Introduction

Approximately 60% of firms experience payment delays of 30 days or more, according to Global Trade Review.

Do you also fall in the 60% of businesses that receive late payment and are stressed due to cash flow constraints?

If yes, it might be impacting your credit score and business reputation.

Well! You need not worry; there are a lot of solutions in the market that can automate invoicing and ensure you receive all payments with their reminder features.

What is the best invoicing tracking software: We have come up with 19 of the best invoicing software for 2025.

They’ll help revolutionize your invoicing process, streamline cash flow management, and ensure prompt payments.

Now, say goodbye to financial stress and hello to smoother operations!

Join us to explore these invoicing solutions.

How Late Payments Affect Your Business?

Late payments can

- Disrupt The Cash Flow: If you are a small business, you might need consistent revenue to continue your services. But when you get delayed payments, it affects your cash flow. You might need operational costs for payroll, inventory, or utilities, but a disrupted cash flow can lead to difficulties in meeting your financial needs. This could eventually result in missed growth opportunities.

- Strain Client Relationships: Late payments affect your business and can strain relationships with suppliers, vendors, or freelancers. It can break trust and affect long-term partnerships vital for the smooth functioning of your operations.

- Increase Administrative Burden: It can be burdensome to track late payments and follow up with clients all the time. As we all know, this can lead to wasting time and resources and cause your team to lose its burden from core business activities.

- Impact Credit Score And Financial Health: Consistently late payments can negatively impact your business credit score. It can affect your ability to secure financing or favorable terms with lenders in the future. A poor credit score might also deter potential partners or investors, limiting your business’s growth potential.

- Lead To Legal Implications: In severe cases, prolonged late payments can lead to legal disputes or the need for debt collection measures. It is more resource-intrinsic and can damage your business’s reputation.

An invoicing tracking software like Invoicera can help you avoid all the above late payments’ cons and get a healthy cash flow.

Let’s learn how invoicing tracking software like Invoicera can help you manage your cash flow better.

How Automated Invoicing Software Helps In Getting Prompt Payments?

Payments play a very important role in a business irrespective of its size. However, getting your payments recovered can take extra time and effort.

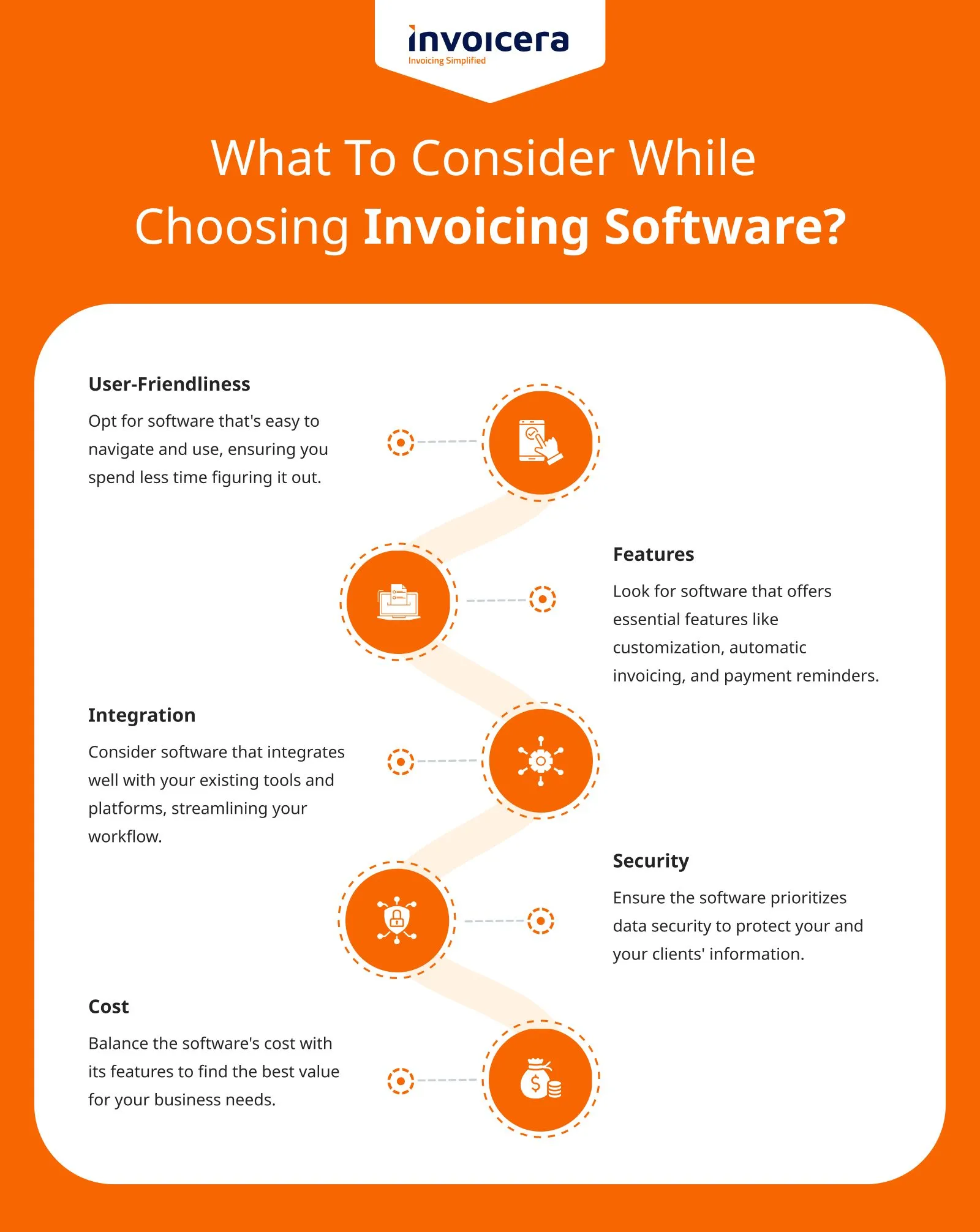

A software for invoicing can benefit your company with the following features and help you in getting payments within the due date:

- Automates the invoicing process: You can create and issue professional invoices automatically in a very short time. You just need to enter the details, click a button and your client will receive the invoice.

- Lets you create custom invoices: You can enhance your brand image with custom invoicing software. You can add logos and colors and add notes to the invoices.

- Schedules your invoices: If you own a subscription business, it might not be every time you are available to send invoices monthly or yearly that too manually. An invoicing software automated the recurring invoices for your regular customers. It saves you time.

- Offers real-time invoice tracking: You can check the status of your sent invoices at any time through a dashboard. It lets you check when they were viewed and paid. You can also see the payments that are due.

- Integrates with your accounting software: I think, it is the best feature that comes with invoicing software. You can easily integrate it with your existing accounting software. It directly transfers all the required data from your accounting software to it and saves time from copy-pasting the data.

All the above features can help you generate and send invoices in very little time. This makes it possible for any business to receive early payments.

Importance of expense management tool for best invoice software and business invoice software

19 Best Invoicing Software for Prompt Payment

Let’s explore the 19 best invoicing software in detail to help you get timely payments.

1. Invoicera

Invoicera is an automated invoicing tool that offers you create professional invoices in few steps. And fast and reliable invoices eventually result in getting paid faster.

Coming to business requirements, it offers a number of features for all business sizes. It even offers custom solutions such as integration with your existing system or any platform of your choice.

Features

- Late Payment Reminders: You can schedule follow-ups for unpaid bills, ensuring that your business receives cash on time.

- Automated Recurring Billing: You can set up recurring invoices for your regular clients or if you provide subscription-based services. It will save your time and the bills will be sent consistently without manual intervention.

- 14+ Payment Options: It lets you offer your clients with various payment gateways that include credit cards, PayPal, and online bank transfers.

- Expense Management: Keep your expenses documented and monitored effectively to generate accurate invoices and improve financial tracking and accountability for your business.

- Time Tracking: Accurately track billable hours and convert work time into billable invoices, preventing any confusion or misunderstanding with your clients.

- Multi-Currency Support: Do business internationally by billing your clients in their preferred currency, making it easier to serve your global customers.

- Security Measures: Increase data protection for your business by enabling strong encryption and protocols that meet best practices for handling financial information.

What’s Exceptional?

With support for multiple currencies and languages, Invoicera makes it easier to manage your international business. Furthermore, it’s the best invoice payment software that allows you to receive international payments effortlessly.

Pricing

One potential drawback is that Invoicera offers a tiered subscription-based pricing structure starting at $30 per month for the basic functionalities, with costs increasing according to the complexity of your small business requirements.

The higher tiers also provide features like an unlimited number of clients, custom workflows, additional teammates, and more.

2. Paymo

Paymo is a powerful invoicing software that offers a range of features tailored to help businesses streamline their invoicing process and get paid faster. With its intuitive interface and robust functionality, Paymo is an excellent choice for small companies and teams of up to 20 people in diverse fields, from creatives to architects and IT developers.

Key Features

- Quick invoice generation based on automatic time tracking, timesheet, and outstanding tasks

- Recurring invoice profiles and automated invoices

- Integrated online payments via credit card and ACH through PM Payments, Stripe, and PayPal

- Real-time invoice tracking and client reminders for late payees

- Customizable invoice templates with multilingual and multi-currency abilities

What’s Exceptional?

Paymo stands out with its seamless integration of time tracking and invoicing, allowing users to easily convert billable hours into professional invoices with just a few clicks. However, for those seeking feature-rich and more cost-effective Paymo alternatives, platforms like Invoicera offer additional customization, multi-business management, and automated workflows.

Pricing

Plans start at $5.9/user/month

3. Freshbooks

FreshBooks isn’t just a tool; it’s a game-changer for small businesses.

FreshBooks is the best invoice software for small businesses. It has been praised for having an easily understandable and user-friendly interface. Furthermore, it offers tools for time reports, expenses, and client communication, which makes it especially suitable for freelancers and small businesses.

Features

- Customize invoices effortlessly with automated recurring options.

- Track client interactions with invoices in real-time.

- Set automatic late payment reminders and fees.

- Seamlessly accept credit card payments online.

- Generate and send professional estimates.

- Gain business insights through intuitive reports and dashboards.

- Access and work on any device – computer, tablet, or mobile.

What’s Exceptional?

FreshBooks allows you to monitor and record time for projects and clients while effortlessly working with your team.

Pricing

Starts at $15/month

4. Zoho

Zoho business invoicing software is another solid option if you need a full set of business apps. Zoho interface is simple and versatile and can provide efficient invoicing, tracking of the expenses and managing the projects.

Features

- Generate well-formatted invoices, automate recurring billing, and easily accept online payments.

- Organize and bill expenses to clients seamlessly within a unified platform.

- Link Zoho Books to your bank for live cash flow updates and instant transaction categorization.

- Access insightful financial reports (P&L, Balance Sheet, Cash Flow Statement) for better financial management.

- Implement inventory tracking to oversee stock movements efficiently.

What’s Exceptional?

Other accounting tools often demand expertise, but Zoho Invoices offers instant business insights through its user-friendly dashboard, no accounting background needed.

Pricing

Starts at $15/month

5. Xero

Xero brings accounting services to another level with their cloud-based solution. Standard features include invoicing, bank reconciliation, and real-time financial reporting which makes it versatile for businesses that want easy access and capability to join to other systems.

Features

- Design personalized professional invoices easily.

- Schedule recurring invoices for convenience.

- Automate payment reminders to speed up customer payments through tailored emails.

- Accept online payments via debit/credit cards or PayPal directly from the invoice for improved cash flow.

- Mobile invoicing software helps you generate and send invoices instantly from your phone or tablet upon job completion.

- Enable customers to pay online using debit/credit cards or their PayPal account.

What’s Exceptional?

Using Xero, you can bulk-invoice customers, saving ample time, and receive notifications when invoices are opened—a helpful feature worth noting!

Pricing

The plan which includes global invoicing starts at $6.20/month.

6. Sage

Sage is popularly known for its reliability and scalability. This billing and invoicing software makes the management of invoices super easy.

You can manage inventory and generate detailed financial reports. This can further help your business evaluate and make better financial strategies to grow in the market.

Features

- Generate, modify, and dispatch invoices seamlessly within the software.

- Monitor cash flow by connecting to your bank account, instantly logging sales and receipts.

- Craft polished quotations effortlessly.

- Access impactful reports and dynamic dashboards.

- Keep tabs on project earnings, costs, and profits.

- Conduct transactions in diverse currencies.

What’s Exceptional?

Sage merges the strength and efficiency of a reliable desktop tool with safe online access and integration with Microsoft 365 services.

Pricing

Starts at $61.92/month

7. Invoicely

Invoicely is perfect for freelancers and small businesses that do not require complicated invoicing tools but need the essentials. It allows you to edit invoices, manage expenses and billing, and offer recurring payments. It is an invoicing companion to count on for your needs.

Features

- Connect to your bank account for real-time tracking

- Generate professional quotes with ease

- Access comprehensive reporting tools and dynamic dashboards

- Track project revenue, expenses, and overall profit

- Conduct transactions conveniently in multiple currencies

What’s Exceptional?

Invoicely offers and automates invoice templates which means that you do not have to design them out on your own.

Pricing

Its professional plan starts at $19.99/month

8. Wave

Wave is an invoicing software free for self-employed and small businesses. You can generate as many invoices as you want, scan receipts, and not be charged. This tool falls in a low price range.

Features

- Generate personalized invoices, estimates, and receipts swiftly.

- Automate billing with scheduled recurring invoices.

- Send automatic payment reminders for timely payments.

- Monitor invoice and payment status for better financial tracking.

- Accelerate payments by accepting credit cards, often settled within 2 days.

- Keep tabs on income, expenses, and receipts through scanning tools and bank connections.

What’s Exceptional?

Even if it is a free invoicing software, it easily dispatches invoices on-the-go using free iOS and Android apps. Wave’s integrated tools ensure instant updates across invoicing, accounting, credit card payments, and payroll.

Pricing

Wave pricing for a standard plan starts at $16/month.

9. Invoice2go

Invoice2go is very easy to use as a business tool. It allows you to create personalized invoice formats and manage payments. With this mobile app, business owners are able to create and manage their invoices and their payment status while on the go.

Features

- Customize invoices using various templates to suit your style.

- Track invoices to know exactly when clients view them.

- Use payment reminders to save time on chasing unpaid invoices.

- Access charts and reports to monitor business performance and outstanding payments.

- Track expenses seamlessly.

- Accept debit and credit card payments effortlessly.

What’s Exceptional?

With Invoice2go, craft and send invoices instantly from your phone, syncing all your data across devices for easy access anytime.

Pricing

The most popular plan of this software starts at $9.99/month.

10. Chargebee

Chargebee is perfect for your business if you deal with subscriptions. You can automate recurring invoices easily and it further helps you get early payments. This helps in a better relationship with your customers.

Features

- Craft stunning, detailed invoices effortlessly.

- Simplify tax handling with Chargebee.

- Use built-in metered billing to bill based on usage.

- Offer diverse payment options like cards, checks, direct debit, and online wallets.

- Access subscription management, reporting, and analytics tools as well.

What’s Exceptional?

Chargebee supports multiple client libraries catering to Net, Ruby, Python, PHP, Node.js, and Java developers.

Pricing

Starts at $249 per month

11. Zervant

Zervant is a useful invoicing software for both small businesses and self-employed persons. It helps you to create accurate invoices in less time. Moreover, with this platform, you can design invoices, control expenses, and receive notifications.

Features

- Create and send invoices, quotes, and estimates effortlessly

- Send invoices via paper, email, or PDF attachments

- Set up recurring invoices

- Manage credit and delivery notes

- Send payment reminders

- Generate receipts

What’s Exceptional?

Zervant was chosen as the most promising fintech startup in the Nordic countries.

Pricing

Starts at $8 month

12. Maxio

Maxio allows you to create good-looking invoices and send them to your clients quickly. It ensures that you receive your payment at the right time and also provides you with records to monitor your business cash.

Features

- Effortlessly generate and dispatch invoices, quotes, and estimates

- Dispatch invoices via various methods: printed, emailed, or as PDF attachments

- Automate recurring invoicing processes

- Manage credit memos and delivery notes seamlessly

- Send automated payment reminders

- Generate receipts for transactions

What’s Exceptional?

Maxio undergoes annual independent audits to ensure financial reporting and stringent security, availability, processing integrity, confidentiality, and privacy controls are in place.

Pricing

You can get the Grow plan at $599 per month, but for the other plans, you need to connect with Maxio’s support team.

13. Hiveage

Hiveage is a comprehensive invoicing platform that caters to businesses of all sizes.

Offering a range of customizable invoice templates and payment options, Hiveage empowers users to create invoices tailored to their brand.

Features

- Effortlessly create and dispatch personalized and recurring invoices.

- Embed online payment forms in email templates using clickable payment buttons.

- Subscription-based billing.

- Real-time dashboard to track invoices.

- Automated reminders and receipts for unpaid invoices.

What’s Exceptional?

Small business owners leverage this secure cloud-based platform, reclaiming an average of two days monthly while alleviating the stress of managing invoicing and billing tasks, saving both time and resources.

Pricing

Starts at $16/month/user

14. Harvest

Harvest is not just about invoicing; it’s a versatile tool for time tracking and billing.

With its seamless integration, Harvest simplifies invoicing by effortlessly converting billable hours into professional invoices.

Its intuitive interface and reporting tools provide valuable insights into project profitability, making it an ideal choice for freelancers and businesses alike.

Features

- Invoicing, time tracking, expenses, and projects in one place

- Send invoices with a click, track client views

- Stripe & PayPal integrations for swift client payments

- Automatic payment reminders keep things on track

What’s Exceptional?

See all your invoices at a glance focus on open ones for follow-ups. The invoice graph shows yearly revenue, while filters track specific clients or timeframes.

Pricing

Starts at $10.80 /user/month

15. Tipalti

Tipalti is designed for global businesses dealing with complex payment processes.

This platform streamlines payment operations, handling everything from supplier onboarding to tax compliance.

Features

- Capture billable events automatically

- Create polished invoices and quotes with custom templates

- Track time and invoices

- Monitor payments

What’s Exceptional?

The integrations provided by Tipalti help you to grow your business.

Pricing

Starts at $129 per month

16. Scoro

Scoro offers a unified platform combining project management, time tracking, and invoicing.

Scoro’s real-time dashboards provide a holistic view of project progress and financials, making it a go-to solution for businesses seeking comprehensive project management and invoicing capabilities.

Features

- Create personalized sales, prepayment, and credit invoices effortlessly.

- Automate recurring payments for quicker monthly billing.

- Promptly remind overdue payments and ensure timely transactions.

- Gain a comprehensive view of each client’s/project’s profitability.

- Access real-time dashboard insights like sent invoices and monthly revenue estimates.

What’s Exceptional?

Scoro streamlines business management by consolidating projects, clients, and invoicing into one efficient platform, saving you valuable time typically spent toggling between spreadsheets and emails.

Pricing

Starts at $26/user/month

17. Zipbooks

Zipbooks is a user-friendly automatic invoicing software tailored for small businesses and freelancers. Its simple interface and customizable invoice templates make creating and sending invoices smooth. Its focus on user convenience extends to features like automated reminders and expense tracking, ensuring timely payments and financial organization.

Features

- Easily generate customized invoices and estimates according to your business needs.

- Simplify recurring billing with automated invoicing for seamless monthly transactions.

- Set up automatic payment reminders to ensure timely payments and smoother cash flow.

- Track and analyze project profitability with detailed insights into client finances.

- Access real-time dashboard data, including sent invoices and revenue summaries, for better decision-making.

Pricing

Starts at $15/month

18. Bill.com

Bill.com is a cloud-based invoicing and payment delay software designed to streamline accounts payable and receivable processes.

With features like invoice tracking and seamless integrations, Bill.com is a valuable asset for businesses aiming for efficiency in financial transactions.

Features

- Select between ACH or credit card for quick electronic payments.

- Choose to send invoices electronically through Bill.com or opt for paper invoices via mail.

- Customers can conveniently view and pay invoices online.

- Receive advance email notifications for upcoming payment deadlines.

- Automatic online payments directly deposited into your bank account.

What’s Exceptional?

Bill.com’s calendar displays incoming deposits and due payments, providing an instant view of your cash inflow and outflow.

Pricing

Starts at $29/user/month

19. Kashflow

Kashflow is a user-friendly invoicing and accounting software designed for small businesses. Its intuitive interface and customizable templates enable users to create professional invoices easily.

Kashflow’s automation features, including recurring invoices and payment reminders, ensure a smooth invoicing process, assisting businesses in maintaining a healthy cash flow.

Features

- Customize, edit, email, or print invoices with recurring options.

- Instantly convert quotes to invoices in a single click.

- Automate invoicing, including reminders for pending payments.

- Integrate with partners like PayPal for one-click customer payments.

- Set up automated reminders for unpaid invoices based on preferred intervals.

What’s Exceptional?

KashFlow simplifies managing small or large businesses, requiring no accounting expertise.

Pricing

Starts at $22/user/month

20. BQE Core

BQE Core is a comprehensive invoicing and time-tracking solution suitable for professional service firms.

Its project management capabilities and detailed reporting tools provide insights into project profitability, making it valuable for service-based businesses seeking efficiency in invoicing and time management.

Features

- 180 templates, batch processing, auto PDF creation, editable invoices

- Various invoice types: percent complete, retainer, recurring, fixed, etc

- Automated billing follows standard rules for project invoices

- Instant email/print options for single or batched invoices with attachments

- Customizable features: templates, batch processing, auto PDFs, edits

What’s Exceptional?

BillQuick offers project management and time tracking features and is compatible with all major browsers on PC, Mac, and smartphones.

Pricing

You need to request the quote from the sales team.

Tips For Using Invoicing Software Effectively

1. Customize Templates

Tailor your invoice templates to reflect your brand and ensure clarity. Personalized invoices can leave a lasting impression and make payment processing smoother.

2. Set Clear Payment Terms

Clearly outline payment terms and due dates to make sure everything runs smoothly and smoothly. This includes specifying late fees or discounts for early payments and encouraging timely settlements.

3. Automate Recurring Invoices

For regular clients or subscription-based services, set up recurring invoices. Automation saves time and ensures timely billing without manual intervention.

4. Use Online Payment Options

Integrate various payment gateways to offer clients multiple ways to pay. Options like credit cards, PayPal, or online bank transfers increase convenience and prompt payments.

5. Regularly Update Records

Maintain accurate records of sent, pending, and paid invoices. It helps track payments, identify overdue accounts, and maintain financial transparency.

Final Thoughts

In summary, the right invoicing software can revolutionize payment efficiency. Customizable templates, clear terms, automation, payment options, and record-keeping are vital.

Picking software that fits your business is key for cash flow and client rapport.

Understanding this and following these tips will ensure prompt payments and financial management in the coming year.

FAQs

Can I use invoicing software for multiple currencies?

Yes, many invoicing software options like Invoicera support multiple currencies, allowing businesses to invoice clients globally.

How secure are online payment options integrated into this software?

Reputable invoicing software like Invoicera integrates trusted payment gateways with robust security measures, ensuring safe transactions.

Is it possible to track overdue payments with these tools?

Absolutely. Most invoicing software includes features to track overdue payments, send reminders, and manage late fees or penalties.