Managing invoices can sometimes feel a tough task, much like a performance of trust where an error could lead to a complete disaster!

Invoicing is considered an essential need and not a mere want for owners of small and medium enterprises across the United States of America.

Recent statistics reveal that 61% of late invoice payments in the U.S. are due to manual processing errors, highlighting the critical need for efficient invoicing solutions.

Manual errors, missed payments, and clunky systems are all too common headaches that no one has time for.

If you are fed up with Excel spreadsheets or if you are facing issues with integrations, this blog will help you get acquainted with the top 10 best invoicing software in the USA. These tools are here to avoid mistakes and keep your business on the right track.

Who knew managing money could be this stress-free?

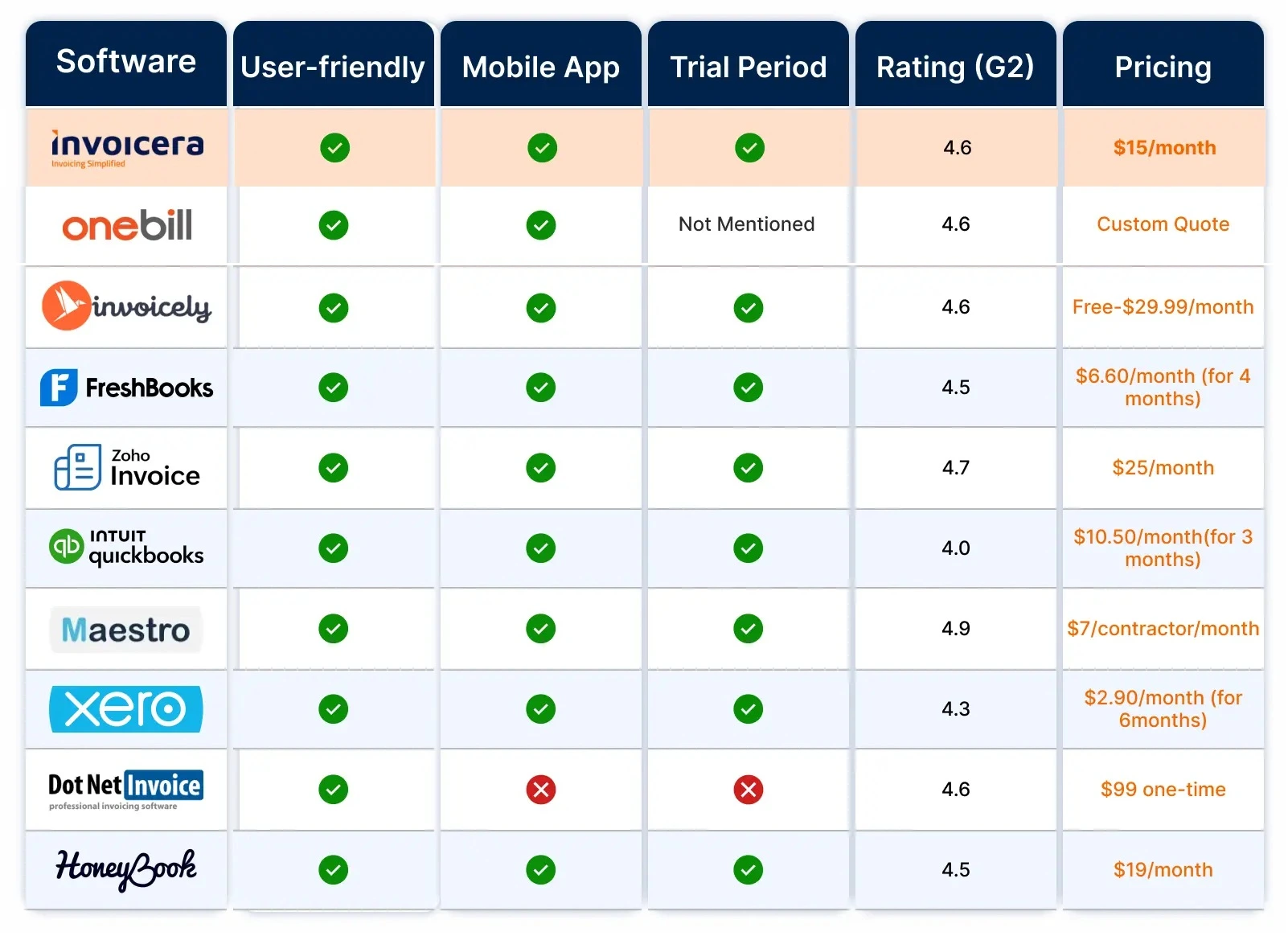

Top 10 Invoicing Software in USA

Let’s have a look at the top billing and invoicing software USA in detail.

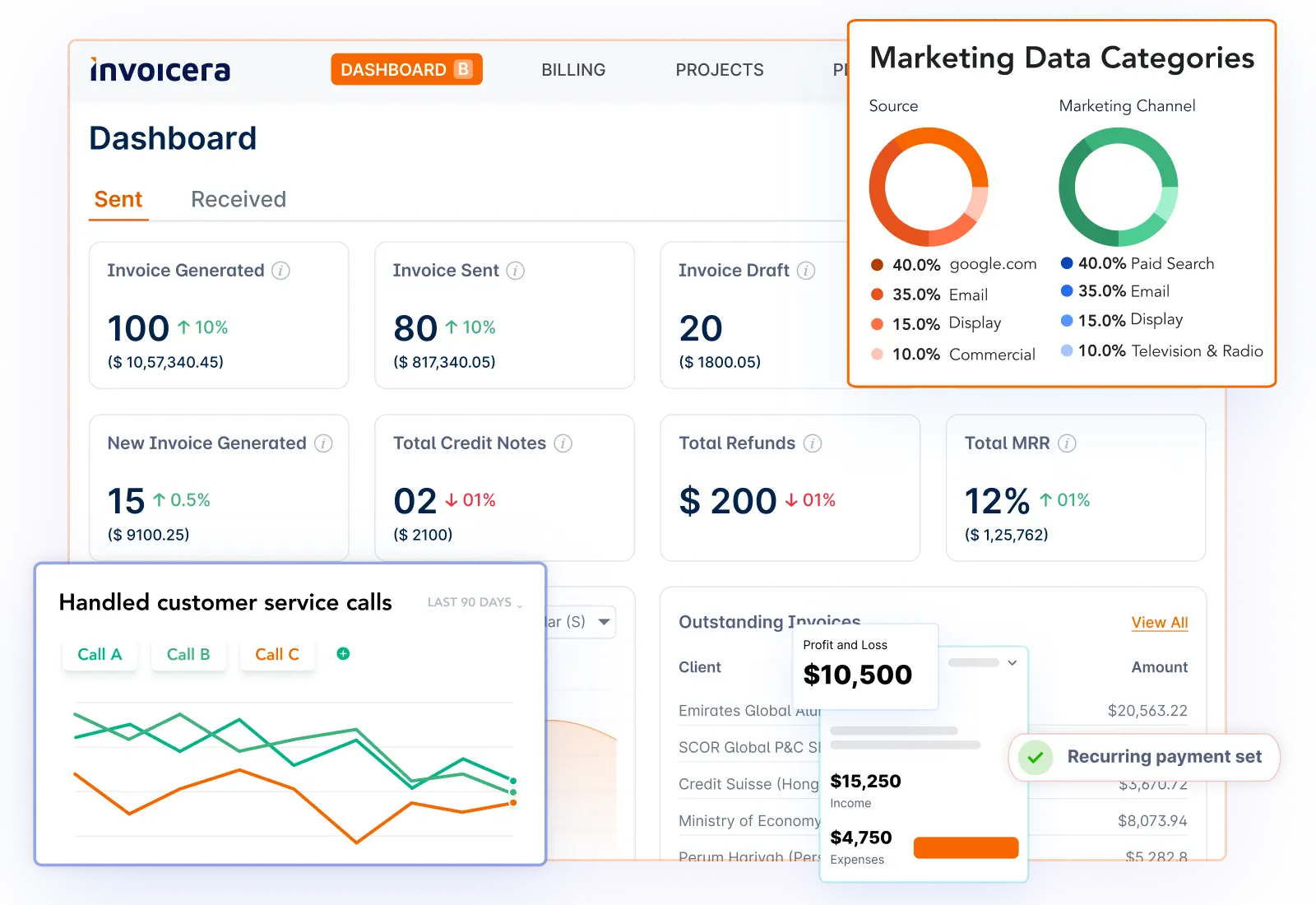

1. Invoicera

It offers significant features compatible with any size of the enterprise and guarantees timely payments with all the necessary tools to support uninterrupted cash flow.

Key Features

Recurring Billing

Create recurring invoices for subscriptions and contracts to avoid manual invoicing and ensure timely payment.

Automated Payment Reminders

Free yourself from the constant pressure of collecting overdue debts. With automated reminders, it becomes easy to have clients pay at the right time.

Detailed Reporting and Analytics

Keep track of revenue, expenses, and outstanding invoices using powerful reports and quickly get an idea of your financial status.

Master Global Payments

Handle all your payments and compliance challenges effortlessly, keeping your transactions smooth and error-free, even across borders.

Multi-Currency Support

Provide and accept payments in multiple currencies, allowing you to survive and thrive in the global economy.

Automated Tax Compliance

Automate your tax calculations and get rid of tiresome manual calculations of taxes and possible legal issues related to regional tax laws.

Late Payment Fees Automation

Optimize due amounts by automatically computation of fine for unpaid dues so as to reduce losses due to late payments.

Estimates and Proposals in One Click

Make professional estimates more rapidly, which will help the clients see the big picture while reducing the time required to seal the deal.

Manage Purchases with Purchase Orders

Track and manage purchase orders effortlessly, keeping your procurement processes organized and hassle-free.

Custom Third-Party Integrations

It can successfully connect with other software and applications you use in your business and improve your business operations.

Real-Time Payment Tracking

Monitor payments in real-time to ensure accurate cash flow reporting and avoid payment disputes with clients.

Multiple Payment Gateways

Provide your clients with multiple payment methods to enable them to conduct transactions easily and safely.

Easy Customer Portal Access

Grant your clients online access to their invoices and payment history. This will increase transparency and speed up the process of support requests.

Pricing

Pricing plans start at $15 per month, offering a free trial and a demo to help you get started with the platform.

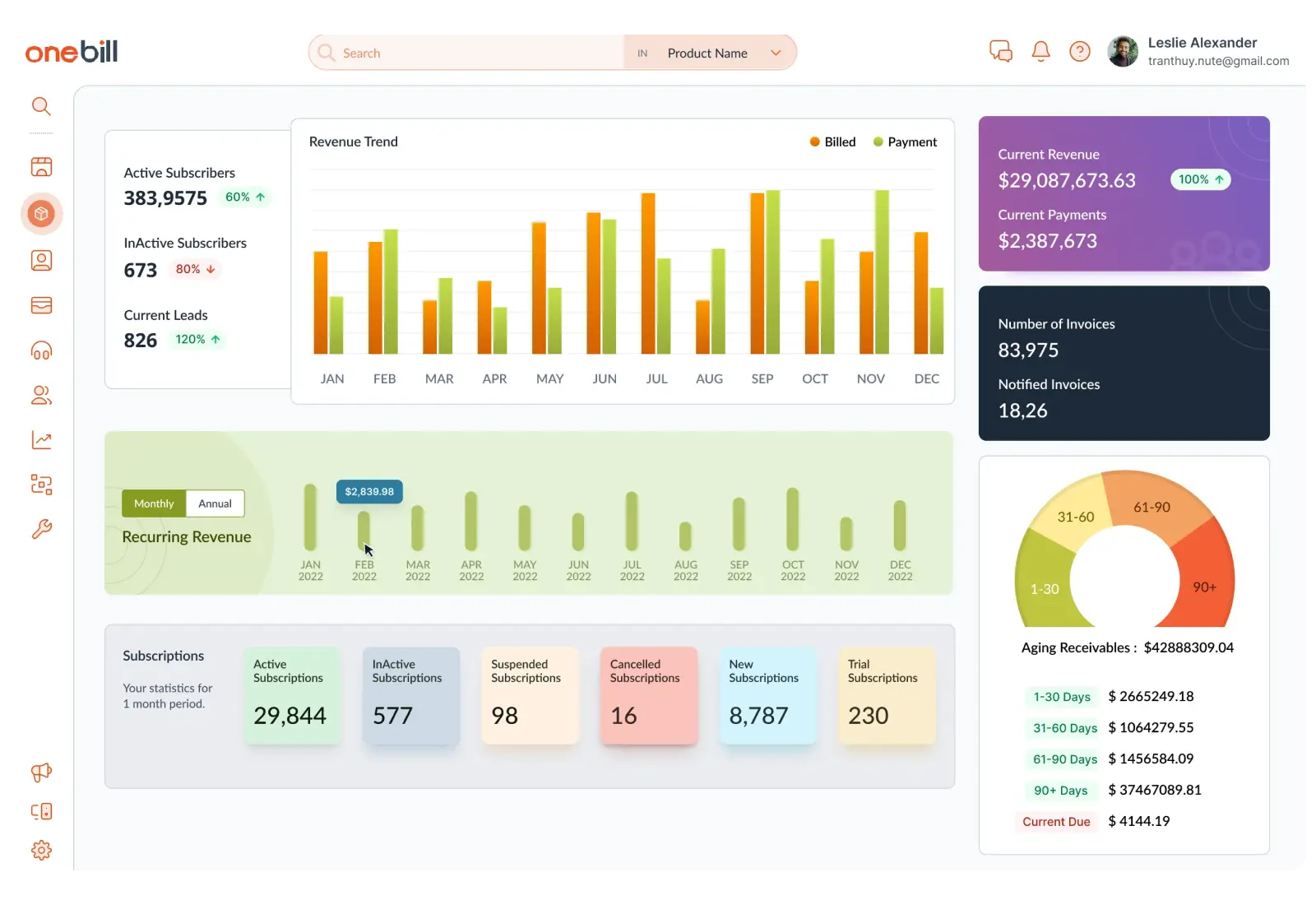

2. OneBill

It offers flexibility with various billing methods and customizable invoice templates to cater to diverse industries, including UCaaS, Telecommunications, SaaS, and IaaS.

From handling one-time billing, multiple billing, dynamic billing, and hybrid billing, OneBill makes invoicing a smooth task.

Key Features

Multiple Billing Methods

You can choose from standard, flex, on-demand, and order-based billing options to match your business needs. This flexibility helps you manage different billing scenarios effortlessly.

Add Discounts and Taxes

Include discounts, run-time charges, and taxes directly in your invoices. This feature saves you time and ensures that all charges are accurately reflected.

Consolidated Billing

Combine charges from multiple vendors or systems into a single bill. This streamlines the process for both you and your customers, reducing confusion and improving clarity.

Brandable Invoice Templates

Personalize your invoices with configurable, brandable, and localizable templates. You can give your business a professional touch while meeting local market needs.

Professional Invoice Design

Choose from pre-designed templates tailored to specific verticals or create your own. This ensures your invoices are both informative and visually appealing, enhancing customer satisfaction.

Self-Service Portal

Give customers the ability to view or download invoices through a self-service portal, adding convenience and transparency to their experience.

Invoice Notifications

Send invoice notifications to one or multiple email addresses on subscriber accounts. This ensures timely communication and improves payment cycles.

Pricing

OneBill offers pricing upon request, tailored to your business’s specific requirements.

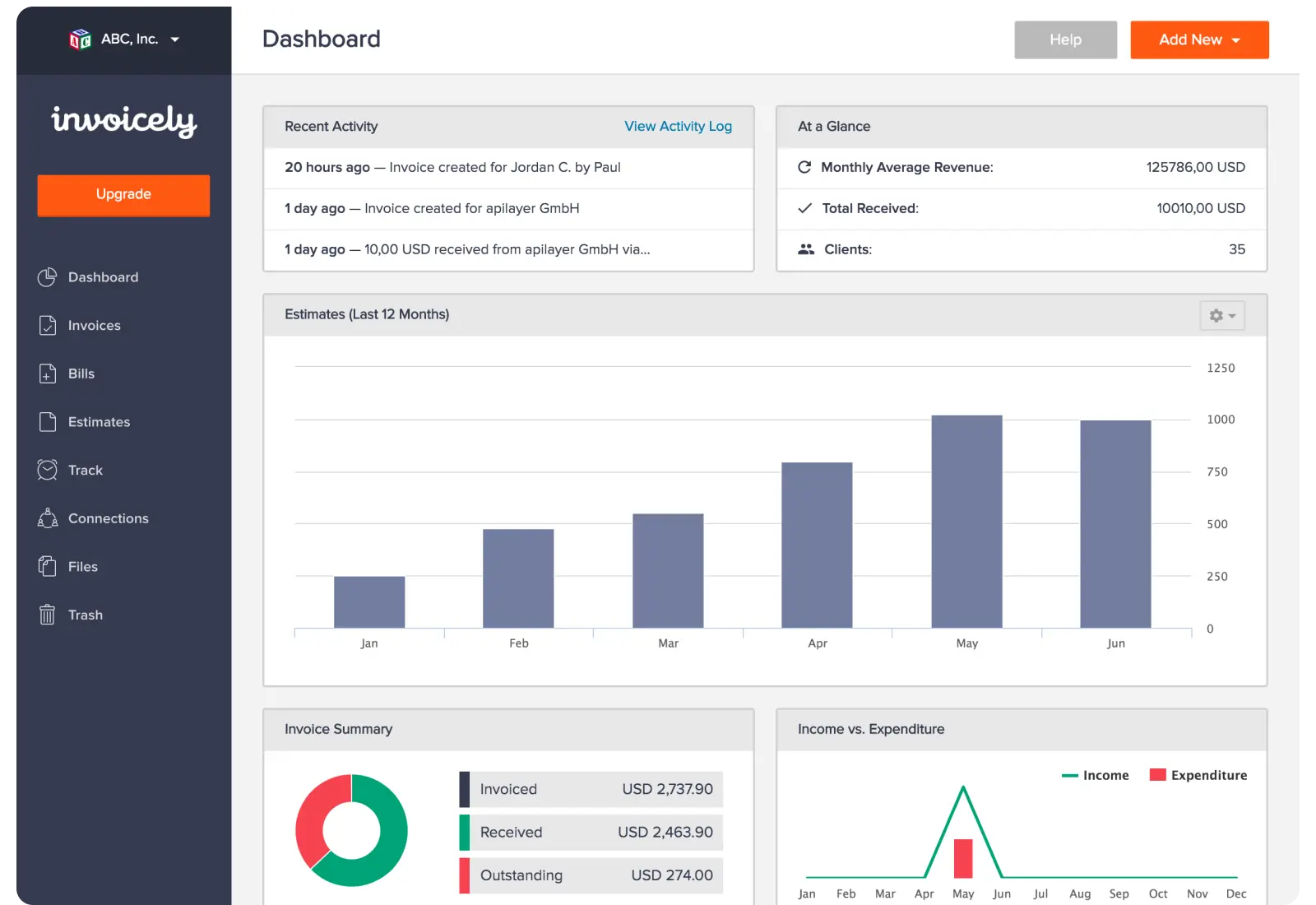

3. Invoicely

It is one of the online invoicing platforms that is easy to use and best of all, it comes at zero cost to users. Every freelancer or business owner should be able to create unlimited invoices, track payments, and manage clients through Invoicely.

Key Features

Effortless Invoicing

It allows you to generate professional and beautiful invoices in any language or currency within seconds. What could be easier than typing a few details and sending the invoice, which needn’t be complicated anymore?

Recurring Invoicing

Save time and boost your cash flow with recurring invoices. Set up automatic payment reminders so you never have to chase a late payment again.

From Estimate to Invoice

Make excellent estimates that your client will definitely agree with, and one click, turn them into an invoice.

Account Statements

Need a summary of your past transactions with a client? Invoicely dynamically generates account statements, which you can view and send at any time. Keeping track of everything has never been simpler.

Invoice Customization

Customize your invoice by incorporating your organizational logo and your preferred color. Ensure your invoices appear professional and in line with your business.

Pricing

Freemium plans are available, with basic versions starting at $9.99/month and going up to the Enterprise Plan, which costs $29.99/month.

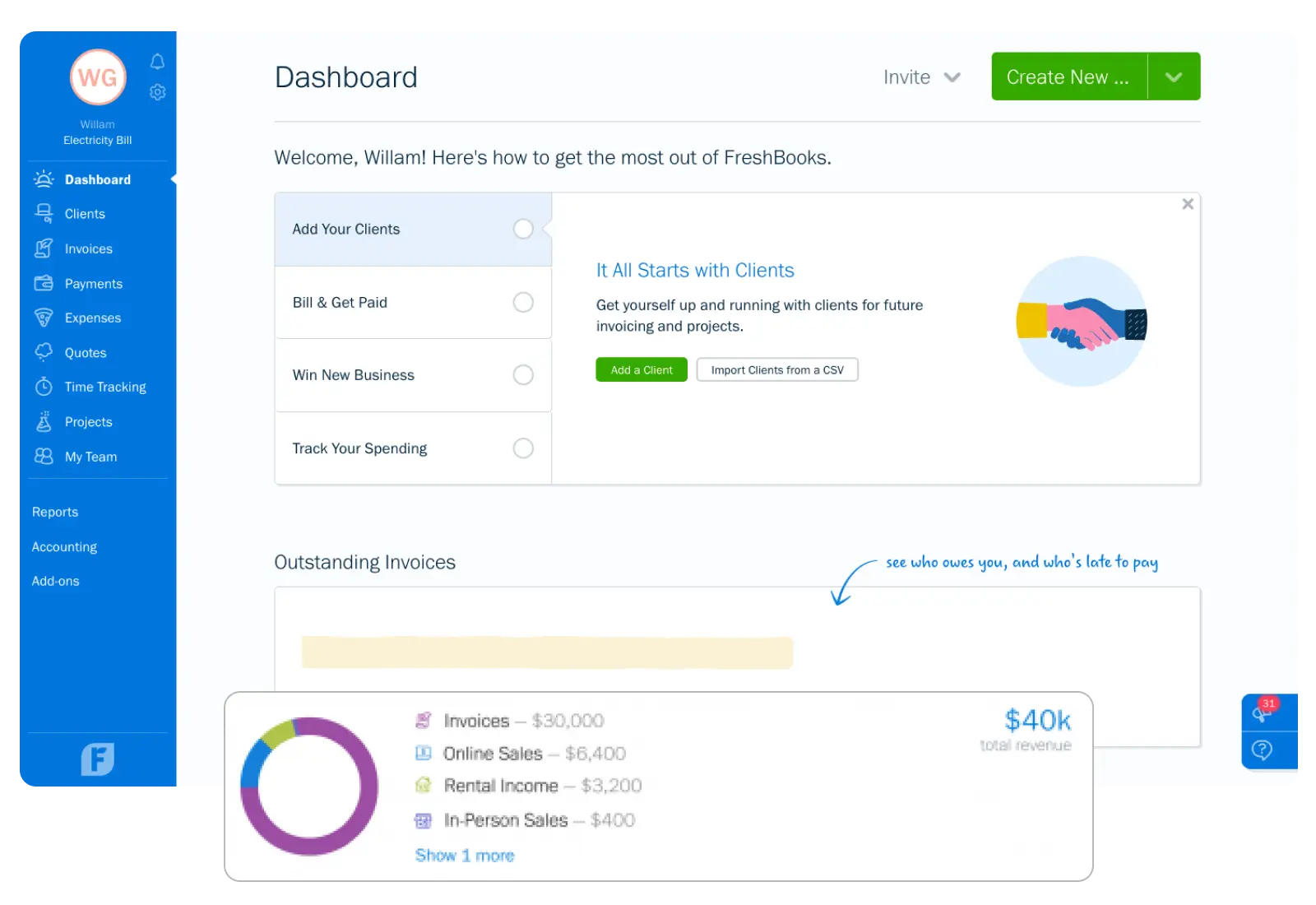

4. Freshbooks

It is a simple yet powerful application used by millions of people to create professional invoices, save time, and avoid mistakes to get paid faster.

Key Features

Create Stunning Invoices

You can create professional invoices, including logos, specific payment terms, and even a thank you note and this will take you only a few seconds.

Automate Your Workflow

Perform functions such as following up on payments or invoicing and spend less time on follow-ups.

Accept Payments Online

The software accepts credit card payments as well as ACH payments, enabling your clients to pay as they wish.

Track Time and Expenses

Include all the tracked time as well as the expenses in your invoices. It makes sure that you are billing only for the hours spent and costs incurred and eliminates situations where one loses money.

Establish Retainers

Negotiate fixed pricing upfront to maintain a stable cash flow. It’s perfect for managing long-term projects with clarity and predictability.

Seamless Integration

It seamlessly connects to other tools for business such as project management and accounting software, and is a tool all in one.

Mobile-Friendly Access

It has a mobile app allowing you to issue invoices and track payments/payments for projects on the move.

Pricing

FreshBooks’s pricing begins at 6.60 USD per month, though, with an ongoing 80% promotion for four months.

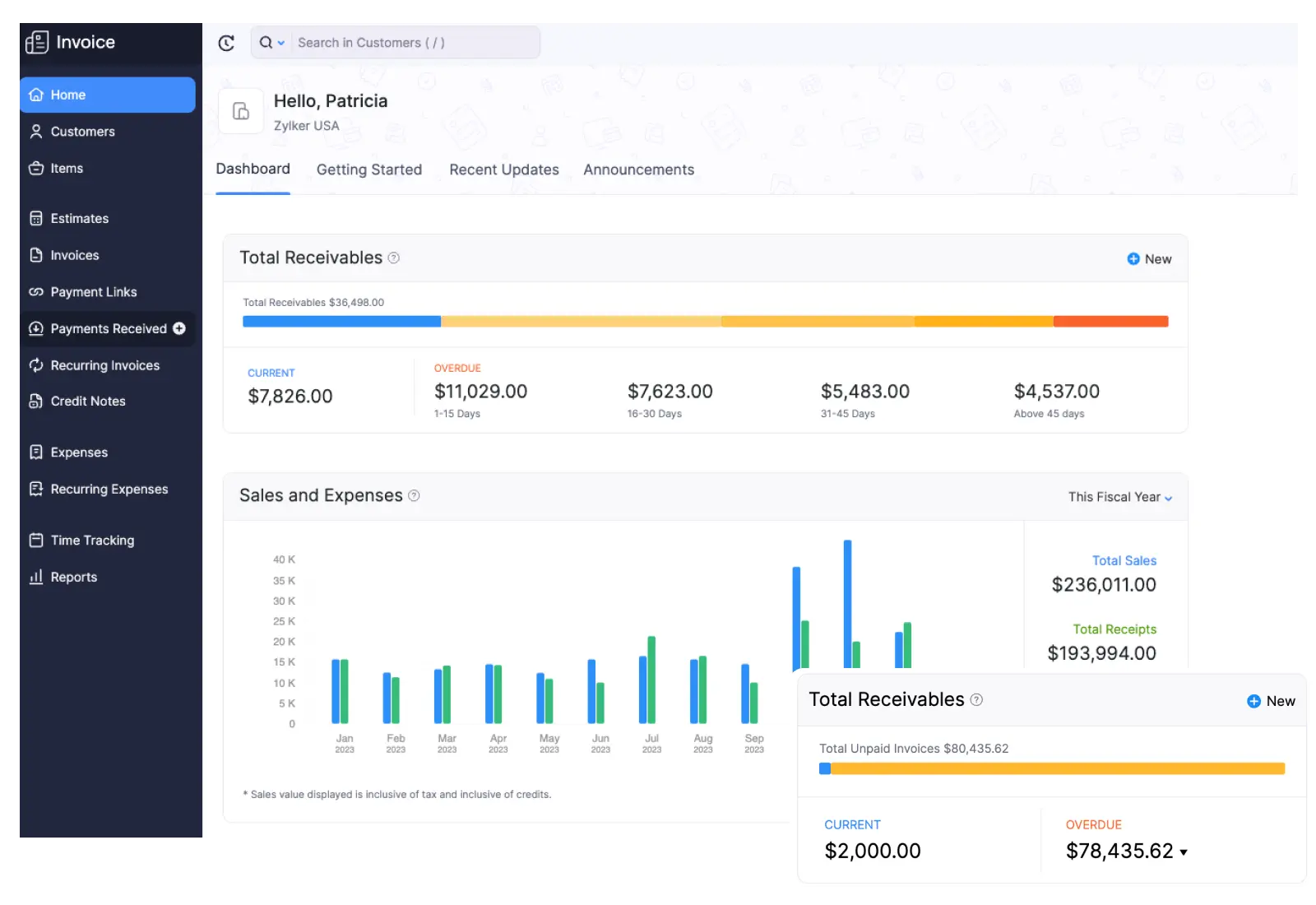

5. Zoho Invoice

Key Features

Create Stunning, Customizable Invoices

Customizable templates enable you to create invoices that have your brand’s appearance. Adjust every detail to feature your own logo, colors, and other peculiarities to make clients remember it.

Multiple Delivery Options

Send invoices directly through email, WhatsApp, SMS, or even as PDFs. This flexibility ensures your invoices reach clients in the most convenient way possible.

Automate Recurring Invoices

Set up recurring invoices for regular clients and let Zoho Invoice handle the rest. With automatic scheduling, you can save time and ensure consistent billing.

Smart Invoice Management

Easily track your invoices with real-time status updates. Use advanced search features to find any invoice by date, number, or payment status in seconds.

Archive and Filter Invoices

Never lose an invoice again! Access archived invoices from weeks or even years ago. Create custom views to filter invoices by status, such as paid, overdue, or written off.

Pricing

Zoho Invoice offers its Standard Plan at $25 per organization per month (billed annually), packed with essential features to support growing businesses.

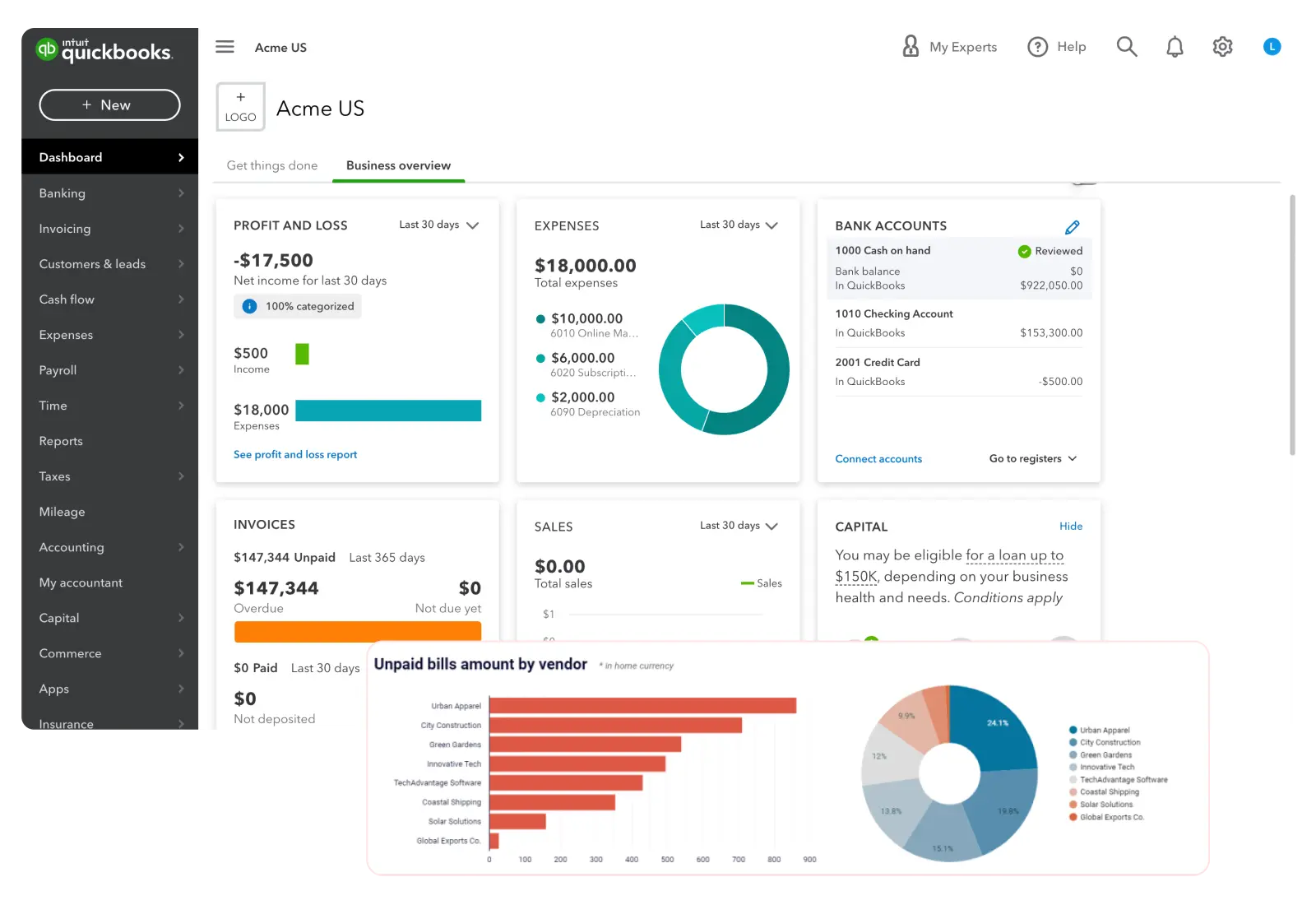

6. Quickbooks

Key Features

Automated Invoicing

Stay under budget with pre-populated invoices and friendly on time reminders. This saves time and makes it easier for QuickBooks to get paid as fast as possible without much paper work.

Customizable Invoices

To ensure that your invoices reflect your company, you can include your company logo, business colors, and custom notes.

Real-Time Alerts

Be notified immediately when invoices are opened, approved, or are due for payment.

Progress Invoicing

Manage projects better by splitting payments into milestones or percentages. This feature helps maintain cash flow throughout the project lifecycle.

Payment Processing

Accept multiple payment methods, including credit cards, ACH, Apple Pay, PayPal, and Venmo, directly through QuickBooks.

Expense Tracking and Reporting

Automatically track expenses, categorize transactions, and generate detailed financial reports to keep your books organized year-round.

Mobile App Access

The QuickBooks mobile app allows you to manage invoices, payments, and reports on the go. It is ideal for business owners who need flexibility.

Pricing

QuickBooks plans start at $10.50/month for the first three months, with advanced plans offering features like inventory management, project profitability, and more.

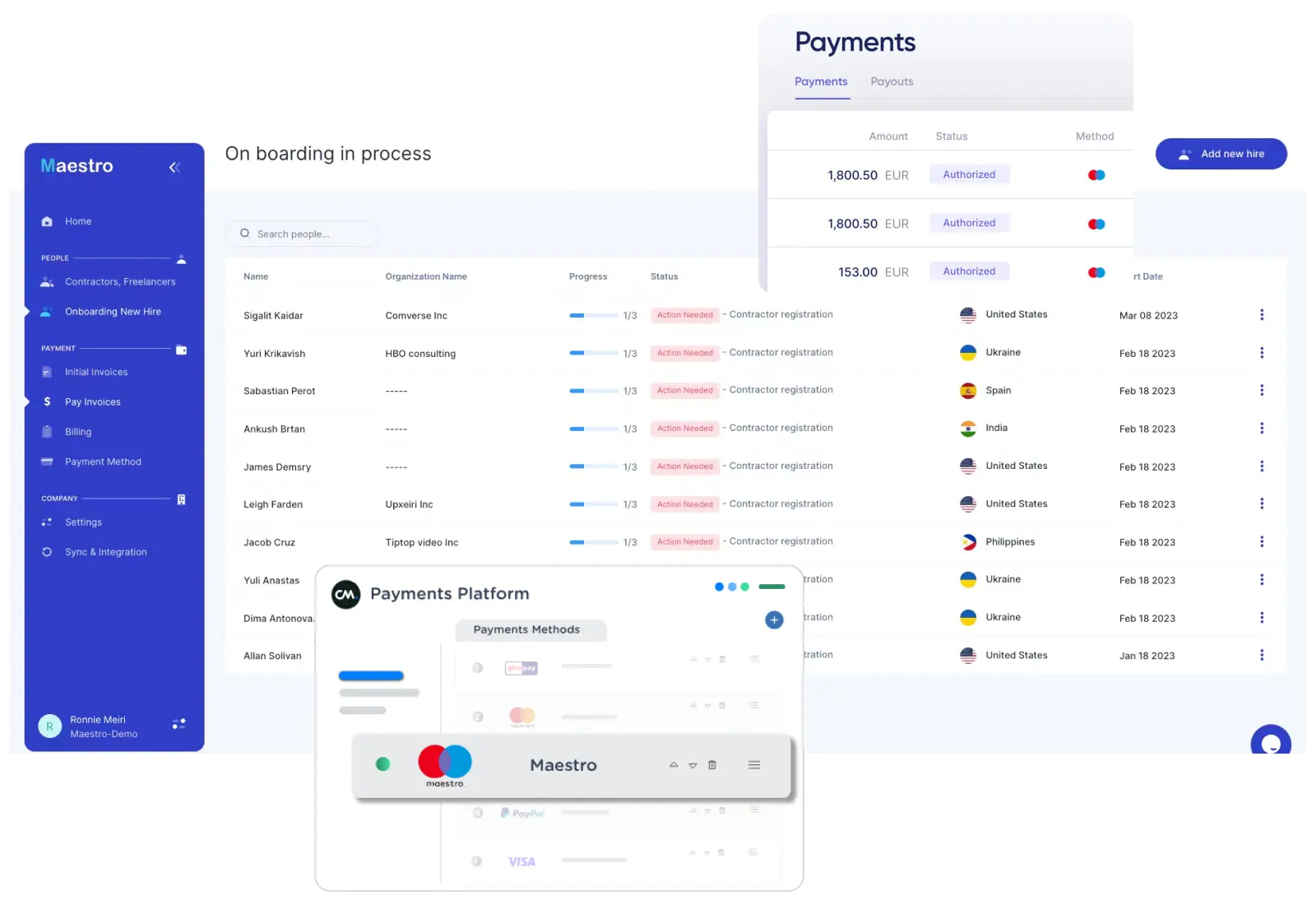

7. Maestro Payments

Key Features

Global Payment Control

Maestro provides convenience by slashing payment processing time by a maximum of 80% and international wiring fees by a maximum of 90%.

Seamless Integrations

Maestro can be easily connected with well-known accounting, HR and time tracking, such as Xero, QuickBooks, Clockify, BambooHR, and others.

Automated Invoice Approval

This requires one to leave behind past issues, such as manual mistakes or even slow invoice processing. It also comes with an approval workflow tool that allows you to approve invoices for payment in minutes.

AI-Powered Error Detection

Do not let yourself be cheated out of your hard-earned money. Maestro provides an AI and machine learning feature that automatically identifies errors, ensuring that your payments are accurate and safe.

Batch Payments Made Easy

Pay multiple contractors in one go with low-cost transactions—making it easier to manage multiple contractors or freelancers without breaking a sweat.

Pricing

Maestro Payments costs $7 per contractor per month and can, therefore, be considered a cost-effective solution for businesses.

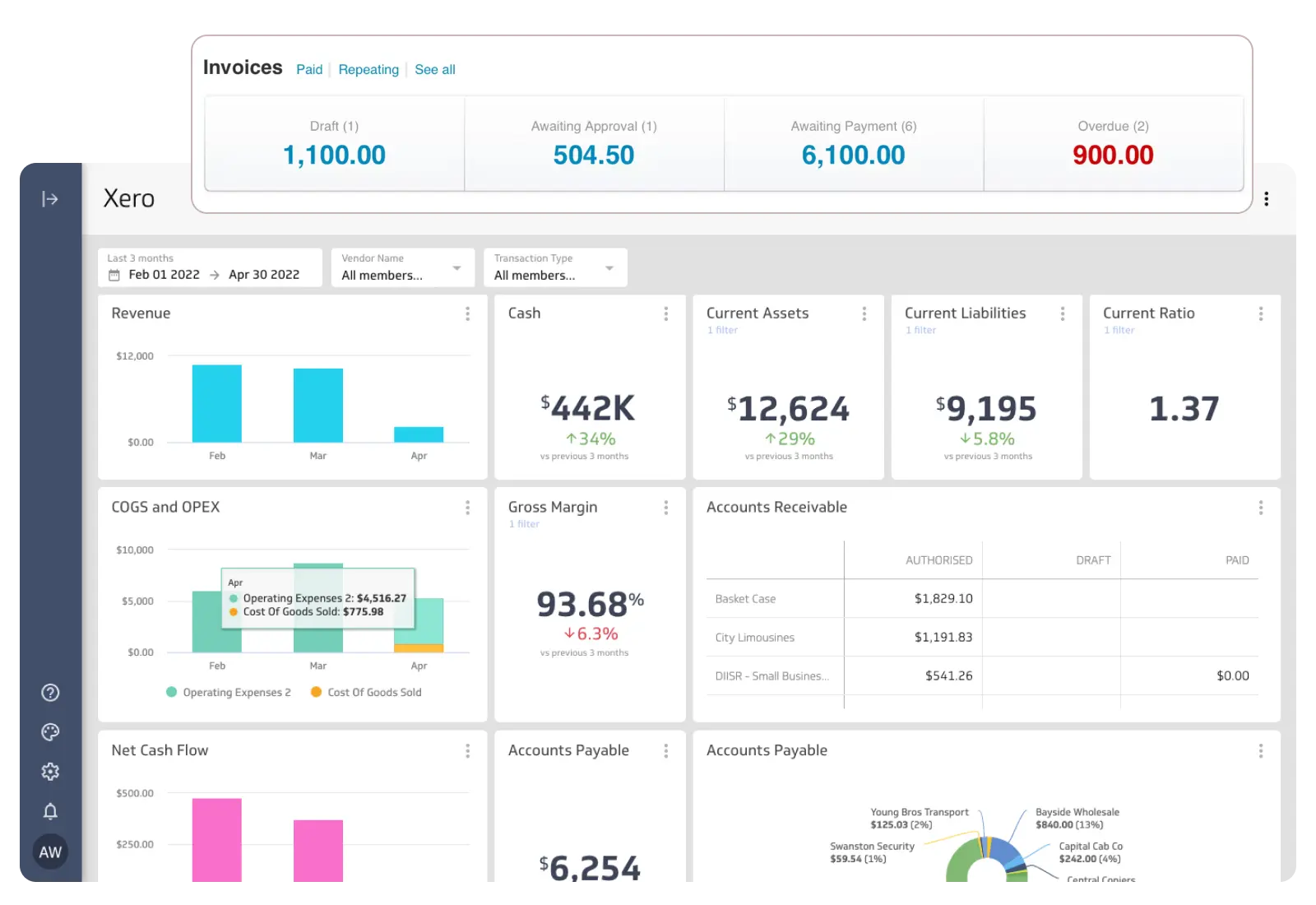

8. Xero

Key Features

Customizable Invoices

Invoicing is simple as it allows you to customize and add your company logo alongside the payment terms. This helps to keep a professional and branded feel every time you issue an invoice to your clients.

Multiple Payment Options

Xero integrates several means through which customers can make payments such as debit/credit cards, direct debit, etc. A ‘Pay Now’ option benefits the clients as well as the firm because it enables the clients to pay directly increasing customer satisfaction.

Automatic Payment Reminders

Pursuing debt can take a lot of time, but with Xero, the customer is notified before or after the due date through a notification.

Mobile Invoicing

The Xero mobile app lets you generate and send invoices, approve them, or even enter new ones directly on your smartphone or tablet. Follow up on unpaid bills, create new clients, and receive real-time updates on when a payment has been made whether on the field or on the go.

Repeat Invoices & Bulk Imports

For recurring billing, Xero lets you set up repeating invoices, saving you from entering the same details every month. You can also bulk import invoices from other platforms, simplifying the transition to Xero.

Pricing

Xero is relatively cheaper as it provides the Starter plan for a fee of $2.90per month for the first 6 months.

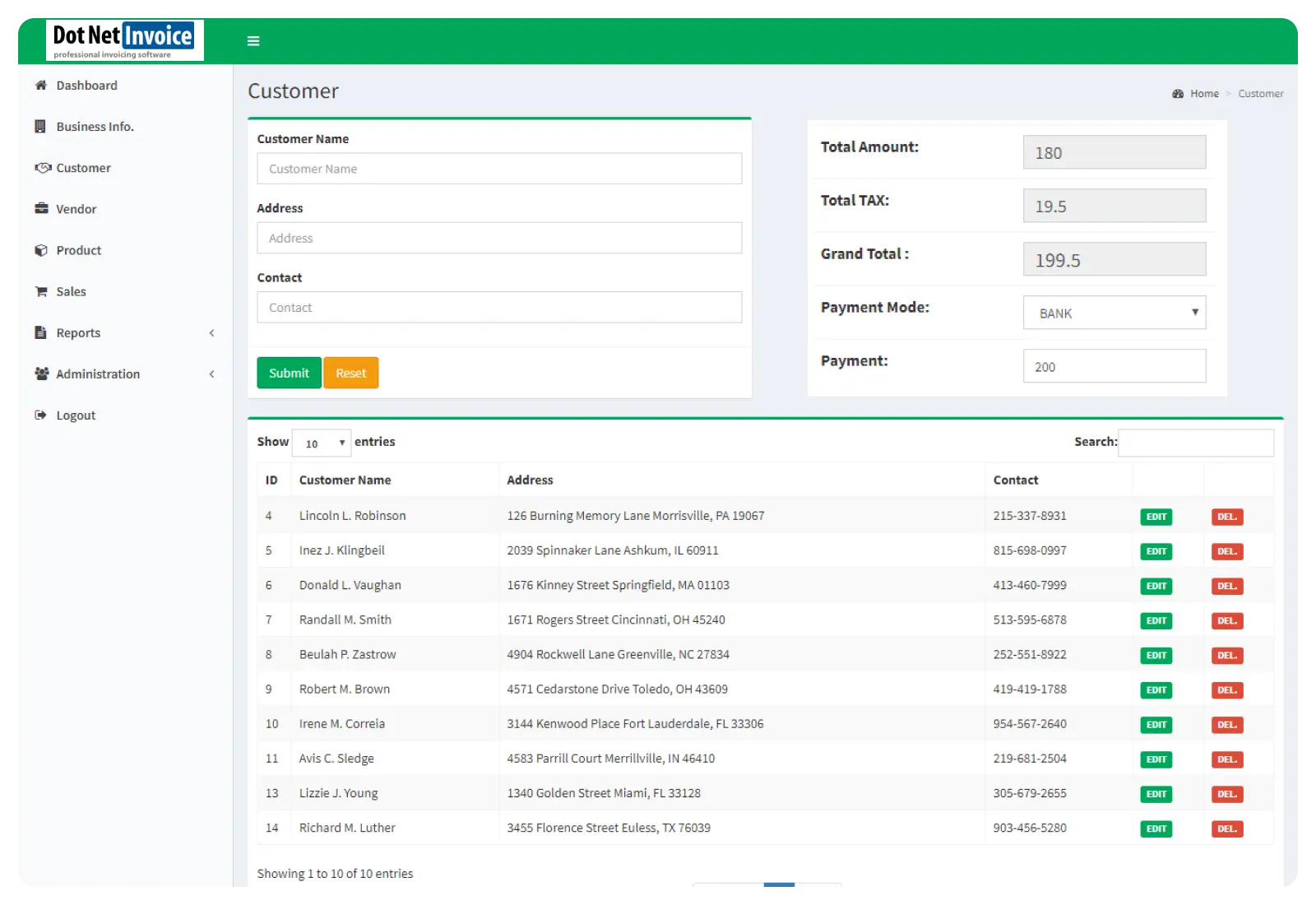

9. Dot Net Invoice

Key Features

Email Invoices & Accept Online Payments

You can send invoices directly via email and collect payments in real-time through your website. With support for PayPal Standard, PayPal Pro, and six other gateways, receiving payments is a breeze.

Easy Configuration and Customization

DotNetInvoice makes it simple to configure your settings via a web-based admin console. You can also personalize the look of your invoices by adjusting colors, fonts, and styles, all through a single style sheet.

Automated Monthly Billing

Automate your recurring invoices in just a few clicks. Set up automatic card charges for your clients each month, saving you the hassle of manual billing and avoiding extra merchant account fees.

Multi-Currency Support

DotNetInvoice supports nine currencies, including USD, EUR, GBP, INR, and more. Plus, if you need additional currencies, adding them is a piece of cake for any .NET developer.

Simple Interface

Get started in less than 3 minutes. Once installed and configured, you’ll be invoicing your first client in no time. DotNetInvoice is designed to be easy to use and scale with your business as it grows.

Pricing

DotNetInvoice is a one-time purchase priced at $99, offering a cost-effective solution for small businesses looking to streamline their invoicing process.

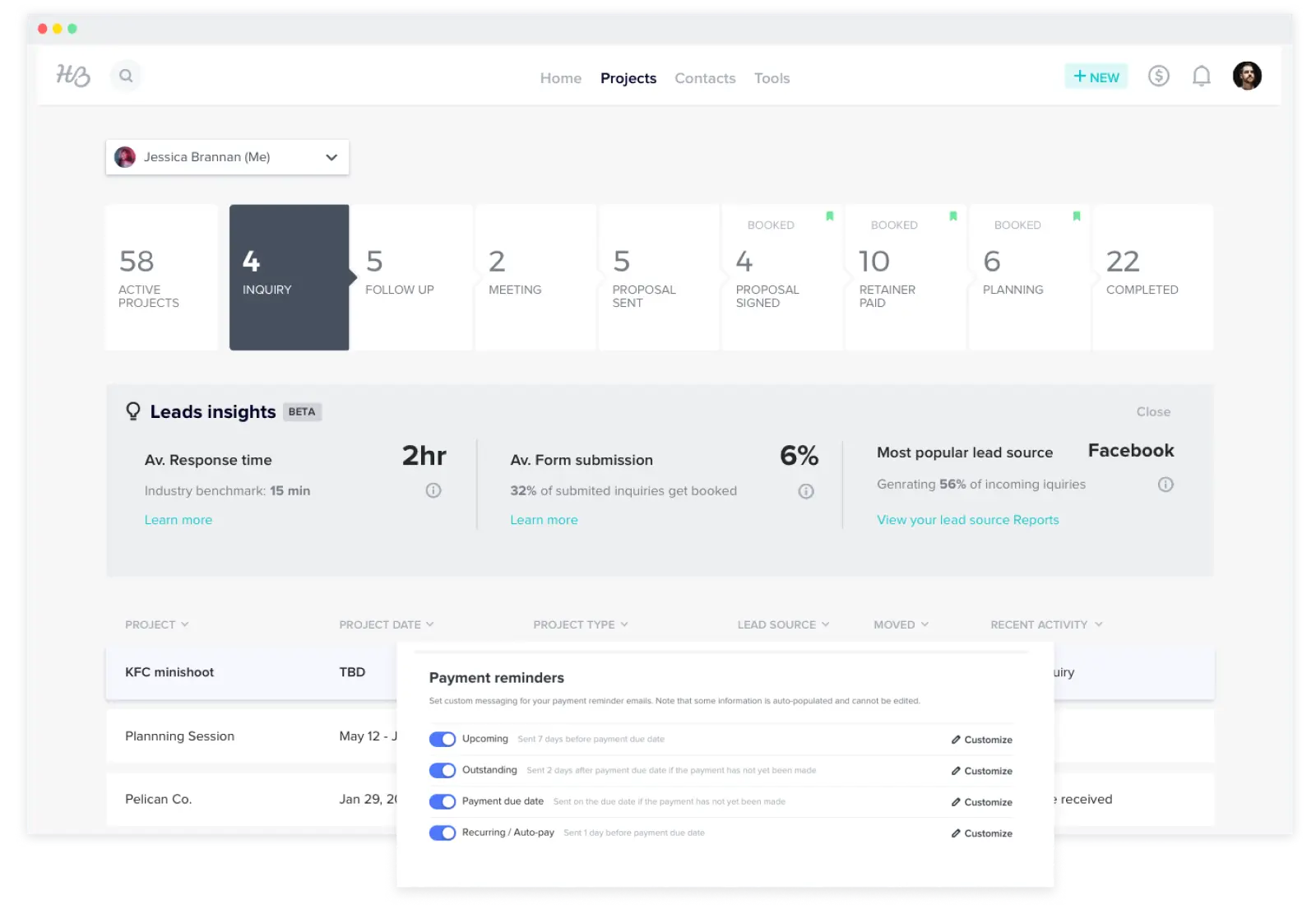

10. Honey Book

Key Features

Customizable Online Invoices

You can create invoices that reflect your brand, making them feel more personal and professional. Customize your invoices to match your business’s look and feel, and get them sent out in no time!

Flexible Payment Terms

Accept deposits, one-time payments, or set up installment plans—HoneyBook gives you the flexibility to invoice as you go. Plus, clients can pay directly from the invoice using credit cards, bank transfers, or autopay, which makes the process quick and easy.

Automated Reminders

Say goodbye to the hassle of chasing down payments. HoneyBook sends automated email reminders to your clients, helping you get paid on time.

Integration with Popular Tools

Connect your favorite apps like QuickBooks, Google Calendar, Zoom, and more to keep all your essential tools in one centralized place.

Pricing

HoneyBook’s Starter plan starts at $19 per month, and you can start with a free trial to explore the features before committing.

Conclusion

Managing your money doesn’t have to be hard anymore with the right invoicing software. Among these top invoicing software for small business, Invoicera is a great choice for its easy-to-use features like handling different currencies, automatic tax calculations, and clear reporting – perfect if you work with clients from other countries.

Whether you’re just starting your business or growing bigger, using one of these modern invoicing tools will save you time, cut down on mistakes, and help you look more professional to your clients.

Don’t get left behind – upgrade your invoicing system today.

FAQs

Ques. Do I really need invoicing software if I’m a small business?

Ans. Yes! Even with just a few clients, invoicing software saves time, looks more professional, and helps you get paid faster. It also keeps all your billing records in one place, which is helpful during tax season.

Ques. How hard is it to switch from my current system?

Ans. Most of these tools make it easy to import your client information and invoice history. They also offer helpful guides and customer support to help you switch.

Ques. Are these invoicing softwares safe to use?

Ans. Yes! These companies use strong security to protect your data and your client’s payment information. They regularly update their security features to keep everything safe.

Ques. What if I need help using the invoicing software?

Ans. All these companies offer customer support through email, chat, or phone. Many also have helpful videos and guides to show you how to use their features.