Introduction

So, if you are here, you must be looking for a detailed explanation of how invoice payment works!

Let’s get a little into Invoices.

These are the most crucial aspect of any business transaction and play a big role in getting money into your company. This is where it becomes important to understand the peculiarities of the invoice payment process.

Thus, in this blog post, we will explain the invoice payment details while focusing on the most important components of invoices.

Ready to become an invoice pro? Let’s get started!

What is an invoice?

An invoice can be described as a bill that the seller/supplier prepares for the buyer to tell the amount that the buyer needs to pay for contracted services or products.

The purpose of an invoice is to communicate transactions and facilitate the payment process effectively.

Elements of an invoice

An invoice typically contains several key elements, including:

- Invoice Number: It refers to a number that is specific to an individual invoice and can assist in tracking and documentation.

- Date: The date when the invoice gets issued to the clients

- Billing Details: Vendor name, contact information, and address

- Client Details: Buyer name, contact information, and address

- Description: Detailed information on goods and services provided

- Quantity and Unit Price: Quantity of each item or the rate at which services are rendered

- Subtotal: Total amount before applying any taxes or discounts

- Taxes and Discounts: Any applicable taxes or discounts to the subtotal

- Due Amount: The final amount the client has to pay

The Invoicing Process

1. Offering Products/Services

Understanding that you must provide services on schedule before continuing with the billing procedure is critical. You can be anyone who offers your clients services, whether you are a freelancer, a project manager, or the boss of a minor or colossal organization. Right?

And this could be anything from consulting services to IT projects.

The key is clearly outlining what you have offered, such as description, quantity, or applicable taxes.

2. Generating an Invoice

Once you have provided the products or services, you have to provide your clients with the invoice. This will ensure clarity to the client on how much amount they have to pay you. While generating an invoice, using the right invoice template ensures all essential details—such as client information, payment terms, and due dates—are included.

The important details that your invoice must contain are:

- Your company’s details

- Your client’s details

- The invoice number and date

- The due date

- Services/products offered

- Costs against each service/product

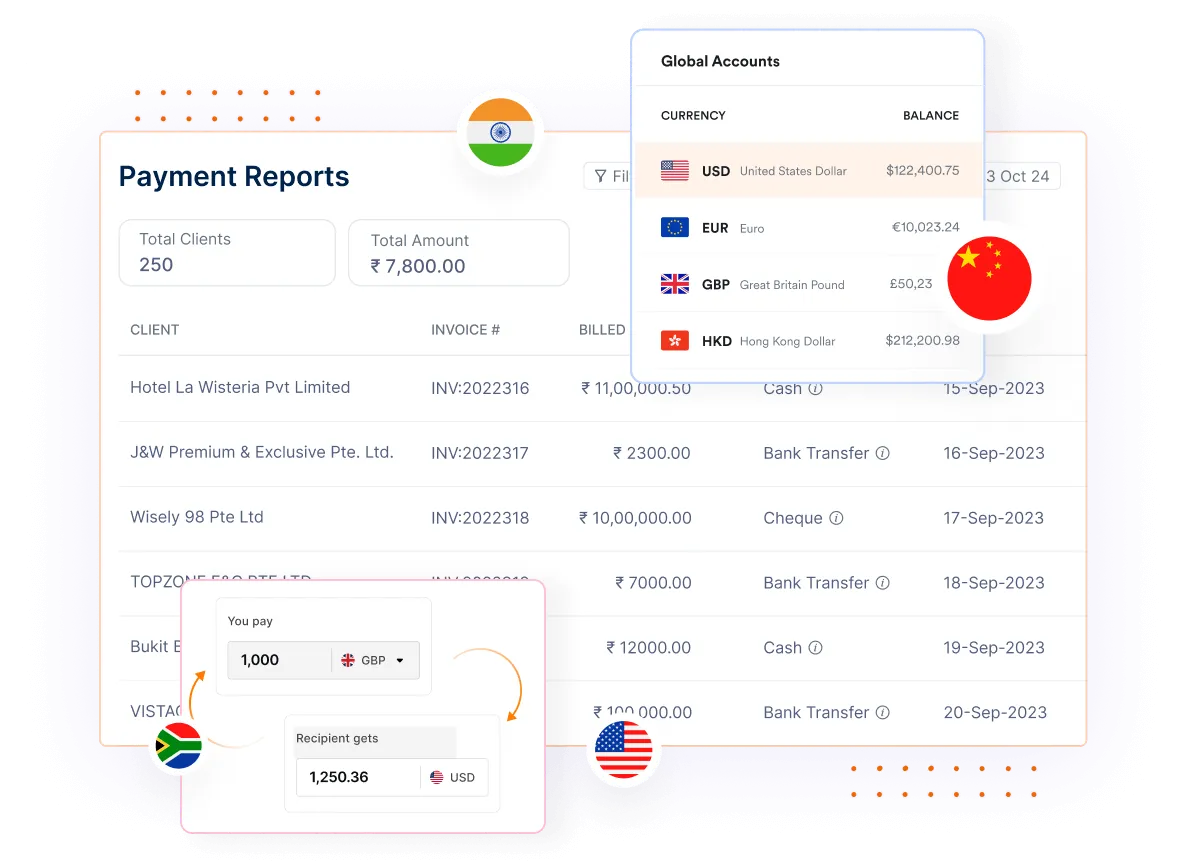

Also, using Invoicera, you can create automated professional invoices without a hustle. The platform offers customizable templates that allow you to include your logo, branding, and all necessary details.

You input the relevant information, and the system automatically calculates the total amount based on the items and their associated costs. Should you need to make any adjustments to your PDF invoice before sending, you can easily edit the file using best PDF editor.

3. Sending the Invoice

3. Sending the Invoice

Once an invoice has been created, the next process is to deliver it to the client. This can be done by using professional email, sending letters, or through an online platform, for instance Invoicera.

You also have to include the payment policies, the payment methods, the frequency that is accepted by clients, and charges for any delayed payments. A big plus of using Invoicera is that you can send bills to customers by email. You can also set up reminders for late payments, so you can contact customers and ask for payment. Moreover, your customers can see their bills and pay easily through the client portal.

4. Payment Confirmation

After receiving the payment, your client thoroughly examines the invoice.

Customers can use any method acceptable to the bank:

- Cheques

- Bank transfers

- Debit or credit cards

- Internet payment system

You must inform your customers that you have received the payment once they have paid.

Invoicera allows you to make your clients pay you through 14+ gateways, thus making it easier for them. Also, it is possible to track the payment status of each invoice.

It provides real-time details on payment initiation and processing to help you effectively manage your company’s financial position.

5. Updating Records

When payments are made, ensure that your records are updated. This includes actions such as checking the invoices as paid and identifying the method of payment made as well as monitoring of balances that are unpaid. It’s important to maintain records for financial reporting purposes and for future reference.

In Invoicera, after the payment confirmation, one can easily identify invoices that were paid.

The platform automatically updates your records and generates reports that provide insights into your business’s financial performance.

6. Receipt and Acknowledgment

It is important to give your client a receipt or acknowledgment of payment after the money has been processed. This proves the transaction was completed and can be useful for both parties’ records.

With Invoicera, you can make and send payment receipts to your customers. You can add your company’s look to the receipts to make them look professional and impressive.

7. Reconciliation

Checking your company’s money at the end of each day is important. This is called reconciliation. It means making sure all money in and out is recorded. Invoicera’s automation helps you reconcile this easily.

There are features to match the issued invoices against the received payments on the platform so that you can easily detect the differences.

8. Resolving Payment Issues

Lastly, it is important to keep in check the unpaid invoices, late payments, and any payment disputes.

You must keep a record of payment disputes with clients, gathering all the necessary information in case they are needed later.

Invoicera has excellent reporting capabilities that can provide you with detailed insights into payment patterns and unpaid invoices. It will easily help you to find out any issue related to payment that you can resolve further.

Conclusion

Every step mentioned in the invoice payment information process must be handled. If you follow the process correctly, it can lead to smoother payments or transactions.

With the powerful tool Invoicera, you can effectively send and track invoice payments while resolving any possible payment issues.

Few Additional Tips

Payment Reminders: You must always set reminders to receive payment promptly. This will help you manage your finances correctly.

Establish Clear Communication Channels: If there are any discrepancies in the invoices or your clients can’t pay you by the due date, you must be clear with them. To prevent disagreements, be sure that you answer every payment-related question in advance.

Regularly Review Payment Processes: Review your payment processes regularly to recognize any inefficiencies or bottlenecks. You can improve these processes over time to improve efficiency and reduce the rate of errors.

FAQs

How can I ensure timely payment from clients?

To get payments on time, you can provide incentives or discounts to the customers who pay on time regularly. Automated reminders can also be useful to remind clients every time their invoice is due.

Lastly, you must add clear payment terms with the late payment fine. You can opt for an invoicing tool like Invoicera to automate all these processes. Even, it gives you regular notifications on the invoice status.

What are the benefits of automating the invoicing process?

Handling invoices through automation leads to reduction of manual errors, enhances payment cycle and provides details on the status of invoices. It also enhances accountability on the financial front while enabling consistency in record-keeping, with little need to manually input data.

Is it necessary to reconcile invoices regularly?

Well, yes, it is important to reconcile invoices on a regular basis in order to keep financial records accurate. It assists you in comprehending any differences between the issued invoices and the received payments hence ensuring that your accounts are balanced.

How do I handle multiple currencies in invoicing?

If you work with clients from other countries, you must go for an invoicing solution like Invoicera. It supports 125+ currencies. It makes it easier and faster to issue invoices, collect payments in different currencies, and manage the exchange rates correctly.

What steps should I take if a client consistently pays late?

In special cases where a client has a regular tendency of paying late, you will have to reconsider payment terms, insist for upfront payments or even strict penalty charges.

3. Sending the Invoice

3. Sending the Invoice