Misleading and fraud invoices might pull down a firm’s reputation, besides consuming a lot of time and money.

Most traditional accounts payable and receivable processes are susceptible to errors such as duplicate entries, errors made by the workers, etc., all because of manual processes.

Did you know?

In the US companies are losing an average of $300,000 per business annually to fraudulent invoices.

E-invoicing is a great solution to all these problems since it eliminates the manual invoice creation completely.

In addition, e-invoicing is efficient since it is real-time and errors are easily detected, hence rectified.

This also helps protect against fraud because checks are performed automatically, and secure digital signatures are used. The need to shift to e-invoicing is not a luxury but a necessity.

This blog discusses the importance and benefits of e-invoicing as a way of decreasing errors and cases of invoice fraud. We will also highlight its advantages, and disadvantages and how Invoicera can assist in implementing e-invoicing for any business.

Relevance of E-Invoicing For Modern Businesses

E-invoicing has become essential for keeping up with modern trends. Traditional methods fail to match the speed, accuracy, and compliance needed in a competitive environment. E-invoicing not only streamlines processes but also ensures organizations meet regulatory requirements efficiently and error-free.

Billing mistakes can lead to

- Late payments

- Losses

- Inefficiencies

- Fines

- Penalties regarding tax rules

These challenges are, however, made easier through e-invoicing through automation of processes, validation in real-time, and minimal manual work.

Also, high-security measures prevent fraud in both businesses and individuals in terms of their financial information.

There is no way a business that is planning to expand or perhaps, rationalize its operations can overlook the benefits of electronic invoicing. It facilitates efficient cash flow, minimizes costs,, and improves trust among the stakeholders.

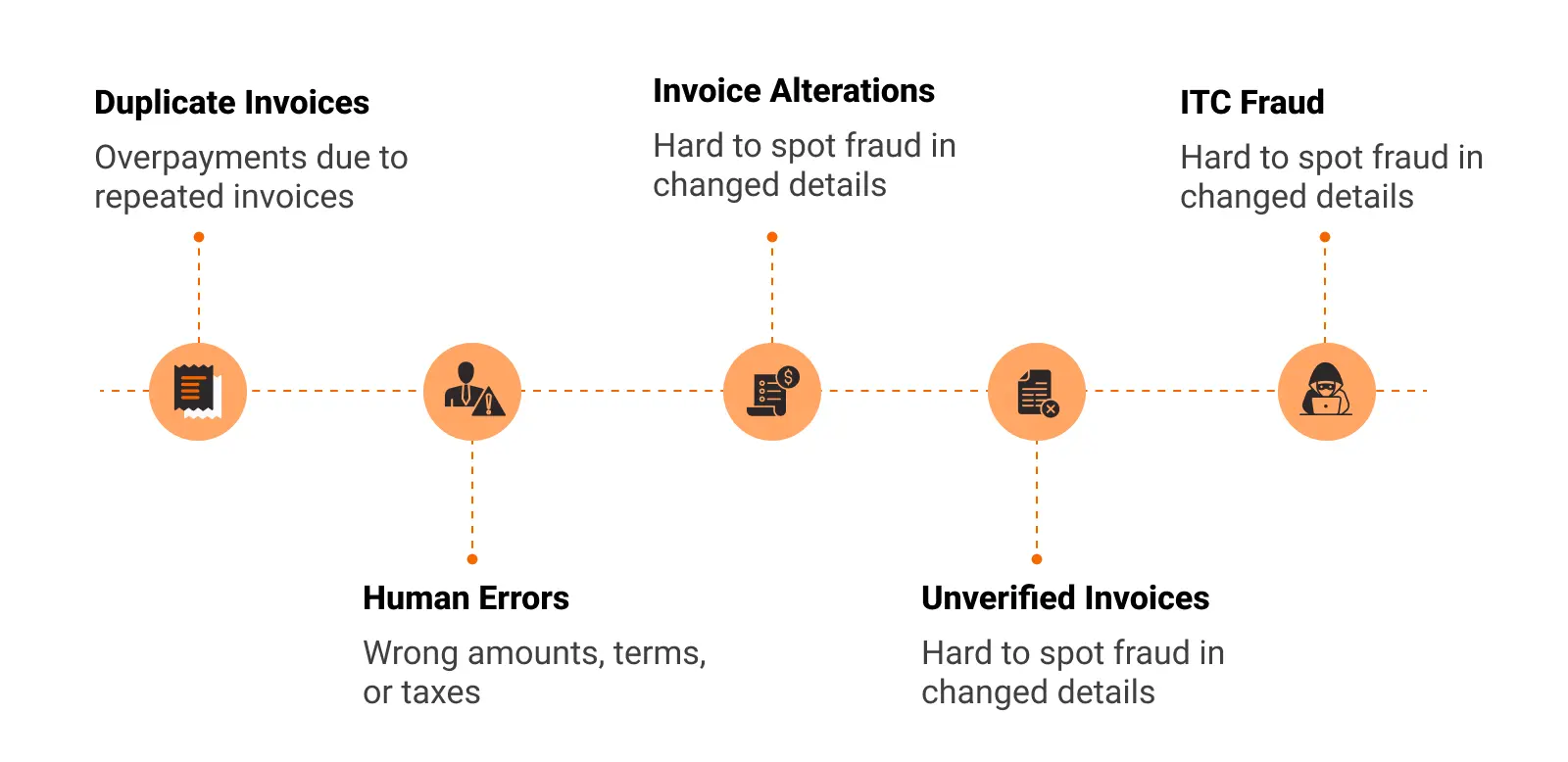

Common Traditional Errors and Invoice Frauds

- Duplicate Invoices: By not utilizing automatic e-invoicing, some businesses might be overpaying for the same invoice received multiple times without knowledge.

- Human Errors: It comes with many errors, including wrong amount, wrong payment terms, or tax computation, thus leading to discrepancies and delays in payment.

- Invoice Alterations: Its details including the amount and the vendor name, might change, and hence, one cannot easily distinguish a fraudulent one from a genuine one.

- Unverified Invoices: At times, there may be instances where payments are made for the goods or services that were never supplied or the bill was wrongly issued, adding to the loss of a business.

- ITC (Input Tax Credit) Fraud: Misreporting of some other GST-related facts leads to claiming the wrong ITC, which can create compliance problems and penalties.

These issues can be expensive and time-consuming to address. With no properly functioning system in place, businesses are exposed to both operational costs and fraud.

How e-Invoicing Streamlines Accuracy

- Automation of Data Entry: Electronic invoicing systems are special systems that are able to pick information from previous invoices and feed it into the billing system, thereby avoiding manual input and potential errors.

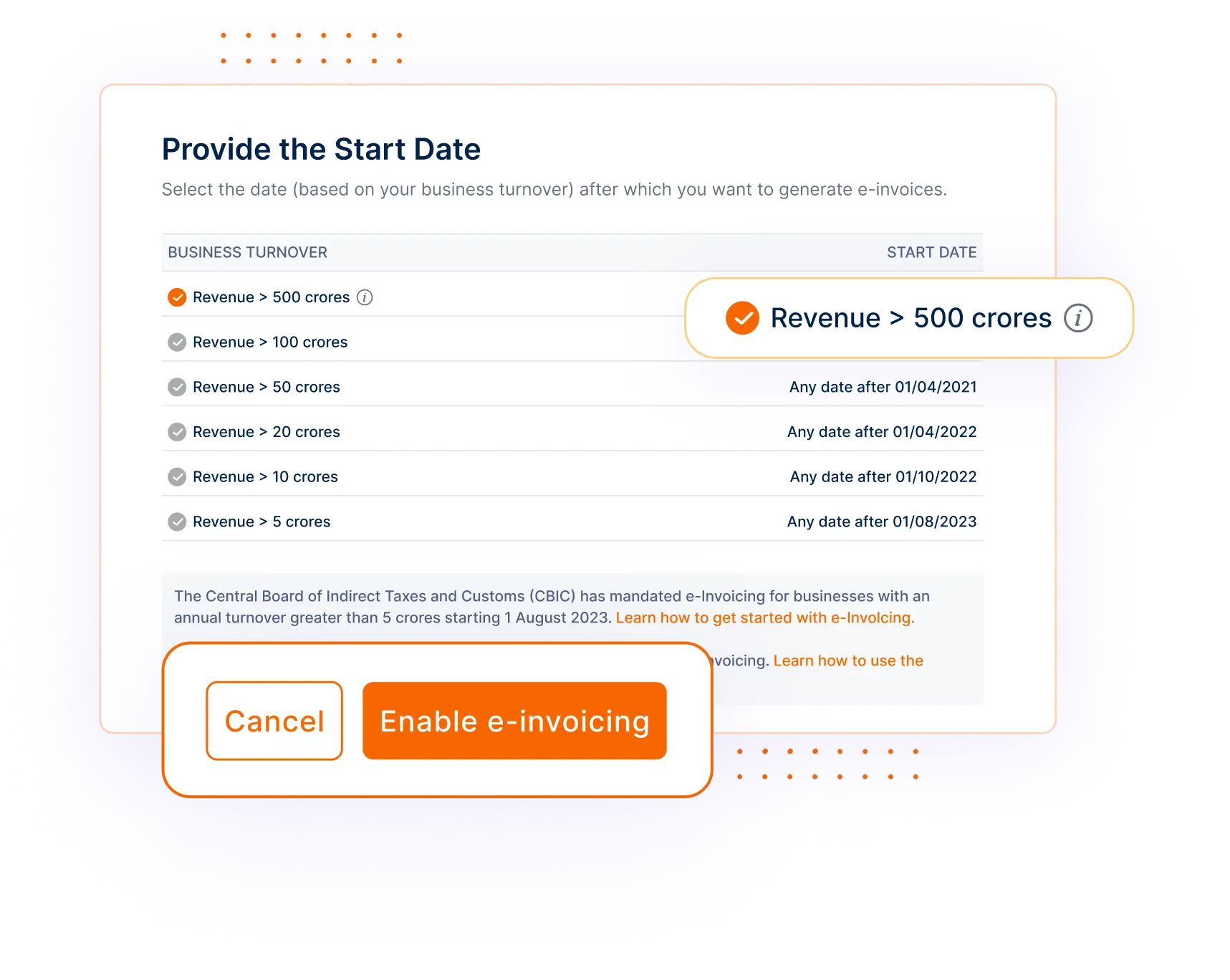

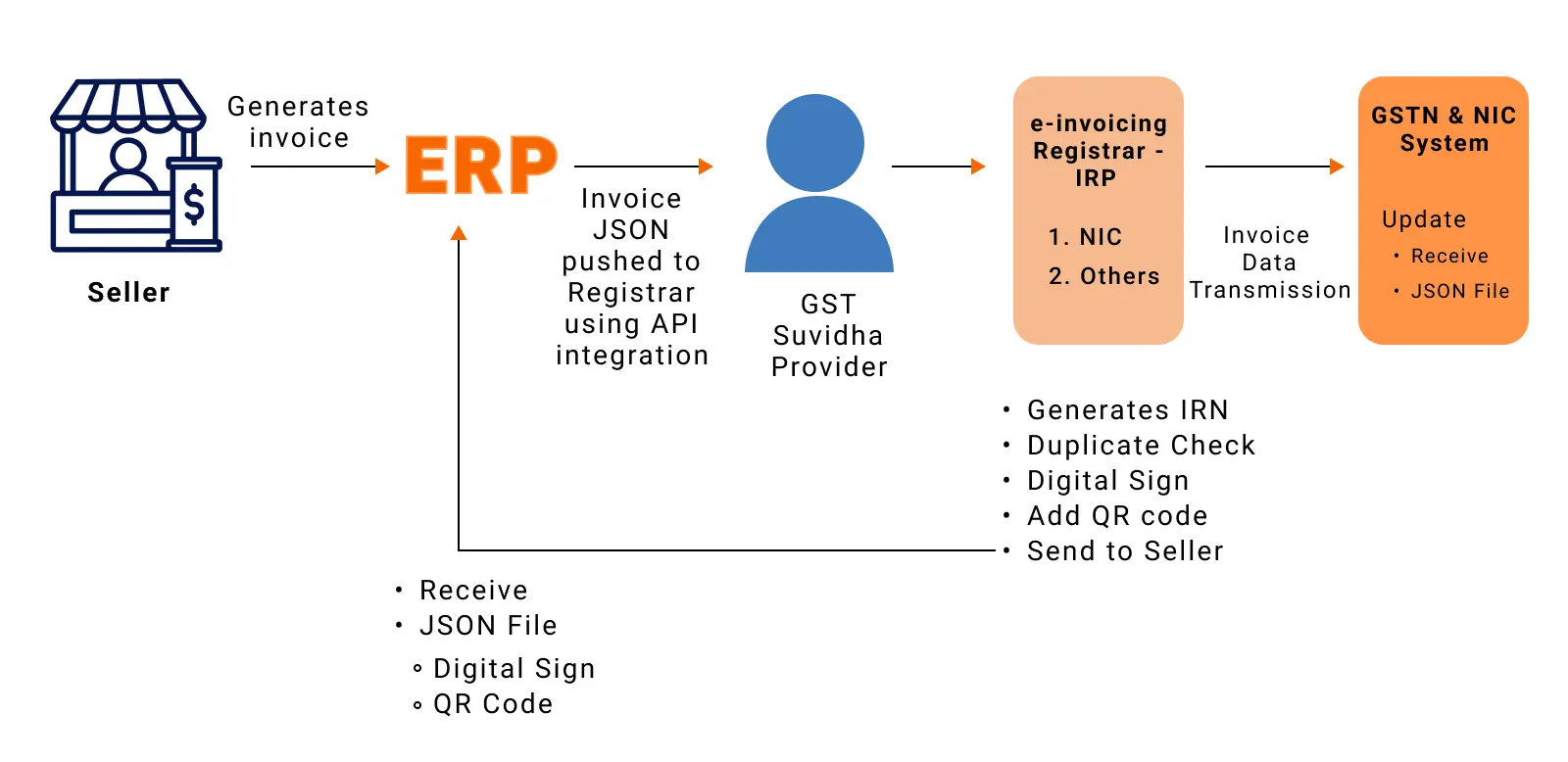

- Real-Time Validation: These systems, including the Invoice Registration Portal (IRP), allow e-invoices to be checked and validated directly. It results in zero discrepancies.

- Unique Identification (IRN): The e-invoice is issued an Invoice Reference Number (IRN) – for each invoice, which simplifies the task of tracking invoices and reducing fraud threats such as duplicate or modified invoices.

- Faster Payment Processing: One of the benefits of e-invoicing is that it cuts time wastage in invoice processing and also reduces the probability of wrong payments.

- Seamless Integration with ERPs: E-invoicing systems are built to work within current ERP systems so that the many issues arising from data conversion between various systems are eliminated and day-to-day working optimized.

With the help of e-invoicing, not only does this system eliminate errors created by people, but it also increases the productivity level, making it an even more reliable and efficient way of invoicing for businesses.

Tackling Invoice Frauds with E-Invoicing

Invoice fraud is expensive for companies, but through e-invoicing one can implement efficient solutions on how to fight and avoid fraudulent acts. Here’s how e-invoicing helps tackle fraud:

- Digital Signatures & Encryption: Effective through advanced encryption and digital signatures, the process of e-invoices reduces the possibility of unauthorized alteration of financial data in invoices.

- Real-Time Tracking & Monitoring: E-invoices are sent at government-authorized interfaces, including the IRP, to facilitate real-time monitoring. You can check the status of their invoices and identify early problems.

- Elimination of Fake Invoices: Since the electronic invoice is first verified and provided with a distinctive IRN number, it avoids the generation and issuing of bogus invoices, which might be generated to defraud the system.

- Automated Fraud Detection: Such systems hold features of automated fraud detection that are designed for preventing and controlling such activities. It includes invoices’ dublets or new patterns of billing that can be considered scams.

- Increased Transparency: Since e-invoicing involves the generation of an electronic trail for each transaction, there is no doubt of full transparency. This definitely makes it easier to identify any inconsistencies or discrepancies, thus drastically minimizing fraud.

Benefits of e-Invoicing for Businesses

The implementation of e-invoicing comes with improvements in process flow, reduced compliance, and better cash flow. Some key advantages include:

- Enhanced Accuracy: The real-time validation by using systems like the IRP and automated data entry significantly reduces the risks of inaccurate human entries.

- Faster Processing: E-invoices are easily processed with automation, thus increasing the efficiency of payments, reducing the long payment cycle, and enhancing cash flow.

- Cost Savings: Eliminating or minimizing the use of paper and invoicing automatically brings about considerable cost savings.

- Improved Compliance: E-invoicing helps avoid fines for violating requirements of government legislation and facilitates integration with taxes such as GST.

- Security and Fraud Prevention: Invoice information security consists of highly secure encryption to minimize the risk of invoice fraud and alteration.

- Environmental Impact: Since e-invoicing decreases the application of paper, in its essence, it helps businesses be eco-friendly and supports sustainability.

- Easy Integration: E-invoicing systems are compatible with accounting and ERP systems to track invoices on one or the other systems.

Based on these benefits, e-invoicing is a real solution for many companies that helps to improve the work and avoid critical difficulties.

Challenges in Implementing e-Invoicing

While e-invoicing brings many benefits, businesses may face several challenges when implementing it:

- Initial Setup Costs: SMEs are likely to face more challenges in terms of costs related to upgrading e-invoicing technology or linking to existing ERP solutions. Invoicera offers cost-effective solutions tailored for SMEs, making the transition smoother and more affordable.

- Compliance Complexity: It can be difficult to be updated about the current e-invoicing regulations and tax rules since some countries undergo constant changes in invoicing laws.

- Technology Integration: The adoption and implementation of e-invoicing may also involve a technical aspect, which means that the integration with other accounting software might take time to implement, and this may also disrupt operations. Invoicera’s seamless integration capabilities ensure a hassle-free transition, minimizing operational disruptions.

- Resistance to Change: It may be difficult for the employees to migrate from the old way of manual invoicing to electronic systems; thus, they call for training and change management.

- Data Security Concerns: Despite the implementation of encryption and security in e-invoicing systems, along with data centers , some business entities may be reluctant to disclose their key sensitive financial information.

- Lack of Infrastructure: One of the disadvantages of implementing e-invoicing is that companies situated in regions with low internet connection are likely to experience a lengthy process of implementing these online invoices.

However, the long-term advantages of e-invoicing are normally much greater than the initial problems. Hence, the development of technology is worth the investment of organizations that wish to cut costs and enhance compliance.

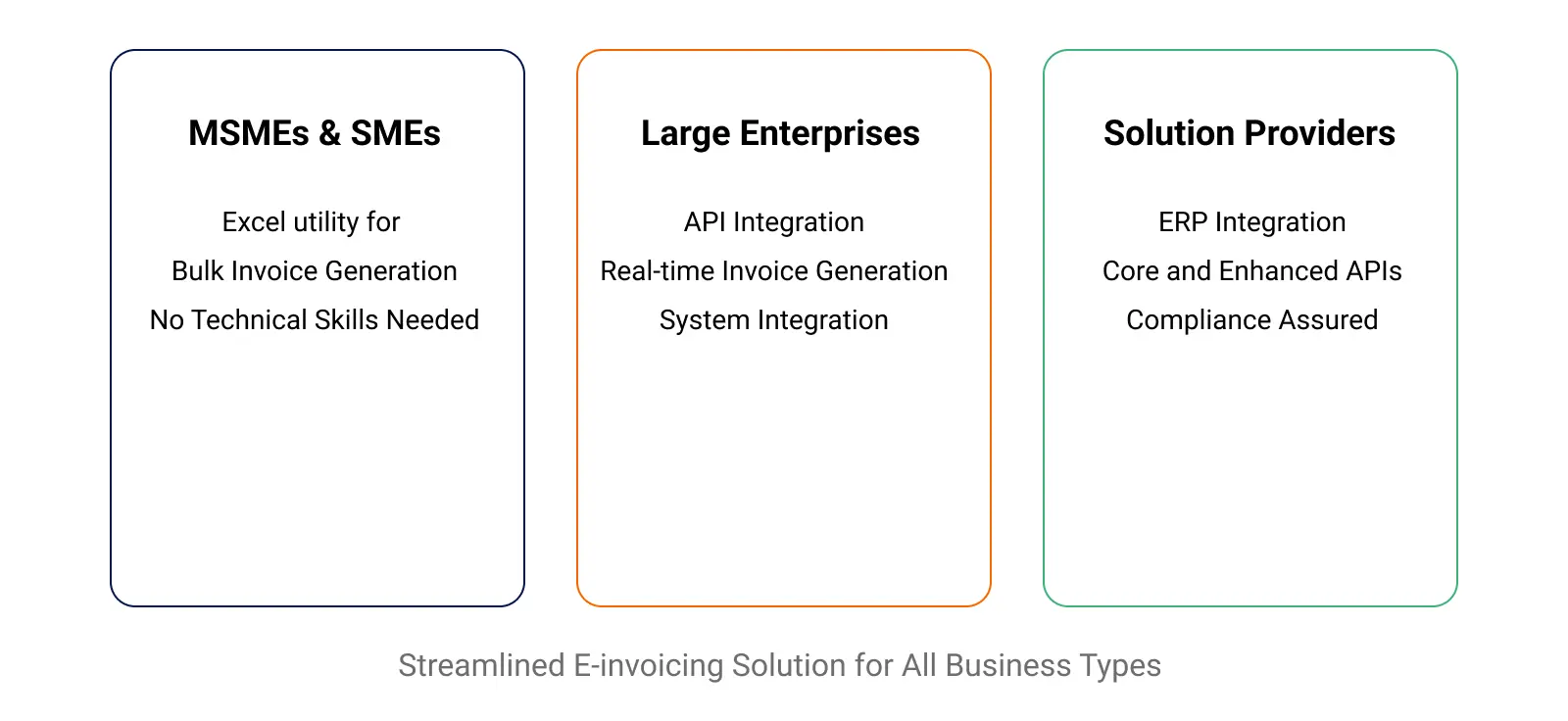

IRP – The Government-Recognized Invoice Registration Portal

For MSMEs and SMEs

- IRP’s offline Excel utility allows small businesses to generate invoices without the need for advanced technical skills.

- Send invoice data to IRP in bulk and get e-invoices generated in real-time.

- Generate both e-invoices and e-way bills from a single platform for convenience.

For Large Enterprises

- IRP provides multiple ways to generate Invoice Reference Numbers (IRN), including API integrations, allowing for seamless generation of e-invoices directly within your accounting system.

- This ensures fast, accurate, and compliant invoice generation.

For Solution Providers

- IRP collaborates with ERP providers and system integrators to offer a robust e-invoicing solution that guarantees seamless user journeys for their clients.

- Core and Enhanced APIs are available for integrating e-invoicing capabilities, ensuring error-proof compliance.

- With IRP, businesses can simplify the entire e-invoicing process, making it fast, efficient, and fully compliant with regulatory standards.

How Invoicera Simplifies E-Invoicing Adoption

Invoicera is an e-invoicing software that makes e-invoicing adoption seamless by offering direct integration with the Invoice Registration Portal (IRP). This software enables businesses to easily comply with government regulations while saving time and minimizing errors. Here are the key features:

IRP Integration

Invoicera allows you to upload invoices directly to the IRP for validation and signing. This reduces manual effort and ensures your invoices meet government compliance standards without the need for complex manual processes.

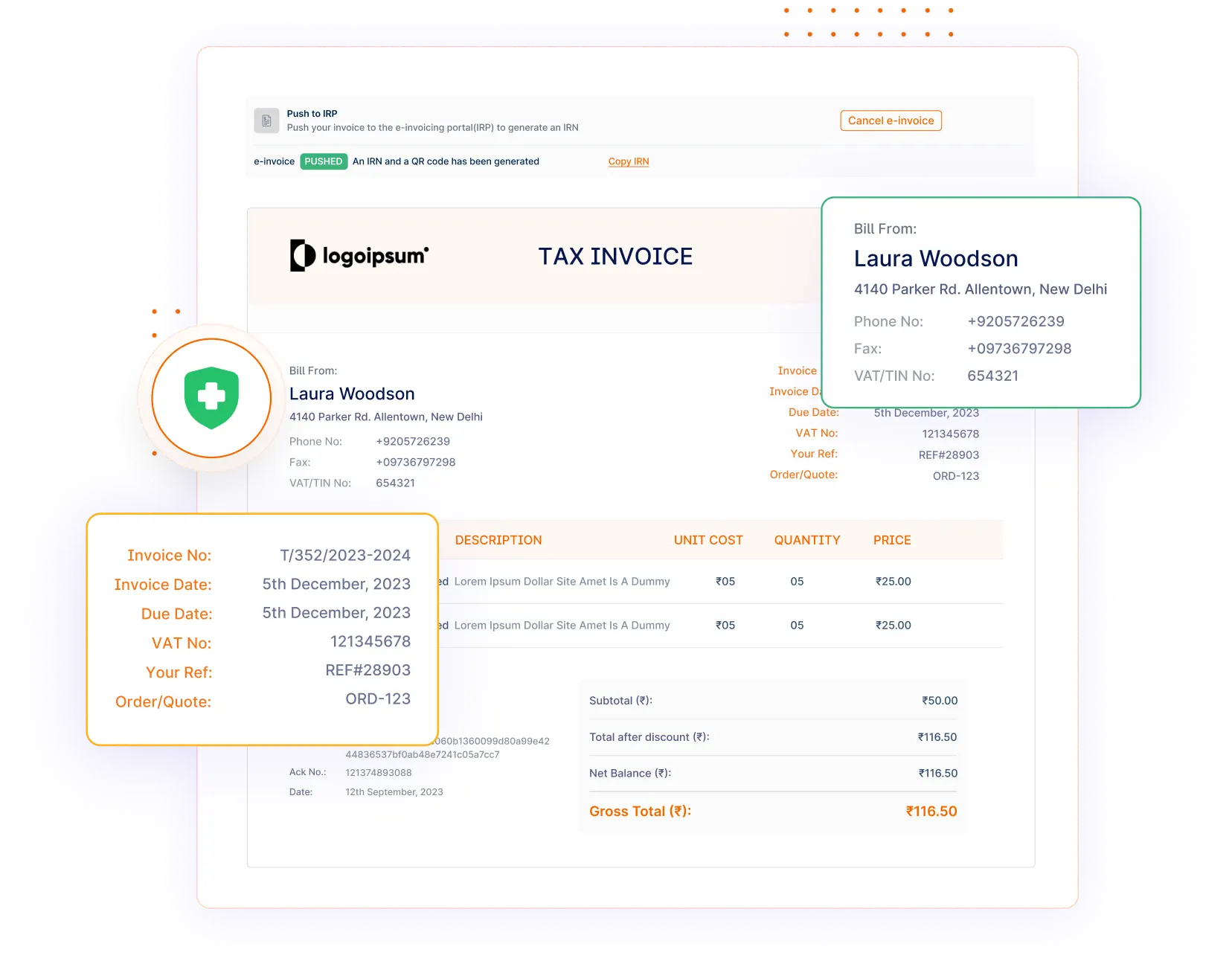

Built-in Security and Validation

Every e-invoice generated in Invoicera is secured with an IRP-generated QR code and digital signature. This guarantees the authenticity and legal validity of the invoice, ensuring it passes compliance checks with ease.

Upload Auto-Validated Invoices to IRP

Invoicera automatically validates your invoices before they are sent to IRP. It checks for errors and missing information, reducing manual errors by up to 95%. This automation saves time and prevents costly mistakes.

Track Your IRP Invoices at a Glance

Stay on top of your invoices with real-time tracking. Invoicera offers an easy-to-understand dashboard that shows the status of your invoices—whether they are pushed, canceled, or pending. The intuitive icons make monitoring simple and quick.

Get Faster Approvals with Automatic IRNs & QR Codes

Invoicera boosts invoice approval times by up to 50%. Once you upload your invoices to IRP, the system automatically generates Invoice Reference Numbers (IRNs) and QR codes, speeding up the approval process and minimizing delays.

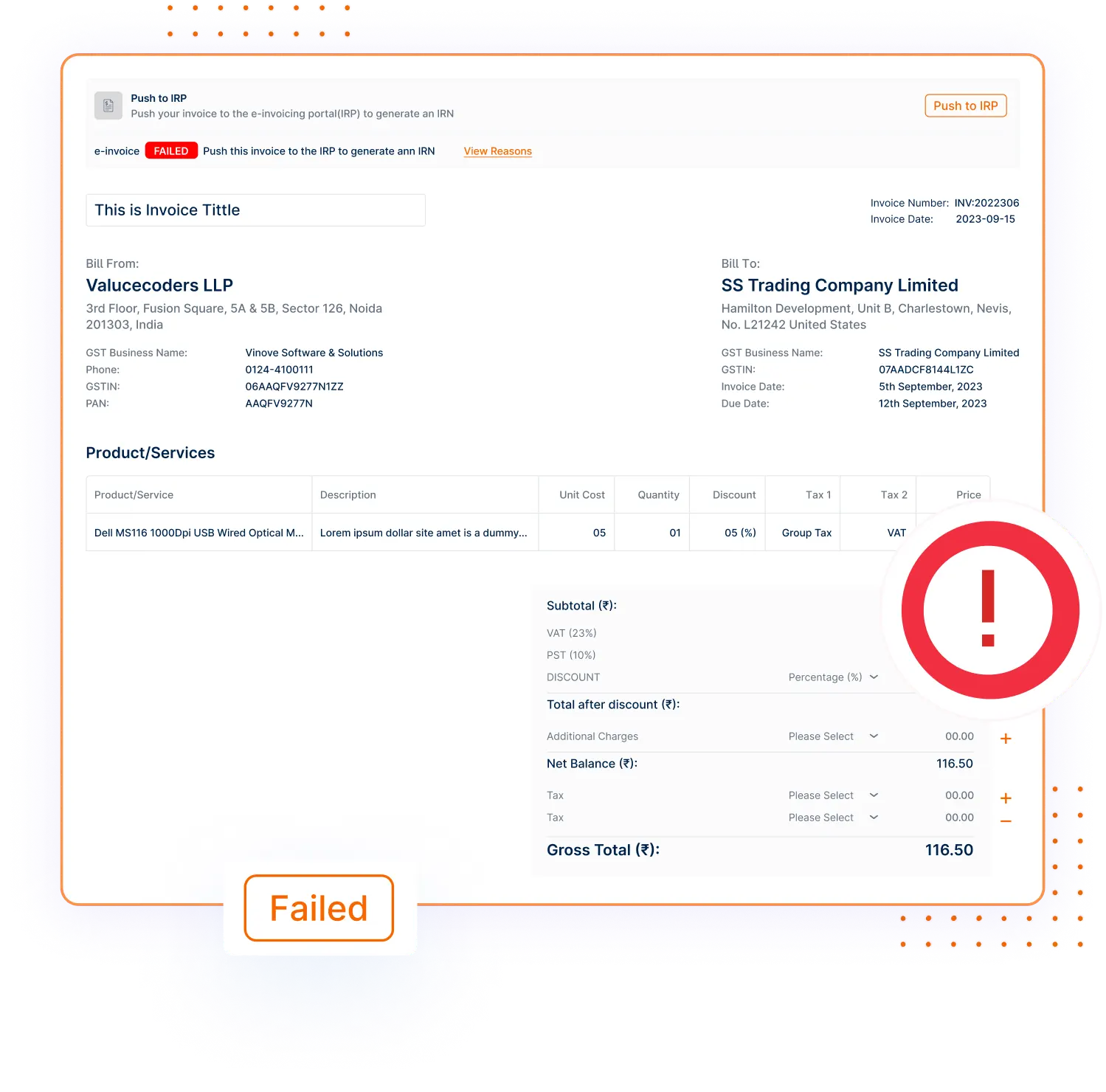

Fix & Resubmit Rejected Invoices Quickly

With Invoicera, you can trim down processing time by up to 40%. This makes it easy for you to locate errors and resubmit them on time, hence making your invoicing to be effective.

Using these features, Invoicera makes the transition to e-invoicing stress-free for businesses & guides you through the IRP process without adding extra work or risking non-compliance.

Conclusion

Over the days, e-invoicing has emerged as a new way of undertaking invoicing, which has the added benefits of better accuracy, quick processing, and greater security. It not only makes it easier to get work done but also assists businesses to conform to new tax laws.

Although the use of e-invoicing may have some difficulties during implementation, it is outweighed by the benefits, which makes it an important tool in modern companies.

With Invoicera, businesses can seamlessly implement e-invoicing, eliminating common obstacles and ensuring a smooth transition. This enhances profitability, cash flow, and compliance, making Invoicera the ideal solution for businesses looking to streamline their invoicing process.