Start managing GST in 2025 by ensuring the invoices you generate are accurate. With ever-changing rules and digital tax systems, having the right GST invoicing software is more important than ever.

If you’re a small business owner, freelancer, or run a growing company, the right GST invoice software can:

- Save time by automating GST calculations

- Reduce billing errors

- Create fully GST-compliant invoices

- Help with e-way bills and return filing

- Keep your records organized and audit-ready

With so many software options, finding the best GST invoice software for your business isn’t easy.

This blog highlights the top GST invoice billing software in 2025. You’ll learn the key factors to check, the differences between various tools, and why Invoicera benefits today’s companies.

Top GST Invoice Software for 2025

Choosing the right GST invoicing software can make tax compliance easier and billing more efficient. Below are the top-performing tools for GST billing software needs:

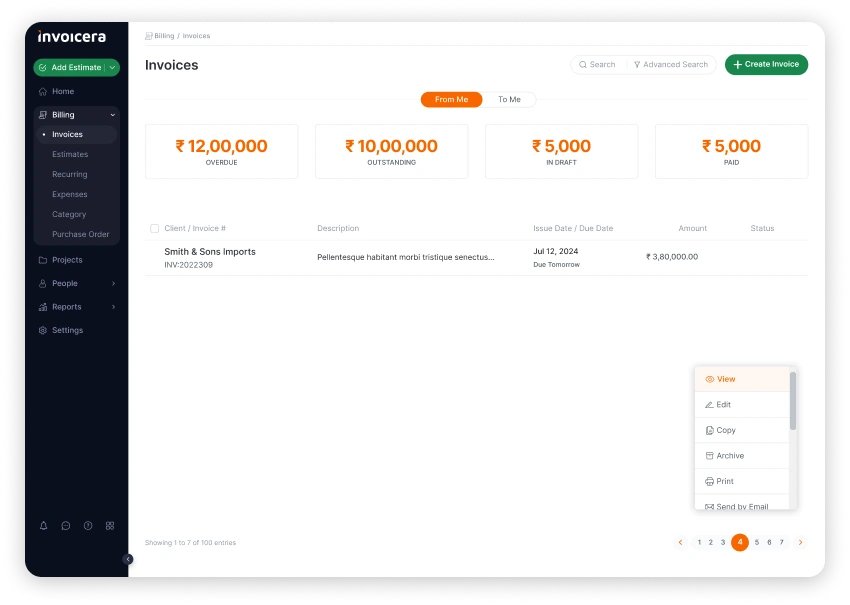

1. Invoicera

Invoicera is a comprehensive GST e-invoicing software with automation and multi-business support. It caters to freelancers, SMEs, and large enterprises with scalable solutions.

Key GST Features

- Automatic GST calculations (CGST, SGST, IGST)

- e-Invoice and e-Waybill generation

- GST-compliant templates with HSN/SAC code support

USP

- Custom billing workflows and automation

- Multi-business management under one account

- Supports 14+ payment gateways and 125+ multi currency invoicing options

Benefits

- Saves time with recurring billing and automated tax handling

- Improves accuracy in GST return filing

- Adapts easily to different business models

Limitations

- Slight learning curve for beginners

- Advanced features are mostly available in higher-tier plans

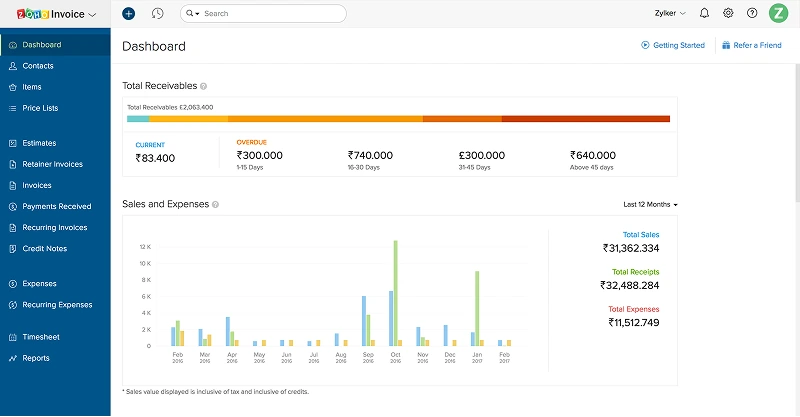

2. Zoho Invoice

Zoho Invoice is considered simple to use and is easily connected to other Zoho applications. This reliable GST invoice software in India is suitable for businesses of various sizes.

Key GST Features

- GST-ready invoice templates

- Automatic tax calculation and breakdowns

- Easy GST reporting and audit logs

USP

- Free for small businesses

- Clean, intuitive interface

- Integrates with Zoho Books for complete accounting

Benefits

- Quick setup with minimal training

- Useful for startups and freelancers

- Great support and documentation

Limitations

- Less features compared to full accounting tools

- Customization options may be basic for larger firms

3. Vyapar

Vyapar is a popular global invoicing software designed specifically for small businesses, offering complete GST compliance.

Key GST Features

- GST-compliant invoicing

- Automatic tax calculations

- GSTR reports and return filing

USP

- Simple billing and accounting in one app

- Offline billing capabilities

- Made for Indian small businesses

Benefits

- Great for small retailers and service providers

- Helps avoid GST errors with built-in checks

- User-friendly mobile and desktop versions

Limitations

- Limited advanced features for growing enterprises

- Fewer third-party integrations compared to larger platforms

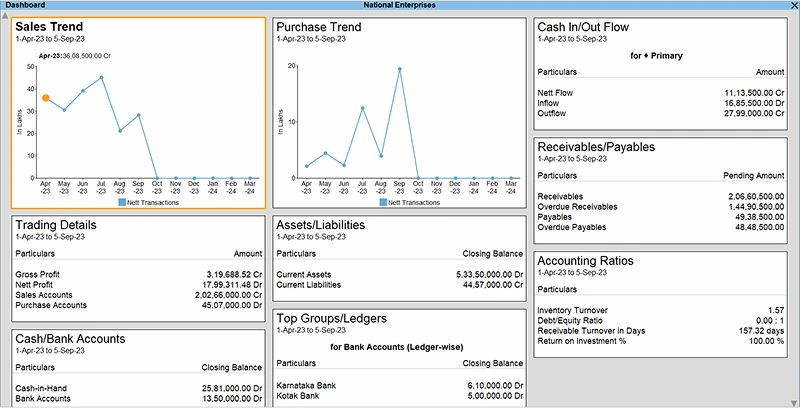

4. TallyPrime

TallyPrime is a leading GST billing & invoicing software, built for deep financial management and end-to-end GST compliance.

Key GST Features

- GST invoice creation with HSN/SAC codes

- e-Invoicing and e-Waybill generation

- GSTR-1, GSTR-3B, and reconciliation tools

USP

- Offline desktop-based accounting

- Detailed reporting and audit trail

- Trusted by CAs and accounting professionals

Benefits

- Strong GST compliance features

- Great for detailed business accounting

- Widely adopted across industries

Limitations

- Requires software installation

- UI can feel outdated compared to modern SaaS tools

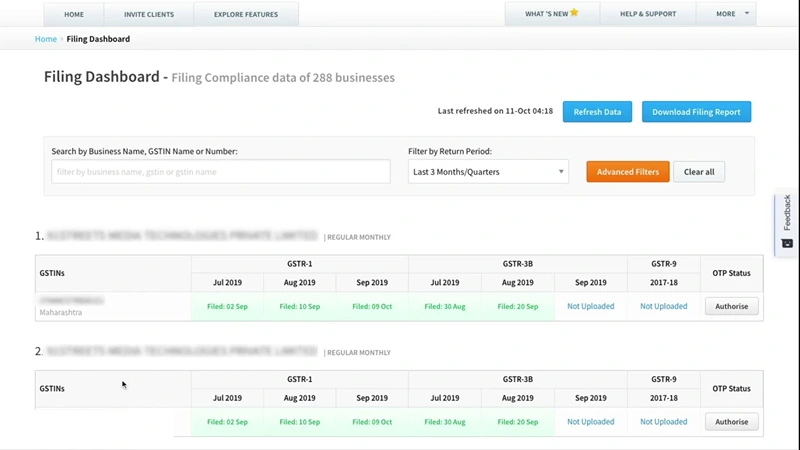

5. ClearTax

ClearTax is a GST invoicing software designed for Indian businesses and tax professionals. It offers robust GST invoicing, return filing, and reconciliation.

Key GST Features

- GST compliance invoicing

- GSTR filing and auto-matching

- Bulk invoice upload and reconciliation

USP

- Built specifically for Indian GST compliance

- Strong analytics and tax insights

- Trusted by CAs and finance teams

Benefits

- Streamlines return filing and reporting

- Reduces manual data entry and errors

- Ideal for high-volume invoicing

Limitations

- Restricted accounting features beyond tax

- Pricing can be high for small firms with simple needs

Each tool offers something unique. If you’re looking for a powerful, all-in-one billing and automation software for your business that handles GST easily, Invoicera will be a top recommendation in 2025.

Key Features to Look for in GST Invoice Software

Choosing the best GST invoicing software depends on features that support daily tasks and legal compliance. Here’s what to look for:

1. Automatic GST Calculations

- Calculates correct CGST, SGST, IGST, and cess

- Updates tax rates automatically

- Minimizes manual entry errors

2. E-Invoicing & E-Way Bill Support

- Integrates directly with government portals

- Generates e-invoices and e-waybills in one click

- Saves time on compliance tasks

3. HSN/SAC Code Management

- Built-in searchable code library

- Auto-fills frequently used items

- Reduces classification mistakes

4. Return Filing Shortcuts

- One-click GSTR-1 and GSTR-3B reports

- Simplifies reconciliation

- Speeds up the return filing process

5. Customisable Invoice Templates

- Add business logo and colors

- Choose what fields appear

- Maintain GST compliance with a branded look

6. Multi-Currency & Multi-Language Options

- Supports international clients

- Handles auto currency conversion

- Sends invoices in preferred languages

7. Real-Time Reporting & Dashboards

- Live tax, sales, and payment insights

- Tracks outstanding invoices

- Helps manage cash flow

8. Cloud Access and Mobile Apps

- Works across devices

- Offers mobile invoicing on the go

- Includes offline access when needed

By picking a tool with these features of GST invoicing software, you can stay compliant and improve efficiency at the same time.

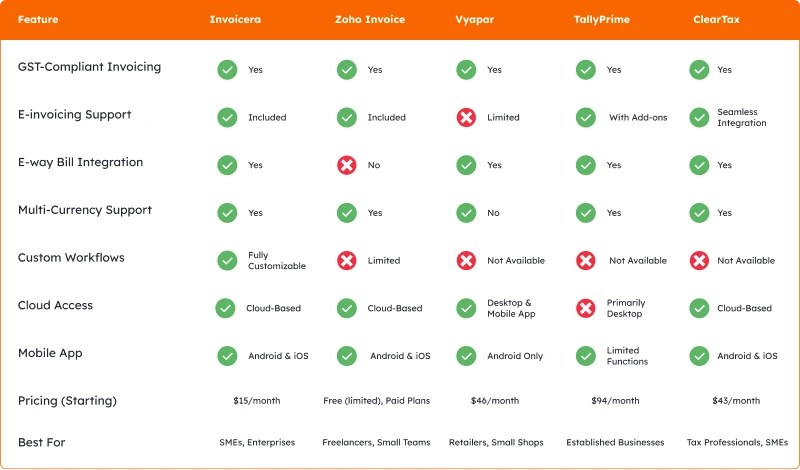

Comparison Table

How to Choose the Right GST Invoicing Tool?

When selecting the best GST invoicing software, focus on your business needs. Here’s a simple way to narrow down your choices and pick a tool that truly works for your business:

1. Understand Your Business Needs

- Do you work as a freelancer, have a small business or lead an enterprise?

- Would you benefit from basic billing or do you prefer extra features such as multiple users, integrated systems and automation?

2. Check for GST Compliance Features

- Ensure the tool handles GST types, HSN/SAC codes, e-invoicing, and e-way bills without manual effort.

- Look for auto-updates with the latest tax rules.

3. Evaluate Ease of Use

- The interface should be simple and intuitive; no need for hours of training.

- Check if you can create and send invoices in just a few steps.

4. Look for Customization Options

- Can you add your branding to invoices?

- Is setting tax rates, payment terms, and invoice fields flexible?

5. Consider Integration Needs

- Does it sync with your accounting software, ERP, or payment gateways?

- Good integrations save time and reduce errors.

6. Review Reporting & Dashboard Tools

- Real-time insights into sales, taxes, and outstanding payments help you stay on top of business performance.

7. Check Support & Documentation

- Reliable customer support (chat, email, or phone) can be a lifesaver.

- Tutorials and help docs should be easy to find and follow.

8. Compare Pricing Plans

- Look beyond the base price; check for hidden costs, user limits, or feature restrictions.

- Opt for multi currency invoicing options that grow with your business.

9. Take a Free Trial or Demo

- Always try the software before committing.

- This helps you see if it matches your workflow.

Following these GST invoicing tips will help you find a tool that saves time and supports GST compliance with less effort.

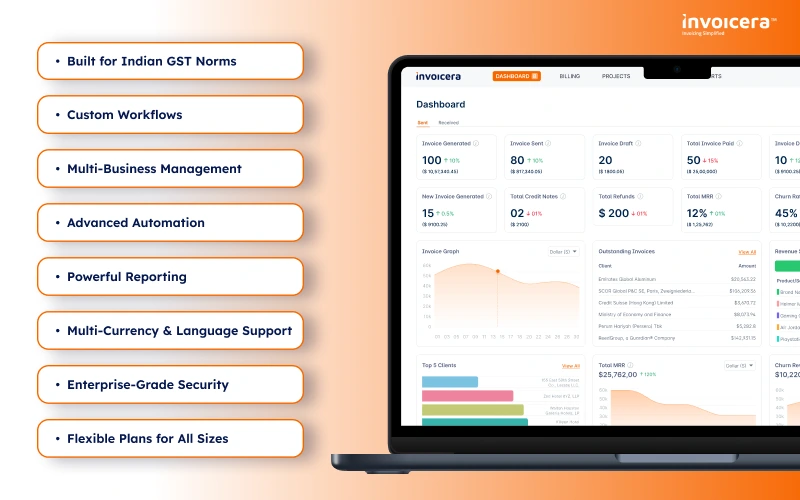

Why Invoicera Stands Out in 2025

Invoicera is more than just a GST invoice billing software; it’s a business automation platform. It stands out by offering:

Here’s why this one is different:

Built for Indian GST Norms

Handle end-to-end GST compliance, auto-tax, e-invoicing, and e-way bills easily.

Custom Workflows

Create billing processes tailored to how your business works.

Multi-Business Management

Manage multiple businesses with separate branding and tax setups.

Advanced Automation

Automate recurring invoices, reminders, late fees, and expenses.

Powerful Reporting

Access real-time tax, payment, and aging reports with a click.

Multi-Currency & Language Support

Convert currencies and send invoices in different languages.

Enterprise-Grade Security

Secure access, data encryption, and automatic cloud backups.

Flexible Plans for All Sizes

Scalable features and pricing for freelancers to enterprises.

Invoicera isn’t just another global invoicing software. It is a complete invoicing solution built for the future of business in India. Whether you’re scaling up or simplifying compliance, Invoicera has you covered.

Closing Thoughts

When selecting the best GST invoice software, the priority should be on finding one that is trustworthy, follows the rules and is simple for anyone to use. A suitable GST e invoicing software can help make filing taxes easier, invoicing faster and increase your cash flow.

Let us do this, comparing your needs, checking out free offers and selecting an invoicing platform that benefits your business.

FAQs

Ques: Why is GST invoice software important for businesses in 2025?

Ans: One can perform GST in multiple countries, produce e-invoices, file various tax returns, access tax reports, deal with several currencies, and work with commonly used accounting apps.

Ques: What features should I look for in GST billing software?

Ans: Features include handling GST around the world, creating e-invoices, managing the filing of different returns, generating tax reports, using multiple currencies, and integrating with popular accounting tools.

Ques: Is Invoicera suitable for small businesses and freelancers?

Ans: Yes, Invoicera gives freelancers, startups and large companies each their own set of pricing options and plans. Regardless of how big a company is, the format can be customized and put to use.

Ques: Can I use GST software to file GSTR returns directly?

Ans: The process of submitting a GSTR return is simplified with the help of Invoicera, ClearTax, TallyPrime, and similar tools.

Ques: Is cloud-based GST invoicing better than desktop-based?

Ans: Since cloud services provide flexibility, automatically save your data and can be used on multiple gadgets, they are better suited for growing companies.