Introduction

Do you know that having the right invoicing software can make a big difference for your business?

Nearly 60% of small businesses struggle with late payments.

That’s a lot!

That’s why it’s essential to pick the right invoicing software.

But don’t worry, it’s not complicated. Think about what your business needs. What would make sending invoices and getting paid easier? That’s what we’ll help you figure out.

So let’s get started!

What Is An Invoicing Software?

Invoicing software is like a digital bookkeeper for your business.

It assists in generating and sending invoices to your customers upon sales. This tool simplifies tracking outstanding payments and their due dates, ensuring efficient management of accounts receivable.

Imagine you sell cookies. When someone buys your cookies, you must tell them how much they owe and when to pay.

Invoicing software does that for you. It creates a clear bill that shows what was bought, how much it costs, and when the payment is due.

This software also saves time.

Instead of writing out every bill by hand or using complicated spreadsheets, you fill in some details, and the software does the rest. It sends the bill to your customer and helps you keep records of all the money coming in.

Benefits of Invoicing Software:

- Saves Time: No more manual bill writing or complex spreadsheets

- Organizes Payments: Keeps track of who owes you money and when it’s due

- Professional Bills: Creates clear and professional-looking bills for your customers

- Easy Record-Keeping: Helps maintain records of all incoming payments

- Improves Efficiency: Streamlines the payment process, making it smoother for both you and your customers

Invoicing software is like having a helpful assistant organizing your payments, ensuring you get paid for your hard work.

Features To Consider In Invoicing Software

Selecting the right invoicing software for your business involves thinking about specific features that can make a big difference in managing your finances and interacting with your clients.

Here are key features to consider:

1. User Interface and Ease of Use

Invoicing software should be easy to use without needing a tech genius to navigate it.

Look for something with a straightforward layout and clear instructions. The best ones offer a simple dashboard to quickly find what you need, like creating invoices or tracking payments.

2. Customization and Branding

Imagine your invoices being like your business’s outfit – they should reflect your brand!

Seek software that allows customization. This means adding your company logo, picking your colors, and having a layout that matches your business style.

When your invoices look professional and consistent, it leaves a great impression on your clients.

3. Integration Capabilities

Your invoicing software should be a team player.

It’s helpful when it can connect and share information with other tools you use for your business, like accounting software, payment gateways, or even customer relationship management (CRM) systems.

This way, data flows smoothly between different platforms, saving time and reducing errors.

4. Automation and Recurring Invoices

Picture this: You set up an invoice to be sent automatically monthly. That’s the beauty of automation.

Look for software that handles recurring invoices, sends reminders, and even processes payments automatically. It saves time and ensures you get paid on time.

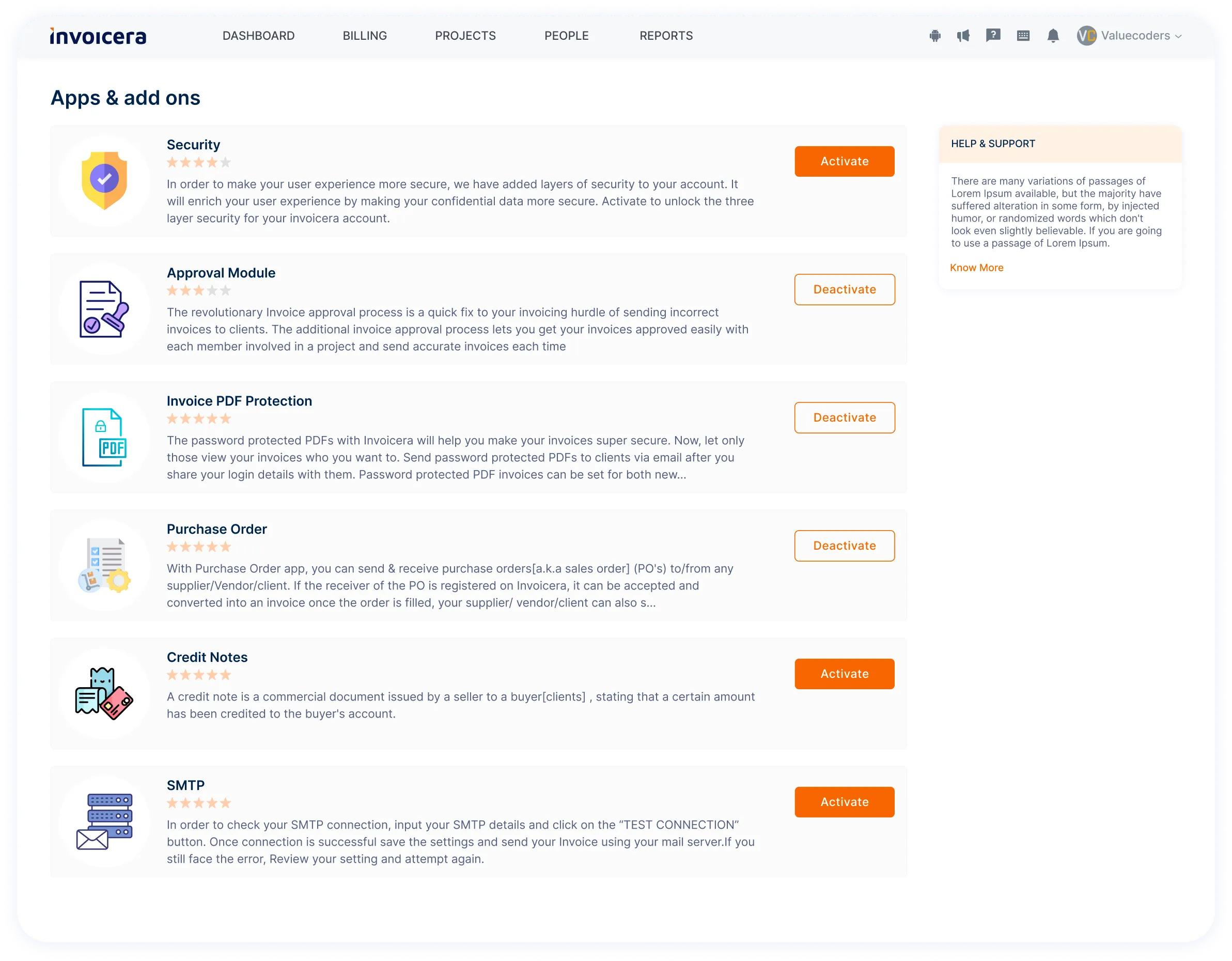

5. Security and Compliance

Your business’s information is precious; you want to keep it safe. Ensure that the invoicing software you choose has robust security measures in place.

Also, check if it complies with industry standards and regulations regarding data protection and privacy. Knowing your data is safe and legally handled brings peace of mind.

Considering these features helps you make an informed decision when choosing invoicing software.

It’s not just about sending bills; it’s about streamlining your processes, presenting your brand professionally, and safeguarding your business’s financial information.

Explore Your Business Needs

Understanding what your business requires from invoicing software is crucial.

Here’s why it matters:

Importance of Assessing Your Business Needs

Assessing your business needs helps in a few significant ways:

- Efficiency Boost: When you know your business needs, you pick a tool that helps you work better. It streamlines your invoicing process.

- Cost Savings: No need to pay for features you won’t use. Knowing your needs helps you avoid overspending on fancy stuff you don’t need.

- Smooth Operations: The right software ensures your day-to-day runs smoothly. It fits into your workflow seamlessly, making life easier for everyone.

Businesses with Different Invoicing Requirements

Every business is unique.

Think about it: a freelancer’s invoicing needs are worlds apart from a retail store’s.

Here’s a quick look at how different businesses have different invoicing requirements:

- Freelancers & Solo Operators: For someone working solo, simplicity often wins. They need software that’s easy to use and helps keep track of clients and payments without extra fuss.

- Small Businesses: Small businesses might need more versatility. They’re likely looking for software to handle a growing client base and support various payment methods.

- Medium to Large Enterprises: These businesses need scalability. Their invoicing software has to handle a larger volume of transactions, maybe across multiple locations or departments.

- Specialized Industries: Some businesses, like those in legal or consulting, might need invoicing software that integrates with specialized tools for time tracking or project management.

Understanding these differences helps you determine where your business fits and what features might be most important for your specific needs.

10 Questions To Ask When Evaluating Invoicing Software

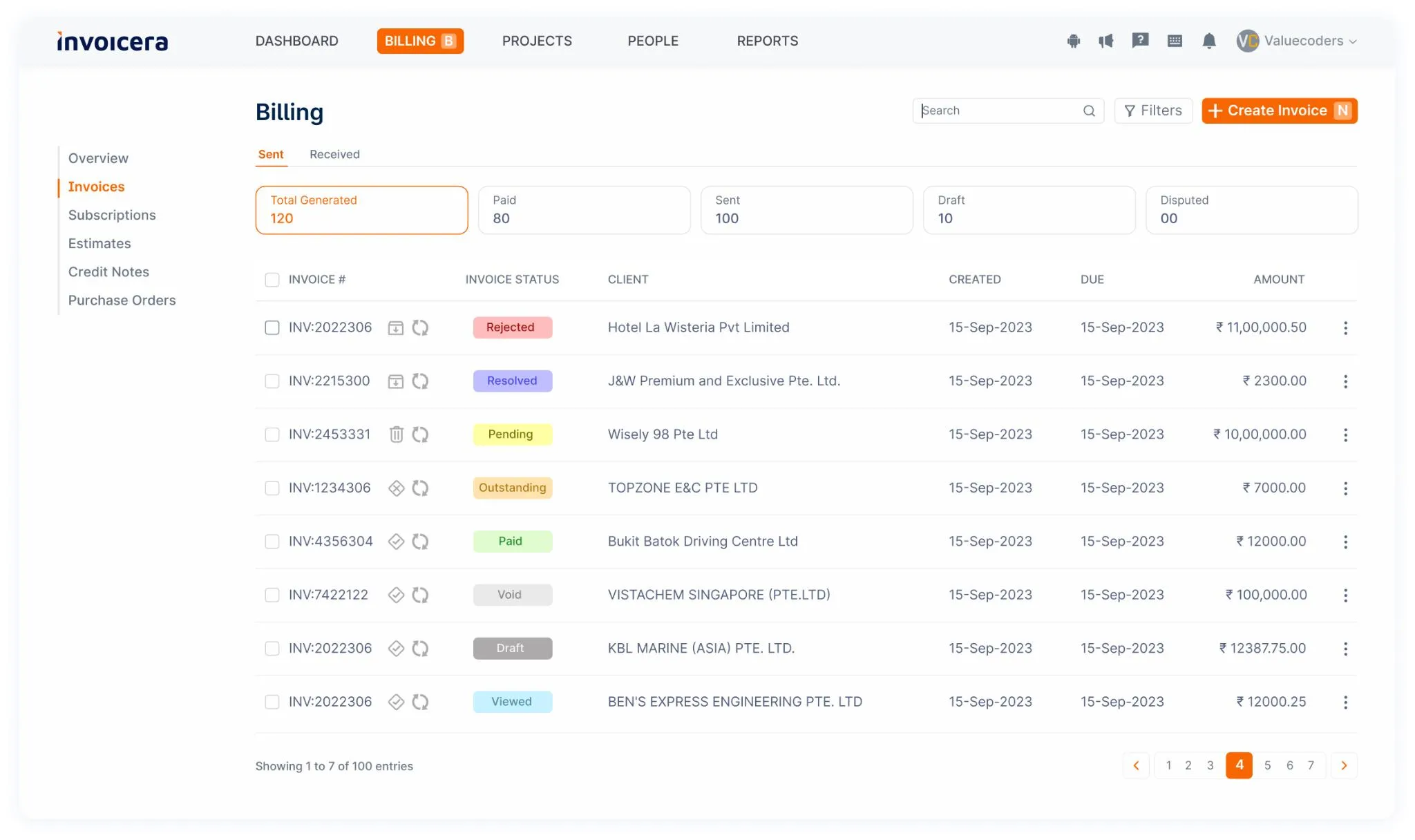

1. Does it align with my business size and type?

When looking for invoicing software, consider if it fits your business’s size and nature. Some software might cater better to large enterprises, while others suit small businesses or freelancers.

For instance, a small bakery might not need the same invoicing features as a multinational corporation. So, finding a fit that matches your specific business requirements is vital.

While evaluating options, it’s essential to check if software like Invoicera caters to small businesses, freelancers, or larger enterprises.

2. What are the key features, and how do they address my specific needs?

Understanding the software’s features is crucial. Look for features that directly address your business’s invoicing needs.

Let’s take an example, if you frequently bill for hourly services, you’ll want software that supports time-tracking and billing based on hours worked. Similarly, if you deal with international clients, multi-currency support might be essential.

Invoicera provides a range of features, such as time-tracking, multi-currency support, and customizable invoice templates, which can directly address specific business needs.

3. Is the software scalable as my business grows?

As your business expands, your invoicing needs might change. Ensure the software you choose can grow with you. Scalability means the software can accommodate increased transactions, clients, or features as your business expands.

Invoicera offers scalability, allowing businesses to expand their usage and features as they grow.

4. How intuitive is the user interface?

An intuitive interface is essential for seamless functionality. Complicated software can lead to confusion and errors. Search for software featuring a user-friendly interface that doesn’t demand extensive training for efficient usage.

Invoicera’s intuitive interface simplifies invoice creation and navigation, ensuring a smooth experience for users, even without extensive learning.

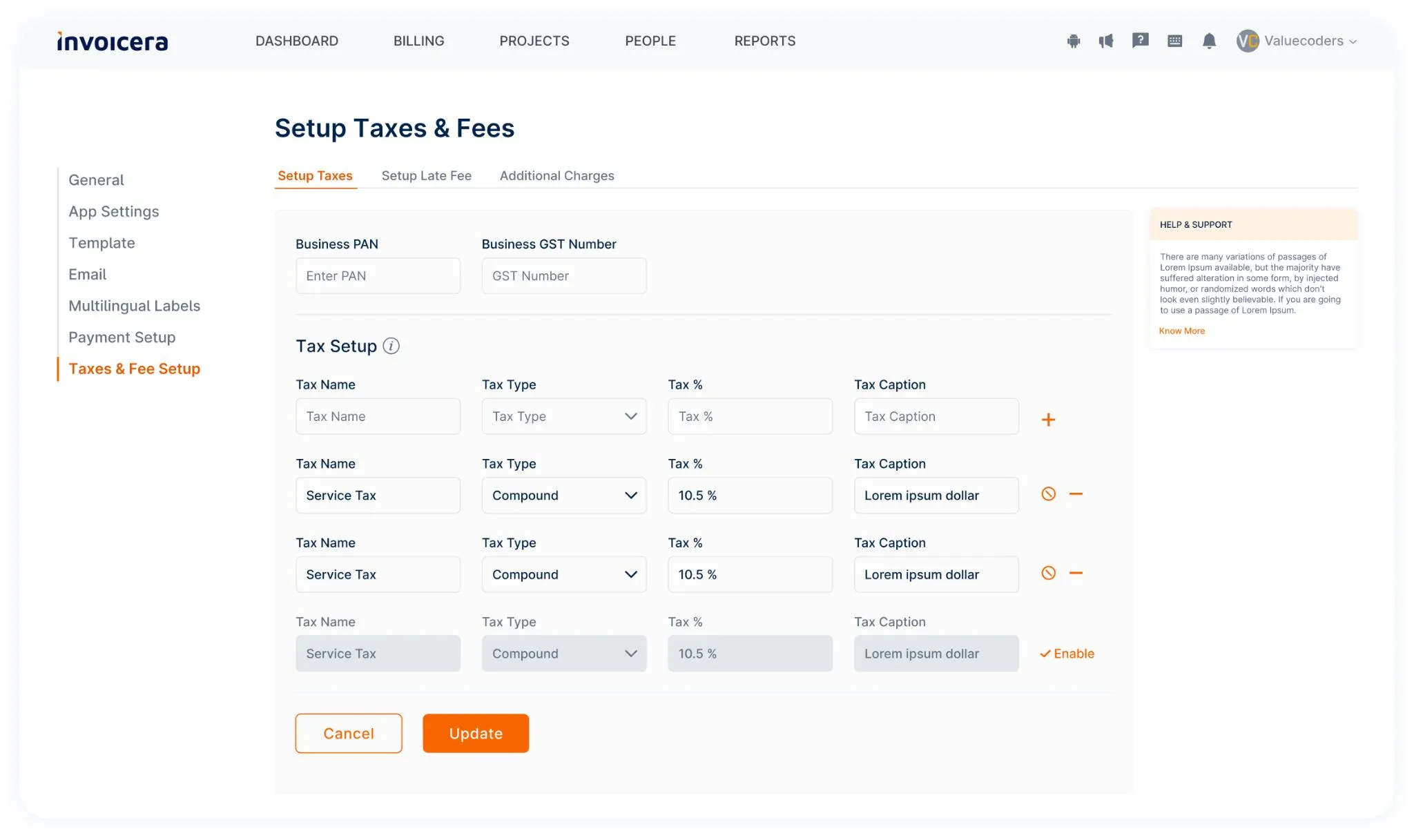

5. Does it offer customization options for invoices?

Customization allows you to personalize invoices with your brand logo, colors, and specific details. This branding can leave a professional impression on clients.

Invoicera provides customization options, enabling businesses to create professional-looking invoices tailored to their brand identity.

6. What integration options does it provide?

Choosing invoicing software that integrates seamlessly with your business’s other tools is crucial for efficient operations. Look for software that offers a range of integration options, such as linking with accounting software, payment gateways, or CRM systems.

By having integration capabilities, you ensure that data can flow smoothly between different platforms, reducing manual entry and the chances of errors.

For instance, Invoicera integrates with various popular platforms, including QuickBooks, and PayPal, streamlining your invoicing process and centralizing your business operations.

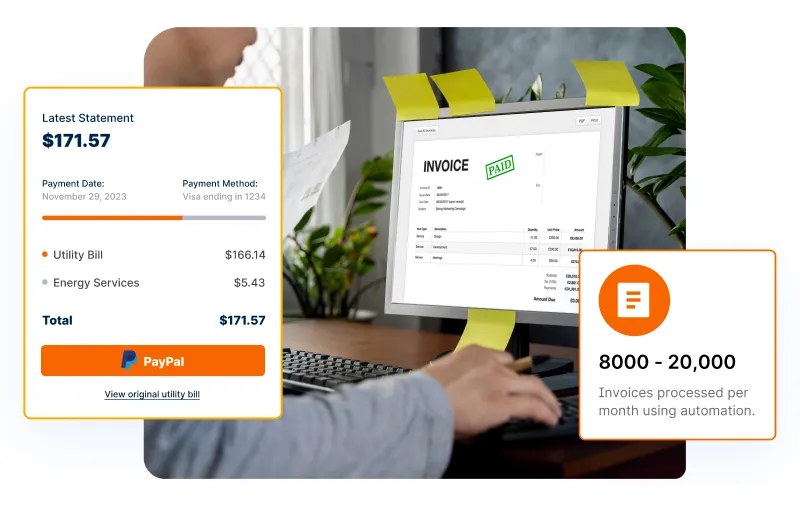

7. How does it handle automated invoicing and reminders?

7. How does it handle automated invoicing and reminders?

A good invoicing software simplifies your workload by automating recurring invoices and reminders for due payments. This feature saves time, ensures timely invoicing, and improves cash flow.

Invoicera, for example, excels in automating invoicing schedules and sending reminders to clients for overdue payments. Its automated features reduce manual follow-ups, helping you maintain a steady income flow without the hassle of constant monitoring.

8. What security measures are in place to safeguard data?

Prioritize security as a key consideration when selecting invoicing software, particularly when handling sensitive financial information. Look for software that employs robust security measures like data encryption, regular backups, and secure servers.

Invoicera prioritizes data security by using advanced encryption protocols to safeguard your information.

It follows security practices accepted across industries, safeguarding your financial data from unauthorized access to maintain confidentiality.

9. Is the software compliant with relevant regulations?

Compliance with regulations is non-negotiable, especially in handling financial transactions. Ensure the invoicing software you choose complies with relevant industry regulations and standards. This includes adherence to tax regulations, invoicing standards, and data protection laws.

Invoicera aligns with global invoicing and taxation standards, ensuring your invoicing practices meet legal requirements worldwide and providing peace of mind.

10. What is the pricing structure, and does it fit my budget?

It’s essential to grasp the invoicing software’s pricing structure. Evaluate whether the software offers a pricing plan that suits your budget and aligns with the value it provides.

Consider factors like subscription plans, additional features, and scalability options.

Invoicera offers flexible pricing plans tailored to different business needs. Its tiered pricing allows businesses to choose plans based on their requirements, ensuring affordability without compromising essential features.

Research And Compare With Other Invoicing Software

When you’re on the hunt for the right invoicing software, doing a bit of detective work can make a huge difference. Here’s how you can smartly research and compare different options:

Where to Look:

- Online Reviews and Comparisons: Websites like Capterra, G2, and TrustRadius offer reviews and side-by-side comparisons from real users. They spill the beans on what works and what doesn’t.

- Social Media and Forums: Check out platforms like Reddit or LinkedIn groups where business owners share their experiences and recommendations.

- Vendor Websites: Visit the websites of software vendors. They often provide detailed information, demo videos, and customer testimonials.

- Ask Around: Don’t hesitate to ask fellow business owners, accountants, or colleagues for their recommendations. Personal experiences can be gold.

How to compare with other software?

- Features Checklist: Make a list of features that matter most to you—things like ease of use, customization, integration with other tools, and automation for recurring invoices.

- Trial Runs: Many software options offer free trials. Take advantage! Test-drive a few options to see which one feels most comfortable and fits your needs.

- Cost Analysis: Pricing structures vary. Compare the initial cost and any hidden fees or additional charges for scaling up your usage.

- Support and Training: Look into what kind of support is offered. Some software comes with excellent customer service and resources for learning how to use it.

- Scalability: Take into account the software’s scalability alongside your business’s growth. You don’t want to switch again in a year because it can’t keep up with your success.

User Feedback: Pay attention to user reviews. They often reveal the real experiences—what’s great and what might be a headache.

How To Make Final Choice On Invoicing Software?

Imagine your business as a puzzle, and this software is a piece that needs to fit just right. Each aspect, from how it looks to how it works, needs to match what your business needs. Rushing this decision might mean missing out on crucial features or ending up with something that doesn’t fit.

Checklist For Choosing Invoicing Software

- Firstly, does it match your business needs in size and type?

- Secondly, consider how easy it is to use and if it can grow alongside your business.

- Thirdly, check if it allows customization to reflect your brand. Next, ensure it integrates smoothly with other tools you use.

- Finally, weigh its security measures, compliance with regulations, and how its pricing fits your budget.

Make a checklist with these questions and go through it carefully. Tick off the ones that the software meets and circle any concerns.

Take your time to weigh the pros and cons.

Conclusion

Remember, it’s not just about finding any software but the one that fits your needs.

Don’t rush this decision. Take your time to compare options, consider what your business truly needs, and weigh the pros and cons.

Ultimately, the right software will make invoicing easier, help you get paid faster, and keep your financial information safe.

So, take a deep breath, trust your research, and make that choice.

Your business will thank you for it.

FAQs

How long does it take to set up and start using new invoicing software?

The setup time varies. Many invoicing tools offer quick setup guides or tutorials to help you get started quickly. Typically, depending on customization needs, it can range from a few minutes to a couple of hours.

Can I access my invoicing data from different devices or locations?

Many online invoicing tools like Invoicera offer cloud-based solutions, allowing access from anywhere with an internet connection. Ensure the software you choose supports multi-device access if that’s important for your business.

What happens if the software doesn’t meet my needs after I’ve started using it?

Many software providers offer trial periods or money-back guarantees. It’s advisable to take advantage of these offers to test the software thoroughly before committing.

How often does the software receive updates or improvements?

Frequent updates can indicate a software’s commitment to improvement. Check the software’s release notes or update history to gauge how often they enhance their product.

7. How does it handle automated invoicing and reminders?

7. How does it handle automated invoicing and reminders?