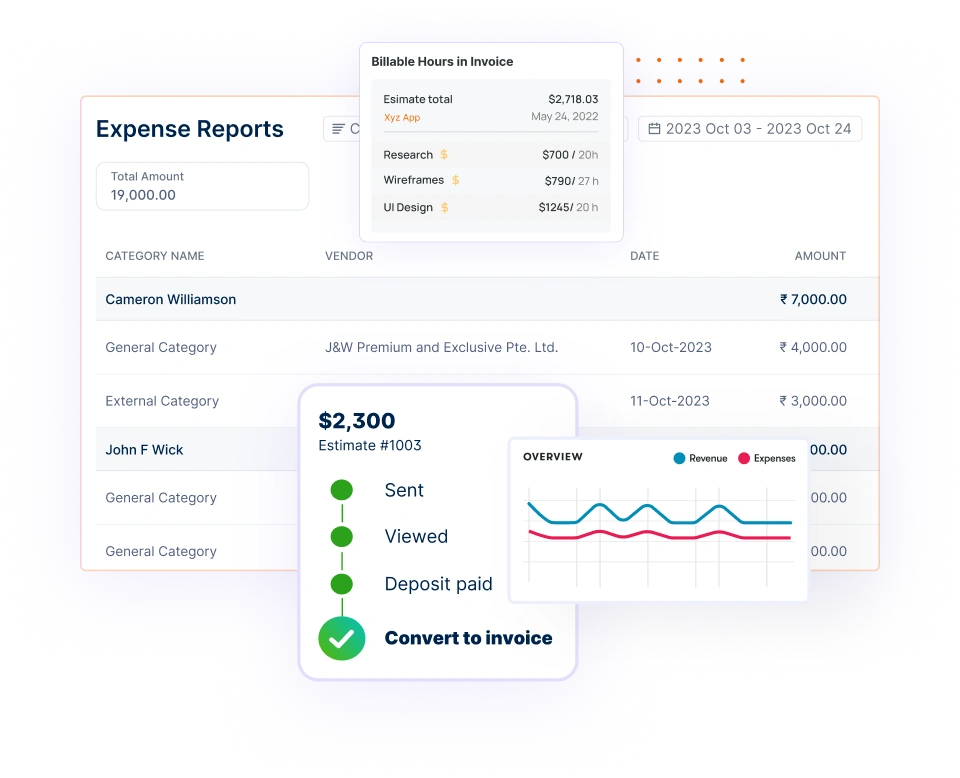

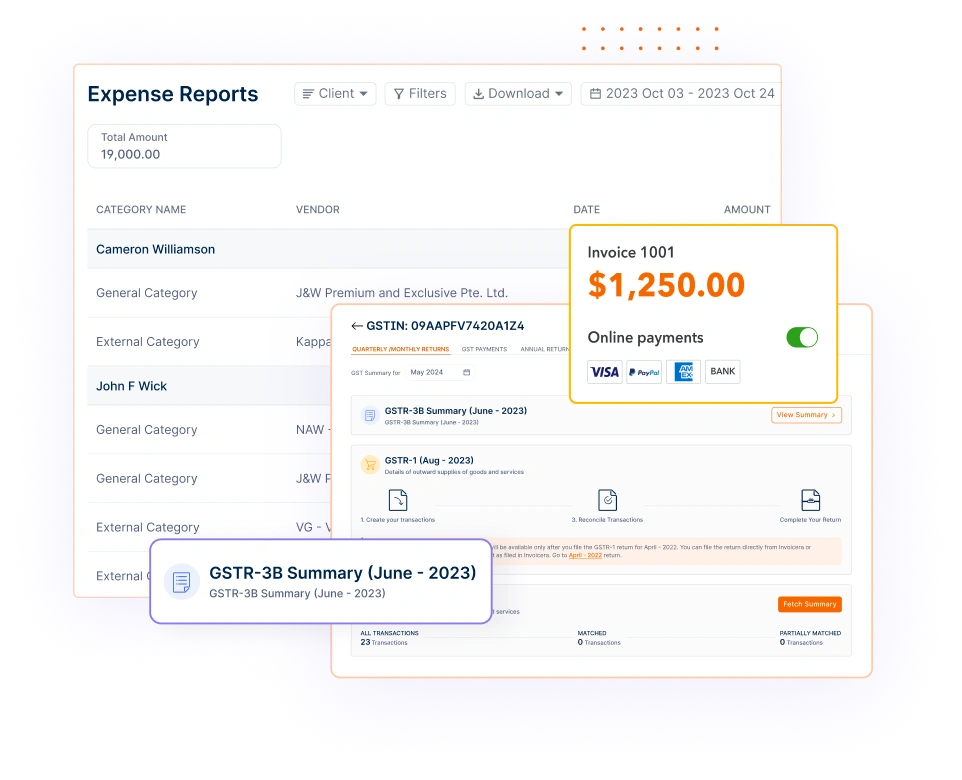

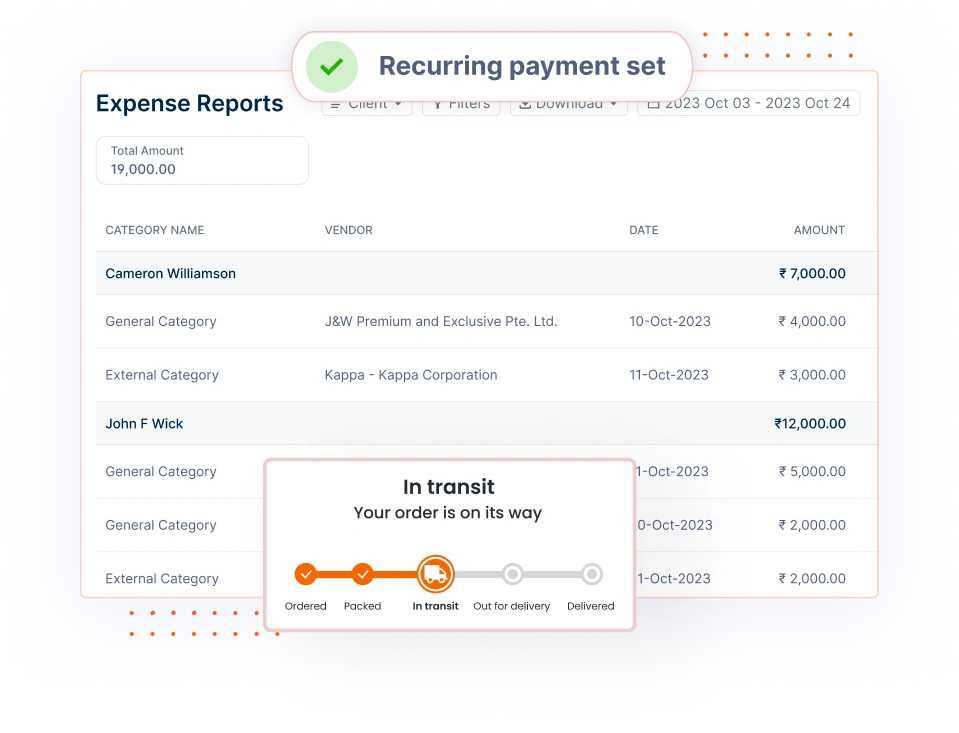

1. Invoicera: Master Your Vendor and Client Expenses

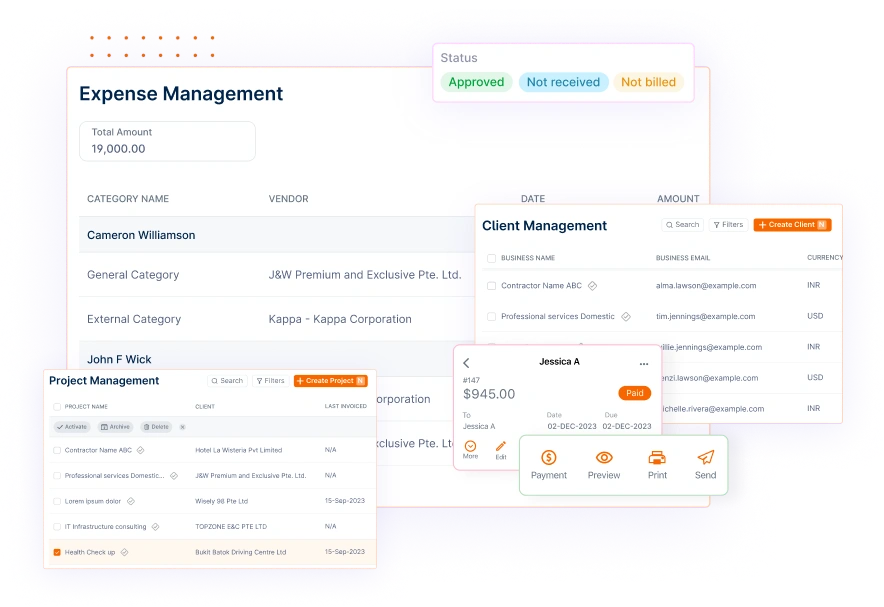

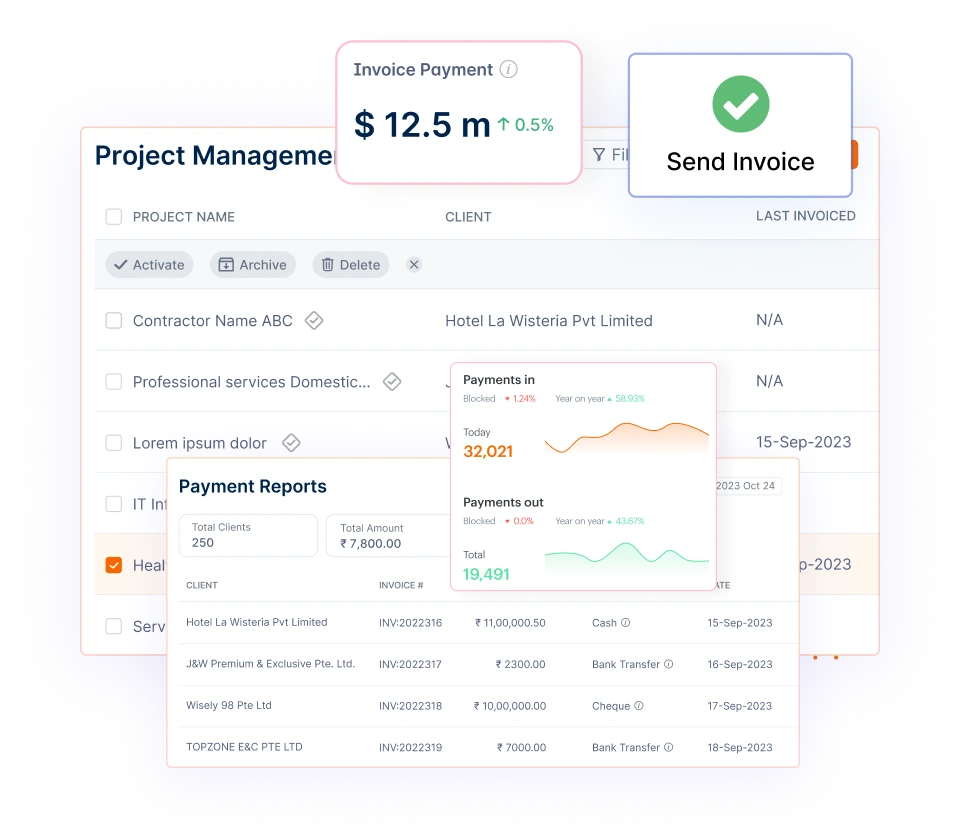

Invoicera is an all-purpose invoicing and expense tracking tool available to any size of the business. Using Invoicera, it becomes convenient to overview, tag, and manage business expenses and combine them with client invoices and financial statements; Invoicera has an intuitive dashboard and automated workflows.

Key Features:

Detailed Expense Management

- Track and manage expenses based on project or specific client in real time.

Smart Categorization

- Automatically categorize expenses for easier budgeting and reporting.

Expense-to-Invoice Conversion

- Convert approved expenses into billable invoices with one click.

Receipt Attachment & Storage

- Upload and attach receipts or supporting documents to each expense entry.

Global Expense Tracking

- Supports multi-currency and multi-business setups for international operations.

Automated Workflows

- Set custom approval processes and automate recurring expense entries.

Pricing:

Free trial available; pricing plans starts at $15/month.

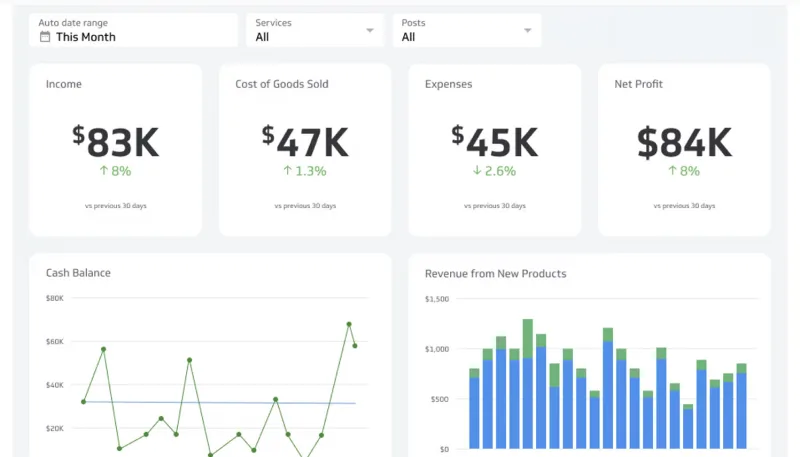

2. QuickBooks: Your Small Business Financial Companion

QuickBooks serves as your business finance solution made exclusively to manage small businesses and independent freelancer operations.

Features

- Link financial accounts for automated tracking

- Capture receipts efficiently with the mobile app

- Categorize expenses automatically for tax filing

- Monitor cash flow with detailed reports

- Generate reports and share them with accountants

- Set custom rules for expense categorization

- Track sales tax automatically for compliance

- Access profit and loss reports anytime

Pricing

- First 3 months: $9.50/month, then $19/month

- Advanced Plan: $38/month for 3 months, then $76/month

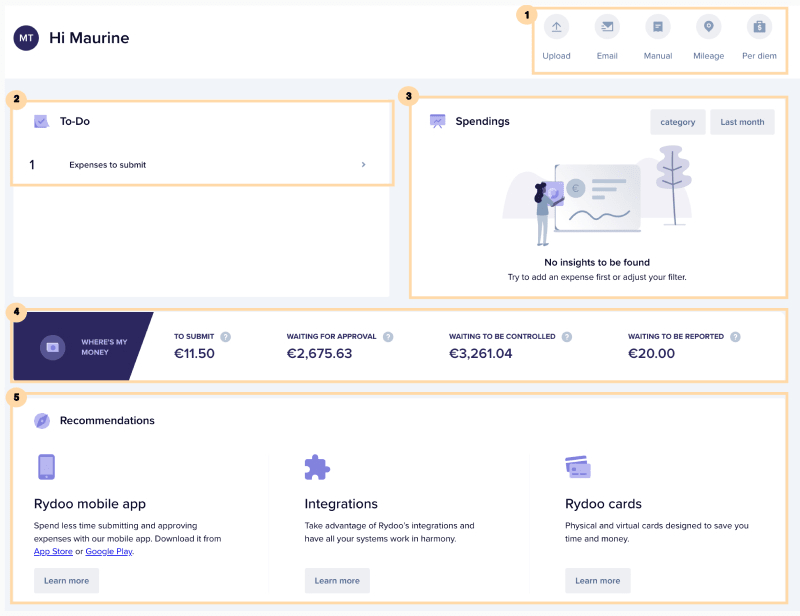

3. Zoho Expense: Your Complete Corporate Expense Solution

Transform your corporate expense management into an easy process with Zoho Expense, the intelligent, automated expense tracking software and expense management software to streamline the expense tracking job.

Features

- AI scans receipts for easy management

- Set approval flows for faster processing

- Ensure compliance with built-in policy controls

- Analyze spending with 20+ analytical reports

- Reimburse employees quickly via a paperless system

- Enforce policies automatically for compliance

- Track departmental spending and optimize budgets

- Manage expenses anywhere with real-time updates

Pricing

- Free plan for small teams

- Standard Plan: $4/user monthly

- Premium Plan: $7/user monthly

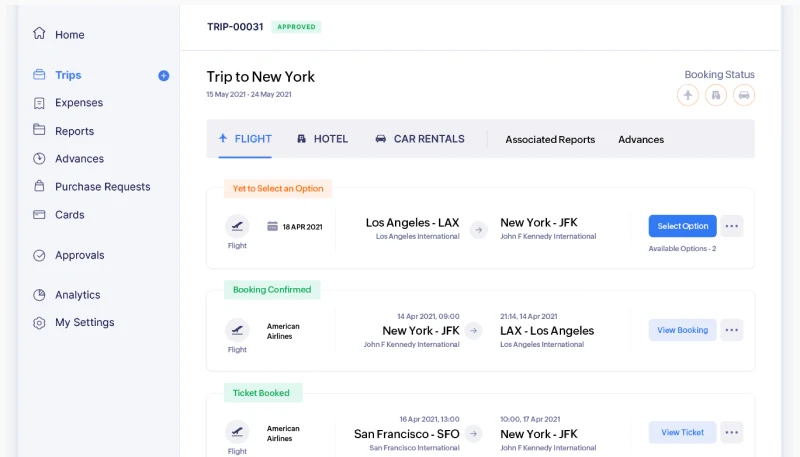

4. Rydoo: Revolutionize Your Business Travel Expenses

To properly manage travel expenses in your business, you need an expense tracking software that reduces your workload. Rydoo enables powerful automation tools in your expense management to provide an effortless user experience.

Features

- Capture receipts and sync expenses instantly

- AI audits expenses to prevent fraud

- Automate approvals while tracking spending

- Ensure compliance across all regions

- Integrate with 35+ finance and HR tools

- Manage corporate cards with real-time control

Pricing

- Essentials: $9/user (annual billing) or $12 monthly

- Pro: $11/user (annual billing) or $14 monthly

- Business & Enterprise: Custom pricing available

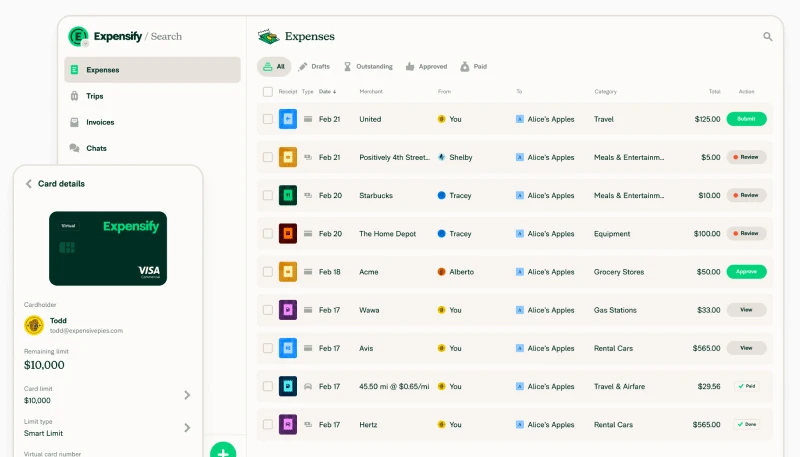

5. Expensify: Your Smart Receipt Management Solution

Make your expense tracking effortless with Expensify’s intelligent scanning technology and automated workflows. Your receipts transform into organized expenses instantly with SmartScan technology through your smartphone. Whether you’re managing your business or personal expenses, you’ll find everything you need in one streamlined platform.

Features

- Track employee spending with custom reports

- Access expense tools via the mobile app

- Split bills and chat with team members

- Generate reports automatically and sync data

- Manage all expenses in one platform

- Gain real-time insights into company spending

Pricing

- Collect Plan: $5/user monthly (annual)

- Control Plan: $9/user monthly (annual)

6. Spendesk: Your All-in-One Spending Platform

Features

- Smart scanning auto-sorts receipts instantly

- Transactions match automatically to save time

- Set team budgets and track spending live

- Managers gain full visibility into budgets

- Get instant receipt alerts after purchases

- Auto-generate reports combining transactions and receipts

The platform’s proactive approach to budget management helps you avoid overruns and gives you better understanding of your spending patterns.

Pricing

Get your custom price quote based on your business needs

7. Fyle: Your AI-Powered Expense Assistant

Features

- Submit expenses by texting receipt pictures

- AI extracts merchant, date, amount, and category

- Track credit card expenses in real time

- Match receipts and enforce policies automatically

- Connect business cards for seamless tracking

- Receive instant alerts for credit card transactions

- AI detects and flags out-of-policy expenses

Pricing

- Growth Plan: $14.99/user monthly

- Business Plan: $17.99/user monthly

- Enterprise: Custom pricing for large teams

How to Choose the Right Expense Tracking Software

Choose expense-tracking software that provides suitable features to match your small business requirements, such as an expense tracking software for small business.

1 . Consider your challenges with expense management at that moment, and ask yourself what problems you want new software to solve.

2. You need to consider both the number of team members who will access the system and their total count during your evaluation.

3. Budget constraints must be considered but you should also account for productivity improvements and time reduction benefits that arrive with the essential solution.

4. You should select software that works together with all business financial tools including your current accounting applications and bank accounts.

5. If your team travels frequently, make sure your chosen solution offers robust mobile capabilities and receipt scanning features.

6. Pay special attention to your reporting needs and ensure your software can generate the insights you require.

7. Consider your approval workflows and whether the software can accommodate your existing processes or help you establish better ones.

8. Finally, check if the vendor provides the customer support level your team needs.

Final Thoughts

To sum up, expense management is not about running after loose receipts or trying to guess what happened to your money. The appropriate expense management software not only track, but it enables.

Be it solopreneur or a growing team preparing hiring documents or a finance manager having to manage several clients at once, there is something here to fit your workflow.

And when you want more than a simple tracking, Invoicera beats others as the best expense management software. Its expense management built on project basis, invoice integration and supporting multiple businesses, making it not only software but a financial command center.

This is a time & expense tracking software that’s simple, powerful, and built to scale with you.

FAQs

Ques. What is the best software for keeping track of expenses?

Ans. The best expense-tracking software depends on your needs. QuickBooks suits small businesses, Zoho Expense is great for corporate management, and Rydoo excels in travel expenses. Invoicera is ideal for managing both vendor and client expenses with seamless tracking and reporting.

Ques. What is better than Expensify?

Ans. While Expensify is excellent for receipt scanning and approval workflows, Invoicera offers several advantages:

- More comprehensive vendor and client expense management

- Better integration with invoicing workflows

- More flexible customization options for different business types

- Enhanced reporting capabilities for client-specific expenses

- Superior project expense tracking features

- More affordable pricing options for growing businesses

Ques. What are the four types of expenses?

Ans.

- Fixed Expenses: Regular costs that remain constant (rent, salaries, insurance)

- Variable Expenses: Costs that change based on usage or activity (utilities, supplies, commissions)

- Operating Expenses: Day-to-day costs of running your business (office supplies, marketing, maintenance)

- Non-Operating Expenses: Costs not directly related to core operations (loan interest, investment losses)

Ques. Can I switch between expense-tracking software platforms easily?

Ans. While most platforms offer data export features, the ease of switching depends on your data volume and format. Look for software that supports common file formats for export/import and offers migration assistance.