A business, no matter how small or large, suffers from many challenges!

Managing invoices becomes a huge challenge sometimes, especially when doing it manually.

Late payments are another major issue associated with improper invoicing. This leads to a decrease in cash flow, which can result in the business being shut down completely in some cases.

According to the Federation of Small Businesses (FSB), late payments result in 50,000 business closures yearly.

But as the saying goes, “every challenge has a solution.” There’s a solution to manual invoicing, too.

That’s where an online invoicing software lands!

Although various invoicing tools are used across the United Kingdom, only the right tool can make a difference.

It can

- Simplify billing

- Track payments

- Help stay organized

- Save time

- Reduce errors

- Boost cash flow

So, let’s learn a little bit about the features you should look for in invoicing software, and then we will discuss the top 7 invoice software in the UK.

What to Look for In An Invoicing Software

- Ease of Use: Your software should feel intuitive. If it takes hours to figure out, it’s not worth the hassle. Look for a solution with a clean design and straightforward navigation.

- Customization Options: Every business is unique, so your invoices should reflect that. Choose software that lets you add logos, payment terms, and other custom details.

- Automation Features: From recurring invoices to payment reminders, automation saves time and ensures nothing slips through the cracks.

- Multi-Currency Support: If you deal with international clients, this feature is a must-have to handle different currencies and exchange rates.

- Integrations: Your invoicing tool should connect seamlessly with accounting, payment, and CRM systems to streamline operations.

- Affordability: Make sure the software fits your budget without sacrificing key features. Free trials or demos can help you test before committing.

These features simplify invoicing and improve cash flow, letting you focus on what matters—growing your business.

Top Invoicing Software in the United Kingdom

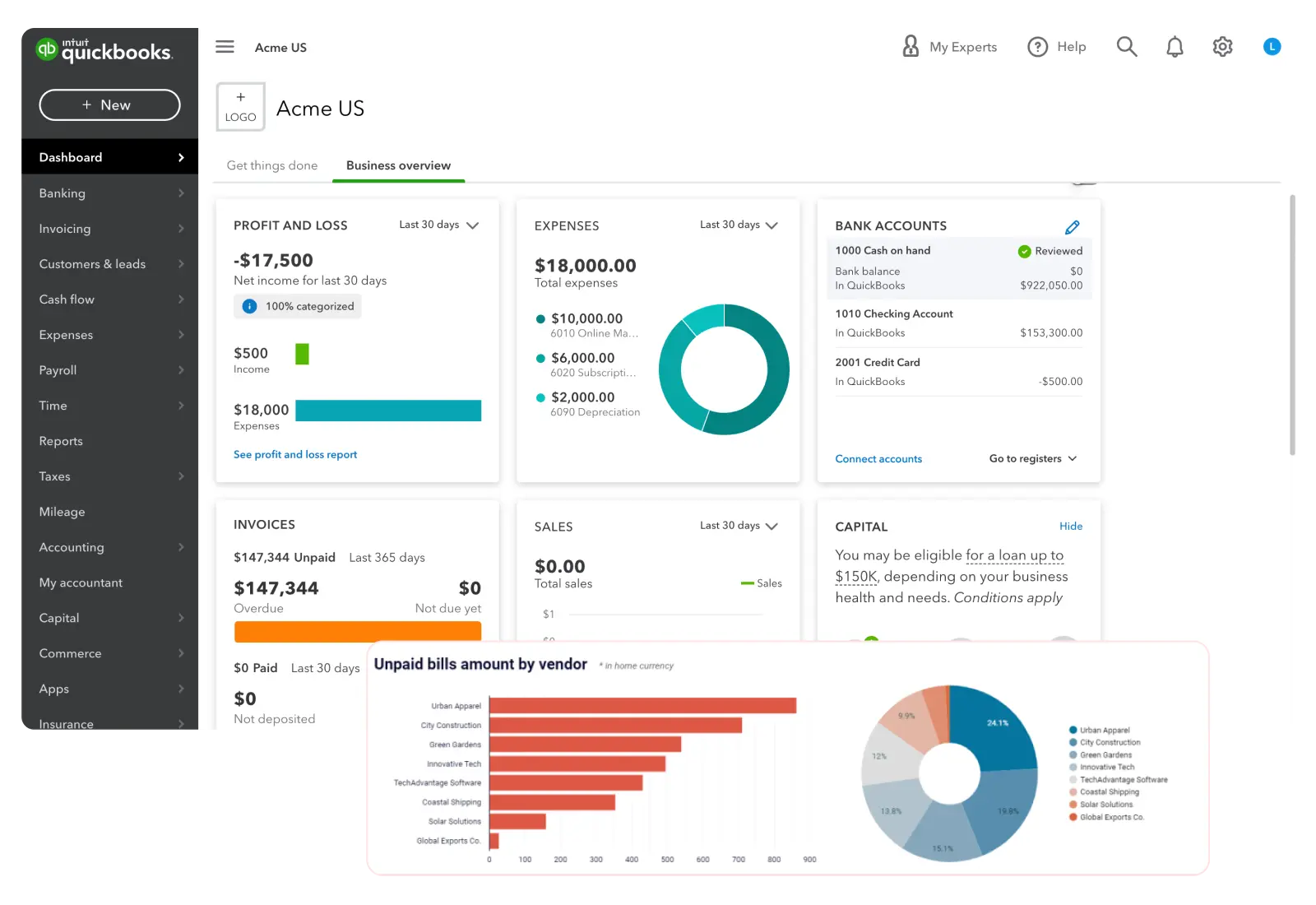

1. Quickbooks

It reduces the intricacies involved in managing your financial affairs such as billing, expenses and payrolls so that you can concentrate on building your business.

Features

Automated Invoicing

It is easy to prepare and send your invoices through QuickBooks with features such as pre-filled form options and payment due notices.

Customizable Invoices

You can also upload your company’s logo, selected brand colors, and additional notes to make your invoices look unique.

Real-Time Alerts

Receive configurable instant notifications whenever your clients open, approve or pay the invoices issued. It informs you at all times and allows no payment due date to pass unnoticed.

Progress Invoicing

By using progress invoicing, you enable clients to split payment to percentages of project completion or stages and thus manage cash flow during lengthy projects.

Payment Processing

QuickBooks, for instance, accepts credit cards, ACH, Apple Pay, PayPal, and Venmo, enabling clients to pay you directly.

Expense Tracking and Reporting

Ensure you can automatically record expenses, classify transactions, and create clear statements to follow the fiscal and financial year rules.

Mobile App Access

QuickBooks has a mobile app allowing users to manage invoices, payments, and reports anytime and from anywhere.

What’s Best?

Progress Invoicing: Break down payments into milestones or percentages to manage cash flow effectively during projects.

Pricing

QuickBooks plans in the UK start at £5/month for the first 6 months, and after that it costs £10/month. The highest plan is for £10/month.

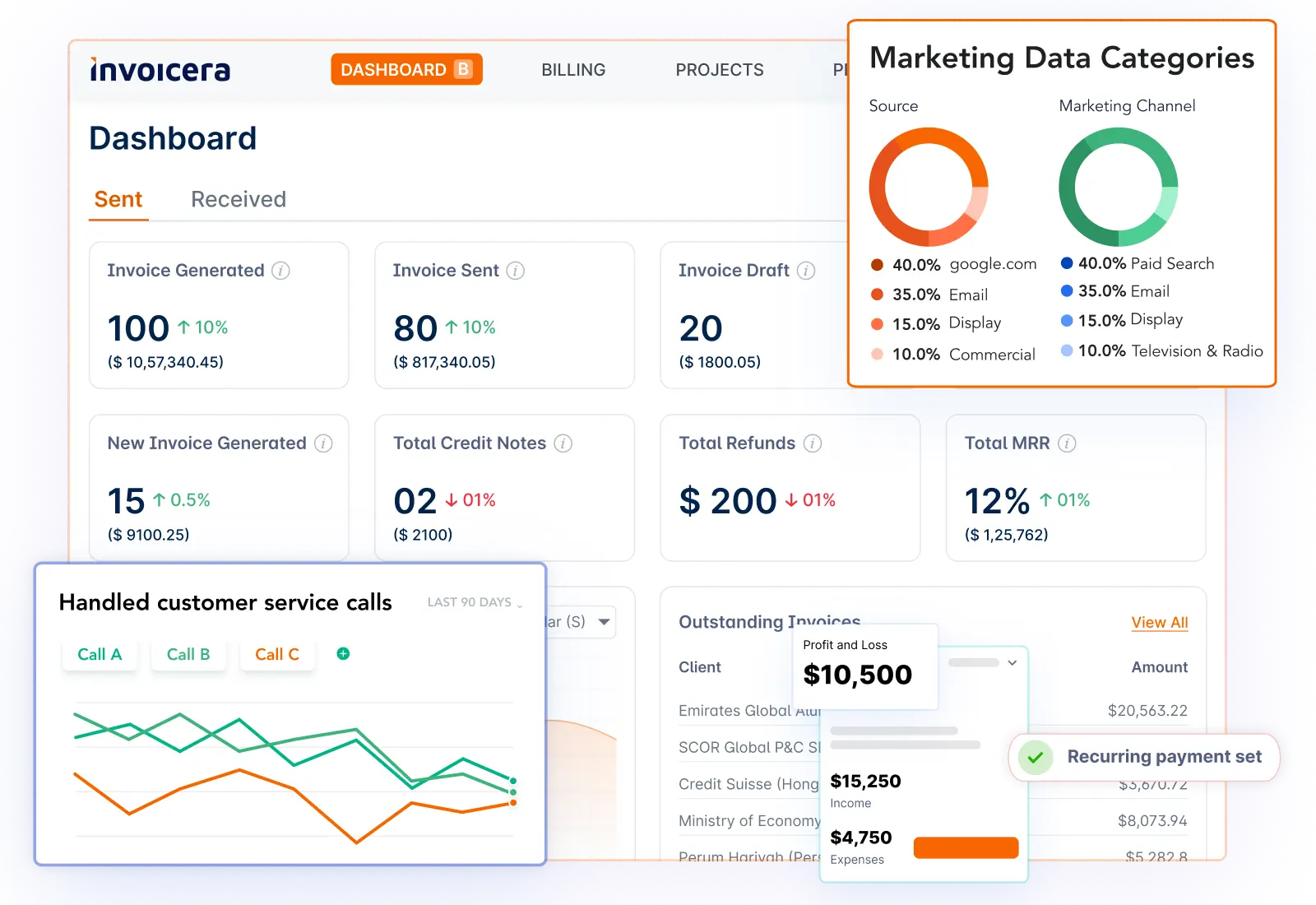

2. Invoicera

Features

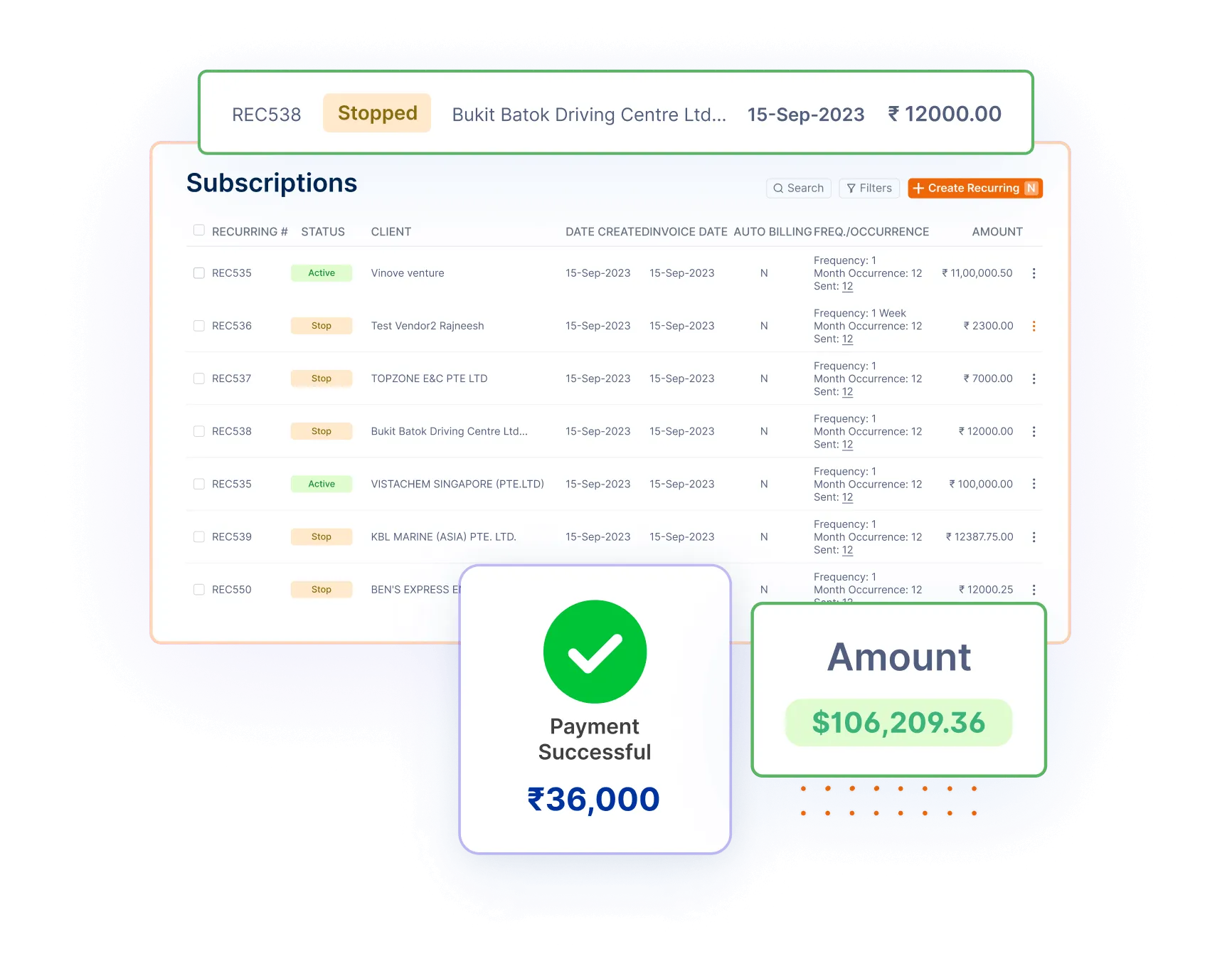

Recurring Billing

To save time, you can set up recurring invoices for subscriptions and contracts. This way, your payments will always be on schedule.

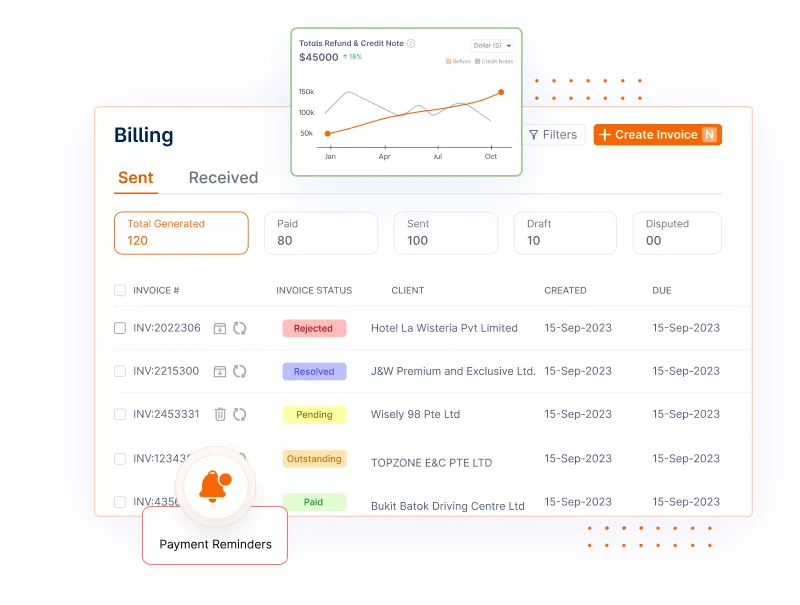

Automated Payment Reminders

Bid farewell to constantly running after late-paying clients. Scheduling follow-up reminders helps clients to make timely payments and stay on schedule.

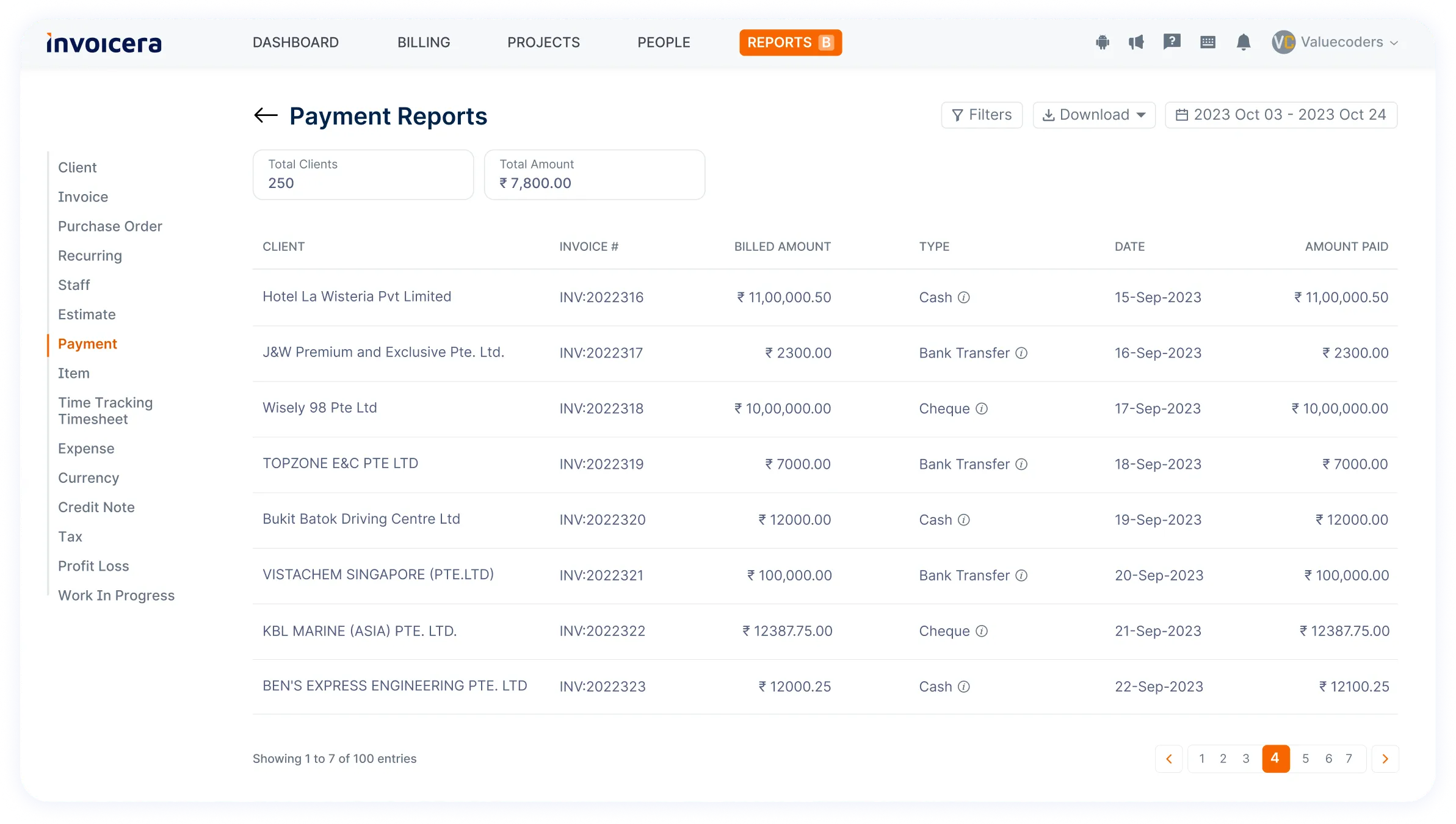

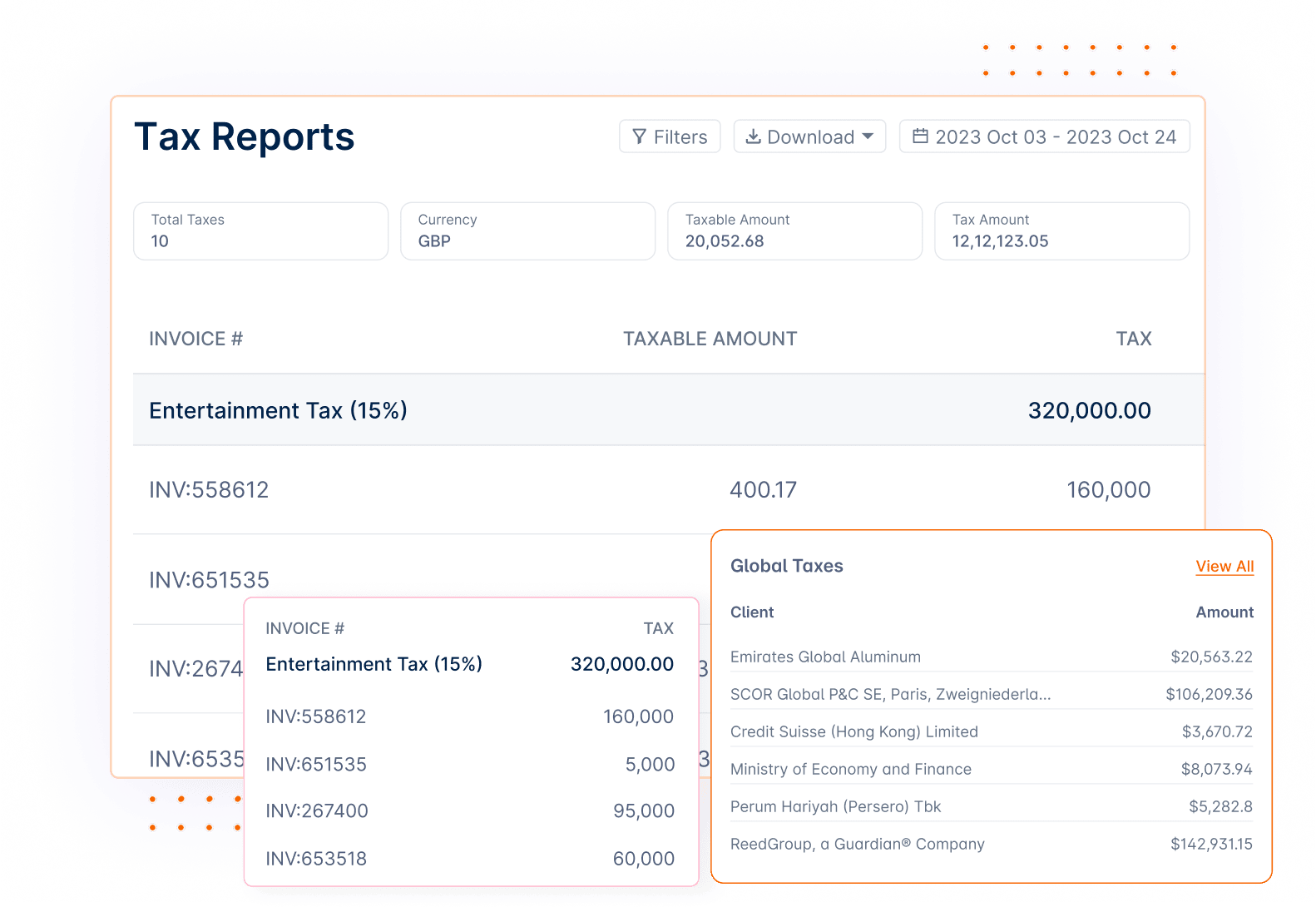

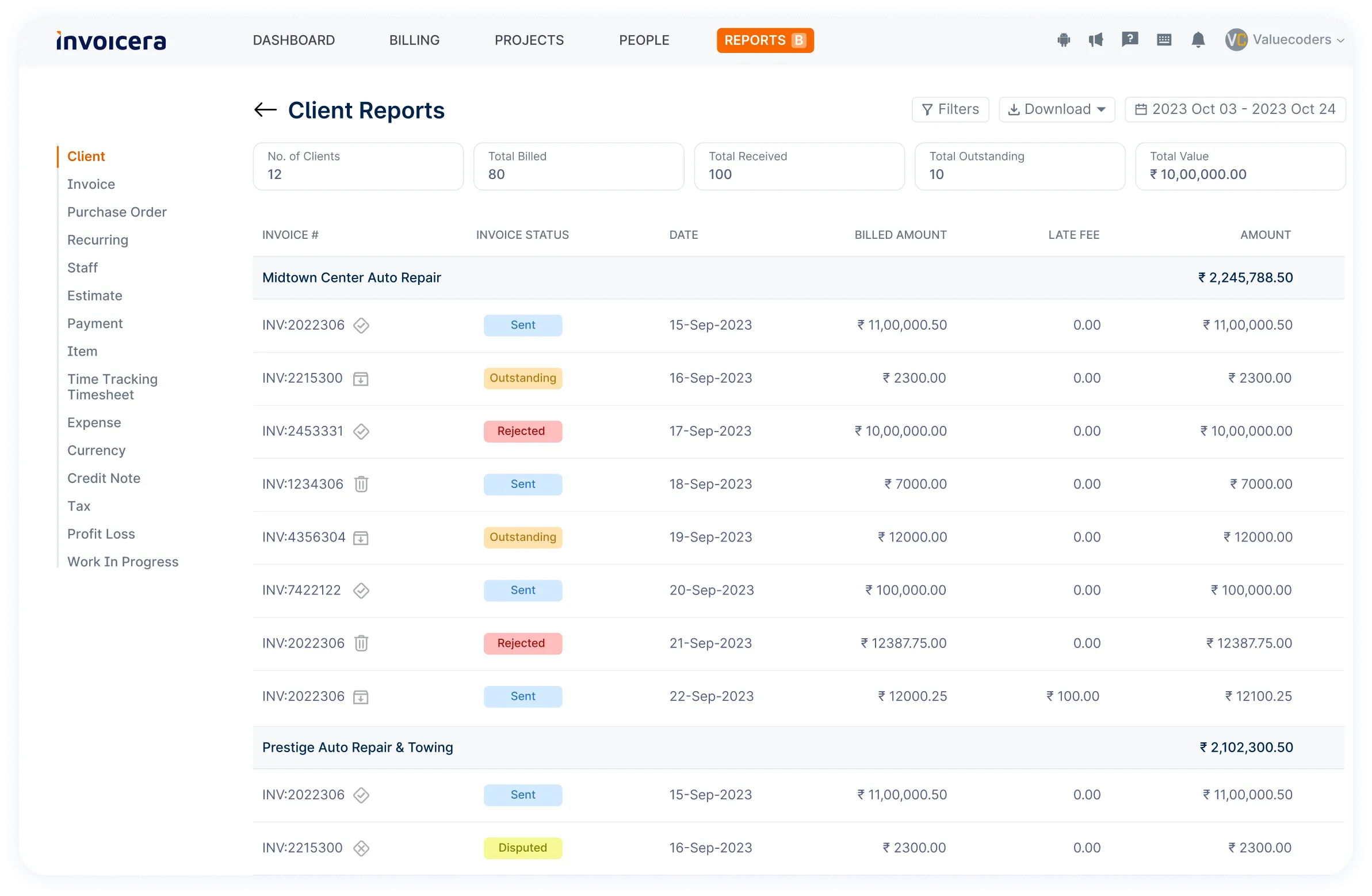

Detailed Reporting and Analytics

You can easily access important revenue, expenditure, and accounts receivable information to run your business effectively.

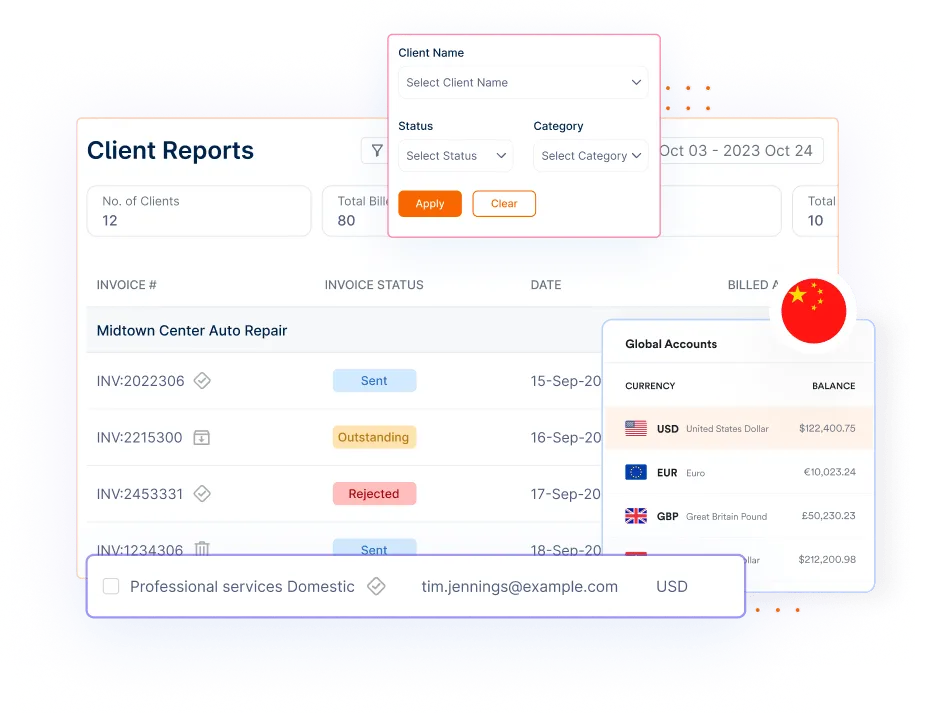

Master Global Payments

With Invoicera, it’s easy to process payments across borders, ensuring that you do not experience any issues with your clients.

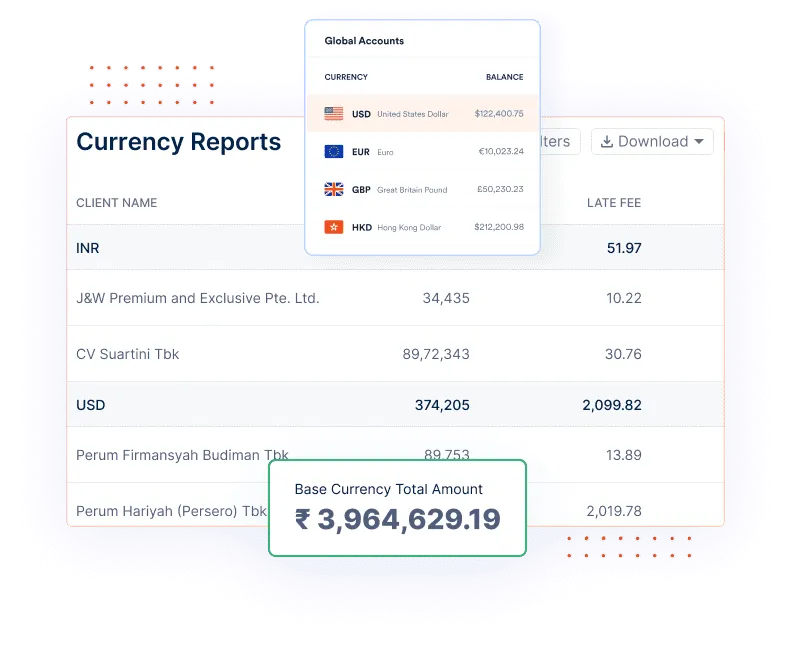

Multi-Currency Support

You can receive and transfer payments in different currencies, allowing you to serve clients worldwide.

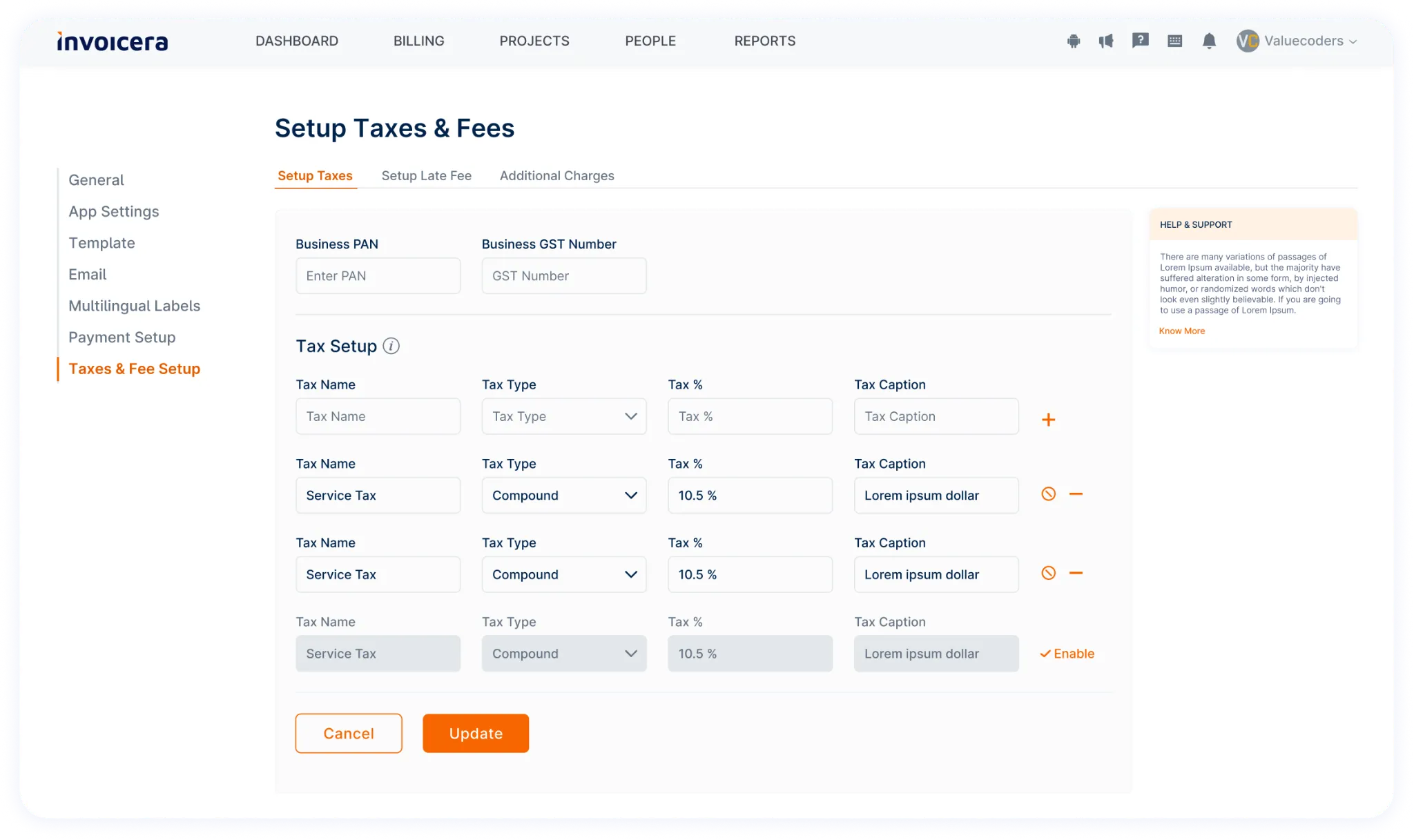

Automated Tax Compliance

You no longer have to worry about manually calculating tax amounts. Leave your taxes to the software to compute based on regional laws.

Late Payment Fees Automation

Charge late fees on past-due balances to prevent additional revenue losses.

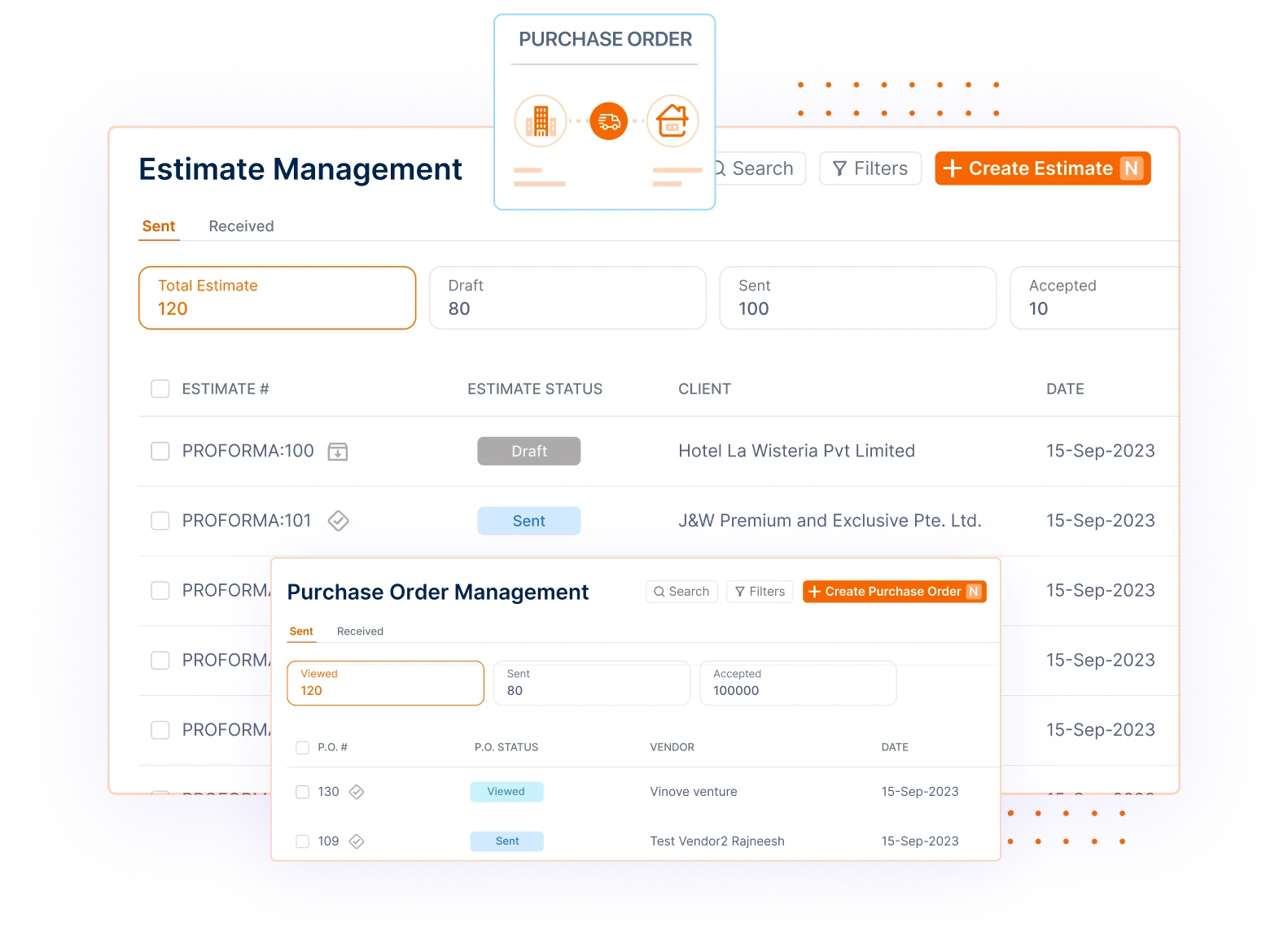

Estimates and Proposals in One Click

You can instantly make professional estimates to impress clients, which are suitable for the fast approval of contracts.

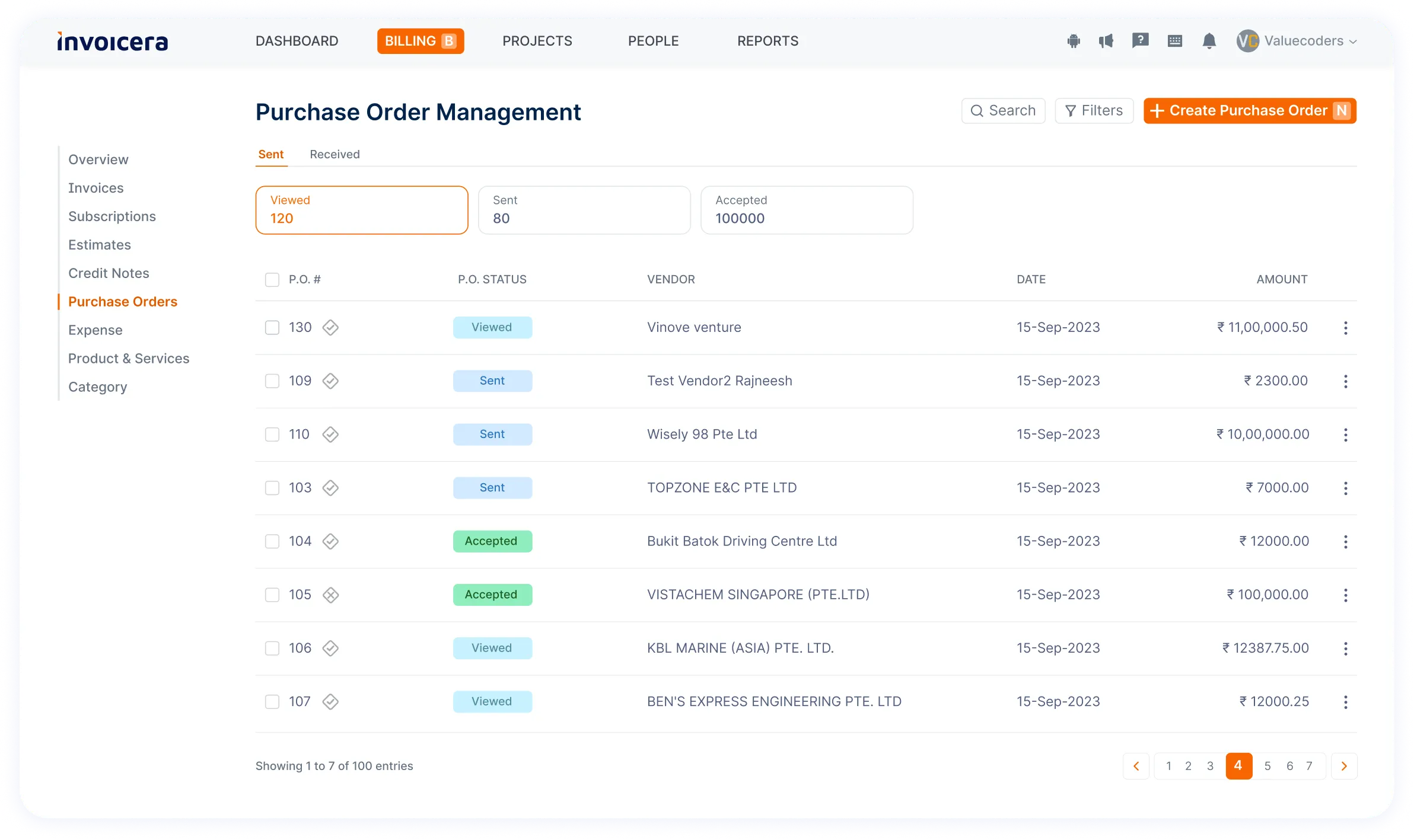

Manage Purchases with Purchase Orders

Track and organize the purchase orders efficiently to manage procurement.

Custom Third-Party Integrations

You can also extend the use of Invoicera by quickly integrating it with other software for an efficient invoicing process.

Real-Time Payment Tracking

Keep track of payments to ensure effective cash control and exclude any payments that may cause controversy.

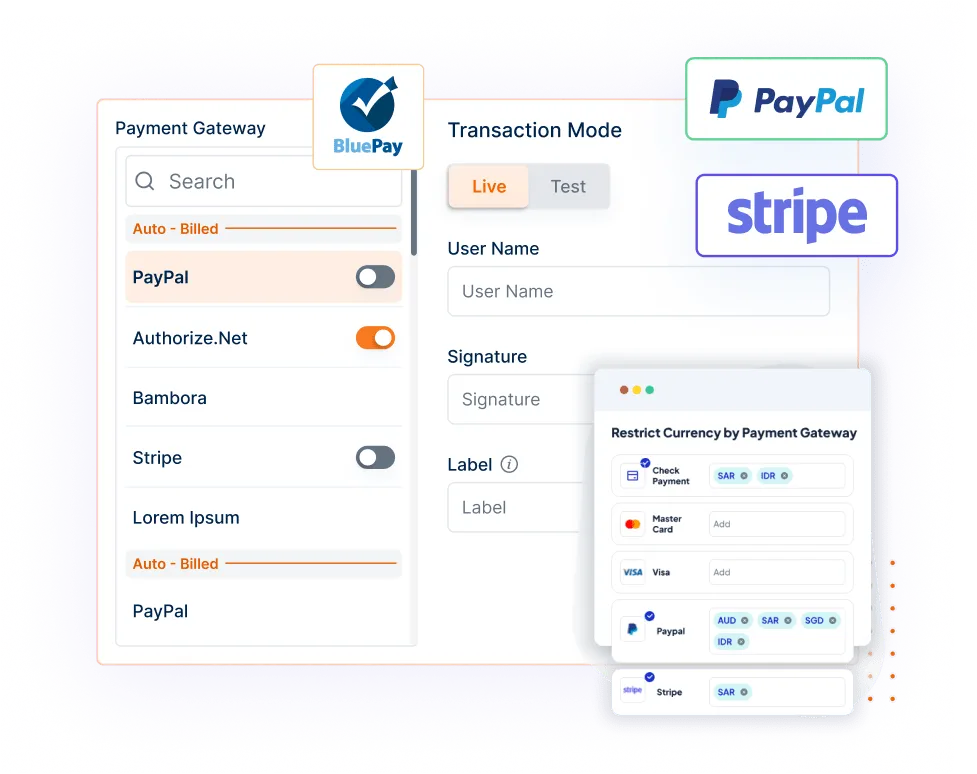

Multiple Payment Gateways

All the payments from clients are smooth and secure with Invoicera.

Easy Customer Portal Access

For better customer satisfaction, provide clients with online access to their invoices and payment records.

What’s Best?

Custom integrations with any third-party software

Pricing

Invoicera starts at £11.75 per month with a free trial and demo to help you get started.

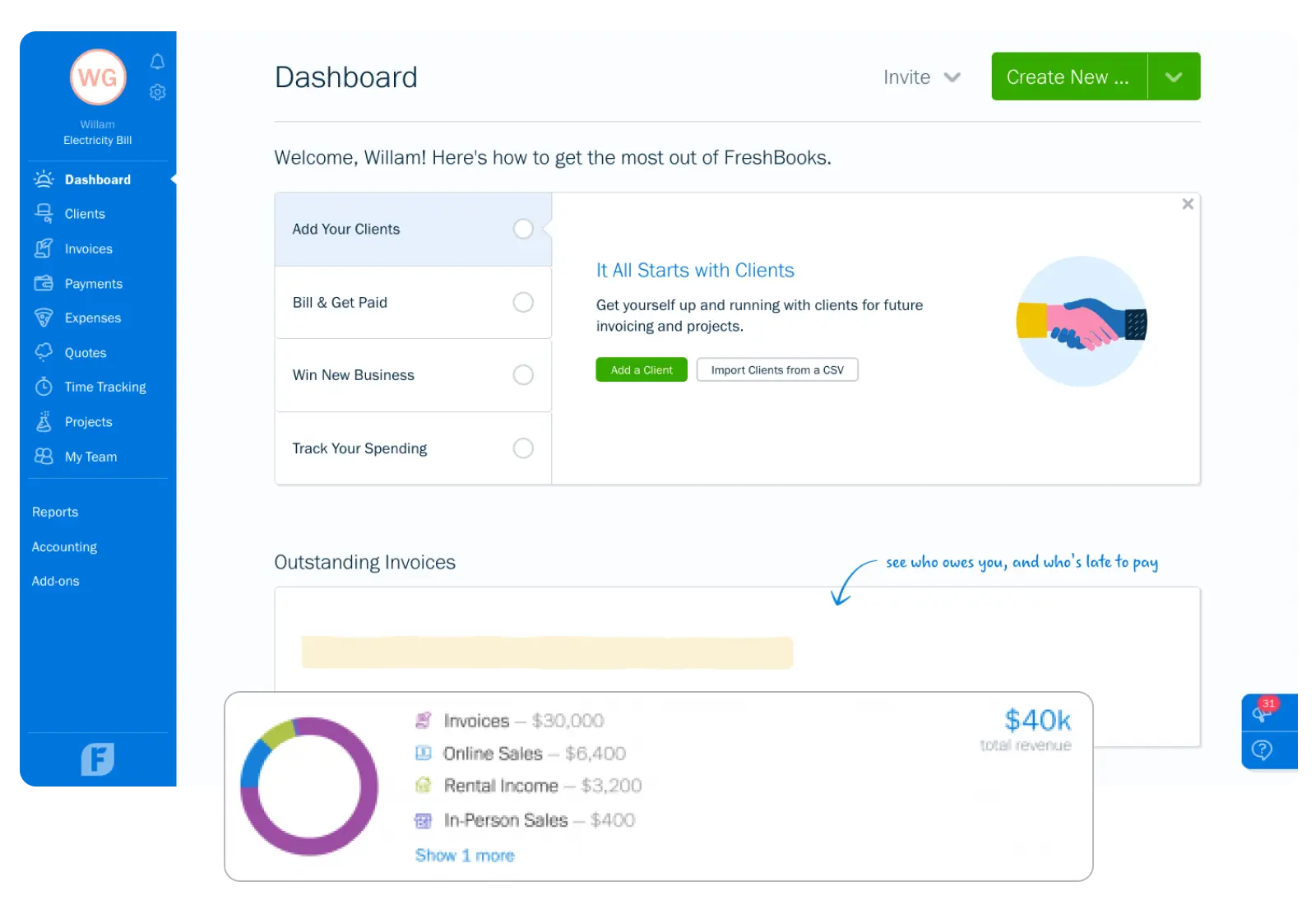

3. FreshBooks

Features

Create Stunning Invoices

Quickly add your logo, payment details, and a message to your invoices with little effort at all.

Automate Your Workflow

Always remember to automate things like sending invoices and following up on payments so that no time is wasted and nothing is missed.

Accept Payments Online

FreshBooks allows your clients to pay online via credit card or ACH, which gives your clients several favorable options to pay.

Track Time and Expenses

Record your working hours and expenses and make sure that you are charging accurately on your invoices to avoid gaps.

Seamless Integration

Expand FreshBooks further by integrating it with other company tools like the Project Management and Accounting platforms.

Mobile-Friendly Access

FreshBooks supports the mobile application, which enables users to create and send invoices and monitor payments on the go.

What’s Best?

Pricing

FreshBooks begins at £7.50 monthly with an ongoing offering of 50% off the scale to new customers for your initial 3 months.

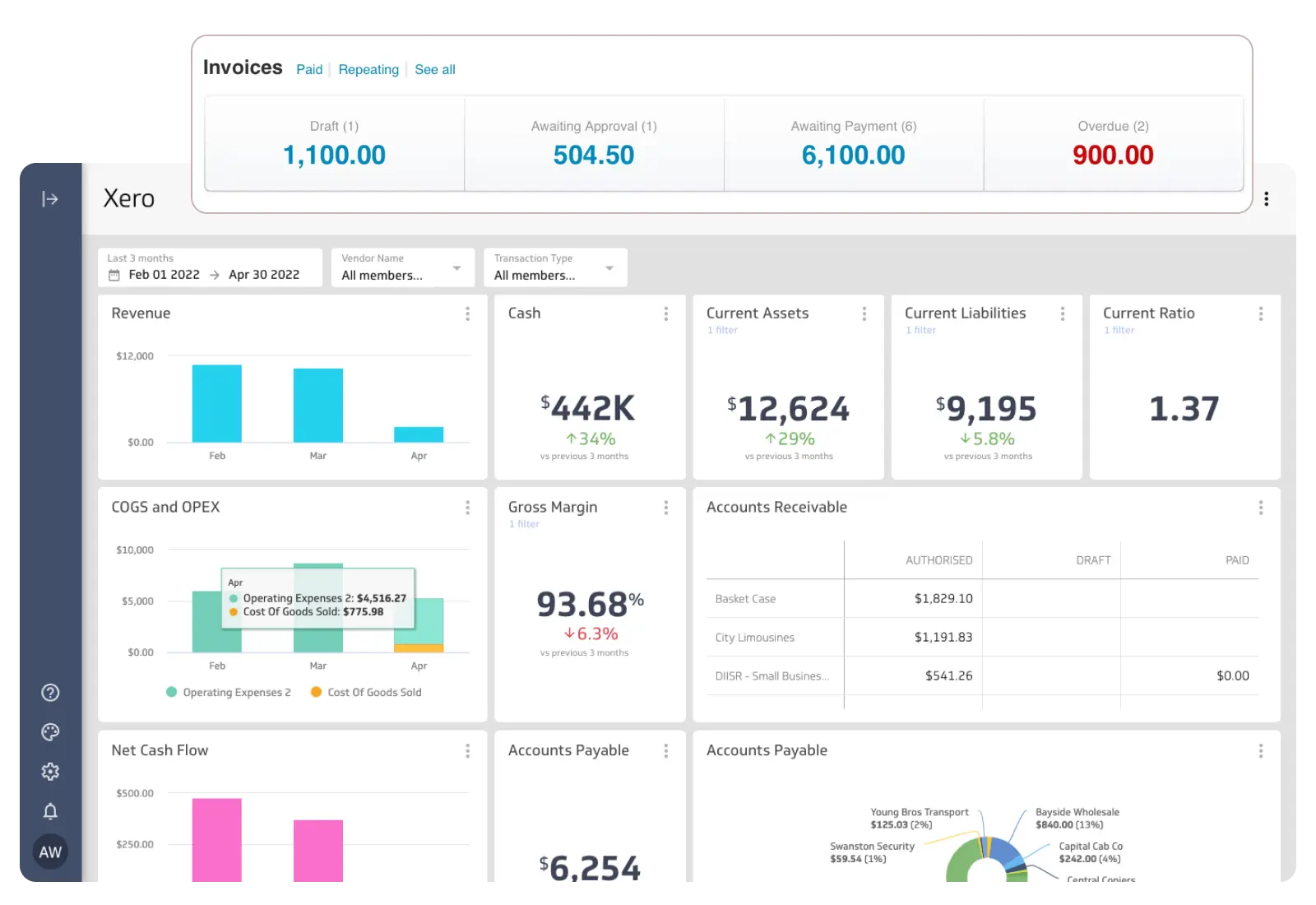

4. Xero

Features

Customizable Invoices

Customize your invoices by adding your company logo, payment terms, and anything else that might be important. The end result is professional-looking invoices.

Multiple Payment Options

Provide customers with flexibility on payment options and accept both debit/credit cards and direct debits.

Automatic Payment Reminders

Xero automatically notifies clients about upcoming and overdue payments, making it easier to get paid on time.

Mobile Invoicing

The Xero mobile app allows users to create invoices, follow up on payments, and manage clients on the go from their office or any other location.

Repeat Invoices & Bulk Imports

Set up recurring invoices to save time on repetitive billing tasks and import bulk invoices from other platforms to simplify the transition to Xero.

What’s Best?

Customizable invoices and recurring billing

Pricing

Xero has a Starter pack of £2.90 per month for the first six months making it ideal for small businesses.

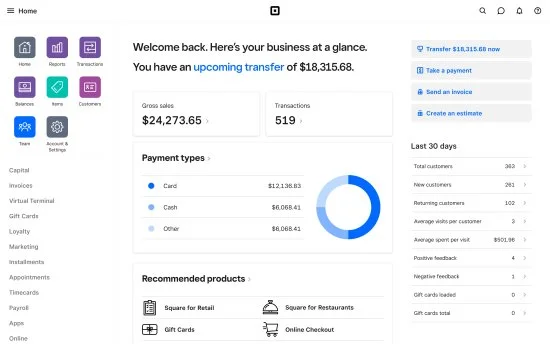

5. Square Invoices

Features

Flexible Payment Options

You can offer various payment methods to your clients, making it easier for them to pay how they prefer. You can also track every payment in real-time.

Customizable Invoices

Customize invoices, change the format of invoices, logo, and the use of brand colors on the invoices.

Live Invoice Tracking

Monitor your invoices at any time and find out which of them are paid, unpaid, or overdue to be mindful of your cash flow.

Recurring Billing

Set up recurring billing with ease, offering daily, weekly, monthly, or yearly payment schedules that suit both your client’s preferences and your business needs.

Secure Deposits

Collect upfront payments to secure client commitments, with the option to set separate deadlines for the remaining balance.

Custom Fields

Add custom fields to your invoices for important details, such as policies and notes, which can improve transparency and strengthen trust with clients.

Integrations

Square offers integrations with popular tools like Invoicera, QuickBooks, Xero, Square POS, and Square Online, helping you streamline your accounting, sales, and customer management from one central platform.

What’s Best?

Flexible payment options and live tracking

Pricing

£29+/month, plus processing fees.

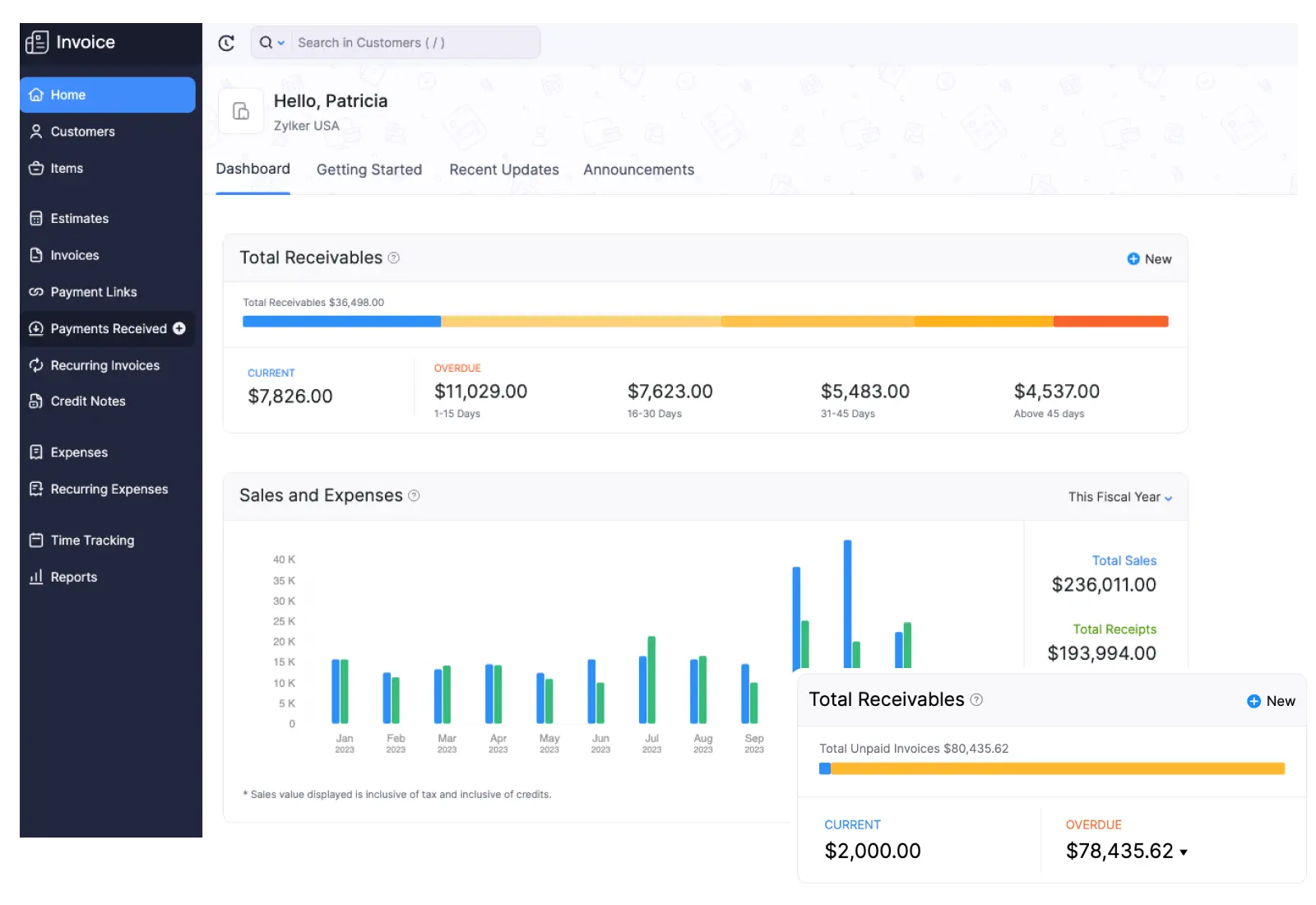

6. Zoho Invoice

Features

Create Stunning, Customizable Invoices

Brand each invoice to match the style of your business, from your logo to the colors and design of the invoice.

Multiple Delivery Options

Send invoices through email, WhatsApp, SMS, or as PDFs. This flexibility means your invoices will always reach your clients in the most convenient format for them.

Automate Recurring Invoices

Eliminate manual recurring invoicing and reduce time wasted in chasing payments and missed rent deadlines.

Smart Invoice Management

Get the latest status on your invoices with real-time tracking. The informative filters enable users to search invoices by date, number, and payment status.

What’s Best?

Customizable templates and multiple delivery options

Pricing

Free for UK users

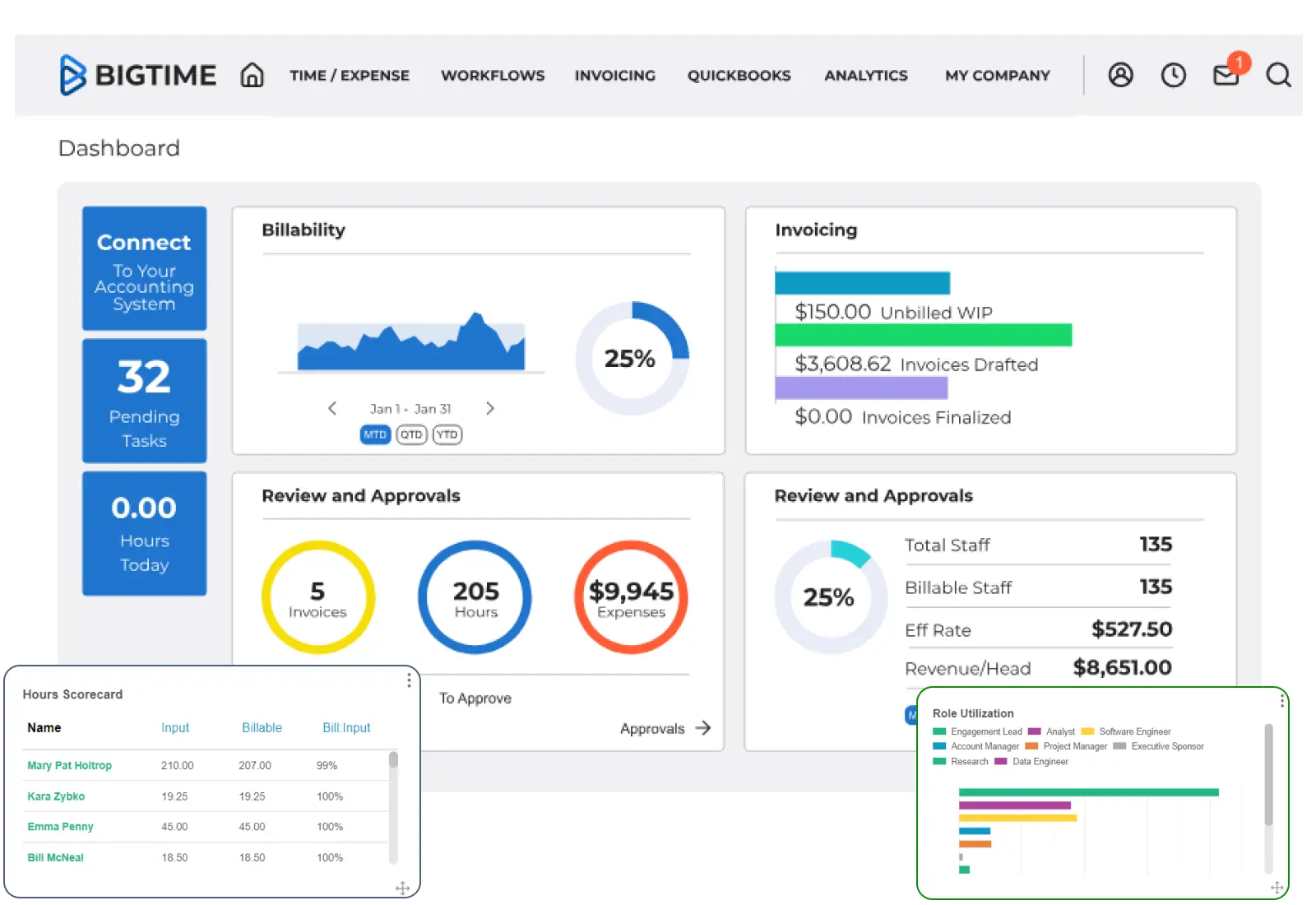

7. BigTime

Features

Smart Invoice Generation

Easily create professional invoices from the time and expenses you have logged. As previously mentioned, BigTime has options for multiple billing methods to ensure proper billing .

Professional Invoice Templates

Choose from templates that reflect your brand’s professionalism. They are simple yet effective, ensuring clarity and leaving a strong impression on clients.

Multi-Level Review System

BigTime’s built-in review process ensures that every invoice is checked before being sent out, maintaining quality control and reducing errors.

Accounting Software Integration

BigTime integrates with your existing accounting tools, streamlining the accounts receivable workflow. This means less friction between your invoicing and financial systems.

Customizable A/R Dashboard

Get a comprehensive overview of your accounts receivable with BigTime’s customizable dashboard, making it easy to monitor and track your financial health.

What’s Best?

Time tracking and invoicing

Pricing

US$20.00/month.

How Automation Boosts Business Revenue

Automation is no longer just about saving time; it is about generating more revenue. Here’s how it helps businesses grow:

- Faster Payments: Automated reminders nudge clients to pay on time. This cuts down on late payments and the fluctuation of your cash flow.

- Minimized Errors: The traditional way of invoicing is prone to human error such as incorrect billing, sending the invoice at the wrong time or not sending it at all. Automation ensures accuracy, saving you from costly corrections.

- More Time for Growth: By handling repetitive tasks, automation frees up your team to focus on winning new clients or expanding services.

- Improved Client Relationships: Accurate and timely invoices convey professionalism to the clients, creating a positive impression of your business.

- Actionable Insights: Another advantage of automated invoicing applications is that you are able to analyze payments and come up with better business solutions.

Conclusion

Selecting the right invoicing software for your business can be key to improving its functioning in the UK.

Good invoicing software is not just about billing but timely collection of your dues, managing your money and making processes convenient. With features like automatic reminders, custom templates, and online payments, these tools can save you time and help you look more professional.

Choosing QuickBooks due to its progress invoicing or choosing Invoicera for its custom integrations or any tool from the list, it is important to make sure you select the one that suits your requirements and cost controls.

Try out the free trials of this software and look for the one that suits you better.

FAQs

Ques. Can I use these tools if I own more than one business?

Ans. Yes, but each tool handles this differently. Some like Invoicera and QuickBooks let you run multiple businesses from one account (usually in more expensive plans), while others might need you to pay for separate accounts for each business.

Ques. Are these tools safe for storing customer information?

Ans. Yes, all these tools follow UK data protection laws. They keep your customers’ information safe and let you handle data requests properly. Just remember that you still need to be careful about how you use customer information in the system.

Ques. What happens to my information if I want to change to a different tool?

Ans. Most tools let you save your data in simple file formats like Excel. You can move basic info like customer details and old invoices. However, you might need to redo some of your custom settings in the new system. It’s best to switch when starting a new business year.