Don’t you think if you are still stuck in the paper invoicing, you are costing your business more time and money?

To be honest, you aren’t alone doing this.

It is estimated that more than 1.2 billion invoices are exchanged between businesses in Australia each year, with 90% still processed through traditional methods. Digitizing this system could save up to $20 per invoice.

That’s billions in potential savings just waiting to be unlocked!

Think about it – if your business processes just 100 invoices monthly, switching to digital could put an extra $24,000 back in your pocket each year. Modern invoicing software isn’t just about saving money but transforming how you do business.

Learn about the top 10 invoicing software in Australia and a little more about how these tools can simplify your business operations.

How Invoicing Software Streamlines Your Operations

Top 10 Online Invoicing Software in Australia

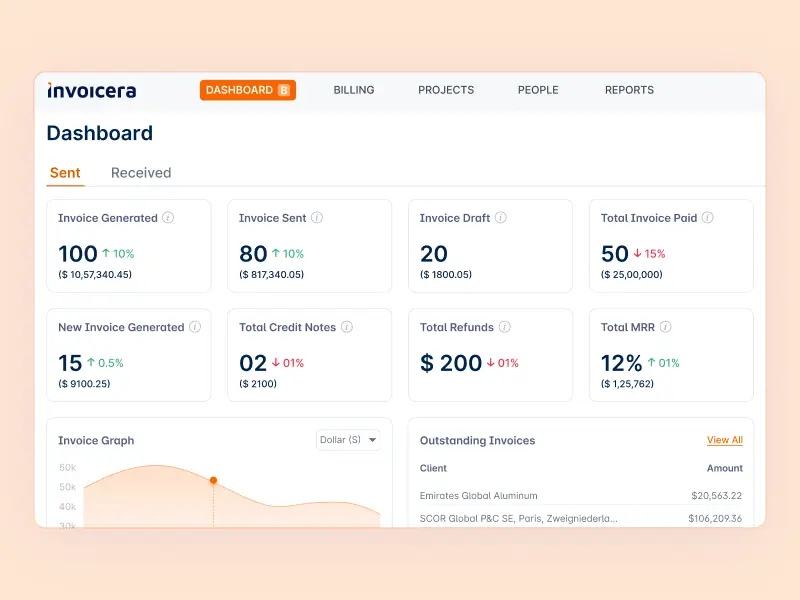

1. Invoicera

Invoicera is the best invoicing software Australia, designed to manage payments, create professional invoices, track overdue payments, and handle recurring billing.

It’s suitable for businesses of all sizes and helps ensure timely payments while supporting smooth cash flow. Below are the features of Invoicera that can streamline your invoicing process.

- Recurring Billing

- Automated Payment Reminders

- Detailed Reporting and Analytics

- Master Global Payments

- Multi-Currency Support

- Automated Tax Compliance

- Late Payment Fees Automation

- Estimates and Proposals in One Click

- Manage Purchases with Purchase Orders

- Custom Third-Party Integrations

- Real-Time Payment Tracking

- Multiple Payment Gateways

- Easy Customer Portal Access

Pricing

Pricing plans start at $15 per month, with a free trial and demo available to help you get started.

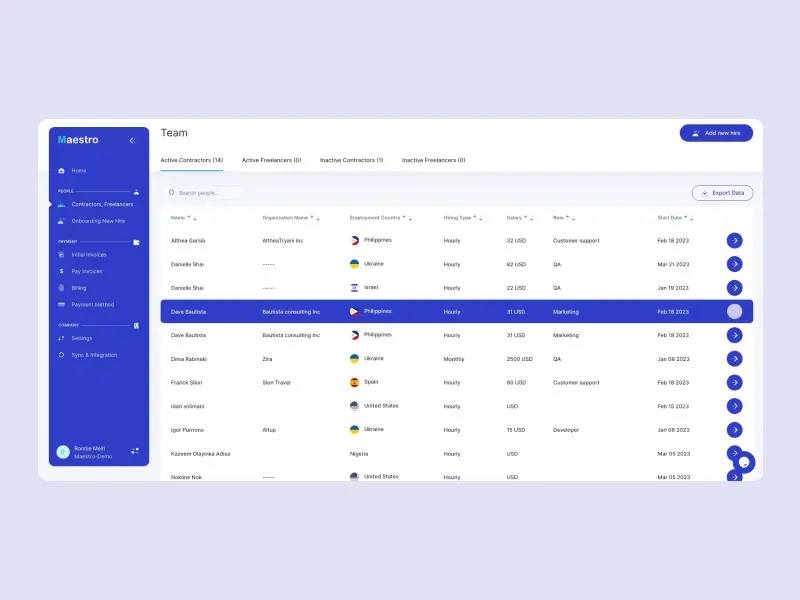

2. Maestro Payment

Maestro Payments simplifies both domestic and international payments with advanced features such as error detection and cost-saving modules.

It streamlines payment processes, saving time and reducing costs for businesses managing global transactions. Below are the key features.

- Global Payment Control

- Seamless Integrations (Xero, QuickBooks, BambooHR, etc.)

- Automated Invoice Approval

- AI-Powered Error Detection

- Batch Payments Made Easy

Pricing

$7 per contractor per month, making it a cost-effective solution for businesses.

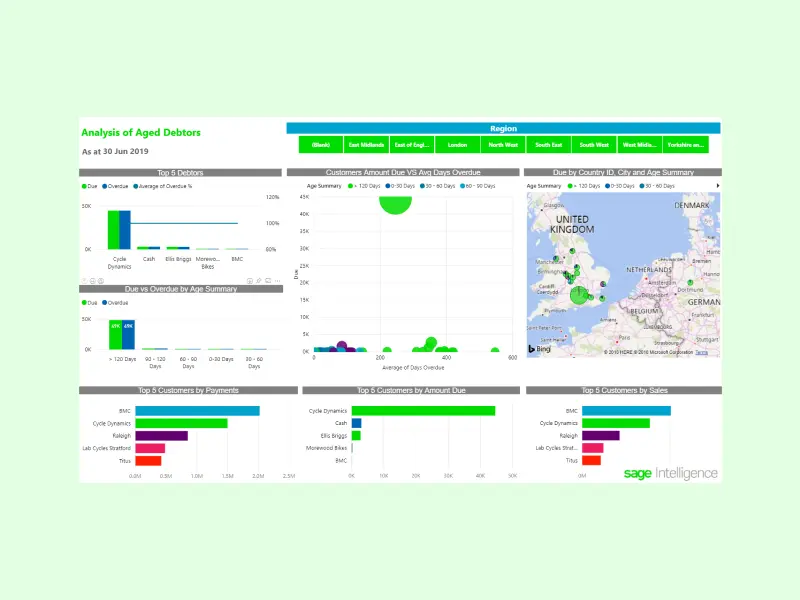

3. Sage

Sage is a reliable and scalable accounting software known for simplifying invoicing, inventory management, and financial reporting. It eliminates repetitive business tasks, offering essential tools for companies of all sizes.

Sage seamlessly connects to bank details, allowing automatic data transfer from sales and receipts to accounts. It also offers multi-currency support, making it ideal for international transactions.

- Invoice creation, editing, and distribution

- Automatic bank data integration

- Multi-currency support

- Inventory management

- Financial reporting

Pricing

Pricing is available on request

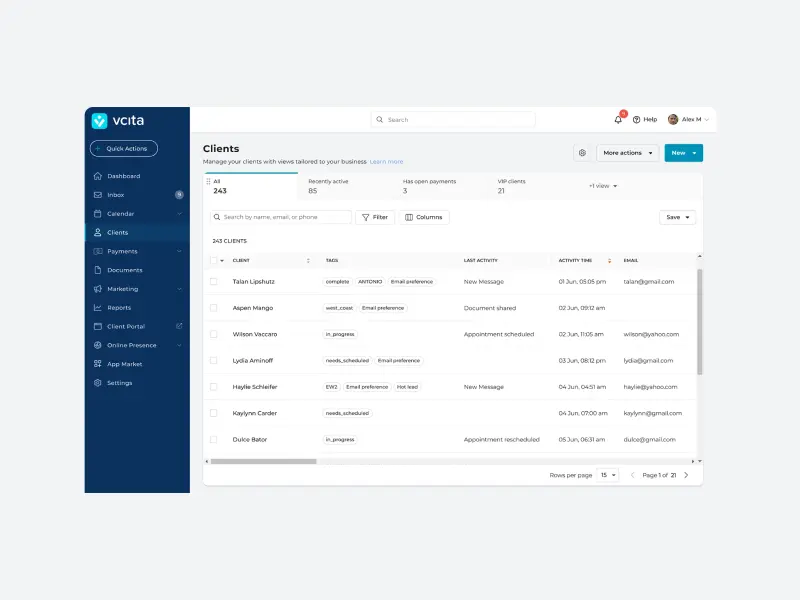

4. vcita

vcita is a comprehensive invoicing software for small businesses that integrates invoicing, scheduling, and client management.

It simplifies billing and payment collection by offering a user-friendly platform that supports estimates, automated reminders, and secure payment options. Below are its key features designed to streamline invoicing and enhance business operations.

- Customizable branded invoices with templates

- Automated invoice creation and payment reminders

- Recurring and auto-billing options

- Secure payment portal for clients

- Payment via credit cards, PayPal, or bank transfers

- Integration with tools like QuickBooks, PayPal, and Google

- Reporting and analytics

- Option for clients to pay with packages/credits

Pricing

vcita offers a business plan that is $54/month and is billed annually.

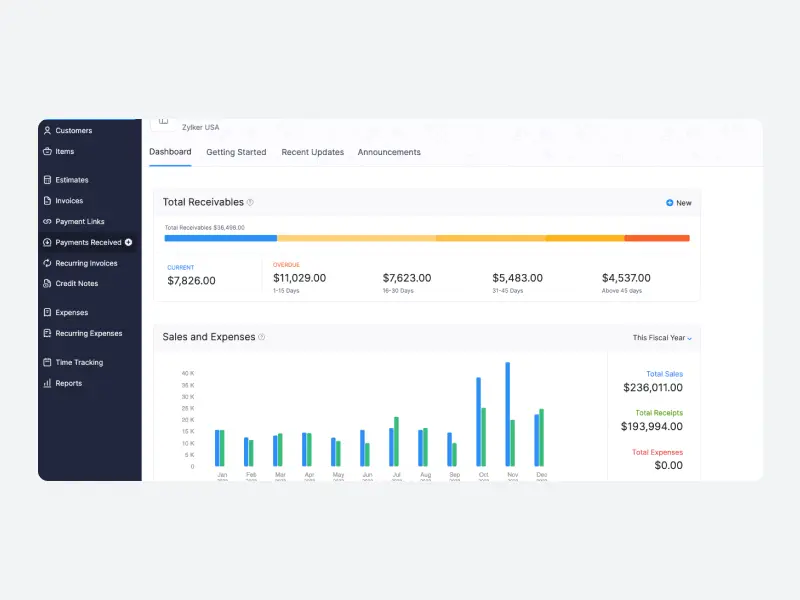

5. Zoho Invoice

Zoho Invoice has all the features that any small business needs to have for managing its invoices to its clients. It enhances the invoicing experience with branded templates, payment gateways, and automation features.

It is easily integrated with other Zoho applications, making it an integrated accounting, inventory, and customer relationship management.

- Automated payment reminders

- Online payment gateway integration

- Inventory management

- Seamless integration with Zoho apps

- Real-time analytics and reporting

Pricing

Starts at A$16.50/month for the Standard plan; up to A$319/month for the Ultimate plan.

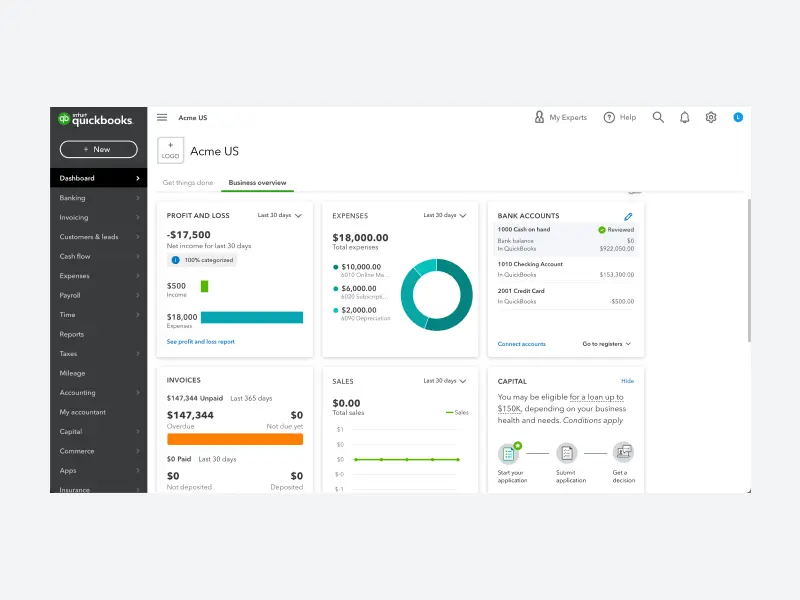

6. QuickBooks

QuickBooks is a versatile invoicing and accounting tool designed to simplify AP and AR management.

It offers robust features like invoicing, bill payments, and expense tracking, with seamless third-party integrations for businesses of all sizes.

- Invoicing and bill payments with payment integrations

- Expense tracking with account syncing

- Financial reports with A/R aging and reminders

- Automated tax calculations with expert support

Pricing

Plans start at $29/month, ranging up to $110/month.

7. FreshBooks

FreshBooks is an invoicing software designed for small businesses and freelancers. It simplifies invoicing and payment processing, making account management hassle-free.

With its intuitive interface, FreshBooks is ideal for single-operation businesses seeking scalable financial management.

- Simple invoice creation and delivery

- Automated accounts payable

- Real-time expense tracking

- Integrated time tracking

- Client and project management tools

- Over 100 app integrations (e.g., Stripe, Zapier)

Pricing

Most popular: Plus plan at $18 AUD/month

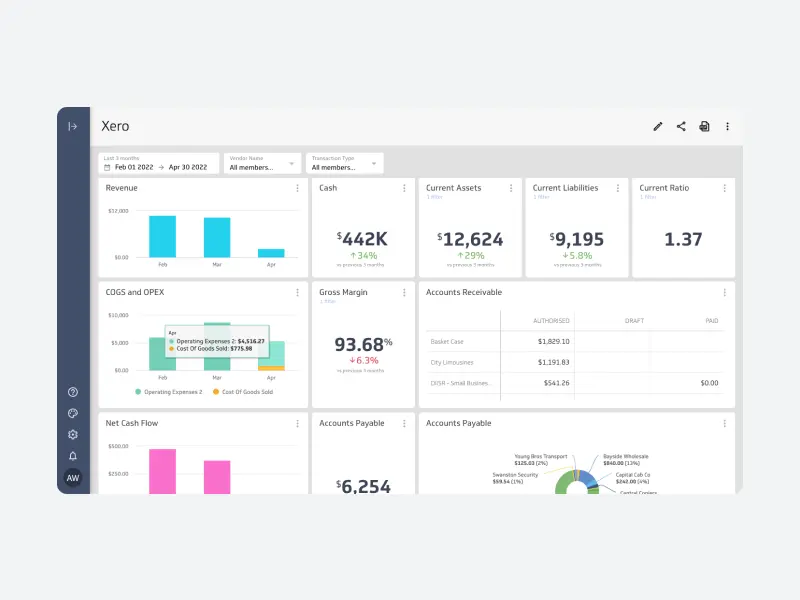

8. Xero

Xero is an invoicing software solution designed for small and growing businesses.

It simplifies invoicing, bill payments, and expense tracking with a user-friendly interface and seamless third-party app integrations, making financial management more efficient. Below are the features:

- Easy invoice creation and tracking

- Automatic payment reminders

- Multi-bill payment processing

- Real-time financial reporting

- Integration with over 1,000 apps (e.g., Stripe, PayPal, Square)

- Mobile app for payments and bill management

Pricing

Plans start at AUD $35/month, with options up to AUD $115/month for advanced features.

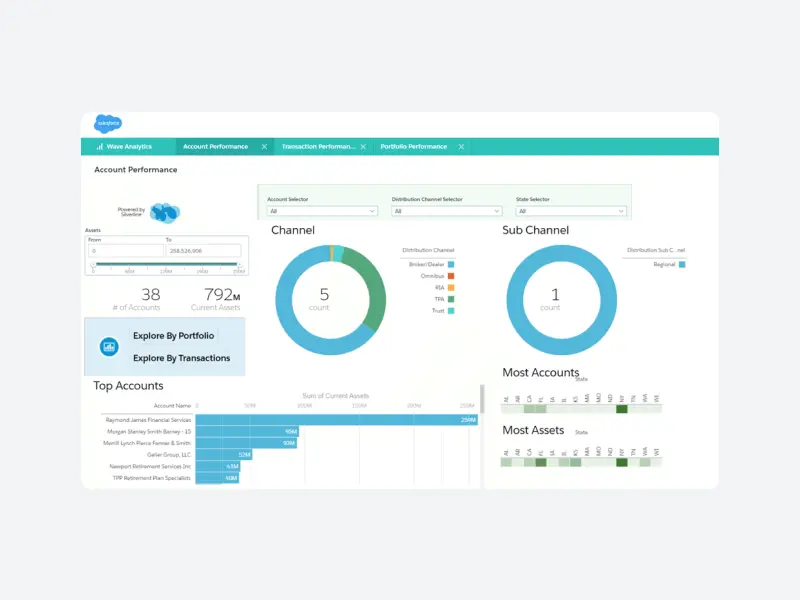

9. Wave

Wave is an invoicing and accounting software designed for small business owners and solopreneurs. It offers unlimited invoices, receipt scanning, and automation features to streamline financial tasks.

With user-friendly tools and efficient tracking, Wave ensures accuracy and ease in managing payments.

- Unlimited invoices and receipt scanning

- Automated recurring billing and payment reminders

- Payment tracking with real-time updates

- Speedy credit card payment settlements

Pricing

Pro Plan: $16/month, billed monthly

10. OneBill

OneBill is a robust cloud-based billing and invoicing software designed to enhance efficiency and cater to diverse industries such as UCaaS, Telecommunications, SaaS, and IaaS.

Below are its key features that streamline complex billing processes and customize invoices to your business needs.

- Multiple billing methods (standard, flex, on-demand, order-based)

- Add discounts, taxes, and run-time charges

- Consolidated billing for multiple vendors

- Brandable and customizable invoice templates

- Pre-designed professional invoice layouts

- Self-service portal for customer access

- Invoice notifications to multiple email addresses

Pricing

OneBill provides customized pricing on request, tailored to your business needs.

Key Features to Look for in Invoicing Software

Shopping for online invoicing software? Here’s what really matters:

1. Professional Brand Appeal

Your invoices should look as professional as your business. Modern software offers sleek, customizable templates that wow customers and perfectly reflect your brand. Create stunning invoices that get noticed—and paid faster.

2. Automation Magic

Let automation handle the boring stuff. Smart automation takes care of recurring invoices, reminder emails, and even “thank you” notes. Your time is better spent growing your business, not chasing payments.

3. Payment Flexibility

Make paying you the easiest part of your customer’s day. Top software connects with every major payment system – from credit cards to digital wallets. The easier it is to pay, the faster you’ll get paid.

4. Anywhere Access

Business never stops, and neither should your billing. Access everything from your phone, whether at home or in the office. Send invoices, check payments, and stay on top of your cash flow from anywhere with internet access.

5. Smart Insights

Know exactly where your money stands. Get clear, visual reports that show payment trends, customer behavior, and cash flow patterns. Make better business decisions with data that actually makes sense.

Conclusion

Notably, every tool we have reviewed for you provides free trial versions for users to test them out. This way, you can try them out risk-free and, finally, find the model that suits you best.

Whether you’re a solo entrepreneur using Wave’s budget-friendly features or a growing business needing Invoicera’s robust capabilities, there’s a solution that fits your needs and budget.

Keep in mind – picking up the right online invoicing software for businesses in Australia is more than just sending bills. It is about paying their bills earlier, presenting a more professional image, and having more time to focus on business. In simple words, it’s not just an upgrade – it’s a necessity.

Are you ready to embrace the change and go digital? Pick a tool, start your free trial, and watch your business transform.

FAQs

Ques. What happens to my data if the invoicing software company goes out of business?

Ans. Most reputable invoicing software providers have data backup and migration protocols. Always ensure your chosen provider offers regular data exports and has a clear data protection policy.

Ques. How secure are these online payment systems?

Ans. These platforms use bank-level encryption (256-bit SSL) and must comply with strict payment security standards like PCI DSS. Many also offer two-factor authentication for extra security.

Ques. Can I switch between different invoicing software without losing my data?

Ans. Most providers offer data import/export features. Look for software that supports common formats like CSV or direct integration with your current system for seamless migration.