Spending hours on putting up invoices, recording payments, or even correcting billing errors? You do not have to be like that, and you are not the only one.

Automated invoice software is no longer a buzzword; it is a method of saving time, making businesses more structured, and getting paid faster.

In this blog, we will simplify the 10 most promising automated invoicing software that is taking billing smart, but not hard. Whether it’s you as a freelancer, a startup, or you keep meaning to manage a new team, there’s something here for everyone.

With the right tool, you can:

- Send invoices in just a few clicks

- Automate reminders and reduce delays

- Accept multiple payment methods

- Track payments and cash flow

- Sync with accounting tools

So, it is time to find a best fit, so you can focus on less billing and more business development.

Top 10 Automated Invoicing Software

With the most convenient billing & invoicing software to suit your business in the modern era, streamline your billing, save time, and get paid faster. Here are the top 10 automated invoicing software to consider:

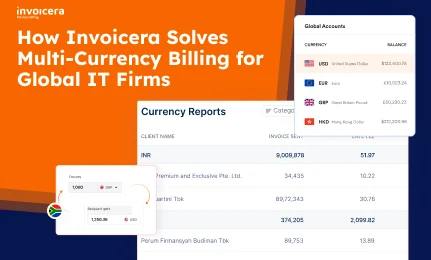

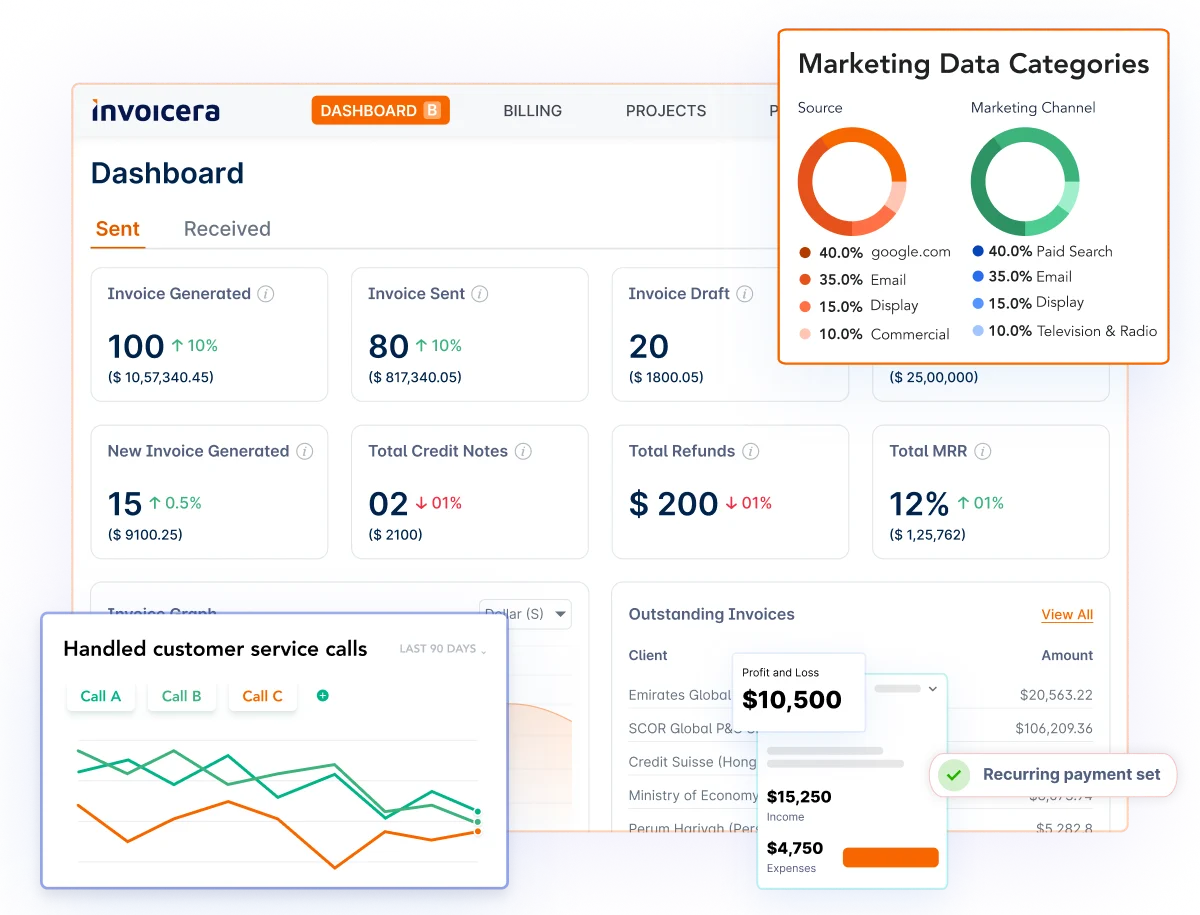

1. Invoicera

Invoicera is a user-friendly and the best billing & invoicing software designed to fit freelancer, small company as well as big business organizations. It makes complex billing easy, convenient to international business, and has flexible characteristics to meet various requirements

That’s why many companies choose it to manage their invoicing smoothly and professionally.

Key Features:

Recurring Invoicing

- Set up and send invoices automatically on a schedule; ideal for subscription-based businesses.

Time & Expense Tracking

- Track billable hours and project expenses directly from the platform.

Multi-Currency & Language Support

- Send invoices in 15+ languages and 125+ currencies to clients worldwide.

Client Portals

- Give clients secure access to their invoices, estimates, and payment history.

Payment Gateway Integrations

- Supports 14+ global payment gateways for faster, flexible payments.

Benefits:

- Reduces manual effort with fully automated workflows

- Supports global billing with currency and language options

- Improves cash flow with real-time insights and faster payments

- Customizes workflows and templates for brand consistency

Limitations:

- Interface can be complex for beginners

- Some advanced features require higher-tier plans

Pricing:

Pricing plans start at $15/month

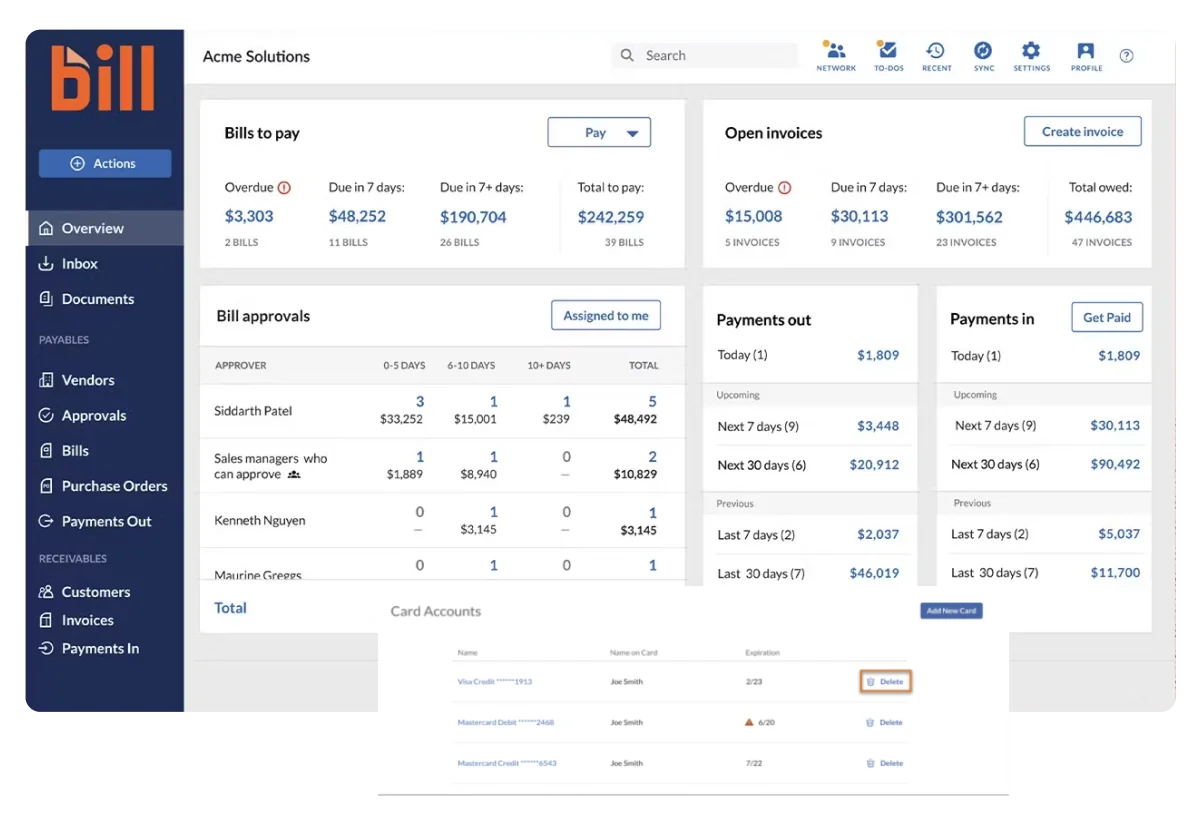

2. Bill.com

Features

Features

- AP automation for faster payments

- Spend and expense management with BILL Divvy Card

- Integration with your accounting software

- Unified platform for AP, AR, and cash flow management

- Accountant Partner Program for bookkeeping and client services

Benefits

- Centralized payment management

- Improved cash flow tracking

- Enhanced accuracy

Limitations

- High transaction fees

- Limited customer support

Pricing

Starts at $45/user/month

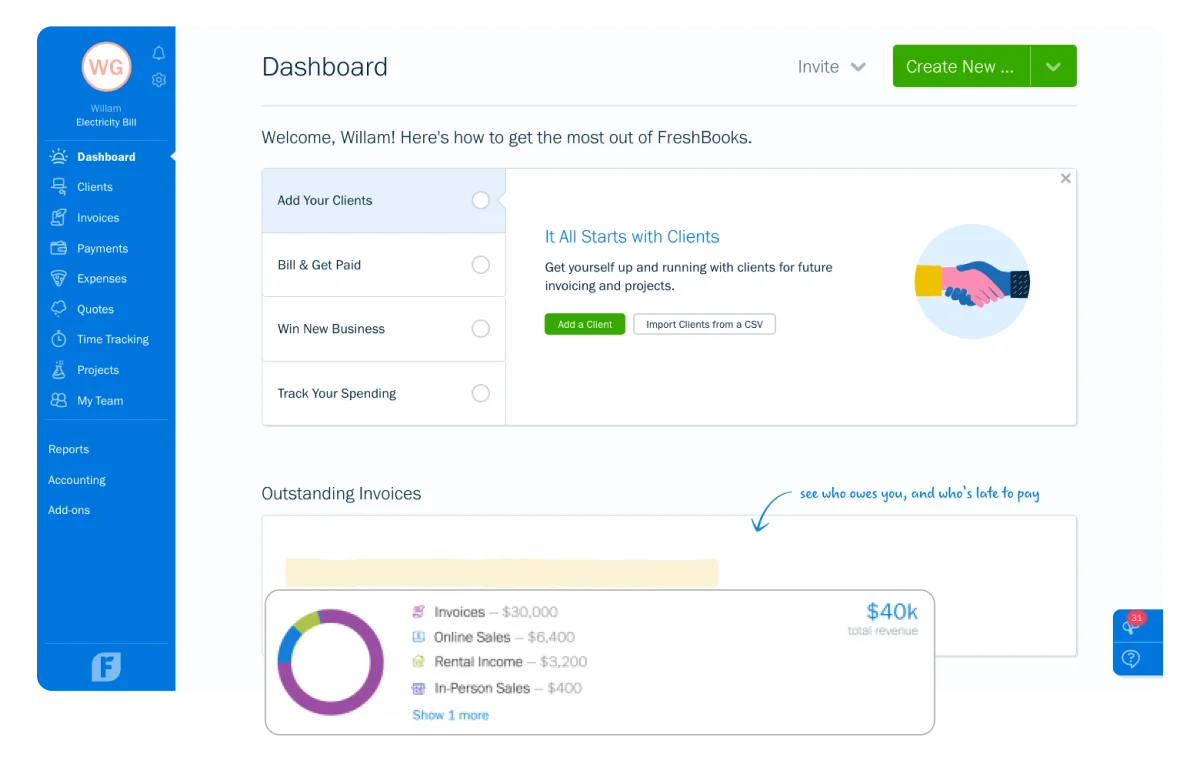

3. FreshBooks

Features

- Create and customize invoices with ease

- Accept payments online via credit cards and ACH

- Automate reminders and client follow-ups

- Request deposits for upfront payments

- Integrate tracked time and expenses into invoices

- Manage retainers for stable cash flow

- Generate professional financial reports

Benefits

- Super easy to use

- Affordable for small businesses and freelancers

- Powerful accounting features for better financial insights

Limitations

- Not ideal for larger businesses

- Charges extra for additional team members

- Limited customization options

Pricing

Starts at $16.50/month

4. Zoho Invoice

Features

- Send professional, customizable invoices

- Automate payment reminders and recurring billing

- Handle e-invoicing for compliance

- Accept multiple payment methods

- Manage refunds with credit notes

- Multi-currency support for global transactions

- Approve invoices before sending

Benefits

- Beginner-friendly interface

- Integrates well with other Zoho apps

- Offers online payments and automated invoicing

Limitations

- Limited to 1,000 invoices/year

- Only three user accounts included

- Advanced features require a paid version

Pricing

Starts at $15/month (billed annually)

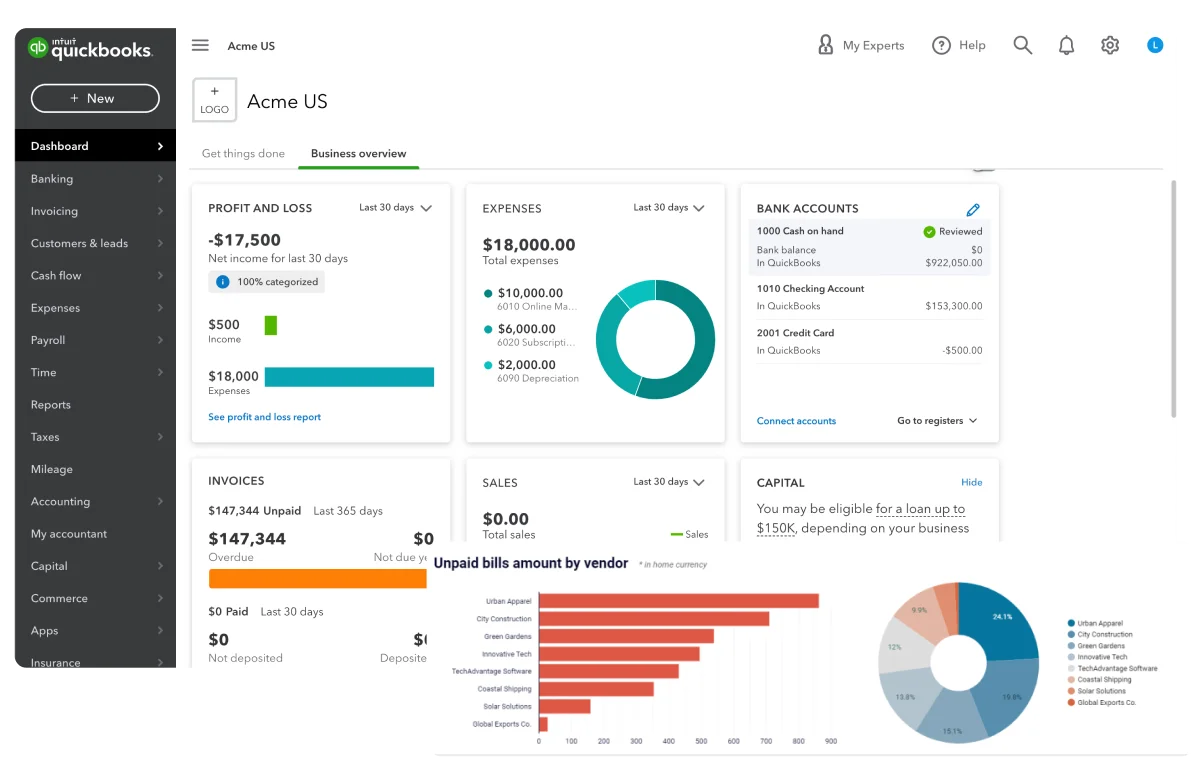

5. QuickBooks Online

Features

- Add billable hours automatically with QuickBooks Time and Google Calendar

- Get instant alerts when invoices are viewed or paid

- Send instantly payable invoices for 4x faster payments

- Auto-match payments to keep your books in order

- Set up recurring invoices for consistent cash flow

Benefits

- Scalable plans for all business sizes

- User-friendly and intuitive interface

- Strong third-party integrations

- Advanced inventory features

Limitations

- Limited user capacity and file size

- Basic reporting capabilities

- Occasional customer support hiccups

- Double-entry errors can happen

Pricing

Starts at $17.50/month for Simple Start

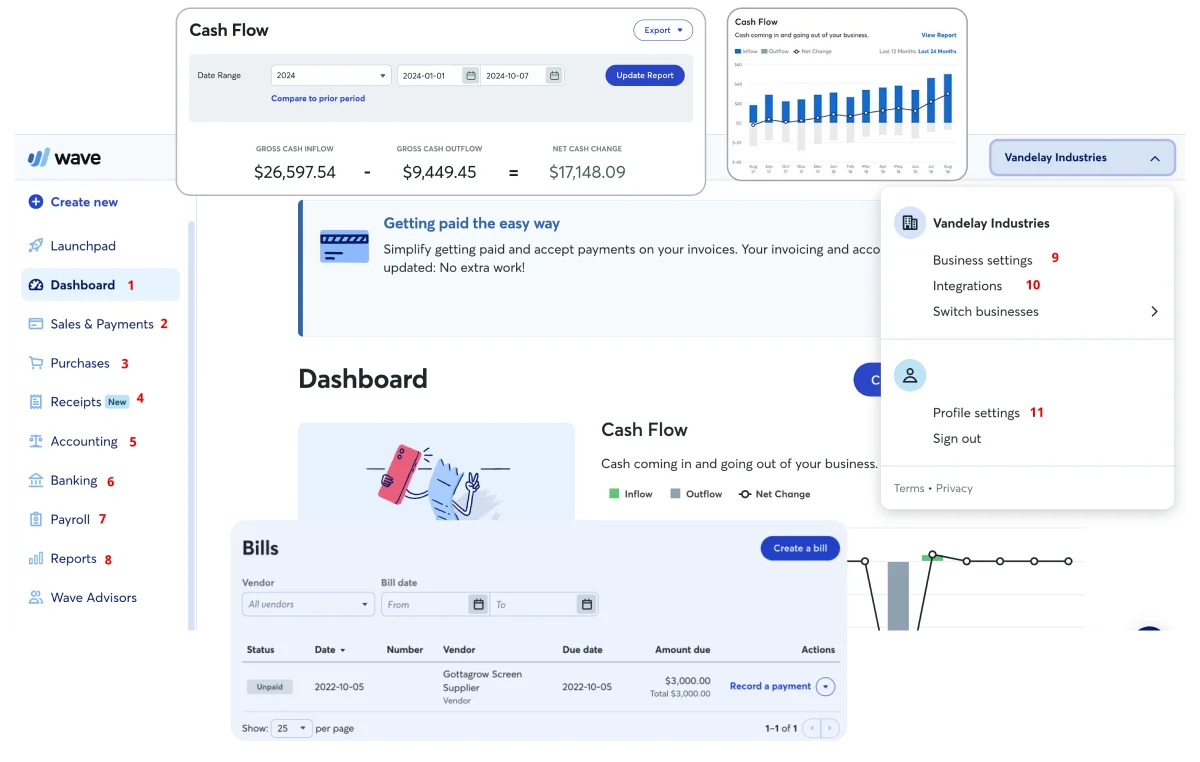

6. Wave

Features

- Create and send invoices in seconds

- Set up recurring billing for repeat clients

- Automatic credit card payments for steady cash flow

- Syncs all invoices and payments with accounting

- Supports double-entry accounting for accuracy

Benefits

- Unlimited invoices, expenses, and receipts

- Easy-to-use mobile app for on-the-go management

- Cost-effective option for small businesses

Limitations

- Limited customer support on basic plans

- Missing advanced features like budgeting and inventory

- Fees for online payments

- Not ideal for complex accounting needs

Pricing

Starts at $16/month, billed monthly

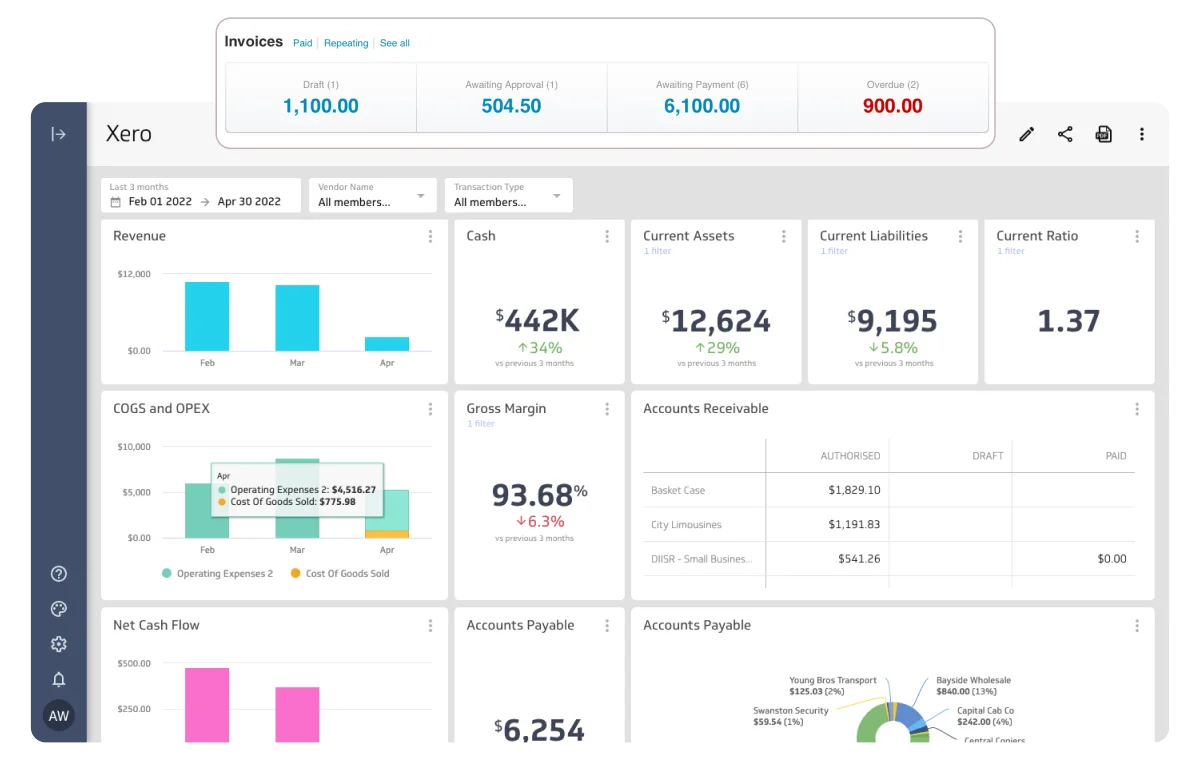

7. Xero

Features

- Customize invoices with your logo

- Send invoices from anywhere via mobile or desktop

- Add a ‘Pay Now’ button for faster payments

- Automatic payment reminders

- Integrates with Stripe and GoCardless for payments

Benefits

- Saves time

- Reduces errors

- Boosts cash flow

Limitations

- Some integrations may cost extra

- Limited features in lower plans

Pricing

Starts at $2.90/month for 6 months, then $29/month

8. Sage 50

Features

- Generate accurate digital invoices

- Automate recurring billing and reminders

- Real-time financial insights

- Seamless integration with banks and tools

- Flexibility to fit your business needs

Benefits

- Cuts manual effort

- Improves payment speed

- Enhances cash flow management

Limitations

- Limited Accessibility

- Scalability Issues

- Prone to System Vulnerabilities

- Limited Automation

Pricing

Essential desktop accounting with cloud access costs $708/year

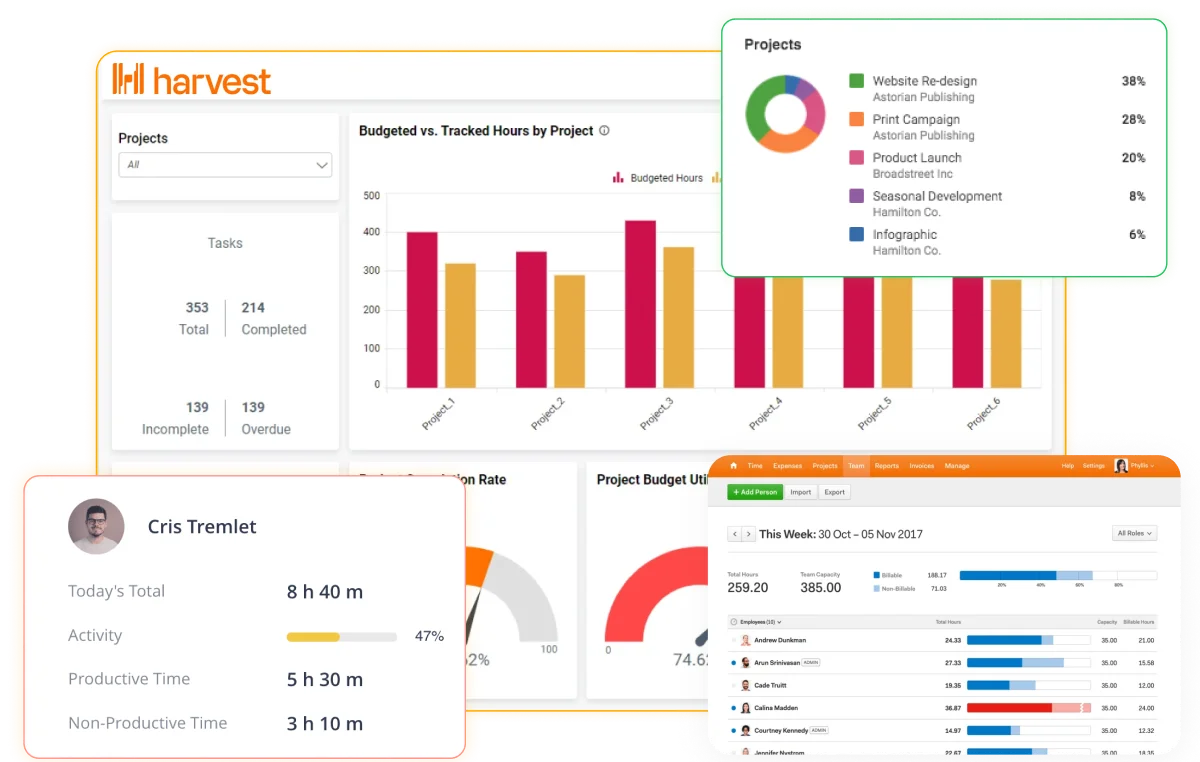

9. Harvest

Features

- Turn tracked billable hours into professional invoices instantly

- Accept payments online via PayPal or Stripe with one click

- Add project expenses and receipt images to invoices seamlessly

- Automate recurring invoices for repeat clients

- Manage invoices in real-time with status tracking and payment reminders

- Sync with QuickBooks Online or Xero for smoother accounting

Benefits

- User-friendly interface

- Easily email invoices and reminders

- Robust integrations with 50+ tools

Limitations

- Costs can add up for larger teams

- Limited customization and reporting options

- Not ideal for enterprises with complex needs

Pricing

Pro Plan: $11 per user/month

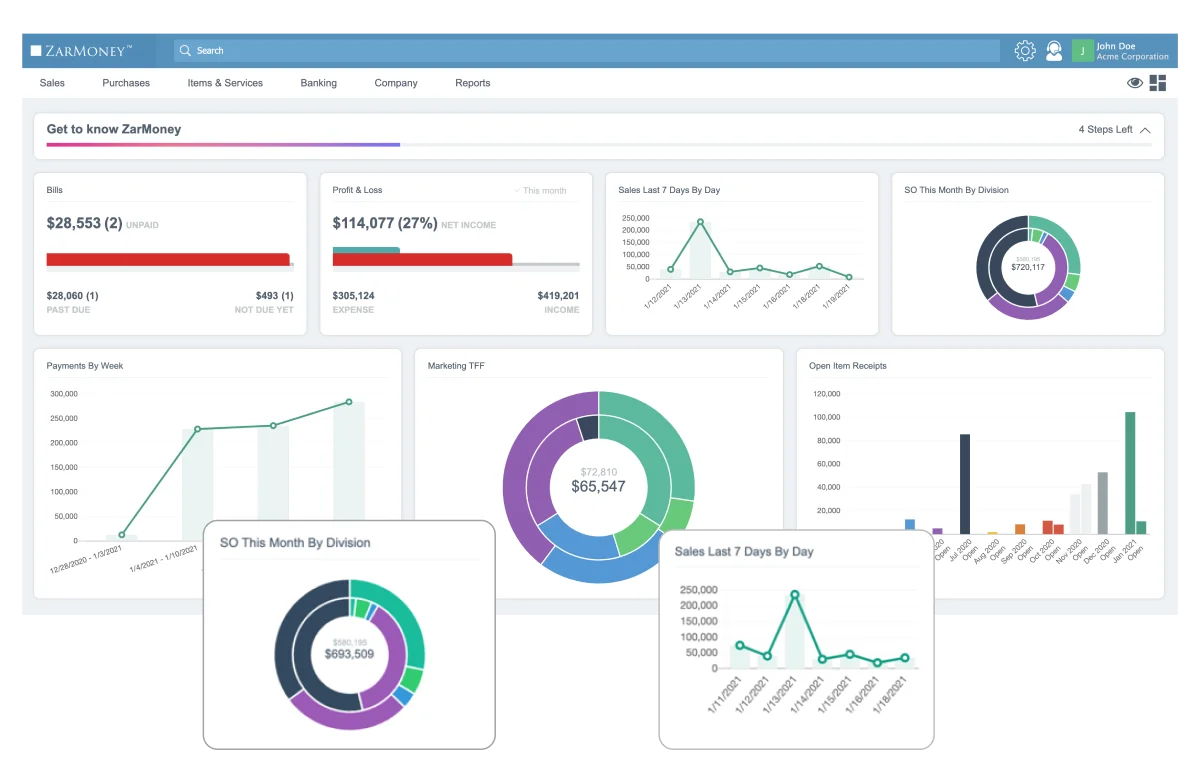

10. ZarMoney

Features

- Create and send custom invoices that match your brand

- Automate invoice follow-ups and reminders for late payments

- Accept online payments effortlessly through multiple gateways

- Real-time collaboration with team members for streamlined billing

- Comprehensive financial reports to track business performance

Benefits

- Highly customizable templates

- Flexible integration options

- Excellent for both small and large businesses

Limitations

- Slight learning curve for beginners

- Some advanced features are only available in higher-tier plans

- Limited mobile app functionality

Pricing

$20 per month

Features to Look for in Automated Invoicing Software

Choosing the right tool can be challenging, yet if you know what to look for, you will certainly select the invoicing software that corresponds to your enterprise’s type.

Here are the key features that you must look for in an automated invoicing software:

Customizable templates

You should also be able to insert your business logo, colors, and any other details on your invoices. Getting your invoice branded goes a long way in confirming your credibility; hence, it is a more professional-looking document.

Recurring invoicing

Ensure that you create recurring invoices so that you don’t have to send the bills manually to your customers each month.

Payment integrations

Make sure the tool you need fits well with such payment services as PayPal, Stripe, or credit card services that can speed up payments.

Expense tracking

Manage expenses relating to projects or tasks and bill them with ease through a few clicks.

Reporting capabilities

Get real-time insights into the invoices, payments, and financial transactions for better business management.

Multi-currency support

If you work with clients worldwide, opt for a tool that supports multiple currencies and makes global billing easy.

Mobile accessibility

Mobile invoicing software is an easy way to manage your invoices while you’re on the move.

How to Choose the Right Invoicing Software for Your Business

1. Identify your pain points

What’s slowing you down? Is it invoicing errors, late payments, or a lack of integration with your current tools?

2. Set your budget

Invoicing software comes in all price ranges. Some tools offer free versions with basic features, while others may offer advanced options at a higher price.

3. Check integrations

Make sure you can integrate the tool with the used accounting software, payment options, and CRM.

4. Look for scalability

If you are considering expansion, you should also consider whether the software is capable of handling higher volumes of invoices without a hitch.

5. Read reviews

Go through the user reviews to get an idea of its effectiveness in real life scenarios.

6. Pro tip

Most invoicing software offers a free trial. Before making a commitment, test a few options to see what works best for your business.

Conclusion

In conclusion, making the right automated invoicing software selection will save you hours a week, increase the accuracy of your invoices, and simplify collection of payments. It does not matter whether you are a freelancer or the one managing a growing crew the right device can really matter.

Invoicera stands out for its flexibility and global-ready features, making it a perfect invoice automation software for modern businesses.

Why choose Invoicera:

- Automates recurring billing and follow-ups

- Supports 125+ multi-currency and 15+multi-language invoicing

- Offers client portals and branded templates

- Integrates with 14+ payment gateways

At the end of the day, invoicing shouldn’t slow you down; it should work quietly in the background, keeping your cash flow steady and your clients happy. With the right solution like Invoicera, you can spend less time billing and more time building your business.

FAQs

Ques. Can I access my invoicing software offline?

Ans. While most automated invoicing solutions are cloud-based and require internet connectivity, some offer offline modes that allow you to create invoices and sync them once you’re back online. Check with specific providers for their offline capabilities.

Ques. How do these software solutions handle different tax jurisdictions?

Ans. Most advanced invoicing software can handle multiple tax rates and jurisdictions, automatically calculating the correct tax based on location. They regularly update their tax tables to reflect current regulations and can generate tax reports for different regions.

Ques. Besides the monthly subscription, what other costs should I consider?

Ans. Additional costs might include:

- Per-transaction fees for payment processing

- Additional user licenses

- Premium support plans

- Custom integration development

- Training and implementation

- Data migration from existing systems

Ques. How long does it take to implement automated invoicing software?

Ans. Implementation timelines vary based on the following:

- Business size and complexity

- Amount of historical data to migrate

- Number of users to train

- Required customizations

- Integration requirements

Typical timeframes range from 1-2 days for small businesses to 2-4 weeks for larger organizations.

Features

Features