Research by the Association of Certified Fraud Examiners says that companies lose approximately 5% of their annual revenue to fraud, with expense reimbursement being one of the top areas.

However, adopting modern expense management systems significantly reduces these risks by enforcing policies and providing real-time monitoring.

Imagine Sarah, a sales executive who used to spend hours wrangling with receipts after every business trip.

With the new expense management system, she now simply snaps photos of receipts, tags them accordingly, and submits her expenses in a matter of minutes.

The finance team, with real-time data, promptly processes her claim, ensuring she’s reimbursed faster than ever before.

Ultimately, simplifying employee spending management isn’t just about cutting costs or reducing paperwork. It’s about creating an ecosystem where employees feel supported, productive, and valued.

Thus, we have come up with this blog post that will cover everything about employee spending management.

Let’s dive in.

What Is Employee Spending Management?

Employee spending management refers to the process of overseeing and controlling the expenses incurred by employees while conducting business activities.

It involves tracking, monitoring, and optimizing these expenses to ensure efficiency, accuracy, and compliance with company policies.

Essentially, it’s about managing how employees spend money on behalf of the organization.

Types Of Employee Expenses

- Travel Expenses: Cover costs related to business trips, including airfare, accommodation, meals, and transportation.

- Office Supplies: Expenses for purchasing necessary office items like stationery, equipment, and other supplies.

- Entertainment: Costs incurred while entertaining clients or conducting business-related events.

- Miscellaneous Expenses: Other work-related costs that might not fit into specific categories, such as internet bills for remote work or training materials.

Challenges In Traditional Expense Tracking Methods

Traditional methods of expense tracking often involve manual processes, like paper receipts and spreadsheets, leading to several challenges:

- Errors and Inaccuracies: Manual data entry can result in mistakes and inaccuracies, leading to discrepancies.

- Time-Consuming: It’s a labor-intensive process, consuming valuable time for both employees and finance teams.

- Lack of Visibility: Limited visibility into spending in real-time, making it challenging to control and analyze expenses promptly.

- Compliance Issues: Difficulty in enforcing company spending policies and ensuring adherence.

How Can Expense Management Tools Benefit You?

Expense management tools offer several advantages:

- Automation: Streamline the expense reporting process by automating data entry, reducing errors, and saving time.

- Real-Time Visibility: Gain instant insights into spending patterns and trends, enabling better decision-making.

- Policy Enforcement: Ensure compliance with company spending policies through automated checks and controls.

- Cost Savings: Identify areas for cost optimization and negotiate better deals with vendors.

- Enhanced Efficiency: Free up time for employees and finance teams to focus on more other important tasks.

Different Types Of Employee Expense Management Software

Employee expense management software comes in various formats, each tailored to meet different needs and preferences.

Here are some of the common types:

1. Cloud-Based Expense Tool

These tools operate online, allowing employees to access them from anywhere with an internet connection. They make expense tracking and submission a breeze, often integrating with mobile apps for on-the-go convenience.

2. Mobile Apps

Mobile-centric expense management tools are designed specifically for smartphones. They enable employees to capture receipts, log expenses, and submit reports using their mobile devices. They’re great for those who are constantly on the move.

3. Integrated Corporate Cards

Some expense management systems come with integrated corporate cards. These cards link directly to the software, automatically syncing transactions and simplifying reconciliation processes.

4. Enterprise Resource Planning (ERP) Systems

ERPs often include modules or add-ons for expense management. These systems offer a comprehensive suite of tools, combining expense tracking with other business functions like HR and accounting.

5. AI-Powered Solutions

Cutting-edge software leverages artificial intelligence to streamline expense management. These systems can automate receipt scanning, categorize expenses, and even identify anomalies, saving time and reducing errors.

Each type of expense management software brings its own set of advantages, so choosing the right one depends on the specific needs and workflow of your organization.

Key Tools For Efficient Expense Management

Managing employee expenses is easier when you have the right tools.

From apps to software solutions, these key tools streamline the process, making expense management simpler and more efficient for everyone involved.

Let’s explore some of the top tools that can revolutionize how you handle employee spending.

1. Invoicera

Invoicera is a versatile expense management tool offering comprehensive features to simplify financial processes.

From expense tracking and reporting to invoice generation, this tool provides businesses with a one-stop solution for managing expenses efficiently.

-

Expense Tracking

Invoicera streamlines expense tracking by allowing users to record, categorize, and monitor expenses effortlessly in real-time.

Its user-friendly interface simplifies the process of

– Logging expenses

– Attaching receipts

– Allocating costs to specific projects or clients

-

Customizable Expense Reports

This tool enables the creation of detailed expense reports tailored to your business needs. Users can generate comprehensive reports showcasing expenditure patterns, categories, and trends.

These reports provide invaluable insights for informed decision-making and budget planning.

-

Automated Expense Management

Invoicera automates repetitive expense-related tasks, such as recurring expenses or approvals, reducing manual effort and ensuring accuracy.

Automation optimizes workflows, minimizing errors in expense reporting and reimbursement processes.

-

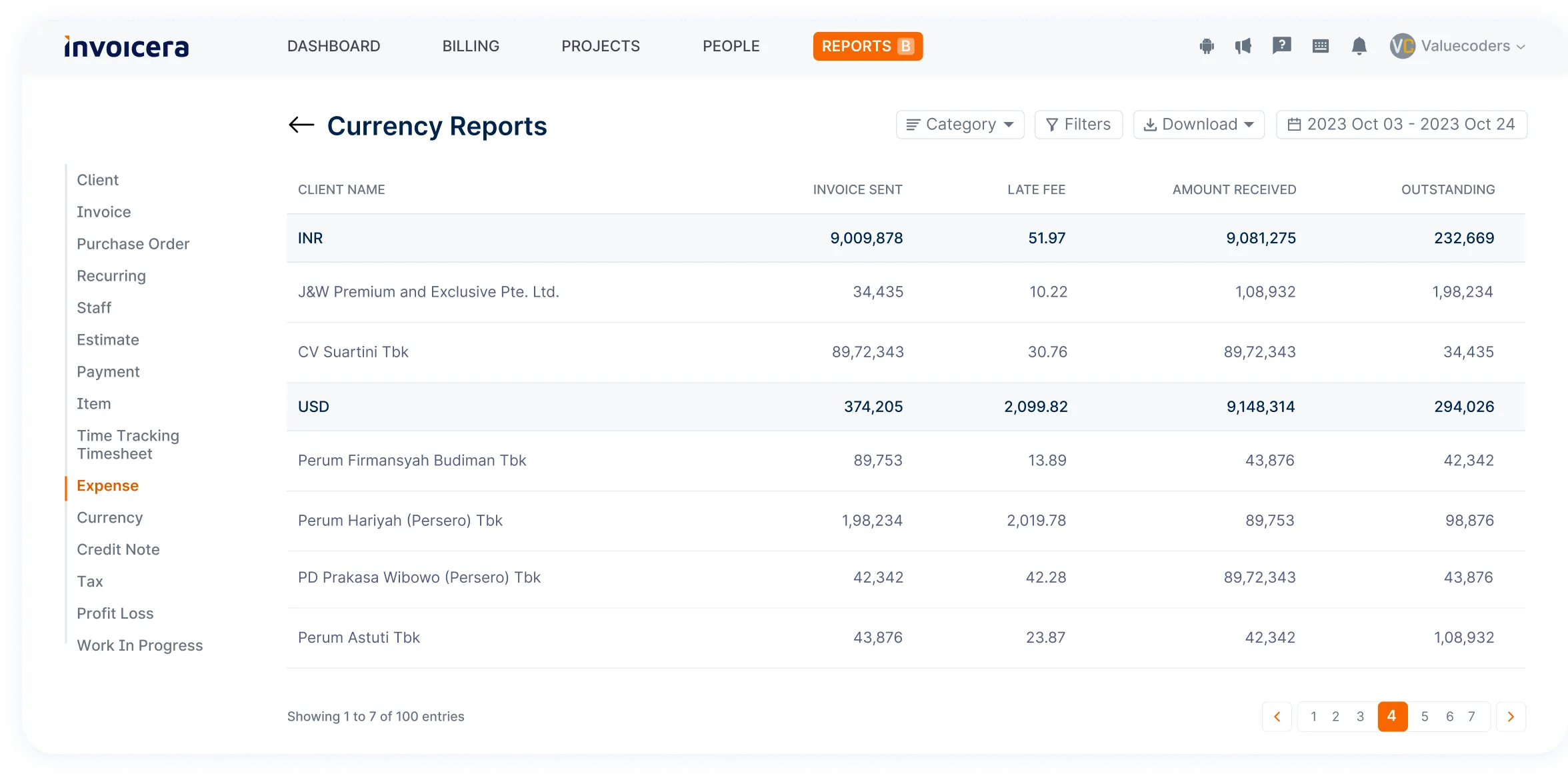

Multi-Currency Support For Expenses

With its multi-currency functionality, Invoicera simplifies international expense management.

Users can effortlessly handle expenses in different currencies and accurately convert and record expenditures, making it an ideal choice for businesses operating globally.

-

Expense Collaboration And Workflow Management

Invoicera supports collaboration among team members, allowing seamless communication and coordination in expense-related tasks.

It facilitates workflow management by assigning roles, responsibilities, and approvals within the expense management process.

Pros

✅ User-Friendly Interface: Its intuitive design makes it easy for beginners and seasoned users alike.

✅ Comprehensive Reporting: Gain deep insights into your finances through detailed reports.

✅ Automation Capabilities: Automate recurring invoices and payments, saving time and reducing errors.

Cons

❌ Customization Limitations: It might have restrictions in certain areas while offering customization.

2. Expensify

Expensify stands out as a handy tool for automating expense and employee management. It’s a user-friendly app for Android and iOS that lets you snap pictures of receipts and handwritten bills from your phone.

With just a click, you can compile and submit expense reports, making things super easy for both employees and the environment.

It offers different plans suitable for businesses of all sizes, though it is best for larger companies.

Features

- SmartScan simplifies receipt tracking and expense management within a single app.

- It integrates seamlessly with ERPs for easy use.

- Provides precise foreign exchange rates for accurate expense tracking

- Detects and prevents duplicate expenses, ensuring accuracy and compliance

Pros

✅ Easy-to-navigate interface

✅ Automatic expense categorization

✅ Reimbursements are sent in direct deposits to the bank account

✅ Mobile app for on-the-go expense management

Cons

❌ Pricing can be expensive for larger organizations

❌ Some users find it challenging to use

❌ Customer service is not satisfactory

3. Zoho

With its user-friendly interface and integration capabilities, Zoho Expense simplifies expense reporting and approval processes.

Features

- Simplifies business travel and automates expense reports

- AI-powered fraud detection for added security

- Automates employee expenses effortlessly

- Syncs credit cards seamlessly with the expense software

- Smooth integration with Zoho’s CRM

- Speedy approval processes

Pros

✅ Enforces policies, customizes reimbursements, and automates workflows

✅ Automatically scans receipts and organizes expenses

✅ Competitive pricing and AI-driven fraud detection for audits

✅ 24/5 support, free onboarding, and an intuitive interactive dashboard

Cons

❌ Compact Expense Reporting

❌ Lengthy Onboarding

❌ Slow Customer Support

❌ Steep Learning Curve

❌ Disconnected Features & Unfriendly UI

4. Spendesk

Spendesk is a spend management platform that combines company cards, expense reimbursements, and invoice processing in one comprehensive tool.

It’s designed to give businesses complete control over their spending and expenses.

Features

- Unlimited virtual cards, users, and subscriptions

- Free setup with no hidden fees

- 7-in-1 platform: cards, invoices, expenses, budgets, approvals, automation, reporting

- Scalable tools for spend management

Pros

✅ Streamlined finance workflow

✅ Accurate revenue reports

✅ Secure virtual cards

✅ Customizable approval flows

✅ Integration with popular accounting systems

✅ Automated receipt collection and reconciliation

✅ Four times faster monthly book processing

Cons

❌ Inconsistent policy workflows

❌ Limited acceptance of card

❌ Errors in auto-scan filling

5. ITILITE

ITILITE is a cloud-based expense management tool that offers various features, including expense tracking, policy enforcement, and analytics.

It caters to businesses looking for a comprehensive solution to control their expenses efficiently.

Features

- Integration with credit cards for seamless transactions

- Automated reminders for timely expense management

- Capability to handle multiple currencies effortlessly

- Mobile app accessibility for on-the-go management

- Intuitive dashboard for easy navigation and overview

- Streamlined approval process workflow for efficient management

Pros

✅ Reduces complexity in travel operations

✅ Convenient for travel business to manage expenses

Cons

❌ Unable to book expenses in an Excel format

How To Choose the Right Expense Management Tool?

- Ease of Use: The tool should be user-friendly. No one wants to spend hours figuring out how to submit an expense report. Look for a tool that’s easy to navigate.

- Mobile Accessibility: Managing expenses on the go is a big plus. Make sure the tool has a mobile app or a responsive mobile site for easy access anytime, anywhere.

- Integration Capabilities: Compatibility with other software your company uses (like accounting or HR system) is vital. An expense tool that integrates seamlessly will save you time and headaches.

- Expense Policy Enforcement: It should support your company’s expense policies. From setting spending limits to non-compliant expenses, the tool should help enforce your rules.

- Receipt Management: It should include features like OCR (optical character recognition) to extract information from receipts easily.

- Reporting and Analytics: Look for a tool that provides insightful reports and analytics. It can help you identify spending trends and make informed decisions.

- Cost and Scalability: Consider the pricing structure. Ensure it matches your budget and offers scalability as your company grows.

- Customer Support: Good customer support is crucial. The tool must have a responsive support team to help with any issues or queries.

Implementing Expense Management Solutions

A. Best Practices For Integration And Onboarding

When integrating expense management solutions into your company, start by understanding your team’s needs.

Look for platforms like Invoicera that align with your workflow and can easily integrate with your existing systems.

It’s essential to choose a solution that’s user-friendly for seamless onboarding. Ensure clear communication about the change, offer training sessions, and provide support for any initial hiccups.

B. Employee Training And Adoption Strategies

To encourage employee buy-in, emphasize the benefits of the new expense management system.

Train your team comprehensively, focusing not just on using the software but also on understanding its advantages.

Consider creating simple guides or hosting interactive sessions to address any concerns. Encouraging feedback during the training phase can help identify and solve potential issues early on.

C. Monitoring And Evaluation Metrics

Tracking the success of your expense management solution is crucial.

Define metrics like time saved on expense reporting, reduction in errors, or improved transparency in spending.

Regularly assess these metrics to gauge the system’s effectiveness and make necessary adjustments.

Gathering feedback from users and analyzing their experiences can provide valuable insights for continuous improvement.

Conclusion

Managing employee expenses doesn’t have to be a headache.

By leveraging modern tools like Invoicera, businesses can streamline the entire process, making it easier for both employees and administrators to handle expenses efficiently.

Incorporating such a tool into your expense management system can revolutionize how your organization handles spending, fostering transparency and accuracy ultimately boosting overall productivity.

Simplify your expense management process today with Invoicera.

FAQs

Is Invoicera suitable for businesses of all sizes?

Whether you’re a small startup or a large enterprise, Invoicera caters to businesses of various sizes. Its scalable features and customizable options make it adaptable to the specific needs and complexities of different organizations.

What are the benefits to the company by simplifying employee spending management?

Simplifying employee spending management can increase efficiency, reduce administrative costs, and help in better decision-making.

It also leads to improved compliance with policies, enhanced employee satisfaction, and a more transparent financial overview for the organization.

Is Invoicera secure for handling sensitive financial data?

Yes, Invoicera employs robust security measures to ensure the safety and confidentiality of financial data.

It uses encryption protocols to secure servers and follows industry-standard security practices to protect user information.