“Like mothers, taxes are often misunderstood, but seldom forgotten.” – Lord Bramwell.

This quote rings especially true when it comes to global invoice taxation. Taxes, while an unavoidable part of business, often leave companies tangled in confusion.

A recent 2024 survey of over 1,000 global tax and finance executives revealed that 37% struggle to keep up with rapidly changing tax laws across different countries. In addition, there is the challenge of relying on technology, with 40% of tax professionals saying they worry about adopting the right tools to manage all this complexity.

Mistakes in tax calculations, failing to understand local laws, or missing key exemptions can lead to costly penalties, delayed payments, and even damage a company’s reputation. The good news is these invoicing mistakes are avoidable.

By understanding the common pitfalls and leveraging the right tools, businesses can navigate global taxation more smoothly and stay on top of compliance.

Are you making such mistakes? This blog will explore avoiding these common mistakes and simplifying your global invoice taxation process.

Understanding Global Taxation Challenges for Businesses

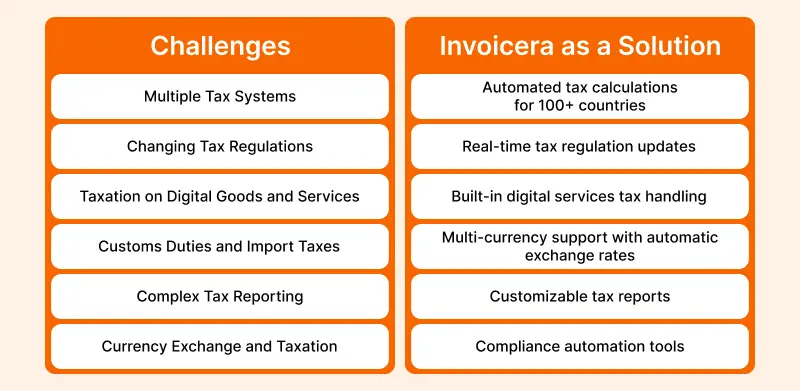

International taxation can be very tricky as the laws, rates, and other international business regulations may differ from country to country. To stay compliant and avoid costly penalties, businesses need to understand the following challenges:

1. Multiple Tax Systems

Every country is governed by its laws, and the taxes that are common consist of the value-added tax (VAT), goods and service tax (GST), and/or the sales tax, though the rates and processes may differ.

This is where it becomes slightly complicated, which is more so for companies operating in diverse geographies.

2. Changing Tax Regulations

Every year, there are tax reforms, and each business must adhere to these laws to avoid legal consequences. It could influence your invoices, payments, or the taxation procedures of products or services you offer.

3. Taxation on Digital Goods and Services

For instance, in most countries, digital products or services such as software-as-a-service are subject to fairly different taxation. It is crucial to know how these goods are taxed in different jurisdictions in order to avoid these invoicing mistakes.

4. Customs Duties and Import Taxes

This is also important when trading internationally since firms are also subject to customs duties and import taxes. Failure to appreciate these can cause additional expenses, time-contending, or compliance complications.

5. Complex Tax Reporting

Companies that operate in various tax jurisdictions may encounter challenges in tax reporting. Even within one country the forms, time limits, and ways of filing do vary. That is why it is difficult to standardize the procedure on the level of several countries.

6. Currency Exchange and Taxation

Currency exchange fluctuations can also affect the amount of tax due on international transactions. Businesses need to account for these changes and make sure their invoices reflect the correct value in local currencies.

Knowledge of these prospects allows companies to minimize costly invoice errors and improve efficiencies in global billing. Taking a proactive approach to understanding and managing global taxation ensures smoother transactions and compliance across borders.

Invoicing Mistakes in Global Invoice Taxation

Mistakes in global invoice taxation can incur costly fines, delayed payments, or damaged business relationships. Some of the common mistakes that businesses make and ways to avoid them:

1. Applying the Wrong Tax Rate

One of the biggest invoicing mistakes negotiators make is not applying the correct tax rate as per the customer or product location. Each country has different regions with different rates, and hence, it is essential to get the computation on goods and services rendered correctly.

2. Wrongly Classifying Goods or Services

Taxation can depend upon whether your goods or services fall into a certain category or not. A software product might be tax-exempt in one country but taxable in another.

3. Omission of Essential Tax Information

The invoices must contain accurate tax identification numbers (TINs), VAT/GST registration details, and other relevant tax information. Failure to provide this information could lead to disputes with tax authorities and delays in receivables.

4. Failure to Coordinate Tax Exemptions/Incentives

Many countries offer tax breaks and incentives for specific types of business activities, particularly exports and services. If companies fail to take advantage of these available incentives, they may end up paying more taxes than necessary or miss out on potential tax waivers.

5. Not Updating the Invoicing System About Changing Laws

Since tax regulations change every day, businesses must update their invoicing systems to account for those changes. Otherwise, the invoices may not comply with the new tax regulations after adjustment or without consideration of tax.

6. Little Attention To Local Requirements For Tax Filing

Every country, including Argentina, has its tax filing requirements that have specific dates of submission and set forms. Failure to comply with these rules may result in unpaid taxes being spellbound with interest charges, penalties, and delays in the operational cash cycle.

7. Uncoordinated Cross-Border Tax Withholding

In international businesses, different departments and tax jurisdictions must work well together. Poor communication can lead to duplicate actions, while some tax issues may go unnoticed.

These failures should be recognized and rectified by companies in order to ward off severe legal and fiscal repercussions. Doing so will allow distinct and smooth global invoicing and ensure compliance with tax norms.

How To Overcome Taxation Blunders?

Overcoming taxation blunders in global invoicing can save your business from hefty fines and legal issues. Here’s how you can ensure accurate tax calculations and prevent mistakes in invoices:

1. Stay Updated on Tax Laws

Tax laws and rates change frequently across countries. Check for updates in the tax regulations of the regions where your business operates. Subscribe to government portals or consult with tax professionals to remain informed.

2. Consult Local Experts

Engage with tax professionals who understand the tax regulations in the countries you deal with. They can provide valuable insights and guidance on how to structure your invoices to avoid invoicing mistakes.

3. Automated Tax Calculation

You’ll want to choose invoicing software that automatically calculates tax according to the location of the customer. This helps to minimize human error and guarantees that the correct tax amount is always charged to your customers.

4. Properly Categorize Products and Services

Be sure to classify your products/services appropriately according to each country’s set of tax laws. Tax rates applied to any product or service fall under different categories, so an accurate classification will help you remember not to overcharge or undercharge.

5. Double-check Invoices Before Submission

Even if tax compliance is ensured by automation, remember to check your invoices for any statute violations before sending them. That extra layer of oversight could unearth an error that had gone unnoticed before.

6. Provide Tax-Inclusive and Tax-Exclusive Invoices

Clearly state whether your invoices contain taxes or not. This will help avoid disputes or confusion with customers related to tax amounts.

7. Regular Internal Audits

Performing regular internal audits can help identify invoice processing errors and highlight areas where tax compliance can be strengthened..

This will lead to a below-the-mark miscalculation in taxes, and global transactions will be smooth and legal.

Tax Compliance Made Easy with Modern Tools

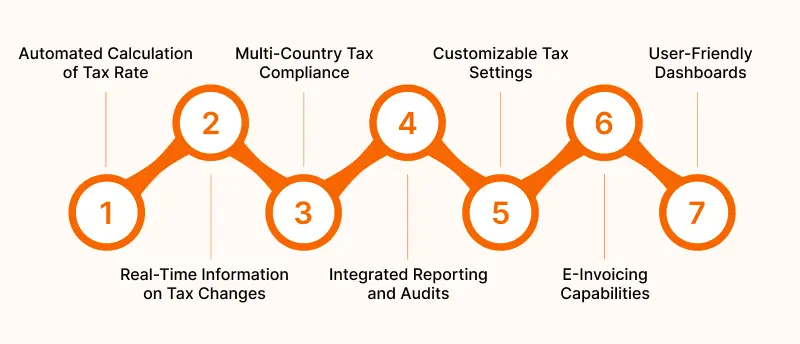

Automated Calculation of Tax Rate

Invoicing software like Invoicera can automatically calculate the correct tax rate for a transaction based on where the customer is located. There’s no risk of people making mistakes anymore; you’ll always charge customers the right amount.

Real-Time Information on Tax Changes

Most modern invoicing tools offer real-time information relating to changes in tax legislation. You never need to fear getting burned with costly invoicing mistakes and compliance infringements ever again because your business would know exactly what to do.

Multi-Country Tax Compliance

Global invoicing tools are there to help manage the tax requirements of several countries, including complex VAT, GST, or other regional taxes. This works to ensure that your invoices are in compliance with local regulations no matter where their customers may reside.

Integrated Reporting and Audits

Modern invoicing software is equipped with advanced reporting features that will leverage enhanced tax reports to speed up the auditing and filing process. The data is now available right at your fingertips, which greatly helps you keep your eyes on tax obligations and resolve any discrepancies.

Customizable Tax Settings

With modern tools, you will be able to create taxation rules depending on the nature of the country, state, or product. This ease of customization ensures that your organization remains compliant, bearing in mind the varied taxation requirements of various jurisdictions.

E-Invoicing Capabilities

Most invoicing solutions provide electronic invoicing capabilities, which help with the progressive submission of tax-compliant invoices. With this option available to you, the risk of any potential Invoice documentation inaccuracies is reduced, allowing you to maintain compliance with international e-invoicing requirements.

User-Friendly Dashboards

These modern taxation compliance tools come with easy-to-use dashboards that help you manage taxes across multiple regions in one place. There, you are able to track tax liabilities, make changes, and get an instant response to documents requested.

These tools help simplify the whole process, delivering tax compliance that’s efficient and accurate without resorting to manual calculations or complex paperwork.

Simplify Cross-Border Transactions with Invoicera

Managing cross-border transactions can be a challenge for any business; Invoicera comes to solve that challenge, making an effort to reduce the most significant burdens of international invoicing. Here is how Invoicera makes it easier:

Automated currency conversion

With Invoicera for managing international invoicing, you will get multiple currency support. Your invoices will be converted automatically to the correct currency depending on where the client is located, which helps save time and minimize invoice errors.

This all-in-one billing software allows businesses to issue invoices in varied languages for the ardor as that specific nature of informalized communication with international clients- a sure shot boost to clarity in transactions.

Elucidated Tax Reporting

Genuinely speaking, the platform lets one generate pictures of all detailed tax reports. Information on what taxes one should potentially pay in different countries helps out tremendously during tax time.

Customizable invoices

If international customers require anything peculiar, it could be dealing with the rates of taxes, adding compliance notes mandatory in that specific region, or any sort of changes to local governances that would need to be reflected.

Integrated payment solutions

Invoicera allows businesses to be paid quickly, which minimizes the hassle of foreign payment systems from the international client side, thus maximizing payment cycles.

Using these features, Invoicera guides businesses to flourish even amid the complex cross-border transactions that make global invoicing easier, more accurate, and fully tax-compliant.

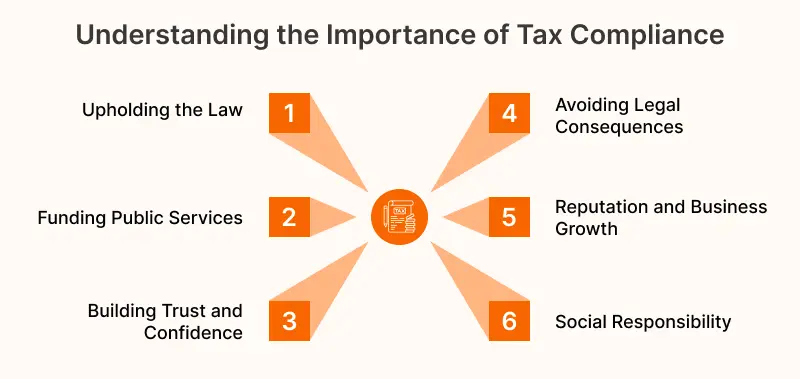

Essential Tips for Tax-Compliant Invoicing

Tax compliance for businesses setting up business in an international market is of utmost significance. If you apply these tips to ensure that your invoices are tax-compliant, you will never be at the receiving end of penalties.

1. Be Aware Of Your Client’s Location Tax Laws

You must always be aware of the tax laws of your client’s country. Different countries have different VATs, withholding tax rates, exemptions from taxes, etc.

2. Correct Tax Identification

Ensure that your invoices bear the correct tax identification number or VAT number. This way, they can accurately report the transactions in their tax filings.

3. Include Clear Tax Breakdown

Clearly itemize the taxes applied on your invoices. This helps clients understand the total tax amount and prevents confusion or disputes later on.

4. Apply The Correct Tax Rate

Different products or services are subjected to different taxation rates depending on the state in which they are sold. Verify that the applicable tax rate in that state is correct, be it the standard rate, reduced rate, or exemption.

5. Accurate Billing Information

Scrutinize the billing information to confirm that all details, including business names, contact details, and addresses, have been accurately patched up. Wrong details can pose tax or legal complications.

6. Stay on Top of Invoicing Deadlines

Keep up with the deadlines for sending out invoices on time, as this will maintain tax compliance. If the invoices are not processed promptly, it could mean more snags with the tax authorities, especially in countries with stringent reporting deadlines.

7. Use Technology to Stay Compliant

Using invoice software, like Invoicera, can keep you in line with the law. Due to automation, your invoice goes out and is updated with current tax rates, thus lowering the risk of human error and putting you in the right position with international tax rules.

Sticking to these pointers, you can easily avoid some common invoicing mistakes businesses often make regarding tax-compliant invoicing and ensure smooth and legal transactions across borders.

Wrapping Up

International invoicing doesn’t have to be such a great hassle. The common invoicing mistakes must be understood, correct software like Invoicera must be used, and tax compliance principles must be observed so that businesses engage in a smooth series of transactions.

Invoicera understands the nitty-gritty of invoices and helps businesses reduce tax errors.

Automation constantly provides real-time modifications of tax rates and allows for free currency conversion.

Businesses can devote time to growth while complying with international tax regulations with that powerful automating facility, following the rules and maximizing their efficiency.

FAQs

Ques. How often do tax rates typically change in different countries?

Ans. Tax rates can change annually during budget announcements, but some countries may implement changes quarterly or even monthly. It’s important to use automated tools that update tax rates in real time to ensure compliance.

Ques. What are the most common tax-related penalties businesses face in international transactions?

Ans. The most common penalties include fines for incorrect tax calculations, late filing fees, and penalties for missing documentation. These can range from a percentage of the tax amount to fixed penalties, depending on the jurisdiction.

Ques. How can small businesses ensure tax compliance without a dedicated tax department?

Ans. Small businesses can achieve tax compliance by using automated invoicing software like Invoicera, partnering with local tax experts in key markets, and maintaining organized digital records. Regular system updates and automated calculations help prevent common mistakes.