We know you’re already wearing multiple hats as a small business owner, and we also understand your pain of not getting paid on time.

Thus, to ensure that your hard work is promptly rewarded, we’re excited to share 10 valuable tips so that your invoices are always paid on time. All these positive tips will definitely help you with delayed payments while maintaining harmonious and healthy client relationships.

By implementing these quite useful strategies, you can streamline your invoicing process and eventually start receiving prompt payments.

Tips to receive timely payments

There is no single method to follow, but a few tips and tricks to get your invoices paid quicker.

1. Agree on clear and short payment terms.

Invoicera is a solution that makes you punctual when it comes to creating and managing invoices. Using it, you’ll never be late in receiving payments.

2. Send invoices to the right person.

The person you deal with might not be the same person who will pay the invoice. Therefore, you must ensure that you send invoices to both persons, including the authorized one and the other who processes payments. Ask in advance your clients to whom you should send the invoice.

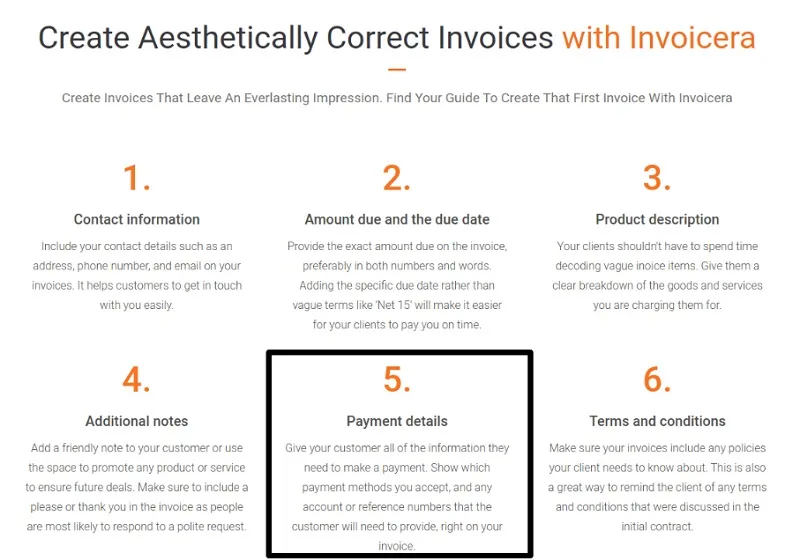

3. Provide easy-to-understand and accurate invoices.

For example, if you need a purchase order from your client, make sure you include it on your invoice. It is important to mention every detail, such as business name, contact, date, bank account, payment terms, policies, etc. in the invoices.

Accuracy is the first-most priority while creating invoices, and Invoicera is the best for creating error-free invoices.

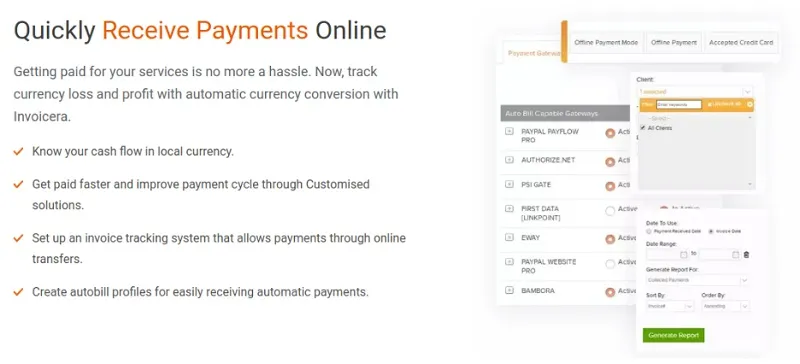

4. Include your bank details or other payment options.

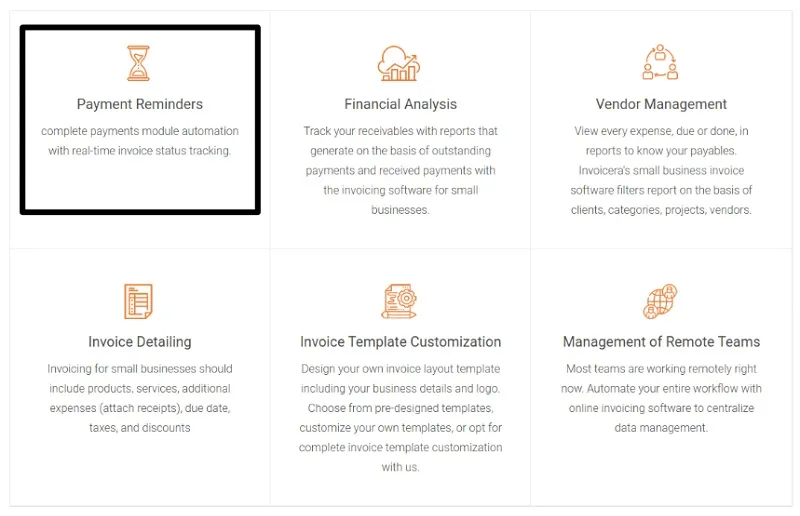

5. Follow up on overdue invoices promptly.

Remain polite to get the invoice paid and maintain healthy relationships with clients. Make sure to get the client’s agreement at the very beginning; then, the terms will be more straightforward, and you can easily follow up with the invoices for each payment later.

6. Add late fees.

Make measures to receive payments early. Inform clients well about your payment policies. Include the terms and conditions in your invoices so your clients have a clear idea about them in their minds. Adding an interest or a late fee on overdue payments makes the invoice paid before the deadline. Let the client understand properly and pay accordingly. Be diligent about collecting cash; allowing clients more than 30 days to get invoices paid can seriously affect the cash flow.

7. Offer early payment discounts.

Providing a client discount can be good, but make it clear what’s more valuable. Ultimately, if you offer payment discounts, it is slightly less than the full payment. Determine if your profit margin allows for a discount. Review all your finances to ensure that you can afford to offer discounts.

8. Have transparent communications.

You can create a professional invoice including all the required details using an invoicing tool like Invoicera.

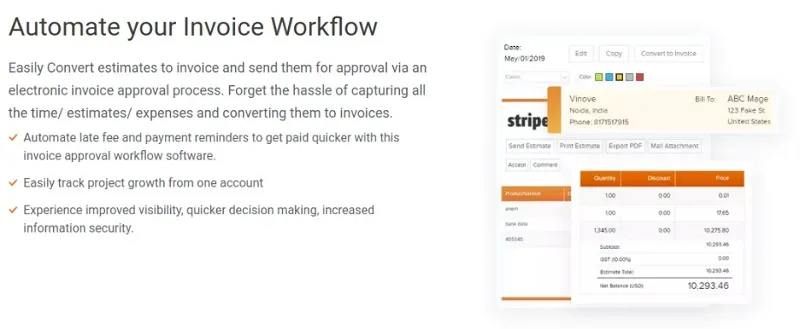

9. Automate the invoicing process.

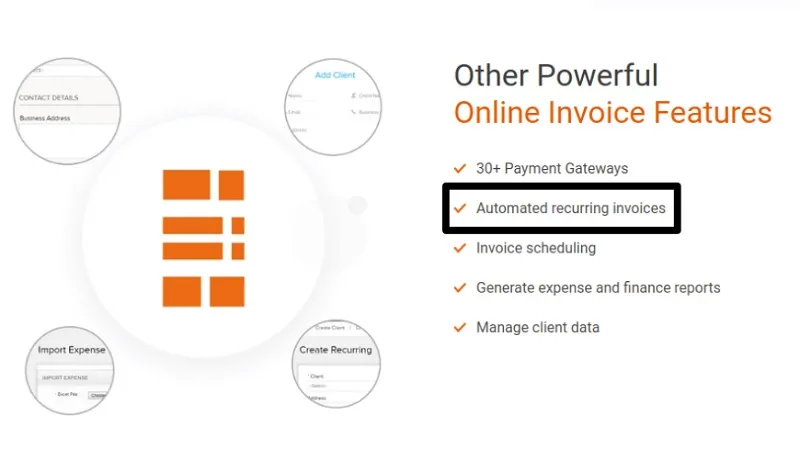

10. Switch to recurring billing.

The recurring invoices feature in a billing tool like Invoicera helps a business with easier forecasting of revenue in the coming months. Recurring profiles help improve the business’s revenue as it improves the regularity of the business. Adding automatic payment reminders to recurring invoices is valuable for getting invoices paid on time. Recurring profiles help improve the business’s revenue as it improves the regularity of the business.

According to Chaser’s late payments report, 9 out of 10 businesses found that their invoices are getting paid after the due date.

The actionable tips above can rank yourself out of the 9 businesses and help you establish a strong foundation for your business. However, if it’s not working manually, you can try Invoicera to boost your cash flow.

Invoicera is the solution.

Conclusion

A drift to an online invoicing system makes your entire process of creating invoices and receiving payments smoother. It enhances your chances of achieving the set goals well in time. Therefore, it becomes of utmost importance to fully use the power of online invoicing.

An online invoicing software like Invoicera not only helps you to make recurring tasks easier but also makes payments faster, manages subscriptions, and ensures accuracy.

Getting paid is no longer a hassle; use the above-mentioned tips to keep your cash flow rolling. Try to leverage online invoicing tools to make it easy for clients to pay you quickly. Then only you can focus on the other priority work rather than wasting time to tracking an unpaid invoice!

FAQs

Q: Why is it important to get invoices paid on time?

Timely payments help to maintain financial stability, healthy cash flow, strong client relationships, and business growth. Moreover, prompt payments could make businesses rely on their clients and foster trust.

Q: How can I encourage customers to pay their invoices on time?

The above-mentioned tips could be highly beneficial in encouraging customers for timely payments. Incentives, discounts, or rewards for early payments could also motivate clients to pay you on time.

Q: How can I make it easier for customers to pay their invoices?

You can offer:

Multiple payment options: These could make clients choose any payment option according to their preferences.

Online Invoicing Portals: Digital systems are more convenient while making payments.

Clear Instructions: Detailed information about the amount, due date, bank account, etc., in invoices, can avoid confusion and delays.