There was once a bustling travel agency that catered to all kinds of clients, each with unique travel dreams—from surfing in Bali to vineyard hopping in Tuscany.

But as the agency’s bookings grew, an unexpected problem surfaced: invoicing. Just like the travel industry itself, their billing needs were a fast-moving maze of custom requests, multiple currencies, and online bookings.

Invoicing software has become a game-changer for travel businesses aiming to keep up with these demands.

In this blog, we’ll dive into the top invoicing software options designed to simplify the invoicing headaches for travel businesses. Whether you’re a travel agency owner, a tour operator, or a budding Airbnb manager, these tools offer solutions to common billing challenges.

Common Challenges In Travel Industry Billing

Billing in the travel industry isn’t just about numbers and due dates—it’s about taming a wild rollercoaster of custom requests, currency differences, and international taxes. Here’s a look at some common hurdles:

1. Complex Booking Structures

Challenge: Travel packages often involve multiple services (flights, hotels, activities), making it tricky to keep track of what clients owe and for what. With so many moving parts, billing can quickly spiral out of control.

Solution: Use automated invoicing software that integrates with booking systems. This ensures each service is tracked and clients are billed correctly for each component of their package. Customizable templates can help break down the bill into clear, understandable sections.

2. Currency Conundrums

Challenge: Today’s travel businesses are going global which means managing invoices in multiple currencies. The conversion fees, exchange rate fluctuations, and tax calculations can make accounting feel like a full-time job.

Solution: Implement invoicing software with multi-currency support. This will allow automatic currency conversion based on current exchange rates, ensuring accuracy and consistency. Additionally, software that integrates with global payment processors can help mitigate exchange rate risks.

3. Delayed Payments

Challenge: Long invoicing cycles are common in the travel industry, as clients often book far in advance. This delay can impact cash flow, as businesses wait for payments for trips scheduled months ahead.

Solution: Set up recurring billing for bookings that span over time, or utilize invoicing software that allows clients to pay in installments. This can smooth cash flow by receiving partial payments over the course of the booking process, rather than waiting for the final settlement.

4. Different Payment Preferences

Challenge: Travellers might prefer paying by credit card, bank transfer, or even new payment apps. A lack of diverse payment options can turn a smooth experience into a missed booking.

Solution: Incorporate more payment options into your invoicing software by including the option of multiple payment gateways. All common methods such as credit cards, PayPal, bank transfers, mobile wallets, and other latest apps make it possible for customers to use the most convenient payment method. This leads to increased conversion rates and customer satisfaction.

5. Tax and Compliance Overload

Challenge: Foreign trips bring strings of taxes on foreheads. Beginning from VAT to GST, such minor aspects are usually unnoticed, but in case they are not well taken care of, they may cause compliance problems.

Solution: Employ the invoicing software that adjusts taxes at the right rates from the client’s region of residence. This reduces the possibility of mistakes and guarantees that invoices adhere to the laws of the client’s country of residence.

6. Frequent Changes

Challenge: It’s very common for most clients to switch their plans at the last minute. This will require instant modifications in the invoices. Manually managing these updates results in confusion, missed interpretations, and displeased clients.

Solution: Select an invoicing software that has the option for editing and customizing bookings. Invoice changes can also be easily implemented in the automated invoicing system whenever they are needed. The client portal in the software lets clients view the invoice changes on their own.

Key Features to Look for in Invoicing Software for Travel Business

Trying to find the best invoicing software for travel is as difficult as trying to find the perfect travel companion—someone who knows everything and can predict everything that has to happen to ensure that it does not become a burden.

Here are some must-have features of invoicing software for the travel business:

- Multi-Currency Support: When people book from different parts of the world, having multiple-currency support is very crucial. When considering software, you should see that it supports multiple currencies and provides real-time exchange rates.

- Automated Billing Cycles: Many travel packages have recurring components, such as monthly subscriptions or regular services. Automated billing cycles can save time and ensure consistency in payments.

- Customizable Invoice Templates: When it comes to a business as exciting as travel, simple, bland invoices are not acceptable. Software having the ability to generate branded invoices with clear itineraries, single services, or personalized messages can take the experience to another level.

- Payment Gateways Integration: Invoicing has to be convenient and flexible because travelers choose convenience. This means that invoicing software must be integrated with the common payment gateways (PayPal, Stripe, credit cards, etc.).

- Expense Tracking: Various expenses are associated with travel businesses (booking accommodation, paying for tours). Invoicing tools with features such as expense tracking help create accurate invoices for clients and evaluate profitability.

- Multi-User Access and Permissions: Some travel businesses have different teams for several tasks such as booking, handling financial aspects, and negotiating with clients. Multi-user access if there in any tool can help the team to operate in an efficient manner while at the same time protecting sensitive data.

- Tax Calculation Tools: Any software that has tools for calculating taxes is useful for dealing with various complicated tax codes, no matter if the trip is interstate or international.

- Real-Time Analytics and Reporting: True copies of the unpaid invoices, revenue data, and the clients’ trends must be available to the agencies in real-time. The best invoicing software offers clear reports to assist the decision making process.

By focusing on these features, travel businesses can streamline billing, enhance client satisfaction, and stay competitive in a digital-first market.

Top 10 Invoicing Software for Travel Businesses

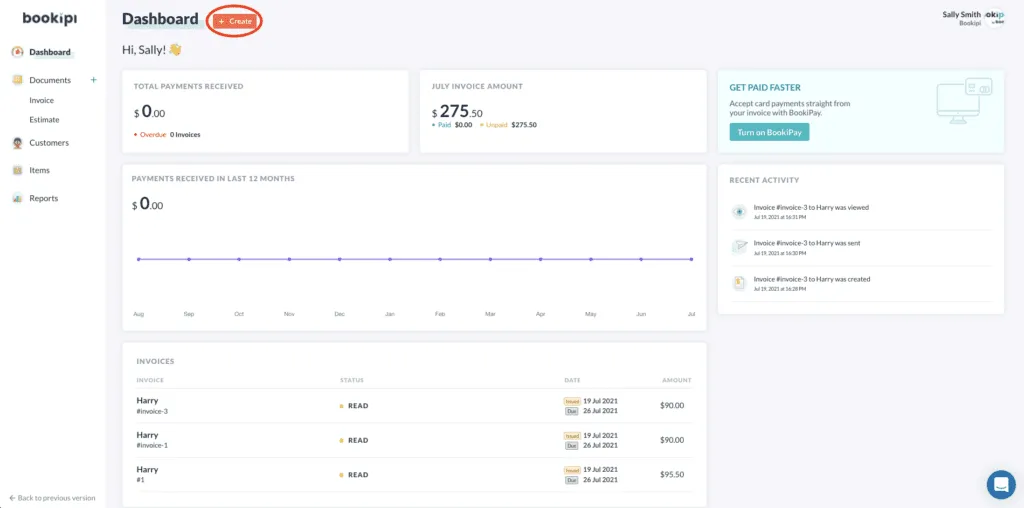

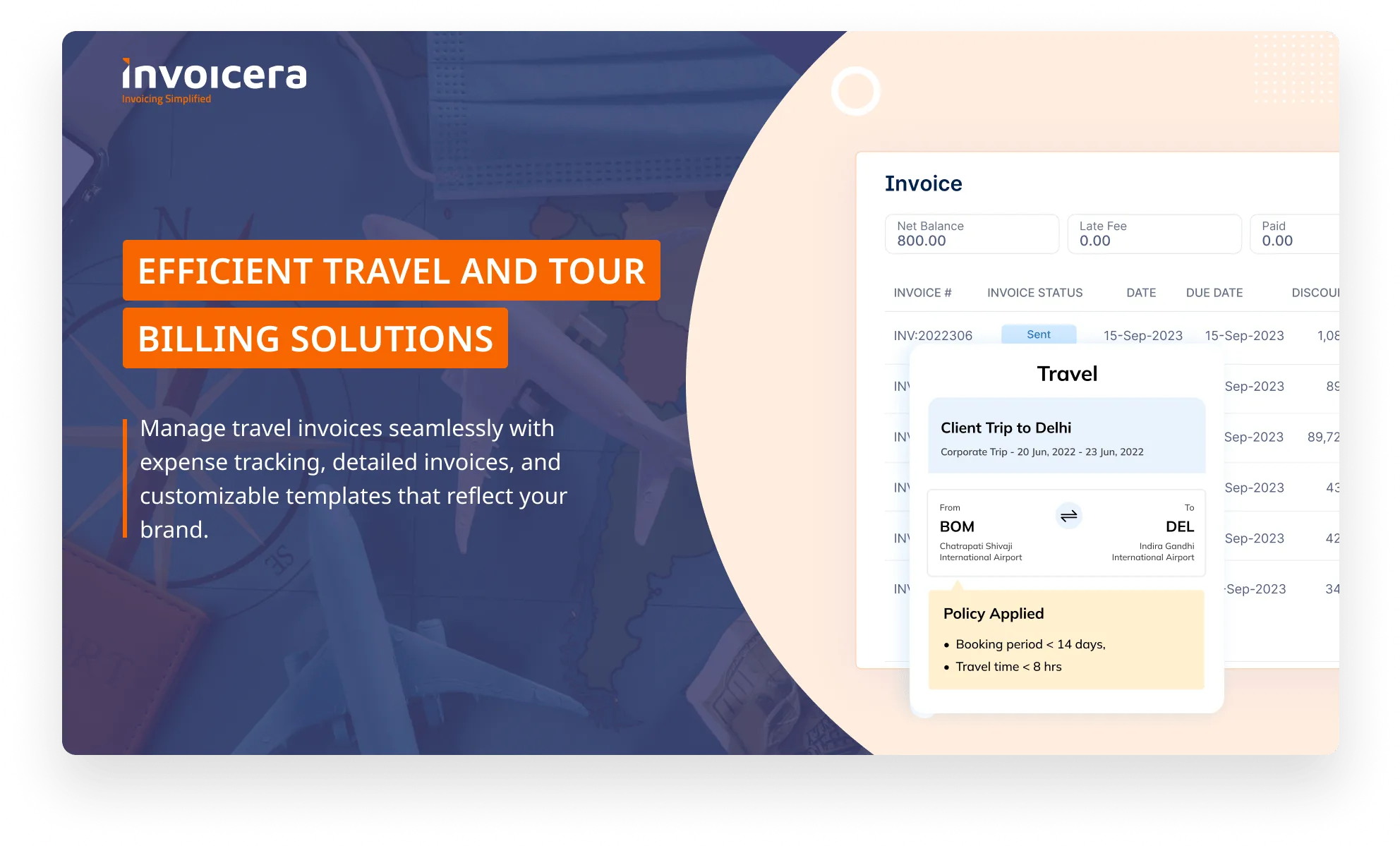

1. Invoicera

With features like multi-currency and multi-language that are relevant for availing services globally, Invoicera is suitable for travel businesses that need to address intricate invoicing solutions.

It offers customizable templates, expense tracking, and integrations with multiple payment gateways to streamline billing and improve cash flow.

Features

- Detailed Trip Estimates: Create comprehensive trip estimates, breaking down each service and cost. Perfect for individual clients or group tours, these estimates minimize confusion and ensure clarity.

- Easy Estimate-to-Invoice Conversion: Convert trip estimates into invoices with a single click, saving time and providing a consistent look across all client documents.

- Customizable Invoice Templates: Choose or create invoice templates that represent your brand. Add logos, colors, and fonts for a cohesive, professional image.

- Real-Time Payment Tracking: Stay informed on overdue invoices in real time, ensuring steady cash flow by addressing payment issues as they arise.

- Simplified Expense Tracking: Upload receipts to Invoicera for streamlined expense tracking. Bill clients for specific expenses, keeping everything organized and transparent.

- Multi-Currency and Multi-Language Support: Invoice clients in over 125 currencies and 15+ languages, ideal for businesses with global clients.

- Diverse Payment Gateway Integration: To expedite transactions and enhance client convenience, offer a variety of payment options, including PayPal, Stripe, and more.

Benefits

- Provides extensive customization options, from trip estimates to branded invoices.

- Simplifies billing for global clients with multi-currency and multi-language support.

- Real-time expense tracking and payment updates improve cash flow visibility.

- Reduces printing costs and improves accuracy by streamlining the invoicing process.

Limitations

- While Invoicera offers robust features, advanced functionality may feel overwhelming for smaller businesses or those new to invoicing software.

Pricing

Pricing plans start at a very budget-friendly price, i.e., only $15/month.

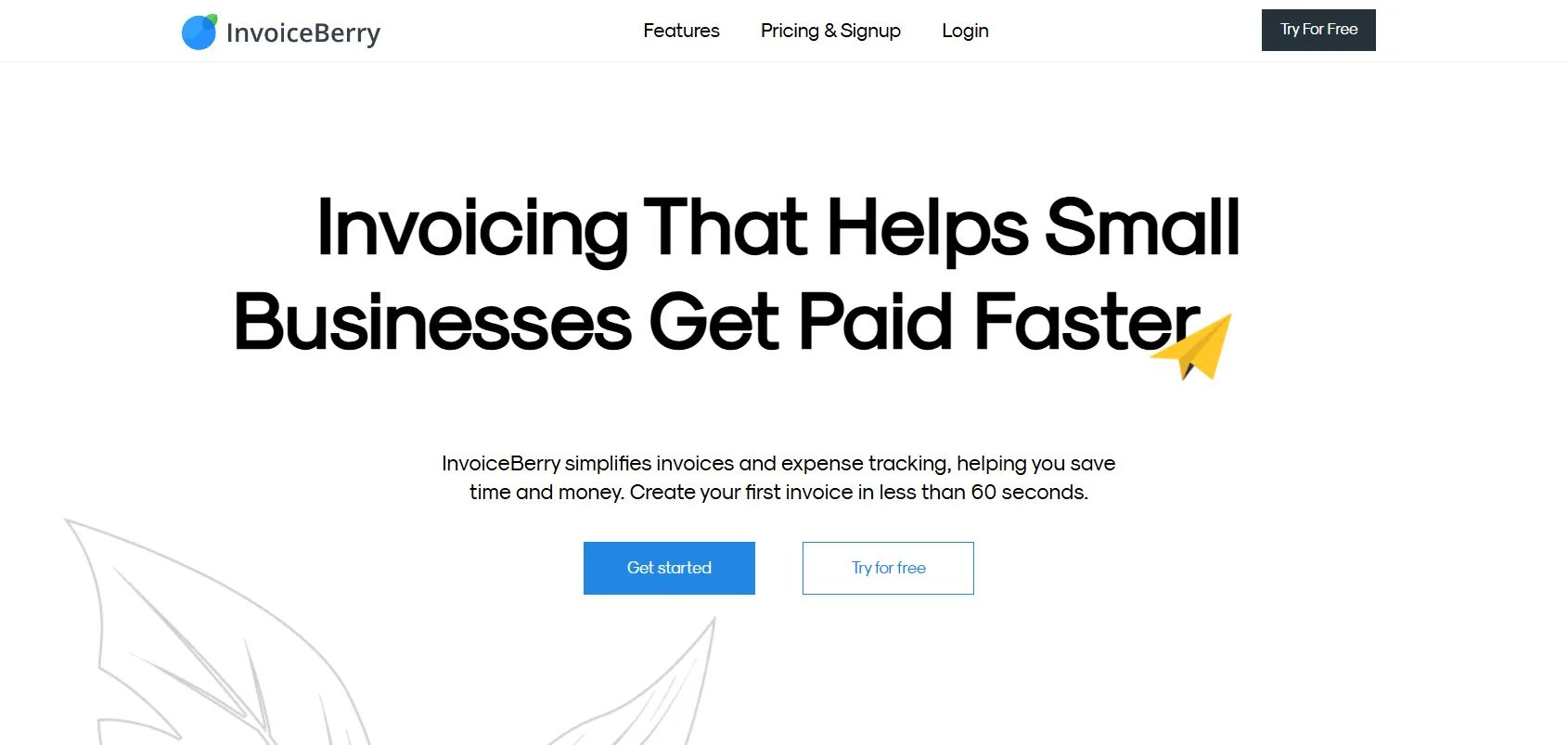

2. InvoiceBerry

This software is easy to use, and users can create professional-looking invoices in a matter of seconds and transmit them by e-mail, thus saving time and money.

Payment reminders, integration of online payment, and the creation of recurring invoices also make invoicing easy with InvoiceBerry.

Features

- Instant, Professional Invoices: Create stunning invoices with a few simple points and clicks. Pick a template, upload your logo and items, and here you go. Your invoice is created and is ready for an email, PDF, or paper format.

- Email Invoicing for Faster Payments: Automatically deliver invoices to clients’ email inboxes, no need to spend time on paper and stamps.

- Payment Tracking on Autopilot: Quickly identify unpaid invoices right from your dashboard. Need a gentle nudge? Send a one-click reminder to keep those payments coming.

- Online Payment Integration: Link your preferred payment gateways like PayPal, Stripe, or Square so customers can pay instantly online. Payments are auto-recorded, keeping your records always up to date.

- Recurring Invoices & Quote Conversion: Streamline tasks by setting up recurring invoices for repeat clients and turn quotes into invoices with a single click.

Benefits

- Fast invoicing process with minimal manual effort

- Boosts client convenience with multiple online payment options

- Simplifies overdue tracking and follow-ups

- Saves on printing and mailing costs, increasing overall efficiency

Limitations

- Interface is quite straightforward, which may limit businesses seeking advanced analytics and customization.

- Although reliable, InvoiceBerry might feel a bit like “vanilla” in terms of features—suitable for basic needs but lacking advanced tools for larger businesses.

Pricing

Pro plan starts at $30/month

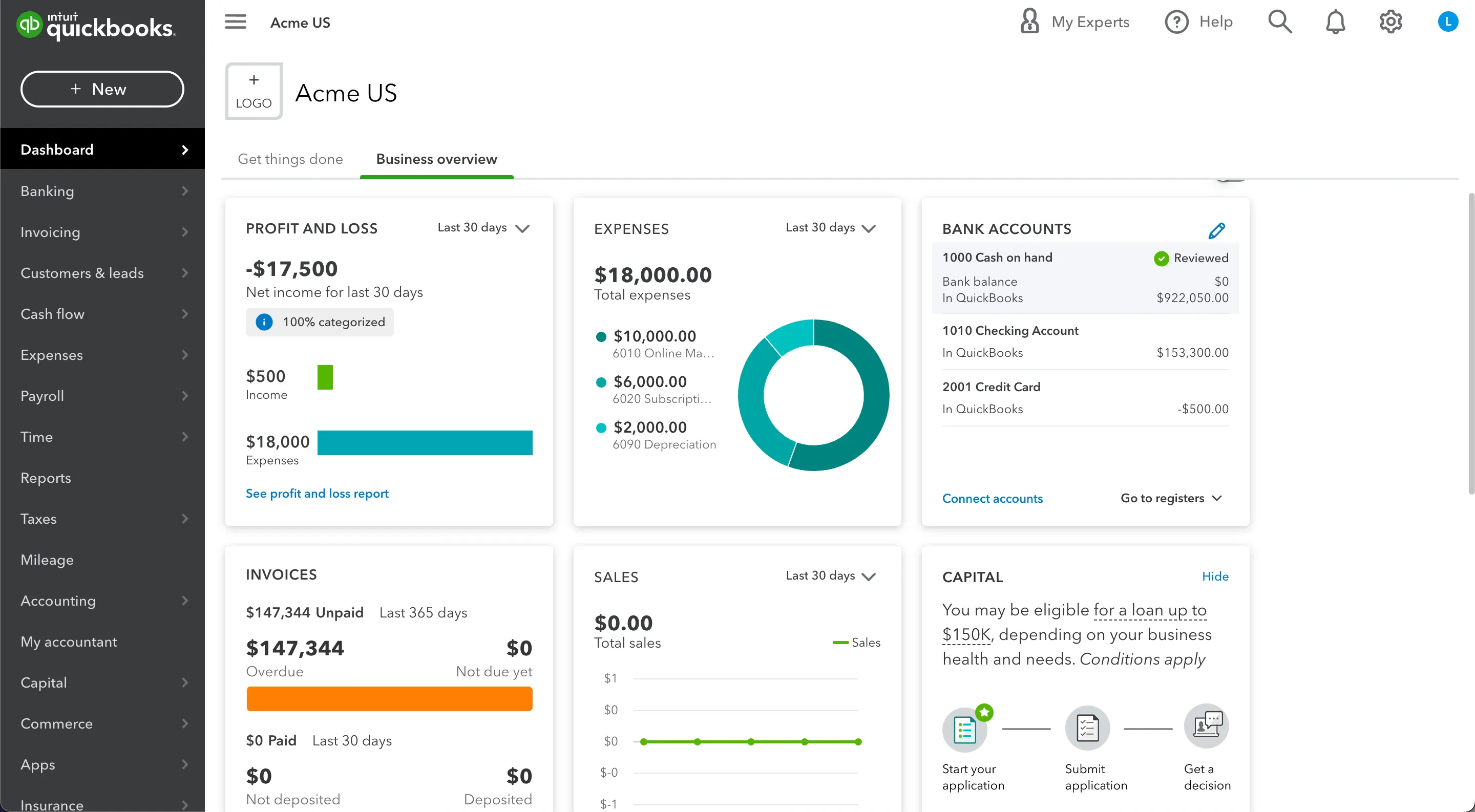

3. Quickbooks

Features

- Invoicing & Expense Tracking: You can send customized invoices, track expenses on the go, and even split bills for group tours – no more trying to figure out who owes what on that last trip!

- Bank Reconciliation & Financial Reporting: Sync your bank accounts to track payments and withdrawals easily. QuickBooks’ financial reports provide a clear picture of your travel business’s financial health.

- Multi-Currency Support: Perfect for travel businesses that deal with international clients. Whether it’s euros, yen, or rupees, QuickBooks has you covered.

- Tax Management: No more headaches at tax time. QuickBooks simplifies sales tax and VAT calculations for your tours across the globe.

- Mobile App: You can track your finances while on the go, whether you’re booking that last-minute flight or heading out to a hotel meeting.

Benefits

- Easy to share information with accountants

- Robust feature set: invoicing, inventory, and reporting

- Available mobile app for on-the-go management

- Good customer support (chat and phone)

Limitations

- Expensive compared to other tools

- Frequent price increases and upselling

- Limited account users per plan

Pricing

Essentials: $14/month – Not too bad for keeping your tour business on track!

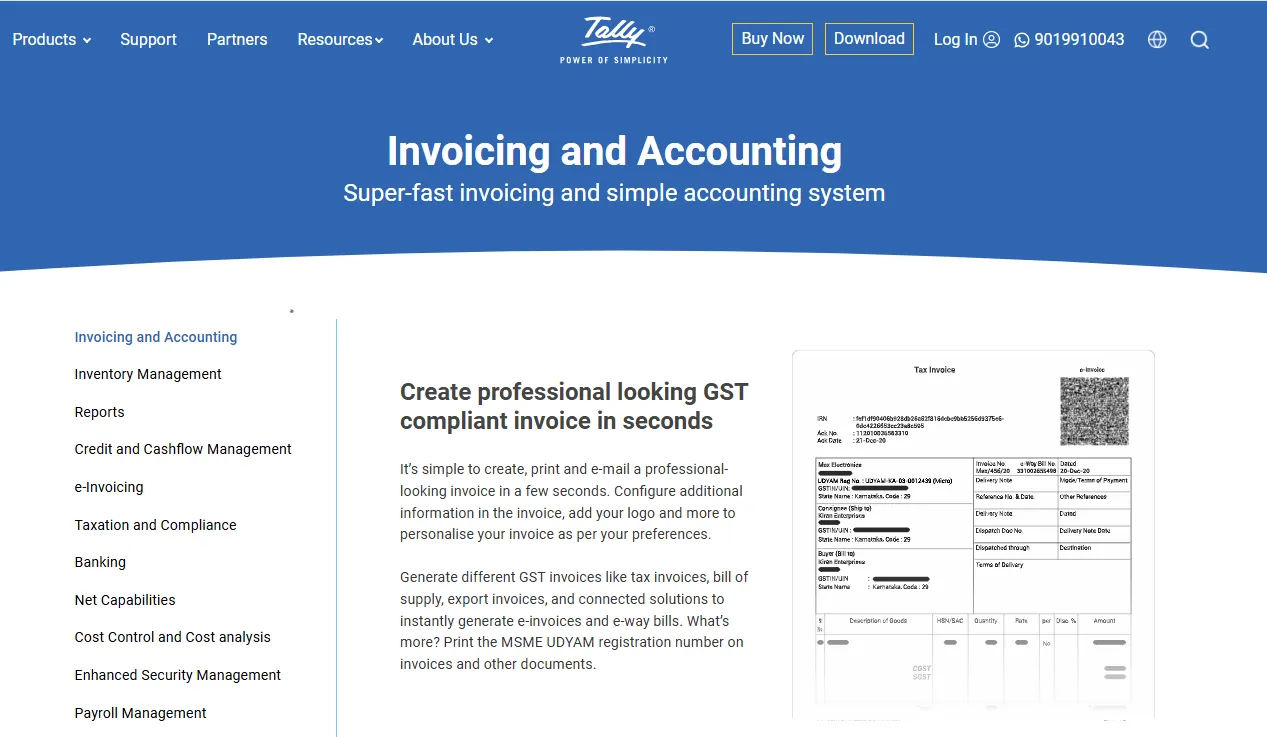

4. TallyPrime

Features

- Invoicing & Accounting: Create professional invoices and track all your expenses with ease. Perfect for tour operators who need to juggle multiple payments for different packages.

- Business Reports & GST Management: Easily generate insightful reports and comply with India’s GST rules, which is crucial for travel agencies running tours in the subcontinent.

- Credit & Cash Flow Management: TallyPrime helps manage incoming payments for bookings and handles those tricky cash flow moments when clients delay payments.

- Multi-task Capabilities: Whether it’s managing multiple tour groups or creating invoices for different services (flights, hotels, tours), TallyPrime can handle it all.

- Secure Data & Excel Import Function: Your data is stored securely, and if you need to import from Excel, it’s all streamlined.

Benefits

- Flexible and customizable for travel businesses

- Detailed GST and tax compliance

- Cost-effective compared to other tools

- Strong reporting and accounting capabilities

- Secure data management and Excel import

Limitations

- Steep learning curve for non-accountants

- Limited customization for advanced needs

- UI can be cumbersome for some users

Pricing

Starts at $99 for 3 months – An affordable option if you’re focused on detailed, tax-compliant billing for your travel company.

5. Bookipi

Bookipi is like your personal travel assistant – only it’s an invoicing app that you can take everywhere. Whether you’re a freelance travel consultant or a small tour operator, Bookipi helps keep your billing simple and efficient with a side of mobile convenience.

Features

- Invoicing & Estimates: Create professional invoices and estimates for your travel services, whether it’s a customized tour or a luxury hotel booking.

- Receipt Capture: Upload receipts for travel expenses like airfares, hotel stays, or meals, keeping everything neat and organized.

- Payment Integration: With Tap to Pay, you can accept payments directly from your clients’ phones, no terminal needed. Perfect for freelance tour guides who want quick, on-the-spot payments.

Benefits

- Easy to use and quick setup

- Syncs across devices (web and mobile)

- Customizable invoices with image upload

- Instant receipt generation

- Simple and mobile-friendly payment processing

Limitations

- Desktop version is harder to use

- Payment collection may be slower

- No option to merge multiple accounts

Pricing

Professional: $39/month – A solid choice for freelancers in the travel industry who need something easy yet effective.

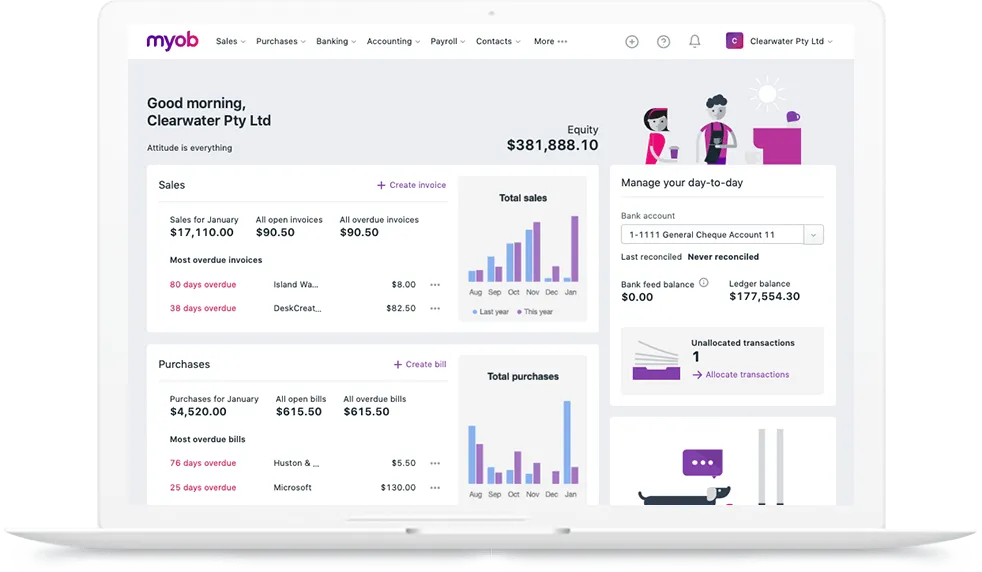

6. MYOB Essentials

Try it for 14 days free to see if it’s the travel buddy your business needs.

Features

- Professional invoicing: Impress clients with sleek, customizable invoices that reflect your brand. With MYOB Essentials, all it takes is a few clicks to make invoices your own.

- Accuracy made easy: Turn quotes into invoices effortlessly, with automated GST and customer details filled in for you.

- Quick payments: The ‘Pay now’ button offers a range of payment options, including PayPal, Google Pay™, and credit cards, so your clients can settle up in seconds.

- Automatic reminders: Track who’s paid and give those late-payers a friendly nudge, keeping your travel funds flowing.

- Snap & store receipts: Capture expenses on the go by snapping pictures of receipts, making tax time and expense tracking as smooth as a tropical breeze.

Benefits

- User-friendly interface

- Customizable invoices with branding

- Automated GST and customer details

- Quick payments with ‘Pay now’ button

- Automatic invoice reminders

- Expense tracking via receipt snapping

Limitations

- Errors can be hard to trace

- Auto-reconciliation may cause issues if rules are set incorrectly

Pricing

MYOB Business Pro: Starting from $8/month.

7. myBillBook

Features

- Customizable invoices: Adapt invoices to fit each tour, adding branding and custom elements easily.

- Recurring invoices: Ideal for subscription-based services or frequent customers.

- Multi-currency support: Invoice international clients without a hitch, accepting different currencies with ease.

- Client management: Keep track of customer details and maintain all records in one spot.

- Expense management: Track tour expenses in real-time for better cash flow oversight.

Benefits:

- Easy-to-use interface

- Customizable invoices

- Multi-currency support

- Mobile & desktop compatibility

- Client and expense management

Limitations:

- No offline mode

Pricing

Diamond Plan: ₹217/month (ideal for small business owners).

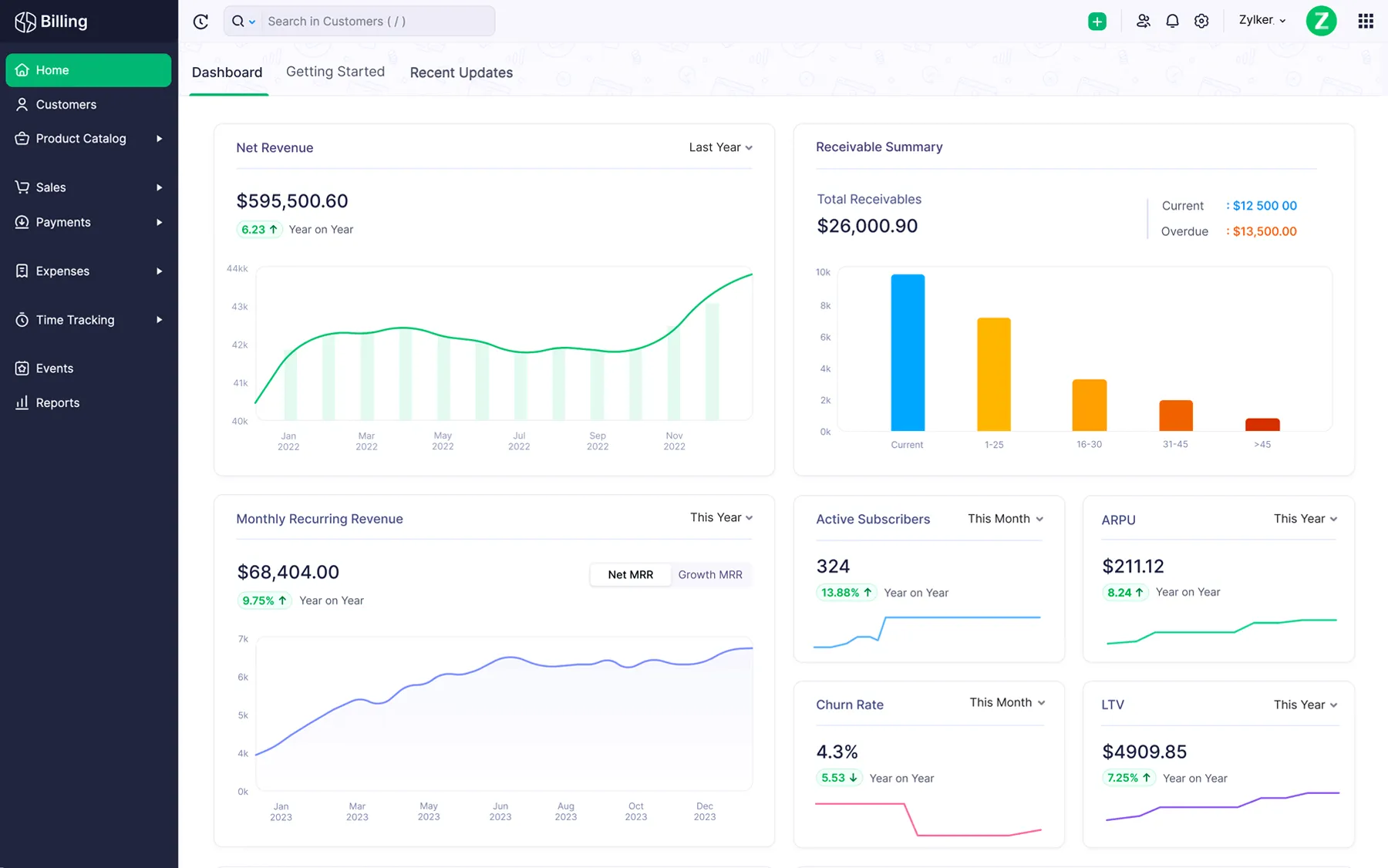

8. Zoho Billing

Features

- Detailed tour estimates: Craft and send estimates for travel packages, adding discounts, terms, and converting them to invoices with a click.

- Customizable invoice templates: Add your brand’s personality with flexible templates that reflect your unique travel style.

- Multiple payment gateways: Integrates with 7+ gateways, so clients can pay online swiftly, helping keep payments timely.

- Expense tracking: Snap receipts and upload them instantly, ensuring no expense goes unbilled.

- Multilingual support: For global clients, invoice in their preferred language to keep things clear and customer-friendly.

Benefits

- Quick tour estimates and invoice conversion

- Customizable invoice templates

- Integration with 7+ payment gateways

- Expense tracking with receipt upload

- Multilingual support for international clients

Limitations

- Slow customer support response

- Lack of clear documentation for new features

Pricing

Standard Plan: $25/month

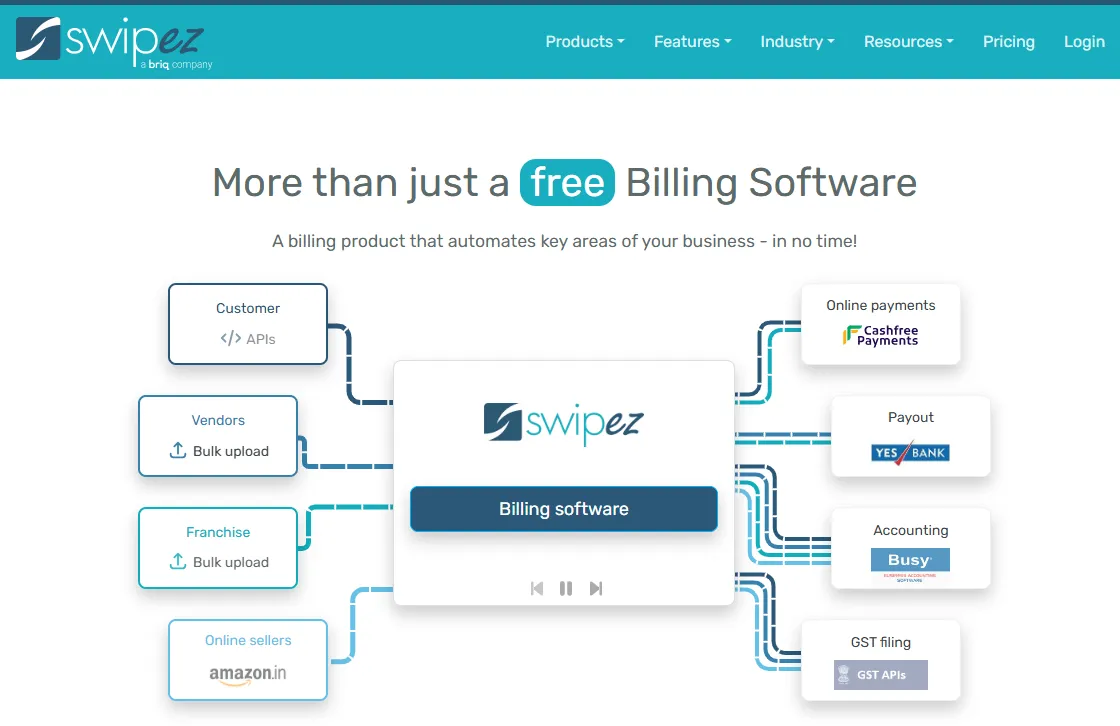

9. Swipez

It offers a variety of features that cater to the unique needs of the travel industry, like multi-currency support, customizable templates, and automatic reminders, ensuring that you never miss a payment deadline while keeping everything organized.

Features

- Invoice Management: Create and manage invoices for different travel services with ease.

- Recurring Billing: For travel agencies offering subscription-based packages, this is a lifesaver.

- Payment Gateway Integration: Swipez integrates seamlessly with multiple payment gateways, making international transactions a breeze.

- Expense Tracking: Keep track of every penny spent on your travel operations.

- Customer Management: Store and organize customer details to streamline billing and improve customer service.

- Tax Calculation: Automates tax calculations to avoid those confusing moments during tax season.

- Multi-Currency Support: Ideal for travel businesses that deal with clients across the globe.

- Automated Reminders: Never forget to send an invoice or follow up with a client again.

- Customizable Templates: Choose from various templates or create your own to match your travel business branding.

- Reporting and Analytics: Get detailed reports to track your finances, making it easy to see where your travel business is going.

- Mobile Access: Manage your invoices, expenses, and payments on the go.

Benefits

- Easy to set up and use

- Fast and responsive customer support

- Highly customizable for various business needs

- Excellent payment conversion rates with multiple payment gateways

- Flexible invoicing for different travel business models

Limitations

- Some business-specific features may not be available initially.

- Custom features are added as business volume increases, which may take time.

Pricing

Swipez offers a free plan for billing and invoicing, while online payments come with fees:

- UPI/Debit cards: 0.5% for transactions under ₹2,000, 1% over ₹2,000.

- Credit cards: 2.1% for Visa, Mastercard, RuPay cards; 2.8% for Amex and Diners.

- Net banking: 2.1% for transactions via 50+ banks.

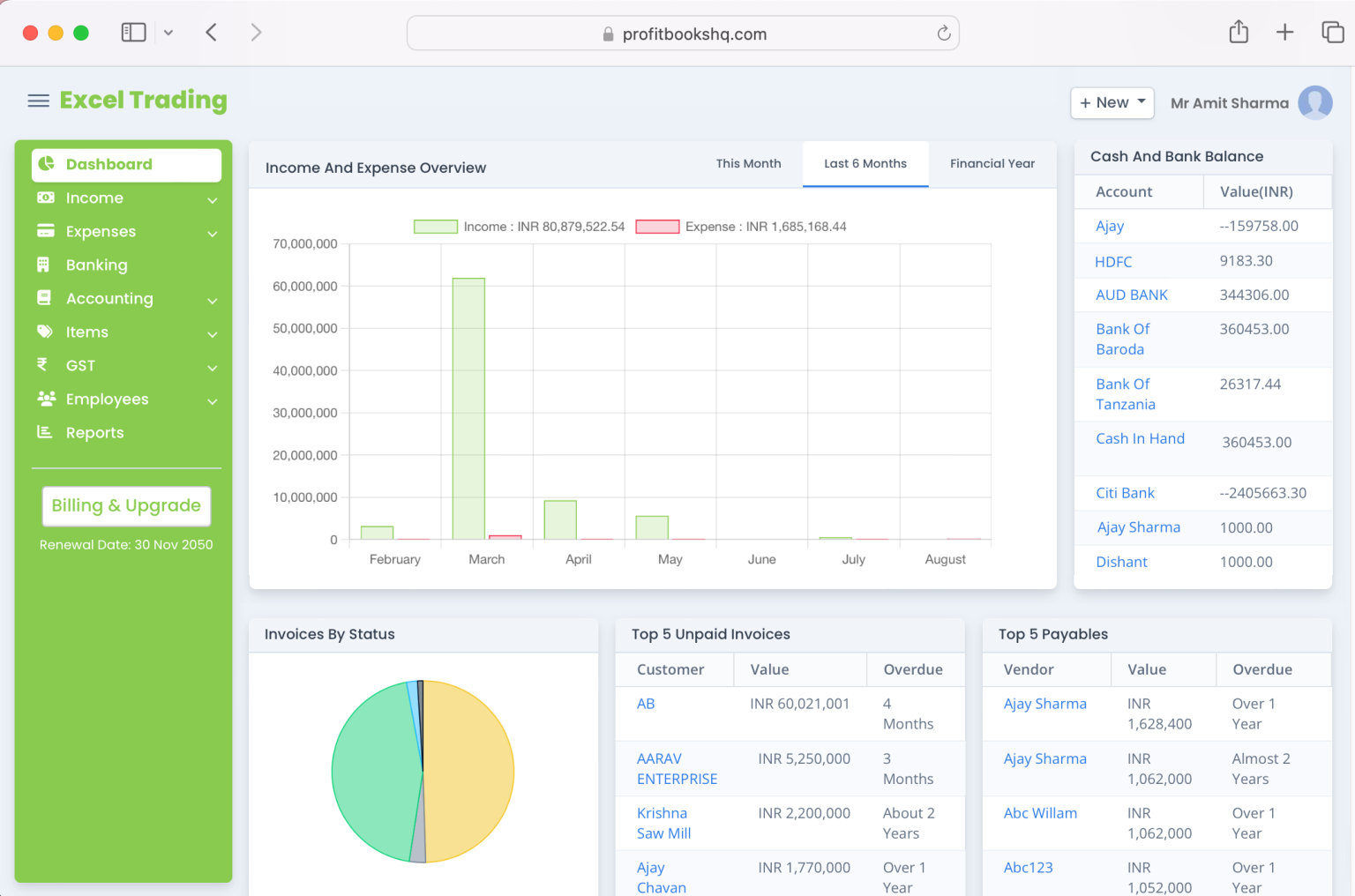

10. ProfitBooks

Features

- Real-time Data Access: Get a live view of your financial health no matter where you are.

- Collaborative Features: Invite team members to work together and stay updated on all travel transactions.

- Automated Backup: Ensure your travel-related data is safe with regular backups.

- Secure Financial Data Sharing: Share data securely with team members, bookkeepers, or accountants.

- Travel Expense Monitoring: Easily track and categorize travel-related expenses, from transportation costs to accommodation fees.

- Multi-Currency Support: Ideal for managing international travel bookings and clients.

- Real-Time Exchange Rates: Keep your invoices accurate with live currency conversion rates.

- Recurring Invoices: Perfect for agencies offering subscription-based services or packages, like travel plans or memberships.

Benefits

- Real-time access to financial data

- Easy collaboration with team members

- Automated data backups for security

- Ideal for tracking travel-related expenses

- Supports multi-currency for global transactions

- Automatically generates GST reports

Limitations

- Limited user permission filters for team members

Pricing

Starts at $15/month, offering a straightforward pricing plan that suits small to medium-sized travel businesses.

Conclusion

Choosing the right invoicing software is crucial for streamlining billing processes in the travel industry.

Whether you’re handling multi-currency transactions, complex itineraries, or offering flexible payment options, the software options highlighted here offer tailored solutions to simplify your invoicing.

From automating recurring payments to ensuring tax compliance, Invoicera is the right tool that can improve cash flow, save time, and enhance client satisfaction.

By leveraging these advanced features, travel businesses can focus more on delivering exceptional experiences to their clients and less on the administrative burden of invoicing.

FAQs

Ques. How do I handle taxes for international bookings?

Ans. Invoicing software like Invoicera and QuickBooks automatically applies the correct taxes based on the client’s location, helping you stay compliant with local regulations and reduce manual errors.

Ques. Is there any invoicing software that works well for small travel businesses or freelancers?

Ans. Yes, InvoiceBerry and Bookipi are both great options for small travel businesses or freelancers, offering simple, cost-effective invoicing solutions with easy setup and mobile compatibility.

Ques. How can invoicing software help improve cash flow for a travel business?

Ans. By offering features like recurring billing, automatic payment reminders, and installment options, invoicing software ensures more timely payments and helps manage cash flow, reducing delays caused by long invoicing cycles.

Ques. What features should I look for in invoicing software for handling group tours and complex bookings?

Ans. Look for invoicing software that offers multi-line items, expense tracking, and the ability to handle multiple services in a single package, like QuickBooks and TallyPrime, to manage bookings with multiple components.