With rapid economic shifts, this year may be ideal for reevaluating your pricing strategy.

Determining when and how to increase your rates can be daunting as a business owner.

You likely already have an established pricing structure but may be unsure how high to raise prices to boost revenue without losing customers. This dilemma leaves many entrepreneurs stuck in analysis paralysis.

If you notice your profit margins shrinking due to increasing costs or competitors implementing higher pricing, it may signal the right time to reevaluate and raise your rates.

But where do you start? How much should you increase prices? And how can you implement changes smoothly?

Did You Know?

Industry leaders adopted a strategic pricing approach in 2024, with a 7% average increase, setting a precedent for others in the market.

This article will determine if a price hike is warranted and what the best practices are for raising rates successfully.

You’ll learn how to analyze your market position, calculate new pricing, phase in changes gradually, and communicate value to retain customers.

With the right tools and strategy, you can consider a price increase this year to improve your bottom line while maintaining great client relationships.

Read on for actionable tips to grow your revenue through strategic pricing adjustments.

Summary

Businesses periodically consider raising their prices. This article guides when and how companies should consider raising their prices. It outlines the following:

- Signs You Should Go For Price Raise This Year

- 5 Simple Steps To Raise Prices

- Tips For Raising Your Prices

- Demonstrate Your Value With Invoicera

- Monitoring and Adjusting Strategies

The article provides a helpful framework for determining if and when price increases may be warranted and best practices for implementing them smoothly.

Signs You Should Go For Price Raise This Year

You should check your prices every year because costs go up over time. You earn less profit if you pay more for supplies and wages. Raising your prices helps cover higher costs.

Also, you can charge more if more customers want your product or service. When you get better at what you do or give customers a better experience, you can ask for higher prices, too.

It might feel weird to raise prices. But keeping old prices when your costs increase or your business improves means you lose money. Checking and changing prices yearly is important so your business grows.

Here are some signs that you should consider for a price raise:

1. Your expenses are going upward

Take a close look at your expenses this year compared to last year.

Are you spending more on raw materials, inventory, shipping, equipment, employee wages, rent, utilities, or other operating costs?

Inflation and rising business costs often mean you must raise your prices to maintain your existing profit margins.

Analyze your accounts and determine where your costs have increased.

Calculate how much price increase you need to cover the higher costs and maintain positive cash flow.

2. Your skills and capabilities get better

Consider new certifications, training programs, or other professional development you have undertaken in the past year. Reflect on new skills, knowledge, and experience from recent projects and clients.

With expanded expertise and capabilities, you can deliver greater value to customers.

Determine how your new abilities can be applied to give clients better results and a competitive advantage.

Then, raise your prices accordingly to account for the increased value you now offer properly.

3. If you have limited capacity to take on new clients

Look at your current workload and schedule. Your availability is capped if you are fully booked for the foreseeable future.

You can reduce the number of new clients you need to take on by raising rates.

This frees up time and mental bandwidth to concentrate on delivering excellent service to your existing customers.

Also, higher prices will attract clients willing to pay more for quality. You can work with fewer, better-paying customers.

4. If you upgraded the client experience

Review recent improvements you made to interactions with customers, your offerings, level of service, speed of delivery, communication channels, or other aspects of the client experience.

Enhancements like these increase the overall value clients receive. Customers will recognize and appreciate professional, polished, and convenient experiences.

Don’t underprice the time and effort required to provide excellent customer service. Adjust pricing to reflect the premium experience properly.

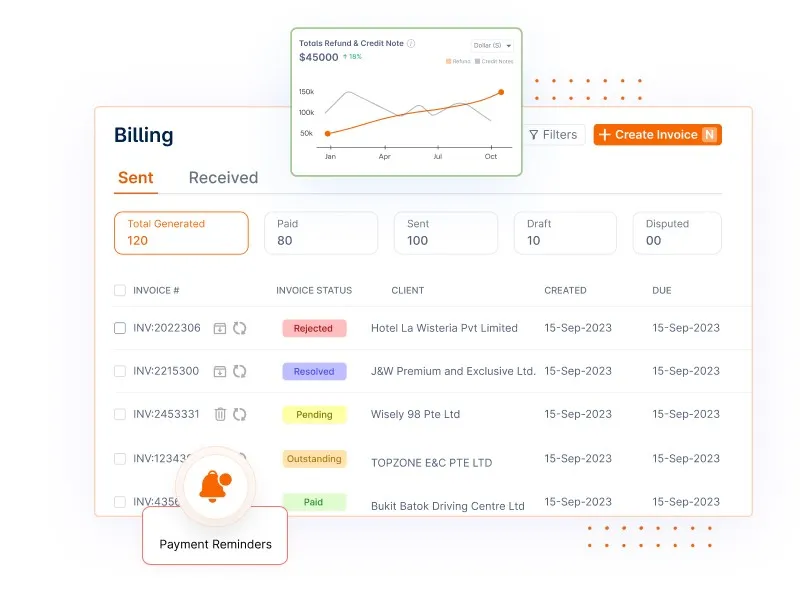

Implementing tools like Invoicera can significantly improve your customers’ billing, transparency, and convenience.

Clients can access billing details 24/7, make secure payments, and download files all in one place. This centralized portal delivers an elevated experience that saves time and frustration.

5. If your business growth plans require investment

If you intend to expand your business substantially this year through hiring, new locations, upgraded systems, more advertising, etc., you will need additional revenue to fund investments.

Before spending more, ensure you are charging enough to support expansion plans. Estimate costs of growth plans.

Then, raise prices sufficiently to generate the extra capital you need to scale the business successfully.

5 Simple Steps To Raise Prices

If you want to increase your prices this year, begin preparing to do it smoothly. Give yourself sufficient time to take the right steps to make and communicate the changes.

Follow the below steps to raise your prices smartly:

1. Analyze Your Market

Analyzing your market is a key first step when preparing to raise prices.

Do thorough research on the pricing of your major competitors by looking at their websites and marketing materials and speaking with contacts at other companies to get insights.

Look for trends in price increases within your industry and specific tiers or customer segments.

Understand the competitive landscape and how much room you likely have to adjust your pricing.

2. Define Your Value

You must also define and quantify your unique value proposition. Make a detailed list of what distinguishes your business, products, and services.

Identify the specific needs you meet for customers that competitors do not.

Review testimonials and feedback to articulate your competitive advantage.

Craft a compelling message that communicates the tangible value customers receive from you.

3. Set Strategic Goals

Setting strategic pricing goals is crucial before calculating new rates. Get very clear on what you hope to accomplish with the pricing change.

Do you need to maintain profitability with rising costs? Want to maximize revenue? Limit growth? Discourage low-value customers?

Set specific objectives such as “Boost profit by 15% this year” or “Increase customer volume by 21%.”

4. Calculate New Rates

Once you analyze the market, define your value, and set strategic goals, you can do the math to calculate optimal new rates.

Look at your costs, competitors’ pricing, and your own objectives.

Model different pricing scenarios and profitability projections. Test alternative packages and tiered structures.

Determine dollar amounts and percentages to increase rates across your offerings. Define the new pricing for all products and services.

Look at your costs, competitors’ pricing, and your own objectives.

You can manage and track expenses with Invoicera to clearly see your cost structures and how much revenue is needed to maintain profitability.

The expense tracking capabilities in Invoicera give you visibility into what you spend on things like subscriptions, payroll, and other operating costs.

It makes it easy to identify where your expenses have increased and by how much.

With these insights, you can accurately determine the price adjustments needed to maintain strong profit margins in light of rising business costs.

5. Communicate the Changes

The last critical step is communicating changes to customers clearly. Notify existing clients about new pricing well in advance – 1-3 months before implementation.

Explain in detail why it is happening and the additional value received.

Carefully manage any objections and be as accommodating as possible.

Offer incentives like discounts for loyal customers to retain their business.

Tips For Raising Your Prices

Here are some major tips that may help you when you are raising your prices.

- Explain the Value: Make sure your customers understand the value they get. If you’ve improved your product or service, let them know how it benefits them.

- Communicate Clearly: Be open and honest about the price increase. Clearly explain the reasons behind it, such as rising costs or improvements to your offerings.

- Give Advance Notice: Tell your customers about the upcoming price change. This gives them time to adjust and shows respect for their loyalty.

- Offer Alternatives: Provide different pricing options or packages to cater to varying budgets. This can help retain customers who may be sensitive to price changes.

- Highlight Added Value: Emphasize any additional features, services, or improvements with the price increase. Show customers they are getting more for their money.

- Reward Loyalty: Consider offering discounts or special deals to existing customers loyal to your business. This can soften the impact of the price increase.

- Monitor Competitor Prices: Monitor what your competitors are charging. If they are raising prices too, it may be more acceptable to your customers.

Demonstrate Your Value With Invoicera

When raising your rates, showcasing the value customers receive is important to justify the increase.

Invoicera has several features that help illustrate the benefits you provide clients. These include:

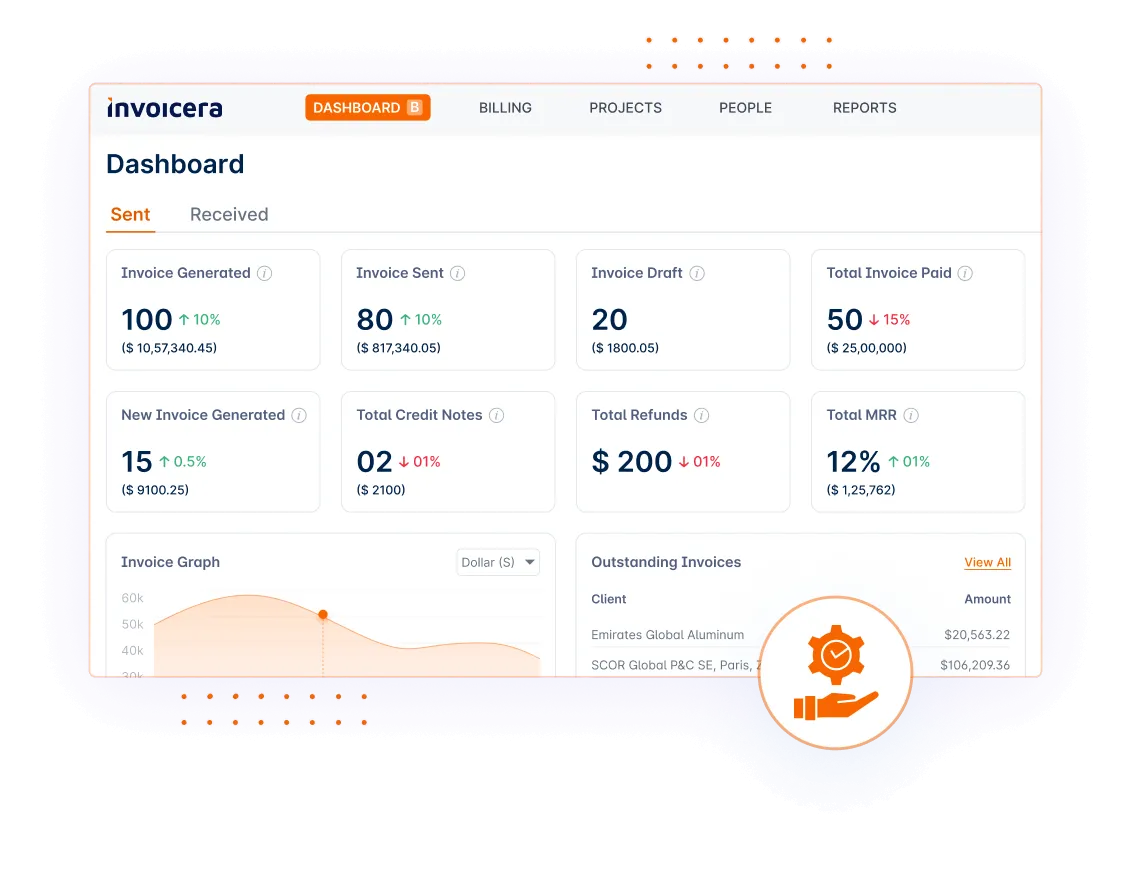

1. Financial Management

Invoicera’s financial tools, like estimates, invoices, and payments, give customers transparency into project budgets and costs.

It shows you manage finances responsibly.

2. Cashflow Management

Automatic payment reminders and tracking in Invoicera improve clients’ cash flow.

On-time payments mean less financial stress for customers.

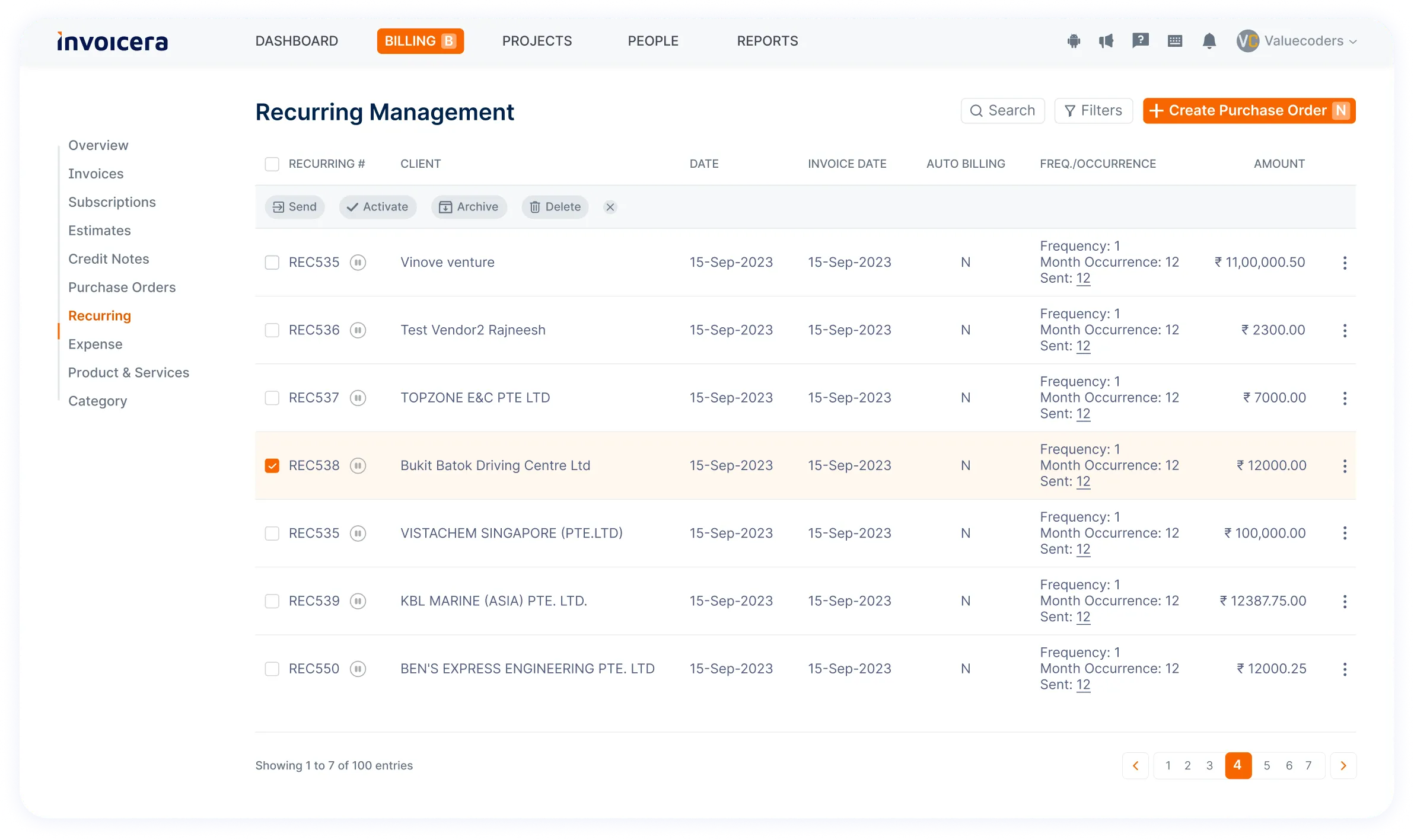

3. Recurring Billing

Options for recurring billing and subscriptions simplify payments for regular clients.

It saves them time and hassle.

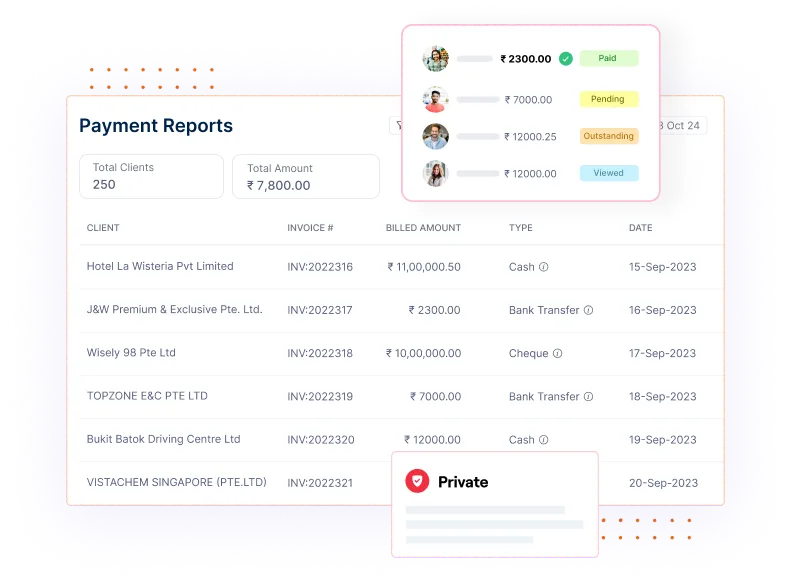

4. Reporting & Analytics

Reports on client projects quantify metrics like costs, timelines, and ROI.

This data demonstrates you complete work efficiently.

Monitoring and Adjusting Strategies

Here are some strategies to follow while raising prices:

1. Check Your Plans

Regularly review your business plans and strategies to ensure they align with your goals.

Look at key performance indicators (KPIs) such as:

- Sales

- Expenses

- Customer satisfaction

If you notice any deviations or areas for improvement, be open to adjusting your plans for better outcomes.

2. Listen to Customers

Paying attention to customer feedback is crucial. Customers often provide valuable insights into their preferences and needs.

By actively listening to their feedback, you can identify areas where your services or products can be improved to foster customer loyalty and satisfaction.

3. Real-Time Payment Tracking

Real-time payment tracking tools, like Invoicera, allow you to stay informed about the financial health of your organization.

You can manage cash flow efficiently by monitoring payments as they come in, sending timely reminders for due payments, and making informed decisions based on your current financial status.

4. Be Ready to Change

Flexibility is key in business. If market conditions, customer preferences, or external factors shift, be prepared to adapt.

A willingness to change allows your business to stay responsive, agile, and better positioned to overcome challenges or capitalize on new opportunities.

Embrace change as a natural part of growth and improvement.

Compliance with Consumer Protection Laws

Companies must follow laws that protect consumers. These laws say companies can’t lie or trick people about their products.

Companies must be honest about what their products do.

They can’t leave out important facts that people need to know. If a product is dangerous, the company must warn people. Companies can’t charge too much for things.

They have to follow the rules on fair pricing. If they break these laws, they can be punished with fines or not allowed to sell their products.

Following consumer protection laws builds trust with customers. It helps ensure companies sell good and safe products at fair prices.

Closing Thoughts

As we’ve seen, with high inflation and rising costs, many businesses will need to raise prices in 2024 to maintain profits. But simply raising prices across the board can backfire.

A better approach is to raise prices selectively and strategically. This starts with analyzing your costs and competitive landscape.

Look for areas where you can cut costs before considering price hikes. When you raise prices, do so modestly on your most in-demand and premium products and services. Avoid steep price hikes that could shock customers.

Communicate changes early and frame them as needed to maintain quality and service. Implement targeted promotions to soften the impact on loyal customers.

With careful analysis and strategic execution, price increases can be managed successfully, even in challenging economic times.

The key is keeping the customer’s experience and perspective in mind.

FAQs

Ques: What types of invoices can I create with Invoicera?

Ans: Invoicera provides a complete invoicing solution that lets you create and customize professional invoices, estimates, timesheets, and recurring invoices for your business. It supports all standard invoice types across different industries, including service, product, subscription, and milestone invoices.

Ques: Does Invoicera offer payment processing?

Ans: Yes, Invoicera integrates seamlessly with leading online payment processors such as Stripe, PayPal, Authorize.Net, and Braintree. This allows you to securely accept credit card and online payments for your invoices directly within Invoicera. You can get paid faster without leaving the software.

Ques: Can I track my invoice status in Invoicera?

Ans: Invoicera provides complete visibility into invoice status tracking. You can quickly check the status of invoices as paid, unpaid, partially paid, overdue, and drafts. It even shows a timeline of all payments received for an invoice. Automatic payment reminders are sent for unpaid invoices. It helps you track payments and follow up efficiently.